VaR-Optimal Risk Management in Regime-Switching Jump-Diffusion Models ()

1. Introduction

In this paper we study a classical hedging policy based on options followed by an institutional manager whose aim is to minimize the Value-at-Risk of a position in a regime-switching jump-diffusion market. Although sharply criticized for the lack of sub-additivity and its inability to quantify the severity of an exposure to rare events, VaR has been adopted as a benchmark in the financial industry and for regulatory purposes. It plays a central role in banking regulation and internal risk management, mainly due to its simplicity. The analysis of this hedging strategy has been initiated by [1] a decade ago for a portfolio made by a risky asset following a lognormal random dynamic, and hence analytically solved in a Black-Scholes setting. More recently, it has been considered for a bond portfolio in [2,3]. By taking the VaR as the risk measure for potential losses L of a portfolio, we hedge the risky position by buying a fraction h of a put option with maturity T and strike price K: but what K and h? By fixing a hedging constraint, the corresponding (constrained) optimality condition involves quantiles computations and derivative pricing. Both steps can be efficiently faced with the Fourier transform technique, under historical and risk-neutral probability respectively.

The dynamic model we consider for the risky position is , where

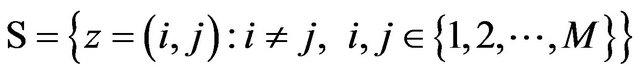

, where  is specified on a filtered probability space as a jump-diffusion whose parameters change over time, driven by a continuous time and stationary Markov Chain on a finite state space

is specified on a filtered probability space as a jump-diffusion whose parameters change over time, driven by a continuous time and stationary Markov Chain on a finite state space , representing the unobserved state of the world. In fact, empirical studies on the behavior of financial markets show the ability of regime-switching models to capture some peculiarities in the observed data, as firstly highlighted in the seminal paper by Hamilton [4]. Since then, there has been a growing effort in applying switching models to a wide class of financial and/or economic problems. On the other hand, the necessity of including jumps in the underlying models to provide better representation of their dynamical properties is widely recognized (see e.g. [5]). Empirical stylized facts about observed data, such as volatility clustering and heavy tails, are then well captured by regime-switching jumpdiffusions which turns out to be an appealing and flexible class of dynamic models. The computation of quantiles in regime-switching models has been considered by several authors mainly in discrete-time setting (see e.g. [6,7] and ref. therein). Here we consider this problem in the continuous time framework in which the required computations can be very efficiently implemented with the help of Fourier Transform methods (see e.g. [8]). The use of this kind of technique for the analytical calculation of VaR has been considered in Duffie and Pan [9] in terms of the Fourier inversion of the characteristic function. The use of Generalized Fourier Transform and the FFT algorithm is more recent: see Le Courtois and Walter [10], Kim et al. [11] and Scherer et al. [12].

, representing the unobserved state of the world. In fact, empirical studies on the behavior of financial markets show the ability of regime-switching models to capture some peculiarities in the observed data, as firstly highlighted in the seminal paper by Hamilton [4]. Since then, there has been a growing effort in applying switching models to a wide class of financial and/or economic problems. On the other hand, the necessity of including jumps in the underlying models to provide better representation of their dynamical properties is widely recognized (see e.g. [5]). Empirical stylized facts about observed data, such as volatility clustering and heavy tails, are then well captured by regime-switching jumpdiffusions which turns out to be an appealing and flexible class of dynamic models. The computation of quantiles in regime-switching models has been considered by several authors mainly in discrete-time setting (see e.g. [6,7] and ref. therein). Here we consider this problem in the continuous time framework in which the required computations can be very efficiently implemented with the help of Fourier Transform methods (see e.g. [8]). The use of this kind of technique for the analytical calculation of VaR has been considered in Duffie and Pan [9] in terms of the Fourier inversion of the characteristic function. The use of Generalized Fourier Transform and the FFT algorithm is more recent: see Le Courtois and Walter [10], Kim et al. [11] and Scherer et al. [12].

The paper is organized as follows: we firstly derive the optimality conditions for the VaR minimizing strategy (Section 2) and then (Section 3) we introduce the regimeswitching dynamic model, its generalized characteristic function and the change-of-measure result for switching from the historical to the risk-neutral probability. Finally, in Section 4 we specify the Fourier Transform technique for calculating quantiles and put/call option prices and report some numerical experiments to show the impact of jumps and regime-switching on the optimal hedging strategy.

Some final comments can be briefly outlined. Firstly, the analysis of the hedging strategy is fairly general, that is it can be applied to any dynamical model for which Fourier transform methods are viable, for example it can be extended to Variance-Gamma or Bates models. Furthermore, besides the choice of different dynamic models, it would be interesting to consider alternative risk measures, such as the Conditional Value at Risk (CVaR). This is certainly less commonly used in finance industry, but it is widely used in insurance industry being a coherent, convex and stable risk measure (see [13]).

2. VaR and Optimal Risk Management

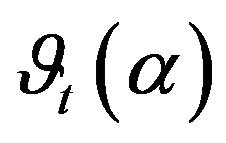

Given a confidence level , the set of

, the set of  -quantiles of the random variable

-quantiles of the random variable  is the interval

is the interval

where

where

and

and

. For a random variable having continuous and strictly increasing distributions function

. For a random variable having continuous and strictly increasing distributions function ,

,

, i.e. it solves the equation

, i.e. it solves the equation .

.

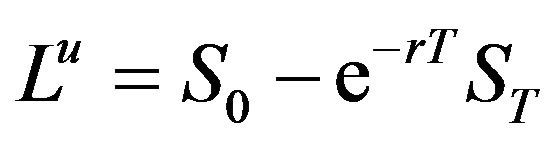

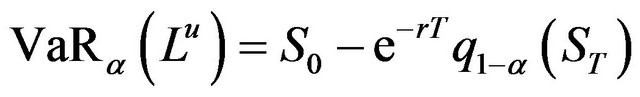

Here we take the portfolio loss  to describe a financial position in a fixed time interval and, in order to simplify notations, we assume in this section that

to describe a financial position in a fixed time interval and, in order to simplify notations, we assume in this section that  has a continuous and strictly increasing distributions function. The Value-at-Risk at level

has a continuous and strictly increasing distributions function. The Value-at-Risk at level  is defined as

is defined as

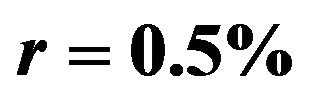

Let  be the value of the risky asset,

be the value of the risky asset,  and

and  be the risk-free rate, that without loss of generality we consider fixed in the period: we define the loss at time

be the risk-free rate, that without loss of generality we consider fixed in the period: we define the loss at time  of such a position as

of such a position as  implying

implying . Let us now consider a classical hedging problem in which an institution has an exposure to a risky asset

. Let us now consider a classical hedging problem in which an institution has an exposure to a risky asset  and decide to hedge such an exposure in the interval

and decide to hedge such an exposure in the interval  by buying a fraction

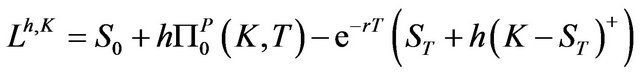

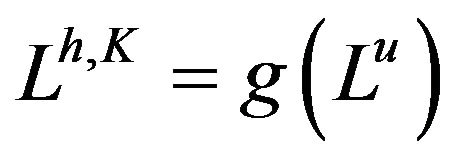

by buying a fraction  of an European put option on the asset with maturity T and strike price K. Analogously to the situation considered in [1], we take as the hedged position the portfolio composed by the risky asset and the put option: the loss of the hedged portfolio at time

of an European put option on the asset with maturity T and strike price K. Analogously to the situation considered in [1], we take as the hedged position the portfolio composed by the risky asset and the put option: the loss of the hedged portfolio at time  is therefore

is therefore where

where  is the price of the put option at time

is the price of the put option at time . By defining the strictly increasing function

. By defining the strictly increasing function

, where

, where

, it is immediately seen that

, it is immediately seen that

; therefore

; therefore

Let us firstly notice that if , then

, then

since

since . Hencegiven the budget constraint C, the optimal hedging strategy is specified by the following problem:

. Hencegiven the budget constraint C, the optimal hedging strategy is specified by the following problem:

(1)

Since , the optimality first order condition for

, the optimality first order condition for  is given by the following non-linear equation:

is given by the following non-linear equation:

(2)

(2)

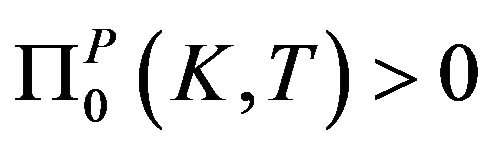

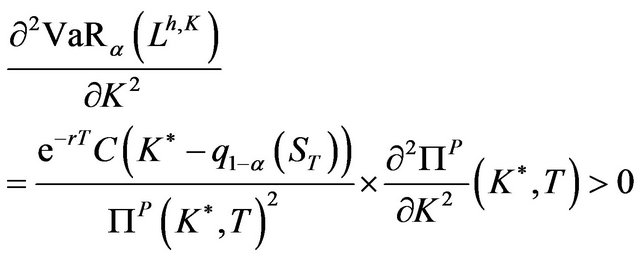

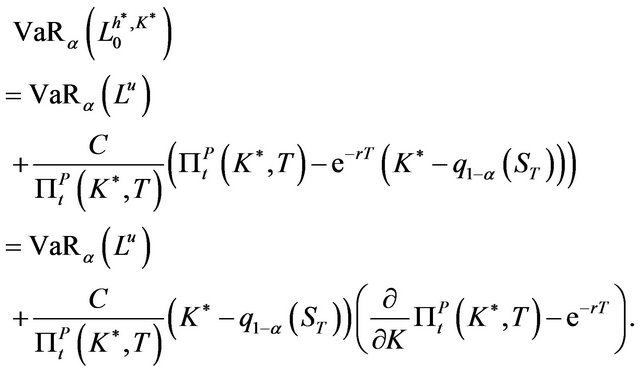

Assuming that (2) has a solution  and the twice differentiability of the price functional we can prove that this is actually a minimum since

and the twice differentiability of the price functional we can prove that this is actually a minimum since

by the convexity of the price functional w.r.t. the strike. Correspondingly, the optimal amount of the hedging put option is

(3)

(3)

We now assume the following:

Assumption 2.1. The price of the put option can be represented as the discounted expected value of the payoff at time  under a risk-neutral measure

under a risk-neutral measure :

:

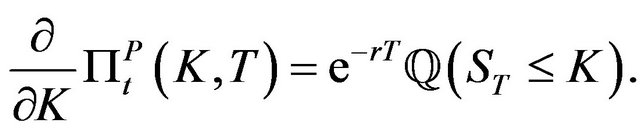

Furthermore, let  be the cumulative distribution function (cdf) of the random variable

be the cumulative distribution function (cdf) of the random variable  under such a measure: hence

under such a measure: hence

and

We can finally prove the following property:

Proposition 2.1. If , then

, then .

.

Proof. Since  and

and  are characterized through (2) and (3), we get

are characterized through (2) and (3), we get

From Assumption 2.1, we have

.

.

Therefore

Remark 2.1. Notice that the optimality condition (2) under Assumption 2.1 simplifies to

(4)

(4)

and depends on both the objective and the risk neutral distributions  and

and . Furthermore, it easily seen that the l.h.s. is equal to the conditional expectation

. Furthermore, it easily seen that the l.h.s. is equal to the conditional expectation

which is an increasing function of K bounded by

which is an increasing function of K bounded by . Therefore, (4) has a unique solution if and only if

. Therefore, (4) has a unique solution if and only if .

.

3. Regime-Switching Jump Diffusions and Measure Change

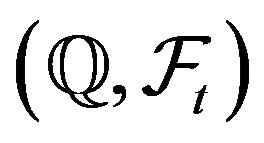

Let us consider on a filtered probability space

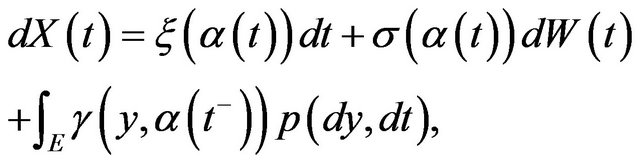

a stochastic process of the form

a stochastic process of the form

,

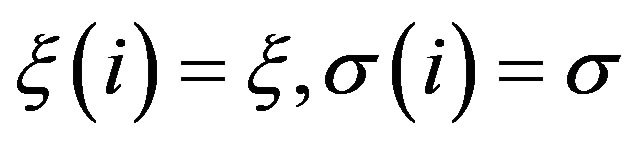

,  , modeling the value, of a risky asset for

, modeling the value, of a risky asset for . We consider a jump-diffusion setting in which the jump process is described as a marked point process (MPP), that is a random measure

. We consider a jump-diffusion setting in which the jump process is described as a marked point process (MPP), that is a random measure  characterized by the intensity process

characterized by the intensity process

, the parameters of which are driven by a finite state and continuous time Markov chain. So, let

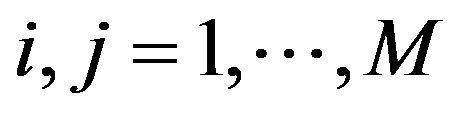

, the parameters of which are driven by a finite state and continuous time Markov chain. So, let  be a continuous time, homogeneous and stationary Markov Chain on the state space

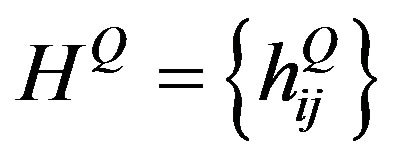

be a continuous time, homogeneous and stationary Markov Chain on the state space  with generator

with generator : the elements

: the elements  of the matrix

of the matrix

are positive numbers such that

are positive numbers such that , for

, for

. Furthermore,

. Furthermore,  ,

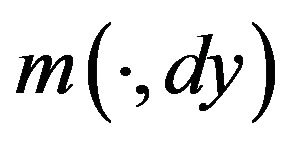

,  and

and  are given functions,

are given functions,  being the measurable mark space. Without loss of generality, we can assume in the following

being the measurable mark space. Without loss of generality, we can assume in the following . In a given interval

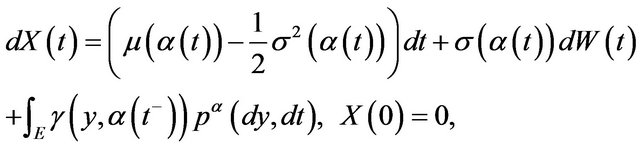

. In a given interval , we consider the dynamic

, we consider the dynamic

(5)

where  is a standard brownian motion and

is a standard brownian motion and  is a MPP characterized by the intensity

is a MPP characterized by the intensity . Here

. Here  represents the (regime-switching) intensity of the Poisson process

represents the (regime-switching) intensity of the Poisson process , while

, while  are a set of probability measures on

are a set of probability measures on , one for each state (regime)

, one for each state (regime) . The function

. The function  represents the jump amplitude relative to the mark

represents the jump amplitude relative to the mark  in regime

in regime . The couple

. The couple  is called the

is called the

-local characteristic of

-local characteristic of .

.

Furthermore  is a martingale for a suitable class of processes

is a martingale for a suitable class of processes  (see [14]),

(see [14]),

being the compensated process.

Throughout the paper we assume that the processes  and

and  are independent,

are independent,  and

and  are conditionally independent given

are conditionally independent given  and that

and that

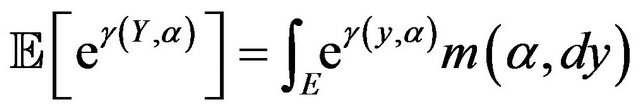

is finite for each regime

is finite for each regime

. An application of the generalized Ito’s Formula gives the corresponding jump-diffusion SDE for the asset price

. An application of the generalized Ito’s Formula gives the corresponding jump-diffusion SDE for the asset price

(6)

(6)

with  and

and .

.

Measure changes. An absolutely continuous transformation of measures in a jump-diffusion setting allows to change the intensities of the MPP and the Markov chain in addition to the translation of the Wiener process (see [14]). It results convenient to represent the underlying Markov chain itself as the MPP  with finite mark space

with finite mark space ,

,

and

and : the compensator is

: the compensator is

(7)

(7)

being the Dirac measure. Consequently, let

being the Dirac measure. Consequently, let

be a square integrable predictable processes,

be a square integrable predictable processes,

a non-negative function such that

a non-negative function such that

and let

and let  and

and

be strictly positive functions defined on

be strictly positive functions defined on  and

and , respectively. We can define a new measure

, respectively. We can define a new measure  on the measurable space by setting

on the measurable space by setting

(8)

(8)

Besides the translation of the Wiener process , we perform a change in the intensity of the MPP giving the compensated process

, we perform a change in the intensity of the MPP giving the compensated process  with

with  -local characteristic (

-local characteristic ( ,

, ) and a change of the intensity of the Markov chain which under

) and a change of the intensity of the Markov chain which under  has generator

has generator  where

where

By taking the Radon-Nikodym derivative

(9)

(9)

and supposing that  for

for , we have a probability measure

, we have a probability measure  on

on  equivalent to

equivalent to  with

with , under which

, under which

(10)

(10)

where  (see [14]).

(see [14]).

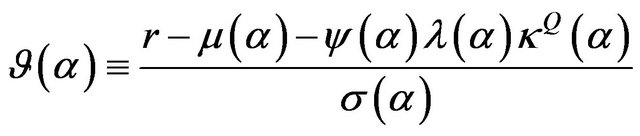

In order to price derivatives under the model (6) we need to specify a risk-neutral or martingale measure, that is a measure under which the discounted price process  is a martingale. This is done by taking

is a martingale. This is done by taking

(11)

(11)

from which we finally get the risk-neutral dynamic for the underlying

(12)

(12)

Correspondingly, for the process  we have

we have

(13)

(13)

The measure transformation defined by (8) through (9) preserves the probability structure of the stochastic process  under both

under both  and

and . It worth noting that we can specify infinitely many equivalent measures

. It worth noting that we can specify infinitely many equivalent measures . In practice, the usual way to select one of the equivalent measures is to calibrate the model to a set of observed data.

. In practice, the usual way to select one of the equivalent measures is to calibrate the model to a set of observed data.

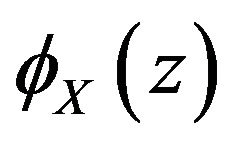

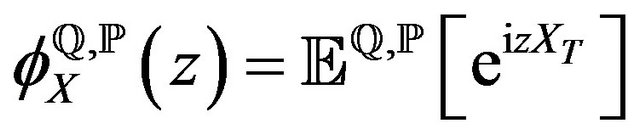

GFT for regime-switching jump-diffusions. In order to apply Fourier methods, we need to calculate the Fourier transform  of our process. Since we have to consider the process

of our process. Since we have to consider the process  under two different measure, we derive its characteristic function for the following general dynamic

under two different measure, we derive its characteristic function for the following general dynamic

(14)

(14)

with  local characteristic, and Markov chain generator

local characteristic, and Markov chain generator . In [8] it was proved the following Proposition 3.1. Let

. In [8] it was proved the following Proposition 3.1. Let  be the generalized Fourier transform of the jump magnitude under the given measure. Then, by letting

be the generalized Fourier transform of the jump magnitude under the given measure. Then, by letting

(15)

(15)

and , we have

, we have

(16)

(16)

where ,

,

and

and  is the transpose of Q.■

is the transpose of Q.■

Different models can be recovered with simple linear constraints on the full parameter set of our model (RSJDM) (6), (12),  ,

, . This follows by noticing that if

. This follows by noticing that if ,

,

and

and  we are implicitly assuming a unique regime so recovering the well-known characteristic function of the (single-regime) jump-diffusion dynamic

we are implicitly assuming a unique regime so recovering the well-known characteristic function of the (single-regime) jump-diffusion dynamic

which includes the standard geometrical Brownian motion (GBM) , the Merton jump-diffusion models (JDM); furthermore, if

, the Merton jump-diffusion models (JDM); furthermore, if  we get the regimeswitching version of GBM (RSGBM).

we get the regimeswitching version of GBM (RSGBM).

The evaluation of the characteristic function requires to compute matrix exponentials for which efficient numerical techniques are available; conversely, the case  can be considered explicitly (see [8] and the references therein).

can be considered explicitly (see [8] and the references therein).

4. Computing Results

In order to implement the optimal hedging strategy, we need to evaluate the VaR of the risky asset and the value of a put option. Both steps can be efficiently faced by means of Fourier methods. In this section we firstly outline such a technique and then we apply it to study numerically a model with two regimes and gaussian jumps.

4.1. Fourier Methods

Fourier transform methods are efficient techniques emerged in recent years as one of the main methodology for the evaluation of derivatives. Here we consider the technique introduced in [15] which consider the generalized Fourier transform with respect to the trigger parameter characterizing the payoff.

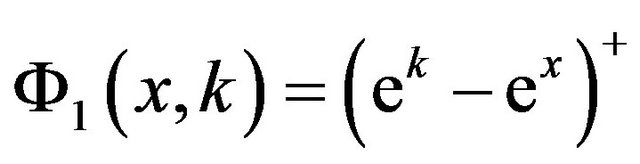

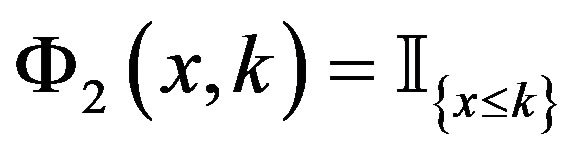

More formally, let  be the payoff at maturity of the derivative: for example,

be the payoff at maturity of the derivative: for example,  is the payoff of the put option. The no-arbitrage price is therefore given by

is the payoff of the put option. The no-arbitrage price is therefore given by

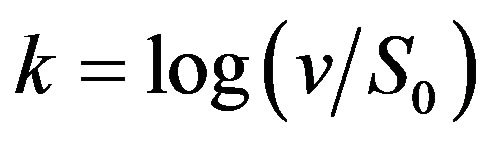

Due to the exponential structure of the underlying dynamic , it is convenient to represent the payoff with respect to the new variables

, it is convenient to represent the payoff with respect to the new variables  and

and , in such a way

, in such a way

.

.

Therefore, let us denote with  an arbitrary payoff function and with

an arbitrary payoff function and with  its generalized Fourier transform (GFT) w.r.t.

its generalized Fourier transform (GFT) w.r.t. , that is

, that is

under proper regularity conditions about the payoff and the Fourier transform of the underlying dynamic variables (see e.g. [16]), it can be proved that

in some strip of . Let us consider the payoff functions

. Let us consider the payoff functions

, and

, and , in such a way

, in such a way  and

and

, with

, with

. Their GFT w.r.t. the trigger parameter

. Their GFT w.r.t. the trigger parameter  are

are

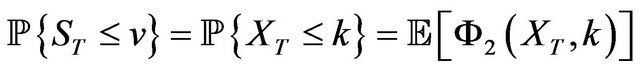

respectively. Hence we get the formulas

(17)

(17)

and

(18)

being the (generalized) Fourier transform, or characteristic function, of the random variable

being the (generalized) Fourier transform, or characteristic function, of the random variable  under the appropriate measure. If this is a regular functions in a properly defined strip of

under the appropriate measure. If this is a regular functions in a properly defined strip of , the transform method can be applied in both cases (see [16]). Since under the Assumption (2.1) the optimality condition is

, the transform method can be applied in both cases (see [16]). Since under the Assumption (2.1) the optimality condition is

the optimal hedging strategy is then implemented by running twice a root search algorithm to find the values 1)  such that

such that

(19)

(19)

2)  such that

such that

(20)

Numerical quadrature must be used for integral evaluation. Alternatively the FFT algorithm can be used to efficiently approximate integrals (see [16]) and then a standard root-finding routine will find the required solutions.

4.2. Some Numerical Results

We report some numerical results about the valuation of the optimal hedging strategy in the regime-switching jump-diffusion framework. An extended set of results can be found in [17]. All numerical procedures were implemented in the MatLab© framework. A standard rootsearch algorithm was used to solve Equations (19) and (20), with  and

and , together with the GaussLobatto quadrature for approximating the corresponding integrals. Few milliseconds were needed to get the required quantities on an Intel© Core i5.

, together with the GaussLobatto quadrature for approximating the corresponding integrals. Few milliseconds were needed to get the required quantities on an Intel© Core i5.

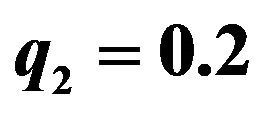

We consider a two-state regime switching version of the jump-diffusion model with gaussian jumps

,

,  , characterized by the parameters

, characterized by the parameters  and

and . The two state Markov chain

. The two state Markov chain  has generator

has generator .

.

The first issue we consider is the reduction of risk obtained by implementing the optimal hedging strategy in the RSJD framework. The risk reduction percentage

evaluated for different set of parameters range from 4.39% up to 58%, meaning that the strategy is effective in reducing the portfolio VaR, even in presence of jumps and regime-switching. On the other hand, by changing the value of some relevant parameters inside each model (GBM, JD, RSGBM, RSJD) the profile of the hedging portfolio VaR can change significantly. Hence we face the following issue: what is the effect of a wrong model specification which discards regime switchings and jumps, when they are indeed present in the market, and consider the simpler GBM model? In order to explore the model sensitivity of the optimal hedging strategy, we implemented the following exercise. We firstly fixed a RSJD model by choosing a complete set of parameters. Then we generated a set of call/put prices on which we calibrate the GBM model, finding the volatility

evaluated for different set of parameters range from 4.39% up to 58%, meaning that the strategy is effective in reducing the portfolio VaR, even in presence of jumps and regime-switching. On the other hand, by changing the value of some relevant parameters inside each model (GBM, JD, RSGBM, RSJD) the profile of the hedging portfolio VaR can change significantly. Hence we face the following issue: what is the effect of a wrong model specification which discards regime switchings and jumps, when they are indeed present in the market, and consider the simpler GBM model? In order to explore the model sensitivity of the optimal hedging strategy, we implemented the following exercise. We firstly fixed a RSJD model by choosing a complete set of parameters. Then we generated a set of call/put prices on which we calibrate the GBM model, finding the volatility  with a constrained non-linear leastsquares algorithm: hence we run the optimal hedging strategy obtaining

with a constrained non-linear leastsquares algorithm: hence we run the optimal hedging strategy obtaining  and correspondingly the minimal VaR,

and correspondingly the minimal VaR, . We finally calculated the probability

. We finally calculated the probability

under the RSJD model. This step requires to evaluate the integral in (18): as before, we use a Gauss-Lobatto quadrature algorithm. Results are shown in Tables 1 and 2.

Table 1. Optimal hedging strategy  under the simulated true model (first column), the fitted GBM model (second column—estimated volatility) and the corresponding value of

under the simulated true model (first column), the fitted GBM model (second column—estimated volatility) and the corresponding value of . Here

. Here ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

, ; furthermore

; furthermore ,

,  and the budget constraint is

and the budget constraint is .

.

Table 2. Optimal hedging strategy  under the simulated true model (first column), the fitted GBM model (second column—estimated volatility) and the corresponding value of

under the simulated true model (first column), the fitted GBM model (second column—estimated volatility) and the corresponding value of . Here

. Here ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

, ; furthermore

; furthermore ,

,  and the budget constraint is

and the budget constraint is .

.

Table 3. Optimal hedging strategy  under the simulated true model (first column), the fitted GBM model (second column—estimated volatility) and the corresponding value of

under the simulated true model (first column), the fitted GBM model (second column—estimated volatility) and the corresponding value of . Here

. Here ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

, ; furthermore

; furthermore ,

,  and the budget constraint is

and the budget constraint is .

.

Notice that even when the optimal strategies are similar, the probability that the portfolio loss exceeds the (optimal) VaR is greater than the fixed level . Of course this behavior depends on the choice of the parameters, but the underestimation produced by a wrong model choice can be quite severe: see Table 3, where parameters from a real data set were used (see [8]).

. Of course this behavior depends on the choice of the parameters, but the underestimation produced by a wrong model choice can be quite severe: see Table 3, where parameters from a real data set were used (see [8]).