Journal of Mathematical Finance

Vol.05 No.02(2015), Article ID:55496,2 pages

10.4236/jmf.2015.52010

On Historical Value at Risk under Distribution Uncertainty

Atsushi Iizuka1, Yumiharu Nakano2

1Informatix Inc., Kanagawa, Japan

2Tokyo Institute of Technology, Tokyo, Japan

Email: senkonoshine@yahoo.co.jp, nakano.y.ai@m.titech.ac.jp

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 11 February 2015; accepted 7 April 2015; published 10 April 2015

ABSTRACT

We investigate the asymptotics of the historical value-at-risk under capacities defined by sublinear expectations. By generalizing Glivenko-Cantelli lemma, we show that the historical value-at- risk eventually lies between the upper and lower value-at-risks quasi surely.

Keywords:

Value-at-Risk, Sublinear Expectation, Capacities, Glivenko-Cantelli Lemma

1. Introduction

In financial industry, the value-at-risk has been one of main tools for risk management (see, e.g., McNeil et al. [1] , and Föllmer and Schied [2] ). In this framework, the random variables for assets or asset returns are assumed to have distributions without uncertainty. In other words, it is implicitly assumed that there are true asset distributions and the estimation difficulty comes from our limited capability. However, it should be remarked that there is a possibility that the assets have the distribution uncertainty, i.e., the assets may have Knightian uncertainty (see Knight [3] ).

To capture the distribution uncertainty, the theory of sublinear expectation is introduced and developed (see Peng [4] [5] and the references therein). In this theory, the term probability is replaced by the ones of the upper and lower capacities induced by the upper and lower expectations, respectively, and the distribution uncertainty is described by the gap between the upper and lower expectations.

In this paper, we consider the value-at-risk type risk measure under the sublinear expectation, where the reference probability measure in the classical framework is replaced by the upper and lower capacities. We call these the upper and lower value-at-risk, respectively. Our aim is to study the asymptotic behavior of the historical value-at-risk under uncertainty. In doing so, we prove a generalization of Glivenko-Cantelli lemma under uncertainty, and then show that the historical value-at-risk eventually lies in between the upper and lower value- at-risks quasi surely.

This paper is organized as follows: In Section 2, we recall the theory of sublinear expectation. Section 3 is devoted to the statement of the main results and its proofs.

2. Sublinear Expectation and Capacities

In this section, we recall the basis of the sublinear expectation, introduced by Peng [4] . Let Ω be a given set and  a linear space of

a linear space of  -valued functions on Ω. We assume that

-valued functions on Ω. We assume that  whenever

whenever  and

and  is a bounded function on

is a bounded function on  or

or  where

where  denotes the linear space of functions

denotes the linear space of functions  on

on  satisfying

satisfying

for some  and

and  depending on

depending on . We call an element in

. We call an element in  a random variable.

a random variable.

We consider a sublinear expectation , in the sense of [4] . Namely, E is assumed to be satisfy the following conditions: for any

, in the sense of [4] . Namely, E is assumed to be satisfy the following conditions: for any

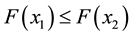

1) Monotonicity: if

2) Constant preserving:

3) Subadditivity:

4) Positive homogeneity:

Moreover, we assume that

where

define capacities, where 1A denotes the indicator function of a set A. That is, each

1)

2) If

We refer to Denenberg [6] for the theory of capacities. Throughout this paper, we assume that each

3) If

4) If

Let us recall several concepts in the sublinear expectation theory. The random variable

We say that

A sequence

Then if

3. Main Resutls

For any

Proposition 3.1 Let

1)

2)

3)

Proof. The assertion (1) follows from the monotonicity of

To prove (2), take

Similarly,

Finally, by an argument similar to the proof of (2) with

The proposition above justifies the following definition:

Definition 3.2 For a random variable X, we call the function

For an IID sequence

If

Indeed,

We show a stronger result, which is a generalization of Glivenko-Cantelli lemma.

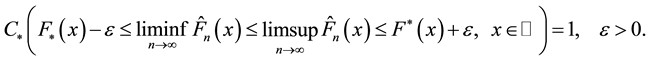

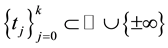

Theorem 3.3 Let

the upper and lower cumulative distribution functions of X respectively, and denote by

We need the following lemma for the proof of the theorem.

Lemma 3.4 Under the assumtions imposed in Theorem 3.3, for

where

Proof. Let

By this recursion, we can find

With the help of Lemma 3.4, we can show Theorem 3.3.

Proof of Theorem 3.3. Let

By (2), we have,

Thus,

where for

So we have

Now, for any

so

Therefore, on

If we write

meaning the assertion of the theorem. □

Recall that for a function

Then we have the following:

Theorem 3.5 Let

Suppose that for

Then, the historical value-at-risk eventually lies in between the upper and lower value-at-risk, i.e.,

Proof. Consider the event A defined by

In view of Theorem 3.3, it suffices to show that for a given

To this end, fix

Thus we can take

Next, take

and set

So we have

leading to

References

- McNeil, A. J., Frey, R. and Embrechts, P. (2005) Quantitative Risk Management: Concepts, Techniques and Tools. Princeton University Press, Princeton.

- Föllmer, H. and Schied, A. (2004) Stochastic Finance: An Introduction in Discrete Time. 2nd Edition, Walter de Gruyter, Berlin. http://dx.doi.org/10.1515/9783110212075

- Knight, F.H. (1921) Risk, Uncertainty, and Profit. Houghton Mifflin, Boston.

- Peng, S. (2006) G-Expectation, G-Brownian Motion and Related Stochastic Calculus of Itô’s type, In: Benth, F.E., et al., Eds., Stochastic Analysis and Applications: The Abel Symposium 2005, Springer-Verlag, Berlin, 541-567.

- Peng, S. (2010) Nonlinear Expectations and Stochastic Calculus under Uncertainty. arXiv:1002.4546[math.PR]

- Denneberg, D. (1994) Non-Additive Measure and Integral. Kluwer Academic Publishers, Dordrecht. http://dx.doi.org/10.1007/978-94-017-2434-0

- Chen, Z. (2010) Strong Laws of Large Numbers for Capacities. arXiv:1006.0749[math.PR]