Optimal Expected Utility of Wealth for Two Dependent Classes of Insurance Business ()

1. Introduction

The classical Cramer-Lundberg risk model assumes that the number of claims up to time t is independent of the claim size  and the claim sizes are independent and identically distributed. However, the independence assumption can be restrictive in practical applications. Several authors have therefore suggested models where the risks dependence is assumed. Within this models, we distinguish between risk models with dependence among claim size and among inter-occurrence time (see [1-5]) and risk models that consider aggregate claims amount processes generated by correlated classes of insurance business (see [6-13]). In [14] a wide set of dependent risk processes involving particular classes is presented with references therein. In some cases, the authors consider reinsurance contracts (see [9,10]) to improve the risk situation to which the company is subjected. In particular, [10] suggests an unlimited Excess of Loss reinsurance and maximizes the expected utility of the wealth of the insurer or the adjustment coefficient. In this paper, we consider a risk model involving two dependent classes of insurance business and a limited Excess of Loss reinsurance with the aim to maximize the expected utility of the first insurer wealth, having the retention limits as decision variables. The paper is organized as follows. Section 2 presents the risk model and the reinsurance contract. In Section 3 the maximization problem is proposed and in Section 4 the solution is discussed.

and the claim sizes are independent and identically distributed. However, the independence assumption can be restrictive in practical applications. Several authors have therefore suggested models where the risks dependence is assumed. Within this models, we distinguish between risk models with dependence among claim size and among inter-occurrence time (see [1-5]) and risk models that consider aggregate claims amount processes generated by correlated classes of insurance business (see [6-13]). In [14] a wide set of dependent risk processes involving particular classes is presented with references therein. In some cases, the authors consider reinsurance contracts (see [9,10]) to improve the risk situation to which the company is subjected. In particular, [10] suggests an unlimited Excess of Loss reinsurance and maximizes the expected utility of the wealth of the insurer or the adjustment coefficient. In this paper, we consider a risk model involving two dependent classes of insurance business and a limited Excess of Loss reinsurance with the aim to maximize the expected utility of the first insurer wealth, having the retention limits as decision variables. The paper is organized as follows. Section 2 presents the risk model and the reinsurance contract. In Section 3 the maximization problem is proposed and in Section 4 the solution is discussed.

2. The Model

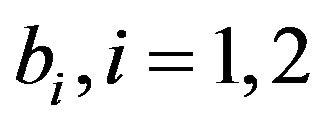

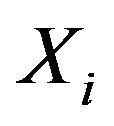

We consider a risk model involving two dependent classes of insurance business. Let  be the claim size random variables for the first class with common distribution function

be the claim size random variables for the first class with common distribution function  and let

and let  be those for the second class with common distribution function

be those for the second class with common distribution function . We assume that

. We assume that  and

and  have continuous and positive first derivative, with

have continuous and positive first derivative, with  if

if  Their expected values are denoted by

Their expected values are denoted by  respectively. Then, the aggregate claims amount process generated from the two classes of business, in a given period of time, is

respectively. Then, the aggregate claims amount process generated from the two classes of business, in a given period of time, is  with

with

, (1)

, (1)

where  is the number of claims, for classes

is the number of claims, for classes , in the given period of time.

, in the given period of time.

We assume that  and

and  are independent, and they are independent of

are independent, and they are independent of  and

and . The claim number processes are correlated by means of the following relationships (see [10]):

. The claim number processes are correlated by means of the following relationships (see [10]):

(2)

(2)

where  and K are independent Poisson random variables with parameters

and K are independent Poisson random variables with parameters  and

and , respectively.

, respectively.

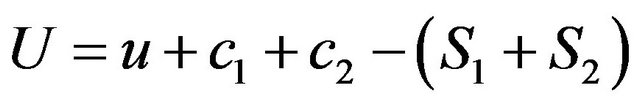

As usual, we define the surplus process in the given period of time:

(3)

(3)

where , is the insurance premium of risk i and u is the value of the surplus at the beginning of the time period.

, is the insurance premium of risk i and u is the value of the surplus at the beginning of the time period.

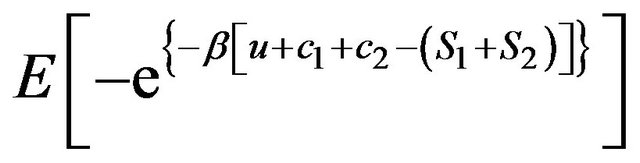

We assume the following exponential utility function:

(4)

(4)

then, in the absence of reinsurance, the expected utility of wealth is

(5)

(5)

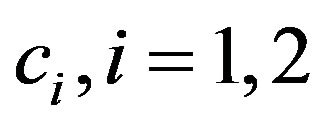

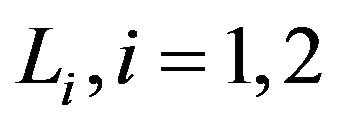

We instead assume that the first insurer concludes an Excess of Loss (XL) reinsurance contract limited by , with retention limits

, with retention limits , for the respective classes of insurance business. In [10], an unlimited XL reinsurance is considered.

, for the respective classes of insurance business. In [10], an unlimited XL reinsurance is considered.

In the following, we will consider the variables , identically distributed to

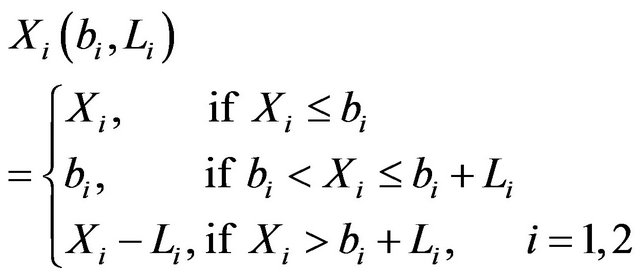

, identically distributed to . In practical, XL reinsurance contracts with retention limit

. In practical, XL reinsurance contracts with retention limit  are limited by some constant

are limited by some constant , which leads to the following division of claim size

, which leads to the following division of claim size .

.

The reinsurer pays

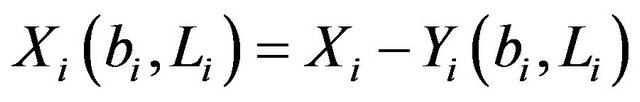

and the first insurer pays what is left: , (see [15]). That is:

, (see [15]). That is:

(6)

(6)

and

(7)

(7)

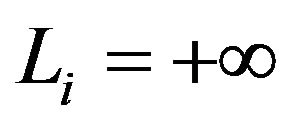

Observe that if  the limited XL reinsurance becomes unlimited. We fix

the limited XL reinsurance becomes unlimited. We fix  with

with , for the two classes of insurance business, respectively, and we make use of the retention limits

, for the two classes of insurance business, respectively, and we make use of the retention limits , as decision variables. We refer to (6) and (7) and we set

, as decision variables. We refer to (6) and (7) and we set

(8)

(8)

identically distributed to the j-th payment of the reinsurer  and

and

(9)

(9)

identically distributed to the j-th payment of the first insurer .

.

Then, the aggregate claims amount process for the insurer generated from the two classes of business after reinsurance, in a given period of time, is  with

with

. (10)

. (10)

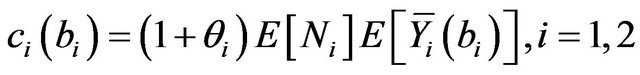

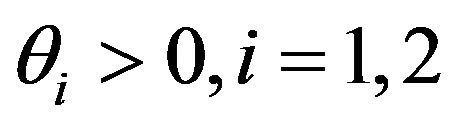

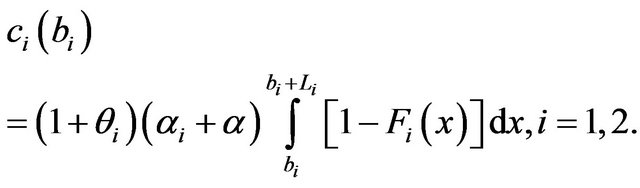

As usually, the reinsurance premiums are evaluated as follows:

where

where , is the corresponding safety loading. We therefore have

, is the corresponding safety loading. We therefore have

(11)

(11)

Then, after reinsurance, the surplus process in the given period of time is

(12)

(12)

and the expected utility is

(13)

(13)

In the following Section, we will take the problem of the maximization of the wealth expected utility, having the retention limits , as decision variables.

, as decision variables.

3. The Problem

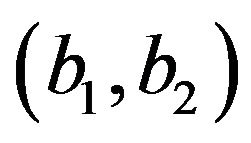

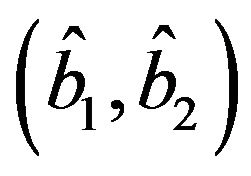

As already mentioned, our problem is to find the pair , with

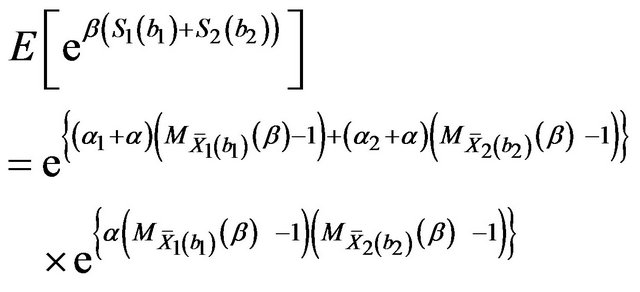

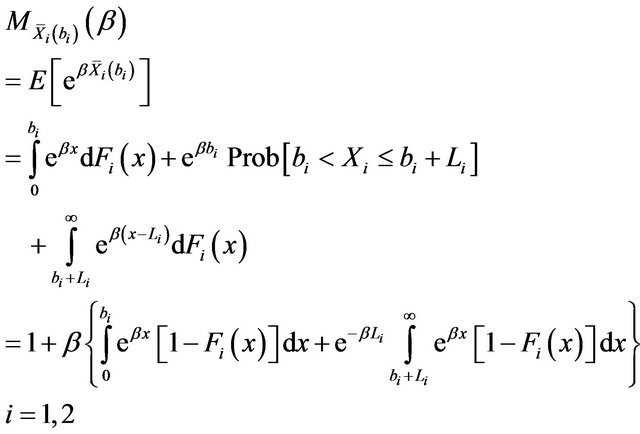

, with , that maximizes (13). We observe that from the moment generating function of the bivariate Poisson distribution (see [10,16]) it follows that

, that maximizes (13). We observe that from the moment generating function of the bivariate Poisson distribution (see [10,16]) it follows that

(14)

(14)

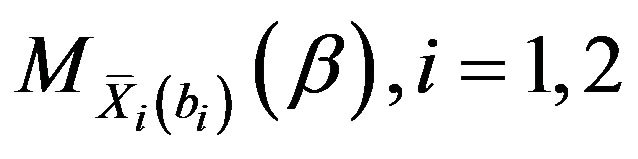

where we assume that the moment generating function

, exists. In particular, we assume that the variables

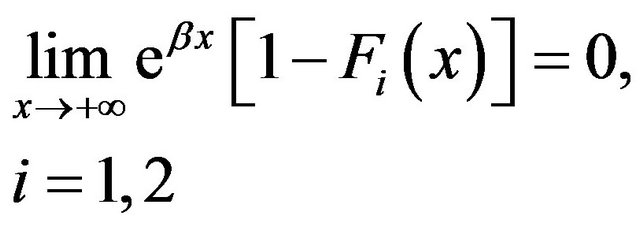

, exists. In particular, we assume that the variables  have a limited distribution or that the following relationship is true:

have a limited distribution or that the following relationship is true:

(15)

(15)

It therefore results

(16)

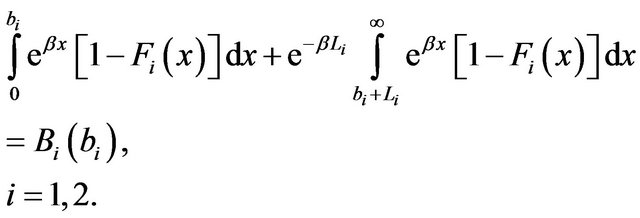

We put:

(17)

(17)

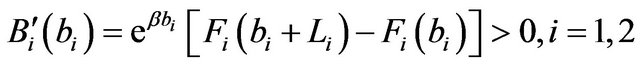

and we straightaway observe that

(18)

(18)

since it is  and

and  by assumption.

by assumption.

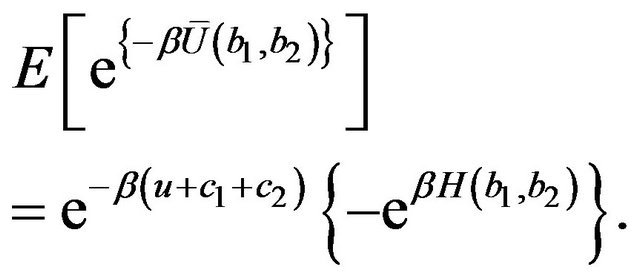

Because of (14), (16) and (18), (13) can be written as

(19)

(19)

that is, putting

we have

(20)

(20)

Therefore, maximizing (13) is equivalent to minimizing  it follows that, since

it follows that, since

, our problem consists of

, our problem consists of

(21)

(21)

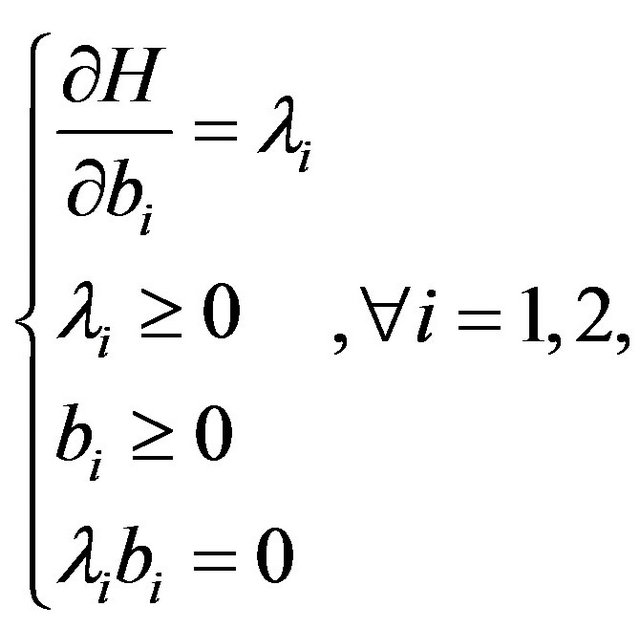

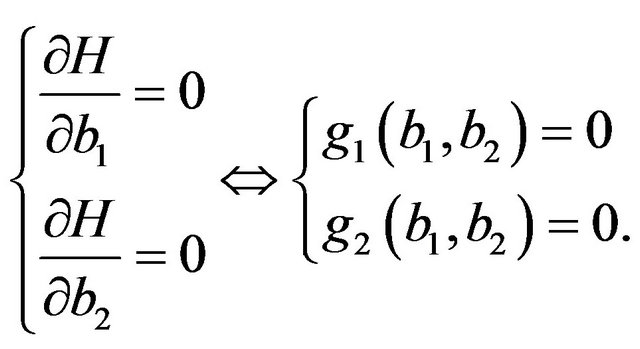

We proceed in a similar way to that followed in [10]. The Kuhn-Tucker conditions for the P problem are

(22)

(22)

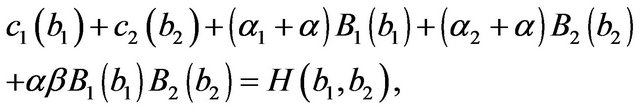

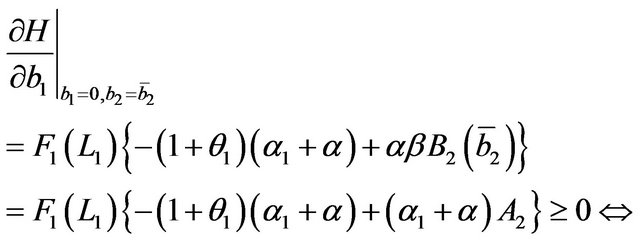

where, remembering (11) and (18):

(23)

(23)

and

(24)

(24)

Let us start by proving the following theorem.

Theorem 1.

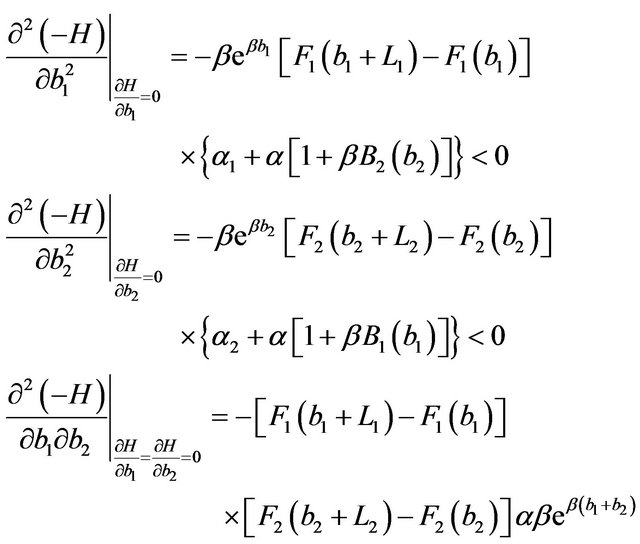

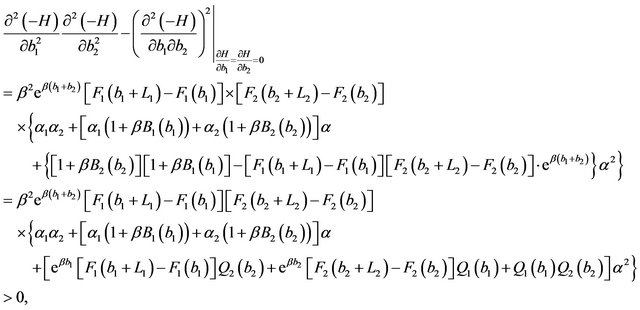

The Hessian matrix of  is negative definite, whenever the gradient is null.

is negative definite, whenever the gradient is null.

Proof. Considering (23) and (24), it results

and

where

4. The Khun-Tucker Conditions

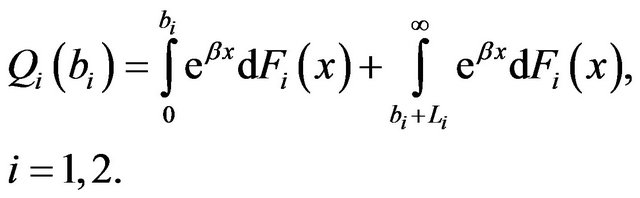

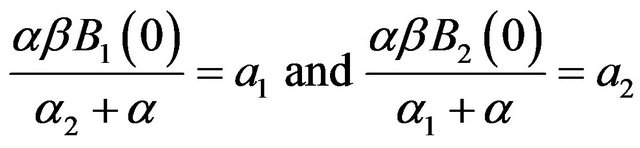

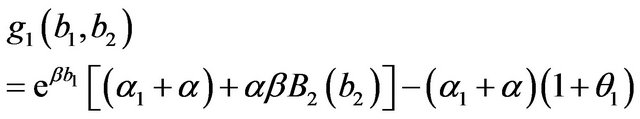

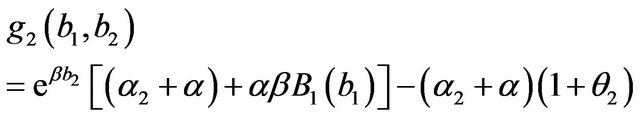

We look for the points  that fulfill the KuhnTucker conditions. To this purpose, we put

that fulfill the KuhnTucker conditions. To this purpose, we put

(25)

(25)

(26)

(26)

(27)

(27)

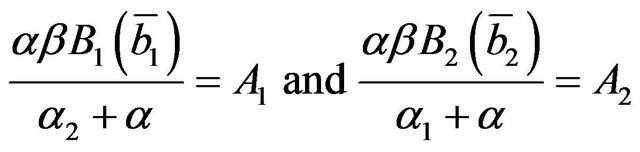

and we prove the following theorem where  and

and , are defined by (25), (26) and (27), respectively.

, are defined by (25), (26) and (27), respectively.

Theorem 2.

1) The point  satisfies the system (22) if and only if it is

satisfies the system (22) if and only if it is

(28)

(28)

2) The point , with

, with , satisfies the system

, satisfies the system

(22) if and only if it is

(29)

(29)

3) The point , with

, with , satisfies the system

, satisfies the system

(22) if and only if it is

(30)

(30)

4) If it is

(31)

(31)

and it is

(32)

(32)

or

(32')

(32')

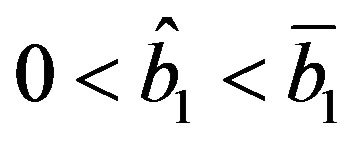

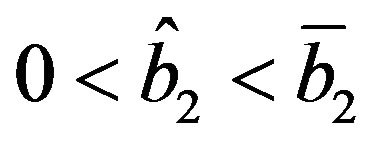

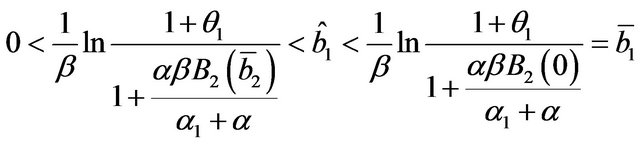

then it exists the point , with

, with  and

and , satisfying the system (22), and it is

, satisfying the system (22), and it is

(33)

(33)

Proof.

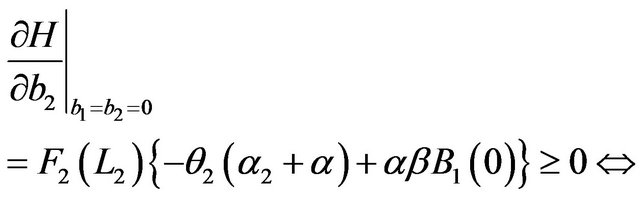

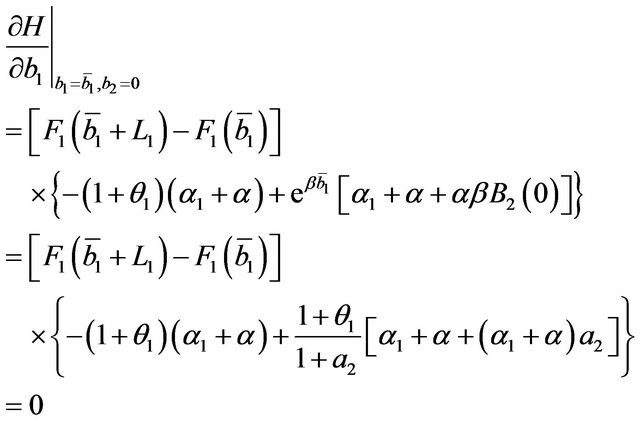

1) It results

the first of (28) holds and

the second of (28) holds.

2) We recall that  is defined by (26). From (29) it follows that

is defined by (26). From (29) it follows that  the first of (29) holds.

the first of (29) holds.

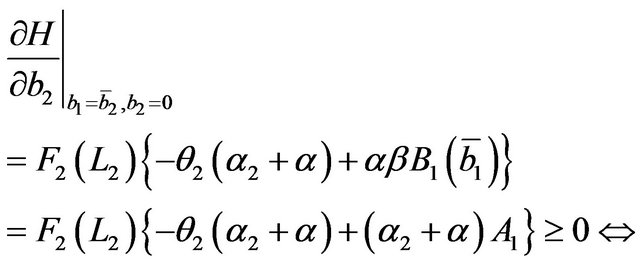

Furthermore, remembering (25) and (26),

and, remembering (27)

the second of (29) holds.

3) We recall that  is defined by (26). From (29) it follows that

is defined by (26). From (29) it follows that  the second of (30) holds.

the second of (30) holds.

Furthermore, remembering (25) and (26),

and, remembering (27)

the first of (30) holds.

4) Because of (31) it results

(34)

(34)

We put

and

and we note that it results

(35)

(35)

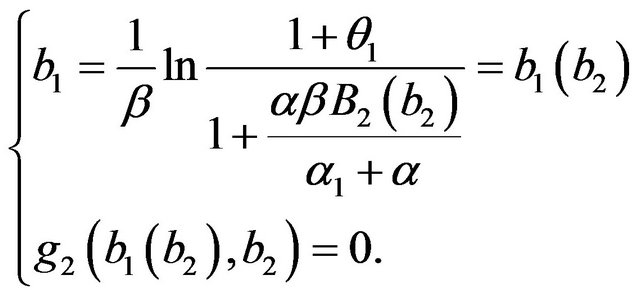

We solve the system (35). We have:

(36)

(36)

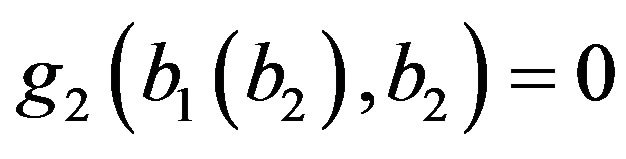

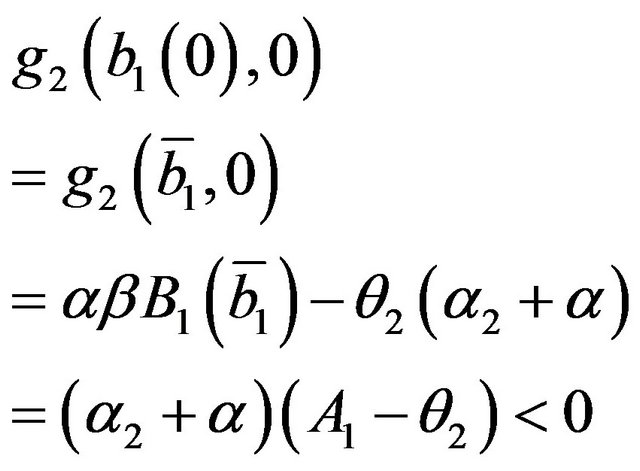

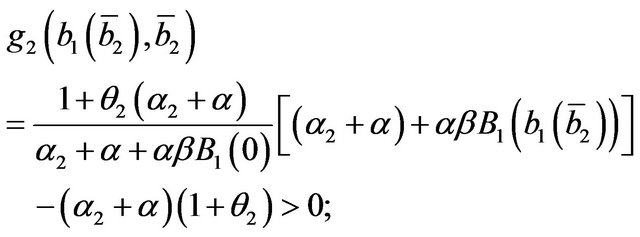

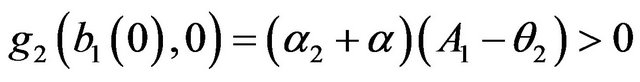

To solve the equation , we make use of a similar procedure to that in [10]. We note that g2 is a continuous function of

, we make use of a similar procedure to that in [10]. We note that g2 is a continuous function of  and that, by (34), it results

and that, by (34), it results

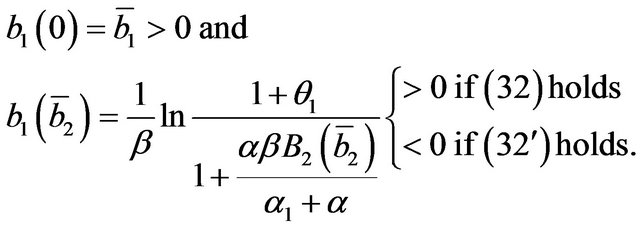

If (32) holds, remembering (27) and (25), and being  an increasing function, it results

an increasing function, it results

and

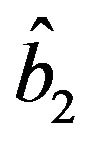

it therefore exists , satisfying the second of (36). Substituting

, satisfying the second of (36). Substituting  in (36), it results

in (36), it results

(37)

(37)

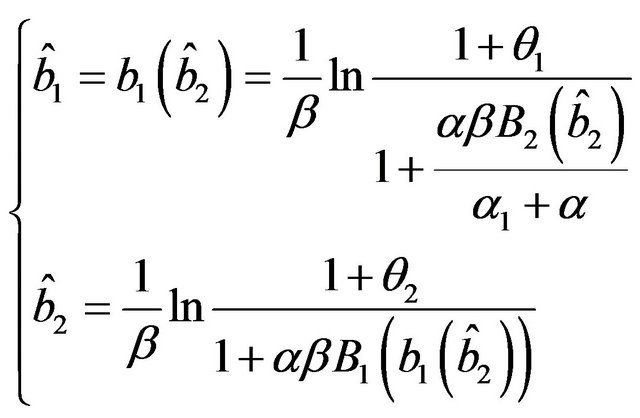

with, by (31) and (32), since  is an increasing function:

is an increasing function:  (38)

(38)

therefore,  satisfying (33) fulfills the system (22).

satisfying (33) fulfills the system (22).

Similarly, if (32’) holds, remembering (27) and (25), and being  an increasing function, it results

an increasing function, it results

and

it therefore exists , satisfying the second of (36). Substituting

, satisfying the second of (36). Substituting  in (36) we obtain (37), (38) and the point

in (36) we obtain (37), (38) and the point  fulfilling the system (22).

fulfilling the system (22).