1. Introduction

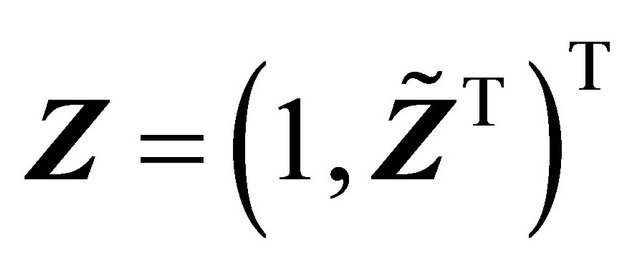

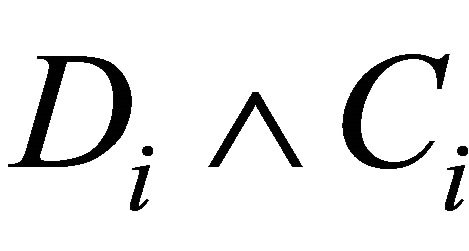

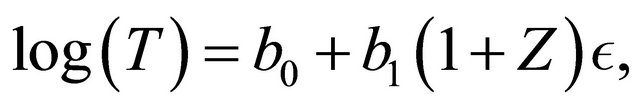

Quantile regression analysis has received increasing attentions in the recent literature of survival analysis. Compared with conventional regression models such as the proportional hazards (PH) model or the accelerated failure time (AFT) model, quantile regression models provide direct assessment of the covariate effect on different quantiles of the failure time variable. This model also allows covariates to affect both location and shape of the distribution. Let T be the failure time of interest,  be a

be a  vector and

vector and . Consider the following linear quantile regression model on

. Consider the following linear quantile regression model on , where

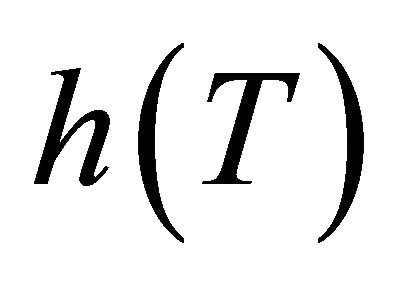

, where  is a known monotonic function, such that

is a known monotonic function, such that

(1)

(1)

where  and

and  is the

is the  th quantile of Y conditional on Z. Note that when we set

th quantile of Y conditional on Z. Note that when we set , model (1) is equivalent to

, model (1) is equivalent to  . Many papers for estimating

. Many papers for estimating  without specifying the distribution of

without specifying the distribution of  or

or  have appeared in the literature. [2-5] considered quantile regression analysis under a fixed censoring mechanism in which all the censoring times are observed. Independent right censorship has been assumed by many papers including [6-11].

have appeared in the literature. [2-5] considered quantile regression analysis under a fixed censoring mechanism in which all the censoring times are observed. Independent right censorship has been assumed by many papers including [6-11].

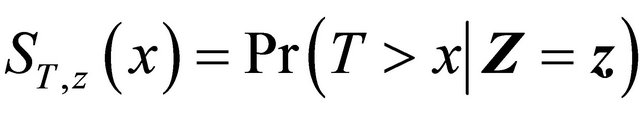

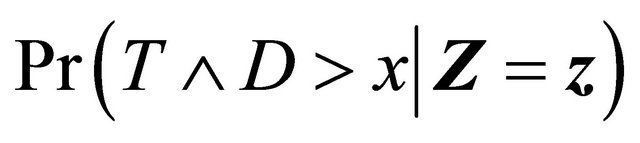

In this paper, we consider semi-competing risks data [12] in which the failure time of a non-terminal event T is subject to dependent censoring by a terminal event time D but not vice versa. Consider an example of bone marrow transplantation for leukemia patients described in [1] such that T is the time to leukemia relapse and D is the time to death. One important risk factor is the disease classification (i.e. ALL, AML low-risk, and AML highrisk) which was determined based on patient’s status at the time of transplantation. Here we assume that T, the time to a non-terminal event, follows model (1). Note that [13,14] also considered quantile regression analysis for competing risks data and left-truncated semi-competing risks data respectively. They defined the quantiles based on the crude quantity, namely the cumulative incidence function . In contrast, the proposed regression model (1) is defined based on the net quantity

. In contrast, the proposed regression model (1) is defined based on the net quantity  which is not identifiable without extra assumption on the dependence structure. There has been some controversy over which quantity should be used in presence of dependent competing risks. We believe that both quantities are important and not mutually exclusive as they provide information on different aspects of the data. Here

which is not identifiable without extra assumption on the dependence structure. There has been some controversy over which quantity should be used in presence of dependent competing risks. We believe that both quantities are important and not mutually exclusive as they provide information on different aspects of the data. Here  measures the covariate effect on T after separating the potential influence from D. Such analysis is also useful in practical applications. For example, a covariate may prolong D so that increase

measures the covariate effect on T after separating the potential influence from D. Such analysis is also useful in practical applications. For example, a covariate may prolong D so that increase  but have no direct effect on the nonterminal event. The dependence between T and D complicates the estimation of

but have no direct effect on the nonterminal event. The dependence between T and D complicates the estimation of . We will adopt a semi-parametric copula assumption to model their joint distribution and apply the technique of inverse probability weighting (IPW) to correct the bias due to dependent censoring in the estimation procedure. The association parameter in the copula model will also be estimated using existing methods.

. We will adopt a semi-parametric copula assumption to model their joint distribution and apply the technique of inverse probability weighting (IPW) to correct the bias due to dependent censoring in the estimation procedure. The association parameter in the copula model will also be estimated using existing methods.

The rest of this paper is organized as follows. In Section 2, we introduce the data structure and model assumptions. The proposed methodology for parameter estimation and model checking is presented in Section 3. The proofs of the asymptotic properties are given in the Appendix. Section 4 contains simulation results. In Section 5, we apply the proposed methods to analyze the bone marrow transplant data in [1] and in Section 6, we give some concluding remarks.

2. Data and Model Assumptions

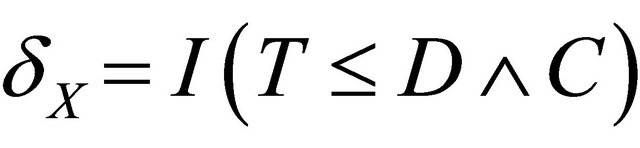

Recall that T and D denote the time to a non-terminal event and the time to a terminal event respectively such that T is subject to censoring by D but not vice versa. In presence of additional external censoring due to drop-out or the end-of-study effect, one observes  such that

such that ,

,  ,

,  ,

,  , where

, where  is the minimum operator and

is the minimum operator and  is the indicator function. The covariate vectors can be denoted as

is the indicator function. The covariate vectors can be denoted as  and

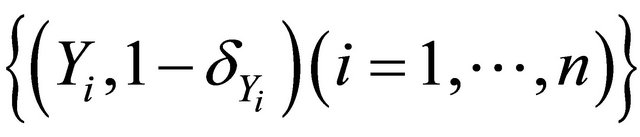

and . The sample Contains

. The sample Contains  which are random replications of

which are random replications of . We will assume that

. We will assume that  and C are independent given Z. The covariate effect on T is specified by model (1) and the major objective is to estimate

and C are independent given Z. The covariate effect on T is specified by model (1) and the major objective is to estimate  based on semi-competing risks data.

based on semi-competing risks data.

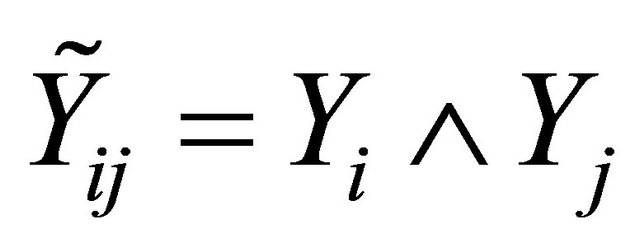

To handle dependent censoring, we have to make extra assumptions about the dependence structure between T and D in the upper wedge. According to [15] who extended Sklar’s theorem to the regression setting, we consider the following copula model

(2)

(2)

where ,

, and

and  are the marginal survival functions of T and D, given

are the marginal survival functions of T and D, given , and

, and  is a parametric copula function defined on the unit square. The association parameter

is a parametric copula function defined on the unit square. The association parameter  in (2) is related to Kendall’s tau defined by

in (2) is related to Kendall’s tau defined by

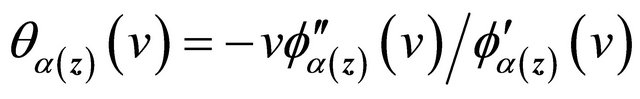

In particular, we will assume  in the upper wedge follows a popular subclass of copula models, namely Archimedean copula (AC), in which the copula function can be further expressed as

in the upper wedge follows a popular subclass of copula models, namely Archimedean copula (AC), in which the copula function can be further expressed as

(3)

(3)

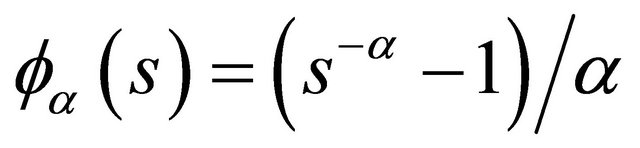

where  is a non-increasing convex function defined on

is a non-increasing convex function defined on  with

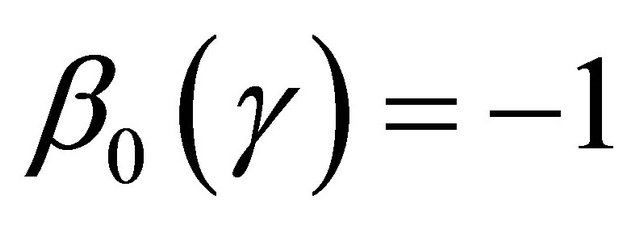

with . Examples of Archimedean copula include Clayton’s copula with

. Examples of Archimedean copula include Clayton’s copula with

and

;

;

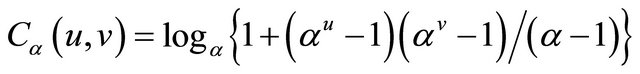

and Frank’s copula with

and

.

.

3. The Proposed Inference Methods

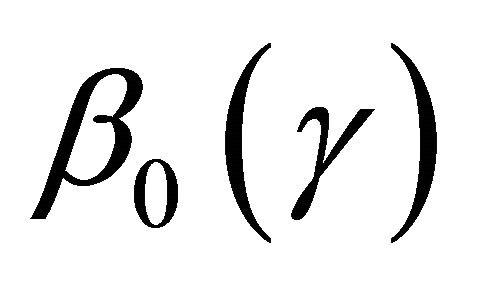

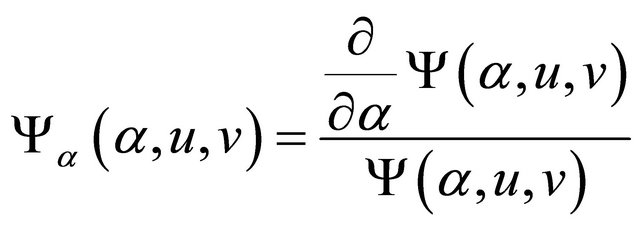

Our major objective is to develop an inference method for estimation  but, in the mean time, employ existing methods for estimating

but, in the mean time, employ existing methods for estimating  based on semicompeting risks data such as those proposed by [16] and [17].

based on semicompeting risks data such as those proposed by [16] and [17].

3.1. Estimation of  for Discrete Covariates

for Discrete Covariates

In absence of censoring, one can estimate  by solving

by solving

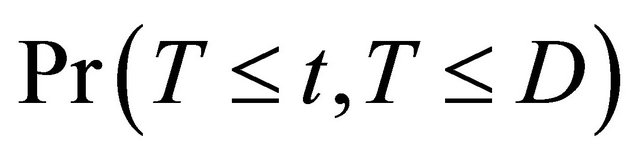

Since  is subject to censoring by

is subject to censoring by , it follows that

, it follows that

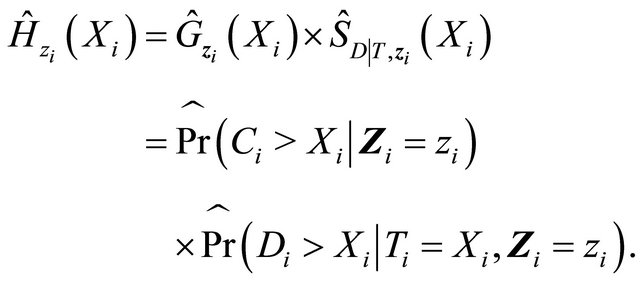

where the reciprocal of the weight function is given by

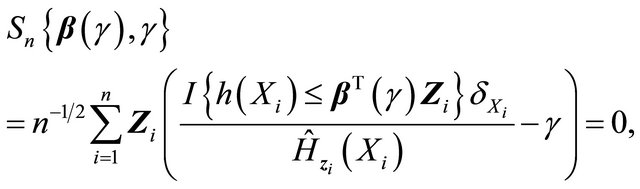

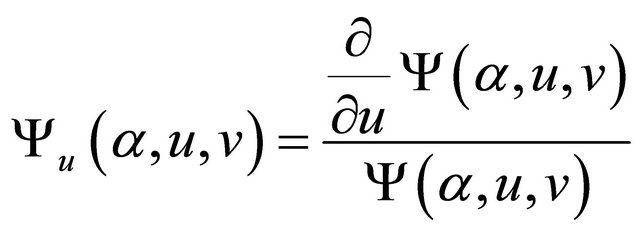

The above derivations yield the following estimating function for

This is the so called inverse probability weighting technique for bias correction. Since  needs to be estimated, it is natural to modify the estimating equation as

needs to be estimated, it is natural to modify the estimating equation as

(4)

(4)

where the estimated components in the weight can be denoted as

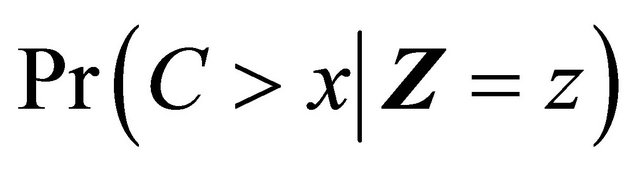

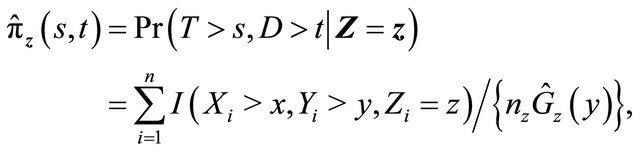

Now we discuss estimation of the weight components. We will first address the situation that Z takes discrete values, and then briefly discuss possible modification for continuous covariates. Since  is independent of T and D given Z,

is independent of T and D given Z,  can be estimated by the Kaplan-Meier estimator based on data

can be estimated by the Kaplan-Meier estimator based on data

or

or

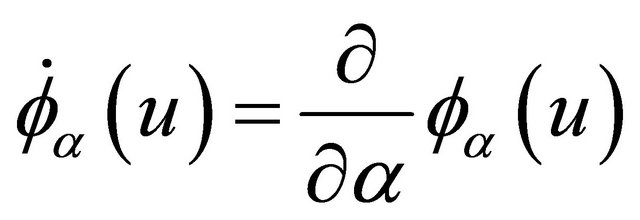

with . We will utilize some analytic properties of the chosen AC model to derive an explicit expression of

. We will utilize some analytic properties of the chosen AC model to derive an explicit expression of . Denote

. Denote ,

,

and

and

. It follows that

. It follows that

We suggest to estimate  by applying the estimators in [17] for quantities in the right-hand side of the above expression. Specifically

by applying the estimators in [17] for quantities in the right-hand side of the above expression. Specifically  is the Kaplan-Meier estimator of

is the Kaplan-Meier estimator of  based on

based on

, where

, where ,

,

is the copula-graphic estimator

is the copula-graphic estimator

where the estimator  is the root of the following estimating equation,

is the root of the following estimating equation,

where ,

,  ,

,  ,

,

,

,  ,

,  is a weight function,

is a weight function,  , and

, and

where . Then

. Then

(5)

(5)

This estimator is then used in estimating Equation (4).

The Equation (4) may not be continuous so that an exact solution may not exist. Here we define  as a generalized solution as in [13,18]. By the monotonic property of (4), the set of generalized solutions is convex. Using the arguments in [13], the solution of (4) can be reformulated as the minimizer of the following function,

as a generalized solution as in [13,18]. By the monotonic property of (4), the set of generalized solutions is convex. Using the arguments in [13], the solution of (4) can be reformulated as the minimizer of the following function,

where M is a large enough positive value to bound

and

and  from above.

from above.

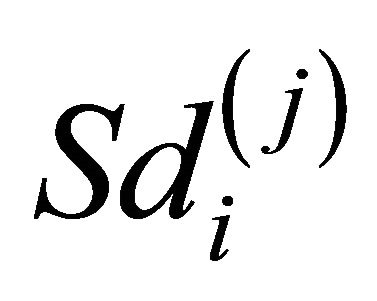

We suggest using a re-sampling approach for variance estimation since the analytic formula for the variance of  is complicated to calculate. Based on the nonparametric bootstrap approach, we can sample replications

is complicated to calculate. Based on the nonparametric bootstrap approach, we can sample replications  from the original data. Given a bootstrap sample, we can compute

from the original data. Given a bootstrap sample, we can compute . Repeating the re-sampling procedure B times, we obtain

. Repeating the re-sampling procedure B times, we obtain

and the variance of

and the variance of  can be estimated by

can be estimated by

where . Furthermore, we can construct the

. Furthermore, we can construct the  confidence interval for

confidence interval for  as

as

, where

, where , and

, and

is the cumulative distribution function of a standard normal random variable. The bootstrap percentile method suggests another way of constructing a  confidence interval of

confidence interval of  with the formula

with the formula

, where

, where ,

,

are the order statistics of  for

for .

.

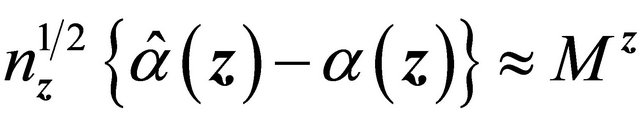

3.2. Asymptotic Properties for Discrete Covariates

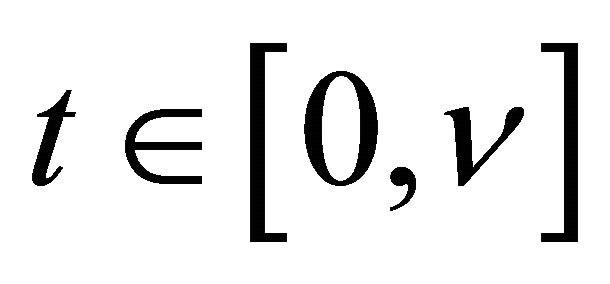

We establish the uniform consistency and weak convergence of the proposed estimator  for

for , a region that

, a region that  is identifiable. We first state the regularity conditions.

is identifiable. We first state the regularity conditions.

(C1) Denote the set of possible covariate Z values as  which is a compact set in

which is a compact set in . The probability density function

. The probability density function  for covariate Z is uniformly bounded above and below on

for covariate Z is uniformly bounded above and below on .

.

(C2) There exists a compact set  in the parameter space for the copula parameter

in the parameter space for the copula parameter  such that all true values of

such that all true values of  are interior points of

are interior points of  for all

for all .

.

(C3) There exists  such that

such that ,

,  ,

,  and

and

.

.

(C4) 1)  is Lipschitz continuous for

is Lipschitz continuous for ;

;

2) The density  is bounded above uniformly for

is bounded above uniformly for  and

and ; 3) The copula generator function

; 3) The copula generator function  has continuous derivatives

has continuous derivatives ,

,

,

,  ,

,  and

and  which do not equal 0 for all

which do not equal 0 for all  and

and .

.

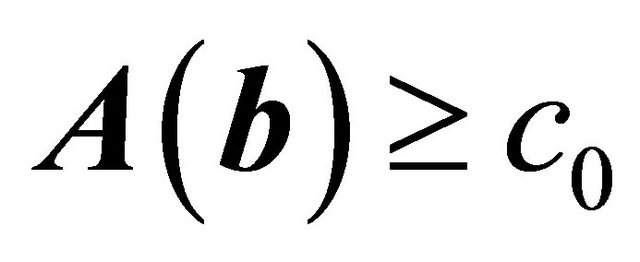

(C5)  eigmin

eigmin , for some

, for some

and , where

, where ,

,

and

and  for a vector u.

for a vector u.

Condition C1 assumes the boundedness of covariates and is satisfied for finite discrete covariates. This assumption is only used to derive the asymptotic properties of  for proving Theorem 1. Condition C2 assumes that the true value of

for proving Theorem 1. Condition C2 assumes that the true value of  is an interior point in the parameter space which is a common regularity condition. Condition C3 is assumed to simplify theoretical arguments similar to condition C1 in [13], and generally

is an interior point in the parameter space which is a common regularity condition. Condition C3 is assumed to simplify theoretical arguments similar to condition C1 in [13], and generally  is the study end time in practical applications. Conditions C4 1) and 2) assume the smoothness of coefficient processes, and the uniform boundedness on the density of T, which are standard for quantile regression methods. Condition C4 3) imposes the smoothness requirement on the copula generator function similar to the regularity conditions in [17,19]. Condition C5 is similar to condition C4 in [13] which ensures the identifiability of

is the study end time in practical applications. Conditions C4 1) and 2) assume the smoothness of coefficient processes, and the uniform boundedness on the density of T, which are standard for quantile regression methods. Condition C4 3) imposes the smoothness requirement on the copula generator function similar to the regularity conditions in [17,19]. Condition C5 is similar to condition C4 in [13] which ensures the identifiability of  and is needed for proving the consistency of

and is needed for proving the consistency of .

.

Therefore with finite , we prove the following result.

, we prove the following result.

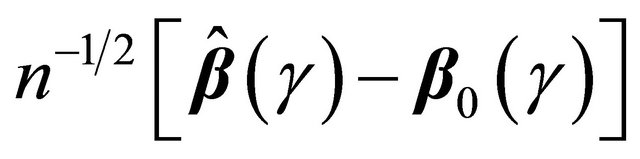

Theorem 1 If conditions C1-C5 hold, then

and

and  converges weakly to a meanzero Gaussian process.

converges weakly to a meanzero Gaussian process.

The detailed proofs are presented in the Appendix.

3.3. Model Checking and Model Diagnosis

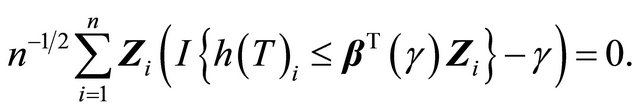

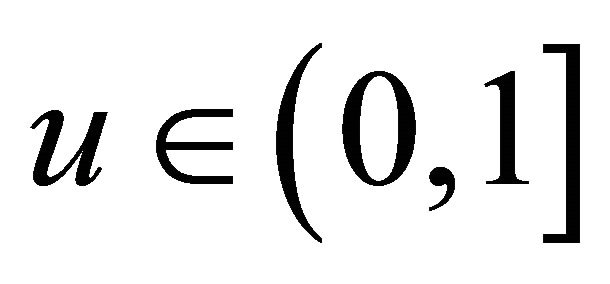

Motivated by the work of [20-22] in which complete data are considered, we define the residual quantities as

for  and consider

and consider

where  is a known bounded weight function. Similar to the arguments in [13,23],

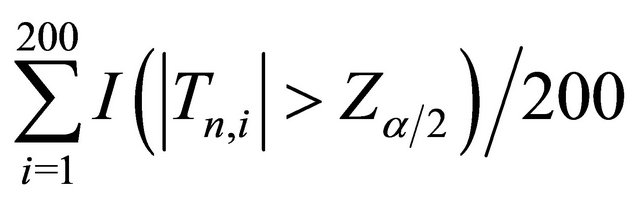

is a known bounded weight function. Similar to the arguments in [13,23],  converges weakly to a zero-mean Gaussian process if model (1) is specified correctly and the covariate takes discrete values. Therefore we propose the following test statistic

converges weakly to a zero-mean Gaussian process if model (1) is specified correctly and the covariate takes discrete values. Therefore we propose the following test statistic

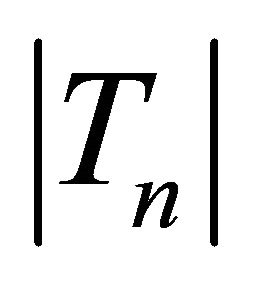

where  is an estimator of the standard deviation of

is an estimator of the standard deviation of  which can be obtained by applying the bootstrap approach mentioned earlier. Thus, we have that Tn converges to the standard normal random variable asymptotically as the model is correct. On the other hand, when the model is mis-specified, Tn will deviate from zero. Accordingly we can reject the model assumption if

which can be obtained by applying the bootstrap approach mentioned earlier. Thus, we have that Tn converges to the standard normal random variable asymptotically as the model is correct. On the other hand, when the model is mis-specified, Tn will deviate from zero. Accordingly we can reject the model assumption if , where

, where  is the quantile of

is the quantile of  and

and  is the level of significance. If there are K candidate models under consideration, we compute the absolute value of Tn for each model for

is the level of significance. If there are K candidate models under consideration, we compute the absolute value of Tn for each model for  and choose the one with the smallest value.

and choose the one with the smallest value.

3.4. Estimation for Continuous Covariates

We briefly discuss how to extend our estimation method for continuous covariates. One can apply a smoothing approach to estimate the probability functions conditional on z. Following [24], without loss of generality, assume that  and

and  are ordered. Let

are ordered. Let

where ,

,  is the bandwidth and

is the bandwidth and  is the kernel. Then

is the kernel. Then

where  are the rearrangement

are the rearrangement  sorted according to Wi, where

sorted according to Wi, where  and

and

, and

, and  is the copula-graphic estimator in [24]

is the copula-graphic estimator in [24]

(6)

(6)

and  solves estimating equation

solves estimating equation

Special techniques are needed to derive the asymptotic properties for the case of continuous covariates. For example properties of the smoothed versions of  and

and  are not fully available yet. The

are not fully available yet. The  convergence rate for the normality proof may not be directly extended since the smooth version of

convergence rate for the normality proof may not be directly extended since the smooth version of  may not be

may not be  asymptotic normal. However the estimator for the quantile regression parameter may still be

asymptotic normal. However the estimator for the quantile regression parameter may still be  asymptotic normal even when some component converges at a slower rate.

asymptotic normal even when some component converges at a slower rate.

4. Simulation Studies

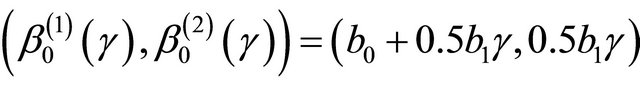

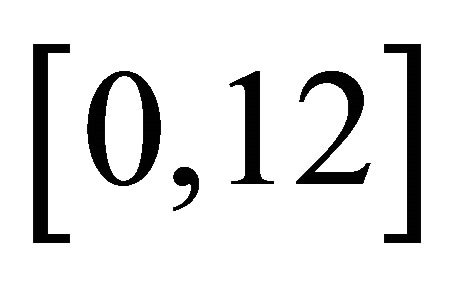

We conduct simulation studies to examine the finitesample performance of the proposed methods with R software. Here we consider two cases. For the first one, we consider the model,

(7)

(7)

where  and

and . We generate

. We generate  which follow the Clayton copula and Frank copula with

which follow the Clayton copula and Frank copula with  marginally following

marginally following  so that

so that , and D marginally following exp(2). For the second case, we consider

, and D marginally following exp(2). For the second case, we consider

(8)

(8)

where ,

,  and

and  generated from the Clayton copula and Frank copula with

generated from the Clayton copula and Frank copula with  following

following  and

and . In this case,

. In this case, . Three levels of association τ = 0.3, 0.5, 0.7 are considered. The censoring variable C follows a uniform distribution on

. Three levels of association τ = 0.3, 0.5, 0.7 are considered. The censoring variable C follows a uniform distribution on .

.

We evaluate the performances for γ = 0.1, 0.3, 0.5 and the sample size n = 100 based on 400 simulation runs. To obtain the standard error of the proposed estimator, we use the bootstrap method with B = 50. Based on the settings, we also present a naive estimator of , which is constructed under the wrong assumption that T is independently censored by

, which is constructed under the wrong assumption that T is independently censored by . That is, we estimate

. That is, we estimate  by solving the estimating Equation (4) with

by solving the estimating Equation (4) with

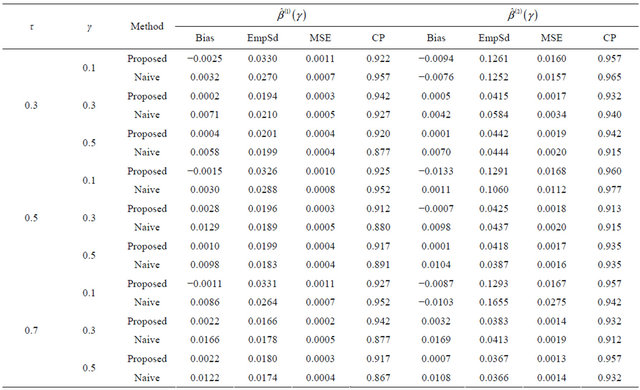

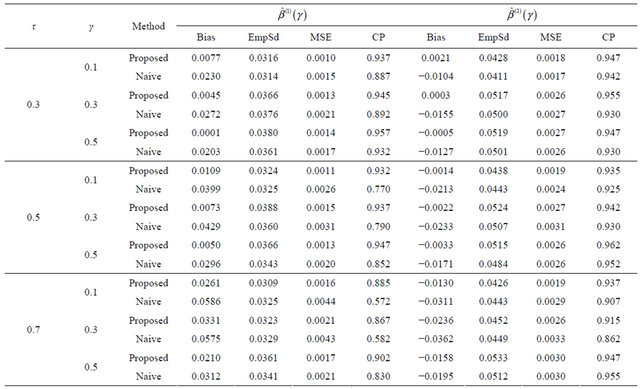

Tables 1-4 report the average bias of the proposed

Table 1. Finite-sample results for estimating the quantile regression parameters under model (7) with Clayton copula.

The results are based on 400 simulation runs each with a sample size 100.

Table 2. Finite-sample results for estimating the quantile regression parameters under model (8) with Clayton copula.

The results are based on 400 simulation runs each with a sample size 100.

Table 3. Finite-sample results for estimating the quantile regression parameters under model (7) with Frank copula.

The results are based on 400 simulation runs each with a sample size 100.

Table 4. Finite-sample results for estimating the quantile regression parameters under model (8) with Frank copula.

The results are based on 400 simulation runs each with a sample size 100.

point estimator,  , (Bias);

, (Bias);

the empirical standard deviation,

where

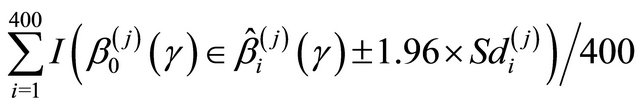

where , (EmpSd); the mean squared error, Bias2 + EmpSd2, (MSE); and the coverage probability of the 95% confidence intervals,

, (EmpSd); the mean squared error, Bias2 + EmpSd2, (MSE); and the coverage probability of the 95% confidence intervals,

where

where  is the estimated standard deviation of

is the estimated standard deviation of  by the bootstrap approach, (CP). From the results, we can see that our proposed estimator has much smaller bias and smaller mean squared error than the naive estimator. The confidence intervals coverage probabilities are close to the nominal level 95% in most cases while the naive estimator has the coverage rate far below the nominal level in many cases. Although the proposed estimator of

by the bootstrap approach, (CP). From the results, we can see that our proposed estimator has much smaller bias and smaller mean squared error than the naive estimator. The confidence intervals coverage probabilities are close to the nominal level 95% in most cases while the naive estimator has the coverage rate far below the nominal level in many cases. Although the proposed estimator of  has the coverage rate lower than 90% in the first case with Kendall’s tau τ = 0.7 but it still performs better than the naive estimator. As the sample size increases to n = 200 for that case (data omitted here), the coverage probabilities for proposed estimator become close to the nominal level while the coverage probabilities for the naive estimator get worse. This confirms that our estimator is asymptotically correct while the naive estimator is not.

has the coverage rate lower than 90% in the first case with Kendall’s tau τ = 0.7 but it still performs better than the naive estimator. As the sample size increases to n = 200 for that case (data omitted here), the coverage probabilities for proposed estimator become close to the nominal level while the coverage probabilities for the naive estimator get worse. This confirms that our estimator is asymptotically correct while the naive estimator is not.

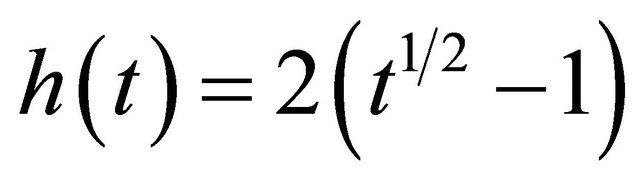

Then we examine the proposed model diagnostic method when the true model is generated from

where ,

,  , and

, and

so that

so that  and

and

follow Clayton copula with . We consider τ = 0.3, 0.5, 0.7 and γ = 0.1, 0.3, 0.5 under n = 100 based on 200 replications.

. We consider τ = 0.3, 0.5, 0.7 and γ = 0.1, 0.3, 0.5 under n = 100 based on 200 replications.

Three forms of transformation are fitted: 1)  ; 2)

; 2) ; 3)

; 3) . Table 5

. Table 5

presents the rejection probability where α = 0.05, and the probability that the fitted model is selected as the one which gives the smallest value of

where α = 0.05, and the probability that the fitted model is selected as the one which gives the smallest value of  among the three candidates. From the results, we see that when

among the three candidates. From the results, we see that when , the rejection probability (type-I error rate) is close to the specified level of α = 0.05. When the fitted model is wrong, the rejection probability (power of the test) is very high in most cases.

, the rejection probability (type-I error rate) is close to the specified level of α = 0.05. When the fitted model is wrong, the rejection probability (power of the test) is very high in most cases.

Table 5. Finite-sample results for the proposed model checking method.

Note: The sample size is 100 and replications are 200. “Power” = , where

, where . “Selection rate” is the proportion that the fitted model is selected as the one giving the smallest value of

. “Selection rate” is the proportion that the fitted model is selected as the one giving the smallest value of  among the three candidates.

among the three candidates.

Even for the case where the power is relatively low around 40% (the γ = 0.1 quantile for ), the probabilities of selecting the correct model are still high.

), the probabilities of selecting the correct model are still high.

5. Data Analysis

We apply the proposed methodology to analyze the bone marrow transplant data based on 137 leukemia patients provided by [1]. Patients were classified into three risk categories: ALL, AML low-risk, and AML high-risk based on their status at the time of transplantation. The covariates (Z1, Z2) are coded as ALL (Z1 = 1, Z2 = 0), AML low-risk (Z1 = 1, Z2 = 0), and AML high-risk (Z1 = 0, Z2 = 1). We want to investigate how the risk classification is related to the quantile of the relapse time. Specifically the fitted model is given by

(9)

(9)

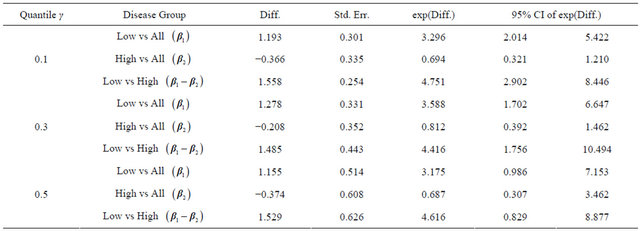

The results are summarized in the Tables 6 and 7 based on B = 1000 bootstrap replications. Table 6 contains the estimators and model checking tests with  . The p-value is the testing result by the model checking approach provided in SubSection 3.3. Since all the p-values are greater than 0.05, we adopt the model in (9) for further analysis.

. The p-value is the testing result by the model checking approach provided in SubSection 3.3. Since all the p-values are greater than 0.05, we adopt the model in (9) for further analysis.

From the analysis we see that patients of AML lowrisk had longer relapse time than those in the other two groups and the difference is more obvious for those with earlier relapse. For example, the 10% quantile of the relapse time in the AML low-risk group is 3.2964 times of that in ALL group and 4.751 times of that in AML highrisk group. The group differences are statistically significant for the 10% and 30% quantiles. but no longer significant for the 50% quantile.

6. Concluding Remarks

In this paper, we consider quantile regression analysis for analyzing the failure-time of a non-terminal event under the semi-competing risks setting. The Archimedean copula assumption is adopted to specify the dependency between the two correlated events. This assumption is utilized to calculate the weight for bias correction in the estimation of quantile regression parameters. Here we focus on the case of discrete covariates and derive the asymptotic properties of the proposed estimators. The bootstrap method is suggested for variance estimation. For checking the adequacy of the fitted model, a model diagnostic approach is proposed. Simulation results confirm that the proposed methods have good performances in finite samples. In the data analysis, we see that the risk classification is particularly influential for earlier relapse. The methodology can be extended to allow for continuous covariates by employing some smoothing techniques but the corresponding theoretical analysis is beyond the scope of the paper.

Table 6. Estimation of quantile regression parameters and model checking test based on the bone marrow transplant data.

Table 7. Comparison of leukemia relapse time for the three risk groups.

7. Acknowledgement

This paper was financially supported by the National Science Council of Taiwan (NSC100-2118-M-194-003- MY2).

Appendix: Proofs of Theorem 1

The proof follow the outline similar to the proof in [13]. The technical details need to be adjusted for dependent censoring which make things harder.

Define

For simplicity, we use  and

and  to denote supremum taken over

to denote supremum taken over ,

,  and

and  respectively.

respectively.

First, we show that  converges uniformly to

converges uniformly to

. Since

. Since  is finite,

is finite,  as

as

. Hence by [17],

. Hence by [17],  is consistent for

is consistent for  for all

for all . Using this and conditions C2, it implies that

. Using this and conditions C2, it implies that  with probability 1 for large enough n. From condition C3,

with probability 1 for large enough n. From condition C3,  and

and  converge to

converge to

and

and  uniformly for

uniformly for . Condition C4 (iii) together with conditions C1 and C3 ensure the uniform boundedness of the first two derivatives of

. Condition C4 (iii) together with conditions C1 and C3 ensure the uniform boundedness of the first two derivatives of  and

and  for

for  and

and

, same as the regularity condition in [19]. Hence as

, same as the regularity condition in [19]. Hence as , by [17] and [19],

, by [17] and [19],  also converges to

also converges to  uniformly for

uniformly for . Then there exists a number

. Then there exists a number  such that

such that  and

and  fall into

fall into  with probability 1 for large enough n and all

with probability 1 for large enough n and all  by condition C3 and the uniform convergence of the two estimators. Denote

by condition C3 and the uniform convergence of the two estimators. Denote . Condition C4 (iii)

. Condition C4 (iii)

implies that ,

,  and

and

are all uniformly bounded above for

are all uniformly bounded above for  and

and . Hence

. Hence

converges to

converges to

uniformly for  and

and . This result and the uniform convergence of

. This result and the uniform convergence of  imply the uniform convergence of

imply the uniform convergence of  for

for  and

and . Hence we have

. Hence we have

The function class

is Donsker because the class of indicator functions is Donsker and both  and

and  are uniformly bounded by conditions C1 and C3. Therefore, by Glivenko-Cantelli theorem,

are uniformly bounded by conditions C1 and C3. Therefore, by Glivenko-Cantelli theorem,  . Also

. Also

(1)

(1)

Then the consistency of  comes from the identifiability condition C5 using the arguments in the proof of Theorem 1 in [13].

comes from the identifiability condition C5 using the arguments in the proof of Theorem 1 in [13].

Similar to [13] the following lemma holds with the uniform boundedness of Z,  and

and  that comes from conditions C1, C3 (i) and C3 (ii).

that comes from conditions C1, C3 (i) and C3 (ii).

Lemma 1. For any positive sequence  satisfying

satisfying ,

,

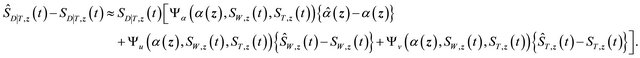

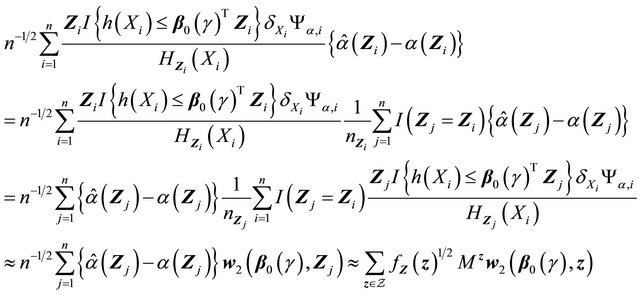

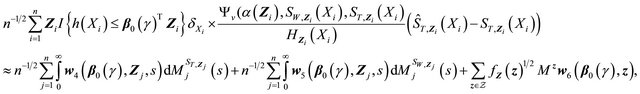

Now, we provide the proof for the asymptotic normality of . One can write

. One can write

From the uniform convergence and asymptotic weak convergence of  and condition C3, we have

and condition C3, we have  for any r > 0. Hence the above quantity is dominated by the first term

for any r > 0. Hence the above quantity is dominated by the first term . By Lemma 1 and the uniform convergence of

. By Lemma 1 and the uniform convergence of  to

to ,

,

where  denotes asymptotic equivalence uniformly in

denotes asymptotic equivalence uniformly in . Applying Taylor expansions for

. Applying Taylor expansions for  at

at , and using the uniform convergence of

, and using the uniform convergence of  to

to , we have

, we have

where . Since

. Since ,

,

(2)

(2)

It remains to prove the weak convergence of  to a zero-mean Gaussian process. It follows that

to a zero-mean Gaussian process. It follows that

The first two terms (I) and (II) can be proved to converge to zero-mean Gaussian processes by applying the arguments in [13] as follows. The family

is Donsker by the Lipschitz continuity of  (condition C4 (i)) and uniformly boundedness of

(condition C4 (i)) and uniformly boundedness of  and

and  (conditions C1 and C3). Thus, the first term

(conditions C1 and C3). Thus, the first term

converges weakly to a zero-mean Gaussian process.

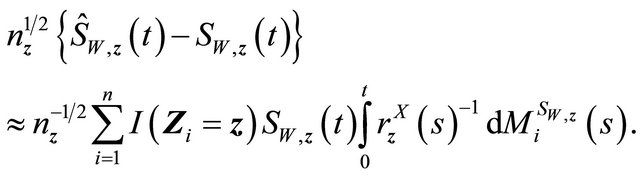

Denote  and

and  as the at-risk processes at time t. Let

as the at-risk processes at time t. Let

,

,

,

,

.

. .

.

Then  is a martingale.

is a martingale.

From martingale representation theory for univariate independent censoring,

So the second term can be written as

where .

.

From uniform boundedness of ,

,  and

and , it is easy to show that

, it is easy to show that

is Lipschitz in b. Then similarly

is Lipschitz in b. Then similarly  can be shown to be Donsker, and the second term also converges weakly to a zero-mean Gaussian process.

can be shown to be Donsker, and the second term also converges weakly to a zero-mean Gaussian process.

For the third term , recall

, recall

with . Denote

. Denote

,

,

and

.

.

So for ,

,

For notation brevity, denote

,

,

and

.

.

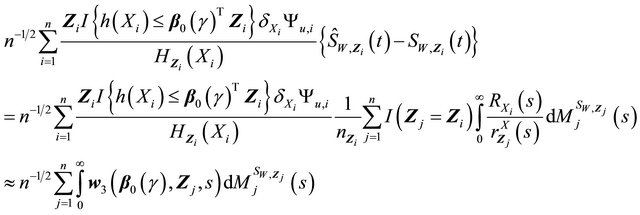

The third term becomes

Since  is finite,

is finite,  by condition C1 for all

by condition C1 for all . So

. So  with

with  follows a Gaussian distribution. Let

follows a Gaussian distribution. Let

Now term  is

is

which follows a Gaussian distribution by the boundedness of  and

and .

.

Denote

,

,

.

.

Denote

where

.

.

.

.

Then

is a martingale. Then

Now similar to the martingale expression for the second term , we have term

, we have term  as

as

where

.

.

Similar as (II) above,  is Lipschitz in b, and

is Lipschitz in b, and  is Donsker. Thus the term (B) converges weakly to a zero-mean Gaussian process.

is Donsker. Thus the term (B) converges weakly to a zero-mean Gaussian process.

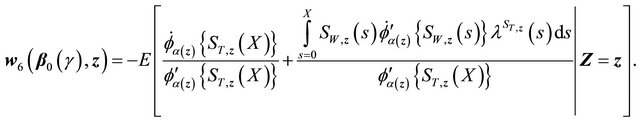

Finally, for term , let

, let

be the crude hazard function in [17],

.

.

.

.

Then

is a martingale. From [17], we have

where

Similar to terms (A) and (B), we have term (C) equals

where

Then each of the three terms in (C) can be shown to converge to zero-mean Gaussian process similarly as above.

Summarizing the results above,  converges weakly to a zero-mean Gaussian process. Hence (2) implies that

converges weakly to a zero-mean Gaussian process. Hence (2) implies that  converges weakly to a zero-mean Gaussian process for

converges weakly to a zero-mean Gaussian process for .

.