Multi-Period Portfolio Selection with No-Shorting Constraints: Duality Analysis ()

1. Introduction

Portfolio theory deals with the question of how to find an optimal distribution of the wealth among various assets. Mean-variance analysis and expected utility formulation are two different tools for dealing with portfolio selections. A fun- damental basis for portfolio selection in a single period was provided by Mar- kowitz. Under the assumption that short-selling of stocks is not allowed, ana- lytical expression of the mean-variance efficient frontier in single-period port- folio selection was derived by solving a quadratic programming problem in Markowitz (1952) [1] . Later, an analytical solution to the single-period mean- variance problem with assumption that short-selling is allowed is derived in Merton (1972) [2] .

Recently, a multi-period portfolio selection problem has been studied. This problem is more interesting as investors always invest their wealth in multi periods instead of only one period. Work of Li and Ng (2000) [3] considers the multi-period portfolio selection problem in a mean-variance framework when short-selling of stocks is allowed. Li and Ng have derived the analytical formu- lation of the frontier of the multi-period portfolio selection by embedding the assets-only multi-period mean-variance problem into a large tractable problem. When short-selling is not allowed, the multi-period portfolio selection problem is much more difficult to deal with. For continuous-time mean-variance port- folio selections, Xun, Xunyu and Andrew (2002) [4] use stochastic optimal linear-quadratic method. For multi-period setting, the portfolio selection pro- blem with no-shorting constraint has been studied in Xu and Shreve (1992) [5] [6] . These papers investigated a utility maximization problem with a no short- selling constraint using a duality analysis.

The objective of this paper is to investigate dynamic mean-variance portfolio selection when short-selling is not allowed. Instead of using optimization me- thod, this paper used a martingale approach, which was originally proposed by Pliska (1986) [7] . To our knowledge, no analytical numerical method using martingale measure for finding the optimal portfolio policy with no-short shelling constraint for the multiperiod mean-variance formulation has been reported in the literature. In this sense, this paper extends existing literature by utilizing a martingale approach to solve an optimal portfolio selection problem with no-shorting constraint. This approach also showed that a unique equivalent martingale measure exist in the no-arbitrage complete market model. An effec- tive algorithm is derived for finding the maximum quadratic utility function with no-short selling constraint.

To outline of this paper, In Section 2, we build up the security market model. In Section 3, we consider the optimal portfolio selection problem with no short- selling constraint. By transforming the original market to some auxiliary markets, the optimal value of original constrained problem can be derived by the optimal valued of the unconstrained problem in the auxiliary markets. In Section 4, we use martingale approach to solve the unconstrained problem in the auxiliary markets. In Section 5, the optimal terminal wealth was derived by solving a dual problem. In Section 6, the derive the optimal trading strategy based on the optimal terminal wealth. A numerical example is also given in the Section 7. Finally, we conclude the paper.

2. Security Market Model

We consider a multi-period security market model with

trading dates (indexed by

), and the time horizon T is finite. There are n risky securities and one bond in the market. Let

be the probability space. Suppose there are finite states of the world, and let

be the state space of the economy at time t. The sample space

of the economy has a finite number of element

with

. The filtra- tion

where

is generated by

reveals the information on the economy. Specifically,

and

. We claim that the process

is

-adapted. For any

,

.

The

securities are traded in the market without transaction cost. Denote the stochastic process of the security price as

, where

is a random vector, and the bond price process as

, where

is constant. Let

be the risky security return process defined by

and

for

, and

be the bond return process defined by

with

for all

.

Assumption 2.1. 1) The state space at time

has

elements; 2) For any

, if

, then

; 3) Denote a matrix

of the securities’ prices

for

and

The above assumption makes the security market a complete one. We can easily verify that the sample space of the market

has

elements under assumption 2.1.

We consider an investor in the financial market with initial wealth v. She or he follows a self-financing trading strategies

where

and

is the number of units of the ith risky security held between time

and

. The number of money invested in the bond is

.

Assumption 2.2. The investor invests her or his wealth in the complete market with no short-selling constraint, that is

(1)

Let

be the value of portfolio at time

, it satisfies

(2)

where

For our convenience, we introduce the discounted price process

with

and

. So the discounted value of portfolio is

. The change of the discounted prices of risky security is defined as

with

.

We can also defined the self-financing trading strategies as

, where

and

is the fraction of money invested in ith risky security at time

. Similarly, the no short-selling requires that

is non-negative for any

. Therefore, the value of portfolio can be re- written as

. It is easy to verify that

.

3. Primal and Auxiliary Problem

The multi-period portfolio optimization problem under mean-variance frame- work in this paper can be formulated as follows:

for

. Varying the value of

yields the set of efficient solutions.

As indicated in Li and Ng (2000), above problem is difficult to be solved directly because of the non-separability in the sense of dynamic programming. In Li and Ng (2000), the relation between the multi-period mean-variance portfolio selection problem with a fixed investment horizon and a separable portfolio selection problem with a quadratic utility function is investigated and the analytical solution is derived by using an embedding scheme. Fortunately, Theorems 1 and 2 in Li and Ng (2000) can be also applied in the current subject with an uncertain investment horizon. We now consider the following auxiliary problem:

The objective function of the auxiliary problem is equivalent to the quadratic utility function

,

. It is concave and twice con- tinuously differentiable function.

Proposition 3.1. 1) The first derivative of

is

.

2) The inverse function of

is

.

The optimal portfolio problem is to maximize the expectation of

under the no short selling constraint

. So the con- strained optimal portfolio problem is:

where

denote the set of all admissible trading strategies belong in

.

Since there is a no short-selling constraint in the optimal portfolio selection problem, it is difficult to be solved directly by dynamic programming. We will try to solve the problem by introducing unconstraint auxiliary problems.

Denote the support function

of

by

In order to eliminate the situation

, we defined that the effective domain of

is the convex cone

, and

for

. We introduce the predictable process

with

for all

. Let

denote the set of all such process

. Define an auxiliary market

for each

by modifying the return processes for the bond and the risky securities as:

Specially, the market

with

is the original market.

We consider the unconstraint optimal portfolio problem in the market

:

Let

denote the corresponding optimal objective value in the market

.

Theorem 3.1. Suppose

is the optimal solution of the primal constrained problem, and

is the optimal solution of the dual problem

where

is the optimal objective value in the unconstrained market

, associated with the optimal solution

. If the optimal trading strategy

for the unconstrained market

satisfies.

a)

b)

, for all

Then

is the optimal strategy for the original constrained market, and

.

Proof. For the market

and optimal trading strategy

which satisfies (a) and (b), the value of portfolio at time

is

As

is a feasible solution of the original constrained problem, the expected utility of

is smaller than or equal to the optimal value of the original constrained problem. So we have

.

On the overhands, for an arbitrary market

and the optimal trading strategy

of the original constrained portfolio problem, we have,

Since

for any

, therefore,

for any

. Hence,

.

Putting together the above two inequalities, we have

.

4. Martingale Method

Now we try to solve the auxiliary problems

Denote the risk neutral probability in the market

as

. Let

be the state price density.

Proposition 4.1. Under the no-arbitrage consideration, The expected dis- counted terminal wealth based on the risk neutral probability is equal to the initial wealth, i.e.

So the problem is equivalent to

Theorem 4.1. For the above optimal problem with quadratic utility function, the optimal attainable wealth is:

and the optimal objective value is

Proof.

The necessary conditions to maximize this expression must be:

This is equivalent to

The value of the parameter

is the one that makes

satisfies

. Hence

Therefore,

. Hence, we have

and the optimal objective value

5. Optimal Terminal Wealth

Now we come to the dual problem:

Since

and

, the problem is equivalent to

Definition 5.1. For arbitrary

, we defined the matrix of the price change at time

as

where

is the change of discounted price of jth security at time

when the market is at state

at time

.

Definition 5.2. Denote

as an

matrix, which comes from

by deleting column

.

Definition 5.3. Denote

as an

matrix, which comes from

by replacing the row

with

.

Theorem 5.1. Under the assumption 2.1, the market exists an unique risk neutral probability

is the price of the ith risky security at time

when the market is at the state

.

Proof. We can see that

for any

. First, we try to prove that the sum of

is equal to one.

For

, we have

and

.

Because

where

hence

Suppose for

, the sum of the

is one.For

, the sample space is

. Under the assumption 2.1,

can be divided into

subspace

, where

includes all the

which has the same state in the first k period (i.e.

), and

.

for any

. So for arbitrary subspace

,

we can verify that

Therefore,

So we conclude that for any T, the sum of

is one, and this defines a probability.

Now we try to prove that the probability is a risk neutral probability in the market. Consider an arbitrary time t, and arbitrary event A corresponding to

(i.e. for

,

have been known). Suppose

, we know that

,

. We denote the subset of A as

, where all element in

has

(

). For ith

risky security we have

There are four part. For part (1),

where

is the ith row of

.

For part (2), because

for

, where

is the ith row of

. Hence,

For part (3),

For part (4),

Hence,

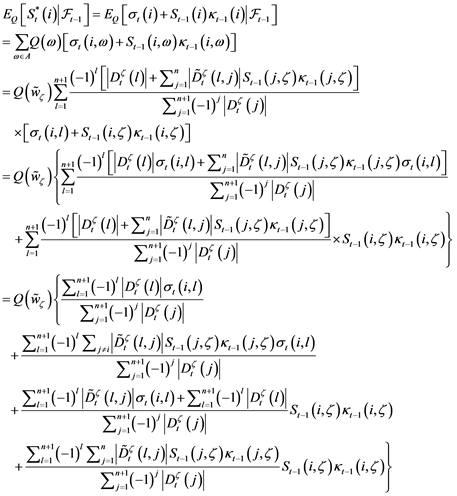

So this probability is a risk neutral probability of the market.

The dual problem is equivalent to

To simplify our problem, we give the following notations:

So the problem can be rewrite as:

There have some special properties of the objective function, which makes the calculus much easy. Denote

Proposition 5.1. Under the assumption 2.1,

have the following pro- perty:

So we have

The problem is separable and can be solved by dynamic programming.

Theorem 5.2. If

has full rank for any

and

, then the optimal solution of the dual problem is

for

and

, with

where

is:

Proof. Let

At

, for

,

We separately solve the following problem for each

:

We solve the unconstrained problem, and the optimal

is:

The optimal solution of the constrained problem is

where

So

, and

Now we come to

. We separably to solve the following problem for

:

We solve the unconstrained problem, and the optimal

is:

The optimal solution of the constrained problem is

where

So

, and

Generally, at stage

, we suppose is

We separably to solve the following problem for each

:

We solve the unconstrained problem, and the optimal

is:

The optimal solution of the constrained problem is

where

Hence, the optimal solution of the dual problem is

for

and

, with

where

is:

Hence, the risk neutral probability with optimal

is

and the optimal terminal wealth is

Hence, the expectation and variance of terminal wealth are:

where

The optimal

must satisfy the optimality condition of

, that is,

6. Optimal Trading Strategy

Let

, so

.

Proposition 6.1. For any

,

are equivalent for

where

is belong to the

period sample space, and

. We denote

We have the relationship between

and

for any

:

So we can iteratively derive

and corresponding trading strategy

for each

.

For

, we consider

, and

. For each i there are

element in the set

. For an arbitrary set

, we notate the

element in it as

. So

Rewrite the above equations as the matrix form as

, where

If

is full rank,

.

Generally, for

, we consider

, and

. For each i there are

element in the set

. For an arbitrary set

, we notate the

element in it as

. So

Rewrite the above equations as the matrix form as

, where

If

is full rank,

.

7. Numerical Example

We consider a market with one risky security and one bond, and the investment horizon is

. Suppose the bond price is constant. The prices of the risky security are:

The risk neutral probability in market

are:

We solve the dual problem:

The optimal solution of this is easily found to be:

The optimal value is

Finally, we get the optimal trading strategy of the original problem by solving some linear equations. The optimal strategy are

8. Conclusion

Optimal mean-variance multiperiod portfolio selection with no shorting con- straints problem is studied in the paper. We connect the original mean-variance problem to an auxiliary problem by using an embedding technique. Since the auxiliary problem is difficult to solve directly, we extend the literature by using duality theory and martingale approach to do the analysis. Finally, the derived analytical optimal multiperiod portfolio strategy provides investors with the best strategy to follow in a no-short selling dynamic investment environment. The limitation in this paper is that we derive the optimal portfolio policy by maxi- mizing the quadratic utility function. A future research subject is investigation of an optimal solution using different utility objective function.

Acknowledgements

Jinan University scientific research cultivation and Innovation Fund, Number: 17JNQN025.