Consistency of the Model Order Change-Point Estimator for GARCH Models ()

1. Introduction

Modelling volatility of financial asset returns is particularly an important area in Finance. This is because volatility is considered to be a measure of risk when pricing financial instruments. The series particularly is characterized by the property of volatility clustering and thus can be considered to display a stationary behavior for some time then suddenly the variability changes, it stays constant for some time at this new value until another change occurs. This therefore suggests that the financial returns series is non-stationary and can be looked at as a union of several stationary series. GARCH models have been commonly used to capture volatility dynamics in financial time series particularly in modelling of stock market volatility as seen in [1] [2] [3] and derivative market volatility as utilized by [4] [5] and [6] .

Given the changing pace of the underlying economic mechanism and technological progress, modeling economic processes over a long time horizon, it is possible that structural changes may occur. This can cause the time series to deviate from stationarity and result to volatility clustering. The detection of these structural change points is therefore vital to various players in a given economy to ensure timeliness of decisions. A fundamental problem in financial trading is the correct and timely identification of turning points in stock value series. This detection enables one to make profitable investment decisions, such as buying-at-low and selling-at-high, hence traders require early identification of local troughs and peaks of stock values. In macroeconomics, knowing the beginning of a recession leads to an increase of government expenditure or an expansion of money supply.

A key assumption of the GARCH models used is that the process is stationary as this allows for model identifiability. However, this violates the volatility clustering property exhibited by the financial returns series. This phenomenon is manifested by the fact that the absolute value of returns or their squares display a positive, significant and slowly decaying autocorrelation function despite the fact that the returns are uncorrelated. This indicates that modeling financial returns series over long time horizons deviates from the stationarity assumption suggesting the existence of a change-point in the series. A modification of the GARCH model, specifically the IGARCH model, has been proposed to model the persistent changes in volatility as the stationarity assumption is relaxed. However the IGARCH model is prone to some shortcomings. [7] showed that the behavior of an IGARCH process depends on the intercept, such that, if the intercept is positive then the unconditional variance of the process grows linearly with time. In practice this means that the amplitude of the clusters of volatility to be parametrized by the model on the average increases over time. The rate of increase needs not, however, be particularly rapid. If the intercept is zero in the IGARCH model, the realizations from the process collapse to zero almost surely. However, a potentially disturbing fact is that the model assumes that the unconditional variance of the process to be modeled does not exist in that the variance may be infinite [8] and [9] .

It is argued that in applications, the assumption of parameter constancy in GARCH models may not be appropriate especially when the series to be modeled are long [10] . To overcome this problem of modeling financial time series in the presence of structural changes, the duo suggests that one option is to assume that the parameters change at specific points of time, divide the series into sub-series according to the location of the change-points and fit separate GARCH models to the sub-series. This brings about the challenge of determining the number of change-points and their location because they are normally not known in advance. This proposition has been adopted by various researchers who have utilized different methodologies to be able to locate the change-points attributed to change in parameter specification. The use of squared model residuals and likelihood ratio to detect parameter changes is proposed by [11] while [12] proposes the use of Markov-switching GARCH models estimated through Markov Chain Monte Carlo simulation methods. Modeling of equity volatilities as a combination of macroeconomic effects and time series dynamics by combining exponential splines and GARCH models is utilized by [13] . An alternative approach is to use smooth transition GARCH model. This can be achieved by defining a transition function where the coefficients are expressed as a function of time as in [9] or by employing non-linear functions that are lagged for the squared observations [14] and [15] or lagging the conditional variance [16] . CUSUM tests have also been proposed as suitable methods of identifying change-points by establishing breaks in moments of the time series. The use of the unconditional variance is proposed by [17] while [18] [19] use the mean. However, these methods are mainly based on the assumption that change-points occur solely due to change in parameter specification. The approach presented here seeks to identify change-points attributed to change in model order specification.

This paper is organized as follows. Section 2 gives an overview of GARCH model specification with corresponding assumptions utilized in the proof of the main result. Section 3 presents the proposed change-point estimator for change attributed to in the model orders p and q in GARCH models. The estimator is based on the Manhattan distance of sample autocorrelations of a squared returns series. Section 4 provides proof of the consistency of the proposed change-point estimator.

2. GARCH Model

Assume that the data

, for

, are independent and sampled at equi-spaced points. The series

describe a financial returns time series modeled using

model specified as:

(1)

The sequence of innovations

is an independent and identically distributed (iid) sequence with mean zero and unit variance.

is the volatility sequence of the GARCH model. Assume that

and that all coefficients

and

are non-negative to avoid ambiguity with regards to orders

. Since we are not interested in the trivial solution

to (1), further assume that

.

Let

and

for

, where

is a sequence of independent and identically distributed random variables such that

is independent of

. This allows us to rewrite (1) as

(2)

Model (2) is utilized in the proof of consistency of the proposed change-point estimator.

The GARCH (p,q) model (1) can also be represented as an ARMA(max(p,q),q) as showed by [20] as

(3)

where

and

is white noise.

This representation of the GARCH model follows the standard ARMA form for the squared series, therefore, conventional methods used to identify ARMA processes may be used to determine the presence of GARCH. Of keen interest is the use of the sample autocorrelation function (SACF) and partial autocorrelation functions (PACF). Specifically, the orders p and q are drawn from the autocorrelation function and partial autocorrelation function respectively. Empirically, these orders are chosen such that the SACF cuts off after lag p and the PACF decline exponentially to zero after lag q for which they are significant. In light of this it can be asserted that the SACF and PACF can be used to distinguish GARCH model with different model orders specifications.

The following assumptions are necessary to prove the subsequent theoretical results.

Assumption 1 (Independence)

i)

’s are independent and identically distributed

ii)

’s are independent of the

’s for

Assumption 1 will ensure parameters in model (1) are estimated using Quasi-Maximum Likelihood Estimation method.

Assumption 2 (Strictly Stationary)

According to [21] the existence of a unique strictly stationary solution to (1) is the negativity of the top Lyapunov exponent. This however cannot be calculated explicitly but a sufficient condition for this is given by

(4)

Assumption 3 (Ergodic Process)

According to [22] standard ergodic theory yields that

is an ergodic process. Thus its properties can be deduced from a single sufficiently large random sample of the sample.

3. Change-Point Estimator

Assume that the data

describes a financial returns time series modeled using

process. A single change-point testing problem is first considered where it is assumed that a change-point can happen only at time k where

. The hypotheses to be investigated are assumed to follow the following definition:

(5)

Let

be a finite index sequence and

satisfy Assumptions 1 and 2. Let

be a k dimensional vector and

be a

dimensional vector. The autocovariance and autocorrelation functions can be expressed in terms of the inner product as

(6)

(7)

where

and

represents the standard deviation of X and Y respectively which represents an

distance from the mean.

By the Assumption 3 that the series

is ergodic, then it is implied that the sample moments converge in probability to the population moments. It therefore follows that the sample autocovariance and autocorrelation converge in probability to the population autocovariance and autocorrelation respectively.

Theorem 1. (Holder’s Inequality)

Let I be a finite or countable index set. Given

, if

and

, where

then

and

(8)

Let

in the Holders Inequality Theorem 1 we obtain

(9)

Thus, applying the result in (9) to (6) and (7) yields

(10)

(11)

Following (11) define sequences of autocorrelation functions

where for fixed

,

and for fixed

,

to be such that we have two subsequences

and

where

and

denote the autocorrelation of the sequence

and

for

.

An estimator is proposed drawn from a process

quantifying the deviation between

and

using a divergence measure motivated by the weighted

distance, with k denoting the change-point. For

define

(12)

Specifically, assume the case when

in (12) resulting into a weighted Manhattan distance and by linearity and absolute value of inequalities of the expectation operator results into

(13)

To facilitate the construction of the proposed estimator the lower bound of the divergence measure (13) is assumed. Further assume that the autocorrelation function is calculated at lag

. The proposed change-point estimator is thus developed from the process generated by this measure as follows:

(14)

From (14) it can be seen that the proposed test is a weighted difference between the sample autocorrelation functions

and

with

denoting the weight.

Assumption 4. (Weight)

The weight

is a measurable function that depends on the sample size n and change-point

. It is arbitrarily chosen such that it satisfies the condition that

(15)

Equating (14) and (15) determines the weight

as follows:

(16)

The resultant process is obtained from (14) and (16) and defined as

(17)

The change-point estimator

of a change point

is the point at which there is maximal sample evidence for a break in the sample autocorrelation function of the squared returns process. It is therefore estimated as the least value of k that maximizes the value of

where

is chosen as:

(18)

4. Simulation Study

The performance of the proposed estimator is examined by considering the effects of the change in sample size. Assume that

is a stationary

process where

. The single change-point estimation

problem is considered where the change-point k is fixed at

for

,

and

. Figures 1-3 display the plots for the location of the change-point estimator as estimated by the proposed estimator (18) for various sample sizes. The hypothesis considered here is when change occurs in model order q, described as;

(19)

The following table gives the parameter estimates used in the simulation.

The change-point estimators obtained are

,

and

for sample sizes 500, 1000 and 2000 respectively as displayed in Figures 1-3. The performance of the estimators is evaluated using the Adjusted Rand Index (ARI) which compares the segmentation created by the change-point estimator and the true segmentation. The Adjusted Rand Index lies between 0 and 1. When the two partitions agree perfectly, the ARI is 1. The results of the ARI are provided in Table 1 for changes in order q.

The results for the change in order q in Table 1 show that as the sample size increases, the similarity index given by ARI generally increases.

5. Consistency of the Change-Point Estimator

Consider a sample

satisfying (2) and (5) and the change-point estimator

given by (18). If the sequences

and

satisfy

![]()

Figure 1. Single Change-Point for Stationary Series GARCH

for

![]()

Figure 2. Single Change-Point for Stationary Series GARCH

for

![]()

Figure 3. Single Change-Point for Stationary Series GARCH

for

![]()

Table 1. Adjusted rand index given changes in order q.

(20)

then for

,

(21)

where C is a positive constant.

Proof Suppose that

and

are two

sequences as defined in model (2). Further suppose that a sample

from the model is observed, such that

(22)

where

is the unknown change point. More specifically assume that the two sequences have different model order specification such that

(23)

where

and

but

and

. Let

and assume that

, then in the presence of the change-point, the sequence

is no longer stationary.

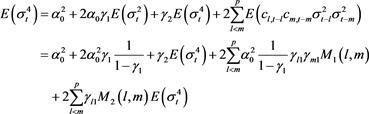

The foundation of this proof is based on the second and fourth moments of

which will first be derived. Assume that the GARCH(p,p) model (2) has a finite fourth moment and let

. The assumption that the second moment of

exist it implies that

. Let

,

and

for

and

. The second and fourth moments of

is established by determining

and

as follows:

(24)

Equation (24) shows is that

exists for

.

(25)

To establish

the

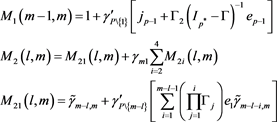

is determined using the following Theorems as proved by [23] .

Theorem 2. Assume that

. Under this condition,

(26)

where for

is a

vector

is a  vector with the first

vector with the first  elements equal to 1

elements equal to 1

is a matrix of order

is a matrix of order  with

with  a matrix of order

a matrix of order  and Γ a matrix of order

and Γ a matrix of order

is maximum absolute eigenvalue of the matrix Γ

is maximum absolute eigenvalue of the matrix Γ

In particular

Proof. For proof of Theorem 2 see Appendix 5 of [23] .

Substituting (24) and (26) in (25) yields

(27)

(27)

(28)

(28)

From (28) it can be deduced that  for

for ![]() and

and![]() .

.

Now the fourth moment of ![]() is evaluated as

is evaluated as

![]() (29)

(29)

Equation (29) implies that fourth moment of ![]() exist if

exist if ![]() and

and![]() .

.

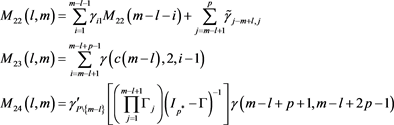

The mixed moment ![]() has the form

has the form

![]() (30)

(30)

where for![]() ,

,

![]()

![]()

![]()

Proof. For proof of Theorem 2 see Appendix 9 of [23] .

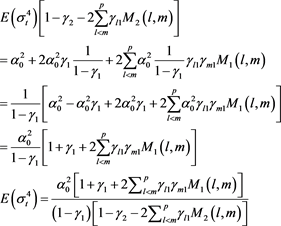

The expected value of the sample autocorrelation function, ![]() , is first evaluated using (29) and (30).

, is first evaluated using (29) and (30).

![]() (31)

(31)

Further assuming that (22) and (23) are satisfied, evaluate (31) for ![]() as follows:

as follows:

![]() (32)

(32)

![]() (33)

(33)

For GARCH(1,1) model,![]() . Substituting (37) and (33) in (31) results to

. Substituting (37) and (33) in (31) results to

![]() (34)

(34)

Equation (34) shows that, in the presence of a change-point, the expected value of the sample autocorrelation function before and after the true change-point ![]() is not equal. We consider a special case of change from GARCH(1,1) to GARCH(2,2) where we evaluate (31) for

is not equal. We consider a special case of change from GARCH(1,1) to GARCH(2,2) where we evaluate (31) for ![]() as follows:

as follows:

![]() (35)

(35)

![]() (36)

(36)

Applying Theorem 3 and letting ![]() yields

yields ![]()

![]()

The expected value, ![]() , for (23) for model order specification

, for (23) for model order specification ![]() and

and ![]() for lag 1 results to

for lag 1 results to

![]() (37)

(37)

From (34) and (37), it can be seen that in the presence of a change-point then

![]() (38)

(38)

To proof consistency of the estimator we need to show that as the sample size n increases![]() . Thus the

. Thus the ![]() is evaluated noting that it reaches its maximum at the point

is evaluated noting that it reaches its maximum at the point ![]() resulting to

resulting to

![]() (39)

(39)

Thus

![]() (40)

(40)

From (39) and (40) it follows that

![]() (41)

(41)

We also have that

![]()

![]() (42)

(42)

Thus from (41) and (50) as well as replacing τ with ![]() in (41) we have that

in (41) we have that

![]() (43)

(43)

Consider ![]() as given in (17), the estimate

as given in (17), the estimate ![]() is now established as follows

is now established as follows

![]()

![]() (44)

(44)

Theorem 4. Let ![]() be any random variables with finite second moments and

be any random variables with finite second moments and ![]() be any non-negative constants. Then

be any non-negative constants. Then

![]() (45)

(45)

Proof. For proof of Theorem 4 see Theorem 4.1 of [24] .

Applying Theorem 4 with![]() ,

, ![]() and

and ![]() yields

yields

![]()

![]() (46)

(46)

implying ![]() (47)

(47)

Substituting the result in (47) to (53) results to

![]() (48)

(48)

As ![]() from (48) we can see that

from (48) we can see that![]() , which completes proof. Thus the estimator τ is a consistent estimator of

, which completes proof. Thus the estimator τ is a consistent estimator of ![]() implying that k is a consistent estimator of

implying that k is a consistent estimator of![]() .

.

6. Conclusion

In this paper we argue that change in GARCH process can be attributed to model order specification which results into a nonstationary series that depicts real data. Given that possible values for p and q can be arrived through inspection of sample autocorrelation and sample partial autocorrelation os squared series, an estimator for the change-point is derived based on the Manhattan distance. Results based on the similarity index ARI show that the estimator performs better as the size of change increases. We are also able to prove consistency of the estimator theoretically. The proposed estimator can be improved to examine departure from other model order specification other that GARCH(1,1). The next paper will focus on establishing the limiting distribution of the estimator.

Acknowledgements

The authors thank the Pan-African University Institute of Basic Sciences, Technology and Innovation (PAUSTI) for funding this research.