Market Knowledge and Stakeholder Considerations for the Biopharmaceutics Sector—Incorporating User Value and Societal Needs in Therapeutic Interventions ()

1. Introduction

Recent studies conclude that healthcare utilization, including the demand for complex and expensive interventions, will increase dramatically in the near to mid-term future [1] [2] [3] [4]. New health technologies offer significant potential for addressing previously untreatable disorders, and more effectively and efficiently managing complex conditions. They also allow disinvestment of less cost-effective interventions and, in turn, contribute to meeting increased and hitherto unmet demand for healthcare [5] [6].

Academic entrepreneurs and small and medium-sized enterprises (SMEs; henceforth: innovators) in the biopharmaceutics sector are major repositories of new health technologies [7]. However, the development of new interventions in the heavily regulated healthcare sector is associated with high cost and risk of failure—9 of 10 potential new interventions do not reach the market [8]. In addition to technical risk, one important factor that contributes to product failures is the suboptimal appreciation and utilization of market intelligence (MI). For various reasons, SMEs tend to underinvest in identifying the requirements of their (prospective) market(s) [7] [9]. A British Academy of Management report (2014) cites a variety of barriers for the utilization of MI by SMEs, such as lack of 1) financial resources, 2) market information, 3) human resources, 4) time, and 5) marketing expertise [10]. Subsequently, innovators might not have access to, or sufficient expertise to proficiently analyze, MI; not be aware that their information is incomplete; due to their value judgements dismiss relevant vignettes, or underestimate MI’s utility for commercialization success [11] [12] [13] [14]. Not judiciously considering MI at the earliest development stage possible can inter alia frustrate efforts to secure funding for crucial development activities, or considerably delay and/or prevent market entry [7]. Indeed, failure of various stakeholders to maximize the potential of new health technologies can lead to unnecessarily foregone opportunities to adequately address unmet (societal/medical) needs [15] [16] [17].

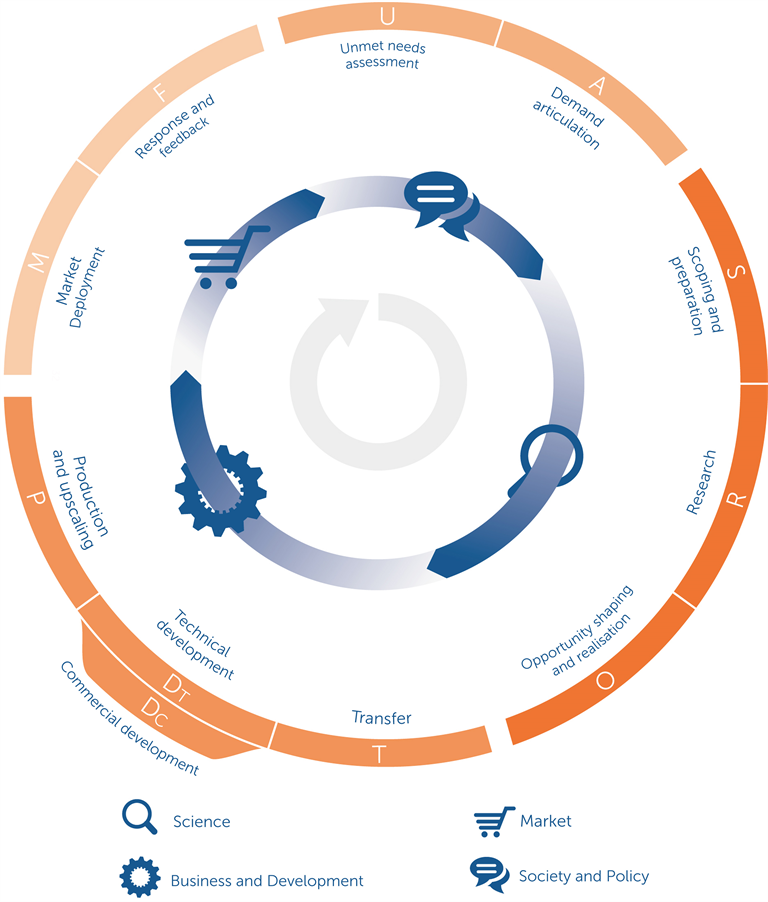

To provide a more holistic approach to addressing these issues, a recent study systematically reviewed the extant literature relating to innovation frameworks and identified a plethora of factors that can accelerate science-based innovation and knowledge valorization, i.e. the translation of academic knowledge into products, services, etc., that create societal value [18]. These factors were stratified across 4 overarching domains and are illustrated in the Societal Impact Value Cycle (SIVC, see Appendix 1). The SIVC was designed to help stakeholders relate their activities to those of others and the steps to consider in their developments [15]. However, due to its broad scope, guidance regarding market research has not been incorporated as of yet.

In this contribution, we provide innovators and policymakers with the findings of our qualitative study of MI considerations pertinent to the biopharmaceutics sector, including methods of their elicitation and examples of product improvement responses. Our results are presented as an innovator toolbox consisting of a high-level overview map (based on the SIVC), a decision pathway model to trace stakeholder reasoning and value, and detailed MI considerations (checklists) per stakeholder, see Appendixes 5-9.

2. Methods

2.1. Theory

Our study utilises a solid theoretical foundation: market orientation (MO) theory [19]. MO focusses on determinants and processes of the successful implementation of marketing, and how these activities are coordinated and used across entire organisations: “[…] [MO] is the organization wide generation of MI [market intelligence] pertaining to current and future customer needs, dissemination of the intelligence across departments, and organization wide responsiveness to it.” ( [19]: p. 6) MO was first popularised by Kohli & Jaworski in 1990 and has been repeatedly, and recently, associated with positive performance of new products [20] [21] [22] [23] and entire organisations, also in the healthcare-pertinent pharmaceutical, [24], biotech [25] and food industries [26]. For more detail regarding the study-relevant components of MO, see Appendix 12.

2.2. Data Collection

2.2.1. Sample

Our purposive sample consisted of industry experts who 1) were senior managers or leaders in the biopharmaceutics industry, 2) had a commercial or marketing background, and 3) had led the introduction of at least one successful biopharmaceutic intervention (according to regulatory therapeutic registers, see below). Potential respondents were identified via the Australian biotech association’s (AusBiotech) member directory, the BIO World Congress 2017 attendant list, press releases from Australian Life Sciences-related Venture Capital funds, the European EMA’s and U.S. FDA’s therapeutic registers, or were members of the authors’ networks. JH, a biopharmaceutics commercialisation expert, provided support in assessing the adequacy of interview candidates. We first approached individuals identified through the sources above, and later expanded our sample by interviewee referral. By selecting individuals from a range of biopharmaceutics companies, and sizes thereof, we increased the diversity of our sample.

2.2.2. Instrument: Semi-Structured Interviews

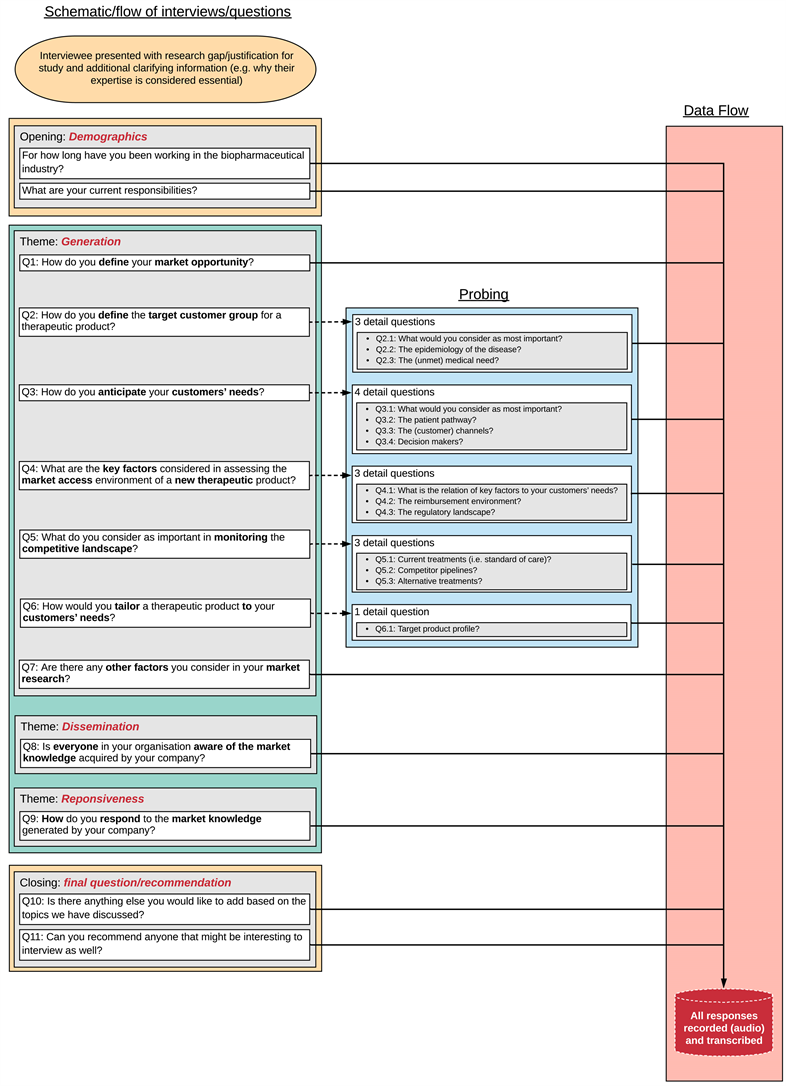

To render each interview as consistent, repeatable and replicable as possible and support the quality of data collection, we performed all interviews utilising the identical interview guide [27], see Appendix 2. Questions for the interview guide were based on core MI concepts of the MO-framework, i.e. generation, dissemination and responsiveness to MI. However, since collection and analysis of MI is not, or is suboptimally, executed by innovators, questions focussed on MI generation. Follow-up questions were used to explore comments that merited further investigation. The guideline structure was as follows (and is shown in detail in Appendix 2):

• Opening: demographics (2 questions);

• MI generation (7 questions + 14 probes);

• MI dissemination (1 question);

• MI responsiveness (1 question);

• Closing: comments and snowballing (2 questions).

To enhance face and content validity of the interviews, test if the questions were pertinent to our subject and sample, and improve comprehension, two health technology commercialisation experts reviewed the interview guide. In addition, two pilot interviews were performed to improve the construct validity and reliability of the interview guide, and elicit suggestions on improving the guide. The interview guide was adapted accordingly.

2.3. Data Analysis

To improve the validity of our study, we continued interviewing until we reached data saturation. If no new concepts were mentioned in two consecutive interviews, we considered saturation to have been achieved [28] [29]. Following the recording and transcription of interviews, a summary was shared with the interviewee, for their review (member-check). This helped us verify if we had correctly interpreted their elaborations and, thereby, improve the reliability of our analysis [30].

Analysis was performed by the first and second authors. Interview transcripts were evaluated using thematic analysis, which provides for a structured approach to extract and cluster data from textual evidence [31] [32] [33]. Analysis involved the following steps: creation of initial codes based on the MO framework, familiarisation with the data and assigning codes to text passages we deemed relevant, (sub-)theme review, summary and refinement of themes (3 iterations), and report production. In total, 21 codes were used to identify relevant passages in our data. We used computer-assisted qualitative data analysis software (Atlas.ti, version 8.4.4) to assign codes and export data in a tabular format. We then summarised similar extracts of text and grouped them into sub-themes and repeated the process until we had identified top-level themes.

3. Results

3.1. Sample

In June 2017, we invited 80 individuals via email. 16 responded and offered to participate. From 21 June to 1 August 2017, 14 interviews (duration: ~45 minutes) were conducted face-to-face (n = 2), or by phone (n = 12). All respondents permitted us to record the interviews. The participation rate was 17.5%. Eight participants were associated with SMEs (5 pharma, 3 biotech), five with Big Pharma, and one with a service provider (consultancy). All participants were, or recently had been senior managers, vice-presidents or chief-operating officers and had extensive experience (~29 years) in marketing and/or R&D. Central data about our interviewees are shown in Table 1, and Appendix 3. Data saturation (86 unique concepts, see Appendix 4) was achieved by the end of the 12th interview, see Figure 1. Two further control interviews were conducted but no further concepts identified.

3.2. Analysis

After concluding thematic analysis, we stratified our findings by stakeholder. Subsequently, we re-clustered, visualised and discussed our data several times. During this iterative analysis stage, we identified overarching themes, which we

![]()

Table 1. Central characteristics interviewees.

AU: Australia, BD: Business Development, CA: Canada, CCO: Chief Commercial Officer, CEO: Chief Executive Officer, CSO: Chief Scientific Officer, Dir.: Director, Ex.: Executive, SG: Singapore, Sr.: Senior, SME: Small and Medium-sized Enterprises, US: United States, VP: Vice President.

![]()

Figure 1. Data saturation curve for our sample.

mapped against the main stages of the SIVC, see Figure 2. Furthermore, we identified a similar analytical pattern that respondents consider for stakeholder stratification (reasoning and value), see Figure 3.

3.2.1. Core Market Intelligence Map

Figure 2 indicates the MI considerations we found and their position on the SIVC, indexed by keywords. Table 2 provides explanations and shows central stakeholders. The principle stakeholders here are: patients, providers, national regulatory agencies (NRAs), payers, and competitors. See Appendix 13 for working definitions.

Across SIVC stages Unmet needs assessment (U) and Demand articulation (A), overall unmet needs, governmental priorities and major interest groups (and the direction of their advocacy) are determined to assess the degree of demand/pull for specific interventions at the health system level. Primarily qualitative enquiry, such as review of public tenders, information on health ministry/NRA websites and scientific and grey literature, and personal conversations/interviews can provide pertinent information. At the Opportunity shaping and realization (O) stage, target markets are characterized in-depth to evaluate the concrete business opportunity and market deployment feasibility. At this stage, analysis of secondary health-market data, provided by pertinent data analytics providers, or head-offices and subsidiaries, is the primary mode of inquiry. However, mixed-methods studies (in particular interviews and surveys) are useful for stakeholder stratification, as is the review of websites and literature for competition assessment, respectively. Across the Technical/Commercial development (Dt/Dc) and Production and upscaling (P) stages, market deployment

![]()

Figure 2. Market intelligence considerations mapped to the societal impact value cycle.

![]()

Figure 3. Stakeholder information flow and decision pathway model.

![]()

Table 2. Market knowledge and stakeholder considerations. Considerations are sorted according to their stages on the societal impact value cycle, see Figure 2.

facilitators are identified to prepare the market, and identify the evidence requirements for product introduction.

Interviews, in particular with providers and patient groups, can provide relevant data. Mapping of the patient journey via referrals and the information shared between providers helps identify crucial stakeholder value, interactions and decision-points. Importantly, for regulator and payer consideration, it is crucial to maximize a product’s stakeholder utility by aligning target product profiles (TPPs) with provider preferences. Review of guidelines on NRA and payer websites, and of potentially existing previous applications and literature, helps innovators understand the type and quantity of data required for applications to regulators and payers. Finally, in stage Response and feedback (F), the experience of users with (recently introduced) interventions, and alternatives thereof, is elicited to understand and increase user-value, i.e. (health) outcomes, but also financial rewards for innovators. User experience is primarily collected in mixed-methods studies.

3.2.2. Stakeholder Stratification and Value Determination Model

Our analysis indicates, that, to better understand stakeholder reasoning and value, respondents consider similar information in sequential analysis across all principle stakeholders (Figure 3): first, they determine the baseline of stakeholder awareness, literacy and experience regarding the target condition and its management. This establishes an overview of which stakeholder is an appropriate source of which type and detail of information. Second, they focus sub-sequent analysis on stakeholder value, i.e. to understand pain points and preferences (patients and providers) or requirements and priorities (NRAs and payers). Both aforementioned steps support comprehension of the reasons for stakeholders’ current decisions and indicate how products/services and positioning strategies can be designed or modified to align with stakeholder benefits.

Finally, our respondents elicit which stakeholder requires which type and detail of information, and which “language”, or style, of presentation resonates with them. This informs the design and improvement of engagement strategies to, in turn, improve disease awareness/literacy and how a new intervention addresses the former. Importantly, thoughtfully designed engagement strategies facilitate trust and maintain rapport. However, they can also adversely impact on decisions and, in consequence, behaviours. Pertinent intelligence is primarily sourced through interviews and surveys.

3.2.3. Market Research Checklists

As alluded to above, we first stratified our data by stakeholder. These data have been tabulated into detailed checklists that are sub-categorized into Stakeholder and target mapping, Stakeholder decision drivers, and Stakeholder engagement, see Appendixes 5-9. For a list of responses to MI, see Appendix 11.

4. Discussion

We provide here the first market orientation-based overview of market intelligence considerations pertinent to the biopharmaceutics sector, methods of their elicitation and examples of health intervention improvement. Our results map readily to six out of ten stages of the Societal Impact Value Cycle, providing innovators with an accessible overview and orientation. For stakeholder stratification and analysis, we present a synthesised model that supports innovators in tracing and understanding stakeholder reasoning, decision-points and value. Our findings are also related to the findings of a recent study that identified key factors of successful innovation for the probiotic sector. In combination, our illustrations, checklists and elaborations can be used as an integrated toolbox for innovators to perform their own basic market research, analysis and response activities.

4.1. Closing the Research Gap

Various studies have found a positive correlation between a company’s degree of MO and its product and organisational performance, for both first-to-market and late-entrants [22]. Evidence suggests that the sooner innovators increase their degree of MO, the more sustainable their stakeholder and market alignment (and competitive advantage) is [34]. Our findings even suggest that the Pareto principle applies to market research: rapid (and early) review of easily accessible resources can provide substantial and relevant decision information. As market analysis plays such an important role for improving the potential societal value of new health interventions, it is all the more surprising that there exists paucity of market research direction for innovators in the biopharmaceutics sector. Our study addresses this important gap in the current body of MO literature and provides actionable guidance to reduce information discrepancy between innovators and their target market needs.

4.2. Improving MO across Stakeholders

Being able to readily map our results against six out of ten stages of the SIVC has facilitated their meaningful stratification across a novel and pertinent innovation framework. It also emphasises, once again, the high degree of market information fragmentation across diverse stakeholders involved in the innovation process, as also observed by others [15]. A recent study found that even basic definitions of unmet needs are not identical across stakeholders [35]. This is problematic as concerted efforts based on shared understanding, awareness of and alignment towards needs and preferences of relevant actors, are required to maximise the value of interventions for society. On a more encouraging note, one of our respondents mentioned that one regulator liaises with providers and patients to identify unmet needs, and with companies to assess regulatory time-lines and the compassionate use of medicines in clinical trials. We contend that policies to incentivise the system-wide overall increase of MO should be more thoroughly explored for all relevant stakeholders, irrespective of if they add value to new interventions by, for example, vetting the safety and quality, or covering the costs, thereof. Systematic support (and empowerment) of all stakeholders to this end could lead to various benefits. For example, the long-term reduction of information fragmentation could contribute to strengthening and streamlining collaboration in healthcare innovation processes. However, to be effective, support must be nuanced and acknowledge the specific role and contribution of individual stakeholders, and stakeholder:stakeholder interfaces to de facto increase overall MO.

4.3. Informing Health Decision Models

In addition to providing an analytical sequence of data per stakeholder, our stratification model is well-suited to inform and complement the population of decision support systems in the healthcare sector. Multi-criteria decision analysis (MCDA), which takes into account diverse, and potentially conflicting, criteria and requirements, is being used for reimbursement prioritisation in market access decisions [36] [37]. Recently, MCDA has been investigated as a decision tool for regulators assessing applications [38], but also suggested as a payer decision prediction tool for R&D organisations [39]. If innovators had, across various markets, access to stakeholder MCDA requirement profiles, which could be elicited and structured based on our stakeholder stratification model, the burden of MI collection and barriers for intervention improvement could be, potentially significantly, decreased. In addition, such profiles could improve the level of detail of needs for better segmentation of markets, group markets with similar stakeholder and need profiles, etc., and reduce resource consumption for MI.

4.4. MI Consideration across Health Sectors

Our findings also relate to a range of key factors of successful innovation as identified in a recent study for probiotics [15], further indicating the relevance of MI and orientation across industries in the broader healthcare sector with differential pain points and requirements. First, regarding early phases of technical development, our interviewees stated the importance of incorporating considerations relating to stakeholder value and decision-points at an early stage. In addition, our respondents highlighted that, to improve resource allocation and collecting evidence for applications with regulators and payers, it is important to align as closely as possible TPPs (target product profiles) with provider and patient preferences. The key factors of successful innovation, however, do not include payers, which is not surprising as probiotics usually do not require an intermediary institutional payer. Second, when designing early market introduction strategies, our interviewees (primarily referring to prescription interventions) indicated that interactions with leaders in the field can facilitate collaborations and help establish or increase awareness of the medical need and potential intervention(s) among healthcare providers. In addition to said interactions, the key factors of successful innovation include issues related to determining sales channels and strong competition on retailer shelves (for functional foods). Although of secondary nature, this was also a theme in our data pertinent to OTC products sold by pharmacies. Nevertheless, innovators in the biopharmaceutics industry should have a clear understanding of how their product will be classified and accessed, and who will be the payer. A timely example of novel classifications, in this case for the hospital-market, is CAR-T therapy in Australia: on one hand, it is regulated as a biologic and not a prescription medicine and, on the other, reimbursed as a medical service rather than a pharmaceutical [40] [41]. Third, while the key factors of successful innovation highlight the importance of good manufacturing practices (GMP), GMP was not a central theme in our data. This is surprising, as in particular in the biopharmaceutics industry, GMP and the specific quality standards that underpin GMP are mandated and monitored by regulators in essentially all markets, and indeed GMP standards can be identified by market research. [42] However, this might be due to the fact that the implementation of GMP is not primarily a marketing-related activity. Nevertheless, this once again shows that market research informs and aligns various stages of development or, in this case, manufacturing and evidence needs respectively with market requirements. Finally, our interviewees stated the importance of eliciting and responding to market feedback by improving their interventions and engagement strategies to better match customer needs. Regarding responses to market feedback, the key factors of successful innovation focus on inference of future customer needs from market feedback. Our respondents, on the other hand, emphasised the extrapolation of future needs by monitoring competitor pipelines and potential changes in regulator and payer priorities. Forecasting is an important function of MO and our stakeholder information and decision pathway model is suited to guide innovators in their assessment of the (future) needs and activities of diverse stakeholders, and indeed of the other above-mentioned factors.

4.5. Strengths and Limitations

By focussing exclusively on senior executives and marketing experts of the biopharmaceutics sector, our study provides evidence particularly pertinent to academic entrepreneurs developing new medical interventions. Our sample ranged from both consolidated as well as highly dynamic markets increasing the degree of external validity. In line with other works [29], we reached data saturation at the end of the 12th interview. This confirms that we asked a specific research question to a specific group of stakeholders. Additionally, the use of a consolidated theoretical framework and two researchers working in tandem improved the validity of data collection and analysis. This study provides a clear overview of the factors that are important primarily for prescription drugs because it was the type of intervention respondents alluded to most frequently. It is conceivable that for OTC drugs different aspects play a role, especially with regard to payers. Future studies could therefore explore differences between prescription and OTC interventions. Moreover, to fully understand the extent to which different factors resonate in society, a quantitative follow-up study could investigate, if priorities exist in our results across various stakeholders.

4.6. Implications for Policy

Above, we have primarily appealed to innovators to perform market research. Funding models can readily support innovators with market research, especially those developing interventions that promise step improvements in disease management. Importantly, a decreased dependence on private funding, for which incentives can be misaligned with unmet need, [43] with access to a market research toolbox, such as the one proposed here, could persuade innovators to invest more resources in market research. Issuers of public tenders, and in particular seed funds that can have a major impact on the sustainability of growth of (biotech) start-ups [44], are in a unique position to incentivize market research activities as early as possible [45]. In addition, some funding consortia, e.g. European Innovation Council [46], also offer coaching services that can include access to MI via partner networks [47]. They can thereby support innovators in, first, appreciating that market research is not merely an academic exercise but rather, serves to fundamentally inform them of the value judgements of their target audiences, and options to improve their interventions and the societal impact they are, in all likelihood, seeking; and, second, understanding which potential barriers they might face if they do not align their developments with the needs of stakeholders. Naturally, with available product-specific market research data, funders would have better grounds to evaluate the probability of new developments meeting the requirements of stakeholders and take decisions on further funding, and, over time, establish a baseline of experience with MI data facilitating differential decision outcomes. Funding models could also include earmarked budgets: first, limited funding for innovators to conduct basic market research (pre-application)—to inform the funding decision; and second, should development funding be approved, more substantial financial support for thorough market research—to align interventions with the needs of market(s).

4.7. Prioritising MI Considerations

Because our study is exploratory, it can be considered a starting point for future, more targeted research into the impact of different MI aspects on development timelines, health technology assessment, commercialisation success, etc., of therapeutic interventions. For example, although analysts might agree that certain MI considerations are important, it might not be clear which specific considerations and to which degree contribute to the success of interventions. Moreover, as alluded to above, besides MI a host of determinants exist that can drive the success of new interventions, and their utility for society. Similarly, future research could assess and quantify the relative contribution, and hence value, of each of these innovation drivers. Thereby, an overview of innovation policy blind-spots and corresponding priorities could be created to inform innovator support strategies.

5. Conclusion

The scholarly enquiry into marketing in the biopharmaceutics sector is in the early stages. This is surprising when considering the utility that proper market research can provide to increase the long-term societal return-on-investment of new health interventions. This study provides the first overview of market orientation-based market intelligence considerations for the biopharmaceutics sector. Our toolbox for guiding data collection and analysis, and translation of insights into actions can be of interest to both innovators and policymakers: by pinpointing relevant considerations, steps and activities to specific innovation stages, our findings can improve understanding of stakeholder needs and changes thereof over time, inform new interventions and maximise value for society. The importance of integrating insights from market intelligence with product development at the earliest stage possible cannot be overstated.

Supplementary Materials

Appendix 1

Simplified version of the societal impact value cycle

Appendix 2

Interview guide and flow diagram

Appendix 3

Composition of our sample (invitees versus participants).

Appendix 4

Unique concepts mentioned per interview—colour coding indicates the interview in which a concept was first mentioned, and the numbers indicate frequency per interview.

Appendix 5

Core considerations (market research checklists)—Patients.

Appendix 6

Core considerations (market research checklists)—Providers.

Appendix 7

Core considerations (market research checklists)—NRAs.

Appendix 8

Core considerations (market research checklists)—Payers.

Appendix 9

Core considerations (market research checklists)—Competitors.

Appendix 10

Dissemination of Market Intelligence.

Appendix 11

Responsiveness to Market Intelligence.

Appendix 12

Study-relevant components of the market orientation framework.

Generation of market intelligence

According to the MO framework, MI “is a broader concept than customers’ verbalized needs and preferences in that it includes an analysis of exogenous factors that influence those needs and preferences.”[19, p.4] First, it is essential for an organisation to understand who specifically their customers are—in healthcare markets, e.g., buyers (prescribers/healthcare providers), payers (health insurances/funds), and consumers (patients) [48]. In addition to understanding customers’ current preferences, an important function of MI is to anticipate customers’ future needs. According to MO, the most prominent examples of exogenous factors are: the regulatory (and policy) environment, existing and prospective technology, competitor activities, and the dynamics of, and changes in, the industries/environments of customers [19].

The generation of MI is facilitated by various collection, analysis and synthesis methods: analysis of quantitative data using statistical methods and modelling is frequently used to gauge e.g. the size of the market, the potential of developing a feasible product, whereas qualitative but also mixed-methods approaches, such as questionnaire- and interview-based research, are used to identify motivations and preferences that lead to behaviours of customers, and thus estimate their potential to adopt, or switch to, a prospective product [19].

Dissemination of MI

According to MO, a necessary pre-requisite to facilitating proper, i.e. coordinated and cross-functional, responsiveness of an organisation to MI is its dissemination across the entire organisation. Ideally, all departments and individuals generate and disseminate intelligence to, and receive intelligence from, one another. This can include particular effort on behalf of one department to convince key individuals or other departments of the relevance of “their” intelligence. Regular meetings between various departments, pre-defined information dissemination routes across and within departments, as well as regular internal newsletters can be considered formal, proactive mechanisms of dissemination. “Hall-talk” and the establishment of central repositories containing market data, and customer needs and characteristics conveyed e.g. through story-telling notes, can be powerful informal, passive dissemination tools, the value of which, according to K&J, should not be underestimated [19].

Responsiveness to MI

Finally, responsiveness activities might include the selection or re-selection and priming of target markets, and adapting development and product characteristics, services, distributions channels, and promotion strategies. Regarding marketing authorisation (regulatory approval) and market access (formulary listing and reimbursement), activities will at the very least include the collection, analysis and presentation of pertinent MI and the coordination of the regulatory, medical affairs and sales departments to facilitate concerted responses to newest intelligence, and ensure non-conflicting communication with relevant agencies in target market(s) [19].

Appendix 13

Working definitions

Patients

“Individuals participating in the health care system for the purpose of receiving therapeutic, diagnostic, or preventive procedures.” (Source: Pubmed)

Providers

“A licensed person or organization that provides healthcare services.” (Source: NCI)

National regulatory agencies (NRAs)

“NRAs are national regulatory agencies responsible for ensuring that products released for public distribution (normally pharmaceuticals and biological products, such as vaccines) are evaluated properly and meet international standards of quality and safety.” (Source: WHO)

Payers

Payers are any entity that covers the cost of healthcare utilisation, and can range from public payers such as, for example, sickness funds (in social health insurance systems) or government institutions (single payer systems) or, private parties, such as insurances, individuals. (Source: JKT)

Competitors (Competition)

“Competition is an activity involving two or more firms, in which each firm tries to get people to buy its own goods in preference to the other firms’ goods.” (Source: Collins Dictionary)