1. Introduction

In [1], Shiryaev and Peskir have considered the problem:

(1.1)

(1.1)

where  is standard Brownian process and they found the optimal stopping time as:

is standard Brownian process and they found the optimal stopping time as:

(1.2)

(1.2)

where  is the solution of the equation

is the solution of the equation

and .

.

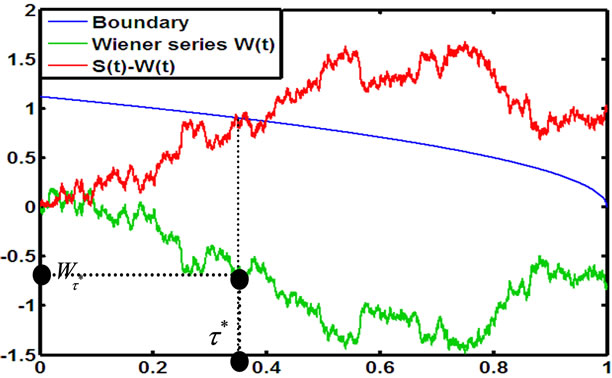

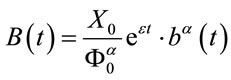

The simulation for , boundary

, boundary  and

and  are given in Figures 1-3.

are given in Figures 1-3.

In [2], Albert Shiryaev, Zouquan Xu and Xun Yu Zhou solve the following problem: There is an investor holding a stock, and he needs to decide when to sell it for the last time with given time to sell T. It is obvious that he wants to sell at a time of highest price on the interval from 0 to T. Assume that the discounted share price  complies with the following dynamic equation:

complies with the following dynamic equation:

on a filtered probability space  where a is the growth rate of the price and

where a is the growth rate of the price and  is the volatility, r is interest rate,

is the volatility, r is interest rate,  is the standard Brownian motion with

is the standard Brownian motion with  under the measure P. Here,

under the measure P. Here,  is Pincreasing filter generated by

is Pincreasing filter generated by . Then,

. Then,

Figure 2. A simulation for the stopping time in (1.2). In this case  is less than 0 but is not

is less than 0 but is not .

.

Figure 3. A simulation for the stopping time in (1.2). In this case  is very large but is not

is very large but is not .

.

where

. We define:

. We define:

and .

.

Then, the following cases:

• If ,

,  is an unique optimal selling time.

is an unique optimal selling time.

• If ,

, or

or  are optimal selling times.

are optimal selling times.

• If ,

,  is an unique optimal selling time.

is an unique optimal selling time.

In this paper, we will find the optimal time to sell a stock when the appreciation rate is the random variable taking one of two given values  and

and .

.

2. The Problem of Finding the Optimal Selling Time

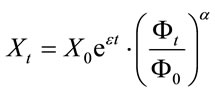

Assume that the asset price process Xt follows a geometric Brownian motion with its drift is a random variable taking one of two given values  or

or , the volatility

, the volatility  is constant, i.e.

is constant, i.e.

(2.1)

(2.1)

where  is a standard Brownian motion independent with

is a standard Brownian motion independent with  of the probability space

of the probability space . Assume

. Assume  is a complete probability space with nondecrease

is a complete probability space with nondecrease  -field. Suppose

-field. Suppose  and

and  satisfy al < r < ah, where r is the interest rate and it is constant and the initial value of assets

satisfy al < r < ah, where r is the interest rate and it is constant and the initial value of assets  is a positive constant.

is a positive constant.

Investors holding assets need to decide when to sell it for the last time with given time to sell them is T. Knowing that at the initial time distribution of α as

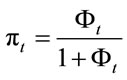

At time  we put

we put , where

, where  is the completion of the filtration generated by X.

is the completion of the filtration generated by X.

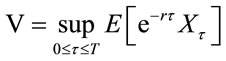

The problem is finding  -stopping time τ, 0 ≤ τ ≤ T such that

-stopping time τ, 0 ≤ τ ≤ T such that

(2.2)

(2.2)

where supremum is taken in  -stopping time τ, 0 ≤ τ ≤ T.

-stopping time τ, 0 ≤ τ ≤ T.

The price process  and posterior probability process

and posterior probability process  satisfying the equations

satisfying the equations

(2.3)

(2.3)

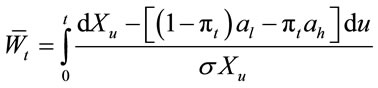

where  is a P-Brownian motion defined by:

is a P-Brownian motion defined by:

(see [3], theorem 9.1)

Define the process  by:

by:

and a new measure  satisfying:

satisfying:

where .

.

According to the Girsanov theorem,  is a

is a  Brownian motion. Let

Brownian motion. Let , we have

, we have

Then, price process  and process

and process  satisfy the equations

satisfy the equations

(2.4)

(2.4)

So, X and  are geometric Brownian motions under measure

are geometric Brownian motions under measure . Moreover,

. Moreover,  -field generated by

-field generated by  coincides with the one generated by X.

coincides with the one generated by X.

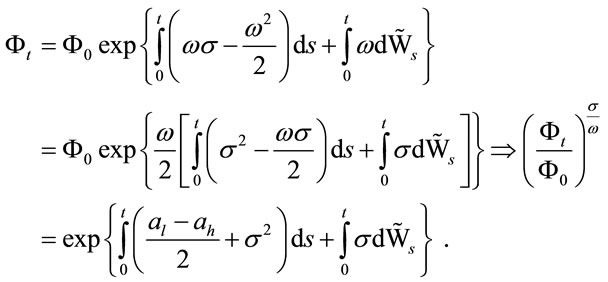

We define the likelihood process

We know that  is a

is a  -Brownian motion, so

-Brownian motion, so  is an

is an  -martingale under measure

-martingale under measure .

.

We have:

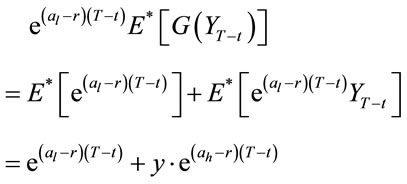

Denote that  is an expectation operator with respect to measure

is an expectation operator with respect to measure  and let

and let  is an

is an  -stopping time. Then, by the property

-stopping time. Then, by the property  -martingale under measure

-martingale under measure  of

of  (see [4], theorem 11), we have:

(see [4], theorem 11), we have:

(2.5)

(2.5)

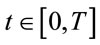

Lemma 1.  can be written as:

can be written as:

(2.6)

(2.6)

where:  and

and

Proof.

We have:

and

We consider an optimal stopping problem as:

(2.7)

(2.7)

where:

where supremum is taken in  -stopping time

-stopping time  with respect to filtration generated by

with respect to filtration generated by  It can be seen that the optimal stopping time in (2.7) can be turned to the optimal stopping time in the problem (2.2).

It can be seen that the optimal stopping time in (2.7) can be turned to the optimal stopping time in the problem (2.2).

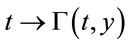

Now, we study the optimal stopping problem (2.7). We will prove that existing an increasing and continuous monotone function:

such that the stopping time

is an optimal stopping time for the problem (2.7).

satisfies the equation:

satisfies the equation:

On the other hand, we can write  where

where

With this notation, we have:

Give  in (2.7), we have

in (2.7), we have

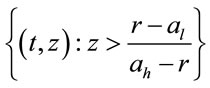

Define the continuation region C:

and the stopping region D:

According to general theory about optimal stopping problems, the stopping time

is optimal stopping time problem (2.7). Thus, determining the optimal stopping time is sufficient to defining the stopping region D.

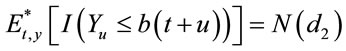

Theorem 1. There exists a right continuous and nondecreasing function

such that

Furthermore, supremum in (7) is achieved with the stopping time

Proof.

We know that

with every fix  and

and , assume that

, assume that , there exists a stopping time

, there exists a stopping time  such that:

such that:

So:

And process  is a submartingale, so we have:

is a submartingale, so we have:

Therefore, . This proves that remaining a function

. This proves that remaining a function

such that:

We have  to be a submartingale for

to be a submartingale for

, so all points in region

, so all points in region

belong to the continuation region.

belong to the continuation region.

Therefore, . The monotonicity of b follows from monotonicity of function

. The monotonicity of b follows from monotonicity of function .

.

The right continuity of  follows from the continuation region C is an open set.

follows from the continuation region C is an open set.

Theorem 2. Assume that b is the function described above whose existence is proved in Lemma 1. Define stopping time:

(2.8)

(2.8)

Then,  attains the supremum in (2.2).

attains the supremum in (2.2).

Proof. Deduce directly from Theorem 1 and Lemma 1 by replacing  by

by .

.

Theorem 3. The optimal stopping boundary b(t) satisfies the integral equation (see Equation (2.9) below):

where

Proof.

Fix  and

and . Then,

. Then,

where .

.

But:

Consider:

We have:

where .

.

Let  and

and

then

In a similar way, we have

where .

.

Put  we attain (2.9).

we attain (2.9).

3. The Numerical Solution of the Integral Equation and Simulation Results

Below we follow [5], devided  by the points

by the points ,

,  which

which , then Equation (2.8) can be discretized as:

, then Equation (2.8) can be discretized as:

For , we have equation

, we have equation

Due to , from the above equation we determine

, from the above equation we determine , continue to

, continue to , we obtain the following equation for determining

, we obtain the following equation for determining :

:

Just do so until , it has been determined

, it has been determined . Thus, we obtain a sequence of values

. Thus, we obtain a sequence of values  of

of  and approximate the optimal boundaries for the asset liquidation process.

and approximate the optimal boundaries for the asset liquidation process.

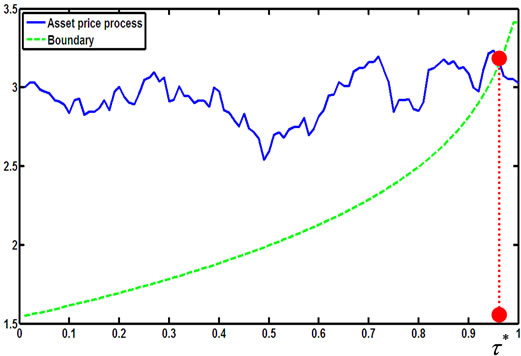

We have the approximate solution of Equation (2.9) by a computer program written in Matlab software, then set the boundaries for the process  is

is

. Then the optimal time to sell is the first time the line describes the process

. Then the optimal time to sell is the first time the line describes the process  lies below the line describes the process

lies below the line describes the process . These figures (Figures 4-19) and tables below (Tables 1-3) illustrates the stopping time in (2.8) and the solutions of Equation (2.9) in some cases.

. These figures (Figures 4-19) and tables below (Tables 1-3) illustrates the stopping time in (2.8) and the solutions of Equation (2.9) in some cases.

Figure 4. The line describes b (t) with al = 0.1; ah = 0.2; r = 0.15; σ = 0.2.

Figure 5. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.1; ah = 0.2; r = 0.15; σ = 0.2; π0 = 0.5.

Figure 6. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.1; ah = 0.2; r = 0.15; σ = 0.2; π0 = 0.2. In this case π0 = 0.2 is small so is τ*.

Figure 7. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.1; ah = 0.2; r = 0.15; σ = 0.2; π0 = 0.4.

Figure 8. The line describes b (t) with al = 0.09; ah = 0.15; r = 0.11; σ = 0.1.

Figure 9. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.09; ah = 0.15; r = 0.11; σ = 0.1; π0 = 0.5.

Figure 10. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.09; ah = 0.15; r = 0.11; σ = 0.1; π0 = 0.4.

Figure 11. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.09; ah = 0.15; r = 0.11; σ = 0.1; π0 = 0.3.

Figure 12. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.09; ah = 0.15; r = 0.11; σ = 0.1; π0 = 0.2.

Figure 13. The line describes b (t) with al = 0.09; ah = 0.15; r = 0.13; σ = 0.1.

Figure 14. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.09; ah = 0.15; r = 0.13; σ = 0.1; π0 = 0.2.

Figure 15. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.09; ah = 0.15; r = 0.13; σ = 0.1; π0 = 0.4.

Figure 16. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.09; ah = 0.15; r = 0.13; σ = 0.1; π0 = 0.5.

Figure 17. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = 0.09; ah = 0.15; r = 0.13; σ = 0.1; π0 = 0.5.

Figure 18. A simulation for the stopping time in (2.8) with parameters X0 = 3; al = –0.3; ah = 0.5; r = 0.1; σ = 0.2; π0 = 0.4.

Figure 19. A simulation for the stopping time in (2.9) with parameters X0 = 3; al = –0.3; ah = 0.5; r = 0.1; σ = 0.2; π0 = 0.6.

Table 1. The numerical solutions of (2.9) with al = 0.1; ah = 0.2; r = 0.15; σ = 0.2.

Table 2. The numerical solutions of (2.8) with al = 0.09; ah = 0.15; r = 0.11; σ = 0.1.

Table 3. The numerical solutions of (2.9) with al = 0.09; ah = 0.15; r = 0.13; σ = 0.1.

4. Conclusion

This paper solves the problem to find the optimal stopping time for the holding asset and make a decision when to sell assets with discounted price reaching the greatest expected value. The optimal stopping time is the first time the price of the asset hit the boundary or be at the time T. In next study, we will study the distributions and characteristics of the optimal stopping time.