Paper Menu >>

Journal Menu >>

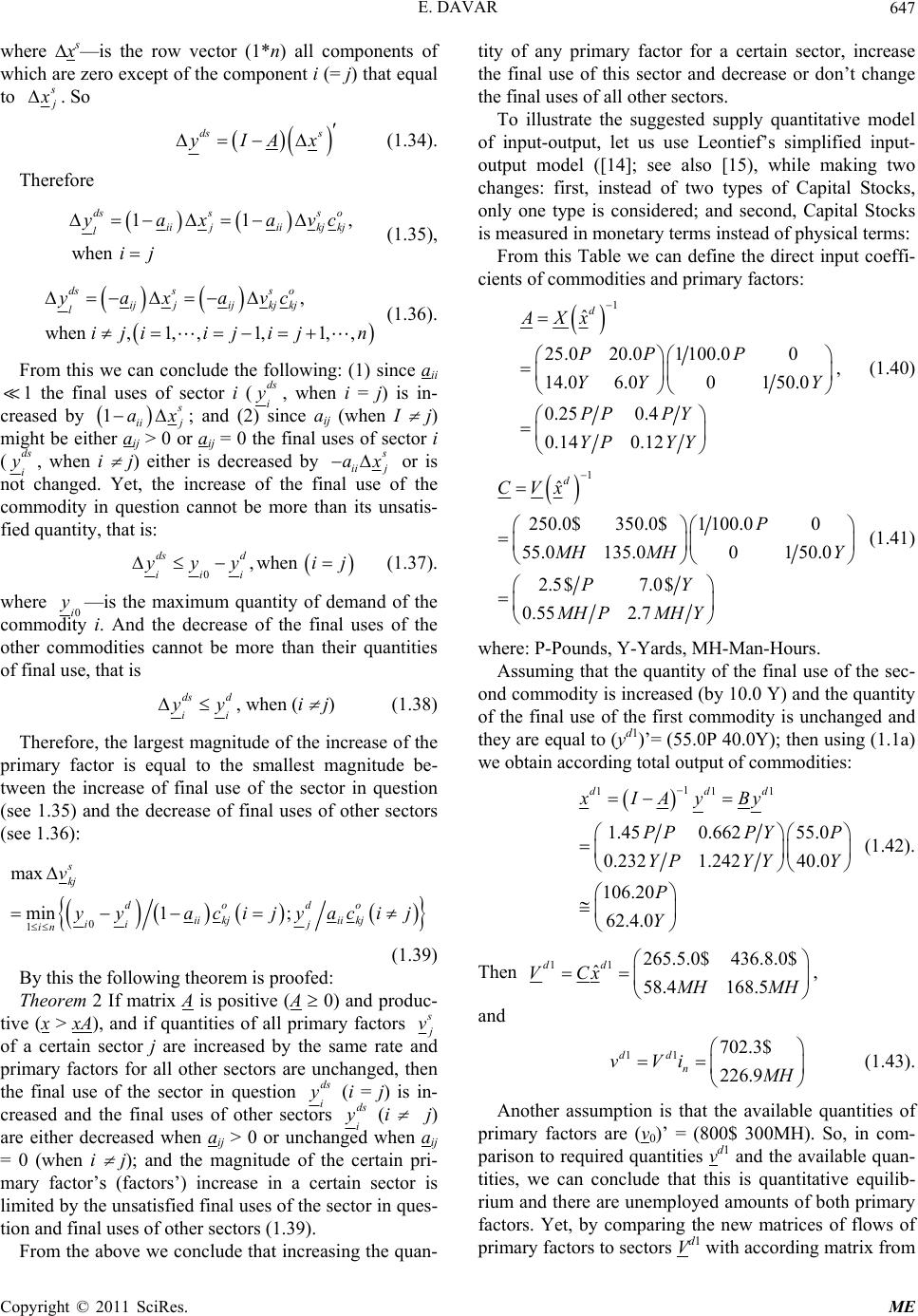

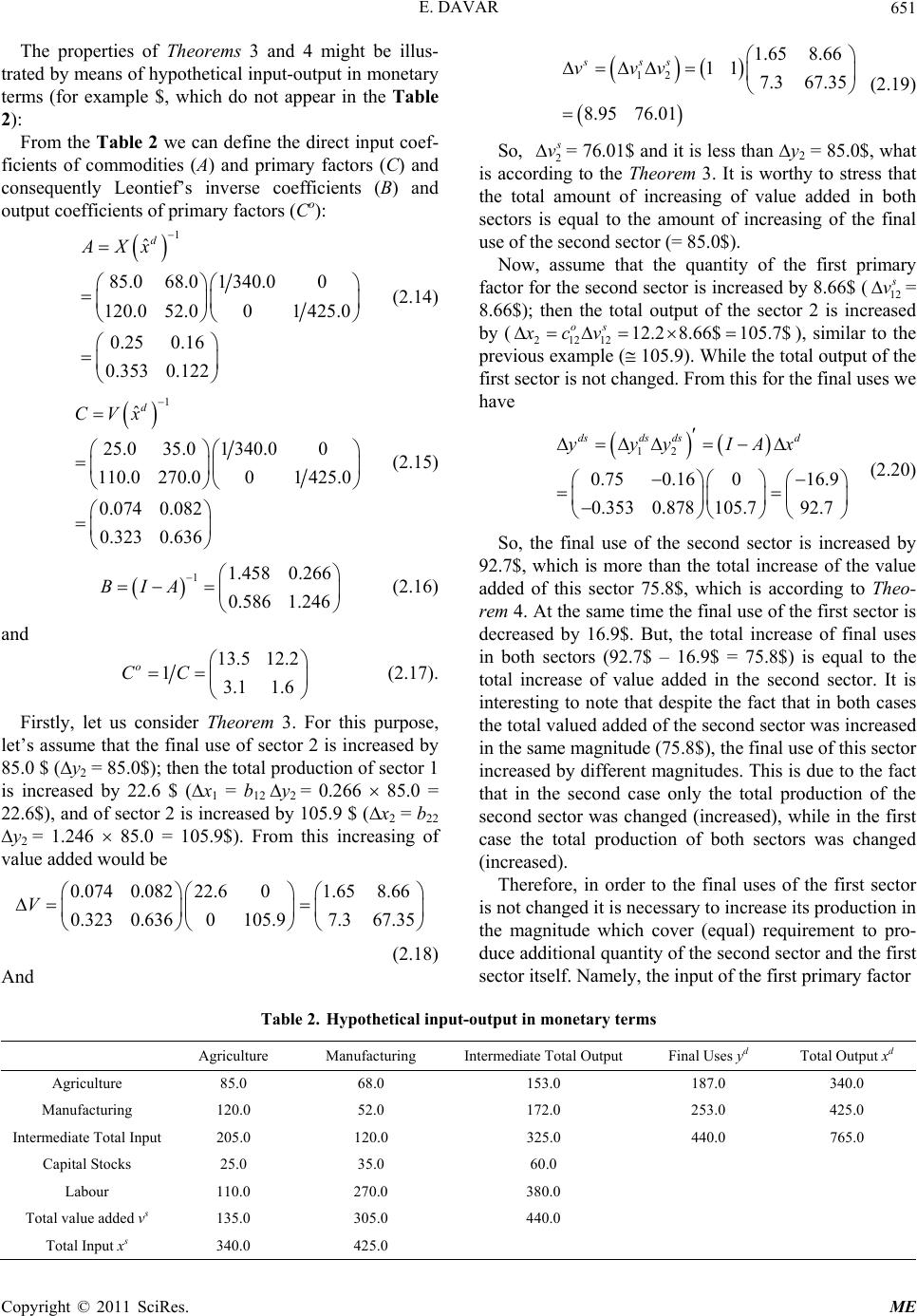

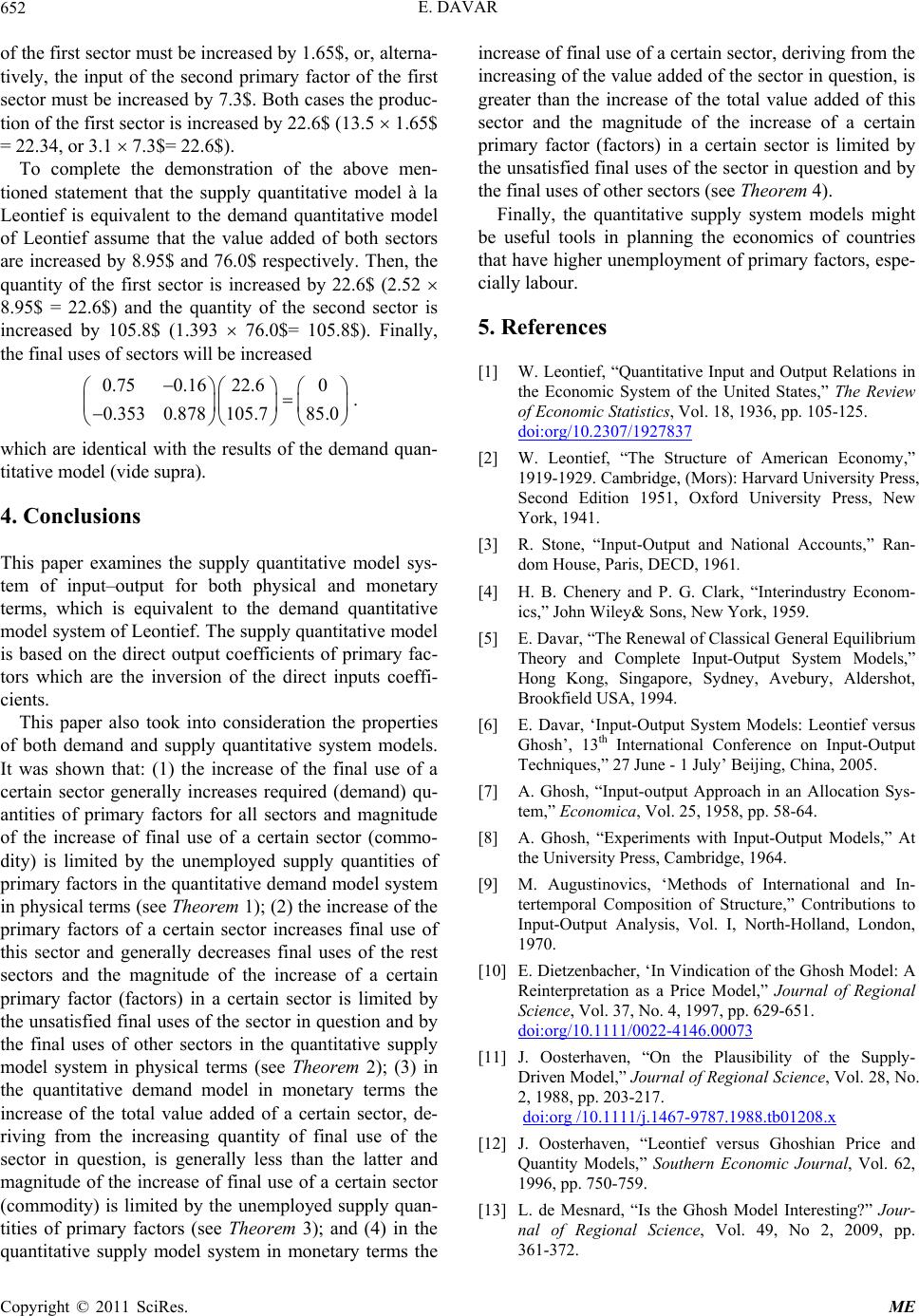

Modern Economy, 2011, 2, 642-653 doi:10.4236/me.2011.24072 Published Online September 2011 (http://www.SciRP.org/journal/me) Copyright © 2011 SciRes. ME Supply Quantitative Model à la Leontief* Ezra Davar Independent Researcher, Amnon Vtamar, Netanya, Israel E-mail: ezra.davar@gmail.com Received May 13, 2011; revised July 6, 2011; accepted July 16, 2011 Abstract This paper focuses on the supply quantitative model system of input–output, which is equivalent to the de- mand quantitative model system of Leontief. This model allows us to define the total supplied quantities of commodities for any given supplied quantity of primary factors, and consequently enables us to define the final uses of commodities. The supply quantitative model is based on the direct output coefficients of pri- mary factors. The Hadamard Product is also used. The quantitative supply system models might be useful tools in planning the economics of countries that have higher unemployment of primary factors, especially labour. Keywords: Leontief, Demand and Supply Quantitative Model, Output Coefficients, the Hadamard Product 1. Introduction Leontief used the term “Input-Output” in the title of his first and seminal paper on Input-Output Analysis, in “Quantitative Input and Output Relations in the Eco- nomic System of the United States” [1]. This means that every activity in economics is simultaneously character- ized by two sides: income (revenue) expenditure, de- mand supply, input-output, export-import, and so on. In other words, the income of a certain economic unit (household, firm, institution, country) is co ncurrently ex- penditure for another economic unit; demand for any commodity by any individual is also supply for another individual or firm; input of any commodity to a certain sector is also output for the sector producing that com- modity. Using this postulate, Leontief describes his in- put-output table as: ‘Each row contains the revenue (out- put) items of one separate business (or household) … If read vertically, column by column, the table shows the expenditure sides of the successive accounts’ [1]. There- fore, this allows us to describe and analyze economies on two sides so that if the same conditions exist, the results must be equivalent for both—in quantity an d pr ice terms. For example, the development of the whole economy might be modeled on either the input side or the output side. Each direction has its own targets and allows us to solve different types of problems of contemporary eco- nomics. Since that period in economic literature on Input- Output, there have been attempts to formulate models describing the whole economy in both sides: demand (input) and supp ly (ou tput) for quantity and supp ly (input) and demand (output) for price. Until today, only two types of system models of input-output have been for- mulated. These system models were first formulated by Leontief in their original form, and in the following years they were improved upon: quantitative demand (input) and price supply (input) models ([1-4]). The first model allows us to define the demand (required ) quantity of the total production (input) of commodities for any given amount of final uses and consequently also for defining the demand (required) quantity of the primary factors. The second model allows us to def ine the cost of produ c- tion (supply price) of commodities on the basis of pri- mary factors’ prices which are determined according to their required quantities by means of their total supply curves ([5,6]). When Ghosh ([7,8]) formulated the allocation model, it was unfortunately labeled into an “output” (supply, supply-driven) model by his followers ([9-12])1. More- over, Dietzenbacher ([10]; see also [13]) attempted to prove that Ghosh’s allocation model is equivalent to Le- ontief’s price model. However, the recent paper [6] 1I also, unfortunately, finally called Ghosh’s model an output model, despite the fact that in my first paper [19] the distribution and outpu t coefficients (are) were used equivalently, but in my book [5] I men- tioned ‘distribution coefficients’ only once and after that ‘output coeffi- cients’ and ‘output models’ were used. *The author thanks Prof. A. Brody and Prof. E. Einy for useful sugges- tions; This paper is dedicated to Leontief’s 100th birthday, and 70 years since his first paper on Input-Output.  E. DAVAR643 shows that Leontief’s Input-Output system model differs from Ghosh’s system, and therefore they cannot be equi- valent. This paper focuses on the supply quantitative model that allows us to define the total supplied quantities of commodities for any given supplied quantity of primary factors, and consequently to define the final uses of com- modities for both physical and monetary input-output systems. The supply quantitative model à la Leontief is based on the output coefficients of primary factors and input coefficients of commodities. The output coeffi- cients of primary factors are the inverse magnitudes of their inputs coefficients; therefore, if the input coeffi- cients are given and constant by assumptions, then the output coefficients are also given and constant. The Ha- damard Product is also used. Hence, this model allows us to define the total sup- plied quantities of commodities for any given supplied quantity of primary factors, and consequently to define the final uses of commodities. Such approach allows us to manipulate by each components of primary factor (types of labour or fixed capital). While Ghosh’s model is based on the allocation coefficients of commodities, which are not inverted of the input coefficients, and on the input coefficients of primary factors, and therefore, allows manipulate generally by an aggregate magnitude of value added. This paper consists of two sections. Following the in- troduction the first section describes supply quantitative equilibrium system models for Input-Output in physical terms; and the second section deals with supply quantita- tive equilibrium system models for Input-Output in mo- netary terms. Finally conclusions are presented. 2. Supply Quantitative Equilibrium for I-O in Physical Terms à la Leont ief2 Let us start with the demand quantitativ e model of Leon- tief’s input-output system, before describing the supply quantitative mod el, for two reasons: (1) to consider addi- tional property of the demand model; and (2) to compare and understand characteristics of these models. The de- mand quantitative equilibrium for I-O in physical terms consists of two systems [6]: 1 ,or ,or dddddd d x AxyxIAyxBy (1.1) 0 0 ˆ or ddd nn dd d vVi CxiCxv vCxCByv (1.2) where ij X x —is the square matrix (n*n) of the quantita- tive flows of commodities in the production; ir Yy —is the matrix (n*R) of the quantitative flows of commodities to the categories of final uses; d y– is the column vector (n*1) of commodities’ quantities for final uses; d x —is the column vector (n*1) of the total output quantity of commodities; kj Vv —is the matrix (m*n) of the quantitative flows of primary factors to the sectors of production; d v– is the column vector (m*1) of the total quantities of primary factors required in the production ; ij A a —is the square matrix (n*n) of the direct in- put coefficients of commodities in real (physical) terms in the production and 1 ˆ,.., ij dij d j x AXx iea x ; (1.3) i.e., the input coefficient aij measure quantity of com- modity i required for the production of one unit of com- modity j in physical terms; kj Cc —is the matrix (m*n) of the direct input co- efficients of factors in real physical terms in the produc- tion and 1 ˆ,.., kj dkj d j v CVx iec x ; (1.4) i.e., the input coefficient of primary factors kj c measure quantity of factor k required for the production of one unit of commodity j in physical terms; B—is Leontief’s inverse matrix, and ij bis the total required quantities (direct and indirect inputs) of com- modity i to a satisfied one unit of demand of the com- modity j; — 0 v—is the vector of the available quantities of pri- mary factors; n The system (1.1) allows us to obtain the total requ ired quantities of commodities for any given quantities of final uses for the certain conditions of the direct input coefficients of commodities i—is a unit column vector (n*1); A . Consequently, by the substitution of the obtained required output quantities in the system (1.2), the required quantities of primary fac- tors are defined as d v. Therefore, if the required quanti- ties of primary factors are within the limit quantities drawing from their supply curves, i.e., if the required quantities are less or equal to the available quantities (0 d vv ), then there is a quantitative equilibrium and then a price equilibrium establishing might be considered. 2Input-Output in physical terms, in this paper, differs from the physical input-output table (PIOT), which recently appeared in input-output literature. In the former, each commodity has its own physical meas- urement: meter, ton, unit, M3 and so on, while in the latter, all com- modities have uniform physical measu r ement, for example ton. Copyright © 2011 SciRes. ME  E. DAVAR 644 Conversely, when, if at least the required quantity for one factor is larger than its available quantity, then the process must be carried out for the new different quanti- ties for final uses, until the above conditions are satisfied. Worthy to discuss the character of changes of the total required quantities of primary factors due to change of quantities of final uses. We assume, for the simplifica- tion, that only th e quantity o f final us e for a on e of sector (commodity) l is changed (increased) (d l), while the final uses for other sectors (commodities) stay un- changed. Substitute this in (1.1), and we have: y 11dd dddd x ByB yyxx (1.5) where d y—is the column vector (n*1) all components of which are zer o exce pt of the compo nent l that equ al to d l y. So dd x By (1.6) and ,,1,2, dd iij l x byjli n (1.7) From (1.7) we can conclude that increasing the final use of the commodity of a certain sector l either in- creases the total production of commodities of the se- ctors where according inverse coefficients of inputs are more than zero (bij > 0, j = l) or unchanged if according inverse coefficients of inputs equal zero (bij = 0, j = l). Consequently, the qu antities of primary factors are either increased, if direct input coefficients of primary factors are more than zero (ckj > 0), or unchanged if direct input coefficients of primary factors are equal to zero (ckj = 0) in the sectors where the total production is increased. This is ,1,2,,;1,2,, d kjkjji ll vcb ykmjn (1.8) Now, the total increase of each primary factor is de- termined as 11 ,1,2,, dd nn jj kkjkjjil l vvcbyk m (1.9) From (1.9) d l yis determined as 1 dd n j kkjj l yv cb il (1.10) However, these total increases of each primary factor must be less or equal to its unemployed quantities, this is: 0,1,2,, dd kk k vvvk m (1.11) Therefore 0 11 max minn dd kk kjji lkm j yvvcb l , (1.12) This proves the following theorem: Theorem 1 If matrix A is positive (A 0) and produc- tive (x > xA), and if the quantity of final use of a certain sector d yl is increased and final uses for all other sec- tors are unchanged, then the required quantities of pri- mary factors are either increased if direct input coeffi- cients of primary factors are more than zero (ckj > 0) or unchanged if direct input coefficients of primary factors are equal to zero (ckj = 0) for the sectors where the total production is increased; also the magnitude of the in- crease of final use of a certain sector (commodity) is limited by the unemployed supply quantities of primary factors (1.12). To sum up, this theorem indicates that increasing of the quantity in the final use of the commodity of a certain sector, increases the required quantities of primary fac- tors almost in all sectors. On the other hand, careful examination of the demand system models shows that they might be used for oppo- site purposes (direction) too. Namely, the system (1.1) might be used to obtain the total quantities of final uses for any given total quantity of commodities, rewriting it as: d yIAx d (1.13) So, (1.13) allows us to obtain the total quantity of final uses for a given total quantities of commodities. This means that in order to determine the total demand of fi- nal uses, the total quantities of commodities have to be known, so that the latter have to be connected with pri- mary factors. For example, the total quantities of com- modities must be determined on the basis of the given quantities of primary factors. In other words, the oppo- site model to (1.2) is required. The question is, therefore, whether the system (1.2) may be transformed into such a model which may allow us to determine the total quantities of commodities for any given quantities of primary factors. Until today, the answer was obviously negative. It asserted that the co- lumn of primary factors for a certain sector, for the input- output system in physical terms, is heterogeneous and therefore, not be summed. Thus the negative answer is based on the ordinary analysis of input-output system models. Let us try another approach. Let’s start from the determination of the flows of pri- mary factors to sectors of production (V—matrix). From (1.2) it is determined that: ˆ d VCxd (1.14) If we take into account the fact that when regular ma- trix is multiplied on a diagonal matrix, it means that the first component of each row of regular matrix is multi- plied on the element of the first column of the diagonal Copyright © 2011 SciRes. ME  E. DAVAR645 matrix and the second element of each row is multiplied on the element of the second column, and so on. There- fore, the diagonal matrix may be replaced by a matrix where all elements of a certain column are identical and equal to the according diagonal magnitude; and new ma- trix’s dimension is defined according to the dimension of matrix C, i.e. (m*n). This is, taking case ˆd x under dis- cussion, might be replaced by the matrix dd X (m*n) where all elements of the first column would be the total output of the first sector, all elements of the second co- lumn – the total output of the second sector, and so on: 11 121 21 222 12 dd dn dd dn dd dm dmdmn xx x xxx X xx x (1.15) It is necessary to emphasize that there might be an opposite case, namely, when a diagonal matrix is multi- plied by a regular matrix, and, in such a case, each ele- ment of the row of replacing matrix has to be identical and the dimension of the matrix must be according to the regular matrix (vide infra). Now, (1.14) might be rewritten as ˆ dd VCxCXdd (1.16) The sign () means the Hadamard product of two ma- trices C and Xdd when matrix d V is formed by the ele- mentwise multiplication of their elements. The matrices must be the same size. So, every component of d V is obtained as the following: each component of matrix C is multiplied on the according component of matrix dd X , for example, the element c23 is multiplied on the accord- ing element xd23. On the other hand, from (1.16) dd X might be deter- mined as ddd o X VC (1.17) where o C—is the matrix of direct output coefficients of primary factors, which are inverted of the direct input coefficients of primary factors and it is the same size and structure of the matrix C, this is, 1 o kj kj cc if 0 kj c and if ckj = 0 then o kj c also equal to 0; the output coeffi- cient indicates the quantities of commodity j produced by a unit of primary factor k. If, by assumption, the direct input coefficients of pri- mary factors are given and constant, then the direct out- put coefficients would also be given and constant. Therefore, according to (1.17) in order to determine the total quantities of commodities, the flow of primary fac- tors to sectors (matrix V) is required. As mentioned above for the equilibrium state, when it is determined from the demand side, the elements of a certain column of dd X are identical, and they are the same quantity. But, when the elements of matrix V are determined acciden- tally as supply (notate as s V), according to the available quantities of primary factors, and they have to use for determination of the total output of commodities, then the total quantity of a certain commodity may be differ- ent for various primary factors. In such a case, it is nec- essary to choose one amount from them (vide infra). The required quantities of primary factors (vd-column vector), which are determined by the required flows of primary factors to sectors of production (Vd), has to be a source for the determination of the supplied version of the latter matrix ( s V). If the required quantities of pri- mary factors are far from their available quantities (vd < v0), then there are unemployed quantities of primary fac- tors (includi ng labour). Ther efore, in such a situation, the opposite process is desirable, namely, the process has to start from the side of primary factors instead of the side of final uses as in the previous case. Here, in the begin- ning, the amount of quantities of primary factors (notate as vds—the total supply quantities of primary factors) are determined and then their distribution between the sec- tors of production must be determine. So, the question now is how the given quantities of primary factors have to be distributed between sectors of production. There are infinite ways of distribution of the given supply quantities of primary factors between production sectors, starting from the occasional distribution and fin- ishing with the planning distribution according to a cer- tain criterion. Let us discuss the type of distribution where the structure of new distribution is identical to the structure of the distribution for the demand side. For the purpose of defining the structure of the demand side let us rewrite the equation system (1.2) as follows: 12 ,1,2,, ddd d kkk kn vvv vkm (1.18) or 12 ,1,2,, dd d dd dd kk k kk kkn dd d kk k vv v vv vvkm vv v (1.19) and 12 ,1,2,, ddd d kk kn kkkk vvvvk m (1.20) where ,1,2,, ;1,2,, d kj kj d k vkmj v n m (1.21) 11,1, 2,, n kj j k (1.22), kj—is the share of the sector j in the total required quantities of primary factor k. From (1.21) we can define Copyright © 2011 SciRes. ME  E. DAVAR 646 ,1,2,, ;1,2,, dd kj kj k vvk mj n (1.23) Therefore d VV dd , (1.24) where —is a sing of the Ha d am ar d product; – [ kj] —is the matrix (m*n) of distribution of pri- mary factors between sectors of production; Vdd—is the matrix (m*n) where all elements of a cer- tain row are identical (vide supra) and equal to the re- quired quantity of the according factor. So, assuming that is constant (1.21) allows us to de- termine Vd when Vdd is given, that is, determine Vs when Vss (vds) is given. To sum up, the process is completed. If the total sup- ply quantities of primary factors are given then (1.24) allows us to determine their distribution between branches of production; substituting the obtain results into (1.17), the total supply quantities of commodities are obtained; thus, substituting the latter into (1.13), accord- ing quantities of the final uses of commodities are deter- mined. Therefore, assuming that the new total quantity of pri- mary factors is vds3, the matrix Vss is compiled where all elements of each row are the same according to vds. Sub- stituting it in (1.24), the matrix Vs is obtained. Namely: s ss VV (1.25). Substitute the latter into (1.17) we have: s sso X VC (1.26). Because of that the total quantities of various primary factors are independently determined from the input structure of sectors, columns of the matrix Xss might be heterogenic, and that is, components of a certain column might be different. So, there might be the following 11 121 21 222 12 ss sn s ss ss n s msm smn xx x xx x X xx x (1.27) where xskj—is the total quantities of commodity j deter- mined according to the supply quantities of primary fac- tor k. In such a situation, it is necessary to choose one com- ponent from each column according to the following criterion: 1 min,1,2, , sj skj km This means that for each column the lowest total quantity is chosen to guarantee existence of required quantities of all primary factors. Substitute these total quantities of commodities xs into Equation (1.13) and the total quantities of final uses yds are obtained. To sum up, the supply quantitative equilibrium for Input-Output in physical terms can be placed into the following systems: s sso X VC, (1.29) 1 min,1,2,, sj skj km x xj n, (1.30) ds s y IAx (1.31) where Vs, Co, A—ar e gi ven. The Equation (1.29) defines the matrix of possible to- tal products of commodities for each primary factor Xss as the Hadamard product of the matrix of the flows of primary factors to sectors (Vs) and the matrix of direct output coefficients of primary factors (Co). Here, there might be m different total quantities of commodity for each sector (commodity). Consequently, the equation system (1.30) allows for the choosing of one total quan- tity for each sector so that it might be possible from the point of all primary factors. Finally, the equation (1.31) allows obtaining the final uses of commodities for the choosing of total quantities of production. From the point of using the supply quantitative model in practice is worthy to consider the character of changes of the total quantities of final uses in according to changing of primary factors. To simplify, assume that only the quantity of primary factors for one sector of production is changed, while other sectors are unchanged. This means that the total productions of the latter sectors are also unchanged. Assume that the quantity of the primary factor k (la- bour) for the sector j is increased by 0 s kj v>. Substi- tute this in (1.26) we have 1 s ssosss j kjkj kjjjj x vvcxxx (1.32) Assuming that such an increase of the total production of the commodity j is also possible from the side of other primary factors in this sector, i.e., there exist unem- ployed quantities of the rest primary factors. This means that quantities of all primary factors are accordingly in- creased. Then, when we substitute the latter in the Equa- tion (1.31) we have: x xj n, (1.28) 11dsss s s sd yIAxIAxx ds I AxI Axyy (1.33), 3Where (ds) expresses the fact that these quantities are determined from the supply side. Such notation is used in order not to confuse it with vs– the total required inputs of all primary factors for a certain sector, using for the in p u t -out p ut s y stems in monetar y terms. Copyright © 2011 SciRes. ME  E. DAVAR647 where xs—is the row vector (1*n) all components of which are zero except of the component i (= j) that equal to s j x . So ds s y IA x (1.34). Therefore 11 when dsss o iijiikj kj l yaxav ij ,c (1.35), , when,1,,1,1, , dsss o ijjijkj kj l yaxavc ijiij ijn (1.36). From this we can conclude the following: (1) since aii 1 the final uses of sector i ( ds i, when i = j) is in- creased by y 1 s ii j ax; and (2) since aij (when I j) might be either aij > 0 or aij = 0 the final uses of sector i (ds i, when i j) either is decreased by y s ii j ax or is not changed. Yet, the increase of the final use of the commodity in question cannot be more than its unsatis- fied quantity, that is: 0,when ds d iii yyy ij (1.37). where 0i y —is the maximum quantity of demand of the commodity i. And the decrease of the final uses of the other commodities cannot be more than their quantities of final use, that is ds d i yy i , when (i j) (1.38) Therefore, the largest magnitude of the increase of the primary factor is equal to the smallest magnitude be- tween the increase of final use of the sector in question (see 1.35) and the decrease of final uses of other sectors (see 1.36): 0 1 max min 1; s kj dodo iikjii kj ii j in v y yacijyaci j (1.39) By this the following theorem is proofed: Theorem 2 If matrix A is positive (A 0) and produc- tive (x > xA), and if quantities of all primary factors s j v of a certain sector j are increased by the same rate and primary factors for all other sectors are unchanged, then the final use of the sector in question ds i (i = j) is in- creased and the final uses of other sectors yds i (i j) are either decreased when ay ij > 0 or unchanged when aij = 0 (when i j); and the magnitude of the certain pri- mary factor’s (factors’) increase in a certain sector is limited by the unsatisfied final uses of the secto r in ques- tion and final uses of other sectors (1.39). From the above we conclude that increasing the quan- tit ly quantitative model of ci y of any primary factor for a certain sector, increase the final use of this sector and decrease or don’t change the final uses of all other sectors. To illustrate the suggested supp input-output, let us use Leontief’s simplified input- output model ([14]; see also [15), while making two changes: first, instead of two types of Capital Stocks, only one type is considered; and second, Capital Stocks is measured in monetary terms instead of physical terms: From this Table we can define the direct input coeffi- ents of commodities and primary factors: 1 ˆd AXx 25.020.01 100.00 14.06.001 50.0 0.25 0.4 0.14 0.12 PP P YY Y PP PY YP YY , (1.40) 1 ˆ 250.0$350.0$1 100.00 55.0135.00150.0 2.5$ 7.0$ 0.55 2.7 d CVx P M HMH PY MHPMH Y Y (1.41) where: P-Pounds, Y-Yards, MH-Man- Hou rs. of the sec- onAssuming that the quantity of the final use d commodity is increased (by 10.0 Y) and the quantity of the final use of the first commodity is unchanged and they are equal to (yd1)’= (55.0P 40.0Y); then using (1.1a) we obtain according total output of commodities: 1 111ddd xIAyBy 1.450.662 55.0 0.232 1.24240.0 106.20 62.4.0 PP PY P YPYY Y P Y (1.42). Then 11 265.5.0$ 436.8.0$ ˆ58.4 168.5 dd VCx M HM , H and 11 702.3$ 226.9 dd n vVi M H (1.43). Another assumption is that the available quantities of primary factors are (v0)’ = (800$ 300MH). So, in com- parison to required quantities vd1 and the available quan- tities, we can conclude that this is quantitative equilib- rium and there are unemployed amounts of both primary factors. Yet, by comparing the new matrices of flows of primary factors to sectors Vd1 with according matrix from Copyright © 2011 SciRes. ME  E. DAVAR Copyright © 2011 SciRes. ME 648 assuming that the goal of economics is to achieve ful Table 1, we can also see that each element of the first is larger than the according element of the second, which is according to Theorem 1. This is because, in this case, all inverse input coefficients of commodities and all direct input coefficients of primary input are strictly positive (>0). Now of the second factor it is necessary to increase the first factor, i.e. investment must be increased. Finally, according quantity of final uses is determined by mean of (1.31), namely 0.750.4 129.6 0.14 0.8864.6 71.4 38.8 dss yIAx PP PYP YP YYY P Y (1.49) l employment for both primary factors (the available quantity minus 3% for reserve), this is the new vector of suggested quantities of primary factors will be (vsd1)’ = (776.0$ 281.0MH )’. For the following we need matrix and Vss. The first might be computed on the basis of Ta- ble 1, and it is 0.417 0.583 0.290.71 (1.44) and the second is 776.0$ 776.0$ 281.0 281.0 ss V M HM H (1.45) And 324.0$ 452.0$ 81.0 200 sss VV M HMH (1.46) And, o C the matrix of direct output coefficients of primary factors is 0.4$0.143 $ 11.82 0.37 oPY CC PMH YMH (1.47) Substitute (1.48) and (1.49) into (1.29) we obtain Despite the fact that the total productions are increased in both sectors, (129.6P > 106.2P, and 64.6Y > 62.4Y), the final use of the first sector is increased (71.4P > 55.0P), however, the final use of the second sector is decreased (38.8Y < 40.0Y). These results are according to Theor em 2, because the rate of increase of the first sector is greater than the second sector (0.22 > 0.035) and therefore, the increasing of the final use of the se- cond sector deriving from the in creasing its total produc- tion (0.88 2.4 = 2.1) is less than the decreasing deriv- ing from the increasing of the total produ ction of the first sector (0.14 23.4 = 3.3). While, the increasing of the final use of the first sector deriving from the increasing its total production (0.75 23.4 = 17.55) is greater than the decreasing deriving from the increasing of the total production of the second sector (0.4 2 . 4 = 0. 96 ). 324.0$452.0$0.4$0.143 $ 81.0 2001.820.37 129.6 64.6 147.4 74.0 sss o XVC PY M HMHPMH YMH PY PY (1.48). We can see that the total output differs for pri For the clearly demonstration properties of the Th eo- rem 2, assume that the whole une mployed quan tity of the first factor is used in the second sector, i.e., 12 s v = 526.0$; and therefore, 21212 526.0$ 0.143$ sso x vc Y . Since, the total production of the first sector is un- changed (= 100.0P, see Table 1)), then the according final uses a re: 0.750.4 100.0 0.14 0.8875.2 45.0 52.2 ds s yIAx PP PYP YP YYY P Y various mary factors in both sectors and therefore, using the criterion of choice (1.30) we obtain (that) xs = (129.6 P 64.6 Y). This means that the supply qu antities of the first factor, Capital Stock, is fully employed, while the second factor, Labour, is not fully employed, here is its unem- ployed part. Therefore, in order to increase employment Table 1. Hypothetical input-output in physical term s As Total (1.50) The final use of the first sector is decreased by 10.0P {= (–0.4 25.2) or (45.0P – 55.0P)}, and the fin al use of the second sector is increased 22.2Y {= (0.88 25.2) or (52.2Y – 30.0Y)}. griculture Manufacturing Household Agriculture 100.25.0 Pounds 20.0 Pounds 55.0 Pounds 0 Pounds M 55.0urs 135.urs 40.0 M-Hours 230.urs anufacturing14.0 Yards 6.0 Yards 30.0 Yards 50.0 Yards Capital Stocks 250.0 $ 350.0 $ 600.0 $ Labor Man-Ho0 Man-Hoan0 Man-Ho  E. DAVAR649 3. Supplyntitative E for I- Ine quantities d QuaquilibriumO in Monetary Terms à la Leontief practice it is not always possible to separat and prices with objective and subjective reasons [16]. Hence, the results of economic activities are usually p re- sented in monetary terms. Therefore, almost all existing empirical I-O are compiled in monetary terms since Le- ontief’s first input-output system [1]. Empirical (Marxian-Leontievian) I-O is characterized by “quantity” in monetary terms [17]. This means that in these cases, prices and quantities are not separated and they are amalgamated into one element. Each element is included as quantity and prices. Therefore, empirical I-O has a uniform measurement for all parts: commodities, factors and categories of final uses, namely, money mea- sure. On the one hand, this creates some problems when it’s used for planning and analysis. On the other hand this allows extend ing a scope of analysis by th e formula- tion of additional models. For example, as it was men- tioned above, Ghosh formulated the allocation model which, unfortunately, was labeled into an “output” (sup- ply, supply-driven) model by his followers ([9-12]). It is important to stress that it is impossible to formulate such models for the I-O in physical terms. This is due to the heterogeneous character of both the structure of the use of factors for the production of certain products and the structure of commodities for a certain category of final uses. Moreover, Dietzenbacher [10] has attempted to prove that Ghosh’s allocation model is equivalent to Le- ontief’s price model. But, the recent paper [6] shows that Leontief’s Input-Output system model differs from Gho- sh’s system, therefore they cannot be equivalent. At this point let us start from the demand quantitative equilibrium model in monetary terms, which is identical to quantitative equilibrium for I-O in physical terms and consists of two systems: dd 1 ,or , or dd dd x AxyxI Ay xBy (2.1) , (2.2) All notations, determinations and indexes here are iden quired ary fa as vd. 0 0 ˆ, or ddd nn dd d vVi CxiCxv vCxCByv tical to systems (1.1) and (1.2), except that they are in monetary terms. Here as well as for I-O in physical terms, by means of system (2.1), the total required outputs of commodities are obtained for the given quantities of final uses in the certain conditions for the matrix of the direct input coef- ficients (A); (and) consequently, by the substitution of the obtained required output quantities in the system (2.2) If required quantities are less or equal to the available quantities (vd v0), then there is a quantitative equilib- rium and the price equilibrium might be considered. Conversely, when at least the required quantity for one factor is larger than its available quantity, then the pro- cess must be carried out for the new different quantities for final uses, until the above condition will be satisfied. The demand quantitative model system in monetary terms is widely used in practice, and it's worth while to consider the character of changes of the total required quantities of primary factors due to change of quantities the requantity of primctors are defined of final uses similar to the deman d quantitative model in physical terms (vide supra). To clarify the matter, let's assume that only the quantities of final use for a one of sector (commodity) l is changed (increased) (d l y ), while final uses for other sectors (commodities) stay un- changed. Substitute this in (2.1) as we did in physical input-out put (s ee (1. 5), (1. 6) , (1 .7 )) and we h a ve: ,,1,2,, dd iijl x by jlin (2.3) From (2.3) we can conclude that increasing the final use of commodity of a certain sector either increases the total production of commodities of part of sect according iors when nverse coefficients of inputs is more than zero or doesn't change if according inverse coefficients of inputs equal zero. Therefore, the quantities of primary factors are either increased if direct input coefficients of primary factors are more than zero (ckj > 0) or unchanged if direct input coefficients of primary factors are equal to zero (ckj = 0) in sectors where the total production is in- creased. In addition, input-output in monetary terms in the equilibrium state is characterized by the balance between the total value added for all sectors and the total final uses for all sectors too ([18]; [5]): 11 nn s d j i ji vy (2.4) This is also true for the particular case which is dis- cussed. Changes (increasing) of valu tors (all primary factors used in each eq e added in all sec- sector) must be ual to the change in the final use of the sector in ques- tion, that is: 111 nm n ssd kjjij jkj vvy (2.5) If we take into account (2.5), we can conclude that in- creasing the final use in the sector in question ally more than increasing of value added in this s is gener- ector. By this we proved the following theorem: Theorem 3 If matrix A is positive (A 0) and produc- tive (x > xA), and if quantities of final use of a certain Copyright © 2011 SciRes. ME  E. DAVAR 650 - to ary factors ar sec m indicates that in- creasing of quantities in the final use of com certain sector, increases required quantities n, an increase of th sical terms and consists in the following sy sector d l y is increased and final uses for all other sec rs are unchanged, then th e quantities of prim e either increased if direct input coefficients are more than zero (ckj > 0) or unchanged if they are equal zero (ckj = 0) in tors where the total production was increased; and the magnitude of the in crease of final use of a certain sector (commodity) is limited by the unemployed supply quantities of primary factors; also the derived increase of value added of the sector in question is less than the in- crease of the final use in this sector 1 smsd jkkj ij vvy (2.6) if at least one of ckj > 0 when ( j i). Similar to Theorem 1, this theoremodity of a of primary factors almost in all sectors; in additio e total required quantities of primary factors for the sector in question is less than the in crease of the final use in this sector. On the basis of the above, we can also conclude that the supply quantitative equilibrium for I-O in money terms is identical to the supply quantitative equilibrium for I-O in phy stems: s sso X VC, (2.7) min,1,2, , sj skj 1km x xj n (2.8) ds yIA s x (2.9) where Vs, Co, A—are gi ven. All notations and determinations here are identical to systems (1.29), (1.30) and (1.31), except th monetary terms. es matrix of possible total pr (V) and matrix of direct output coef- fic t. In th d properties (see Theorem 2) for the la at they are in The Equation (2.7) defin oduction of commodities for each primary factor by ordinary multiplication matrix of the flows of primary factors to branchess ients of primary factors (C0). Here, there might be m different total quantity of commodity for a certain com- modity. Consequently, the Equation system (2.8) allows us to choose one total quantity so that it might be poss- ible from the point of all primary factors. Finally, the equation (2.9) allows us to obtain the final uses of com- modities for choosing total quantities of production. The character of changes of the total quantities of final uses for the supply qu antitative model in mo netary terms has additional economic sense because of the homoge- neity of measurement of the monetary input-outpu is case, the value of different primary factors used for a certain branch and the value of different commodities demanded for a certain category of final uses might be summarized. Because the supply quantitative equilibrium for I-O in money terms is identical to the supply quantitative equi- librium for I-O in physical terms we can conclude that the above considere tter have to be correct also for the former in the same framework. We see that increasing the quantity of any primary factor for a certain sector increase the final use of this sector and decrease or don’t change the final uses of all other sectors: 1,when ds s iijj yax ij (2.10) , ds s iijj yax when,1, 2,,1,1,, ij iijijn (2.11) These changes are derived from the changes (increases) of primary factors for branch j. Because of the bala between the total value add ed for all sectors and t final uses for all sectors (2.4), changes (increasing) of va into account (2.12), we can conclude that increasing of final use in the sector in question deriving from the increasing of value added in this sector erally more than the latter. By this we proved the fol- lo nce he total lue added in one sector (all primary factors used in this sector) must be equal to changes in final uses of all sec- tors, that is: 111 mnn ssds dsds kj ji ij ij kii vvy yyy (2.12) If we take is gen- wing theorem: Theorem 4 If matrix A is positive (A 0) and produc- tive (x > xA), and if quantities of all primary factors s kj v of a certain sector j is increased by the same rate, and primary factors for all other sectors are unchanged, t th hen e final use of the sector in question ds i y (i = j) is in- creased and the final uses of other sectors ds i y (I either decreased when aij > 0 or unchang ed when aij = 0; and therefore, the derived increase of the final use of the sector in question is more than the increase of value added in this sector ,when sds ji vy ij j) (2.13) if at least one of aij > 0 (i j); and the magnitude of the certain primary factor’s (factors’) increase in a certain sector is limited by the unsatisfied final use in question and final uses of other sectors. ectors; and, in ad of primary factors for the sector. s of the sector Here also, similar to Theorem 2, the increase of the quantity of any primary factor for a certain sector, in- creases the final use of this sector and decreases or doesn’t change the final uses of all other s dition, derived increase of the final use in this sector in question is more than the increase of the total quantities Copyright © 2011 SciRes. ME  E. DAVAR Copyright © 2011 SciRes. ME 651 the direct input coef- fic The properties of Theorem s 3 and 4 might be illus- trated by means of hypothetical input-output in monetary terms (for example $, which do not appear in the Table 2): From the Table 2 we can define ients of commodities (A) and primary factors (C) and consequently Leontief’s inverse coefficients (B) and output coefficient s o f primary factors (Co): 1 ˆ 85.068.01 340.00 120.052.001 425.0 d AXx (2.14) 0.25 0.16 0.353 0.122 1 ˆ 25.035.01 340.00 110.0270.001 425.0 0.0740.082 0.323 0.636 d CVx (2.15) and 11.458 0.266 0.586 1.246 BIA (2.16) 13.5 12.2 13.1 1.6 o CC (2.17). Firstly, let us consider Theorem 3. For this purpose, assume that the final use of sector 2 is increased by 85.0 $ (y2 = 85.0$); then the total production of sector 1 is increased by 22.6 $ (x1 = b12 y2 = 22.6$), and of sector 2 is in creased by 105.9 $ (x2 = b22 y (2.19) So, 12 1.65 8.66 11 7.367.35 8.95 76.01 sss vvv 2 s v = 76.01$ and it is less than y2 = 85.0$, what is acco to the Theorem 3. It is worthy to stress that the total amount of increasing of value added in both sectors is equal to the amount of increasing of the final use of the second sector (= 85.0$). Now, assume that the quantity of the first primary fa rding ctor for the second sector is in creased by 8.66$ (12 s v = 8.66$); then the total output of the sector 2 is incrd by (21212 12.2 8.66$105.7$ os xcv ), similar to the previo tal output of the first sector is not changed. From this for the final uses we have ease us example ( 105.9). While the to 12 0.750.16 016.9 0.353 0.878105.792.7 dsds dsd yyyIAx let’s 0.266 85.0 = 2 = 1.246 85.0 = 105.9$). From this increasing of value added would be 0.074 0.08222.601.658.66 0.323 0.6360105.97.367.35 V (2.18) And (2.20) So, the final use of the second sector is increased by 92 Table 2. Hypothetical put-o Agriculture ManufacturIntermediate Total Output Final Uses yd Total Output xd .7$, which is more than the total increase of the value added of this sector 75.8$, which is according to Theo- rem 4. At the same time the final use of the first sector is decreased by 16.9$. But, the total increase of final uses in both sectors (92.7$ – 16.9$ = 75.8$) is equal to the total increase of value added in the second sector. It is interesting to note that despite the fact that in both cases the total valued added of the second sector was increased in the same magnitude (75.8$), the final use of th is sector increased by different magnitudes. This is due to the fact that in the second case only the total production of the second sector was changed (increased), while in the first case the total production of both sectors was changed (increased). Therefore, in order to the final uses of the first sector is not changed it is necessary to increase its production in the magnitude which cover (equal) requirement to pro- duce additional quantity of the second sector and the first sector itself. Namely, the input of the first primary factor utput in monetary terms in ing Agriculture 85.0 68.0 153.0 187.0 340.0 Manufacturing 120.0 253.0 425.0 Intermediate Total Inpu t Capital Stocks 270. s Total Input x340.0 425.0 52.0 172.0 205.0 120.0 325.0 440.0 765.0 25.0 35.0 60.0 Labour 110.0 0 380.0 Total value added v s 135.0 305.0 440.0  E. DAVAR 652 of thust be ined by 1.65$, terna- tively, the input of the secoary factorrst secased byth cases oduc- tion ofcry 22.6$ (1 1.65$ 22.3 7.3$= 22.6$) spectively. Then, the qu 4. Conclusions demand quantitative tief. The supply quantitative m output coefficients of primary fac- increafinal use of a certa sector, derivingrom the increasing of the value added of the sector in question, is greate the increase of total value add sector ahe magnitude of the increase of a certain primary factor (factors) in a certain sector is liited by e first sector mcreasor, al nd prim of the fi tor must be incre 7.3$. Bothe pr the first sector is in 4, or 3.1 eased b . 3.5 =To complete the demonstration of the above men- tioned statement that the supply quantitative model à la Leontief is equivalent to the demand quantitative model of Leontief assume that the value added of both sectors are increased by 8.95$ and 76.0$ re antity of the first sector is increased by 22.6$ (2.52 8.95$ = 22.6$) and the quantity of the second sector is increased by 105.8$ (1.393 76.0$= 105.8$). Finally, the final uses of sectors will be increased 0.750.1622.60 0.353 0.878105.785.0 . which are identical with the results of the demand quan- titative model (vide supra). This paper examines the supply quantitative model sys- tem of input–output for both physical and monetary rms, which is equivalent to the te model system of Leon based on the direct odel is tors which are the inversion of the direct inputs coeffi- cients. This paper also took into consideration the properties of both demand and supply quantitative system models. It was shown that: (1) the increase of the final use of a certain sector generally increases required (demand) qu- antities of primary factors for all sectors and magnitude of the increase of final use of a certain sector (commo- dity) is limited by the unemployed supply quantities of primary factors in the quantitative demand model system in physical terms (see Theorem 1); (2) the increase of the primary factors of a certain sector increases final use of this sector and generally decreases final uses of the rest sectors and the magnitude of the increase of a certain primary factor (factors) in a certain sector is limited by the unsatisfied final uses of the sector in question and by the final uses of other sectors in the quantitative supply model system in physical terms (see Theorem 2); (3) in the quantitative demand model in monetary terms the increase of the total value added of a certain sector, de- riving from the increasing quantity of final use of the sector in question, is generally less than the latter and magnitude of the increase of final use of a certain sector (commodity) is limited by the unemployed supply quan- tities of primary factors (see Theorem 3); and (4) in the quantitative supply model system in monetary terms the the unsatisfied final uses of the sector in question and by the final uses of other sectors (see Theorem 4). Finally, the quantitative supply system models might be useful tools in planning the economics of countries that have higher unemployment of primary factors, espe- cially labour. 5. References [1] W. Leontief, “Quantitative Input and Output Relations in the Economic System of the United States,” The Review of Economic Statistics, Vol. 18, 1936, pp. 105-125. se of in f r thanhe ted of this nd tm doi:org/10.2307/1927837 [2] W. Leontief, “The Structure of American Economy,” 1919-1929. Cambridge, (Mors): Harvard University Press, Second Edition 1951, Oxford University Press, New York, 1941. [3] R. Stone, “Input-Output and National Accounts,” Ran- . and P. G. Clark, “Interindustry Econom- ics,” John Wiley& Sons, New York, 1959. hot, dom House, Paris, DECD, 1961 4] H. B. Chenery[ [5] E. Davar, “The Renewal of Classical General Equilibrium Theory and Complete Input-Output System Models,” Hong Kong, Singapore, Sydney, Avebury, Alders Brookfield USA, 1994. [6] E. Davar, ‘Input-Output System Models: Leontief versus Ghosh’, 13th International Conference on Input-Output Techniques,” 27 June - 1 July’ Beijing, China, 2005. [7] A. Ghosh, “Input-output Approach in an Allocation Sys- tem,” Economica, Vol. 25, 1958, pp. 58-64. [8] A. Ghosh, “Experiments with Input-Output Models,” At the University Press, Cambridge, 1964. [9] M. Augustinovics, ‘Methods of International and In- tertemporal Composition of Structure,” Contributions to Input-Output Analysis, Vol. I, North-Holland, London, 1970. [10] E. Dietzenbacher, ‘In Vindication of the Ghosh Model: A Reinterpretation as a Price Model,” Journal of Regional Science, Vol. 37, No. 4, 1997, pp. 629-651. doi:org/10.1111/0022-4146.00073 [11] J. Oosterhaven, “On the Plausibility of the Supply- Driven Model,” Journal of Regional Science, Vol. 28, No. 208.x 2, 1988, pp. 203-217. doi:org /10.1111/j.1467-9787.1988.tb01 esnard, “Is the Ghosh Model Interesting?” Jour- [12] J. Oosterhaven, “Leontief versus Ghoshian Price and Quantity Models,” Southern Economic Journal, Vol. 62, 1996, pp. 750-759. [13] L. de M nal of Regional Science, Vol. 49, No 2, 2009, pp. 361-372. Copyright © 2011 SciRes. ME  E. DAVAR653 , Wages, and Economy hoice of Technology,” Scien [14] W. Leontief, ‘Technological Change, Prices Rates of Return on Capital in the USA ,” In- put-Output Economics, Second Edition, Oxford Univer- sity Press, New York, 1986. [15] W. Leontief, “The C American, Vol. 252, No. 6, pp. 25-33, 1985. tific doi:org/10.1038/scientificamerican0685-37 [16] E. Davar, “Input-Output in Mixed Measurements,” 13th International Conference on Input-Output Techniques , 2000. w-Hill, New Equilibrium,” Eco- , no 21-25 August, Macerate, Italy [17] R. Dorfman, “Samuelson, P. and R. Solow: Linear Pro- gramming and Economic Analysis,” McGra York, 1958. [18] W. Leontief, “Input-Output Economics,” Oxford UP, New York, 1966. [19] E. Davar, “Input-Output and General mic Systems Research, Vol. 1, No. 3, pp. 331-343, 1989. Copyright © 2011 SciRes. ME |