What Types of Small and Medium-Sized Businesses are Utilizing New Financial Products? ()

1. Introduction

The increased diversification of fund rising methods among small and medium-sized businesses has been a major policy challenge in recent years. According to the “Status of Progress of the Action Program for the Promotion of Functional Enhancement of Community-Based Finance” published by the Financial Service Agency, private financial institutions have been making effort in the areas of 1) financing methods such as intellectual property-collateralized loans focusing on business values, loan-collateralizing movables or transfer of receivables, nonrecourse loans (loans for which the nonexempt property of performance obligation is limited to those subject to financing), or project finance loans; and 2) securitization such as the issuance of asset-backed securities utilizing local CLO (Collateralized Loan Obligation) or accounts receivable held by small and medium-sized businesses. Generally speaking, substantial achievements have generally been obtained.

However, such efforts are not necessarily equally effective for every small and medium-sized business, and currently, many are still suffering amidst the severe financial environment. Therefore, in order to enable the utilization/dissemination of new financial products to lead toward a real facilitation of financing for small and medium-sized businesses, consideration of what may further be required must be sought. Because it is difficult to analyze such aspects with ordinary data, more detailed corporate data such as questionnaires is necessary. Now, in this paper, the current status and challenges of utilizing new financial products among small and mediumsized businesses are analyzed using survey questionnaires (Kansai RIETI Questionnaires) that the RIETI has implemented.

2. Kansai RIETI Questionnaires

2.1 Summary of Questionnaires

I implemented a survey called “Corporate awareness survey regarding corporate financing in the Kansai Region” in June 2005 as collaborative research with the

height="313.78498840332 " />

height="313.78498840332 " />

Table 1. Utilization of diversified fund procurement methods

Local Financing Study Group (General manager of the project: Professor Yoshiro Tsutsui, Osaka University) of the Research Institute of Economy, Trade and Industry (RIETI). Survey sheets were sent to 9,000 companies with headquarters located in Osaka, Hyogo, and Kyoto prefectures1. Survey sheets were mailed out on June 6, 2005, and the 2,041 companies from which we received responses (return rate: 22.68%) became subjects in the analysis. However, the actual number of companies that responded varied per questionnaire.

The survey sheets that were mailed to the companies consisted of 54 questions. The questions were divided into eight major sections. Part 1 is the attribution of questionnaire respondents. Part 2 is the attribution of respondent companies. Part 3 consists of questions regarding the general management of respondent companies. General management policies are queried in Part 4, while the relationship with main banks is asked about in Part 5. Part 6 deals with questions regarding general bank transactions. Part 7 consists of questions on how small and medium-sized businesses evaluate financial institutions in terms of loan screening and borrowers monitoring, and Part 8 deals with questions regarding the public creditguarantee system.

2.2 Current Status of Utilization of New Financial Products and Corporate Size

In the RIETI Questionnaire, current utilization of various fund procurement methods were asked as shown in Table 1 (Question 19). According to those questions, leasing showed an outstanding utilization rate, and 62.9% of the respondent companies utilized leases. Factoring, installment, and Credit Guarantee Corporation-backed privately subscribed bonds follow in this order, and it is clear that fund procurement from non-bank institutions plays a certain significant role. However, such financial methods are not discussed in this paper, in order to facilitate a greater focus on the fund-providing functions of banking institutions.

The five items from the lump sum settlement method (transfer of accounts receivable as collateral) to the securitization of account receivables (liquidation) in

class="cs_fig_con">

Table 1 are, in a broad sense, fund procurement methods utilizing accounts receivable (hereinafter referred to as “Procurement utilizing Accounts Receivable”). Furthermore, secured privately subscribed bonds and Credit Guarantee Corporation-backed privately subscribed bonds are fund procurement by privately subscribed bonds. Then, we investigate how this “Procurement utilizing Accounts Receivable” and “Fund Procurement by Privately Subscribed Bonds” have been utilized and by what types of companies. Since some companies utilize multiple methods

2, excluding duplications, 287 companies have experience with Procurement utilizing Accounts Receivable, while 179 companies have experience in utilizing privately subscribed bonds.

First, respondent companies were divided into ten groups, depending on the corporate size as determined by the number of employees, and the utilization rate of Procurement utilizing Accounts Receivable and “Fund Procurement by Privately Subscribed Bonds” were calculated for graphic description (Figure 1). With regard to privately subscribed bonds, the effect of size is significantly clear. In other words, there is a tendency in which the larger a company is, the higher will be the utilization rate, excluding the largest companies (210 or more employees)3.

On the other hand, with regard to the utilization rate of

height="379.90499420166 " />

height="379.90499420166 " />

Figure 1. Corporate size and utilization rates of fund procurement methodsNote: Employee size 1 = 8 or less, Size 2 = 22 or less, Size 3 = 30 or less, Size 4 = 40 or less, Size 5 = 56 or less, Size 6 = 70 or less, Size 7 = 90 or less, Size 8 = 127 or less, Size 9 = 210 or less, and Size 10 = 211 or more. The number of companies belong to each group is about 200

Table 2. Status of utilization of new financial products

width="643.81501159668" height="401.94500579834 " />

width="643.81501159668" height="401.94500579834 " />

Figure 2. Employee size and status of utilization of new financial products

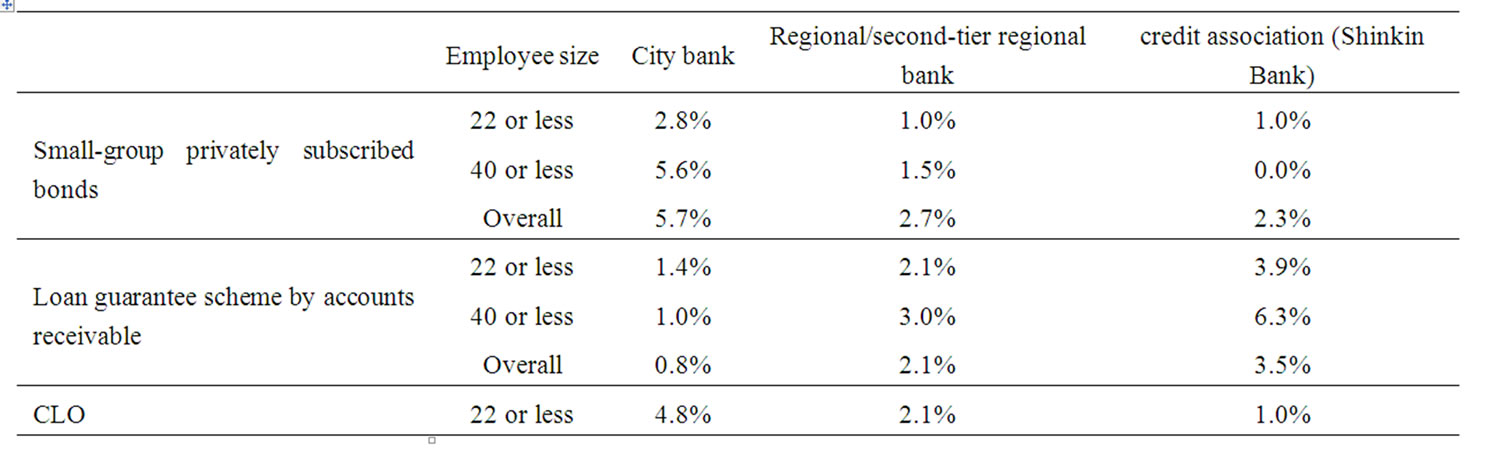

Table 3. Utilization rates of new financial products by small and medium-sized businesses and type of operation of main banks

height="689.794976806641 " />

height="689.794976806641 " />

Table 4. Evaluation of main banks and status of utilization of new financial products

Procurement utilizing Accounts Receivable, the larger the size, the higher is the rate in the four groups having up to 40 employees, but no clear trend is seen in other size groups. What is clearly found is that those with employee sizes 1 and 2 (that is, companies with 22 or fewer employees) have a lower utilization rate of Procurement utilizing Accounts Receivable compared to other size companies. Conversely, according to responses to question asking about difficulties in fund procurement during the past year (Question 10), small businesses responded more frequently that “procurement is difficult”4. Therefore, the diversification of fund procurement has not significantly disseminated among small businesses, despite the fact that they suffer more from fund procurement difficulties. This trend is also seen in the pretax profit status. Namely, while 9.2% of the companies with two consecutive business years in the red utilized Procurement utilizing Accounts Receivable, 14.7% of the companies with two consecutive business years in the black utilized this method. The same applies to privately subscribed bonds; specifically, while the utilization rate for companies with two consecutive business years in the red was 2.8%, companies with two consecutive business years in the black showed a rate of 9.8%5. This indicates that the diversification of fund procurement is popular in well-run companies with comfortable fund management.

2.3 Roles of Main Banks in the Utilization of New Financial Products

We ask the roles of main banks as the trigger for deciding to use new financial products of “(1) small-group privately subscribed bonds,” “(2) loan guarantee scheme by accounts receivable,” “(3) CLO,” and “(4) Quick loan,” for the past 3 years. Increased dissemination of these products has been supported by policies for facilitating finance for small and medium-sized businesses. In the RIETI questionnaires, the “small-group privately subscribed bonds” is defined as corporate bonds that solicit undertaking subject to less than 50 private individuals (those who have a relationship with the company, such as executives, employees, and clients), the “loan guarantee scheme by accounts receivable” as the scheme that Credit Guarantee Corporation guarantees when borrowing from financial institutions is made, by having accounts receivable as collateral, the “CLO” as the fund procurement from the financial market by selling securities backed by loans to investors, and the “quick loan” as the product in which financial institutions quickly determine whether to finance or not by using the credit scoring model, etc.

While the result is summarized in Table 2, in the case of “(1) small-group privately subscribed bonds,” about 90% of those (85 companies) that had used within the previous 3 years responded that “the trigger of use was an introduction by a main bank.” In sum, many were triggered basically by the introduction from main banks for any new financial product, although the introduction rate was slightly lower in the case of a quick loan6. This indicates that it is difficult for small and medium-sized businesses that have poor financial information or knowledge to consider adoption of new financial methods by themselves, and the roles of financial institutions are significantly larger.

Figure 2 shows the utilization rates calculated by the same employee size classification as Figure 1 for these four financial products. By looking at this figure, in the case of small-group privately subscribed bonds, the utilization rate is higher in the group of companies with employee sizes 6 to 8, and almost no utilization is implemented in the smallest size groups. CLO has the same tendency as the small-group privately subscribed bonds. On the other hand, the loan guarantee scheme based on accounts receivable shows an exceptionally high rate in the largest size group, but other than that, the utilization rate is clearly quite high in the smaller employee size groups. However, the rate remains at about 2% at the highest. The same can be said for quick loans, showing a higher utilization rate in smaller employee size groups. Furthermore, although it is not shown in a figure or table, when the status of utilization of these four financial methods in the current earnings situation was investigated, companies with poor performance utilized the loan guarantee scheme by accounts receivable or quick loans, while companies with good performance often utilized small-group privately subscribed bonds or CLO.