Optimum-Welfare and Maximum-Revenue Tariffs in Vertically Related Markets ()

1. Introduction

There have been a number of theoretical studies comparing optimum-welfare and maximum-revenue tariffs. Johnson [1] demonstrated that the maximum-revenue tariff is generally higher than the optimum-welfare tariff under perfect competition and the large-country assumption. In contrast, Collie [2] showed that the optimumwelfare tariff may exceed the maximum-revenue tariff in a Cournot duopoly with homogeneous products and linear demand. This result is more likely the lower costs of the home firm compared to the costs of the foreign firm. In addition, Larue and Gervais [3] demonstrated that the maximum-revenue tariff can be lower than the optimum-welfare tariff in a model where a few domestic Cournot firms take the leadership position over a competitive fringe of foreign firms. Further, Clarke and Collie [4] showed that the optimum-welfare tariff may exceed the maximum-revenue tariff under both Bertrand duopoly and Cournot duopoly with product differentiation1. In these analyses, however, vertical trade structures are not considered.

World trade in intermediate good has been expanding rapidly. In East Asia, for instance, the international division of production has developed, and intermediate goods such as parts and components have been actively traded among production bases located across borders in the region. According to the Ministry of Economy, Trade and Industry, Japan [6] , the share of parts and components in East Asian intra-regional trade was 32.5% in 2010. Therefore, in designing the import-tariff policy, each country should consider the growing trade in intermediate goods. Now, the possible effect of this new consideration on the comparison of optimum-welfare and maximum-revenue tariffs needs to be observed.

The purpose of this study is to compare the optimum-welfare tariffs with the maximum-revenue tariffs on intermediate-good and final-good imports in a model of vertically related markets2. We construct a model where a home and a foreign upstream (intermediate-good) firm act as Cournot competitors in the home and foreign upstream markets; and a home and a foreign downstream (final-good) firm operate as Cournot competitors in the home and foreign downstream markets.

We provide the following findings. The optimum-welfare tariff on intermediate-good imports exceeds the maximum-revenue tariff if the marginal costs of the home upstream firm are much lower than those of the foreign upstream firm. Further, the optimum-welfare tariff on final-good imports exceeds the maximum-revenue tariff if the home upstream firm’s costs are sufficiently higher than the foreign firm’s costs. For example, when the costs of the home and the foreign upstream firms are equal, the maximum-revenue tariff on the intermediate (respectively final) good exceeds the optimum-welfare tariff on the intermediate (respectively final) good. In the presence of vertical trade structures, it is less likely that the optimum-welfare tariff exceeds the maximum-revenue tariff. This is because the tariff on upstream (respectively downstream) imports has a negative vertical effect on the profits of the home downstream (respectively upstream) firm, thereby reducing the optimum-welfare tariffs on upstream and downstream imports.

The paper is organized as follows. Section 2 describes the model and derives the market equilibrium. Section 3 analyzes the maximum-revenue and the optimum-welfare tariffs on intermediate-good and final-good imports. Section 4 provides the conclusions of this study.

2. The Model

Assume that there are two countries, a home and a foreign country, each with one upstream firm producing a homogeneous intermediate good and one downstream firm producing a homogeneous final good. The home and the foreign upstream firms act as Cournot competitors in supplying the intermediate good to the upstream markets in both countries. The home and the foreign downstream firms supply the final good to home and foreign downstream markets, where they compete in a Cournot duopoly. The home government imposes a specific tariff  on intermediate-good imports and a specific tariff T on final-good imports3.

on intermediate-good imports and a specific tariff T on final-good imports3.

The model is characterized by a three-stage game. In stage 1, the home government sets its tariffs against the intermediate-good and final-good imports. In stage 2, the home and the foreign upstream firms choose their supplies of the intermediate good. In stage 3, taking the home and foreign prices of the intermediate good as given, the home and the foreign downstream firms choose their supplies of the final good4. The intermediate-good price is simply the market-clearing price. The solution concept employed is a subgame perfect equilibrium, obtained by a process of backward induction.

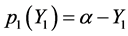

2.1. The Downstream Markets

Sales by the home and the foreign downstream firms in the home market are denoted  and

and , respectively. Their sales in the foreign market are denoted

, respectively. Their sales in the foreign market are denoted  and

and . The prices,

. The prices,  and

and , of the final good in the home and the foreign country are determined by the inverse demand functions,

, of the final good in the home and the foreign country are determined by the inverse demand functions,  and

and

, respectively, where

, respectively, where . We assume that production of one unit of the final good requires one unit of the intermediate good. The profits of the home and the foreign downstream firms, respectively, are then given by

. We assume that production of one unit of the final good requires one unit of the intermediate good. The profits of the home and the foreign downstream firms, respectively, are then given by

(1)

(1)

where  and

and  are the prices of the intermediate good in the home and the foreign country, respectively.

are the prices of the intermediate good in the home and the foreign country, respectively.

We first set up the conditions determining the Cournot-Nash equilibrium in stage 3. Given  and

and , the first-order conditions for profit maximization by the home and the foreign downstream firms in the home market under Cournot assumption are

, the first-order conditions for profit maximization by the home and the foreign downstream firms in the home market under Cournot assumption are

(2)

(2)

The profit-maximizing conditions for the home and the foreign downstream firms in the foreign market are

(3)

(3)

From conditions (2) and (3), we obtain the Cournot-Nash equilibrium sales of the home and the foreign downstream firms as follows:

(4)

(4)

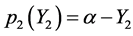

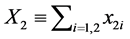

2.2. The Upstream Markets

Sales by the home and the foreign upstream firms in the home market are denoted  and

and , respectively. Their respective sales in the foreign market are denoted

, respectively. Their respective sales in the foreign market are denoted  and

and . The total sales are

. The total sales are  in the home country, and

in the home country, and  in the foreign country.

in the foreign country.

In stage 2, the home and the foreign upstream firms anticipate the derived demand for the intermediate good arising from the Cournot-Nash equilibrium in stage 3. From the market-clearing conditions in the two countriesi.e.,  , we can derive the inverse demand for the intermediate good in the home and the foreign country as follows:

, we can derive the inverse demand for the intermediate good in the home and the foreign country as follows:

(5)

(5)

The home and the foreign upstream firms have constant marginal costs of producing the intermediate good,  and

and , respectively5. The profits of the home and the foreign upstream firms are given by

, respectively5. The profits of the home and the foreign upstream firms are given by

(6)

(6)

The first-order conditions for profit maximization by the home and the foreign upstream firms under Cournot behavior are

(7)

(7)

Solving condition (7), we obtain the equilibrium sales of the home and the foreign upstream firms as follows:

(8)

(8)

From (5) and (8), the equilibrium prices of the intermediate good in the home and the foreign country are

(9)

(9)

Substituting (9) into (4), we have the equilibrium sales of the home and the foreign downstream firms as follows:

(10)

(10)

From (10), the equilibrium prices of the final good in the home and the foreign country are

(11)

(11)

3. Optimum-Welfare and Maximum-Revenue Tariffs

This section analyzes the maximum-revenue tariffs and the optimum-welfare tariffs on imports of the intermediate and the final good. In stage 1, the home government sets its tariffs against intermediate-good and finalgood imports, realizing the effects of its intervention on the firms’ decisions in stages 2 and 3.

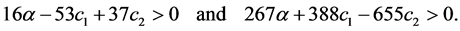

In the subsequent analysis, we assume that the following conditions are satisfied:

(12)

(12)

Condition (12) guarantees that all upstream and downstream firms sell positive quantities in the home and the foreign markets in both cases of the maximum-revenue tariffs and the optimum-welfare tariffs, i.e.,  and

and

.

.

3.1. Maximum-Revenue Tariffs

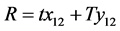

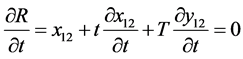

Here, we consider the maximum-revenue tariffs on intermediate-good and final-good imports. The maximumrevenue tariffs are the tariffs that maximize the home government’s tariff revenue. The home country’s tariff revenue is . The first-order conditions for the maximization of tariff revenue by the home government are given by

. The first-order conditions for the maximization of tariff revenue by the home government are given by

, (13)

, (13)

. (14)

. (14)

The sum of the first and second terms in (13) is the effect of the tariff  against intermediate-good imports on the tariff revenue of the home government from intermediate-good imports: an increase in the tariff

against intermediate-good imports on the tariff revenue of the home government from intermediate-good imports: an increase in the tariff  raises (respectively reduces) tariff revenue from intermediate-good imports for low (respectively high) tariffs. The third term is the effect on the tariff revenue from final-good imports: an increase in

raises (respectively reduces) tariff revenue from intermediate-good imports for low (respectively high) tariffs. The third term is the effect on the tariff revenue from final-good imports: an increase in  increases imports of the final good, thereby raising tariff revenue from final-good imports.

increases imports of the final good, thereby raising tariff revenue from final-good imports.

The sum of the first and second terms in (14) is the effect of the tariff  against final-good imports on the tariff revenue from final-good imports: an increase in the tariff

against final-good imports on the tariff revenue from final-good imports: an increase in the tariff  raises (respectively reduces) the tariff revenue from final-good imports for low (respectively high) tariffs. The third term is the effect on the tariff revenue from intermediate-good imports: an increase in

raises (respectively reduces) the tariff revenue from final-good imports for low (respectively high) tariffs. The third term is the effect on the tariff revenue from intermediate-good imports: an increase in  increases imports of the intermediate good, thereby raising tariff revenue from intermediate-good imports.

increases imports of the intermediate good, thereby raising tariff revenue from intermediate-good imports.

Using (8) and (10) to solve (13) and (14) yields the maximum-revenue tariffs on imports of the intermediate and the final good as follows (the superscript  denotes maximum-revenue tariff):

denotes maximum-revenue tariff):

, (15)

, (15)

. (16)

. (16)

From condition (12), the maximum-revenue tariffs on intermediate-good and final-good imports are positive.

Using (15) and (16) to compare the maximum-revenue tariff on intermediate-good imports with that on finalgood imports yields6

. (17)

. (17)

The maximum-revenue tariff on final-good imports is higher than that on intermediate-good imports. The reason is that the negative effect of the upstream tariff  on intermediate-good imports outweighs the negative effect of the downstream tariff

on intermediate-good imports outweighs the negative effect of the downstream tariff  on final-good imports

on final-good imports  7.

7.

3.2. Optimum-Welfare Tariffs

Now, we focus on the optimum-welfare tariffs on intermediate-good and final-good imports. The optimumwelfare tariffs are the tariffs that maximize the welfare of the home country. The welfare of the home country is given by the sum of the profits of the upstream and the downstream firms, the consumer surplus, and the tariff revenue.

(18)

(18)

where  denotes consumer surplus in the home country, and

denotes consumer surplus in the home country, and  and

and

denote the profits made by the home firm in the home and the foreign markets, respectively. The first-order conditions for welfare maximization by the home government are given by

denote the profits made by the home firm in the home and the foreign markets, respectively. The first-order conditions for welfare maximization by the home government are given by

(19)

(19)

(20)

(20)

The first term in (19) is the effect of the tariff  against intermediate-good imports on the profits made by the home upstream firm in the home market: an increase in the tariff

against intermediate-good imports on the profits made by the home upstream firm in the home market: an increase in the tariff  increases its domestic sales and raises the intermediate-good price in the home country, thereby increasing its local profits. The second term is the effect on the export profits of the home upstream firm: an increase in

increases its domestic sales and raises the intermediate-good price in the home country, thereby increasing its local profits. The second term is the effect on the export profits of the home upstream firm: an increase in  decreases its volume of exports and its export profits. The sum of the third and fourth terms is the effect on the profits of the home downstream firm: an increase in

decreases its volume of exports and its export profits. The sum of the third and fourth terms is the effect on the profits of the home downstream firm: an increase in  raises the marginal costs that the home downstream firm faces because of a rise in the home price of the intermediate good, thus decreasing its sales and profits in the home and foreign markets. The fifth term is the effect on consumer surplus: an increase in

raises the marginal costs that the home downstream firm faces because of a rise in the home price of the intermediate good, thus decreasing its sales and profits in the home and foreign markets. The fifth term is the effect on consumer surplus: an increase in  raises the price of the final good in the home country and decreases the consumer surplus. The sixth term is the effect on the tariff revenue of the home government.

raises the price of the final good in the home country and decreases the consumer surplus. The sixth term is the effect on the tariff revenue of the home government.

The first term in (20) is the effect of the tariff  against final-good imports on the profits of the home downstream firm in the home market: an increase in the tariff

against final-good imports on the profits of the home downstream firm in the home market: an increase in the tariff  increases its domestic sales and profits from the home market. The second term is the effect on the export profits of the home downstream firm: an increase in

increases its domestic sales and profits from the home market. The second term is the effect on the export profits of the home downstream firm: an increase in  decreases its volume of exports and its export profits. The third term is the effect on the home upstream firm’s profits in the home market: an increase in

decreases its volume of exports and its export profits. The third term is the effect on the home upstream firm’s profits in the home market: an increase in  increases its domestic sales because of an increase in the derived demand for the intermediate good in the home country, thereby increasing its local profits. The fourth term is the effect on the export profits of the home upstream firm: an increase in

increases its domestic sales because of an increase in the derived demand for the intermediate good in the home country, thereby increasing its local profits. The fourth term is the effect on the export profits of the home upstream firm: an increase in  decreases its exports and lowers the foreign price of the intermediate good because of a decrease in the derived demand for the intermediate good in the foreign country, thus reducing its export profits. The fifth term is the effect on consumer surplus: an increase in

decreases its exports and lowers the foreign price of the intermediate good because of a decrease in the derived demand for the intermediate good in the foreign country, thus reducing its export profits. The fifth term is the effect on consumer surplus: an increase in  raises the final-good price in the home country and decreases consumer surplus. The sixth term is the tariff revenue effect.

raises the final-good price in the home country and decreases consumer surplus. The sixth term is the tariff revenue effect.

Using (8), (9), (10), and (11) to solve (19) and (20) yields the optimum-welfare tariffs on imports of the intermediate and the final good as follows (the superscript  denotes optimum-welfare tariff):

denotes optimum-welfare tariff):

, (21)

, (21)

. (22)

. (22)

From condition (12), the optimum-welfare tariffs on intermediate-good and final-good imports are positive.

Using (21) and (22) to compare the optimum-welfare tariff on intermediate-good imports with that on finalgood imports yields

(23)

(23)

The optimum-welfare tariff on final-good imports is greater than that on intermediate-good imports. As we have mentioned in 3.1, the upstream tariff  causes a larger reduction in imports than the downstream tariff

causes a larger reduction in imports than the downstream tariff . In addition, the tariff

. In addition, the tariff  increases only the home upstream firm’s profits from the home market, whereas the tariff

increases only the home upstream firm’s profits from the home market, whereas the tariff  increases the profits of the home upstream and downstream firms in the home market. Therefore, the optimum-welfare downstream tariff exceeds the optimum-welfare upstream tariff.

increases the profits of the home upstream and downstream firms in the home market. Therefore, the optimum-welfare downstream tariff exceeds the optimum-welfare upstream tariff.

From (17) and (23), we have the following proposition.

Proposition 1: In both cases of the maximum-revenue tariffs and the optimum-welfare tariffs, the tariff on final-good imports is higher than that on intermediate-good imports.

Proposition 1 implies that tariff escalation, which refers to a situation where tariffs increase as the level of processing increases, occurs.

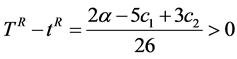

Using (15) and (21) to compare the optimum-welfare tariff with the maximum-revenue tariff on intermediategood imports yields

. (24)

. (24)

If , then the optimum-welfare tariff on intermediate-good imports will exceed the maximum-revenue tariff (i.e.,

, then the optimum-welfare tariff on intermediate-good imports will exceed the maximum-revenue tariff (i.e., ).

).

Using (16) and (22) to compare the optimum-welfare tariff with the maximum-revenue tariff on final-good imports yields

. (25)

. (25)

If , then the optimum-welfare tariff on final-good imports will exceed the maximum-revenue tariff (i.e.,

, then the optimum-welfare tariff on final-good imports will exceed the maximum-revenue tariff (i.e., )8.

)8.

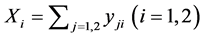

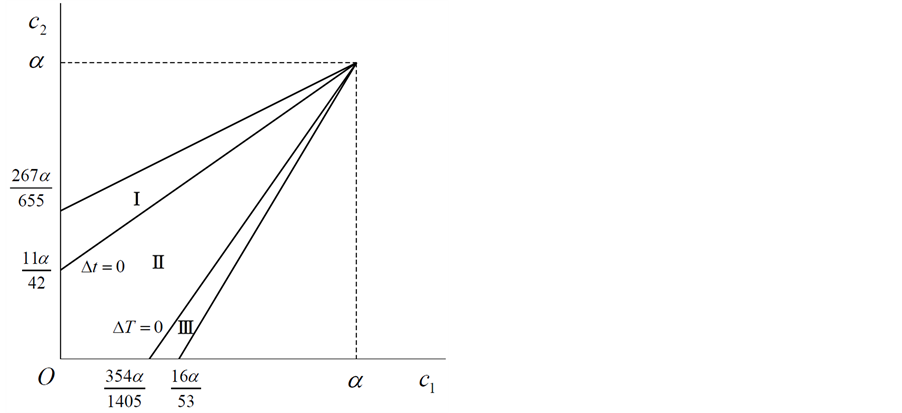

Figure 1 compares the optimum-welfare and the maximum-revenue tariffs. The  locus and the

locus and the  locus are plotted in the (

locus are plotted in the ( ,

, ) space. Above (respectively below) the

) space. Above (respectively below) the  locus, the optimumwelfare tariff on intermediate-good imports is higher (respectively lower) than the maximum-revenue tariff. Above (respectively below) the

locus, the optimumwelfare tariff on intermediate-good imports is higher (respectively lower) than the maximum-revenue tariff. Above (respectively below) the  locus, the optimum-welfare tariff on final-good imports is lower (respectively higher) than the maximum-revenue tariff. These two loci divide the region where condition (12) is satisfied into three regions, I, II, and III. In region I,

locus, the optimum-welfare tariff on final-good imports is lower (respectively higher) than the maximum-revenue tariff. These two loci divide the region where condition (12) is satisfied into three regions, I, II, and III. In region I,  and

and . In region II,

. In region II,  and

and . In region III,

. In region III,  and

and . From Figure 1, the lower the marginal costs of the home upstream firm relative to those of the foreign upstream firm, the more likely it is that the optimum-welfare tariff on intermediate-good imports will exceed the maximum-revenue tariff. The optimum-welfare tariff on final-good imports is more likely to exceed the maximum-revenue tariff the higher the home upstream firm’s marginal costs relative to the foreign marginal costs.

. From Figure 1, the lower the marginal costs of the home upstream firm relative to those of the foreign upstream firm, the more likely it is that the optimum-welfare tariff on intermediate-good imports will exceed the maximum-revenue tariff. The optimum-welfare tariff on final-good imports is more likely to exceed the maximum-revenue tariff the higher the home upstream firm’s marginal costs relative to the foreign marginal costs.

The above analysis establishes the following proposition.

Proposition 2: 1) The optimum-welfare tariff on intermediate-good imports exceeds the maximum-revenue tariff if the home upstream firm is much more cost competitive than the foreign upstream firm (i.e., ). 2) The optimum-welfare tariff on final-good imports exceeds the maximum-revenue tariff if the home upstream firm is significantly more inefficient than the foreign upstream firm (i.e.,

). 2) The optimum-welfare tariff on final-good imports exceeds the maximum-revenue tariff if the home upstream firm is significantly more inefficient than the foreign upstream firm (i.e., ).

).

The intuition behind Proposition 2 1) can be explained as follows. Evaluating the welfare effect of the tariff  against intermediate-good imports, given by (19), at the maximum-revenue tariff

against intermediate-good imports, given by (19), at the maximum-revenue tariff  on the intermediate good, the sixth term, the tariff revenue effect, is zero. An increase in the tariff

on the intermediate good, the sixth term, the tariff revenue effect, is zero. An increase in the tariff  beyond the maximum-revenue tariff will increase the welfare of the home country if the sum of the first to fifth terms in (19) is positive. In other words, if the positive effect of the tariff

beyond the maximum-revenue tariff will increase the welfare of the home country if the sum of the first to fifth terms in (19) is positive. In other words, if the positive effect of the tariff  on the local profits of the home upstream firm outweighs the negative effects on the home upstream firm’s export profits, the home downstream firm’s profits, and the consumer surplus, then the optimum-welfare tariff

on the local profits of the home upstream firm outweighs the negative effects on the home upstream firm’s export profits, the home downstream firm’s profits, and the consumer surplus, then the optimum-welfare tariff  on the intermediate good will exceed the maximum-revenue

on the intermediate good will exceed the maximum-revenue

Figure 1. Optimum-welfare and maximum-revenue tariffs.

tariff . The lower the costs of the home upstream firm are, the larger its price-cost margin,

. The lower the costs of the home upstream firm are, the larger its price-cost margin,  , and its domestic sales,

, and its domestic sales,  , consequently, the larger the positive effect on its profits. Therefore, if the home upstream firm is sufficiently more cost competitive than the foreign upstream firm, the positive effect dominates the negative effect; therefore, the optimum-welfare tariff on the intermediate good will exceed the maximum-revenue tariff.

, consequently, the larger the positive effect on its profits. Therefore, if the home upstream firm is sufficiently more cost competitive than the foreign upstream firm, the positive effect dominates the negative effect; therefore, the optimum-welfare tariff on the intermediate good will exceed the maximum-revenue tariff.

With regard to Proposition 2 2), evaluating (20) at the maximum-revenue tariff  on the final good, the sixth term, the tariff revenue effect, is zero. An increase in the tariff

on the final good, the sixth term, the tariff revenue effect, is zero. An increase in the tariff  on final-good imports beyond the maximum-revenue tariff will enhance the welfare of the home country if the sum of the first to fifth terms in (20) is positive. In other words, if the positive effects of the tariff

on final-good imports beyond the maximum-revenue tariff will enhance the welfare of the home country if the sum of the first to fifth terms in (20) is positive. In other words, if the positive effects of the tariff  on the local profits of the home upstream and downstream firms dominate the negative effects on their export profits and consumer surplus, then the optimum-welfare tariff

on the local profits of the home upstream and downstream firms dominate the negative effects on their export profits and consumer surplus, then the optimum-welfare tariff  on the final good will exceed the maximum-revenue tariff

on the final good will exceed the maximum-revenue tariff . The higher the home upstream firm’s costs are, the smaller its price-cost margin,

. The higher the home upstream firm’s costs are, the smaller its price-cost margin,  , and its exports,

, and its exports,  , therefore, the smaller the negative effect on its profits. Thus, if the home upstream firm is much more inefficient, the negative effect is insufficient to outweigh the positive effect; therefore, the optimum-welfare tariff on the final good exceeds the maximum-revenue tariff.

, therefore, the smaller the negative effect on its profits. Thus, if the home upstream firm is much more inefficient, the negative effect is insufficient to outweigh the positive effect; therefore, the optimum-welfare tariff on the final good exceeds the maximum-revenue tariff.

We now consider the symmetric case where the home and the foreign upstream firms have equal marginal costs, i.e., . Using (24) and (25), we obtain

. Using (24) and (25), we obtain

, (26)

, (26)

. (27)

. (27)

From (26) and (27), we obtain the following result.

Corollary 1: In the symmetric case, the maximum-revenue tariff on the intermediate (respectively final) good exceeds the optimum-welfare tariff on the intermediate (respectively final) good.

This result is in contrast to the result in a Cournot duopoly model without an intermediate-good sector (e.g. Collie, [2] ) that when home and foreign marginal costs are equal, the optimum-welfare tariff exceeds the maximum-revenue tariff9. The explanation for the difference is as follows. In a model with a vertical industry structure, the upstream tariff  decreases the profits of the home downstream firm. The negative effect of the downstream tariff

decreases the profits of the home downstream firm. The negative effect of the downstream tariff  on the export profits of the home upstream firm outweighs the positive effect on its local profits; consequently, the downstream tariff decreases the upstream firm’s profits. This negative vertical effect reduces the optimum-welfare tariffs on upstream and downstream imports. Thus, it is less likely that the optimumwelfare tariff exceeds the maximum-revenue tariff in the presence of vertical industry relationships than in their absence.

on the export profits of the home upstream firm outweighs the positive effect on its local profits; consequently, the downstream tariff decreases the upstream firm’s profits. This negative vertical effect reduces the optimum-welfare tariffs on upstream and downstream imports. Thus, it is less likely that the optimumwelfare tariff exceeds the maximum-revenue tariff in the presence of vertical industry relationships than in their absence.

4. Conclusions

We have investigated the maximum-revenue tariffs and the optimum-welfare tariffs on intermediate-good and final-good imports in a model of vertically related markets characterized by Cournot competition. There are two main conclusions to this study. First, in both cases of the maximum-revenue and the optimum-welfare tariffs, the tariff on the final good is higher than that on the intermediate good, implying that tariff escalation appears. Secondly, the optimum-welfare tariff against intermediate-good imports exceeds the maximum-revenue tariff if the cost advantage of the home upstream firm is sufficiently larger. Further, the optimum-welfare tariff against final-good imports exceeds the maximum-revenue tariff if the cost disadvantage of the home upstream firm is significantly larger. For example, in the symmetric case, the maximum-revenue tariffs on the intermediate and the final good, respectively, exceed the optimum-welfare tariffs on the intermediate and the final good.

Our model suggests some extensions. Incorporating the technological difference between the home and the foreign downstream firms into this framework would enrich our analysis and provide fruitful results. Further, it would be an interesting undertaking to consider the case of general numbers of upstream and downstream firms. We would like to extend our model to include these topics in future research.

NOTES

1Clarke and Collie showed that the maximum-revenue export tax always exceeds the optimum-welfare export tax under Bertrand duopoly with product differentiation.

2Studies concerning strategic trade policy in vertically related markets include Bernhofen , Ishikawa and Spencer , Chang and Sugeta , Hwang et al. , and Kawabata .

3For simplicity, we assume that the foreign government pursues a policy of laissez-faire.

4This setting implies that the downstream firms have no market power as buyers of the intermediate good, even though they have market power as sellers of the final good. This setting is adopted in Bernhofen , Ishikawa and Lee , Ishikawa and Spencer , Hwang et al. , Kawabata , and McCorriston and Sheldon . Ishikawa and Spencer provide a detailed discussion of the justification for this setting.

5It is assumed that .

.

6Using condition (12), it can be shown that .

.

7The positive effect of the upstream tariff  on final-good imports is equal to the positive effect of the downstream tariff

on final-good imports is equal to the positive effect of the downstream tariff  on intermediate-good imports

on intermediate-good imports .

.

8It can be shown that .

.

9Clarke and Collie showed that in the symmetric case, the optimum-welfare tariff will exceed the maximum-revenue tariff under both Bertrand duopoly and Cournot duopoly if the degree of product substitutability is sufficiently high.