An Empirical Investigation of the Export-Led Growth (ELG) and Import-Led Growth (ILG) Hypotheses in Sierra Leone ()

1. Introduction

Theories of the trade-growth nexus are some of the oldest in economic history and still remain pertinent today. Economists have always been interested in identifying the key drivers of economic growth in nations over time. In the 19th century, the neoclassical economists claimed that international trade is one of the main causes of economic growth of nations (Marshall, 1959). This was a reaffirmation of the earlier classicalists’ view that international trade induce economic growth through specialisation, which generates surplus goods and services that can be exchanged for money or other commodities (Smith, 1776 and Ricardo, 1876). Ever since then, trade in the form of exports and imports have been strongly endorsed by standard economic theory as a catalyst for economic growth (Carbaugh, 2003). In this respect, most developing economies have applied international trade strategy for growth in several jurisdictions, following it success stories in China, India, Japan, and the Asian tigers. Thus, the important role of exports and imports in economic performance cannot be overemphasized given their strategic role in determining the trade balance of a country and ultimately, the welfare of the citizens of a nation.

World trade measured as the sum of exports and imports of goods and services accounted for about 60.4 percent of global GDP in 2019 representing a more than 100 percent change when compared to the share of 27.3 percent in 19701. Exports are seen as an engine of economic and social development because of their ability to influence economic growth and poverty reduction and are the subject of growth strategies adopted by most developing countries. Also, recent endogenous growth models have emphasized the importance of imports as an important channel for foreign technology and knowledge to flow into the domestic economy. These new technologies could be embodied in imports of capital goods such as machines and equipment and labor productivity could increase over time with workers acquiring the knowledge of the new embodied technology.

The significance of either exports or imports to the economic performance of a country varies from one region to the other and from country to country, based on structural issues like the size of the economy, nature of the real sector, and stage of economic development. The way exports and imports affect economic growth in large economies like the US and China may not be the same way it affects economic growth in small open economies like The Gambia and Sierra Leone. Whereas exports tend to affect economic growth directly, the effect of imports on economic growth seems to lag and depends more on the type of commodities being imported.

In Sierra Leone, achieving sustainable economic growth and macroeconomic stability has been a major challenge over the past four decades, due to a number of factors—ranging from socio-political unrest to natural and external economic shocks. The civil war of 1991-2001 massively destabilized the economic strides in the country and disrupted production activities in all sectors with adverse effect on exports. International trade is one of the key channels recognized by the government and development partners for the recovery of the economy after the civil war. As a result, a number of important documents were developed to help in formulating appropriate trade policies for sustainable growth and development. These documents include amongst others, the Sierra Leone Diagnostic Trade Integration Study (DTIS) developed in 2006, and the National Export Strategy (NES) in 2010. The NES Plan supported by the International Growth Centre (IGC), for the period 2010-2015 was aimed at evaluating and discussing the potentials and constraints to export. Based on the recommendations in these documents, the government shifted its strategic focus on not only to increase the value and volume of products that are currently exported, but also tried to shift the specialization structure from traditional products (mining, cocoa) to non-traditional ones (fisheries, agricultural processed food, mango, pineapple etc). However, despite all the focus on improving exports performance over the years, the expected impact of trade on economic growth remains untenable. This problem has prompted a need for more empirical assessment of the relative significance of both exports and imports for economic growth in the country.

As at the time of this study and to the best of our knowledge, there was only one study by Turay (2020) who examined the relationship between exports, imports and economic growth in the case of Sierra Leone using Johansen cointegration, Vector Autoregression and Pair-wise Granger Causality test to analyse the data. Although the work by Turay (2020) provided useful insights in terms of the above relationship, the use of exchange rate as a control variable was overlooked in the model and this may be essential for the trade and economic growth relationship. Also, the time span of the data only covered up to 2017, an extension of such a period may also be very helpful.

Therefore, this study aims to fill this gap and make meaningful contribution to the existing body of literature on the trade-growth nexus in the country. Specifically, the study attempts to answer the question “Does export-led growth and import-led growth hypotheses hold for the Sierra Leone economy in the short and long run horizons?” The findings could serve as useful guide in the design and implementation of trade policies in Sierra Leone and similar small open economies. It will also serve as a good reference material for future studies on the drivers of growth in Sierra Leone.

Following the introduction in this section, the next section presents stylized facts on trade and economic growth in Sierra Leone, section three gives a review of the theoretical and empirical literature, section four presents the data and methodology used in the study, section five analyses the empirical results, while section six draws the conclusion to the study.

2. Stylized Facts

Sierra Leone is mainly a non-industrialized economy with a high ratio of foreign trade to GDP that is mainly complemented by a large agricultural sector. There is a widely shared view in the country on the significance of increasing export over imports. This follows the recognition of the potential role of export as an engine of growth especially for a country with a small domestic market. However, even though the country has a huge export potential, its export base is relatively shallow and largely consists of minerals (diamond, rutile, bauxite and iron ore in recent times) and a few agricultural commodities (including cocoa, coffee, palm oil etc.). Meanwhile, importation is mainly skewed towards essential commodities for consumption with limited scope for investment ventures (Belloc and Di Maio, 2011).

Prior to the civil war, the ratio of exports to GDP and imports to GDP in Sierra Leone, averaged 22.58 percent and 25.75 percent, respectively. During the civil war period, the ratio of exports to GDP dropped to 21.19 percent mainly on account of disruption in production activities, but the ratio of imports to GDP increased to 27.04 percent. Similarly, during the post-war recovery period from 2001 to 2018, which was disrupted by the Ebola epidemic and collapse of iron ore prices in 2014-2015, exports further declined to 18.72 percent of GDP on average while imports surged to 39.50 percent of GDP on average. The surge in imports was mainly due to significant import of capital goods in the mining sector-between 2009-2011 that subsequently enhanced economic growth, with the country rated as the fastest growing economy in Sub-Saharan Africa in 2012-2013. In Figure 1 below, it is observed that both exports and imports are strongly correlated with GDP growth in Sierra Leone over the period under study. But, exports appears to have a more immediate effect on growth than imports over time.

However, Sierra Leone’s exports remain largely uncompetitive in the international market, given its narrow export base. Meanwhile, the country is highly dependent on foreign products in a number of important sectors. Such a situation leads to balance of payments problems, causing a tenacious situation of high external debt burden, with the country continuously having to borrow from international sources to cover the deficit. Another problem is the lack of value addition in the composition of domestic exports which are highly dependent on mineral extraction and other non-mineral traditional exports.

To reiterate, export is perceived as the main driver of growth from the external sector perspective in Sierra Leone, as oppose to import due to the direct inflow of receipts from the exports of goods like minerals. But as established by theory, the importation of intermediate and capital goods used in the agriculture and mining processes may have equally impacted economic growth over the years.

![]()

Figure 1. Trends in exports, imports and economic growth in sierra Leone 1980-2020. Data Source: World Bank World Development Indicators (WDI) *Note: Two major economic shocks in the country have been highlighted. That is the Ebola & iron ore price collapse in 2014-2015 and the COVID-19 pandemic in 2020.

3. Theoretical and Empirical Literature

3.1. Theoretical Literature

Theories of the trade-growth nexus have been discussed since the time of Thomas Mun in the fifteenth century and David Ricardo in the eighteenth century. Whereas Thomas mun argues in support of export-led growth through trade surplus, David Ricardo used the concept of comparative advantage to argue that, irrespective of whether an economy exports more or less than it imports, it will always gain by making use of its comparative advantage in international trade2. Proponents of the export-led growth hypotheses argue that export create productive opportunities for a country and thus, enhances economic growth. Theoretically, they highlighted a number of logical reasons to support their point. The most significant ones are as discussed.

First, export has a scale effect on economic growth through the expansion of market size for domestically produced commodities. Foreign markets demand for the exports of an economy could promote sustained growth, which would otherwise be difficult to maintain with only domestic market demand (Feder, 1983). Conceptually, an excess of exports over imports in a country result to a trade surplus which could boost aggregate demand and hence economic growth. More exports also translate to more investment and employment, raising consumer spending and hence national income (Siliverstovs and Herzer, 2007).

Second, export performance promotes the efficient allocation of productive factors in an economy, raising economic growth (Kunst and Marin, 1989). As an economy specializes in the production of commodities for which it has comparative advantage, the more foreign exchange revenue it can generate from its exports and the more imports of intermediate and capital goods it can afford, enhancing economic performance in the long run (Taban and Aktar, 2008).

Additionally, exports can increase the productive capacity of a country through rapid innovation and effectiveness as domestic firms compete with foreign firms in the international market (Thangavelu & Rajaguru, 2004). This was further backed with evidence by Guerzoni (2010) who concludes that the enhancement of profit maximisation coming from the expansion of market size increases innovation in an economy and by extension, economic growth.

However, critiques of the export-led growth hypothesis and proponents of the Import-led growth hypothesis are suggesting that economic growth may have come from increased productivity due to imports, which enhance domestic economic activities and cause an import-led growth as well as growth-led export. Theoretically, the importation of intermediate, and capital goods (machinery and technological equipment), which are productive factors, could enhance economic growth in the long run (Békés & Harasztosi, 2020). In line with this, Coe et al. (1997) highlighted the channels through which imports affect economic growth. First, they observe that intermediate capital goods importation increases the stock of productive capital, by extension leading to economic growth. Also, import increase GDP by allowing countries with low technological expertise to adapt advanced technologies from the technology frontier nations. Moreover, imports create opportunities for countries to learn efficient resource allocation methods from others which could have a positive impact on productivity and national output.

Further, it is worth noting that the increase in number of goods in an economy through importation allows both consumers and producers to be more economically efficient as they try to minimize cost and maximize satisfaction and profits, respectively. Such efficiency could give rise to specialization, leading to a rise in national output and low inflation (Carbaugh, 2008).

3.2. Empirical Literature

Following the theoretical analysis, both exports and imports appear to be very important for the economic wellbeing of a country. However, the validity of either export-led growth or import-led growth hypotheses continue to be debated in modern times with no clear consensus among researchers and policy analysts leading to a number of empirical research studies in this area.

The empirical literature comprised of country-specific studies as well as cross-country studies and ranges from investigating only the export-led growth hypothesis to generally examining the export-import-growth nexus. At country-specific level for instance, Qazi and Houda (2011) examines the validity of export-led growth and import-led growth hypotheses in Tunisia for the period 1960-2008. Employing the ARDL and variance decomposition methods, they established that both hypotheses are indeed valid in Tunisia for the period under study. Similarly, Paul (2014) examines the export-led growth relationship in Bangladesh from the period 1979-2010. Using an ARDL and bounds testing technique, he found strong evidence to support export-led growth in both the long run and short run. However, his result did not indicate any significant relationship between import and growth. He concluded that the trade liberalization that began in Bangladesh in the later part of the 1970s seem to have enhanced the country’s economic growth. Gabriel & Charity (2014) also examined the dynamics of the relationship between imports and economic growth in Nigeria for the period 1970-2011. Using the error correction methodology, they concluded that while the importation of manufactured goods have an adverse impact on economic growth, the importation of factor inputs led to positive economic growth in the country.

Moroke & Manoto (2015) investigated the exports, imports and economic growth nexus in South Africa for the period 1980-2013. Using cointegration and Granger causality techniques, they found strong links between exports and growth as well as imports and growth. They concluded that both the export-led and import-led growth hypotheses were valid in the case of South Africa for the period under study. Nurhaliq & Masih (2017) explored the relationship between trade and economic growth in Malaysia, emphasizing the separate roles of exports and imports for the period 1970-2014. Using cointegration and VAR method, they found evidence of significant relationships between exports and growth as well as imports and growth concluding that both hypotheses of export-led growth and import-led growth as well as growth-export and growth-led import are valid in Malaysia during the period of study.

Turay (2020) also used annual data to explore the relationship between export, import and economic growth in Sierra Leone for the period 1964 to 2017. The study employed Johansen cointegration, VAR model and Pair-wise Granger Causality test to investigate the above relationship. Using the VAR Model, the study found evidence of significant relationship between export and economic growth, while import is found to have no effect on economic growth in Sierra Leone. However, one of his conclusions appears to be incorrect because the premise that export and import do not granger cause economic growth does not support his conclusion that both export and import are sources of economic growth.

On a cross-country perspective, Sampathkumar & Rajeshkumar (2016) examines the relationship between export and economic growth in the SAARC countries during 1990 to 2013. Applying the cointegration and granger causality methodology, the result showed a unidirectional causation from economic growth to exports for Bangladesh and India, and bidirectional causation for the case of Afghanistan and Sri Lanka, while no causation was found for Bhutan, Maldives, Nepal and Pakistan. Akter & Bulbul (2017) investigated the validity of the export-led growth and import-led growth theories using cross-sectional data for eight selected developing countries between 2001-2015. Using cointegration and vector error correction methods, the study yielded mixed results. While exports and imports were shown to drive economic growth in the short run in Bangladesh and in the long run in Nigeria, economic growth and exports were found to drive imports in Turkey in both the short and long run. Also, Economic growth and imports were found to drive exports in Egypt and Indonesia in the short run and in Malaysia in the long run. Lastly, no significant evidence was found to support the two hypotheses for Pakistan and Iran.

In line with the theoretical literature, the empirical literature is mixed. The validity of the export-led growth and import-led growth hypotheses appears to vary from country to country and based on the period of study as well as the methodology used. Following the inconclusive debate, this paper seeks to add to the body of literature by including recent data and dynamic econometric method to test the validity of the hypotheses in Sierra Leone. Key contributions to the existing literature therefore include the following:

To the best of our knowledge, this is the first study to employ an ARDL bounds test and cointegration approach to empirically examine the Export-led Growth and Import-led Growth Hypotheses in Sierra Leone. Second, priori to 1980, the macroeconomic fundamentals in the country, such as GDP, inflation, exchange rate, employment and trade were relatively stable. Hence, this study considers the period 1980 to 2020 which reflects the nature of the structure of the current economy. Lastly, and more importantly, the study introduced exchange rate as a control variable in the model, which is a key variable through which trade can affect economic growth, as well as a war dummy to account for the effect of the rebel war for the period 1991-2001.

4. Methodology and Data

4.1. Model Specification and Estimation Techniques

To estimate the impact of export and imports on economic growth in Sierra Leone, this study adopted the model from Turay (2020), which was modified to incorporate nominal exchange rate and a WAR dummy as follows:

(1)

where, EXPTS and IMPTS represent export and import of goods and services, EXR is the nominal exchange rate of the Leone to the US Dollar (SLL/USD), WAR is war dummy to capture the effect of the civil war from 1991-2001. The term εt is the error while β0 is the constant term. β1 is the coefficient of the export variable, β2 is the coefficient of the import variable, and β3 is coefficient of the exchange rate variable and β4 is the coefficient of the war dummy. Based on classical theory, when export increases it enhances the trade balance and by extension increases GDP. Thus, the sign of β1 is expected to be positive. The effect of imports on economic growth is ambiguous, implying that β2 can take any sign (positive or negative). It could be positive when importation is geared towards capital goods for productive activities or negative when imports is dominated by consumption goods. In general, an increase in exchange rate (depreciation) could increase both foreign and domestic demand for local products and vice versa. Hence, β3 is expected to carry a positive sign. All of the variables except the dummy variable are expressed in natural logarithms.

4.2. Estimation Technique

We investigated the impact of export and imports on economic growth by using the ARDL modelling approach to cointegration technique due to the advantages it has over the Johansen cointegration approach. First, the ARDL model is more appropriate for small samples with respect to the statistical significance in order to establish any cointegration relationship (Ghatak and Siddiki, 2001). Conversely, the Johansen co-integration techniques, entails large data samples for validity. Second, the ARDL approach can be employed to regressors that are either I (1) and/or I (0), while Johansen co-integration approach call for all regressors to be integrated of the same order. This implies that the ARDL approach can get around issues of pre-testing which are usually related to standard cointegration, where variables are expected to be already ordered into I (1) or I (0) (Pesaran et al., 2001). The third advantage the ARDL approach has over the Johansen co-integration technique is that, the ARDL does not require to make large number of decisions such as the number of endogenous and exogenous variables to include, how to treat the deterministic elements, the ordering of the VAR as well as the decision of determining the optimal number of lags. Thus, making such estimation techniques to be sensitive to the kind of method employed in order to make such decisions (Pesaran and Smith, 1998). The fourth advantage in using the ARDL approach is that there is the likelihood that some variables can have different optimal numbers of lags, while this is not the case with the Johansen co-integration approach. Given this advantages, the ARDL presentation of Equation (1) is specified as follows:

(2)

where Δ is the first difference operator and all other variables are as earlier defined. The relationship among the variables in Equation (2) is estimated by means of bounds testing procedure of Pesaran et al. (2001). In the ARDL bounds testing framework, Equation (2) is estimated by Ordinary Least Squares (OLS) in order to test for the existence of a long run relationship among the variables by conducting an F-test for the joint significance of the coefficients of the lagged levels of the variables, that is: the null hypothesis of no cointegrating relationship, defined as:

is tested against the alternative hypothesis of the existence of cointegrating relationship defined as:

The cointegration test is based on the F-statistics or Wald statistics. The ARDL bounce test is used to test for cointegration given the relatively small sample size of 41 observations in this study. The test involves asymptotic critical value bounds test, depending on whether the variables are I (0) or I (1) or a mixture of both. Two sets of critical values for the cointegration test are generated. The lower critical bound assumes that all the variables are I (0), meaning that there is no cointegration among the variables, while the upper bound assumes that all the variables are I (1). If the computed F-statistic is greater than the upper critical bound, then the null hypothesis of no cointegration will be rejected. Conversely, if the computed F-statistic falls below the lower critical bounds value, and then the null hypothesis of no cointegration is accepted. The test is however inconclusive if the computed F-statistic lies between the lower and upper bounds.

If a long run relationship is established, the long run and error correction estimates of the ARDL model can be obtained from Equation (2). Thus, a general error correction representation of Equation (2) is specified as:

(3)

where ECM is the residual that is obtained from the estimated cointegration model, βs are the short run dynamic coefficients of the model’s convergence to equilibrium, and θ is the speed of adjustment.

To ascertain the goodness of fit of the ARDL model, the diagnostic and stability tests are conducted. The diagnostic test examines the serial correlation, functional form, normality and heteroscedasticity associated with the model. The stability test of the regression parameters is undertaken using the Brown et al. (1975) stability testing technique, also known as cumulative sum of recursive residuals (CUSUM) and the cumulative sum of squares of recursive residuals (CUSUMQ).

4.3. Data

In this study, we estimate the influence of export and import on economic growth based on annual data from 1980-2020. The variables of interest are economic growth, export and imports of goods and services. We also included the nominal exchange rate as a control variable, given its relevance for a small open economy like Sierra Leone. All the data are sourced from World Bank’s World Development Indicators (WDI) database.

5. Presentation and Discussion of the Empirical Results

We start with a graphical presentation of the variables in the time series data to determine whether there is co-movement among variables and whether the variables are stationary or not. Thus, Figure 2 below depicts the movement of the variables used in the study.

![]()

Figure 2. Graphical representation of the variables. Source: Author’s computation using e-views 9.

From observation of the graphs, it seems that exports and imports are moving together with real GDP. However, none of the variables appear to be stationary. As a result, the unit root test is carried out on each of the variables to ascertain whether they are stationary or nonstationary.

5.1. Unit Root Tests

Although the ARDL cointegration technique does not always require pre-testing for unit roots, the stationary condition has to be checked for all series as an initial step of model estimation to avoid ARDL model crash in the presence of integrated stochastic trend of I (2). In checking for stationarity, the Augmented Dickey Fuller unit root test was applied using the Schwarz Bayesian information criterion (SBC).

The ADF unit test result from Table 1 indicates that all the variables are stationary at first difference except the exchange rate which was stationary at levels. This outcome supports the use of the ARDL model as an appropriate approach for the study.

5.2. Bounds Test

The cointegration test reported in Table 2 shows that the null hypothesis of “no cointegration” can be rejected because the F-stat, 5.61, lies above the upper bound, I (1), at 5% level of significance. This shows that there exists a long run relationship between economic growth and all the explanatory variables.

5.3. Long Run Results

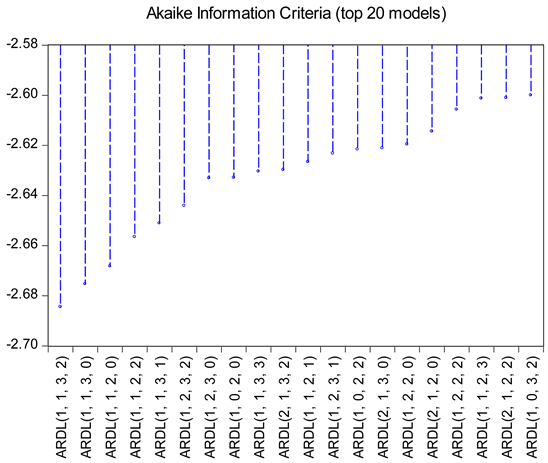

Following Liew (2004)3 the ARDL model is estimated based on the Akaike

Source: Author’s computation using e-views 9.

![]()

Table 2. ARDL bounds testing results. Null hypotheses: No long run relationships.

Source: Author’s computation using e-views 9.

Information Criterion (AIC). The estimated ARDL model with automatic lag selection using E-views version 9 is ARDL (1, 1, 3, 2) model, it was selected depending on the least AIC, as shown in the Appendix section.

The ARDL static long-run results are shown in Table 3.

The result shows that both exports and imports are important in explaining economic growth in Sierra Leone in the long run. The sign of the coefficients of exports is consistent with prior expectation and statistically significant at 5 percent level of significance. Specifically, 1 percent increase in exports will cause about 0.10 percent rise in GDP in the long run. Similarly, 1 percent rise in imports will lead to approximately 0.20 percent increase in GDP. In addition, the war dummy was found to have a statistically significant negative effect on economic growth in Sierra Leone in the long run. However, exchange rate was not found to have a significant impact on economic growth in the long run. These findings are broadly consistent with the findings of Qazi and Houda (2011) in Tunisia, as well as Moroke & Manoto (2015) in South Africa. The findings also appear to support the argument put forward by the proponents of the import-led growth hypothesis, suggesting that economic growth may have come from increased productivity due to imports, which enhance domestic activities and cause an import-led growth, as well as growth-led export. Our findings also resonates with the work done by Turay (2020) in terms of export having a positive effect on economic growth.

5.4. Short Run Results

The results of the short run dynamics associated with the ARDL (1, 1, 3, 2) model are presented in Table 4. Export is observed to be very important in explaining economic growth in Sierra Leone in the short run. Specifically, 1 percent increase in exports will lead to about 0.15 percent growth in GDP. Although imports and exchange rate appear to be positively related to GDP, the relationship was, however, not found to be statistically significant. The war dummy was found to have a negative and statistically significant effect on GDP in Sierra

![]()

Table 3. Long run coefficients based on AIC-ARDL (1, 1, 3, 2) model.

Note: ***Significant at 0.01 (1%) and **Significant at 0.05 (5%). Source: Author’s computation using e-views 9.

![]()

Table 4. Short run dynamics and error correction representation of the ARDL (1, 1, 3, 2) Model selected based on AIC.

Source: Author’s computation using e-views 9.

Leone, even in the short run. The result is consistent with the findings by Paul (2014) for Bangladesh, but contradict the findings by Turay (2020) for Sierra Leone.

The short run model provides information on how economic growth adjusts to restore long-run equilibrium in response to disturbances in the system. Based on the result, the coefficient of the error correction term is −0.6426 and was found to be statistically significant at the 1 percent level of significance. Since the coefficient is negative, it gives strong evidence of long run reversion to equilibrium at a speed of about 64 percent.

5.5. Diagnostic Tests

In a view to determine the reliability, stability and robustness of the model for

![]()

Figure 3. CUSUM and CUSUM of squares. Source: Author’s computation using e-views 9.

![]()

Table 5. Results for the diagnostics tests.

Source: Author’s computation using e-views 9.

possible policy purposes, a series of residual diagnostic and stability tests are carried out. The null hypotheses in this case are that there is no serial correlation, the model is homoscedastic, and the errors are normally distributed and that the model is correctly specified. The tests results presented in Table 5, showed that the baseline model results are robust.

The CUSUM and CUSUM of Squares graphs confirm the stability of the model over time as illustrated in Figure 3.

6. Conclusion

The study seeks to empirically test the export-led growth (ELG) and import-led growth (ILG) hypotheses in Sierra Leone spanning the period 1980 to 2020 using ARDL bounds test approach to cointegration. Both pre-estimation and post-estimation tests were carried out in a view to prevent the problem of spurious regression, and to ensure that the estimation results are robust enough to inform policy design. The study mainly focused on external sector drivers of economic growth in Sierra Leone. Thus, export and import were considered as the two key explanatory variables, while exchange rate entered the equation mainly as a control variable. A dummy was also used to capture the effect of the rebel war from 1991 to 2001.

The study concludes that both the export-led growth and import-led growth hypotheses are valid in the case of Sierra Leone for the period under consideration. However, export appears to be relatively more important than import for economic growth in Sierra Leone. The findings are broadly consistent with the findings of Qazi and Houda (2011) in Tunisia, as well as Moroke & Manoto (2015) in South Africa. The findings also appear to support the argument put forward by the proponents of the import-led growth hypothesis, suggesting that economic growth may have come from increased productivity due to imports, which enhance domestic activities and cause an import-led growth, as well as growth-led export. Our findings also resonate with the work done by Turay (2020) in terms of export having a positive effect on economic growth.

In line with the findings in the study, it can be deduced that the right combinations of exports and imports could stimulate sustainable economic growth in Sierra Leone if given serious attention. The government needs to be committed to the promotion of strategies that will broaden the export base of the country. The industrial manufacturing sector in the country remains very shallow and uncompetitive. To fully realize the export potentials of the country, the industrial manufacturing sector needs to be deepened. In addition, the government must double its efforts in pursuing policies that encourage value addition to agriculture, forestry, fishing and mining activities with the aim of making these sectors competitive in the export markets. Specifically:

• In agriculture, efforts need to be increased in adapting modern scientific methods of farming which are likely to improve output and production throughout the year.

• In forestry, reforestation and afforestation has to be increased over the rate of deforestation to ensure sustainability and high future output in the sector. Given higher output in the sector, some of the raw materials can be converted to intermediate and final products that can be traded for even higher value.

• In the mining sector, there is room for improvement especially in the area of iron ore mining. Government should make efforts to lure investors that could establish high quality steel producing companies in the country. This has the potential to significantly increase the country’s receipts from the sector, while at the same time reduce the import bill of steel, which is currently in high demand in the country and the sub-region.

Finally, the country has a lot of beautiful and historic tourist sites which have deteriorated over the years. An improvement of such sites could significantly improve the value of services in the tourism sector of the country.

Appendix: Model Selection Summary Graph

Source: Author’s computation using e-views 9.

NOTES

1World Bank development indicators October 2020.

2See Pressman (2006), “Fifty Major Economists”.

3 Liew (2004) argues that Akaike Information Criterion (AIC) and Final Prediction Error (FPE) criteria have superior properties in small sample estimations since they minimize the chance of underestimation while maximizing the change of recovering the true lag length.