The Pricing of Dual-Expiry Exotics with Mean Reversion and Jumps ()

1. Introduction

Dual-expiry option is a class of exotic options that depends on a single underlying asset but whose payoff structure involves two fixed future dates. Usually, at the first expiry date, the option holder receives a contract that matures at the second expiry date. Chooser options, compound options, extendable options, shout options, American call options on an asset with a single known dividend payment and partial barrier options are good examples. The dual-expiry exotics can be easily generalized to multiple-expiry options, whose payoff structure involves several fixed future dates. Examples include ladder options, multiple shout options, Bermudan options, multiple extendable options and barrier options with discrete monitoring.

[1] develops a new technique for pricing dual-expiry exotic options by assuming the underlying asset price dynamics follows continuous geometric Brownian motion. The method exploits the observation that dual expiry options have payoffs that can be perfectly replicated by a particular set of first and second order binary options. Hence, in order to avoid arbitrage, the exotic option prices are obtained by static replication with respect to this family of binaries. As pointed out by [1] , the representation of prices in terms of binaries is quite general and does not depend on any particular underlying asset price dynamics. In the Black-Scholes (BS) framework, [2] extends the method of [1] for pricing multiple-expiry options using a concept of higher order binary options. [3] [4] generalize [1] for dual- and multiple-expiry exotics to a Lévy environment. The binary option prices are derived using the mathematical methodology of [5] that employs the pseudo-differential operators whose symbol is expressed in terms of the characteristic exponent of the underly Lévy process. [6] further generalizes method of [1] to exotics with multiple-asset and multiple-expiry.

In this paper, we present a new class of models for pricing dual-expiry exotic options. We assume the underlying asset price is an exponential function of OU process subject to stochastic time change. The time change process is modeled by a Lévy subordinator. The resulting asset price then exhibits mean reversion and jumps.

We generalize the works of [1] [2] [3] [4] in two directions. In the previous works, the mean reversion is absent in the underlying asset price dynamics. As a result, these models are restricted to the dual-expiry exotics written on equities. On the other hand, the empirical evidence on mean reversion in financial asset is abundant. There is a census that many underlying assets of exotic option contracts, such as currencies, commodities, energy, temperature and even some stocks, display mean reversion. Our models are built on the OU process and can therefore be applied to a wider range of asset classes.

Time-changing a continuous time Markov process such as OU process can lead to a much wider class of models than classical jump-diffusion models. In the typical jump-diffusion models, such as [3] [4] , the state-independent jumps are added to the diffusion process. In these models, upon arrival, the direction of the jump and the probability distribution of jump amplitude are independent of the current state of the process. Through Lévy subordination of OU process, our model, in contrast, can feature state-dependent mean reverting jumps with the jump direction and the jump amplitude dependent on the current state of the process. The subordinate OU process is found to be a better candidate for modeling phenomena where jumps depend on the state, such as mean-reverting jumps. See its successful applications for callable and putable bonds in [7] , commodities in [8] , electricity in [9] and variance swaps in [10] . We also refer to [11] for a brief introduction of subordinate Markov processes and [12] [13] [14] [15] for their further applications.

To solve the dual-expiry exotics pricing problems, we extend the works of [1] to the case where the asset price follows the mean reverting process with jumps. We are able to derive the analytical pricing formulas for first and second order binary options using eigenfunction expansion method. After that, we apply them to pricing of some dual-expiry exotics such as chooser options, compound options and extendable options by static replication. We need to emphasize that eigenfunction expansion method is particularly suitable for pricing contingent claims written on the subordinate processes. The subordinate process is as analytically tractable as the original process without time change. The subordinate process shares the same eigenfunctions with the original one and the only modification is the replacement of eigenvalues of the original process with the Laplace transform of the eigenvalues. To the best of our knowledge, this is the first piece of work that applies this method for pricing dual-expiry options and it can be extended with little effort to the case of multiple-expiry exotics. We refer to [11] [16] for the surveys on the eigenfunction expansion method and [7] [8] [9] [10] [12] [13] [14] [15] for its various applications.

The rest of the paper is organized as follows. In Section 2, we introduce the general framework for modeling asset price as a time changed exponential OU process, where the time change process is modeled by the Lévy subordinators. In Section 3, we introduce the eigenfunction expansion method for our new model and also discuss how to calculate some important integrals that are essential for the determination of the eigenfunction expansion coefficients. In Section 4, we apply the eigenfunction expansion method to the valuation of first and second order binary options. We provide the analytical formulas for these binaries. In Section 5, we express the payoffs of some dual-expiry options in terms of binary options and then demonstrate how to valuate these options by static replication. We also implement the model and analyze the effect of parameters of the model on the selected option prices through specific numerical examples.

2. The Model Framework

Let

be a probability space with an information filtration (

). Suppose under the risk neutral measure Q, the asset price process S is governed by a time-changed exponential OU process, that is,

(1)

where

(2)

where

is a time change process and

is an OU process

(3)

where

and

is a standard Brownian motion.

To introduce jumps into the asset price dynamics, we will follow [7] - [15] and model the time change process T as a Lévy subordinator. The Lévy subordinator

is a nondecreasing process with positive jumps and non-negative drift with the Laplace transform:

(4)

where

is the Lévy exponent and given by the Lévy-Khintchine formula (see e.g., [17] )

(5)

where

and the Lévy measure

must satisfy

To make sure that the expectation in (4) is finite for

,we also impose the following restriction

An important sub-class of Lévy subordinators are the tempered stable subordinators. For such subordinators, the Lévy measure

is given by

where

and

. Important special cases are the Gamma subordinator

with

,the IG subordinator with

and the compound Poisson

subordinator with

and

. For such subordinators, the Lévy exponent is given by

We can also reparameterize the exponent by setting

where

and

.

According to [11] , when the process X is time changed by a Lévy subordinator T, the resulting process Y will be a jump-diffusion process with mean-reverting diffusion drift and mean-reverting jumps if

or a pure jump process with mean-reverting jumps if

.

3. Eigenfunction Expansion Method

For the OU process X in (3), its infinitesimal generator

is defined by

(6)

where f is transformation function.

and

are first- and second-order derivatives of f, respectively.

Let

denote the space of functions on

square integrable with the speed measure

and endowed with the inner product

,where

(7)

and

(8)

Then, for any

,we have (see e.g., [11] )

(9)

where

,

are the eigenvalues of

and

are the corresponding eigenfunctions satisfying the following Sturm-Liouville equation

For the OU process X defined in (3), its eigenvalues and eigenfunctions can be summarized in the following result (see e.g., [11] ):

Proposition 1 For the OU process X defined in (3), the eigenvalues

and eigenfunction

,

,are

(10)

and

(11)

where

,

and

is the Hermite polynomial defined as

For the time changed OU process Y defined in (2), for any

,we can also employ the eigenfunction expansion method to compute the following expectation (see e.g., [8] ):

(12)

where

and

are the eigenvalues and eigenfunctions of OU process and can be obtained from (10) and (11), respectively.

is the Lévy exponent for the time change process T.

It is clear that the eigenfunction expansion of Y has the same form as X, but with

replaced by

. Thus, the eigenfunction expansion method makes the time changed model as tractable as the original model. This important result explains why eigenfunction expansion method is the natural way of computing option prices for the time-changed processes.

For our new pricing model, the eigenvalues and eigenfunctions of OU process can be calculated easily from Proposition 1. To employ the eigenfunction expansion method to calculate the dual-expiry exotics prices, we still need to obtain the eigenfunction expansion coefficient

. In this section, we provide the formulas for several integrals that will later be employed to calculate

.

The following formulas can be found in [18] :

Lemma 1

1) For

,

(13)

2)

(14)

3)

(15)

The following integrals can be computed using the results of [7] :

Lemma 2

1) Define

(16)

Then,

can be computed recursively as follows:

where

is the error function defined by

and for

,

2)

(17)

where

is the CDF of standard normal distribution.

3) Define

(18)

Then,

can be calculated recursively as follows:

and for

,

4. Valuation of First and Second Order Binaries

Following [1] , we define the first order up (or down) binary option as the option that delivers an agreed payoff on expiry date if the price of underlying asset is above (or below) a fixed exercise price and zero otherwise. Let Y be the time changed OU process defined in (2). Let

be sign indicators for the up and down binaries, respectively. Let

denote the time t value of binaries with payoff function

at time

,

,conditioning on

,that is,

Clearly, the up and down binaries satisfy the parity relation

We also denote three specific options as follows.

・

is the asset binary with

.

・

is the bond binary with

.

・

is the Q-option with

.

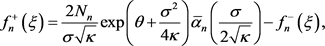

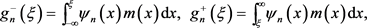

In the following theorem, we can derive the analytical formulas for the above three option prices.

Proposition 2 Assume the processes for the underlying asset price are given by (1)-(3). Let T be a Lévy subordinator with Lévy exponent

. Then,

1)

(19)

where

and

are in (10) and (11), respectively. Furthermore,

(20)

(20)

and

(21)

(21)

where  and

and  can be calculated using Lemma 1 and Lemma 2, respectively.

can be calculated using Lemma 1 and Lemma 2, respectively.

2)

(22)

(22)

where

(23)

(23)

and

(24)

(24)

where  and

and  can be calculated using Lemma 1 and Lemma 2, respectively.

can be calculated using Lemma 1 and Lemma 2, respectively.

3)

(25)

(25)

Proof. To prove 1), using eigenfunction expansion, we have

where

where the equality in the last line comes from Lemma 2.

For ,using Lemma 1, we obtain

,using Lemma 1, we obtain

The proof for 2) is similar to 1). The only differences are that we need to compute

which can both be analytically solved using Lemma 1 and Lemma 2.

3) can be obtained using the definition of Q-options.

We also define the second order binary option as an expiry  binary contract on an underlying expiry

binary contract on an underlying expiry  binary option,

binary option, . Let

. Let ![]() denote a first order binary,

denote a first order binary, ![]() be up-down indicators at times

be up-down indicators at times ![]() and

and![]() ,respectively and

,respectively and ![]() be their corresponding exercise prices. The time t value of the second order binaries, conditioning on

be their corresponding exercise prices. The time t value of the second order binaries, conditioning on![]() ,is given by

,is given by

![]()

It is clear that the following up-down parity relation exists:

![]()

Depending on if the first order binary is an asset binary, a bond binary or a Q-option, we can define the corresponding second order binaries. We derive the analytical formulas for the second order binaries in the following theorem.

Proposition 3. Assume the processes for the underlying asset price are given by (1)-(3). Let T be a Lévy subordinator with Lévy exponent![]() . Then,

. Then,

1)

![]() (26)

(26)

where functions ![]() is given in Proposition 2 and

is given in Proposition 2 and ![]() and

and ![]() are in (10) and (11), respectively. Furthermore,

are in (10) and (11), respectively. Furthermore,

![]() (27)

(27)

and

![]() (28)

(28)

where ![]() and

and ![]() can be calculated using Lemma 1 and Lemma 2, respectively.

can be calculated using Lemma 1 and Lemma 2, respectively.

2)

![]() (29)

(29)

where ![]() is given in Proposition 2.

is given in Proposition 2.

3)

![]() (30)

(30)

Proof. It suffices to prove 1). Using eigenfunction expansion and iterated conditional expectation, we have

![]()

![]()

where

![]()

and

![]()

5. Examples

Once we obtain the analytical formulas for the first and second order binary options, we can apply the theoretical framework for pricing dual-expiry options developed by [1] . We can express the payoffs of dual-expiry exotics in terms of a portfolio of elementary binary options. According to the principle of static replication, if the payoff of a European style derivative can be expressed as a portfolio of elementary contacts, then the arbitrary free price of the derivative is the present value of this portfolio. Hereby, we utilize the results of the previous section to the pricing of some dual-expiry exotics.

5.1. Chooser Options

These exotics give the holder at time![]() ,the choice of either a European call option of strike

,the choice of either a European call option of strike ![]() and expiry

and expiry![]() ,or a European put option of strike

,or a European put option of strike ![]() and expiry

and expiry![]() . The payoff at time

. The payoff at time![]() ,conditioning on

,conditioning on![]() ,is therefore

,is therefore

![]()

where C and P are the call and put options, respectively. And ![]() and

and![]() .

.

We can calculate time t value of chooser options from the following result.

Lemma 3 Assume the processes for the underlying asset price are given by (1)-(3). Let T be a Lévy subordinator with Lévy exponent![]() . Then, the time t value of chooser option, conditioning on

. Then, the time t value of chooser option, conditioning on![]() ,is

,is

![]() (31)

(31)

where d is the unique solution of

![]() (32)

(32)

Proof. Since the call option function ![]() is a monotonic increasing function of

is a monotonic increasing function of ![]() and the put option function

and the put option function ![]() is a monotonic decreasing function of

is a monotonic decreasing function of![]() ,we will have a unique solution d to (32). Then the value of chooser option at time t is given by

,we will have a unique solution d to (32). Then the value of chooser option at time t is given by

![]()

5.2. Compound Options

For these exotics, the underlying are options. There are four basic types of compound options, generally referred to as call-on-call, call-on-put, put-on-all and put-on-put options. At time![]() ,the holder of a compound option has the right to buy (or sell) a standard European call (or put) option with strike price

,the holder of a compound option has the right to buy (or sell) a standard European call (or put) option with strike price ![]() and expiry

and expiry ![]() for price

for price![]() . Let

. Let ![]() for call or put at time

for call or put at time ![]() and

and![]() . Then the time t value of a

. Then the time t value of a ![]() -compound option can be obtained from the following result.

-compound option can be obtained from the following result.

Lemma 4 Assume the processes for the underlying asset price are given by (1)-(3). Let T be a Lévy subordinator with Lévy exponent![]() . Then, the time t value of compound option, conditioning on

. Then, the time t value of compound option, conditioning on![]() ,is

,is

![]() (33)

(33)

where![]() ,

,![]() and

and ![]() is the unique solution of

is the unique solution of

![]() (34)

(34)

Proof. Since the function ![]() is a monotonic increasing (decreasing) function of y when

is a monotonic increasing (decreasing) function of y when ![]() (

(![]() ), the solution

), the solution ![]() to (34) will be unique. The value of compound option at time t is given by

to (34) will be unique. The value of compound option at time t is given by

![]()

5.3. Extendable Options

These exotics allow expiry date to be extended to a future date for a fee with a different strike price at the extended expiry. The holder of an expendable call option has the right at time ![]() to exercise a standard European call option with strike price

to exercise a standard European call option with strike price![]() ; or for premium p, to extend the expiry date to time

; or for premium p, to extend the expiry date to time ![]() and change the strike from

and change the strike from ![]() to

to![]() . The time t value of an extendable option can be obtained using the following result.

. The time t value of an extendable option can be obtained using the following result.

Lemma 5. Assume the processes for the underlying asset price are given by (1)-(3). Let T be a Lévy subordinator with Lévy exponent![]() . Then the time t value of extendable option, conditioning on

. Then the time t value of extendable option, conditioning on![]() ,is

,is

![]() (35)

(35)

where ![]() and

and ![]() and

and ![]() are the solutions of

are the solutions of

![]() (36)

(36)

and

![]() (37)

(37)

Proof. Assume that the ![]() and

and ![]() are the unique solutions to (36) and (37), respectively. Then the value of extendable option at time

are the unique solutions to (36) and (37), respectively. Then the value of extendable option at time ![]() is given by

is given by

![]()

![]()

5.4. Numerical Analysis

In this section, we numerically study chooser, compound and extendable options based on a specific time-changed process. We assume the time change process T is a Gamma subordinator with the Lévy exponent

![]()

To calculate the prices for dual exotics, we need to truncate the eigenfunction expansion after a finite number of terms. Following [14] , we truncate the infinite series when a given error tolerance level is reached. In practice, we find the convergence of the expansion is rather fast.

In Figures 1-3, we perform some sensitivity tests to demonstrate how sensitive the selected dual-expiry exotics are to the changes in the key parameters in the model. We can summarize the findings as follows:

・ The option prices decrease with the mean reverting parameter ![]() for chooser and compound options, but increase for extendable options.

for chooser and compound options, but increase for extendable options.

![]()

Figure 1. Sensitivities of chooser option prices to the parameters of the model. The parameters in the base case are![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() and

and![]() .

.

・ The option prices are decreasing function of long-run mean parameter ![]() for chooser options but increasing for compound and extendable options.

for chooser options but increasing for compound and extendable options.

・ The option prices are monotonically increasing with asset variance parameter ![]() for compound options, whereas the relationship between option prices and variance is U-shaped for both chooser and extendable options.

for compound options, whereas the relationship between option prices and variance is U-shaped for both chooser and extendable options.

・ The option prices increase with the mean of Gamma subordinator ![]() for both compound and extendable options but decrease for chooser options.

for both compound and extendable options but decrease for chooser options.

We note that the sensitivities of option prices to the model parameters depend on the option types. This is plausible for two reasons. First, different types of exotics respond differently with respect to the changes in the parameters. Second, the existence of mean reversion together with Lévy subordination can produce complex price dynamics. For example, when the mean reversion speed increases, the conditional mean of asset price will increase/decrease depending on if spot price is below/above the long-term mean, whereas there is no clear-cut relation

![]()

Figure 2. Sensitivities of compound option prices to the parameters of the model. The parameters in the base case are![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() and

and![]() .

.

![]()

Figure 3. Sensitivities of extendable option prices to the parameters of the model. The parameters in the base case are![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() ,

,![]() and

and![]() .

.

between conditional variance and mean reversion speed. The subordination complicates the issue further. Therefore, it is not surprising to find the impacts of model parameters differ across the option types.

6. Conclusion

This paper studies a new class of models for pricing dual-expiry exotic options. The underlying asset price is modeled as exponential function of OU process time changed by a Lévy subordinator. The resulting asset price can display both mean reversion and jumps often observed in a large range of underlying assets of exotic option contracts. We employ the method of [1] to decompose the exotic option prices into a portfolio of first and second order binaries. We are able to employ the eigenfunction expansion technique to derive the analytical pricing formulas for the binaries. After that, we can compute dual-expiry exotics option prices by static replication. We also implement the model and analyze the effect of parameters of the model on some examples of exotics through specific numerical examples. We need to emphasize our techniques can be extended with minor changes when pricing multiple-expiry options.