Fair Value and Its Economic Consequence on the Volatility Measures of Earnings, Stock Price and Government Debt Yield ()

1. Background Studies of Fair Value and Economic Consequences

Researchers study the economic consequences of adopting fair value accounting as part of IFRS and find that fair value measures are more value relevant in explaining stock prices. Barth [1] , Bernard et al. [2] , Barth et al. [3] , and Barth and Clinch [4] compare the effects of fair value accounting and historical cost accounting on stock prices and find that fair value has significant explanatory power in explaining stock price movements. Landsman [5] surveys fair value accounting studies in the US, UK and Australia and argues that fair values are informative to investors but the level of informativeness is affected by the amount of measurement error. Khurana and Kim [6] found that fair values of available-for-sale securities are more informative relative to book values. However, fair values of loans and deposits are less informative than those of their book values of historical cost measure. Nelson [7] also reported fair values are informative only in measuring investment securities but not for loans, deposits and long-term debt, implying that fair value accounting was appropriate and value relevant for actively traded assets and when there existed available market-determined fair values. In contrast, Beatty et al. [8] found that fair value accounting had a negative impact on the stock price movements for those banks who had frequently trading investments, in longer maturity, and being more hedged against interest rate changes.

Previous studies suggest that share prices reflect a risk premium associated with earnings volatility (Litzenberger and Rao [9] , Collins and Kothari [10] , Easton and Zmijewski [11] ) and earnings measured under fair value accounting are more volatile than those measured under historical cost accounting (Bernard et al. [2] , Barth et al. [3] , Hodder et al. [12] . The relationship between share price and earnings has been studied by Foster et al. [13] who found that share prices respond to firms’ earnings announcement. The difference between actual earnings that announced and the previous forecasted earnings is called the “earnings surprise”. They observed a large excess positive returns for positive earnings surprise firms; conversely a large negative returns for negative earnings surprise firms. More interesting, share prices movement showed a momentum, prices of positive earnings surprise firms continue to rise whereas prices of negative earnings surprise firms continue to fall. This suggests that stock markets adjust for earnings information and such an adjustment will last for a sustained period.

In reviewing the US Financial Accounting Standard 133 for derivative instruments, Barton [14] argues that this standard has the potential to increase corporate earnings volatility by requiring daily fluctuations in the fair asset value of derivatives are exposed as net changes in profit or loss. Barth et al. [3] investigate US banks investment securities from 1971 to 1990 and found that earnings is more volatile under fair value accounting, though share prices do not reflect the incremental volatility. Bernard et al. [2] and Barth et al. [3] suggest that earnings volatility is a result of recognizing unrealized gains and losses from changes in fair value. Hodder et al. [12] further explain that fair value income is more volatile because fair value captures the risk elements which are not captured by historical cost net income or comprehensive income. As fair value increases earnings volatility, Turel [15] reported that Turkish real estate investment trusts were less willing to value investment properties at fair value.

Earnings volatility is a particular concern for investors. Market valuation of firms is largely driven by earnings expectation and volatility in earnings is likely to increase investor perceptions of risk in an investment (Bao and Bao [16] , Bordurtha and Thornton [17] . The level of volatility is simply a reflection of risk from a firm’s income. Investors demand for higher returns from investing in a higher risk firm and thus the firm’s cost of capital will increase. If the accounting information using fair values overstates volatility or risk, and investors do not fully understand the effect of fair value accounting, there is possibility that investors could over price the security with a risk premium that is higher than justified by the true underlying economic value of the firm. It may be argued that markets are efficient that financial statements incorporate all public available information so that increased volatility in accounting information will have no impact on investors’ decisions. Goel and Thakor [18] point out higher volatility in reported earnings results into a greater information acquisition cost and hence lower the value of these firms. Cornett et al. [19] also argue that fair value accounting announcements introduced a new cost to the banking industry. Longstaff and Piazzesi [20] suggest that volatility in corporate earnings and in stock price will reduce shareholders value.

The effect of fair value accounting has particularly evident in the European capital markets. Armostrong et al. [21] argue that despite EU banks widely oppose IAS 39, average investors view that IFRS has benefits that outweigh its costs and European capital markets show positive reaction to the likelihood of adopting of IAS 39. Nonetheless, Nessrine [22] found that the adoption of IAS 39 by French banks led to negative abnormal stock returns and thus concluded that the market perceives adoption of fair value accounting as harmful to the economic values of banks. Callao et al. [23] suggest that the main difference between IFRS and Spanish accounting standards is the use of fair value in measuring financial instruments. They argue that fair value accounting may improve relevance of financial information to the local stock market in the medium and long-term, but in a short-term fair value will compromise the relevance and comparability of financial reporting.

2. Definition of Fair Value and Volatilities of Earnings, Stock Price and Government Debt

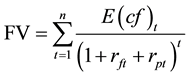

International Accounting Standard Board (2003) defines fair value as the price for which an asset could be exchanged, or a liability settled between knowledgeable, wiling market participants in an arm’s length transaction. Thus, fair value is a selling price or exit value in an active market. It is the amount that would be received from selling an asset or transferring a liability in an orderly transaction. The fair value of an asset (or liability) can be derived by a three levels’ hierarchy of inputs: Level 1 inputs, quoted prices available in active markets for identical assets (liabilities); Level 2 inputs, quoted prices for similar assets (or liabilities) that can be observed from the markets; Level 3 estimated as the present value of future cash flows that are associated with assets (or liabilities). A generalized equation will be:

where  is the future cash flows that are expected to generate from assets and liabilities;

is the future cash flows that are expected to generate from assets and liabilities;  is the risk- free rate and

is the risk- free rate and  is the risk premium; and

is the risk premium; and  indicates the holding period of the asset or liability. The equation suggests that fair values FV are estimated as the present value of expected future cash flows associated with the asset or liability, discounted by an appropriate discount rate which is the risk free rate plus a risk premium.

indicates the holding period of the asset or liability. The equation suggests that fair values FV are estimated as the present value of expected future cash flows associated with the asset or liability, discounted by an appropriate discount rate which is the risk free rate plus a risk premium.

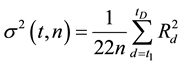

Earnings volatility is measured as the standard deviation of aggregate earnings per share of a stock index in any country over a testing period and  is used to stand for earnings volatility. Modeling stock price volatility has been the subject of vast empirical and theoretical investigation over the past decade by academics and practitioners. Exponentially Weighted Moving Average Model (EWMA), GARCH and Non-linear GARCH models are used to estimate stock price volatility. In estimating debt return volatility, one can use the realized second moment, i.e. the realized volatility of government bond returns between the end of month

is used to stand for earnings volatility. Modeling stock price volatility has been the subject of vast empirical and theoretical investigation over the past decade by academics and practitioners. Exponentially Weighted Moving Average Model (EWMA), GARCH and Non-linear GARCH models are used to estimate stock price volatility. In estimating debt return volatility, one can use the realized second moment, i.e. the realized volatility of government bond returns between the end of month  and the end of month

and the end of month :

:

where  denotes the sample of available daily returns between the end of month

denotes the sample of available daily returns between the end of month  and the end of month

and the end of month ;

;  is the log daily returns on 10-years government bonds on day

is the log daily returns on 10-years government bonds on day . The number of days in a month is normalized to 22 (normally every month has 22 trading days).

. The number of days in a month is normalized to 22 (normally every month has 22 trading days).

3. The Association between Fair Value and the Volatilities of Earnings, Stock Price and Government Debt

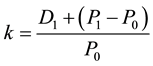

Debt markets and stock markets are essentially connected. This study predicts that fair value is associated with the overall market volatility, namely, earnings volatility, stock price volatility and specifically government debt volatility. The mathematic derivation of the association between fair value and market volatility is based on the equilibrium relationship between earnings, stock prices and government bond yields. Suppose an investor longs one share, the expected return from investing in this share can be expressed as:

The expected rate of return on share is ,

, ![]() is next period dividend and

is next period dividend and ![]() and

and ![]() are share prices in

are share prices in

current period and next period respectively. The return consists of two components, the dividend yield ![]() and the capital gain

and the capital gain![]() . Rearranging the above equation to find

. Rearranging the above equation to find![]() :

:

![]()

The equation states that the investor is willing to pay for the share is equal to the discounted value of the dividends and proceeds from selling the share. Same logical can be applied to derive ![]() and if the process continues indefinitely, the current price is specified as:

and if the process continues indefinitely, the current price is specified as:

![]()

This is the dividend discount model which states that the current share price depends on all future discounted dividends. If dividends are expected to grow at a constant rate![]() , the stock price is derived from the constant growth dividend model:

, the stock price is derived from the constant growth dividend model:

![]()

The model holds true if the rate of return is greater than the dividend growth rate. Replacing dividends in the constant growth dividend model with the payout ratio, ![]() , times earnings at time

, times earnings at time ![]() and assuming all earnings are reinvested at the expected rate of return

and assuming all earnings are reinvested at the expected rate of return ![]() results in:

results in:

![]()

where the growth rate is determined as the retention ratio, ![]() , times the reinvestment rate,

, times the reinvestment rate,![]() . Rearranging the above equation results in:

. Rearranging the above equation results in:

![]()

The expected rate of return is usually expressed as the risk-free rate, such as 10-year government bond yield, plus a risk premium required by investors for holding this share. Yardeni [24] [25] modified the above equation and assume a simplest case if the equity risk premium is equal to zero, and derived the risk free rate as:

![]()

This is known as the Fed Model which later is used as a simple tool to measure the trade-off between two competing asset classes investment, equities versus bonds. The Fed Model illustrates a substitution effect between equities and bonds: when the stock market’s earnings yield (Earnings per share) is above the long-term government bond yield, investors are better off investing in stocks and they should shift funds from bond markets to stock markets. The opposite should be true when interest rates are high. The Feb Model states that bond and stock market are in equilibrium when the 10-year government bond yield equals the expected earnings yield; the stock market is undervalued (overvalued) when the expected earnings yield is higher (lower) than the 10-year government bond yield. The log form of the Feb Model is:

![]()

To find the volatility or variance of the log risk free rate, we can impose a restriction on the weights of two variables in the right-hand side of the equation equal to (1, −1). So, the variance would be:

![]() or

or

The above equation suggests that the volatility of government bonds equals the sum of earnings volatility and stock prices volatility, minus two times their covariance. The risk free rate, earnings and prices are all in log forms. Subsequently, when the aggregate earnings are decomposed into fair value and historical cost two components, one can further derive the equation:

![]()

![]()

Therefore, mathematically we have shown that the government bonds volatility is affected by earnings volatility and its decomposition of fair value and historical cost earnings volatilities, stock price volatility, and the covariance between fair value earnings and historical cost earnings, the covariance between fair value earnings and stock prices, and the covariance between historical cost earnings and stock prices. Using![]() ,

, ![]() and

and ![]() to denote the government debt volatility, fair value earnings volatility and historical cost earnings volatility respectively, we will have:

to denote the government debt volatility, fair value earnings volatility and historical cost earnings volatility respectively, we will have:

![]()

All the variables are previously defined. ![]() is the government debt volatility, estimated from the realized second moment of debt returns;

is the government debt volatility, estimated from the realized second moment of debt returns;![]() , is historical cost earnings volatility;

, is historical cost earnings volatility;![]() , is fair value income volatility. Both historical cost earnings volatility and fair value income volatility is resulted from the decomposition of earnings volatility

, is fair value income volatility. Both historical cost earnings volatility and fair value income volatility is resulted from the decomposition of earnings volatility![]() .

.

4. Limitation and Future Research Direction

Accounting information plays an important role in healthy functioning of financial systems because an efficient capital resource allocation depends on assessment of firms’ financial position and performance and accounting standards are the key to ensure that firms’ financial position and performance is measured in a way that reflect economic substance, comparable across entities and adequately disclosed. The concept of fair value is a key element in the international accounting standards and its implementation pose serious concerns in terms of financial stability. Fair value measurement is supported on the ground that it provides information which is more relevant to the economic substance and presumably such information will be more useful to investors. However, fair value could potentially introduce volatility into the financial system. A further empirical study will warrant the debate on fair value as to what extent fair value convey different messages to the market, either value relevance or volatility which subsequently leads to different economic consequence in allocating capital resource and for general investors they need to understand the tradeoff between fair value relevance and volatility in making an investment decision.

5. Conclusion

Mathematically this study has shown that the government bonds volatility is affected by earnings volatility and its decomposition of fair value and historical cost earnings volatilities, stock price volatility, and the covariance between fair value earnings and historical cost earnings, the covariance between fair value earnings and stock prices, and the covariance between historical cost earnings and stock prices. The research design shows an attempt to link the micro aspects of accounting standards and accounting information at firm-level to the macro implications on market-level earnings, stock markets and government debt markets. To achieve this goal, researchers can first apply the principle components analysis to capture an aggregate volatility of fair value accounting information. Manly [26] states that the principle components analysis can capture the variance of a data set with a small number of scores called the principal components that are linear combination of the original variables. In essence, the principle components analysis seeks to find a few orthogonal linear combinations of the original data sets that extract the maximum variance. In this sprit, researchers can use the principal component analysis, for all companies of each investigated country, to generate an aggregate measure of fair value volatility by extracting the maximum portion of the variance from a data set that contains fair value accounting items with gains and losses that go through net income. Such an aggregate measure with the maximum variance of fair value net income is used as a proxy for the volatility of fair value accounting at a market level which then becomes comparable in the subsequent tests of market volatilities in earnings yield, stock index yield and government debt yield.