An Evaluation of Lesotho’s Fiscal Policy Stance across the Business Cycle ()

1. Introduction

Counter-cyclical fiscal policy allows for an improvement of fiscal positions and buffers in times of economic recovery and expansion. The resultant fiscal space is essential to support the economy during contractions, in a way that does not jeopardise debt sustainability. There is intense interest to understand the nature of fiscal policy and the underlying drivers of countries’ fiscal positions. In the case of Lesotho, a small open economy with a fixed exchange rate regime and very limited monetary policy space to influence aggregate demand, fiscal policy plays an important role in macroeconomic stability. Actual fiscal positions (i.e., budget deficit or surplus) at particular points in time are affected by cyclical1 and structural factors. This makes them less informative to policymakers and economic analysts that wish to use them as indicators of fiscal policy stance and/or fiscal sustainability. To characterise the effects of fiscal policy as either being expansionary, restrictive, pro-cyclical, or stabilising, one would have to control for cyclical and structural factors that would otherwise misinform the policy’s true nature (Cohen-Setton & Vallée, 2021; Batini et al., 2021; Attinasi et al., 2018; Bornhorst et al., 2011; Hlivnjak & Laco, 2018; Vladimirov & Neicheva, 2008; Turrini, 2008).

The cyclically adjusted budget balance (CAB) is the fiscal position net of the business cycle effects. It can also be defined as the fiscal position that would prevail in periods when the economy is at its full potential. It adjusts the fiscal aggregates for transitory effects caused by deviations of actual output from its potential. It presents a better reflection of the fiscal space and/or effort needed to control fiscal imbalances. It allows for a closer inspection of fiscal suitability since the fiscal position can be evaluated against prevailing debt dynamics, debt thresholds, and other fiscal vulnerability indicators to inform the course of fiscal policy (i.e., sustain the course, or adjust taxes and spending). The structural budget balance (SBB) is an extension of the CAB. It quantifies and removes the effects of a wide range of factors on the fiscal balance. These factors include asset and commodity prices, output commodity effects, and one-off/temporary revenue and expenditure shocks that do not have a lasting impact on the budget position2 (Attinasi et al., 2018; Bornhorst et al., 2011; Hlivnjak & Laco, 2018; Vladimirov & Neicheva, 2008).

This paper sets out to fill an identified policy and research gap about the calculation and evaluation of the CAB in Lesotho. Using quarterly data from 2007Q1 to 2019Q4, the study has four specific objectives: 1) to calculate the potential output; 2) to identify the peaks and troughs in the business cycle; 3) to calculate the cyclically adjusted primary budget balance (CAPB)3 and 4) to evaluate the fiscal policy stance across the business cycle. The results of the exercise will benefit policymakers and economic analysts looking to better interpret fiscal positions. The findings can be used to improve insights into fiscal policy analysis and ensure the counter-cyclicality of fiscal policy measures. The rest of the paper is organised as follows: Section 2 offers a review of relevant literature, focusing on approaches to calculating the CAB. Section 3 outlines the data and methodology used in the study. Section 4 presents the results, and Section 5 concludes.

2. Literature Review

Cyclical Adjustment of Fiscal Policy Aggregates

There are generally two ways to perform a cyclical adjustment on fiscal policy aggregates. The first is the aggregated approach, also known as the International Monetary Fund (IMF) method. The second is the disaggregated approach, often referred to as the Organisation for Economic Corporation and Development (OECD) methodology (Attinasi et al., 2018; Bornhorst et al., 2011; Hlivnjak & Laco, 2018; Vladimirov & Neicheva, 2008). The subsections that follow provide explanations of each method.

The aggregated approach

The aggregated approach to calculating the CAB separates the overall fiscal balance into two parts, namely, a cyclical and cyclically adjusted component, respectively:

(1)

where OB is the overall balance, CB is the cyclical balance (i.e., the part of the overall fiscal balance that reflects an automatic response—increase or decrease in revenues and expenditures—to the business cycle), and CAB is the cyclically adjusted budget balance (i.e., the overall balance without the cyclical movements), expressed in nominal terms.

In the aggregated approach, the CAB is computed as a function of cyclically adjusted overall revenue (RCA) and cyclically adjusted expenditures (GCA):

(2)

where RCA can be obtained by adjusting actual revenues for the effect caused by the deviation of actual output from its potential.

(3)

where

and

are the potential output, actual output, and the revenue elasticity of output, respectively. The revenue elasticity defines the strength of the cyclical effect. Equation 3 holds under the assumption that the ratio of potential output to actual output moves together with the ratio of the cyclically adjusted revenue to the actual revenue:

(4)

According to Attinasi et al. (2018) and Bornhorst et al. (2011), a revenue elasticity of

can be interpreted in economic terms to mean that a one percentage point increase in the output gap leads to a change in the revenue of a magnitude larger than one.

The GCA can be obtained in a similar way as the RCA:

(5)

If the elasticity of expenditure to output is assumed to be zero, (

), then the changes in the business cycle have no effect on expenditure levels. That is, the GCA is equal to the actual expenditure, GCA = G. This makes intuitive sense in some cases since government expenditure is often taken to be discretionary and independent of business cycle effects (Attinasi et al., 2018; Bornhorst et al., 2011).

The elasticities used in the calculation of the RCA and GCA can either be assumed, sourced from the literature or estimated from a country level regression framework. Common values assumed in the literature are 1 for revenues and 0 for expenditures. This choice of values is more suitable in the case of an aggregated approach to calculating the CAB, since it does not distinguish between the different revenue and expenditure components. It is noteworthy that this convenience could lead to loss of accuracy, especially in the disaggregated approach to CAB calculation (Cohen-Setton & Vallée, 2021; Batini et al., 2021; Attinasi et al., 2018; Bornhorst et al., 2011; Hlivnjak & Laco, 2018; Vladimirov & Neicheva, 2008; Turrini, 2008).

The disaggregated approach

The disaggregated approach to calculating the CAB differs from the aggregated method in that it focuses on the cyclical adjustment of individual categories of revenue and expenditure (Bornhorst et al., 2011; Hlivnjak & Laco, 2018; Girouard & André, 2005). The CAB under the disaggregated approach is expressed as:

(6)

where

and

represent the cyclically adjusted components of the i-th revenue category and the cyclically adjusted current primary expenditures, respectively. In addition,

and

reflect the categories of revenue and expenditure that do not to be cyclically adjusted. These could include net-interest expenditures, non-tax-revenue, capital (Bornhorst et al., 2011; Girouard & André, 2005). Cyclical adjustment on the revenue side requires decomposition of the elasticity of each revenue category into two parts. The output elasticity of tax revenue (denoted

) can be decomposed into the product of the elasticity of tax revenues with respect to the associated tax base (denoted,

) and the elasticity of the tax base with respect to the output gap (denoted,

)

(7)

Once the decomposed revenue elasticities of output have been obtained, the decomposed parts are used in the derivation of the cyclically adjusted revenues as follows:

(8)

In a similar way to the aggregated approach, the elasticities in the disaggregated approach can either be assumed, sourced from the literature or estimated from a country level regression framework. To derive the elasticities using an econometric framework, knowledge of the statutory tax rates, country tax codes, social security scheme (if applicable) and the income distribution is essential (Bornhorst et al., 2011; Girouard & André, 2005).

The elasticities needed for the calculation of the cyclically adjusted primary expenditure can also be decomposed into factors; those that need cyclical adjustment, and those that do not. Unemployment benefits are an example of current transfers that are likely to show signs of cyclical behaviour, owing to automatic stabilisers in the benefit system. Conversely, items that are less likely to be influenced by the business cycle fluctuations are nominal spending on wages and goods and services (Attinasi et al., 2018; Bornhorst et al., 2011; Hlivnjak & Laco, 2018; Vladimirov & Neicheva, 2008). If the level of unemployment (U) is taken as the base, the output elasticity of expenditures (denoted,

) is the product of current expenditures with respect to the base (denoted,

) and the elasticity of the base with respect to the output gap (denoted,

):

(9)

The decomposed elasticity is inputted into the computation of the cyclically adjusted primary expenditure as follows:

(10)

Just like in the cyclical adjustment cases already discussed, the choice of elasticities in the computation of the cyclically adjusted expenditure can either be assumed, derived econometrically or informed by the literature (Attinasi et al., 2018; Bornhorst et al., 2011; Hlivnjak & Laco, 2018; Vladimirov & Neicheva, 2008).

Empirical Review

Batini et al. (2021) make use of a model-based dynamic monetary and fiscal conditions index (DMFCI) to examine the separate and combined evolution of monetary and fiscal policy stance in the euro area (EA) and its three largest member countries from 2007 to 2018. The study’s main findings indicate that in the aftermath of the global financial crisis, overall policy became looser. Additionally, the study reveals heterogeneity in the policy stance between the EA, France, Germany, and Italy over the review period, with stronger loosening of fiscal policy during the global financial crisis in France than Germany and Italy. Recommendations called for greater coordination between monetary and fiscal policy to deal with crisis shocks.

Hlivnjak and Laco (2018) investigate the nature of the fiscal stance of Bosnia and Herzegovina by calculating the cyclically adjusted budget balances using a commonly agreed methodology advanced by the European Commission. The method first calculates the potential GDP and then determines how different components of the budget respond to fluctuations in economic activity. The results of the study showed that the fiscal stance in Bosnia and Herzegovina was stabilizing and expansionary in the early years and mostly restrictive and procyclical in the later years. The implication is for authorities to build buffers to sustain growth in periods of a downturn.

Ghosh and Misra (2016) use the IMF method to cyclically adjusted budget balance for India over the period 1990-91 to 2013-14 and thus separate the impact of impact of business cycles on the government budgets. The study’s findings showed that fiscal policy was largely procyclical during the crisis period (2009-11). Despite a positive output gap and subsequent increases in the level of inflation in the period after the crisis, the fiscal stance continued to be expansionary. The main recommendation is for the strengthening of institutional reforms and developing more binding frameworks of fiscal rules to credibly inform policy and withstand business and electoral cycles.

Rivero and Vergara (2015) evaluate the nature of fiscal policy in Bolivia using quarterly data from 2003Q1 to 2011Q2 and the cyclically adjusted balance methodology. The efficiency of fiscal policy is assessed by incorporating the country’s normalisation of hydrocarbons) and the administration of oil and non-oil fiscal revenues. Efficiency was measured through an evaluation of public debt and the primary balance (with and without oil). The study discovers that fiscal policy’s role had a deficient and procyclical orientation to economic activity and natural gas prices over the study horizon. To achieve a fiscal stance, authorities are encouraged to administer fiscal revenues by establishing formal fiscal rules for budget formulation.

Spilimbergo (2007) evaluates the performance of fiscal policy in Russia from 1996 to 2005 using various measures. First, the debt stabilizing primary surplus is used to measure and evaluate public debt’s long-term sustainability. Second, the constant oil-price balance is used to evaluate fiscal policy’s response to the oil cycle. Third, the nonoil fiscal balance is used to indicate how actual fiscal policy differs from optimal fiscal policy towards exhaustible resources and measure how the fiscal position is affected by oil revenue. Last, the fiscal stance and impulse are used to evaluate the extent of fiscal policy’s contribution to aggregate demand. The study’s main results indicate that the fiscal impulse did not contribute to the increase in aggregate demand. However, the policy has not been restrictive enough to sterilise the effect of the oil windfall on the entire economy. At the same time, it may still be prudent to have an appropriate automatic saving mechanism to support economic growth in downturns.

De Mello and Moccero (2006) use the OECD methodology to evaluate the changes in the fiscal stance of Brazil. The study makes a distinction between changes caused by deliberate policy action and those caused by automatic stabilizers built into the tax code, the social security system and unemployment insurance. The main finding is that discretionary fiscal policy is often pro-cyclical in downturns. Additionally, periods of high indebtedness introduce a pro-cyclicality bias in fiscal policy. This makes it difficult to avoid corrective tightening in bad times. This is explained by expenditure spending on personnel (i.e., payroll) tending to pro-cyclical in upturns, which motivates a sharp increase in expenditure over time.

Research gap

The review of literature revealed that actual budget balances are affected by cyclical factors and structural measures. To understand whether fiscal policy is expansionary or restrictive, pro-cyclical or stabilizing, the cyclical effects should be removed from general government balances. The aggregated and disaggregated approaches are widely accepted in the literature as ways to perform a cyclical adjustment on fiscal policy aggregates. Although numerous insightful empirical studies have been undertaken to evaluate the fiscal stance in various jurisdictions, most of them are undertaken in developed economies, with a noticeable shortage of evidence from low-income countries. The current study seeks to fill this research gap by investigating the character of Lesotho’s fiscal stance, over the business cycle.

3. Data and Methodology

Some of the major factors behind discretionary fiscal policies include 1) the level of debt, 2) the starting level of the primary balance, and the 3) the business cycle. The debt level is important since high debt to GDP ratios beyond some established threshold may warrant fiscal consolidations to ensure sustainability. Similarly, if the starting level of the primary balance is a high surplus, this implies less of a need to build fiscal buffers against potential economic downturns. The business cycle and its cyclical effects on components of fiscal aggregates is essential since it may dictate a need for government to build fiscal buffers during an economic recovery, to counter the effects of a subsequent recession (Cohen-Setton & Vallée, 2021; Batini et al., 2021; Attinasi et al., 2018; Bornhorst et al., 2011; Hlivnjak & Laco, 2018; Vladimirov & Neicheva, 2008; Turrini, 2008). The study uses quarterly fiscal and macroeconomic data from 2007Q1 to 2019Q4. The choice of variables and the study timeline are informed by the literature and the availability of data. The variables and their sources are presented in Table 1. Descriptive statistics of

Source: Author.

the variables are presented in Appendix A1. In the analysis, the fiscal variables are based on the Government Financial Statistics (GFS) methodology and consolidated by the Central Bank of Lesotho (CBL). The GDP is in real terms and seasonally adjusted.

Calculating the potential output

A clearer depiction of the fiscal stance is determined by correcting fiscal aggregates for the short-term effects of changes in the output gap, or the deviations of actual output from its potential. This task is made challenging by the need to find a measure of potential GDP with which to compare actual output, in the determination of the output gap. The most frequently used methods of calculating potential output involve statistical filtration techniques that separate a series’ underlying trend from its cyclical component (Attinasi et al., 2018; Bornhorst et al., 2011; Hlivnjak & Laco, 2018; Vladimirov & Neicheva, 2008). The Hodrick-Prescott (HP) filter is widely regarded as a workhorse in statistical univariate filtration and is the main method used in our paper.

The HP filter assumes that actual output at time t is:

(11)

where

and

are the trend and cyclical components, respectively. The trend component,

is calculate using:

(12)

In the equation, the trend is obtained from minimising the sum of squared deviations of the original GDP series from its trend

and the discrepancies of the actual trend

. The value of the trend is calculated as the weighted average of all elements in the original series. The weights depend of the period length and the value of the

smoothing parameter. If

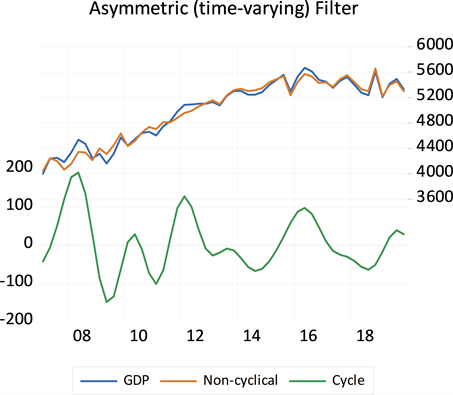

is large and nears infinity, the trend will resemble a linear trend. If it is small and nears zero, the trend will be the same as the original series. Hodrick and Prescott (1997) recommend a smoothing parameter of 1600 for quarterly data. For robustness, we also make use of the Christiano and Fitzgerald (2003) (CF) filter, in the same way as Rivero and Vergara (2015). Essentially, the CF filter is a band-pass form of statistical filtration method. In our paper, it is adopted in its asymmetric sample under the assumption that the series were non-stationary. This method is best suited for small sample sizes, as is the case in our study.

Calculating the business cycle

In order to evaluate the nature of Lesotho’s fiscal policy stance across the business cycle, the study defines and calculates the economic downturns (recessions) and contractions (expansions) during the timeline. Figure 1 presents a stylised depiction of the business cycle. In the study, an expansion (shown by the red portion of the curve) is explained as the period after the level of real GDP has returned to its previous peak and continues to grow until it reaches the next peak. A contraction is defined as the period between the peak and the trough, when output is declining. It is usually characterised by at least two consecutive

quarters of negative GDP growth.

Lesotho’s business cycle dynamics during the period 2007Q1 and 2019Q4 are identified using the Harding and Pagan algorithm (Harding & Pagan, 2002). The algorithm, famously known as the BBQ algorithm, was developed based on quarterly data, inspired by work done by Bry and Boschan (1971). To determine the peaks and troughs of a series Y(t), BBQ requires that the series be expressed in natural logs (i.e., y(t) = log(Y(t)). The user then has to select the 1) “symmetric window length”, 2) the “minimum phase length” and 3) the “minimum cycle length”. The symmetric window parameter, k, is the window over which the peaks and troughs (local maxima and minima) are to be computed. Censoring rules are used to determine the peaks and troughs of the series. A peak is defined as occurring at time t if y(t − k), ..., y(t – k + 1) < y(t) > y(t + 1), …, y(t + k); while a trough occurs at y(t − k), ..., y(t – k + 1) > y(t) <y(t + 1), …, y(t + k). in the censoring rule, the value of k is left to the user’s discretion. Literature often recommends k = 2 for quarterly data, k = 5 for monthly data and k = 1 for yearly data. In addition, under the BBQ, the minimum length of a complete cycle (contraction plus expansion duration) of five quarters is common for quarterly data. However, this minimum threshold can be overruled at the discretion of the analyst.

Subsequent to the identification of turning points, the sample period can be divided into phases of expansions and contractions. A minimum phase parameter of two quarters for expansions and contractions, respectively, is often applied in the BBQ. The minimum cycle parameter measures the complete cycle length (i.e., duration of contraction and expansion). It is usually set to five quarters. These standard parameter settings of the BBQ are in line with internationally recognised practice such as the rules used by the United States National Bureau of Economic Research (NBER). However, they can be altered at the user’s discretion (Harding, 2008).

4. Results

Our study calculates the CAB for Lesotho using the aggregated approach. The approach relies on assumed values of revenue and expenditure elasticity. The revenue elasticity is assumed to be 1 and the expenditure elasticity is assumed as 0. Potential output is calculated using the HP filter with a smoothing parameter of 1600 since our data is quarterly. The peaks and troughs of the business cycle are identified using the BBQ algorithm. To run the BBQ algorithm, the study uses the community contributed package for Stata, “SBBQ” developed by Bracke (2012). For the purpose of this study, and in the same way as Attinasi et al. (2018) and Bornhorst et al. (2011), the fiscal stance is defined as the change in the cyclically adjusted primary balance (CAPB). The discussion that follows is divided into three parts, namely, the calculation of the potential output; then determination of the business cycle and last; an evaluation of the fiscal stance.

The output gap

Figure 2 presents the estimated potential GDP in Lesotho using the HP filter. The results show that the economy was broadly below its potential over the review period. This is especially the case following the global financial crisis of 2007/08 and towards the outer years of the sample in (i.e., 2017-2019). Results from the CF Filter (presented in Appendix A2) are broadly like those from the HP filter.

The business cycle

Figure 3 provides an illustration of Lesotho’s business cycle over the period 2007Q1 to 2019Q4 as calculated with the SBBQ algorithm (Bracke, 2012)4. During this review period, the business cycle is characterised by a series of four peaks (i.e., 2008Q2, 2009Q4, 2013Q4 and 2016Q2) and four troughs (i.e., 2009Q2,

![]() Source: Author’s own calculation, using HP filter.

Source: Author’s own calculation, using HP filter.

Figure 2. Potential GDP (2007Q1-2019Q4).

2011Q1, 2014Q3 and 2019Q1). The average growth of quarterly GDP was the highest in 2009Q4 at 5.95 per cent and lowest in 2019Q1 at −7.14 per cent.

The study defines a contraction as a period of at least two consecutive quarters of negative GDP growth, while a recovery is defined as a period of at least two consecutive quarters of positive GDP growth. Expansionary periods are denoted by quarters after the GDP level has returned to its pre-contraction peak and until it reaches the next peak. An expansion can also be characterised by comparing the output gap with the actual output. If the output gap is positive and the growth in actual output is greater than the growth in the potential output, then the economy is in expansion (Attinasi et al., 2018; Harding, 2008). The study does not make a distinction between a recovery and an expansion, but it appreciates the difference. The two are taken to represent the combined improvement in economic activity from the trough, before reaching the next peak. Table 2 offers a combined presentation of the periods of contraction as well as those of recovery and expansion, respectively.

During the periods of contraction, the level of average GDP growth was the lowest in 2008Q3-2009Q1, at −1.2 per cent. This was followed by an average

![]() Source: Author’s own calculation, using SBBQ (Bracke, 2012).

Source: Author’s own calculation, using SBBQ (Bracke, 2012).

Figure 3. Lesotho’s Business cycle (2007Q1-2019Q4).

![]()

Table 2. Lesotho’s business cycle dynamics between 2007Q1 and 2019Q4.

Source: Author’s own calculation, using SBBQ (Bracke, 2012).

growth rate of −0.6 per cent in the period 2014Q1-2014Q2. Average growth in the period of recovery and expansion was highest in 2011Q2-2013Q3, at 1.3 per cent.

The fiscal stance

The fiscal stance is defined as the change in the CAPB. In broad terms, a neutral fiscal policy stance is generally one between −0.2 and 0.2 percent of GDP. When fiscal policy is neutral, discretionary policies neither act as impulse nor as a drag to economic activity (Cohen-Setton & Vallée, 2021; Batini et al, 2021; Attinasi et al, 2018; Bornhorst et al., 2011; Hlivnjak & Laco, 2018; Vladimirov & Neicheva, 2008; Turrini, 2008). In the study, a fiscal stance lower than −0.2 of GDP, in a contractionary period, is considered expansionary while a stance greater than 0.2 in an expansionary period is considered contractionary. Both cases are examples of counter-cyclical or stabilising fiscal policy.

Table 3 presents the fiscal stance and fiscal developments during the four contraction periods. The fiscal stance was mildly pro-cyclical during the contraction period of 2008Q3-2009Q1. This was despite a build-up of public debt as well as negative quarterly average output gap and GDP growth rates, respectively.

Lesotho entered the 2010Q1-201Q4 contraction period with a CAPB of −15.4 per cent of GDP and an average total government debt of 35.8 per cent of GDP per quarter. The CAPB and total debt improved to only −0.5 and 30.9 per cent of GDP at the end of the contraction period, respectively. However, the average output gap over this period was the lowest out of all the four contraction periods, at −1.5 per cent of GDP per quarter. During this time, the stance of fiscal policy was neutral in nature. The countercyclical (i.e., expansionary) fiscal stance that prevailed during the subsequent contraction periods; 2014Q1-2014Q2 and 2016Q3-2018Q4, was accompanied by relatively high levels of public debt and low levels of GDP growth.

![]()

Table 3. Fiscal stance and fiscal developments during periods of contraction.

Sources: Central Bank of Lesotho; National Bureau of Statistics and Author’s Calculations. Notes: A contraction is defined as a period of at least two consecutive quarters of negative GDP growth. The average fiscal stance is calculated as the average quarterly change in the cyclically adjusted primary balance (CAPB) in the same period as the contraction period. The “Beginning” and “End” represent the positions at the beginning and end quarters of the contraction periods, respectively. The total government debt is the ratio of nominal total government debt in a quarter, to annual GDP at current prices.

![]()

Table 4. Fiscal stance and fiscal developments during periods of recovery.

Sources: Central Bank of Lesotho; National Bureau of Statistics and Author’s Calculations. Notes: A recovery is defined as a period of at least two consecutive quarters of positive GDP growth. Expansionary periods are denoted by quarters after the GDP level has returned to its pre-contraction peak and until it reaches the next peak. The average fiscal stance is calculated as the average quarterly change in the cyclically adjusted primary balance (CAPB) in the same period as the recovery and expansion period. The “Beginning” and “End” represent the positions at the beginning and end quarters of the contraction periods, respectively. The total government debt is the ratio of nominal total government debt in a quarter, to annual GDP at current prices.

The fiscal stance and fiscal developments during periods of recovery are presented in Table 4. The fiscal stance during the recovery periods is broadly counter cyclical (i.e., tighter/contractionary) although with low levels of GDP growth and debt levels that are comparable to the contractionary periods.

5. Conclusions and Recommendations

Conclusions

The objective of this paper was to calculate Lesotho’s cyclically adjusted primary budget balance (CAPB) and evaluate the country’s fiscal policy stance across the business cycle, between 2007Q1 to 2019Q4. The study identified four peaks and four troughs over the review period. When a comparison is made between the business cycle dynamics and the fiscal policy stance, the stance of fiscal policy was found to be generally pro-cyclical to neutral in the early periods of contraction, before turning counter-cyclical, albeit accompanied by relatively high levels of public debt and low levels of GDP growth. During recovery and expansion periods, the fiscal stance was broadly counter cyclical, with low levels of GDP growth and debt levels comparable to those in the contractionary periods.

Limitations of the study

The elasticities of revenue and expenditure used in the calculation of the fiscal stance were not calculated econometrically but were assumed to be one and zero, respectively. Moreover, the study only considers the underlying drives of fiscal positions after controlling only for the cyclical components. It would benefit policy to also consider the structural budget balance that controls for a broader range of factors that could affect fiscal policy such as asset and commodity prices as well as output composition effects.

Areas for further study

The study was successful in evaluating the relationship between Lesotho’s fiscal stance and the business cycle. However, given the study limitations, future work can look to improve o the current study in three ways. First, future work can explore a disaggregated approach to the calculation of the fiscal stance, drilling down to the different revenue and expenditure components. Second, the choice of elasticities in an aggregated or disaggregated approach could be informed by an econometric approach. Third, in addition to the cyclically adjusted budget balance, the structural balance could also be calculated, to provide a richer understanding of the drivers of fiscal positions in the country.

Appendix

A1. Descriptive Statistics.

Source: Author’s own calculation, using CF Filter.

A2. Potential GDP (2007Q1-2019Q4).

A3. Turning points in Lesotho LogGDP.

Source: Author’s own calculation, using BBQ add-in in Eviews 11.

NOTES

1In periods of economic expansion, the levels of cyclically sensitive components of government revenue tend to rise while those of government expenditures usually decline, improving the fiscal balance. The opposite is often true, in cases of an economic downturn (Bornhorst et al., 2011; Hlivnjak & Laco, 2018).

2There are no predefined criteria for determining structural factors. They could, in principle, include short-term changes to the tax system, tax holidays, natural disaster related expenditures and sale of nonfinancial government assets. One rule could be to exclude items that exceed 0.1 percent of GDP (Bornhorst et al., 2011; Hlivnjak & Laco, 2018).

3The choice of primary balance instead of the overall balance is based on the loose assumption that business cycle dynamics have very little impact on interest expenditures. The argument is that even if cyclical movements coincide with government borrowing requirements (i.e., fiscal deficits), the effect is netted out by countercyclical interest rate movements (Attinasi et al, 2018; Bornhorst et al., 2011; Turrini, 2008).

4The business cycle turning points were also calculated using the BBQ algorithm add-in, in the EViews 11 software and the results were generally the same (see Appendix A3).