Practical Application of Decarbonization Methods in the Oil and Gas Sector ()

1. Introduction and Relevance

Decarbonization of the oil and gas sector represents a key challenge in the global fight against climate change. The oil and gas sector is a significant source of greenhouse gas (GHG) emissions, which puts it at the center of attention of climate policy and corporate strategies (Kharin & Shiboldenkov, 2024). This article examines the role of the oil and gas sector in global GHG emissions, as well as the main methods of decarbonization: operational and intra-corporate.

The relevance of the topic of decarbonization of the fuel and energy complex (FEC) in general and, in particular, its key part - the oil and gas sector, is largely confirmed by statistical data. In 2022-2023, concentrations of key greenhouse gases such as carbon dioxide, methane and nitrous oxide reached record levels. According to UNEP’s 2023 report, global greenhouse gas emissions in 2022 totaled 57.4 gigatonnes of CO2 equivalent. This is a 1.2% increase from 2021 (United Nations Environment Programme (UNEP) Emissions Gap Report, 2023).

According to the UN Intergovernmental Panel on Climate Change (IPCC), the energy sector accounts on average for about 70% of total GHG emissions (CSR Foundation Report, 2021). Such a high contribution is mainly due to the combustion of fossil fuels (during extraction and processing) and methane leaks. In Russia, the fuel and energy sector accounts for up to 78% of GHG emissions.

2. Main Part

Building and implementing low-carbon strategies in the oil and gas industry starts with the development of clear benchmarks focused on reducing carbon footprints, including identifying key sources of GHGs, calculating the carbon footprint of an enterprise, and formulating climate targets such as reducing CO2 emissions by a certain percentage within a set timeframe. An important aspect is strategic planning, which identifies how these targets will be achieved through the deployment of technologies including carbon capture and switching to renewable energy sources. Effective strategies for low-carbon development or climate transition require the integration of science-based solutions to ensure sustainability and minimise negative environmental impacts while avoiding a decline in productive activities.

In global practice, a common approach is for a company to aim to reduce 90 per cent of GHGs from its own operations and only 10 per cent by implementing or investing in third-party climate projects.

It is important to realise that a reduction in carbon footprint cannot be accompanied by a reduction in operations. That is why the methods described later in this article are crucial foar decarbonising the fuel and energy complex - they allow optimising production processes, increasing energy efficiency and resource conservation while maintaining equal, and sometimes even higher, volumes of the company’s core operations.

Speaking of greenhouse emissions, it is worth recalling that they are assessed in three scopes and divided into types: direct emissions (Scope 1), indirect emissions from the production of electricity consumed (Scope 2) and emissions from the entire life cycle of a good or service (Scope 3). If we take emissions directly from the oil and gas sector, within the perimeter of its direct and indirect responsibility (Scopes 1 and 2) they amount to less than 6 billion tonnes of CO2eq, which represents only about 12% - 14% of global anthropogenic emissions (Grushevenko, Kapitonov & Melnikov, 2021). In fact, this level is comparable to GHG emissions from agriculture.

Such relatively low figures should not distract from the main goal - decarbonisation of the fuel and energy sector, because over the last 15 years the negative contribution of the oil and gas sector to the growth of GHG concentrations in the atmosphere has doubled. The main reasons in this case are the increasing share of unconventional oil and gas production, as well as methane leaks. Increased monitoring and control of methane leaks has also led to the growth of methane leaks.

Today, according to international standards, companies are obliged to report on Scopes 1 and 2. In the Russian Federation, the calculation of greenhouse gases according to the methodological guidelines of Order No. 371 of the Ministry of Natural Resources and Environment of the Russian Federation contains information on the company’s direct emissions that occur directly from the organisation’s facilities and processes, i.e. Scope 1.

Regulators and investors are putting pressure on oil and gas companies to reduce their carbon footprint. Many large investment funds holding shares in global energy companies are channeling their demand for transformation and support for the energy transition through representatives on their boards of directors. And the largest markets, primarily the EU, are tightening climate policy, especially in terms of carbon regulation (Gorlacheva, Shiboldenkov & Hertsik, 2024).

For example, the European Union from 2030 plans to introduce restrictions on methane emissions from oil and gas imports. The European Commission will set maximum values of methane content for fossil fuels supplied to the European market. Importers will have to demonstrate that the methane emission intensity of oil and gas production is below certain maximum values (In May 2024, EU countries approved a law to introduce methane emission restrictions on oil and gas imports into Europe from 2030).

To date, some 75 jurisdictions have introduced some form of legislation requiring companies to report on their carbon footprint and, in case of exceeding the norm, to pay fines or implement certain compensatory measures (World Bank State and Trends of Carbon Pricing, 2024).

Emissions associated with product use, i.e. Scope 3, account for about 33 per cent of total emissions from this sector and are on average 7 times higher than emissions from Scopes 1 and 2. The large share of methane, reaching 45% of total emissions, emphasizes the need for change in the sector.

Globally, decarbonising energy sector is not possible without reducing the carbon footprint throughout the supply chain. This is why many foreign companies place great emphasis on building a sustainable procurement system, so-called ‘green procurement’. To achieve the result, effective integration is needed between large customers, their suppliers (SMEs, often being contractors to several large companies in the sector at the same time), and consultants able to help SMEs meet the needs of their large customers.

The establishment of a global international platform known as Open-es serves as a prime example of the implementation of this approach (as shown in/see Table 1). This initiative was developed through a collaborative effort with prominent entities in the oil and gas sector, alongside renowned technology companies such as Google and the Massachusetts Institute of Technology. This platform facilitates the convergence of the endeavours of major customers and their contractors throughout the entire product value chain, with the objective of cultivating harmonized or analogous standards in the implementation of ESG principles within the business processes of companies on both sides of the supply chain.

![]()

Table 1. OPENES platform interaction.

Source: http://www.openes.io/.

An example of such co-operation is the OPENES platform, created in 2021 jointly by major oil and gas companies, Boston Consulting Group (BCG) and Google Cloud. Today, it has more than 30,000 foreign member companies from 108 countries, united by one goal―decarbonisation of their own product chain.

3. Results

The specifics of implementing decarbonisation methods in the oil and gas setcor is the need to integrate financial, technological and operational aspects, which requires a comprehensive approach, cooperation of all participants in the process and constant adaptation to the changing external environment. Success in this area can lead not only to improved environmental performance, but also to increased competitiveness of the company in the market (Yan & Shiboldenkov, 2024).

The carbon management agenda has become so significant in the work of energy majors that many of them have introduced the so-called internal carbon price into their models for assessing the investment attractiveness of assets. Today, the cost of carbon in a particular jurisdiction for companies in the oil and gas sector is becoming a significant characteristic in making investment decisions.

Large international energy companies have extensive scientific and financial capabilities to find solutions to climate challenges. Not surprisingly, it is corporations in the oil and gas sector that have become key drivers of energy transformation. The COVID-19 pandemic and corresponding economic changes have heightened awareness of the need for decarbonisation, making it an issue of paramount importance for the entire industry.

In terms of the oil and gas industry itself, the oil industry accounts for about 60 per cent of emissions, while the gas industry is responsible for 40 per cent. The main greenhouse gas emissions are associated with associated petroleum gas production and flaring operations. It is estimated that methane accounts for 45 per cent of all greenhouse gas emissions from the industry, with emissions from oil refineries ranking second or 21% (Grushevenko, Kapitonov & Melnikov, 2021).

The signing of the Paris Climate Agreement and the ensuing changes in the Russian and foreign climate field have led companies in the global oil and gas sector to pay significant attention to decarbonising their operations.

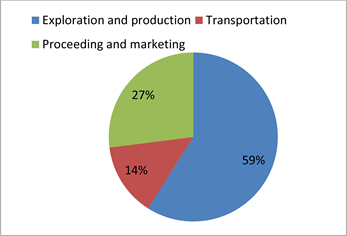

Picture 1 reflects that the major share of GHG emissions in the oil and gas sector is associated with production, accounting for 59% of the total, or 3.3 million tonnes of CO₂-equivalent.

Natural gas extraction is also accompanied by emissions: impurities such as carbon dioxide and hydrogen sulphide must be removed from natural gas before it can be transported, which requires additional energy costs and results in the emission of more than 150 million tonnes of CO2 equivalent per year (Kryuchkov, Serebrovsky & Bagirov, 2016).

Source: Grushevenko, Kapitonov & Melnikov, 2021.

Picture 1. GHG emissions along the oil and gas value chain.

4. Discussion: Transformation of International Oil and Gas Companies in the Context of global Economic Decarbonisation

From 2019 to 2021, major international oil and gas companies such as BP, Total, Shell and Equinor began to develop climate transition strategies and set emission reduction targets, including zero emissions targets for the three main catchment areas. The trigger for this was the European Union’s adoption of the so-called Green Deal, the continent’s ambitious environmental strategy, the essence of which is to achieve carbon neutrality in the bloc’s countries by 2050.

European companies, followed by those from other countries, have started to develop low-carbon business strategies or so-called climate transition strategies. To do this, the first step is to calculate the carbon footprint, then assess the key climate risks for business development, prioritise them and build a new strategy based on this (Startsev & Falco, 2020). In general, the commitments of oil and gas companies are considered insufficient to meet the objectives of the Paris Agreement, according to foreign environmental organisations and activists (Ermakova, 2020). In accordance with the most effective international practices applied in the fuel and energy sector, the process of integrating decarbonisation goals into the corporate business strategy is as shown in/see Table 2.

![]()

Table 2. Stages of adaptation of corporate development strategies of oil and gas companies against the background of decarbonisation policy.

Source: Grushevenko, Kapitonov & Melnikov, 2021.

There are two radically different scenarios for implementing a low-carbon development strategy. According to the first one, energy companies drastically change their business strategy and switch to the low-margin segment ? renewable energy and biofuels, abandoning investments in traditional energy carriers, which is fraught with creating pressure on the company’s financial performance. The second scenario is the application of various decarbonisation methods, discussed below, which allow companies to retain key business segments (exploration and production of fossil fuels, refining, transportation and marketing) but reduce the carbon intensity of their own operations. Companies are integrating decarbonisation into internal corporate management, setting targets and improving emission control systems. The most effective approach is to integrate decarbonisation into strategic and investment plans through the introduction of internal carbon pricing (Safonov, 2020). The carbon price is built into the valuation, and, contrary to the scenario, it can add value to the asset or make it uneconomic.

Most oil and gas companies pay more attention to climate issues when developing their business strategies compared to companies in other industries. This is due to the high dependence of the hydrocarbon market on decarbonisation issues. Within the sector, there are significant differences in approaches to greenhouse gas emissions: European companies operate under strict regulation (the EU GHG emissions trading system has been in place since 2005) and have a lower carbon intensity. At the same time, the introduction of cross-border carbon regulation in the EU in 2023 has prompted many jurisdictions to work on creating national carbon regulation systems, without which their products will lose competitiveness in the European market (CSR Foundation Report, 2021). In addition, many countries reasonably believe that it is better for their national companies to pay the carbon tax at home, and the money from it can be used for the implementation of green projects, rather than this levy will remain in the accounts of foreign jurisdictions.

Decarbonisation is a complex process and unique strategies need to be developed for each company, taking into account their assets and technologies, as well as existing climate policies in their key markets of operation and distribution.

Developing a decarbonisation strategy (also known as a climate transition or sustainability strategy) is a complex and multi-layered process unique to each company. This strategy is determined by the company’s asset structure, production technologies, investment portfolios and applicable national and international legislation (Yan & Shiboldenkov, 2024).

Large energy companies develop and successfully apply various emission reduction methods. There are many methods of decarbonisation, from which companies can choose the most suitable for themselves.

The largest oil and gas companies remain focused on hydrocarbon extraction and processing, transport, refining and sales. The global energy crisis of 2022 clearly showed that the main source of profit for the oil and gas majors is still in the oil and gas exploration and production circuit. But a complete or partial abandonment of green projects would send too strong a signal to the market. That is why the scale of work on renewable energy, low-carbon projects led first to the creation of separate divisions and then even separate subsidiaries (Report of the Centre for International and Comparative Legal Studies, 2023). For example, Shell and Total have formed specialised departments to manage renewable and low-carbon energy projects and investments. In addition, foreign majors are setting up corporate venture capital funds to invest in new green start-ups.

To date, the main types of decarbonisation of oil and gas companies are operational and in-house methods (see Table 3).

![]()

Table 3. Main methods of decarbonisation in the oil and gas sector.

Source: Grushevenko, Kapitonov & Melnikov, 2021; Mitrova, 2021; Safonov, 2020.

Naturally, any of the methods presented above requires the diversion of labour resources for its implementation and the attraction of additional funding. In order to find the optimal balance between investment and profit, a unique organisational and financial approach has been developed. This model is based on the creation of independent companies (joint stock companies with majority control in the hands of the parent company) that can raise capital on the market independently. They can finance their growth by turning to specialised investors (Falco & Yatsenko, 2020).

In this way, the parent company can accelerate the development of promising new ventures related to the energy transition while maintaining its stability, which distinguishes energy companies in traditional activities. These traditional lines of business are also an integral part of the overall decarbonisation process.

Each satellite company remains part of the parent company from which it can benefit in terms of technology, know-how and services. However, despite new investments, the satellite model reduces the amount of capital required to support new ventures. This ensures shareholder remuneration remains based on free cash flow from traditional operations.

This model allows operational and financial synergies to be exploited, maximising growth potential and freeing up more capital for other parts of the portfolio. For example, the market has already seen examples where an energy company, whose capitalisation was estimated at $45 billion, initiated such a spin-off of an internal corporate department, which subsequently became a joint stock company, whose shares were partially sold on the open market, financing was raised for further implementation of the company’s projects, and the spin-off structure was valued by the market at $10 - 12 billion as a result of the sale of its shares.

5. Conclusion and Recommendations

Speaking about the practical significance of applying the various described decarbonisation methods in the oil and gas industry, it is important to note that any traditional fuel and energy company seeks to develop its core business - energy exploration and production. Moreover, the results of the energy crisis in Europe in 2021-2022 clearly showed that those companies that abruptly changed their development strategy towards RES suffered the most damage, as their revenue and profit indicators were incomparably low compared to those companies where the transition towards green energy was not so abrupt (Falco, 2020).

In order to guarantee the financial stability of the company and meet the expectations of shareholders in terms of dividend payments, it is important not to reduce the investment programme aimed at the core business (while allowing for a partial shift of investments from more carbon-intensive sectors (oil) to low-carbon sources (gas). This is where existing decarbonisation tools, both operational and in-house, come in, allowing oil and gas production to be kept at a certain level while reducing the carbon footprint. Many energy majors have announced plans to achieve carbon neutrality of the upstream sector (for Scopes 1 and 2) by 2030-2035, and to achieve full operational carbon neutrality for all three scopes on the 2050 horizon.

In addition to internal corporate changes, the government plays an important role in the decarbonisation of the oil and gas sector. It is it that creates the necessary regulatory framework within which business transformation takes place. It is also necessary to build relevant infrastructure, develop international cooperation and mutual recognition of norms and standards in order to implement a number of initiatives in the field of carbon regulation.

The problem of climate change is interdisciplinary in nature, so the development and implementation of climate policy in Russia is the responsibility of several executive authorities, and interdepartmental groups are created to coordinate it (Mitrova, 2021).

In the last three years, the Russian Federation has created both a legislative framework in the field of carbon regulation, aimed at encouraging decarbonisation of business processes, and an infrastructure that allows companies to apply corporate decarbonisation methods in terms of implementing climate projects, issuing carbon units into circulation and stimulating investment in renewable generation.