Research on Coordination of a Pharmaceutical Dual-Channel Supply Chain Considering Pharmaceutical Product Quality and Sales Efforts ()

1. Introduction

Driven by various reforms and favorable policies such as the national “two-invoice system”, 4 + 7 purchasing with quantity, and prescription outflows, “Internet + medical health” has accelerated development (Deng & Wen, 2020). Pharmaceutical manufacturers begin to rearrange sales channels, both online and offline, to fully realize the fusion development of B-side and C-end, doctor and drug, therefore reducing the intermediate link in pharmaceutical circulation, optimizing the supply chain, and providing the convenience for the public to seek medical treatment and buy medicines. In this way, the relationship between pharmaceutical manufacturers and pharmaceutical retailers has changed from a cooperative relationship into a competitive and cooperative relationship. Pharmaceutical manufacturers build an electronic channel to directly participate in the market on the basis of the original traditional retailer channel (Askarian-Amiri, Paydar, & Safaei, 2021). Channel conflict between pharmaceutical retailers and pharmaceutical retailers is inevitable, which will squeeze the sales space of pharmaceutical retailers. Pharmaceutical retailers must make more sales efforts, provide more considerate services and explore new business models to improve the re-purchase rate and customer loyalty and highlight the retail terminal value. As (Pal, Cardenas-Barron, & Chaudhuri, 2021) think, in retail channels, consumers can benefit from retail services and direct contact with products. Therefore, under the dual-channel model, it is necessary to consider the influence of pharmaceutical retailers’ sales efforts and service quality in the pharmaceutical supply chain. Secondly, medicine is a very special commodity, and the quality of medicine directly affects the health and life safety of patients. Especially in recent years, with the continuous improvement of national living standards, people are increasingly pursuing a healthy life and quality of life, and paying more and more attention to the quality and safety of medicine. Any progress that helps to improve pharmaceutical product quality without damaging to medicine safety will be widely accepted by the industry. For patients, access to affordable safe, effective and quality-assured medicine is critical to achieving good health outcomes (Toroitich, Dunford, Armitage, & Tanna, 2022). (Flavin, Happe, & Hatton, 2022) emphasize every stakeholder in the pharmaceutical supply chain has the responsibility of doing their best to maintain the quality of medicine. (Sizova, 2021) believes that the guarantee of pharmaceutical product quality can help improve patients’ dependence on pharmaceutical products, improve patients’ quality of life, and thus increase the demand for the pharmaceutical products. So, the impact of pharmaceutical product quality on pharmaceutical supply chain is particularly important. Therefore, considering the influence of the sales effort level of pharmaceutical retailers and the quality level of pharmaceutical products on the supply chain, it is of vital importance to explore how to realize the coordination of supply chain under the dual-channel mode, so as to ensure the improvement of the overall profit of the supply chain and improve the profit of each member of the supply chain.

Now, the coordination of dual-channel supply chain has become an important issue concerned by researchers at home and abroad. Many researchers have studied the coordination of dual-channel supply chain. The difference lies in the different influencing factors and the different contractual coordination mechanisms adopted. Some researchers believe that sales efforts have an impact on dual-channel supply chain. (Zhao, You, & Fang, 2021) studied the impact of retailers’ sales efforts and manufacturers’ cost sharing on optimal strategies, and proved that if the market reacted strongly to retailers’ sales efforts, manufacturers’ profits would be lower than retailers’ profits. (Dumrongsiri, Fan, Jain, & Moinzadeh, 2008) believe that in dual-channel, retailers can improve manufacturers’ profits by improving sales efforts and service quality. (Chen, Zhang, & Liu, 2020) use Stackelberg game’s backward induction and two-stage optimization techniques to get the equilibrium solution, which shows that in a decentralized two-channel supply chain, customer loyalty in direct channel has a significant impact on the service and quality strategies of manufacturers and retailers. However, there is no significant effect in centralized two-channel supply chain. In the field of pharmaceutical supply chain, by introducing queuing theory, (Lai & Nie, 2021) established Stackelberg game model with pharmaceutical manufacturers as the dominant player and pharmaceutical retailers as followers, and analyzed the influence of pharmaceutical retailers’ service capability on dual-channel strategy of OTC pharmaceutical supply chain. It is found that under some conditions, pharmaceutical manufacturers and pharmaceutical retailers can achieve a win-win situation under the dual-channel strategy if the service capacity of pharmaceutical retailers is higher. (Chen, Zhang, & Gu, 2019) analyzed the impact of pharmaceutical manufacturers’ promotional efforts on the profits of the pharmaceutical dual-channel supply chain, and found through numerical example study that when certain constraints were met in the promotional efforts, adopting dual-channel was beneficial to pharmaceutical manufacturers. (Hou & Yang, 2019) and (Guan & Huang, 2021) studied the impact of medical insurance reimbursement and medical insurance payment policies on the performance of dual-channel pharmaceutical supply chain, social welfare and dual-channel pricing of drug retail. In considering the impact of product quality on the supply chain, (Ranjan & Jha, 2019) verified that channel coordination could be achieved through residual profit sharing mechanism and win-win situation could be achieved for all members of the supply chain under the consideration of the impact of green product quality on demand. However, there are relatively few literatures regarding the influence of pharmaceutical product quality on pharmaceutical supply chain.

In terms of contract coordination of supply chain, some researchers believe that revenue-sharing or profit-sharing contract can coordinate dual-channel supply chain. (Zhu, Ren, Lee, & Zhang, 2017) analyzed the widely used revenue-sharing contract and buyback contract in single-channel supply chains. Although some researchers have discussed that these two traditional contracts cannot coordinate the dual-channel supply chain, the results of the author’s study show that traditional contracts can still come into play with restrictions on the risk-averse degree. (Chen, Hu, Han, & Du, 2020) considered consumers’ low-carbon preference and solved the conflict problem of dual-channel supply chain in a low-carbon environment by designing a revenue-sharing contract between two parties. (Xu, Dan, & Xiao, 2010) proposed an improved revenue sharing contract to coordinate the dual-channel supply chain. On the one hand, the manufacturer shares a certain percentage of the revenue from the direct sales channel with the retailer; on the other hand, the retailer shares a certain percentage of the revenue from the traditional distribution channel with the manufacturer as compensation. (Das, Barman, Roy, & De, 2022) proved that profit-sharing contracts can coordinate dual-channel supply chains, while cost-sharing contracts cannot. (Hu, Wu, Han, & Zhang, 2020) established a non-cooperative game model, a revenue-sharing coordination model and a profit-sharing contract coordination model under the manufacturer’s leadership. Some other researchers studied other contract coordination mechanisms. (Zhou, Xu, Xie, & Li, 2020) proposed a service cost sharing coordination mechanism and proved its effectiveness in dual-channel supply chain system. (Lv & Liu, 2012) proved that buyback contract cannot achieve the coordination of dual-channel supply chain considering random demand and joint promotion, but under certain conditions, buyback of surplus products was beneficial to both manufacturers and retailers. (Zhu, Wen, Ji, & Qiu, 2020) verified that the combination contract of revenue-sharing contract and buyback contract can coordinate dual-channel supply chain under uncertain demand. (Xin, Chen, Chen, Chen, & Zhang, 2020) studied that both revenue-cost sharing contract and two-part tariff contract were superior to wholesale price contract under uncertain demand condition. Moreover, the two-part tariff contract can always coordinate the supply chain, while the revenue-cost sharing contract can improve the coordination level of the supply chain only when the revenue-cost sharing coefficients satisfied certain conditions. But this paper studied the single-channel case. In the field of pharmaceutical supply chain, (Hou, Wang, Chen, & Shi, 2020) studied that participants in pharmaceutical supply chain could adopt dual-channel mode. In the competition between online channels and traditional offline channels, it was of great significance to study the potential conflicts and coordination between online channels and offline channels. (Chen, Zhang, & Gu, 2019) studied that under the influence of promotional behavior and consumer channel preference in the dual-channel pharmaceutical supply chain, the combination contract of “revenue-sharing + buyback + promotion cost sharing” was beneficial to both pharmaceutical manufacturers and retailers and could effectively eliminate the dual marginal effects. (Li, Dan, Zhou, & Wang, 2019) verified that the “guided pricing + fixed payment” contract could coordinate the pharmaceutical dual-channel supply chain under the influence of price cap policy and public welfare. (Wang, Mu, & Wang, 2022) constructed a decentralized and centralized decision-making model for the drug dual-channel supply chain, considering heterogeneous consumers and the differences between online and offline channel health insurance policies. On this basis, a contract coordination model based on “suggested wholesale price + revenue sharing” was established to coordinate and optimize the drug dual-channel supply chain.

To sum up, there are few studies on the coordination of pharmaceutical dual-channel supply chain in domestic and foreign literature, and few scholars consider the quality of pharmaceutical products as a factor in the research process. The main contribution of this paper is to consider the influence of pharmaceutical product quality and pharmaceutical retailers’ sales efforts on supply chain, design a combination contract mechanism based on “revenue-sharing + quantity discount” to coordinate and optimize pharmaceutical supply chain, and verify the effectiveness of this contract coordination through the numerical example study. The research conclusion of this paper is helpful to provide some reference for pharmaceutical supply chain member enterprises to carry out online channel sales, and provide some reference for the Internet to help the reform of pharmaceutical and medical industry.

2. Model Description and Model Assumptions

2.1. Model Description

This paper studies the pharmaceutical dual-channel supply chain model composed of a pharmaceutical manufacturer and a pharmaceutical retailer, in which pharmaceutical manufacturer sells pharmaceutical products through pharmaceutical retailer and its own online channels. The pharmaceutical manufacturer first determines the direct sales price and wholesale price, pharmaceutical retailers then decide the order quantity. For pharmaceutical retailers, in view of the convenience and price competitiveness of online sales, it is bound to divert some offline consumers. In order to retain consumers and expand sales, pharmaceutical retailers continue to improve sales efforts. For example, due to the particularity of medicine, strict medication guidance is required. Online customer service cannot directly face patients, while offline pharmacies can be equipped with experienced pharmacists to directly guide patients’ medication, or dietitians to formulate health plans for patients. Some pharmacies even hire hospital experts to attract patients. In addition, pharmacies can also provide a variety of testing instruments, add free tasting area, and provide value-added services to consumers, so as to improve consumers’ viscosity and loyalty. It is assumed that all promotional costs incurred by offline pharmacies in providing sales efforts should be borne by them. At the same time, pharmaceutical manufacturers constantly enhance the effort level of the quality of pharmaceutical products in order to improve the demand for pharmaceutical products.

In this context, the pharmaceutical dual-channel supply chain model is shown as Figure 1. Pharmaceutical manufacturers also provide online and offline sales. Pharmaceutical products are not only directly sold to patients through online

![]()

Figure 1. Pharmaceutical dual-channel supply chain model.

sales platform at Pe price, but also are wholesaled to pharmaceutical retailers at w price offline, and pharmaceutical retailers then retail to patients at Pt price. The basic demand for online pharmaceutical products is a and offline is b.

In this model, the market demand is simultaneously affected by the pharmaceutical product quality efforts, pharmaceutical retailers sales efforts and terminal sales price. Based on this, setting parameters are shown as Table 1.

The linear demand function is used to describe the market demand for pharmaceutical products under dual-channel mode. In this study, it is assumed that patients’ demands for online and offline channels of pharmaceutical products are respectively

,

, where:

(1)

(2)

, and all are constants.

. a is the basic demand of patients for pharmaceutical products in online channel. b is the basic demand of patients for pharmaceutical products in offline channel.

is the sensitivity coefficient of patients to the price of pharmaceutical products.

is the cross price elasticity coefficient of the two channels.

.

represents the sensitivity of online and offline demand to pharmaceutical product quality efforts.

represents the sensitivity of offline traditional channel demand to pharmaceutical retailers’ sales efforts.

represents the pharmaceutical quality efforts of the pharmaceutical manufacturer.

represents the sales efforts of the pharmaceutical retailer.

2.2. Model Assumptions

Assumption 1: There are many kinds of pharmaceutical products, and only one pharmaceutical product is considered in this study.

Assumption 2: Pharmaceutical product supply chain is different from other general product supply chain, especially for drugs, once the expiration date is passed, they will lose any use value. Therefore, the carrying cost and residual value of pharmaceutical products in stock are not considered in this study. In order to facilitate the model analysis, the out-of-stock and out-of-stock cost are also not considered.

Assumption 3: Members of the pharmaceutical supply chain are risk-neutral and aim to maximize their own interests.

Assumption 4: The quality of pharmaceutical products is determined by the quality efforts of pharmaceutical manufacturers. Take

to show how much it costs pharmaceutical manufacturers to improve the quality of pharmaceutical products, and

. h represents the minimum requirements for the quality level of pharmaceutical products provided by pharmaceutical manufacturers to ensure the quality of pharmaceutical products.

represents the basic price of pharmaceutical product quality efforts provided by pharmaceutical manufacturers.

represents pharmaceutical product quality efforts provided by pharmaceutical manufacturers.

, and they are both constants. The cost of pharmaceutical manufacturers to improve the quality of pharmaceutical products changes with the quality level of pharmaceutical products, and they are positively correlated. The demand for pharmaceutical products both in traditional offline sales channels and in online direct sales channels are affected by

. The greater

is, the greater the online and offline demand is.

Assumption 5: The demand of offline sales channels is not only affected by the quality efforts of pharmaceutical products, but also affected by the sales efforts of pharmaceutical retailers. The harder pharmaceutical retailers sell, the greater the offline demand is, and vice versa. At the same time, the harder pharmaceutical retailers sell, the higher their costs are. Take

to show the cost of pharmaceutical retailer sales effort, and

.

represents the basic sales effort price of pharmaceutical retailers.

represents sales effort provided by pharmaceutical retailers.

, and it is a constant.

3. Model Analysis

3.1. Cooperative Decision Model

In the cooperative decision model, taking pharmaceutical manufacturer and pharmaceutical retailer as an overall supply chain system, they cooperate to maximize the overall profit of the pharmaceutical supply chain. At this point, the overall profit function of the supply chain system can be expressed as:

(3)

The second-order partial derivative of

in Equation (3) is obtained:

, which shows that

is a concave function of

.

When

, that is:

,

can be solved:

(4)

The second-order partial derivative of

in Equation (3) is obtained:

, which shows that

is a concave function of

.

When

, that is:

,

can be solved:

(5)

By combining Equations (4) and (5), we can get the values of

when

is maximum under cooperative decision are:

(6)

(7)

Substitute Equations (6) and (7) into Equations (1) and (2), we can get the optimal order quantity of pharmaceutical retailer

and the best direct sales quantity online of pharmaceutical manufacturer

. They are:

(8)

(9)

The second-order partial derivative of

in Equation (3) is obtained:

, which shows that

is a concave function of

.

When

, that is:

, we can get the best pharmaceutical product quality efforts

provided by the pharmaceutical manufacturer when

is maximum under cooperative decision is:

(10)

The second-order partial derivative of

in Equation (3) is obtained:

, which shows that

is a concave function of

.

When

, that is:

, we can get the best pharmaceutical sales efforts

provided by the pharmaceutical retailer when

is maximum under cooperative decision is:

(11)

Substitute Equations (6)-(10), and (11) into Equation (3), we can get the maximized profit of pharmaceutical dual-channel supply chain system under cooperative decision is:

(12)

The maximized overall profit of the supply chain system under cooperative decision is expressed as a function:

profit

(13)

3.2. Decentralized Decision Model

Under decentralized decision-making, the members of pharmaceutical supply chain strive to maximize their own interests, which leads to the dual marginal effects. It is assumed that the pharmaceutical manufacturer has the priority in pricing in the pharmaceutical supply chain, and has the priority in setting wholesale price w and online direct sales price

. It is assumed that the. pharmaceutical retailer sets the terminal retail price

according to the wholesale price w and their own sales efforts. At this time, the profit of the pharmaceutical retailer is:

(14)

The profit of the pharmaceutical manufacturer is:

(15)

According to the Stackelberg model, using backward derivation, and assuming

are given, the second-order partial derivative of

in Equation (14) is obtained:

, which shows that

is a concave function of

. When

,

reaches its maximum. At this time,

, we can solve:

(16)

Substitute Equation (16) into Equation (15), the profit of the pharmaceutical manufacturer can be expressed as:

(17)

The second-order partial derivative of

in Equation (17) is obtained:

, which shows that

is a concave function of

. When

,

reaches its maximum. At this time,

Let

, we can solve the best

:

(18)

Substitute Equation (18) into Equation (16), we can get the best

:

(19)

Proposition 1: When the sales effort of the pharmaceutical retailer is fixed, the pharmaceutical manufacturer who improves the quality efforts of pharmaceutical products within a certain range can improve the online direct sales and the profit of the pharmaceutical manufacturer, as well as the order quantity and the profit of the offline pharmaceutical retailer. When

, the pharmaceutical manufacturer’s profit has increased as efforts to improve the quality of pharmaceutical products have enhanced. When

, the profit of the pharmaceutical manufacturer is maximized. When

, the pharmaceutical manufacturer’s profit will decline as efforts to improve pharmaceutical product quality enhance. At this time, the cost of efforts to improve the quality of pharmaceutical products has exceeded the revenue brought to the pharmaceutical manufacturer because of improving pharmaceutical product quality.

Prove: Substitute Equations (18) and (19) into Equations (1) and (2), we can get:

(20)

(21)

In Equation (20),

, which shows as

increases, so does the online direct sales of

.

In Equation (21),

, which shows as

increases, so does the offline order quantity of

.

In Equation (14),

, which shows along with the pharmaceutical manufacturer’s efforts to improve the quality of pharmaceutical products enhancing, the profit of the pharmaceutical retailer is also increasing.

In Equation (15), the second-order partial derivative of

is obtained:

, which shows that

is a concave function of

.

When

,

, the optimal

under decentralized decision can be solved:

(22)

At this time, the pharmaceutical manufacturer’s efforts to improve the quality of pharmaceutical products can achieve the best level. When

. With the continuous enhancement of

, the profit of the pharmaceutical manufacturer continues to increase. When

, the profit of the pharmaceutical manufacturer is maximized. When

, the cost of improving the quality of pharmaceutical products by enhancing quality effort level has exceeded the revenue brought to the pharmaceutical manufacturer, thus making the profit of the pharmaceutical manufacturer gradually reduce.

Proposition 1 is proved.

Proposition 2: When the pharmaceutical manufacturer’s effort to improve the quality of pharmaceutical products are fixed, enhancing the sales effort of the pharmaceutical retailer within a certain range can improve the quantity of orders and profits of the pharmaceutical retailer, and at the same time, it can also increase the profit of the pharmaceutical manufacturer. When

, pharmaceutical retailer’s profit increases as sales efforts enhance. When

, the profit of the pharmaceutical retailer is maximized. When

, the pharmaceutical retailer’s profit will decrease gradually as sales efforts enhance. At this time, the cost of enhancing sales efforts already exceeds the revenue brought to the pharmaceutical retailer.

Prove: The first-order partial derivative of

in Equation (21) is obtained:

, which shows as

continues to increase, the offline order quantity

also continues to increase.

The first-order partial derivative of

in Equation (17) is obtained:

, which shows as the pharmaceutical ret- ailer continues to improve sales efforts, the profit of the pharmaceutical manufacturer also continues to increase.

The second-order partial derivative of

in Equation (14) is obtained:

, which shows that

is a concave function of

.

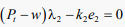

When

, , the optimal

under decentralized decision can be solved:

, the optimal

under decentralized decision can be solved:

(23)

At this time, the sales efforts of the pharmaceutical retailer reach the optimal level. When

, the profit of the pharmaceutical retailer increases as

improves. When

, the profit of the pharmaceutical retailer is maximized. When

, the revenue brought to the pharmaceutical retailer by improving sales efforts is less than the cost of enhancing sales efforts. So the profit of the pharmaceutical retailer gradually decreases.

Proposition 2 is proved.

Proposition 3: The quality efforts of pharmaceutical products, sales effort and overall profit of supply chain under cooperative decision are better than those under decentralized decision, that is

,

,

. When

is fixed, for any

,

. When

is fixed, for any

,

.

Prove: Compare

(

) under cooperative decision in Equation (10) with

(

) under decentralized decision in Equation (22). It is obvious that

, so

.

Compare

(

) under cooperative decision in Equation (11) with

(

) under decentralized decision in Equation (23). It is obvious that

, so

.

,

Using Visual Studio 2019 to program to compare the relationship between

and

(see the source program of Appendix 1), we can conclude

.

Therefore, the quality efforts of pharmaceutical products, sales effort and overall profit of supply chain under decentralized decision are less than those under cooperative decision.

Under decentralized decision, overall profit function of the pharmaceutical supply chain system:

is a concave function of

and it maximizes at

.

,

, so,

,

.

Proposition 3 is proved.

Substitute

into Equations (14) and (15), the profits of the pharmaceutical retailer and the pharmaceutical manufacturer can be expressed:

(24)

(25)

Therefore, the maximized overall profit of the supply chain system under decentralized decision is expressed as a function:

(26)

3.3. Coordination of the Pharmaceutical Dual-Channel Supply Chain under Combination Contract of “Revenue-Sharing + Quantity Discount”

According to the above propositions, due to the existence of dual marginal effects, the sum of profits made by all members of the pharmaceutical supply chain under decentralized decision is less than the overall profit of the supply chain system under cooperative decision. Therefore, this part mainly uses a combination of “revenue-sharing + quantity discount” contract incentive measures to coordinate the whole supply chain. It can be seen from the previous study that both the pharmaceutical manufacturer enhancing the quality efforts of pharmaceutical products and the pharmaceutical retailer enhancing sales efforts can increase the profits of both parties. Therefore, on the one hand, it is necessary to take incentive measures to motivate the pharmaceutical manufacturer to improve the quality of pharmaceutical products. Here, a revenue-sharing contract mechanism is introduced, that is, the pharmaceutical retailer shares part of its revenue with the pharmaceutical manufacturer. On the other hand, there needs to be incentives for the pharmaceutical retailer to order more pharmaceutical products. The more products pharmaceutical retailers order, the more incentive they have to sell products by improving sales efforts. Here, we introduce a quantity discount contract, which is linked to the quantity and price. The more they sell, the more they order and the more discounts they receive. It is assumed that the pharmaceutical retailer shares

of its revenue to the pharmaceutical manufacturer, and the pharmaceutical manufacturer gives

discount according to the quantity ordered by the pharmaceutical retailer. The more pharmaceutical retailer order, the higher the discount is, and the lower the ordering price is. The relationship is

. The combination contract of “revenue-sharing + quantity discount” is used to coordinate and optimize the pharmaceutical dual-channel supply chain, so that the pharmaceutical manufacturer and pharmaceutical retailer can obtain the optimal profit respectively under the constraint of the contract, and the overall profit of the pharmaceutical dual-channel supply chain system can reach the optimal profit. Under combination contract coordination, the profit functions of the pharmaceutical retailer and pharmaceutical manufacturer are shown as follows:

(27)

(28)

The second-order partial derivative of

in Equation (27) is obtained:

(

).

When

,

the profit of the pharmaceutical retailer reaches maximum, the optimal retail price formulated by the pharmaceutical retailer is:

(29)

where

,

.

The second-order partial derivative of

in Equation (28) is obtained:

. So, when

,

the profit of the pharmaceutical manufacturer is the maximum.

Substitute

in Equation (29) into

, the optimal direct sales price

set by the pharmaceutical manufacturer is:

(30)

where

,

.

Substitute Equation (30) into (29),

can be solved:

(31)

Substitute

into Equations (1) and (2),

can be solved.

The second-order partial derivative of

in Equation (27) is obtained:

. So, When

is optimal.

(32)

The second-order partial derivative of

in Equation (28) is obtained:

. So, when

is optimal.

(33)

Substitute

into Equations (27) and (28), the profits of the pharmaceutical retailer and the pharmaceutical manufacturer can be expressed:

(34)

(35)

Therefore, the maximized overall profit of the pharmaceutical dual-channel supply chain system under combination contract coordination is expressed as a function:

(36)

Proposition 4: When parameters

and

meet the constraint conditions of the following two equations, the decision variables of each member of the pharmaceutical dual-channel supply chain reach the optimal value under cooperative decision. At this point,

and

are positively correlated.

(37)

(38)

Prove: Under the coordination of the combination contract of “revenue-sharing + quantity discount”, referring to the research conclusion of (Cachon & Lariviere, 2005), parameters should satisfy the following equation. That is

,

,

,

. By combining Equations (6) and (30), Equations (7) and (29), Equations (10) and (33), and Equations (11) and (32), constraints that

and

should meet can be obtained (Equation (37) and Equation (38)). Combine Equations (37) and (38), so as to determine the value of

and

. According to Equation (37),

and

change in the same direction.

increases as

increases. So, proposition 4 is proved.

Proposition 5: When the contract parameter

meets the following conditions, the profits of the whole pharmaceutical dual-channel supply chain system and its members can reach pareto optimization.

(39)

Prove: Combination contract can eliminate the negative impact brought by the dual marginal effects, so that the pharmaceutical supply chain members can obtain higher profits than under the decentralized decision. That is

,

. Combine Equations (24) and (34), and Equations (25) and (35), when

,

, the threshold value of the contract parameter

can be obtained, which is as shown in Formula (39). It indicates that within a certain value range of

, the combination contract based on “revenue-sharing + quantity discount” can coordinate the pharmaceutical dual-channel supply chain, optimize the profits of each member of the supply chain, effectively promote the pharmaceutical manufacturer and the pharmaceutical retailer to achieve Pareto optimization, and gradually maximize the overall profits of the supply chain system.

4. Numerical Example Analysis

In this part, Use example simulation to verify propositions which have analyzed previous, and analyze the influence of key parameters on optimal decision and profit of pharmaceutical dual-channel supply chain. Based on the actual situation of the pharmaceutical industry and the market, selected parameters are as follows:

.

According to the optimal value formula of

and profits derived above, the optimal values under cooperative decision is:

,

,

. The optimal values under decentralized decision is:

,

,

. See Table 2.

Obviously, the optimal quality effort degree, the optimal sales effort degree and the total profit of supply chain under cooperative decision are better than

![]()

Table 2. Optimal values under cooperative decision and decentralized decision.

those under decentralized decision. Therefore, it is necessary to coordinate the supply chain to make supply chain members improve the quality of pharmaceutical products and make more efforts to sell, so as to obtain greater benefits.

4.1. The Influence of Pharmaceutical Product Quality Effort Level and Sales Effort Level on Optimal Decision Making

In order to verify propositions 1 and 2, sensitivity analysis of key parameters

and

is needed to explore the influence of constantly changing parameter values on terminal selling price, sales quantity and profit of supply chain members.

Firstly, when

is a constant value, sensitivity analysis is performed on

, and the analysis results are shown in Figure 2(a), Figure 2(b).

As can be seen from Figure 2(a), when

is fixed, the online and offline sales quantity and sales price will continue to increase with the continuous enhancement of

. Due to the enhancement of

, for the pharmaceutical manufacturer, the increase of investment and cost will naturally increase the wholesale price w and the online direct selling price

, while due to the increase of w, the pharmaceutical retailer will increase the purchase cost, and naturally increase the retail price

. At the same time, as

enhances, the quality of pharmaceutical products will improve, which will inevitably increase the willingness of patients to buy, thus driving the increase of online and offline demand, that is, the increase of

and

.

As can be seen from Figure 2(b), with the enhancement of

, the profit of the pharmaceutical retailer increases continuously while the profit of the pharmaceutical manufacturer increases first and then decreases. When

, the profit of pharmaceutical manufacturer

is an increasing function. When

,

reaches its maximum value. When

, the increase of marginal revenue of the pharmaceutical manufacturer is less than the increase of marginal cost due to the improvement of

, leading to the situation that

will decline with the continuous enhancement of

. As for the overall profit of the supply chain system, we find that although it also shows a trend of first increase and then decrease, this turning point occurs on the right side of optimal

. In other words, at the optimal point

, the overall profit of the supply chain system is not optimal. Because as

continues to grow, even though the profit of the pharmaceutical manufacturer is decreasing, the profit of the pharmaceutical retailer is still increasing. Only when the profit rise degree of the pharmaceutical retailer is less than the decline degree of the pharmaceutical manufacturer will the overall profit of the supply chain system decrease.

![]()

Figure 2. (a) Influence of

on Q and p; (b) Influence of

on profits.

However, under decentralized decision, the pharmaceutical manufacturer will not consider the overall profit, so the overall optimal result of the supply chain does not exist under decentralized decision.

Secondly, when

is fixed, sensitivity analysis is performed on

, and the analysis results are shown in Figure 3(a), Figure 3(b).

As can be seen from Figure 3(a), when

is fixed, with the continuous enhancement of

, the sales quantity of offline traditional channels

increases significantly. It indicates that the sales efforts of pharmaceutical retailer have significantly affected the purchasing intention of patients from offline traditional channels and increased the demand for offline pharmaceutical products. At the same time, with the continuous enhancement of

, the offline retail price is also slowly rising. That is mainly due to the continuous enhancement of sales efforts of the pharmaceutical retailer, which has increased selling costs, thus raising prices relatively. However, with the continuous enhancement of

, there is little impact on the online sales quantity

and direct sales price

of the pharmaceutical manufacturer.

As can be seen from Figure 3(b), the profit of the pharmaceutical manufacturer increases with the enhancement of

, mainly because the profit sources of the pharmaceutical manufacturer include two parts, one is the profit brought by online direct sales and the other is the profit brought by offline sales through traditional channel. Obviously, as the pharmaceutical retailer continues to enhance sales efforts and increases the demand for offline channels, the profit of the pharmaceutical manufacturer from offline increases. It can also be seen from Figure 3(b) that the profits of the pharmaceutical retailer and the whole supply chain increases first and then decreases. For the pharmaceutical retailer, when

, the profit of pharmaceutical retailer

is an increasing function. When

,

reaches its maximum value. When

,

![]()

Figure 3. (a) Influence of

on Q and p; (b) Influence of

on profits.

the increase of marginal revenue of the pharmaceutical retailer is less than the increase of marginal cost due to the improvement of

, leading to the situation that

will decline with the continuous enhancement of

. As for the overall profit of supply chain, it also shows the trend of first increase and then decrease. However, a careful analysis of Figure 3(b) shows that the point at which the overall profit of the supply chain begins to decline is to the right of the optimal

. Because, as the pharmaceutical retailer’s profit has fallen, the pharmaceutical manufacturer’s profit has still risen. Only when the profit rise degree of the pharmaceutical manufacturer is less than the decline degree of the pharmaceutical retailer will the overall profit of the supply chain system decrease. In other words, at the best

, the overall profit of the supply chain is not optimal. This is the limitation of decentralized decision, not taking into account the overall interest, but only choosing what is best for them only.

The above analysis verifies the correctness of proposition 1 and proposition 2.

4.2. Comparison of Overall Profit of Supply Chain under Decentralized Decision and Cooperative Decision

In order to verify proposition 3, the comparison of the overall profit of the supply chain under different decisions is obtained through sensitivity analysis of

as shown in Figure 4(a) and Figure 4(b).

With the continuous improvement of

and

, the overall profit of the supply chain under different decisions increases first and then decreases. However, in any case, the overall profit of the supply chain under cooperative decision is always higher than that under decentralized decision. In other words, the whole supply chain achieves higher overall profit under cooperation decision than that under non-cooperation decision. Proposition 3 is true.

![]()

Figure 4. (a) Influence of

on

and

; (b) Influence of

on

and

.

4.3. The Relationship between the Sharing Factor and the Quantity Discount Factor

With the introduction of “revenue-sharing + quantity discount” contract coordination, the sensitivity analysis of the sharing factor

and quantity discount factor

is shown in Figure 5.

Under combination contract coordination,

and

present a positive correlation, and the value range of

is [0.0004, 0.1320]. In other words, if the pharmaceutical retailer shares more revenue to the pharmaceutical manufacturer, the discount factor given by the pharmaceutical manufacturer will be higher. So proposition 4 is verified.

4.4. The Comparison of Overall Profit of Supply Chain System and the Profit of Supply Chain Members under Decentralized Decision and Contract Coordination Decision

Figures 6(a)-(d) show the comparative analysis of the overall profit of pharmaceutical supply chain and the profit of the pharmaceutical manufacturer and the pharmaceutical retailer under decentralized decision and contract coordination decision.

When

, both the overall profit and the profit of each member of the pharmaceutical dual-channel supply chain under the contract coordination decision are always higher than those under the decentralized decision which indicates that the combination contract can coordinate and optimize the pharmaceutical dual-channel supply chain when the parameters meet the constraint conditions. As

and

continue to enhance, the degree of profit optimization of the pharmaceutical manufacturer becomes smaller and smaller, while the degree of profit optimization of the pharmaceutical retailer becomes

![]()

Figure 5. Relationship between

and

.

![]()

![]()

Figure 6. (a) Influence of

on overall profits; (b) Influence of

on overall profits; (c) Influence of

on member’s profit; (d) Influence of

on member’s profit.

larger and larger. Both parties choose a mutually acceptable range according to their negotiating ability to ensure the increase of their profits and realize the effectiveness and continuity of contractual coordination. Proposition 5 is verified.

5. Research Findings with Analysis

This paper studies a two-channel pharmaceutical supply chain system composed of a pharmaceutical manufacturer and a pharmaceutical retailer, and the game and coordination between the pharmaceutical manufacturer and the pharmaceutical retailer when considering pharmaceutical product quality and sales efforts. The following conclusions are drawn from the analysis of numerical example study:

1) When the sales efforts of pharmaceutical retailers are fixed, enhancing the quality efforts of pharmaceutical products will improve the willingness of patients to buy, and increase the online demand and offline order quantity. As for members of the supply chain, with the continuous improvement of the quality of pharmaceutical products, the profit of pharmaceutical retailers will show a rising trend, the overall profit of supply chain system and the profit of pharmaceutical manufacturers will first increase and then decrease. But the point at which the overall profit of pharmaceutical supply chain system starts to decline lags behind the profit decline point of pharmaceutical manufacturers. This suggests that pharmaceutical manufacturers need to prioritize the safety and quality of medicines, and integrate review, inspection, supervision, policy and research more closely to strengthen medicine quality control and improve patients drug safety and satisfaction (Yu & Woodcock, 2015). It also shows that when the pharmaceutical manufacturer’s profit reaches the maximum, the overall profit of supply chain system is not optimal. However, since the members of supply chain system take the maximization of their own profit as the pursuit goal, the overall optimal profit is difficult to achieve under the decentralized decision.

2) When the quality efforts of pharmaceutical products are fixed, the promotion of sales effort of pharmaceutical retailers will enhance the purchasing intention of patients from offline traditional channels and increase the offline order quantity, but it has little impact on online demand. As for members of the supply chain, as pharmaceutical retailers continue to improve their sales efforts, the profit of pharmaceutical manufacturers will continue to increase, the overall profit of supply chain system and the profit of pharmaceutical retailers will first increase and then decrease, and the point at which the overall profit starts to decline lags behind the profit decline point of pharmaceutical retailers. Therefore, under the dual-channel supply chain, pharmaceutical retailers need to continuously improve the level of marketing services to provide health services in the whole process of prevention, health care, nutrition, medical treatment and rehabilitation, and provide the most reasonable health solutions through professional diagnostic instruments and health data, so as to promote rational drug use and enhance patients’ adherence to offline drug purchase. However, under decentralized decision, when the pharmaceutical retailer’s profit reaches the maximum, the overall profit of the supply chain does not reach optimization.

The above two points fully demonstrate that under decentralized decision, neither the profit optimal point of pharmaceutical manufacturer nor the profit optimal point of pharmaceutical retailer is the overall profit optimal point of the pharmaceutical dual-channel supply chain. So, it is necessary to optimize the whole supply chain through contract coordination.

3) It is verified that the combination contract coordination mechanism based on “revenue sharing + quantity discount” can effectively coordinate the pharmaceutical dual-channel supply chain when the parameters meet certain constraints and have a positive correlation, which not only improves the overall profit of the supply chain, but also improves the profit of each member of the supply chain. For each member of pharmaceutical supply chain, the degree of contract coordination to optimize their profits depends on the value of parameters, which in turn depends on the negotiation ability and discourse power of both parties.

6. Conclusion

Research shows that in the pharmaceutical dual-channel supply chain, the improvement of pharmaceutical retailers’ sales efforts can not only benefit themselves, but also improve the profits of pharmaceutical manufacturers. The pharmaceutical manufacturers, improving the quality of pharmaceutical products, can not only benefit themselves, but also improve the profits of pharmaceutical retailers. Therefore, in the pharmaceutical dual channel, to a certain extent, the continuous improvement of pharmaceutical product quality efforts and sales efforts is conducive to the profit improvement of pharmaceutical supply chain members. It can also be found from the previous analysis that in the pharmaceutical dual-channel, indicators under cooperative decision are better than the corresponding indicators under decentralized decision. So, it is necessary to coordinate pharmaceutical supply chain through combination contract mechanism. This paper, based on the combination of “revenue-sharing + quantity discount” contract mechanism, through the numerical example simulation, verifies the contract incentive will not only help pharmaceutical manufacturers to improve pharmaceutical product quality, and help pharmaceutical retailers to promote sales efforts, but also contribute to the increase of the overall profit of the whole supply chain and the profit of all members of the pharmaceutical supply chain.

With the separation of drug prescription from medical treatment, prescription outflow, and the further acceleration of the process of medicine marketization, online sales of medicine will usher in faster development opportunities (Deng & Wen, 2020). While ensuring the quality of drugs, pharmaceutical manufacturers should realize a large number of port docking between “online doctor” and “online medicine mall” through the online platform, and improve the “scene docking” through the combination of “medical treatment + drug prescription” to improve the purchase conversion rate. Pharmaceutical manufacturers can also develop the mode of integrating offline retail pharmacies with online channels. The offline channels provide drug picking services for the online channels, while the online channels help the offline pharmacies increase customer flow. For pharmaceutical retailers, taking the consumers as the basis and considering the current health industry, through the transformation and upgrading, in chronic disease management, rehabilitation health, health management, combination of medical treatment and care, etc., form their own professional and characteristic advantage to finally satisfy people’s demand for drugs & health and strengthen retailers’ terminal position.

At last, only pharmaceutical product quality and sales efforts are considered in this study, the influence of medical insurance policy, consumer utility and other factors is worthy of further research and exploration. In practice, pharmaceutical product demand is random and uncertain, so it will be a significant research direction to study the coordination of pharmaceutical dual-channel supply chain under uncertain demand.

Acknowledgements

This research was funded by the enterprise practice training funding project for young teachers of Jiangsu Province (No.2020QYSJ206).

Appendix 1. (Source Program for Comparing

and

)

function fnCalculate() {

//--

if (!fnGetInputs()) return;

//------

Pe1 = fnCalculatePe1();

Qe1 = fnCalculateQe1();

Pt1 = fnCalculatePt1();

Qt1 = fnCalculateQt1();

Nc = fnCalculateNc();

A = fnCalculateA();

Pe2 = fnCalculatePe2();

Qe2 = fnCalculateQe2();

Pt2 = fnCalculatePt2();

Qt2 = fnCalculateQt2();

Nd = fnCalculateNd();

//--

if (Nc > Nd) {

fnShowResult("πC > πD");

} else if (Nc == Nd) {

fnShowResult("πC = πD");

} else {

fnShowResult("πC < πD");

}

}

//------------------------

function fnCalculatePe1() {

//--

var result = 0;

//--

var molecule = u * a + d * b + (u + d) * r1 * e1 + d * r2 * e2;

var denominator = 2 * (u * u - d * d);

//--

if (denominator == 0) {

fnShowError("Pe1 denominator is zero!"); return;

}

//--

result = molecule / denominator + C / 2;

//--

return result;

}

//------

function fnCalculateQe1() {

//--

var result = 0;

//--

var molecule = a + r1 * e1 - (u - d) * C;

var denominator = 2;

//--

if (denominator == 0) {

fnShowError("Qe1 denominator is zero!"); return;

}

//--

result = molecule / denominator

//--

return result;

}

//------

function fnCalculatePt1() {

//--

var result = 0;

//--

var molecule = u * b + d * a + (u + d) * r1 * e1 + u * r2 * e2;

var denominator = 2 * (u * u - d * d);

//--

if (denominator == 0) {

fnShowError("Pt1 denominator is zero!"); return;

}

//--

result = molecule / denominator + C / 2;

//--

return result;

}

//------

function fnCalculateQt1() {

//--

var result = 0;

//--

var molecule = b + r1 * e1 + r2 * e2 - (u - d) * C;

var denominator = 2

//--

if (denominator == 0) {

fnShowError("Q1 denominator is zero!"); return;

}

//--

result = molecule / denominator;

//--

return result;

}

//------

function fnCalculateNc() {

//--

var result = 0;

//--

result = (Pe1 - C) * Qe1 + (Pt1 - C) * Qt1 - k1 * (e1 - h) *(e1 - h) / 2 - k2 * e2 * e2 / 2;

//--

return result;

}

//------

function fnCalculateA() {

//--

var result = 0;

//--

var molecule = 2 * u * a + d * b + 2 * u * d * w + (2 * u * u - d * d - u * d) * C;

var denominator = 4 * u * u - 2 * d * d;

//--

if (denominator == 0) {

fnShowError("A denominator is zero!"); return;

}

//--

result = molecule / denominator;

//--

return result;

}

//------

function fnCalculatePe2() {

//--

var result = 0;

//--

var molecule1 = 2 * u + d;

var denominator1 = 4 * u * u - 2 * d * d;

var molecule2 = d

var denominator2 = 4 * u * u - 2 * d * d;

//--

if (denominator1 == 0) {

fnShowError("Pe2 denominator is zero!"); return;

}

if (denominator2 == 0) {

fnShowError("Pe2 denominator is zero!"); return;

}

//--

var result1 = molecule1 / denominator1;

var result2 = molecule2 / denominator2;

//--

result = A + result1 * r1 * e1 + result2 * r2 * e2;

//--

return result;

}

//------

function fnCalculateQe2() {

//--

var result = 0;

//--

var molecule1 = 2 * u * a + d * b + u * d * w;

var denominator1 = 2 * u;

var molecule2 = 2 * u + d;

var denominator2 = 2 * u;

//--

if (denominator1 == 0) {

fnShowError("Qe2 denominator is zero!"); return;

}

if (denominator2 == 0) {

fnShowError("Qe2 denominator is zero!"); return;

}

//--

var result1 = molecule1 / denominator1;

var result2 = molecule2 / denominator2;

//--

result = result1 + result2 * r1 * e1 + d * r2 * e2 / (2 * u) + ((d * d) / (2 * u) - u) * Pe2;

//--

return result;

}

//------

function fnCalculatePt2() {

//--

var result = 0;

//--

var molecule = b + r1 * e1 + r2 * e2 + u * w;

var denominator = 2 * u;

//--

if (denominator == 0) {

fnShowError("Pt2 denominator is zero!"); return;

}

//--

result = molecule / denominator + d * Pe2 / (2 * u);

//--

return result;

}

//------

function fnCalculateQt2() {

//--

var result = 0;

//--

var molecule = b + r1 * e1 + r2 * e2 - u * w;

var denominator = 2;

//--

if (denominator == 0) {

fnShowError("Qt2 denominator is zero!"); return;

}

//--

result = molecule / denominator + d * Pe2 / 2;

//--

return result;

}

//------

function fnCalculateNd() {

//--

var result = 0;

//--

result = (Pe2 - C) * Qe2 + (w - C) * Qt2 + (Pt2 - w) * Qt2 - k1 * (e1 - h) * (e1 - h) / 2 - k2 * e2 * e2 / 2;

//--

return result;

}

//------------------------------------------------------------------------------------------------