Economic Theory and Reforms of the Electrical Energy Sector in the Republic of Congo: What Lessons? ()

1. Introduction

Electricity sector reforms are not only an economic issue, but also a political and social challenge in all countries. Thus, over the last decades, the electricity sector has been subject to restructuring and numerous reforms, particularly in developing countries (Pollitt, 2012) . If these reforms have not always been the same for all countries, the main objective, on the other hand, remains the same, namely, to improve, among other things, economic efficiency, growth of the sector and the quality of public service. However, to achieve this desired performance, two questions must be asked: what should be the optimal organization of the electrical energy sector? And what can be the optimal pricing for public service concession companies in this sector? If economic theory attempts to provide answers to these organizational and pricing questions (Percebois, 2001) , the fact remains that the type of reforms adopted and their proper execution determine the results. It turns out that some studies conclude that the implementation and success of market-oriented electricity sector reforms in developing countries after more than two decades is rather a failure (Besant-Jones, 2006; Kessides, 2012) . This being admitted, we can therefore formulate two following hypotheses: these failures are associated with reforms, either unsuitable in relation to the characteristics of the market of the country considered, or poorly executed, to the extent that developing countries generally suffer from serious institutional weaknesses (Parker, 2002) .

With regard to the Congo which is, here, our case study, the reforms of the early 2000s in the electricity sector gave rise, on the one hand, to the opening of the market to competition, notably on the production segment, and on the other hand, to the creation of a regulatory agency. However, these changes have so far not been the subject of in-depth analysis, particularly with regard to the scope of these reforms on the economic, social or even political levels. The interest of this contribution therefore falls within this perspective.

Given the absence or at least the insufficiency of empirical data, we cannot, here, claim to make an econometric assessment of the impact of reforms in the sector. However, based on economic theory, the electricity regulation (ERI), regulatory governance (RGI), regulatory substance (RSI) and regulatory effect (ROI) indices produced by the African Bank of Development (BAD), and on the characteristics of the electricity market in Congo, we can produce an analysis and design a mathematical model that can justify, through computer simulations, the effects likely to be observed following these certain reforms.

The remainder of this article will be structured as follows: after a review of the literature on economic theory and reforms in the electric energy sector (2), an analysis of the foundations and framework of reforms (3) in the Republic of Congo will be made. Section 4 will address the optimal organization of the electricity sector, on aspects of regulation and competition. Section 5 will deal with optimal electricity pricing while proposing a mathematical model that will give rise to a discussion. Finally, Section 6 will conclude this research work.

2. Literature Review

Several studies have sought to establish a link between privatizations or at least reforms in the electric power sector and economic performance. It should already be noted that these studies mainly concern developed countries (Megginson & Netter, 2001) . However, the few studies that exist on developing countries present fairly mixed, if not nuanced, results.

By studying data on the privatization of electricity production in 38 countries (developed and developing) between 1977 and 1997, based on three aspects of regulation, in particular, market entry conditions, access to the network and the level of prices, Bortolotti et al. (1998) reach the conclusion that the success of any privatization depends crucially on the effectiveness of regulation.

Hawdon (1996) , in the same vein, studies two distinct groups of countries and estimates that the group of countries engaged in privatizations was significantly more efficient than those that had not undertaken privatizations. However, this result can be qualified by the fact that “privatization was adopted by countries that least needed efficiency gains.”1 Also, Cook (1999) in his case studies on public service reform manages to demonstrate that the creation of a competitive environment and effective regulation is a difficult and slow process, even if companies are privatized.

Conversely, Adhikari and Kirkpatrick (1990) , in a comparative study, arrive at the result that public companies can be more efficient than private companies. However, the causes of this difference are often much more complex and cannot be limited to the question of ownership. Moreover, in a 1987 comparative study of electricity production in 27 developing countries, Yunos and Hawdon (1997) found that public sector electricity suppliers were as efficient as those in the private sector, despite the absence of competition in these countries.

Following the example of Zhang et al. (2002) , it can be argued, with regard to developing countries in general and the Congo in particular, that the evaluation of the performance of the electricity sector must take into account the effects of liberalization, competition, regulatory effectiveness, but also certain institutional factors. Regarding institutional factors, we can draw inspiration from Bergara et al. (1997) who, in their study, were able to establish two political indices to measure the impact of institutions on investment in the electricity sector and their results show a positive correlation between the credibility of political institutions and global electricity production capacity.

1 Hawdon (1996) Performance of Power Sectors in Developing Countries—A Study of Efficiency and World Bank Policy using Data Envelopment Analysis, Surrey Energy Economics Center Discussion Paper 88, University of Surrey, p. 28.

The insufficiency of research work on the electrical energy sector in developing countries, and particularly in the Republic of Congo, comes from the fact that energy issues were not the subject of intense debate until there are still a few decades, that is to say, before the reforms to meet the successive energy challenges that will arise in the coming decades. This article will therefore contribute somewhat to fill this void.

3. Foundations and Framework for Reforms in the Electric Power Sector

3.1. The Foundations of the Reforms

The foundations of electricity sector reforms are both practical and theoretical.

3.1.1. From a Practical Point of View

In 1992 the World Bank changed its lending policy for the development of the electricity sector. It shifts from “traditional project loans” to “strategic loans”, i.e., any borrowing country should adopt the standard market-oriented reform model. Loans from the International Monetary Fund (IMF) are part of this same logic, which is also what has been referred to as “the Washington consensus”. It is in this context of loans conditioned by privatizations that the transition from a vertically integrated public monopoly to a competitive private sector is taking place in the electric energy sector.

If direct or indirect pressure from international financial institutions seems to be decisive in the observed movement of developing countries towards reforms, it must nevertheless be observed that, in most of these countries and particularly in Congo which interests us here, the reforms were necessary given the state in which the electric power sector found itself: energy deficits, inability of the public sector to mobilize sufficient capital, insufficient access to electricity for the population (particularly rural), operational inefficiency and economics of public monopoly, the need to limit state subsidies and the desire to generate income by selling state assets (Bacon & Besant-Jones, 2001) .

Another factor can also be mentioned among the reasons which led certain developing countries to initiate reforms in the electric energy sector: the ripple effects of international experiences, in particular, lessons learned from pioneering reforms in Chile, in England, Wales and Norway in the 1980s and early 1990s, who, on balance, were held up as models of success.

3.1.2. From the Point of View of Economic Theory

2Separation, at least on an accounting level, of production, transport and distribution activities.

Compared to market coordination, the vertical integration of electrical industries is historically justified by the economics of transaction costs theorized by Coase (1937) . Indeed, vertical integration makes it possible to achieve “economies of scale”, to reduce costs in searching for information and to obtain greater efficiency in contractual relationships. However, as an extension of this same theory, Williamson (1988, 1989) was able to show that in certain cases, the firm has an interest in outsourcing its transactions, since market costs can sometimes be lower than internal organizational costs: under these conditions, disintegration2 and/or outsourcing and therefore market coordination is economically preferable. Furthermore, it should be noted that unbundling (partial or total) is only justified if the benefits resulting from this operation are greater than the costs that the latter could generate. Therefore, a thorough cost-benefit analysis is necessary before deciding to segment the electricity sector.

The liberal school justifies the opening to competition of certain activities in the network industry by the growth of physical interconnections, that is to say by the increase in contractual relations passing through the resulting market. Relying not only on the theory of transaction costs, but also on the theory of “contestable markets”3, vertical integration in the electric power sector cannot be maintained indefinitely. It is under these conditions that most developed countries and some developing countries, including Congo, have decided to initiate various reforms in the electrical energy sector.

3.2. The Framework of Reforms in the Republic of Congo

Reforms of the electrical energy sector in Congo are essentially governed by Law No. 14-2003 of April 10, 2003 on the electricity code. Code from which the opening to competition of the electrical energy market is enshrined and that the management of the public electricity service can be attributed to private companies, in this case to the public limited company “Energie Electrique du Congo (E2C.SAU)”, by delegation4.

The opening of the electricity market to competition led, naturally, to the creation of an Electricity Sector Regulatory Agency (ARSEL) whose main missions would be, in theory, the promotion of competition and the participation of the private sector in terms of production, transmission, distribution, marketing, import and export of electricity under objective, transparent and non-discriminatory conditions. This agency, under the supervision of the Ministry of Energy and Hydraulics, would also be responsible for regulating, controlling and monitoring the activities of operators in the sector, in addition to arbitrating possible disputes between all players in the sector. In reality, this agency is still seeking its autonomy and cannot therefore, under current conditions, fulfill all the missions assigned to it.

3A market is said to be “contestable” or “disputable” when entry and exit take place without barriers, that is to say without sunk costs.

4The delegation of public service is defined by the electricity code as being a contract by which the State entrusts the management of all or part of the public electricity service to one or more public or private persons for a period which does not can exceed 30 years. This is how the limited company E2C was created, by decree no. 2018-295 of August 7, 2018. SAU, responsible for managing, on behalf of the State, the public electricity assets.

5It can take three forms. The first is the complete legal separation of activities. The second form is functional unbundling where each activity is managed by a structure independent of the other in terms of management but internal to the same company. The third form is the separation of accounts which requires increased control from the regulator.

With regard to the electricity transmission segment, the legislative framework allows opening to private initiative and competition. However, if we stick to the development strategy of the electrical energy sector, Decree No. 2010-822 of December 31, 2010 establishes a de facto public monopoly in this segment. Like the Electricity Transport Network in France, an agreement to create the Electricity Transport Company (STE) was given by decree no. 2018-296 of August 7, 2018. The effectiveness of Competition in other segments of the sector would only be possible if third party access to the network (ATR) is guaranteed. In any case, this is one of the missions assigned to ARSEL. But the latter cannot claim to succeed in such a mission as long as the historic operator does not succeed in separating5 its activities. This separation is fundamental to opening the market to competition. In fact, it guarantees the absence of cross-subsidies between activities, since the temptation exists for integrated operators to place the maximum burden on monopoly activities for the benefit of competing activities. It should, however, be noted that the STE is still not operational at the time of writing this paper.

Regarding the regulation of the electricity sector in the Republic of Congo, it should be noted that the very latest report (the 5th) of the African Development Bank (AfDB) on the electricity regulation index in Africa (2022), assesses the Congo index at 0.101, in other words, out of 44 African countries surveyed, Congo occupies last place. This therefore implies that the regulatory framework regarding electricity in the Republic of Congo has certain inadequacies (Table 1).

Regardless, political influence in priority efforts to achieve social goals is likely to limit regulatory independence. It is therefore urgent, in terms of suggestion, that the Republic of Congo isolate ARSEL, for example, from the interference and approvals of the supervisory ministry.

Likewise, the regulatory governance index, which is a composite index (see Table 2), remains at a relatively low level (0.540) and Congo ranks 39th out of 44 countries. All this reveals certain weaknesses in ARSEL’s power. These weaknesses certainly come from a lack of decision-making independence and informational asymmetry attributable, to a certain extent, to the absence of autonomy.

Regarding the regulatory substance index, Congo is still not among the best scores, since its value is estimated at 0.286, that is to say that Congo finds itself in 41st place out of 44 countries. Considering the low scores of the sub-indicators (see Table 3), we are entitled to think that ARSEL does not have sufficient power to take regulatory measures and decisions provided for by its mandate.

Another indicator is that of regulatory effect. It is supposed to measure the impact of ARSEL on all players in the electricity sector. This index takes into account the scores for Facilitation of Access to Electricity, Quality of Service Delivered and Financial Performance and Competitiveness. It is measured, with regard to Congo, at 0.025, which is in fact the lowest score of all the countries surveyed. It should be noted, comparatively, that the highest score is 0.747, obtained by Uganda which in fact occupies first place in the ranking. No efforts since 2020 have been noted to improve the ERI score (see Table 4).

There is evidence that electricity sector reforms and regulation in developing countries tend to suffer from low levels of institutional environment: limited regulatory capacity, limited accountability, limited commitment and limited fiscal efficiency (Laffont, 2005) . However, if some institutional progress has been noted in the Republic of Congo, notably with the adoption of the electricity law and the creation of a regulatory agency, the implementation of the electricity policy still presents some weaknesses. Weaknesses linked, among other things, to political injunctions and the lack of autonomy, particularly decision-making, of the regulator.

![]()

Table 1. Congo’s Electricity Regulatory Index (ERI) in 2022.

Source: Author based on the AfDB report on the Africa Electricity Regulation Index 2022.

![]()

Table 2. Regulatory Governance Index (RGI) of Congo in 2022.

Source: Author based on the AfDB report on the Africa Electricity Regulation Index 2022.

![]()

Table 3. Regulatory Substance Index (RSI) of Congo in 2022.

Source: Author, based on the AfDB report on the Africa Electricity Regulation Index 2022.

![]()

Table 4. Evolution of Congo’s ERI from 2020-2022.

Source: Author, based on the AfDB report on the Africa Electricity Regulation Index 2022.

4. Optimal Organization of the Electricity Market

Two aspects can be examined with regard to the optimal organization of the electricity market: regulation and competition.

4.1. The Regulation

The “standard model” of electricity sector organization presented by Joskow (2008) emphasizes the need to create new effective institutions in the form of independent regulatory bodies (regulatory authorities or agencies) which would act as guardians of public interests (Armstrong et al., 1994) . Thus, the State, through the Regulator must, among other things, ensure that public service missions, the application of competition law, third party access to the network are ensured and guaranteed in an efficient and effective manner. non-discriminatory.

It therefore appears that the existence of public service missions requires the presence of a regulator. This monitors the specifications, which provide for the rights and obligations of the concessionaire and ensures that there is fair treatment of the various users. If the State chooses to create a regulatory agency or authority, it must guarantee its independence even if this is by nature always likely to be limited (Percebois, 2001) . In reality, the role of the Regulator is threefold:

• It must protect the investor against destructive competition, by granting “exclusive rights” to the public service concessionaire;

• It must protect the user against abuse of the dominant position of the concessionaire, knowing that any monopoly would naturally tend to abuse its dominant position;

• It must safeguard the collective interest (national independence, territorial planning, redistribution of income, protection of the environment or employment, etc.).

But, generally speaking, a regulatory agency aims, among other objectives:

- The determination of tariffs which better reflect the costs of electricity production;

- Introducing greater efficiency into electricity markets;

- Providing incentives to electricity companies to innovate and invest in infrastructure;

- Monitoring the electricity market with regard to the level of competition;

- Increasing the rate of electrification or, at least, balancing electrical supply and demand.

Furthermore, in a deregulated universe, if the question of the legitimacy of the Regulator can be raised, it must not be overlooked that, unlike pure collective goods, electricity is an “essential” good and that failure, even partial, of the market to allow all to access it makes the intervention of the public authorities essential, hence the need for a Regulator in the electricity sector.

If the presence of a Regulator of the electricity sector, even in a deregulated world, seems indisputable, the regulation of this sector in developing countries poses some efficiency problems, and the Republic of Congo is no exception. Indeed, the Congolese Regulator, not having sufficient material and financial resources, is also faced with difficulties in collecting information (asymmetry of information between the Regulator and the regulated), and problems of decision-making autonomy. It cannot, under these conditions, fully accomplish the missions assigned to it.

4.2. Competition

The essential characteristic of network industries is that they are organized around an infrastructure for which fixed costs are very high compared to variable costs. This is the case in the electricity sector where production, transmission and distribution require heavy infrastructure, the duplication of which results in exorbitant costs. The natural monopoly seems, in these conditions, justified. However, it must be observed, like Percebois (2001) , that technical progress has greatly reduced the specificity of assets upstream of the electricity industry. Indeed, the same transport network, for example, can today be used to transport electricity which comes from the combustion of diesel, gas, nuclear or other inputs. Therefore, network industries can constitute natural monopolies for only the segment of their business that corresponds to infrastructure management6. This is why the production segment should not constitute a natural monopoly, since, taking into account technical progress, the cost function becomes super-additive and competition is, under these conditions, likely to increase the good-be collective.

Regardless, it must be remembered that the theory of transaction costs and that of contestable markets laid the foundations for opening up to competition. Thus, public or private monopolies have often been the subject of numerous criticisms. They are accused of practicing “cross subsidies” between the various customer segments by favoring potentially mobile users to the detriment of captive users. Faced with the threat of competitors, companies in a monopoly situation practice overstaffing and overinvestment (theory of inefficiency X by Leibenstein, 1966 ). The theory of capture (Stigler, 1971) and the existence of informational asymmetries between the supervisory authority and the company tell us that monopolies tend to influence the Regulator and to assert their own interest under cover of the general interest.

6The presence of a Regulator is in these conditions necessary, if only to verify that there is no abuse of a dominant position and that the network access prices are justified and non-discriminatory.

Furthermore, it should be noted that in the economic literature, competition is considered as a reliable mechanism that stimulates both allocative and technical efficiency (Pollitt, 1997; Leibenstein, 1966) . In theory, according to Joskow (2000) two patterns dominate competition models. On the one hand, the competition model on the wholesale market (“Portfolio manager model”) where the production segment is open to competition and producers can sell either to the transmission system operator according to different modalities, or directly to so-called “eligible” large consumers and distributors. This therefore implies the implementation of an ATR. And on the other hand, the model of competition on the retail market (“Customer choice model”) where small consumers can choose or even negotiate directly with a producer, which implies the extension of the ATR downstream of the activity. In this last model, there is separation between the physical operation and the commercial operation. The entity that issues and collects the bill will no longer necessarily be the one that physically distributes the electricity.

It should be noted here that the alternative models are only variants of the two models that have just been presented. Congo is more in line with the first model with a historic operator (E2C.SAU), which is both the sole buyer and manager of the transport network. This model is considered to be a vertically integrated monopoly. In fact, the historic operator assumes almost all the functions in the chain, from production (even if part of its production is purchased) to distribution. For some observers, from a social point of view the natural monopoly seems a more efficient market structure than the competitive structure7. Indeed, it allows economies of scale to be achieved, given that as production increases, the cost per unit of kWh produced decreases. But, strictly speaking, a monopoly is natural when its cost function is sub-additive, that is, the cost of production of a single firm is less than the sum of the costs of several separate firms, each producing part of the total production.

7Institute of Energy and the Environment of the Francophonie: “Electricity pricing”. Theme: Energy management policies. PRIME technical sheet n˚ 9.

This model is open to criticism for the reasons mentioned above, but when the size of the sector is taken into account, it seems that this model with a single buyer is the most suitable, at least for the Congo. In reality, the size of the sector is a crucial factor often ignored by proponents of competition ideology. Above all, we must not hide the fact that the size of the system can influence the capacity and reform options of the reformed country (Nepal & Jamasb, 2013) . Deepening competition through the multiplication of operators and the expansion of interconnections in small markets and small states like Congo can have undesirable effects on the economic, social and political levels. Indeed, the scope of competition may be limited by the market shares to be competed for, the benefits of adopting a highly competitive model may be small compared to the costs of the electricity network in Congo. Moreover, some studies have shown that it is not appropriate to unbundle an electricity system with a capacity of less than 1000 megawatts (MW) into several separate production and distribution companies assuming that competition will develop (Besant-Jones, 2006) . However, the installed capacity of Congo’s electricity network does not even reach 800 MW (see Table 5).

![]()

Table 5. Electricity production capacity installed in Congo.

Source: Author, based on information from operators.

Furthermore, it should be noted that the relatively small size of the electrical energy market in the Republic of Congo, institutional factors, in particular, the lack of confidence in the stability of the regulatory regime and the sectoral structure characterized by the domination of the market by the historical operator are all elements likely to explain the limited attractiveness of private sector investments since the liberalization of the sector. It turns out that the attractiveness of the electricity sector requires, among other things:

- A clear legal and regulatory framework: the roles of each actor must be well defined;

- Reflective tariffs: if tariffs do not reflect costs, financial imbalance is inevitable, unless state subsidies are required to correct the deficit;

- Technical and commercial performance: technical and non-technical losses must be reduced. Indeed, even if the tariffs cover all costs, losses, particularly commercial losses, are likely to prevent the sector from being viable.

Taking into account all these parameters, particularly that of the size of the market, it does not seem appropriate to put the electricity market of the Republic of Congo on a path of increased development of competition. In addition, certain works conclude, contrary to a widely held idea in economics, competitive organization is rarely effective, and to encourage effort, collaboration may be preferable (Fleckinger, 2019) . It is in this perspective that the theory of incentives finds its importance, since it will allow the Regulator to maintain incentives for efficiency in segments, such as the transport and distribution of electricity, which are not naturally subject to the sting of competition (Baron and Myerson, 1982). Regardless, opening up to competition only makes sense because it must make it possible to lower prices for the end consumer. We still need to know the optimal pricing system to adopt for the end consumer!

5. Optimal Electricity Pricing: Mathematical Approach

The choice of a mathematical rather than econometric approach comes from the fact that data from the electricity sector in the Republic of Congo are not always available, and when they are, the quality seems limited, in certain respects. Several factors are likely to bias the empirical approach; overall distribution losses, for example, are estimated at 43.98% (in MWh) of the energy distributed in 2020 (E2C.SAU Report, 2020).

5.1. Pricing Possibilities

On a theoretical level, several approaches make it possible to determine electricity prices, but none is exempt from all criticism. The so-called Ramsey-Boiteux method, for example, seems effective, but it is not necessarily fair for all users. Indeed, prices are inversely linked to the price elasticity of demand, that is to say that for industrial customers whose demand is generally elastic, prices are relatively low, while for customers residential markets which most of the time have inelastic demand, prices are relatively high. However, the main principles of administrative law recall that the public service must ensure equal treatment of users. Regardless, in practice, pricing using the Ramsey-Boiteux method is difficult to implement. This involves maximizing the following function:

Under budget constraints:

where

corresponds to the price of good i produced by the natural monopolist,

the quantity produced of i,

the total cost function borne by the company.

The difficulty of its implementation comes from the fact that, in the application of this Ramsey-Boiteux pricing method, the natural monopolist must be able to segment its customers according to the price elasticity of demand, which t’s not an easy task. Particularly in many developing countries, we rely on customers’ willingness to pay without differentiating them a priori. The burden of discrimination is in some way “subcontracted to users who position themselves at the various levels of the scale” (Curien, 2000) . It is a non-linear two-part pricing system therefore comprising two elements:

where P represents the price of the kWh and F a fixed part independent of the quantities consumed Q making it possible to cover the fixed costs of the infrastructure, and these costs must be distributed uniformly among all users: F = CF/n where CF corresponds to the fixed costs and n the total number of users. It turns out that customers’ willingness to pay is a theoretical concept. Assuming that it is lower than the load CF/n for certain customers, the latter will therefore be excluded from access to the network. In practice, we often settle for billing by subscribed power (case of Congo), otherwise by predefined consumption bracket:

if

if

if

With:

and

Here, the firm sells its electricity to several categories of customers. This involves recovering common costs using the two-part pricing method: consumers pay an electricity access price (Fn) and a usage price (PnQn). The access price remains fixed but it differs per consumption segment. On the other hand, the usage price is different for each group of consumers and for the period of electricity consumption.

There is also the possibility of making users pay, in addition to a fraction of the fixed costs, the variable cost depending on demand; this is “full cost” pricing (Fully Distributed Cost Pricing). By relying on the Pareto optimum theory, some economists8 still manage to justify pricing at marginal cost, despite its incompatibility with the principle of equal treatment of users mentioned above. These economists claim, in any case, that price discrimination is not incompatible with equal treatment of users. It should be noted that marginal cost pricing implies a temporal and spatial “de-equalization” of prices.

Finally, in a regulated world, all these pricing options can only be of some use for the public service if the Regulator has the power and tools necessary to access information on the different costs (production, transport and distribution) of the sector. Indeed, cost control by the Regulator can make it possible, if necessary, to put in place an efficient and equitable public service financing system, through a special fund such as an “equalization fund”. This will come from resources generated by the sector itself.

5.2. The Regulator and Pricing Methodology

The Regulator is required to establish electricity prices so that regulated operators manage to cover the justified costs of the service, that is to say, the necessary and unavoidable costs to offer and maintain the public service at a level of predefined quality, while allowing operators to make a reasonable margin.

8The welfare theorem tells us that market equilibrium is a state in which all exchanges are carried out and they are mutually beneficial. This equilibrium situation is a Pareto optimum, when we cannot improve the satisfaction of one co-exchanger without reducing that of the other, that is to say that any new exchange should necessarily generate a loss for the one of the co-swingers.

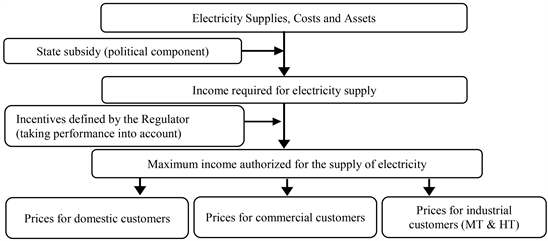

The methodology adopted by the Regulator to set prices follows the following scheme:

The pricing principles adopted by the Regulator are such that the rates must be:

- Economically efficient: prices must reflect costs;

- Fair and equitable: certain social categories are not necessarily able to pay the prices likely to cover costs;

- Stable and predictable over time;

- Financially sustainable/viable: they must generate sufficient revenue to meet financial obligations.

- Simple: to make billing easier and easier for users to understand.

In terms of pricing, it is also important to present the position in which the Regulator is likely to find itself given the divergence of interests between operators and users. The Regulator is the only one capable of finding a balance between the following divergent expectations:

5.3. A Case Study: Mathematical Pricing Model

Among the missions assigned to regulatory agencies is the determination of tariffs which better reflect the costs of electricity production. To achieve this, the cost of service or price cap approach can be used to determine the required dealer revenue.

It is assumed that the determination of prices by the Regulator takes into account the interests of the different actors. Like PRISME technical sheet no. 9 on energy management policies, we can use the standard formula used in practice to calculate the required revenues of the regulated company:

where R = income required for the regulated business; E = operating expenses or cost of service; V = value of real estate, factories and equipment useful and usable for the production and sale of electricity; d = depreciation of useful and usable plants and equipment; w = working capital required by the regulated firm; r = rate of return calculated using the weighted average cost of capital (WACC) for the entire company (WACC). The Regulator must ensure that only expenses associated directly or indirectly with the production of electricity are classified as cost of service and admitted to cost calculations. Rates were to be such that the revenue earned must equal the cost of the service and enable the company to earn a fair and reasonable rate of return on its rate base. The WACC or WACC is calculated as follows:

where kd corresponds to the cost of debt (interest rate on bonds issued by the company); ke is the company’s cost of equity capital; D is debt; E is the company’s equity.

Consider the data in the following Tables 6-11:

And assume the following statements from the electricity operator:

Historical investments (i.e., investments made before 2019!) have the following depreciation and interest:

![]()

Table 7. Net profit of concessionaires (absence of regulatory base).

Source: author’s calculations.

Source: author’s calculations.

Source: author’s calculations.

![]()

Table 10. Evolution of calculated (subsidized) prices.

Source: author’s calculations.

![]()

Table 11. Evolution of reflective cost tariffs (non-subsidized).

Source: author’s calculations.

New investments have a depreciation period of 20 years. The interest rate is 8.0% and 60% of the investment is financed by borrowing (therefore 40% of equity).

5.4. The Discussion

In a tariff system where the Regulator has neither decision-making autonomy nor sufficient power to control the concessionaires, it is very likely that the tariffs do not reflect the costs, since the assets mobilized for the calculation of the costs depend on the “good want” dealers. Consequently, the operational result of our mathematical model (see Table 7) is likely to be biased. This model shows that with a tariff set at 80 FCFA/kWh, in addition to a state subsidy which amounts to 30 FCFA/kWh, the concessionaire’s net profits are, despite everything, decreasing each year, and moreover from the fourth year (2023), the concessionaire records a loss (−8% compared to zero profit).

To simulate the market size hypothesis, we can test, with the same previous data, a growth in electricity demand going from 5% to 20%. The results of the computer simulation are as follows:

With a larger size of the liberalized market, we can finally agree that competition could be increased. The computer simulation results are consistent with theoretical expectations. Indeed, more intense competition should result in a gradual reduction in operators’ net profits, following the entry into the market of new competitors (see Table 12) and a gradual reduction in prices linked to operator competition (see Table 13).

In the presence of a Regulator capable of imposing a regulatory asset base, tariffs are likely to reflect a little more the real level of production, transport,

Source: author’s calculations.

![]()

Table 13. Reflective and calculated cost rates.

Source: author’s calculations.

distribution and marketing costs. In addition, the mathematical model developed reveals the possibilities available to the Regulator, for a given period (4 years in this case), after having determined the maximum authorized income (RMA). Indeed, based, among other things, on assumptions about growth in demand and operating costs (opex), the Regulator is able to propose fairer prices. Given the results obtained and for reasons of financial viability and balance of the sector, the State should continue to subsidize the sector. Also, the subsidy makes it possible to contain prices (see Table 10) and therefore to limit the exclusion of certain social classes from this essential good which is electricity.

On the other hand, for reasons of budgetary constraints in public finances, the State can also demand the gradual or total elimination of subsidies in the electrical energy sector. As a result, electricity prices will obviously experience a proportional increase (see Table 11), with all the knock-on effects that this could have, not only on the economic level but also on the social and policy.

6. Conclusion

This article, based on economic theory and certain surveys, evaluated the reforms of the electricity sector undertaken in the Republic of Congo since the beginning of the 2000s. It turned out that these reforms still did not produce the expected effects: complete opening of the market, effectiveness of regulation, attraction of private investment, etc. However, two fundamental things require attention: competition and regulation. Indeed, this study cast doubt on the net benefit gained from essentially market-oriented reforms, particularly in the electrical energy market in the Republic of Congo, which overall remains a relatively small market. More evidence is therefore needed to affirm the relevance of adopting a model based on complete market opening in a small system. Furthermore, the reforms in the Republic of Congo gave rise to the creation of a regulatory agency which, unfortunately, has neither the necessary material and financial resources nor the decision-making autonomy to regulate the sector for which it is responsible. However, the importance of an independent regulator, with all the necessary means and powers, is such that it can contribute to achieving optimal organization of the market and decide on cost-reflective prices while preserving the financial viability of concessionaires and the financial balance of the sector.

Furthermore, whatever the reform model adopted, the importance of addressing major environmental externalities today requires the presence of an independent and effective Regulator. It is therefore not enough to simply have a reform framework that meets the challenges, but we must also create conditions for implementing these reforms!