Nature of Controlling Stake, Manager Shareholding, and R&D Investment ()

1. Introduction

R&D investment is the key process of enterprise technology innovation, which is the main drive to improve the enterprise competitiveness (Dosi, 1988 [1] ; Ettlie, 1998 [2] ), and also the important conditions for enterprise sustainable development (Hamel and Prahalad, 1994) [3] . In modern companies with the segregation of ownership and control, the manager controls the strategic resources and takes the ultimate responsibility for the resource allocation, because of information asymmetry and incomplete contract in the decision of R&D investment; considering risk and earnings, there may exist opportunity behaviors, such as sacrificing the benefits of shareholders, reducing R&D investment and pursuing self-interests, etc. Agency theory proposes that proper compensation contract can harmonize the goals of the manager and shareholder, which facilitates to encourage the risky behaviors of the managers and prevent the opportunity behaviors of the managers (Jensen and Meckling, 1976 [4] ; Fama, 1980 [5] ). And the relationship between manager equity compensation and R&D investment is an especially hot topic among scholars. The research of Dechow and Sloan (1991) [6] , Cheng (2004) [7] , Li and Song (2010) [8] shows that CEO shareholdings and R&D investment are significantly positive correlated. The research of Wu and Tu (2007) [9] shows that the better the company performance, the greater positive effect of CEO share compensation on the R&D investment. The research of Liu and Liu (2007) [10] , Liu and Liu (2007) [11] , Su et al. (2011) [12] , Wang (2011) [13] shows that executive shareholding and R&D expenditure are significantly positive correlated. But the research of Zhang and Zhang (2007) [14] , Liu and Song (2010) [15] shows that CEO shareholding and R&D investment have no significant correlation. The research of Tang and Yi (2010) [16] shows senior manager shareholding promotes R&D expenditure, but the promotion is not significant when the shareholding ratio is relatively low, only when shareholding ratio reaches 0.1%, R&D intensity rises significantly.

The above literature review shows that though the research on the relationship between manager equity compensation and R&D investment are relatively abundant, the results are quite different. Besides the difference in countries selection, sample quantity and time window, the main reason is that most research ignores the difference in the enterprise nature of controlling stake, which may lead to error and inconsistency in conclusions. Therefore, this study takes the Chinese listed companies as samples and divides the samples into state controlled enterprises and non-state controlled enterprises based on nature of controlling stake, to analyze the effect of manager equity compensation on R&D investment under different nature of controlling stake. The conclusion of this study can further explore corporate governance and R&D investment theory, and also provide theoretical and decision support to optimize manager compensation contract and correct R&D underinvestment for modern companies. The study contains background, theoretical analysis and research hypothesis, research design, empirical results and analysis, robust testing and research conclusions, etc.

2. Background

Since 1978, Chinese economy has reformed from planned economic system to market economic system. As the gradual establishment of market economy system and the further reformation of state-owned enterprise, in order to improve the profitability and competitiveness of state-owned enterprise, motivate managers and reduce agency cost, the Chinese Government reformed the motivation mode of the state-owned enterprise in five stages.

Firstly, the stage of the exploration and establishment of annual salary system. After the reform and opening- up, the Chinese government started market orientation enterprise reform, and performance related pay has emerged in the manager remuneration design in state-owned enterprises. Up to 1997, the annual salary system of state-owned enterprise executive has been the most important remuneration arrangement, but the annual salary was based on accounting performance, which was used to measure the company’s short term performance, and the short term performance was inclined to lead the short term investment decision, and might be contradict with the aim of shareholder wealth maximization. The drawbacks of short term incentives based on accounting performance became more apparent over longer time, which severely restricted the enterprise creativity and competitiveness.

Secondly, the exploration stage of managers equity incentives. Since 1997, the business community began to pilot reform of equity incentive for the managers, and Shanghai pioneered to trail the CEO equity incentives, and followed by Wuhan, Zhejiang, Beijing, and Tianjin, etc.

Thirdly, the establishment stage of equity incentive system. On the basis of practice and theoretical exploration, equity incentives was acknowledged and established by the government policies. In August 1999, the “Decision of the CPC Central Committee and the State Council on Strengthening Technical Innovation, Developing High Technology and Realizing Industrialization” proposed that permitting and encouraging technology and management and other production factors to participate in earning distribution, and piloting in some high-tech companies to take a certain percentage of increase in state-owned net asset as share to reward employees with outstanding contributions especially technology employees and the managers. In the same year, the “Decision of the CPC Central Committee on the Major Issue Concerning the Reform and Development of State-owned Enterprise” stressed once again “establish and improve the motivation and restriction mechanism for the managers in state-owned enterprise. Implement performance related pay, and continue to trial manager (director) annual salary in some enterprises and share option and other distribution methods to sum up experience timely”.

Fourthly, the imperfection stage of manager equity incentives system in state-owned enterprises. On September 9, 2005, SASAC issued “the related issues on stated owned equity in the reform of non-tradable shares in listed companies”, which pointed out that the state-owned listed companies which had completed non-tradable share reform could explore to implement management equity incentives. On December 31, 2005, China Security Regulatory Commission issued “The management of Equity Incentives in Listed Companies (Trial)”, allowing granting restrictive shares and share options to executives in listed companies, proposing restrictive shares and share options as the main ways of equity incentives, and defining the implement procedures and information disclosure requirement for equity incentives. The Company Law (2006) which became operative as of January 1, 2006 stipulated that the senior managers could transfer no more than 25% of the shares of its own company which he held during his tenure, and excluded legal obstacles for the implements of share options. On March 1 2006, “The Trial Scheme for the Implementation of equity incentives in Oversea State-owned listed Companies”, which was jointly issued by SASAC and Ministry of Finance, became operative. However, since the imperfection of related regulations relating manager equity incentives, alienation appeared in equity incentives in practice, a few managers abused the loopholes and defects in regulation, which led to the losses of state- owned assets. Perhaps for the controversy and fear of state-owned assets losses, equity incentives have always been shambling in state-owned enterprises reform.

Fifthly, the adjusted stage for manager compensation. The 2008 US subprime mortgage crisis triggered a global financial crisis. When reflecting the roots of financial crisis, managers remuneration was attacked as the main targets, and since then the restriction on manager’s high remuneration has been sweeping the globe from the US. In the background of global restriction on manager salary, and combined with the public criticism on the state-owned enterprise manager’s astronomical salaries, on August 17, 2009, the Ministry of Human Resources and Social Security of the PRC, in conjunction with the Organization Department of the CPC Central Committee, Ministry of Supervision, Ministry of Finance, Audit Commission, SASAC and other units, jointly issued the “Guiding opinions on Further Regulating the Remuneration of Central Government Owned Enterprises Executives”, which was also called “Remuneration Restriction Order on Executives of Central Government Owned Enterprises” by the public. Since then, equity incentives in state-owned and state-controlled enterprises were in a standstill.

At present, the manager shareholding ratio in state controlled listed companies is relatively low, and there are more enterprises in which managers have no shares. In non-state controlled listed companies, the shareholding ratio ranges in a relative large scope, generally shareholding ratio of the managers who are the founder is higher, and the shareholding ratio of the managers who are recruited in the manager’s market is lower. Therefore, considering the self-interest maximization, different nature of controlling stake and managers with different shareholding ratio may have different influence on R&D investment. Based on this, the research on the influence of manager’s equity remuneration on R&D investment in different nature of controlling stake enterprises, is of important theoretical and practical significance.

3. Theoretical Analysis and Research Hypothesis

R&D investment is an important drive to improve company innovation ability and competitiveness, however, in modern companies in which the ownership and management are separated, R&D investment may cause the interests conflicts between shareholders (the principals) and managers (the agents) (Du and Lin, 2011) [17] , mainly because the R&D investment has high risk profile, hysteretic nature in income and high profitability feature, etc. Firstly, R&D investment is of high risk. Although innovation is an effective means to maintain competitive advantage, R&D investment cannot assure its commercial success, because the results of R&D are uncertain, also R&D is high risky1. An unsuccessful research attempt may lead to the company assets impairment, and even lead the company to bankrupt and other huge losses (Martin et al., 2007) [18] , and thus this may damage the manger’s career reputation and income ability (Fama, 1980) [5] . Secondly, the income from R&D investment has hysteretic nature, because it takes a long time from research to development and then to commercialization of technological achievements. Regarding to the accounting treatment of R&D expenditure, “the Financial and Accounting [2006] No. Three” issued by China in 2006 provides that all expenses in enterprise internal research stage should be recorded into current profit and loss when they occur; expenses in development phase cannot be capitalized and recognized as intangible assets unless they meet five conditions at the same time. This shows that R&D investment cannot bring current profit for the company and even reduce current profit for the company. Thirdly, R&D investment has the feature of high profitability. Although R&D investment is highly risky, once R&D investment is successful, it will lead to significant monopolistic incomes. Technological innovation theory believes that R&D investment can improve corporate technological innovative ability (Tsai, 2004) [19] , form blocking mechanism with market competition obstacle (Srivastavae et al., 1998) [20] , obtain competitive advantages different from other competitors and improve enterprises profitability (Calantone et al., 2002) [21] . In short, considering corporate performance, R&D investment is the exchanging process for future long term performance at the expense of short term performance; for manager, R&D investment is selection process for future risk premium compensation at the expense of risk and short term compensation (Liu, 2014) [22] . Based on the consideration of R&D investment’s influence on their own short term and future remuneration, as rational economic human, managers have the selection behaviors of pursuing self-inter- ests maximization; whether managers pursue or avoid high risky R&D investment, depends on the managers’ remuneration design, which directly influence manager’s selection behavior on R&D investment.

Mangers’ equity compensation has comparably complex influence on R&D investment intensify, and its influence relationship mainly depends on the manager’s shareholding ratio. Interest convergence hypothesis believes that equity compensation makes manager own shares, managers with “golden handcuffs” naturally form interests alliance with shareholders (Mehran, 1992) [23] and achieve interests convergence (Jense and Meckling, 1976) [4] ; equity compensation prompts managers pursuing opportunities more actively, and making high risk investment to get high potential return (Liu and Wen, 2013) [24] , equity compensation is a strong tool to connect manager’s remuneration and long term profitability (Martin et al., 2013) [25] , therefore, equity compensation can motivate mangers to add R&D investment. Managerial entrenchment hypothesis believes that with the increase of manager shareholding ratio, manager control increases, which makes manager be more inclined to empty the companies (Fama and Jensen, 1983) [26] ; when managers’ shareholding ratio reaches to a certain control over the company, which cannot alleviate the agency problem of insufficient of R&D investment, and can also increase the self-interests behavior of reducing R&D investment. The comprise opinion between interest convergence hypothesis and managerial entrenchment (that is range effect hypothesis) believes that management shareholding ratio is not linear with cooperate value but changes in different ranges. R&D investment is an important drive in corporate value creation, therefore there may be range change relationship between management shareholding ratio and R&D investment, that is in R&D investment, there may be different interest convergence effect and managerial entrenchment effect for different management shareholding ratio.

At present, in state-controlled enterprises, management shareholding ratio is relatively low, and there are many “zero” shareholding enterprises, manager shareholding ratio doesn’t has managerial entrenchment effect and possibly has interest convergence effect; while in non-state-controlled enterprise, manager shareholding ratio is comparably in a large scope, and management shareholding may have “range effect” on R&D investment, which presents nonlinear relationship. Based on the above analysis, this paper proposes the following hypothesis:

H1: In state-controlled enterprises, managers’ equity compensation is positively correlated with company R&D investment.

H2: In non-state-controlled enterprises, managers’ equity compensation is nonlinear correlated with company R&D investment.

4. Study Design Selection

4.1. Model Design and Variable

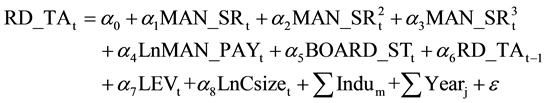

(1)

(1)

In Equation (1), the explained variable is the proportion of current R&D expenditure in total assets at the end of the current period (RD_TAt); the test variables are manager shareholding ratio in current period (MAN_SRt), managers’ shareholding ratio square in current period  and managers’ shareholding ratio cube in current period

and managers’ shareholding ratio cube in current period ; the control variables are the managers’ annual salary in the current period, the ratio of non-executive director in the board, the percentage of last R&D expenditure in total assets, financial leverage, the total operating income in the current period, year variable and industry variable.

; the control variables are the managers’ annual salary in the current period, the ratio of non-executive director in the board, the percentage of last R&D expenditure in total assets, financial leverage, the total operating income in the current period, year variable and industry variable.

The name, symbol and definition of each variable are shown in Table 1.

Explained variables: This paper uses indicator design of Liu and Liu (2010) [10] , Liu (2014) [22] , and chooses the percentage of current R&D expenditure in total assets. In robustness test, R&D investment intensity uses the indicator design of Liu (2014) [22] and selects percentage of current R&D expenditure in operating income (RD_ORt) to measure R&D investment intensity.

Test variables: In order to test whether the manager shareholding ratio has “range effect” influence relationship on R&D investment, this paper uses the indicator design of Liu (2014) [22] , and introduces three variables, including manager shareholding ratio (MAN_SRt), shareholding ratio square  and shareholding ratio cube

and shareholding ratio cube .

.

Control variables: 1) In selecting manager annual salary variables, this paper uses the indicator design of Liu (2014) [22] and chooses natural logarithm of the manager annual salary in current period (Ln MAN_PAYt) to eliminate differentiation; 2) Research both in domestic and abroad indicates that corporate governance has influence relationship on R&D investment2, therefore, this paper introduces the ratio of non-executive director (BOARD_STt) as corporate governance variables; 3) For the continuity of R&D investment, R&D investment in current period is affected by R&D investment in last period; therefore, this paper introduces R&D investment in last period (RD_TAt-1) as R&D investment inertia variable; 4) For the high risk nature of R&D investment, generally enterprises prefer low debt ratio in capital structure to reduce risk, therefore this paper introduces financial leverage variables; 5) Research both in domestic and abroad indicates that company size has influence relationship on R&D investment, therefore this paper introduces company size variable in the model (LnCsizet); 6) In order to discover the influence relation of technology development in different industry and economic condition in different years on R&D investment, we control the industry (Induk) and year (Yearj).

4.2. Sample Selection and Data Source

The study samples in this paper come from Shanghai and Shenzhen A-share listed companies of China during

![]()

Table 1. Name, symbol and definition of variable.

2007-2012, based on which we make a rational screening. The procedures are listed as follows: 1) get rid of financial companies; 2) get rid of ST company and *ST company as ST company and *ST company’s business activities and financial activities may have abnormal variation; 3) in order to inspect the hysteresis effect of R&D investment, select listed companies that disclosed R&D for two consecutive years and get rid of listed companies with data missed; 4) for major continuous variables, detect whether they have abnormal values with box plots and Winsorize those variables with abnormal values. Finally, there are 943 samples in total; classify them by nature of controlling stake of the company into 523 state-controlled enterprises and 420 non-state-con- trolled enterprises. Other data come from CSMAR database and WIND database as well as the websites designated by CSRC, Sina Finance, CNINFO and China Securities Journal, etc. We draw part of the sample data to check with the annual report of listed companies and correct wrong data.

5. Empirical Results and Analysis

5.1. Descriptive Statistics and Sample Difference Test

The descriptive statistics of the main variables in this paper are shown in Table 2.

As shown in Table 2, 1) Among whole sample enterprises, the mean value and median value of management shareholding ratio are 0.056 and 0.000 separately, and the mean value and median value of management shareholding ratio in state-controlled enterprises are 0.005 and 0.000 separately, which are far less than the average value (0.120) and median value (0.050) of management shareholding ratio in non-state-controlled enterprises; The average value and median value of the natural logarithm of manager total remuneration in current period of the whole sample enterprises is 13.939 and 12.929, and the average value and median value of the natural logarithm of manager total remuneration in current period of the state-controlled enterprises is 14.012 and 14.045, which are greater than the average value (13.846) and median value (13.828) of the non-state-controlled enterprises, which means that in state-controlled enterprises the annual salary makes the larger proportion in manager’s compensation contract design; 2) There are great differences between state-controlled enterprises and non- state-controlled enterprises in manager compensation contract design; state-controlled enterprises emphasis annual salary, while non-state-controlled enterprises take into account both annual salary and equity compensation, which is mainly because the manager remuneration contract design in state-controlled enterprises is influenced by the government intervention, and the manager remuneration contract design in non-state-controlled enterprises is influenced more by competition in manager market; 3) Among the whole sample enterprises, the average value and median value of the R&D intensity in current period are 0.026 and 0.013 separately, and among the state-controlled enterprises, the average value and median value of the R&D intensity in current period are 0.028 and 0.017, which are lower than the average value (0.028) and median value (0.017) separately, which means that compared with non-state-controlled enterprises, the corporate governance mechanism (including man- ager compensation incentive mechanism) of state-controlled enterprises is not conducive R&D investment. In order to test whether there are significant difference in the sample variables between state-controlled enterprises and non-state-controlled enterprises, this paper uses T test and Mann-Whitney U test to test the main variables of the sample enterprises; for test results, see Table 3. As shown in Table 3, there do exist significant differences between main variable of the state-controlled and non-state-controlled enterprises.

![]()

Table 2. The descriptive statistics of the main variable.

![]()

Table 3. T Test and mann-whitney U test of the main variables in state-controlled and non-state-controlled enterprises.

Note: Z value represents a significant degree; P value indicates significance level corresponding to the Z value; *, **represents significant level at 0.01 and 0.05 respectively, two-tailed test.

5.2. Regression Result and Analysis

The regression results are in Table 4, there are significant differences between state-controlled and non-state- controlled enterprises, and therefore this paper analyzes the state-controlled and non-state-controlled enterprises separately.

In model 2 and model 3, the regression coefficient of influence relation of management shareholding ratio(MAN_SRt) on R&D investment intensity(RD_TAt) is positive in state-controlled enterprises and significant at 10% level; the regression coefficient of influence relation of management shareholding ratio square  on R&D investment intensity(RD_TAt) is negative in state-controlled enterprises, but the influence relation is not significant; the regression coefficient of influence relation of management shareholding ratio cube

on R&D investment intensity(RD_TAt) is negative in state-controlled enterprises, but the influence relation is not significant; the regression coefficient of influence relation of management shareholding ratio cube  on R&D investment intensity(RD_TAt) is positive in state-controlled enterprises, but the influence relation is not significant; which means management shareholding ratio has interest convergence effect, it may be because the management shareholding ratio is comparably low, and doesn’t reach to degree of control the enterprise to seek person gains, hypothesis 1 passes the test, that is in state-controlled enterprises, managers’ equity compensation is positively correlated with company R&D investment.

on R&D investment intensity(RD_TAt) is positive in state-controlled enterprises, but the influence relation is not significant; which means management shareholding ratio has interest convergence effect, it may be because the management shareholding ratio is comparably low, and doesn’t reach to degree of control the enterprise to seek person gains, hypothesis 1 passes the test, that is in state-controlled enterprises, managers’ equity compensation is positively correlated with company R&D investment.

In model 4 and model 5, the regression coefficient of influence relation of management shareholding ratio(MAN_SRt) on R&D investment intensity(RD_TAt) is significant positive in non-state-controlled enterprises at 5% level; the regression coefficient of influence relation of management shareholding ratio square  on R&D investment intensity(RD_TAt) is significant negative in non-state-controlled enterprises at 10% level; the regression coefficient of influence relation of management shareholding ratio cube

on R&D investment intensity(RD_TAt) is significant negative in non-state-controlled enterprises at 10% level; the regression coefficient of influence relation of management shareholding ratio cube  on R&D investment intensity(RD_TAt) is significant positive in non-state-controlled enterprises at 10% level; which means in non-state-controlled enterprises, management shareholding ratio has range effect on R&D investment: when management shareholding ratio is in [0, MAN_SR1), [MAN_SR1, MAN_SR2) and [SR2, 0.351], the influence relation of management shareholding ratio on R&D investment intensity is positive, negative and positive separately, that is “N” shape relation, H2 passes the test, that is in non-state-controlled enterprises, managers’ equity compensation is nonlinear correlated with company R&D investment.

on R&D investment intensity(RD_TAt) is significant positive in non-state-controlled enterprises at 10% level; which means in non-state-controlled enterprises, management shareholding ratio has range effect on R&D investment: when management shareholding ratio is in [0, MAN_SR1), [MAN_SR1, MAN_SR2) and [SR2, 0.351], the influence relation of management shareholding ratio on R&D investment intensity is positive, negative and positive separately, that is “N” shape relation, H2 passes the test, that is in non-state-controlled enterprises, managers’ equity compensation is nonlinear correlated with company R&D investment.

5.3. Robustness Test

To test reliability of above study conclusion, on the basis of the above model, this paper replaces ratio of current R&D expenditure in total assets at the end of current period (RD_TAt) indicator with ratio of current R&D expenditure in current operating revenue (RD_ORt) indicator. Make econometric regression for whole sample enterprise, state-controlled enterprise and non-state-controlled enterprise of Shanghai and Shenzhen A-share listed companies in China during 2007-2012, the regression results are shown in Table 5. Regression result is basically consistent with above study conclusion, which means that above study conclusion has strong robustness.

6. Conclusions and Implications

The study samples in this article come from Shanghai and Shenzhen listed companies of China during 2007- 2012. With multivariate regression analysis and ordinary least square, this paper studies the influence relationship of manager’s equity compensation on R&D investment in different nature of controlling stake enterprises.

![]()

Table 4. The regression result of manager’s equity compensation influence on R&D investment in companies.

Note: t statistics in parentheses, *p < 0.1, **p < 0.05, ***p < 0.01.

![]()

Table 5. The regression result of manager’s equity compensation influence on R&D investment in companies.

Note: t statistics in parentheses, *p < 0.1, ** p < 0.05, ***p < 0.01.

The study finds that in state-controlled enterprises, the manager’s equity compensation has significant positive influence on R&D investment; while in non-state-controlled enterprises, the manager’s equity compensation has significant “N” shape influence relationship on R&D investment.

The conclusion of this paper has important implication on optimizing manager equity contract design and correcting company R&D underinvestment; scientific manager equity contract design is an important system arrangement in motivating manager to increase R&D investment and is the drive to increase the company R&D investment intensity. Through the above analysis, it is not difficult to find that, in state-controlled enterprises, in order to fully explore manager equity incentive on R&D investment, we should accelerate manager shareholding plan, reduce executives “zero shareholding” companies, appropriately increase manager shareholding ratio, and achieve convergence with shareholder objectives; in non-state-controlled enterprises, we should scientifically design and control management shareholding ratio, prevent manager to reduce R&D investment and opportunity behaviors such as pursuing short term performance.

Acknowledgements

This paper is supported by the National Social Science Fund of China (No.13BGL051; No.14BGL037), Ministry of Education in China Project of Humanities and Social Sciences (No.11YJA630070), and Aeronautical Science Foundation of China (No.2013ZG 55030).

NOTES

1Clayton stated in the book

that above 75% investment in product development failed commercially.

![]()

2Chung et al. (2003) found that external independent director ratio was positively correlated with enterprise R&D investment intensity; Zhang and Zhang (2007) found that independent director had significant positive influence on R&D investment.