The Rent in Capitalism since Keynes General Theory and the Euthanasia of the Rentier: The European and the Greek Economies as Case-Studies ()

1. Introduction

Economists drafted: 1) the so-called macroeconomics, due to Keynes (1883-1946) GT, dealing with the economic variables concerning an entire economy, open or closed, and 2) the microeconomics, dealing with the individual units—firms or consumers—performing in an Economy. However, competition was the characteristic, which attracted the attention of economists at a very early stage. We imagine Economists to ask: “what is the type of market in which the firms will produce ideally?”. They found out—helped by the emerging at that time “marginal analysis”—that the system where the price equals (marginal) cost of production, including a “normal” profit1 is the best!

Unfortunately, the above was an ideal conclusion, addressed to… “Ideal people”! Thus, people left since then, with, at least, a target, which is to try to achieve “Perfect Competition” in all markets, where P = MC! Thus, economics can be defined as a theory about “how the consumers will be treated fairly by the firms”!

The countries deal with the sale of goods and services to other countries—called exports—(EU e.g. exported a rather low 56% of its GDP2022), and with the purchase of goods and services from other countries-called imports, and the transfer of capital from one country to the other (DFI).

The international economic system, we believe, has to be one of cooperation and trade, where one open country to help the others towards a mutual benefit. This, we believe, is not happening yet in the EU-27, the G8, and in the G20, to the extent desired, let alone the frequent local wars...

We all are aware, e.g. about the impact of China’s development, which is now delayed, or fallen, due to the GFC (global financial crisis) starting from USA in end-2008 (Figure 1).

As shown, the GFC, in 2008, and thereafter, reduced China’s GDP growth from 15% to nearly 2%, something which had also a serious impact on the rest of the world, and on Germany’s economy! The estimated growth rates by Nikkei are, however, higher for 2023-2024, as shown.

As far as the worldwide creation of economists/professors is concerned, UK created, first, great ones—USA2 created them later. UK created: Adam Smith

![]()

Figure 1. China’s approximate growth of GDP, 2000-2024 (estimated.)

(1723-1790), Alfred Marshall (1842-1924) and John M Keynes (1883-1946). Smith is considered as the father of economics; Marshall is considered as establishing the “ECONOMIC analysis”, and Keynes is considered as establishing “macroeconomics”, as mentioned.

Aim and Structure of the Paper

We aim at evaluating Keynes’ “reaction”—in GT—on the “Rent in Capitalism”, with case-studies on the economies of Greece and of EU-22. Interesting is also in dealing with a political question, which emerged when asking: whether the EU-22 prefers to have rich companies or rich “Rentiers” or rich Governments (more taxes). Unfortunately, in the EU-22, the policies on this question differ! Latvia and Estonia, e.g. followed by Greece, seem to prefer rich Rentiers, while Hungary and Ireland seem to prefer rich companies! Portugal, however, seems to “prefer” a rich Government!

The paper is organized into 13 parts, as follows, after literature review: Part I dealt with Keynes’ Legacy; Part II dealt with the stock exchange; Part III dealt with the “joint stock company” and the “separation of control from ownership”; Part IV dealt with Keynes’ macroeconomics; Part V dealt with Keynes’ argument that the “effective demand” determines “full employment”; Part VI dealt with the various “employers” in a capitalist economy; Part VII dealt with the impact of a possible reduction in the interest rate; Part VIII dealt with the “Krimpas-Asimakopulos Model”; Part IX dealt with Keynes “investors”; Part X dealt with the Greek and EU-22 economies; Part XI dealt with so-called “financialization”; Part XII dealt with the Greek economic policy; Part XIII dealt with the new phenomenon known as “greed inflation”; finally, we concluded.

2. Literature Review

Kregel (1971: p. 173) argued that the existence of “Rent” in an economy increases real wages—given the J Robinson’s studies—because Rentiers are prone to spend more on consumption. He argued that the “rent payments” do not affect profits.

Blaug (1997: p. 643) argued that the Keynesian economics gave a more convincing explanation of the protracted mass unemployment than the Orthodox theory. He further argued that the best advertisement of Keynes GT was the relevant exposition of the late Professor Samuelson in his book: “Economics: An Introductory Analysis (in 1948)”.

Naito (2013) dealt with “the return of Rentiers”: i.e. Keynes’ view about their euthanasia... Krugman (2014) argued that the “Rentiers” will not be… willing to go gently into euthanasia! Easton (2021) argued that the “rent” is an income generated by the exclusive ownership of a scarce asset—an opinion coincided with that of Keynes.

Birtch K in 2019 argued that the rentier capitalism means gaining income from the ownership or from the control of assets, which create an economic rent (https://doi.org/10.1177%2F0162243919829567). Standing G in 2016 argued that the rentier capitalism predominated in 1980-1990 in the capitalistic economies (https://www.bitebackpublishing.com/books/the-corruption-of-capitalism). Christophesers B in 2020 argued that the rentier capitalism shaped the UK economic policy from 1970-1980 (https://www.theguardian.com/commentisfree/2020/aug/12/ppe-britain-rentier-capitalism-assets-uk-economy). Davies W in 2022 dealt also with this issue (https://www.theguardian.com/commentisfree/2022/may/30/age-of-inflation-economy-rentier-capitalism).

For us, a “Rentier” is “an investor, lending money to a company, out of his/her savings or wealth, etc., looking forward for company’s profit at the end of the year so that to gain a (positive) dividend, after tax, without participating (or being able to) in the control of the company”. The Rentiers thus really take a risk in investing in businesses for which have no idea, and where profitability is not guaranteed and also taxation may be high (as in Ireland 51%)!

Keynes’ prediction about Rentiers’ euthanasia is wrong! The technological innovations obviously created additional and higher requirements of money-capital in every individual investment project, due also to the economies of scale. Of course, Keynes assumed the technological progress as given—so we may forgive him... We must admit, however, that every future economy, tentatively, needs more money per project and for a larger number of projects. Thus, the “demand for rents” must be an increasing function of the expected dividend!

3. Part I: Keynes’ Legacy

Keynes (1936) identified a number of persons working in the economy, the psychology of which plays a substantial role: the Consumer, the Saver, the Enterprise-man, (the nowadays business-man & entrepreneur), the Speculator, the Rentier, as well a number of institutions—or targets—like the Markets, the Prices, the Full employment, the so-called “Shifting” equilibrium of his—a new concept, the Governments, the Central banks, and the stock exchanges!

Keynes lived in a time when a Great Crisis took place (1929-1933) with mass unemployment of about 10m, when European economies were recovering from the Great War—(end July/1914-11/11/1918) —and getting—and more important—into the 2nd World War (1939: 1st Sept.), and getting out of it 6 years latter (02/09/1945).

The USA agreement (at “Bretton Woods”, 1944), designed by Keynes, established the World Bank, the IMF, and latter the WTO. China joined WTO in 1995, something important due to its size. Nowadays, India tries to take the place of China in world seaborne trade… or to sit next to it. The steps of the nations were all towards more specialization of each based on its natural endowments—abandoning the autarky policy prevailed after the 2nd WW—but also to pursue an increased trade.

Each country’s exports are based on its competitive production, and the more competitive in exports one country is, the more it can export, and the more foreign exchange can gather. This is why EU is against subsidies in production if they distort cost and competition to foreigners with a view to boost one’s exports (e.g. the case of the Chinese electric cars concerning EU and solar panels concerning also Norway).

4. Part II: Stock Exchanges

At Keynes’ time, stock exchanges had already a long history, as they were established in UK, in 1571, and in USA, in 1792. Keynes mentioned that it is important their further development (GT, pp. 150-151) (“the organized investment markets”, as he called them).

Keynes, really, saw Stock Exchanges as … the “super markets” of companies, with one important difference: companies’ price is determined by the Stock Exchange, not by the owner! Stock exchanges, amongst other things, are, from moment to moment, the valuers of all listed companies! Moreover, Stock exchanges are destined to be the places where one can get rid of an unprofitable company, or he/she can buy a more profitable one. No “Catholic marriage” between owner and his/her company was valid anymore!

In fact, Stock Exchanges “issue” the divorce-certificate between a present owner and his/her company, as well as a “new marriage-certificate” with another company, or even a death one, for a company the share price of which is zero/and or negative (for say 30 days)! Thus, the stock exchange is the “Registrar Office” of the companies registered there by owners coming-in from all the worldwide nations!

Of course, the main, and more important, role of the Stock Exchanges is to finance new (qualified) investments, or to help the expansion of the existing profitable ones, with the proper funds required, no matter how large these amounts might be! This feature of the unlimited funds is a good point for the companies to prefer Stock Exchanges compared with the commercial banks, which have limited funds to lend, as a rule, if not syndicated. But Capitalism could not confine stock exchanges exclusively to these two important tasks mentioned above… because speculation emerged as well!

Most important, prior to Stock Exchanges, was the role of the enterprise-men, who were establishing companies running them… by a way of life! At the stock exchange period, however, the possibility of another enterprise-man to buy-out the company of another enterprise man became very true! Moreover, the Stock exchanges may cause crises, like the one in 1929-1933! Thus, in capitalism one cannot get something really good, except in exchange of something really bad!

Thus, the human economic constructions invite people to try to exploit them as they are not perfect! The investment decisions were irrevocable prior to the appearance of the Stock Exchanges, but not anymore!

Keynes described the further development of the security markets in GT, p. 151. Of course, Keynes was rather wrong in assuming that the value of the investments financed by Stock Exchanges will become substantially higher than that from the remaining financial sources (Chapter 12). In mid-1996, the market capitalization of just 14 big international companies arrived at about $583b ( Stokes, 1997 )!

Contra to the above trend, however, only 2% of the total number of the Greek ship-owning firms, is financed by the international stock exchanges! Most are financed by commercial banks, for an amount outstanding at round $400 m p.a.!

5. Part III: “The Joint Stock Companies”: The Separation of Control from Ownership

The separation of management from ownership was a crucial management development ( Martin, 2010 ), (massively since 1914?), prevailing already in 1935, as Keynes wrote (GT, p. 150). Moreover, both Smith and Marshall wrote too. The separation occurred when the “large joint stock companies” dispersed their voting shares amongst a larger number of shareholders, who were unable to control the company altogether!

The separation was an apparent result of the increasing size of the companies, during the preceding decades, and their higher requirements of capital, as time went-by, we believe. Smith (1776) recognized the phenomenon by quoting (p. 700 in the Wealth of Nations) that “the directors of the joint stock companies were the managers of other people’s money” (commas and bolds added).

Important, for our time, is that the separation created 2 classes: 1) the enterprise-men, i.e. the original owners of the companies, and founders, i.e. the entrepreneurs, possessing the know-how, conceiving the business idea and taking the risk to buy capital goods, to build a factory and to organize the staff…etc., and 2) the rest of company’s shareholders, who provided (the additional) finance to the company by buying or obtaining its shares, looking after a yearly “rent”, if adequate profits ever achieved!

Without the 1st class, clearly, no company could ever be established; and without the 2nd one, no great growth of companies could be ever achieved! “Finance3 is a necessary condition to establish, and run a company, but not a sufficient one!” Keynes (1936) named Rentiers as the “functionless investors”! From the above analysis one can derive that if an economy desires a faster growth of its firms, it has to welcome Rentiers than to see them… dead!

Marshall (1920) devoted a dozen pages to Rentiers: “there are persons who give their capital to the hands of others, employed by them, where the Directors control the Managers”, he wrote (a comma, bolds & a capital letter added). Of course, Rentiers secure part4 of their “welfare” out of the profits of the companies they have invested in—by… doing nothing, but simply waiting!

Why Rentiers not to be entitled to “interest”, as e.g. the debenture5-holders? But the risk % of the debenture holders is lower, while for Rentiers is higher, because the payment of dividends to the latter depends on making a prior profit, after deducting the interest payable to debenture-holders (no matter company’s profits)! This is a good difference.

The calculations of the Rentiers may be as follows: %Rin the banks − %Sof haircuts < %Ddividend − %Sof the enterprise (1). Or the %Rin the banks − %Ddividend > %Sof the enterprise − %Sof the haircut (2)), where R stands for interest rate and S for the business risk %.

The Demand & Supply of Rents

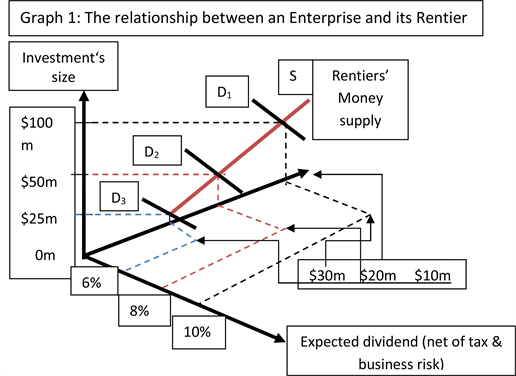

The supply of funds by the rentiers, we will assume it to be a function of the “expected” dividend to be paid—net of tax—by the enterprise at the end of the year. The demand, we will assume it to be, a function of the size and the number of the existing new investment projects in the economy, which could be undertaken by the company if it had the proper funds (Graph 1) (and if their MEC > interest rate).

As shown, an enterprise is assumed to have opportunities to invest from $25 m to 100 m, at a MEC > interest rate, in 3 different investment projects. Given their MECs, the enterprise-man can promise to Rentiers a-net of tax-dividend > the interest rate (payable in a 12-month time bank deposit minus an estimated

Source: Author.

“haircut” risk)! The higher the expected net dividend, say from 6% to 10%, the higher the amounts offered by the Rentiers, taking into account the business risk %.

Keynes (GT, p. 153) mentioned the above phenomenon, where the equity of the companies—in an increasing proportion at his time—held by persons who did not control the company, and moreover they did not know its conditions—real or not! The provided capital received a rent due to its relative “scarcity”! The euthanasia of Rentiers, predicted by Keynes, will take place when capital will cease to be scarce! A time, which this paper, is estimating, will never come!

Let us present next, briefly, Keynes’ macroeconomics.

6. Part IV: Keynes Macroeconomics

Keynes (1936, GT preface) recognized that the orthodox economics—if erred—its errors can be found in its premises—which were less clear, and not general! He argued that the superstructure—of the orthodox economics—erected with great care so that to be logically consistent!

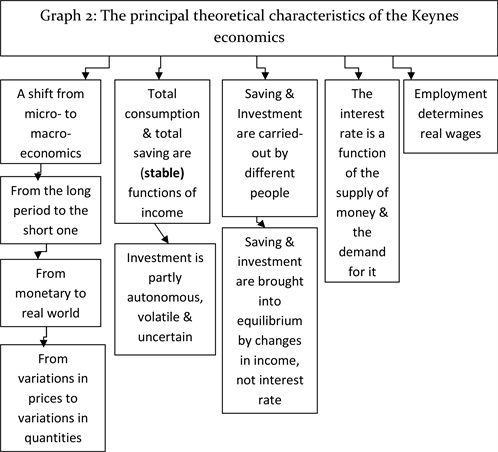

The principal theoretical characteristics of the Keynesian macroeconomics can be shown briefly as follows (Graph 2).

Moreover, Keynes’ Great Heresy was that the “equilibrium” in income and output, can be “achieved” below… full employment (!). Or in other words, full employment cannot be achieved due to a lack in the effective demand! There is also the paradox of thrift: “more saving—with unemployment—means more unemployment, not less”, as believed! This implies as well a low interest rate, which, however, does not invite more saving...

Keynes applied also the equilibrium analysis “from one period to the next”, meaning that all variables are present at the same time, like a theatrical company appearing in full at the end of the play! In addition, Keynes defined the variables he mentioned, in line with the actual—or potential—data, opening-up a vast new

Source: Author; inspired by Blaug (1997: p. 646) .

field to statisticians: the so-called “National Accounts”!

Keynes showed that the multiplier is greater6 than 1, meaning that the impact of investment—private or public—on income had to be greater than that considered before, and its effect was higher on consumption, and on investment.

Keynes showed the possibilities of the fiscal policy to increase real income and employment, unlike the monetary policy, advocated by the Classics. But, this paper showed that taxation (on Rentiers’ dividends) can equally and substantially… boost investment! Of course, the neoclassical school re-brought into the picture the power of the monetary policy weakened during Keynes period.

The key-variable, in the whole Keynes system, is no doubt the effective demand: firms employ N persons producing Z output (called supply price)—valued in terms of its proceeds—and D is the value of the demand from N people (called demand price)—in terms of its proceeds too. The intersection of Z = f(N) and D = f(N) determines effective demand.

We come now to the concept of Keynes, which certain economists forget, and suggest wrongly, e.g. a reduction in Consumption during a slump!

7. Part V: The “Effective Demand” Determines Employment!

Keynes starts his GT by presenting the “Classics’ theory of employment”, and its 2 fundamental postulates (p. 5):

1) The “wage” = the “marginal product” of labor

The wage paid, (to an additional worker), equals7 the (net) value, which he/she adds to total output, (determining also the “demand curve for labor”). This definition emanates, we believe, from that of the marginal product, and its maximization, stating: “the marginal product of an employed person is the value which he/she contributes to firm’s total production” at the margin.

2) The “utility” from the real wage compensates “work’s disutility”

The utility that a wage provides, (from an additional unit consumed out of the products bought with), is equal to the (marginal) disutility of the work. This means that the real wage of a laborer is, (at the margin), sufficient to induce him/her to devote his/her entire working time of 8 hours/day to a particular production (supposed also this to determine the supply curve of labor).

The above 2nd postulate of the Classics has to be revised (Figure 2), we believe, by replacing the real wage by the cost of living of a particular labor class living in a particular place (our opinion). If the money wage covers the cost of living, of an additional person, only then he/she will offer, voluntarily, his entire working time to firm’s production!

![]() Source: Author.

Source: Author.

Figure 2. Employment as a function of labor’s cost of living.

The employed persons, no doubt, know when their money wage covers his/her cost of living! Nowadays, a man and wife—have, (both), to work, especially if they have to support 1 - 2 children. Since the time when women entered into the labor market, massively8, the money wages and salaries paid to males almost halved (on demand and supply laws)! In USA, the employed women equal the employed men in almost all professions! This will happen all round the world as time goes-by, we believe!

The “cost of living”, mentioned above, should cover the $ amount required to let an (average) house, to obtain food, to pay taxes, to get (average) education, to use public transport, etc., amounting in USA at about $50,000 p.a.—in a particular city. Unions, therefore, have to bargain for what additional items have to be added to their cost of living, and to adjust the relevant amounts involved for all previous items—given the prevailing inflation for some time (our proposal)! This cost has to cover at least the basic necessities.

When prices increase, the real wage falls, ceteris paribus, and this was a reason for certain nations to establish the so-called “automatic adjustment” of money wages to prices (APA—automatic adjustment of wages to a price index). In EU, however, only 7 countries9 out of 27 use nowadays the indexation in the private sector. This system, we believe, in order to be effective, has to exclude the possible inflationary pressures of wages and salaries on prices, to avoid the vicious circle.

Keynes, however, denied the validity of the above 2nd postulate, because it cancelled the possibility of having “involuntary unemployment” (Figure 3).

![]() Source: Author.

Source: Author.

Figure 3. Demand & supply of labor.

As shown, the full employment of the Supply of labor requires OQf persons. The labor market, at the real wage Wr, absorbed only OQa. A number of them (= QaQf = 33%; depending on the steepness of the curves) found no job! The Classics argued that unemployment is caused because: Wr > Wrf, and thus Wr had to fall. For Keynes, this is due to the fact that the effective demand, (consumption plus investment), required OQa, though QaQf were willing to work at the lower real wage Wrf (Keynes, GT, p. 289)! QaQf is the unemployed10” called involuntary! Keynes further argued that though each laborer bargains to be paid a real wage, the workers as a whole11, bargain for a money wage12 (Wm).

The Classics ignored13 the involuntary unemployment, and in addition, they admitted it in writing (see Pigou (1932) : in the Economics of Welfare, 4th edition, p. 127)!

In the capitalist system, however, there are many employers to who we turn!

8. Part VI: The Employers in a Capitalist Economic System

There are first the 2 main employers: 1) the ones that produce for whoever has to pay, their entire, or part, of income, to obtain consumable goods and services & 2) the ones that spend their potential profits, and devote their own, or not, capital, etc., under special circumstances, to buy the capital goods. Moreover, there is the Government. But has the Government to employ the excess labor supply so that a full employment to be achieved…?

The answer is that no government can do it! The cost of the full employment is much more than the total “unemployment benefits14”—which anyway are not permanent! The Greek State provides employment already to ~13% of total employment in 2020 (i.e. the civil servants)!

Remarkable is that all nations in EU-262021, learned to live with unemployment, from a low % in Czech, of 2.9% and in Germany, of 3.54%; a higher one in France, of ~8%, in Italy, of ~10%, and in Spain, of ~15%. Greece exported also about 500,000 persons abroad…in 2009, and thereafter, till 2020, where the trend reversed. The next “employer” is the one who invites the incomes—not spent—to transform them into loans, (the banking system), for investors. Stock exchanges provide also funds to create companies.

A demand for labor comes as well from abroad, meaning that the unemployed… can be exported—provisionally or permanently! Further employers are also the municipalities, the peripheries, apart from the central government.

In Greece, the unemployed varied from 518,000 2004 (11%) to a peak of 1,351,000 2013 (28%) and 506,200 2023 (11%) (Figure 4).

![]() Source: Data from “Kathimerini”, a weekly journal.

Source: Data from “Kathimerini”, a weekly journal.

Figure 4. Unemployment in Greece, 2004-2023 (est.)

As shown, the last crisis caused the Greek unemployment to gradually rise, after 2008, to a peak in 2013! To the above end result also “helped” positively the about 500,000 Greek young and educated citizens employed abroad!

Classics, however, rested on the interest rate to fight unemployment (next)!

9. Part VII: The Interest Rate

Keynes showed that the interest rate cannot be reduced by increasing the Supply of Money! The Classics depended on the flexibility of interest rate to bring—in, and—up, investment as required for full employment! Surely, in case of inflation, the real wage is bound to fall, ceteris paribus.

The Classics relied on the downward flexibility of the real wage as well for full employment. Thus, Wr had to fall to Wrf (Figure 3). Also they rested on the trend of prices-up, so that again Wr to fall to Wrf! Thus, in the Classics, the Supply and Demand for labor determined real wage Wr… but at a lower than full employment equilibrium, Qf (due to the deficient effective demand as argued by Keynes, not due to a high interest rate).

The Classics suggested a fall in Wm expected to stimulate demand for the finished products (as cheaper); and this would further increase production, and employment. The fall of the Wm is something not to last forever, as Keynes said, but till the falling marginal efficiency of labor is equal to the reduction in Wm (Keynes, GT, p. 257), as production increases.

Let us next express almost all of the above in a mathematical language!

10. Part VIII: The “Krimpas-Asimakopulos” Growth Model

Gibbs J W (1839-1903) argued that “mathematics” is also a language. We will present a simple—one sector—mathematical model, due to “Krimpas-Asimakopulos” ( Asimakopulos, 1969 ; Krimpas, 1974: pp. 129-137 ). This is based on Joan Robinson’s work between 1956 and 1962, and expressed mathematically by the late Prof. Asimakopulos. This model presents Keynes GT in a growth and capital accumulation one!

· The labor market: The money wage equals real wage: wm = wr (3)15; (or wm > wr), where wr is the (minimum, acceptable by the Unions) real wage. W = wmL (4) stands for the total wage bill; where L stands for Lo + L1 (s.t. L ≤ Lmax.) (5). Labor is distinguished in Lo—the start-up fixed one (overhead)—and the rest, L1, varying with output.

· The time of the model: All relevant decisions—except the one about capacity16—had the time required to be taken.

· The model’s players: The Workers, the Firms and the Rentiers17.

· The maximum output produced depends on the level of the effective demand (given wm). This further depends on the propensities to consume (of workers & rentiers), the receipts (dividends) of the Rentiers, the demand for investment and the gross profit.

· The18 volume of investment, Ivol, (is given), and its value is equal to Ival. Where Ival = PIvol (6). For Ival to be known, P has to be known: (s.t. Ivol ≤ Ivol max.).

· The value of the (current) income (and of output) Yt, are given by Yt/α = Pprοd L1 (7), where Pprod is labor’s L1 productivity19, and the (Yt/L1)—the output per head—is determined by α. Equation (7) stands for the supply of output, (a production function?), by taking into account labor’s productivity and L1 (labor’s quantity).

· The model’s identity: Yt = Wt + Πt + Dt (8), where Dt = depreciation. This shows how the distribution of income is done.

· Savings20 St = Πt − (1-sr) βΠt-1 + Dt (9), where sr (0 ≤ sr ≤ 1) is Rentiers’ “marginal propensity to save”, Πt-1 are past profits, and β (>0) determines the dividend amount (as a fraction).

· The equilibrium is achieved if: Itval = Stval (10), where the amount of investment equals the amount of savings.

Equation (9) can be written as: St = Πt + Dt (9a)), where β = 0 (zero dividends!), and/or sr = 1 (Rentiers save all their dividends). The model is solvable: 8 unknowns: Yt, Lt, Wt, Πt, Ct (total consumption), It (gross investment), w, St (gross savings) and 8 equations. Solving the model, we got Table 1.

![]()

Table 1. Solving the Krimpas-Asimakopulos model, 1974.

Source: Author.

Three further factors influenced investment in the above model, but… not mentioned: 1) the “animal spirits”; 2) the “expectations of the entrepreneurs”, and 3) the mark-up pricing, to this last one we turn next…

The Mark-up pricing: A departure from competition & monopoly!

Krimpas (1974) introduced in the above model the “market price of the output”, pm, as equal to its selling price, ps, using a fixed mark-up, k, over the direct labor cost (per unit), divided by the output per head: pm = (1 + k)w/α) (11). The pm is set by the firm, fixed, at a variable profit margin, (& at a constant labor productivity). Keynes assumed the “degree of competition” as given, in his model, not as zero…anyway. The above Equation (11) is a departure from a competitive market, as the mark-up stands for that part of the ps, which the firm adds, so that to cover its overhead cost, and gain a net profit! Profitability is made compulsory by the model! Before we proceed, we will describe our proposal for mark-up pricing.

Our Proposal

We propose to establish a “controlled” free entry of all new firms into a market, with a view at avoiding mark-up pricing… The capitalist system requires firms to produce at the best technological level, first, and then at the best economic level, (given the input prices), where marginal cost (MC) equals marginal revenue (MR) for maximizing profits!

Then, the economic system ruins it all the above by allowing “free entry” (Figure 5) (we exclude the cases of the super normal profits).

![]() Source: Author.

Source: Author.

Figure 5. Industry & company in a competitive model with “free entry”.

As shown, the company, in the RHS, produces in a competitive environment. Suddenly, the system allows a number of new firms to come into the market, (we assume them to be less competitive than the existing ones), and boost supply, to S2, reducing price, below the previous equilibrium level. As a result: AC > MC = P = AR = MR! The normal profits situation is thus transformed into one with losses!

The “free entry”, we proposed, is to be allowed into an industry if a company gets first a permit from the Ministry of Finance, and given that a market is not fully served by the existing companies. Moreover, free entry to be allowed if a company can show to have a lower unit production cost vis-à-vis the existing ones. Companies thus would have no need to resort to mark-up pricing, we believe.

Worth noting is that a “fixed mark-up” is found in almost all post Keynesian treatments of production! These firms do not operate either in an environment of perfect competition or in one of perfect monopoly! This also assumes, we believe, the absence of economies of scale, and the case where marginal cost pricing creates losses (Figure 5). The higher mark-ups—according to the model—lead to less employment, less (real) output, but higher income and profits!

11. Part IX: Keynes’ Investors

Keynes “biographed”, so to say, the persons working in the economy—providing great economic insights:

· The speculators; meaning the persons dealing with forecasting the psychology of the people in the stock exchanges (GT, p. 158).

· The enterprise-men; the persons dealing with forecasting the prospective net yield of assets over their whole economic life.

· The Rentiers; persons whose main income comes from interest on assets21. These are the owners of capital, deriving all—or most—of their income from it, but having, by choice, no effective control over its use.

Keynes stated, in GT (p. 262), that the Rentiers represent the richer section of a community, with a rather rigid standard of life. He (GT, p. 150) distinguished also the enterprise-men, or business men of the past, from those in 1936! The past enterprise-men, Keynes wrote, owned their undertakings—(frequently together with their friends & associates)—and they were of a sufficient number, having a “sanguine temperament” and “constructive impulses”, so that to embark on business, as a way of life!

The above were not really relying on a precise calculation of the prospective profit, or taking into account the prevailing interest rate! Today we identify this class of people by… Greek ship-owners.

Keynes distinguished those that serve a profession—the professionals, so to say—having management as a job, and those that do it as a “way of life”. Keynes looked forward for the intelligent, the determined; those having executive skills, the entrepreneurs, as well their finance, fond of their craft (GT, pp. 376-377).

It mattered, however, the ability of those managing the businesses for Keynes. The business-men, at Keynes’ time, played a mixed game of skill, and of chance, having unknown results. Keynes admired the innovative, the entrepreneurial, and the economical, employment of resources, and those who carried it out!

The Greek ship-owners… fall in the pre 1936 description of Keynes of the entrepreneurs, as mentioned! In mid-1996, Stokes (1997: p. 182) mentioned 16 leading shipping companies to have a market capitalization of $31b. Greeks, however, fear to be listed, given that in the Stock exchanges it is easy for someone to buy-out another company, especially if its value of shares is falling ( Goulielmos, 2021 ). If owning and managing a shipping company is a way of life, as Keynes argued, in another context, then these Greek ship-owning companies are original ones, working at a pre-Stock Exchange period!

Keynes remarked that, in 1936, the equity capital of the companies, which belonged—in an increasing %—to persons not dealing with management, or having a knowledge about it, was increasing (=the Rentiers). Keynes was not happy with this financial class, which served no purpose other than to “exploit” the scarcity of capital for their own benefit…

Keynes, however, predicted that the growth of those who gain a rent, and have income solely from the ownership and control of an asset, will increase, up to the point where capital will cease to be scarce! The above prediction is not realizable, we believe, as shown by the rapid increase in the mutual funds, and in the amounts invested in international bonds!

Greeks2023 devoted about 4b euro (est.) to participate in various mutual funds! Thus, Keynes was wrong over his predictions that either the capital will become abundant or the Rentiers will die by euthanasia!

As argued by Kozul-Wright and Blankenburg (2017) , the last 40 years the “financial” Rentiers, through private credit creation, obtained… considerable gains. To this, one has to add the large “non-financial corporations”, which emerged… as “Rentiers” too. Moreover, research revealed that the growth of the dominant firms can be shown by the steep upward trend in the “mark-up pricing”, analyzed above!

In addition, the “Surplus profits” rose, during the last 20 years, from 4% in 1995-2000 to 23% in 2009-2015 (taking into account only the non-financial corporations in 56 countries)! The 100 top firms had a share, from 16% to 40%, on average. These also increased their market concentration.

The above trends are clearly ones towards a rising “Rentiers Capitalism”! This means that more people, as time goes-by, will entrust their savings to existing firms, rather than to existing banks, and rather than to existing stock exchanges, for a dividend % higher than interest rate…! A brilliant future for the Fiscal policy! The “Green Transition” can be financed by taxes… if Governments wake-up from their summer 2023 sleep, where fires, high temperatures, earthquakes and floods as well local wars take place!

Our estimation is that the rent trend will be intensified, given that the capital controls imposed, after 2008, and the bank failures, even during 2023, forced people etc. to hoard, when their income obtained through ordinary employment, either curtailed or disappeared, together with their houses! Hoarding influenced the capital supplied for rent… we believe. Thus people during GFC were seeking… for a rent, in large corporations, and this is a rational option from those who used to save to face the Pandemic, etc.

12. Part X: The Greek and the EU-22 Economies as Case-Studies

In this part, we will begin by asking a number of important questions. “What is the impact of taxation on ‘payable’ dividends?” “What is the impact of the unpaid ‘dividends’ on investment (carried-out subsequently by the companies if opportunities arise)”?

The research so far ( Boissel & Matray, 2021 ), showed that the higher the dividends a company pays, the… less it invests!! In addition companies seem to “protect” their “dividend-entitled shareholders” from taxes—by reducing the dividends paid to them … (France 2013) to avoid taxation!!

The above gave us the idea to propose a depreciation tax for depreciation not invested within a certain period! Our further proposal is to make depreciation voluntary! How many billion dollars are going to be invested as a result? This last question is worth to be researched as it would change the entire economic philosophy, as well the prices which we pay! This means for the firms to be free to replace their capital—as and when they deem it proper… The economy will function better we believe. The bankruptcies’ will be also much fewer.

12.1. What Companies Have to Pay?

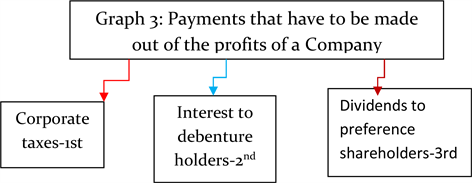

The existence of payable (ordinary) dividends, presupposes a company to have profits, after paying-out certain preceding items (Graph 3).

Source: Author.

The countries imposing a high % of corporate tax, they reduce the available amounts to be paid to dividends, as shown below! One would expect the reverse: i.e. the countries having a high corporate tax to have a low tax on paid dividends! But, Portugal, e.g. had a 31.5% tax on profits and a 28% tax on dividends paid 2022 (Figure 6). Portuguese Government does not want to boost its tax revenue?

![]() Source: Eurostat.

Source: Eurostat.

Figure 6. The % of corporate tax & of dividend tax in EU-22 in 2022.

The governments which count on “profit taxation” (red line) had to prefer a higher corporate tax, we believe. But as shown, they are less aggressive. Their profit tax % varied from about 10 to about 30 maximum. The (Greek) left-wing major party, e.g. favored a higher % of taxation on dividends paid! We believe that both, the “poor” private companies and “poor” citizens, and thus a heavy taxation on both, had to be promoted by the left wing parties! As shown (Figure 6), there are extreme cases for the “dividend tax %” in EU-22: i.e. from 0% in Latvia and Estonia to 42% in Denmark and 51% in Ireland!

The mode for the two kinds of taxation was as follows: for dividends ~26.5% and for corporate tax ~22%, using the formula: Mode = Mean − 3 (Mean − Median)22.

More important than the taxation is the fact that for every $1 not paid to dividends, the “companies” (in France), invested additional 0.30 euro ( Boissel & Matray, 2021 )! This resulted from the increasing tax on dividends from 15.5% to 46%, i.e. 3 times, in France, since 2013!

Can we “see” a new perhaps “social” philosophy, emerging in Europe, saying, implicitly: let us have “less rich rentiers, but rather rich companies”… Latvia and Estonia have zero Rentier tax, followed by Greece with 5%! But Ireland has 51%... China 2022 announced a 10% tax on dividends...

USA2023 announced % from 0 to a 20 dividend tax, depending on the amount! USA perhaps studied the whole issue deeper by taxing the ordinary dividends by 37%... as income, and the “qualified dividends”—named so—15%, from about $42,000 to about $84,000, considered them as…“capital gains”… Apparently confusion exists over taxing Rentiers’…

Moreover, the % of taxes on profits—as shown by the red line in Figure 6 was less volatile, and lower, vis-à-vis “dividend tax”, varying from 9% in Hungary to ~30% in Germany! Given that the EU-22 is a single market, one could expect a uniform %, say a 20% tax on profits, if also this does not prevent the creation of new companies! In addition, a 15% tax on dividends paid to Rentiers should be also adopted, we believe.

The above issue is serious as the amounts paid as dividends are high: Greece had $5b (1$ = 1 euro) “paid dividends” or 2.4% of its GDP 2022. This means that while the % is low, the absolute amount ($500 m) is large, and so the Rentiers, and their companies, will try to avoid… But this as mentioned is more beneficial!

12.2. Investment in Europe

In all capitalist economies, effective demand is the key for growth, but what was the situation in EU2021, in Eurozone and in EU-9 (Figure 7)?

As shown, in the majority of the EU-9, as well in EU, and in Eurozone, the investment % was between 20% and 25% of their GDP2021! Greece2021 invested only near 13% of its GDP (~$24b)! Table 2 presents the amounts of the dividends paid between 2019 and 2022 by the Greek companies. An amount of 900m euro of paid dividends performed by the foreign companies working in Greece,

![]() Source: Eurostat.

Source: Eurostat.

Figure 7. Investment as a % of GDP (2021) in EU, Eurozone & EU-9.

![]()

Table 2. The relationship between dividends paid, taxation and potential investment in Greece in Euro, 2019-2022.

Source: Data from Eurostat.

(5b euro), or about 1/6 of the gross capital formation2022!

Given also the investment multiplier, it seems that fewer dividends paid are preferable—suggesting also a heavier taxation!

12.3. What Is More Important? Investment, Consumption or Money?

We come now to a rather recent phenomenon, where Money (quantity of) took-over a dominant economic role vis-à-vis investment and consumption! This is a very interesting phenomenon where an economic parameter, like money, overshadows the two powerful variables like Investment and Consumption! Have economists nowadays to create tools to manage its quantity? The Monetarists argued that the money supply has to grow at a constant rate equal to the growth rate of Output. The question is: “Who has to see if the above rule is kept…?”

The modern quantity theory of money demands: Md/P = f(Y, r), where Md is the demand for money, P is the price level, Y is Output and r the interest rate. The first variable is the “real money balances”. Important, however, is the “supply of money” in the economy, where at least 5 different categories of money are used!

For Keynes (GT, pp. 304-306), MV = D (12), meaning that the effective demand, D, determines the quantity of Money—required—M, given income’s velocity V. But D affects also M! Now, if V is constant, prices will change proportionally to M, if the elasticity of prices to demand is 1, if wages increase as D increases and if the output is constant, during a short period...!

If effective demand increases, but output does not and if this affects exactly the cost of production, here we have a true inflation (Keynes, GT, p. 303). As shown in Equation (12) money is able to influence D. Indirectly, thus, Rentiers may provide a beneficial influence on the economy—if their dividends are spent, so that output, and not cost of production, increases!

13. Part XI: “Financialization”: A Blessing?

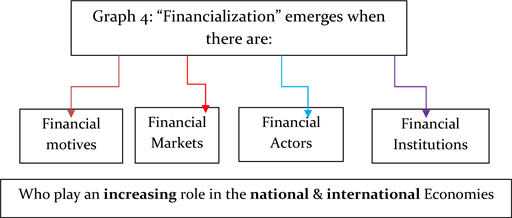

“Financialization” has intensified during the 2003-2009 exceptional economic boom! Epstein (2005) has defined “financialization” as follows (Graph 4).

Source: Author.

The services-sector, where the above phenomenon belongs, became dominant over the last 50 years or so, at the expense of real production! In addition, “securitization” emerged, where “non-marketable” claims are “made-up” “marketable”, after packaging—(e.g. the “mortgage” loans; “red” loans)—them—together. We saw in fact the financial sector to produce a number of new products for sale to another banks, or funds, etc., at a negotiable interest rate!

Banks lost no opportunity to increase their activities, and their profits, using also their bonus system to boost their productivity, and ingenuity, but based on greed. In addition, the Authorities left them loose, especially in USA … USA waked-up in its 2023 administration with the laws CHIPS (infrastructures) and IRA (inflation). But finance became a very dominant issue no doubt.

Authorities—we believe—had to approve all “new banking products for sale” before they are offered to the public, or to other banks. Many talked for “poisonous” products, “toxic” ones and “dangerous” derivatives…! Are we serious?

Orhangagi (2008) argued that “financialization” had a negative impact on the “capital accumulation”, (real investment), from 1973 to 2003, in USA! The economic models limited themselves—by their choice—in presenting only one sector, not the financial one, deriving wrong information about the capital accumulation! The increasing dominance of the finance industry on the total economic activity has destabilized the productive sectors! The supply of money, apparently, is out of the control of the central banks and the Governments…

Moreover, the sizes of the individual investment projects—both in number and in value—increased by leaps and bounds, and their risk also, as time elapsed. Companies, to cope with this new situation, appointed financial controllers in managing company’s financial assets, in “marketing” their securities and, in particular, in synthesizing company’s equities!

Moreover, the rise of the “average cost” of the individual projects—due to various reasons—one being inflation, the other being the new materials, the third being the high prices of steel, cement, oil and gas, and the level of the interest rates—at times—as also the risk %, made all companies to calculate carefully the sources and the cost of finance! Additionally, Rentiers entrusted their savings to the big firms!

We will come now to a case-study of the Greek economy.

14. Part XII: The Recommended Greek Economic Policy

Greece imported too much2022: 121b euro! Greece exported too little: 101b euro, providing so employment to… foreign countries, and creating a trade deficit: 20b euro. Consumption2022 reached 183b euro! Savings were 25b euro. Our first suggestion is to tax heavily unspent depreciation (estimated at 10.5 b euro, 3 x 3.5b, a 3-yearly estimation). Also, to increase investment (classical), which arrived2022 at 25b euro, and 58b (!) euro 2008 (including depreciation estimated at 12% of profits).

Greece had also a decreasing population2022 reaching 10.6m from 11! From this, only about 39% were employed, 4.1m, and 569,609 were jobless (14%). The Greek GDP increased by the imports and diminished by the exports, leaving a positive residual equal to 9.44% on GDP; our estimation is that 260,000 euro of effective demand2022 is needed to create 1 labor position! This indicates how much difficult full employment is!

15. Part XIII: Can Greed Raise Inflation?

This is the first time, (July 2023), when so many (ECB, OECD, IMF & a number of famous economists, Oxfam, ActionAid, Forbes, etc.), and so fast, recognized that companies’ profits—par excellence those of the bigger ones—are responsible for the 75% of the current inflation, during the last 2.5 years (Figure 8)! Indeed, the profits of only 722 top global companies reached the $2.2tr (2021-2022) mark!

As shown, the “wage bill” is held responsible for the global inflation for 62%

![]() Source: Author; data from “Kathimerini”, 09/07/2023, a weekly publication.

Source: Author; data from “Kathimerini”, 09/07/2023, a weekly publication.

Figure 8. What made-up the prices we have paid in 2021-2022?

![]() Source: Author; data from Eurostat.

Source: Author; data from Eurostat.

Figure 9. The % of corporate tax in EU-22 per Country, 2022.

of its rise between 1979 and 2019 (40 years)! But for 2020-2023 (July) the 54% of it was due to companies’ profits! One oil company’s revenue2022 estimated at $36b! The estimated amount from “profit taxation” is $942b (at a 90% tax coefficient) (Financial Press, 12/05/2023)!

Who is going to benefit more from taxing profits (Figure 9)?

As shown, only23 9 countries, out of the 22, will be benefitted more from taxing monopoly profits, unless the 90% coefficient is applied across the board… Even, the Greek companies2022 had ~33% higher net profit (“called net functional surplus” to “net value added”).

16. Conclusion

Almost all democratic countries belong to one and the same family (something not understood by Russia2022), we believe! In fact, what one to seek after is a global cooperation in solving mutual problems win-win. For example, the slow-down of China’s economy, 2023 (1st half), vis-à-vis 2021, diminished the exports of … Germany, and the exports of China to USA! They seem to be right those who advocated that the world became a village.

Keynes argued convincingly that the disequilibrium24—in the labor market—is due to the insufficient demand for investment—given consumption—and to the higher interest rate vis-à-vis MEC!

One important conclusion jumps out, however, surpassing all others: “All economic institutions constructed by economists, (i.e. the banks, the stock exchanges & the markets), have to be under a continuous supervision by the authorities, as they can get easily off the rails!”

The new element of analysis—since 2013—is that the higher dividend taxation led to… higher investment! The evidence supports the conclusion that by increasing the “% tax on dividends to be paid”, the amounts devoted to paying the dividends were reduced!

Moreover, and what is more interesting is that the higher a liquidity is created, the higher the investment! The above is very important where taxation provided a motive to increase investment, where also there is a new multiplier: for every 1$, which is not paid to Rentiers—because of high taxation—30% of it is invested!

If Rentiers’ waiting “induces” people, instead of being enterprise-men, to be Rentiers, then this is a problem... (our argument). But our definition of rentiers excluded25 the possibility for the rentiers to be managers. Rentiers clearly help companies to grasp investment opportunities, if they arise!

Rent should not be considered as an illegitimate way to derive additional income, unless this practice crowds out the entrepreneurship! Of course, this phenomenon will be diminished, if the confidence to banks is restored. Also, if the rise of the “year time deposit interest rates”26 is above the “% dividend minus a % of risk”, taking into account taxes. In Greece now mutual funds and dividends have to provide more than 5.75%: an interest rate provided now by the “time deposits” in the Greek banks!

Keynes undervalued the increasing cost, and the number of the investment projects created over the future, so that “capital” to be never abundant—given a number of reasons (one being inflation, and the other being an increasing population)—especially in heavily populated countries like China and India.

The above trend is clear in the nowadays dimensions of all infrastructural public works, like highways, bridges, trains, airplanes, ships, tunnels, buildings27, etc., including the future size of firms, which expands as time goes by and the climatic failure! Economies of scale also invite Rentiers.

Moreover, the space programs and the local wars will be always thirsty of capital. Society has to understand that applied research is the key for the welfare of the people, including producing energy the way sun does!

In addition, “greed taxes” should be now used to build the thousands of homes required for the young poor couples destined to create a family—amounting desirably to more than 4 members…and students seeking a room to carry out their studies… Economies have to be human-centered … not so much profit-centered.

Keynes wrote in the GT: “I see, therefore, the Rentier aspect of capitalism as a transitional phase, which will disappear when it has done its work”…? Something that will not happen!

“Finance”, however, became a great science by now, where many experts took it over… “Low-cost finance became a competitive advantage of the companies”… and the banks became “super markets” of a number of “financial products” … copying stock exchanges: the true super markets of companies! Rentiers did not die by euthanasia… Money will always be sought after.

NOTES

1Albeit not specified…

2Samuelson P (1915-2009), Solow R (1924-) and Baumol W (1922-2017).

3Onassis is a good example! Greek ship-owners, before Onassis, used only—not without good reasons—their prior profits to buy a ship. So, their growth was slow and cyclical! Onassis established the idea that a faster growth meant to use bank finance (i.e. other people’s money).

4Rentiers are the wealthy people, Keynes, who can finance companies, if they may provide a rather high dividend—or expected—at a % higher than the interest paid by the banks (deducting a % for risk, which every enterprise runs). The risk % in having funds in the banks increased greatly during recent times of “bank deposits & bonds” haircuts, and the rise in hoarding, following the capital controls after 2008! This situation boosted the activity of Rentiers, we believe. The Stock Exchanges in 1929, and the Banking system in 2009, brought-in 2 severe slumps! So, Governments have to watch both, from then on. Unfortunately, the lost confidence in the banking system, though expected to have been forgotten by 2022, 3 or so bank failures in USA reminded of it, in early 2023. The negative or zero interest rates together with the % risk factor in bank deposits, and in bonds, no doubt, boosted the rents!

5These have to be paid the fixed interest rate agreed. These are the true creditors of the company… Taxation in USA considers this as income, paying a 37% tax!

6Some economists dispute this, but we believe is not an important issue.

7Except in cases where markets are imperfect (Keynes). The Classics believed that each laborer contributes to firm’s production, which, given the price of the product, this gets a certain money value. This value, at the margin, has to be paid to the worker. Keynes stated the above in a negative way: “the wage of an employed person is equal to the value, which would be lost, if employment were reduced by 1 unit”.

8Women (in 1950s, and prior) used to stay at home bringing-up their children. Given certain mistakes committed by males, and due to women’s valid desire to gain economic independence, via a job, women sought employment! Most important is that a working woman considered this as a sign of equality, while this adds a further hardship to her! A woman nowadays has to be a perfect Mother, a perfect Wife, and a perfect Worker, and at a lower than male’s salary! Of course, the “institution of the Family” paid the price of all this. Societies have to reconsider what environment helps its children to grow at the best possible manner (away from violence, drugs, etc.), and adopt it, we reckon! I remember when a male’s salary could feed a 5—persons—family, when jobs did not exist, even for men, in Greece in 1950s. When a woman makes studies beyond high school, and/or University, she is destined for a career… than for a family. Modern societies have to find out the golden balance, as only mothers bring children-up! The equality laws about Males and Females are rather stupid efforts (e.g. in UK).

9Belgium, Spain, France, Cyprus, Luxemburg, Malta & Slovenia.

10Nowadays, 11 categories of unemployment exist! Economists thus fail to distinguish the tree (involuntary unemployment) from the forest (total unemployment)!

11Employers that had income from dollars, e.g. were happy to negotiate increases in a national & devalued currency!

12Friedman, in 1968, insisted that not money wage, but real wage, is at bargain! Where is the truth—this is for further research.

13“The fact that some resources are generally unemployed against the will of the owners is ignored” (Chap. 1, introduction, par. 1, p. 127) wrote Pigou.

14Given, in Greece, that about 399 Euro per month is paid to every unemployed for the 569,609 unemployed the cost is ~227m euro per month or 2.73b Euro p.a.!

15The numbering of the equations is the same as in Krimpas (1974) .

16This means the maximum quantity of output, which can be produced with a constant variable cost. Technology is the same.

17Keynes believed that if interest rates become very low—due to an increasing supply of money—the people—who live on interest—will disappear [1] … He was wrong…

18The volume of investment is given, at a certain maximum, given the capacity of the industry producing the capital goods. The investment plans stand for the independent variable of investment, where a number of them are only realized. Ex ante Investment = ex post one = ex post savings = the ex ante savings, but with unemployment.

19Assumed given.

20The capability of the workers to save or not created political arguments concerning the redistribution of income!

21Known as “gilts” in USA.

22The mode, in statistics, represents the most frequently appearing value in a distribution.

23In USA, the 10th bigger industries invested $128b out of $200b, given a favorable legislation about “chips and science” (end 2021) (among them: Intel $30b; IBM $20b; Micron Investment $20b, etc.).

24 Pearce (1992) mentioned that the “standardized” unemployment, in OECD, varied from 5.2% in 1975 to 6.1% in 1990. This means that modern economies have learned to live with unemployment rates round the 5.65%.

25In Greek shipping, we have noticed a case where a rentier bought-over the enterprise following his prior capacity as a minority shareholder.

26The % risk of a bank deposit was near 0% in the past. But the banking risk increased by the haircuts and the bank failures which occurred since 2009. The % of risk to obtain a rent will surely be higher than the banking risk. Hoarding, e.g. has 0% interest, plus x% inflation, plus an x% for the risk of robbery!

27One may visit the university campuses in China (e.g. the Maritime University) and look at the buildings there to understand our argument. Moreover, the railways will ever reach more distant destinations… The climatic reversal and the artificial intelligence (Gilbert, 2021) are going to need huge funds, we believe! Governments have to grasp the opportunity to raise companies’ taxes, especially for the “profits due to greediness”, to finance the transition to a greener world. UK, e.g. taxes the “super profits” by 25%!