The First Order Autoregressive Model with Coefficient Contains Non-Negative Random Elements: Simulation and Esimation ()

1. Introduction

It is well-known that many time series in finance such as stock returns exhibit leptokurtosis, time-varying volatility and volatility clusters. The generalized autoregressive conditional heteroscedasticity (GARCH) and the random coefficient autoregressive (RCA) model have been caturing three characteristics of financial returns.

The RCA models have been studied by several authors [1-3]. Most of their theoreic properties are well-known, including conditions for the existence and the uniqueness of a stationary solution, or for the existence of moments for the stationary distribution. In this paper, we address the stationary conditions for the RCA model, the existence and the uniqueness of a stationary solution and parameter estimation problem for the RCA model with the coefficient have a non-negative random elements.

2. Stationary Conditions of the Series

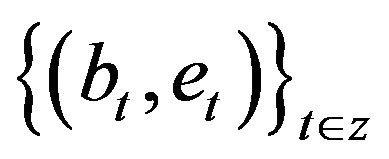

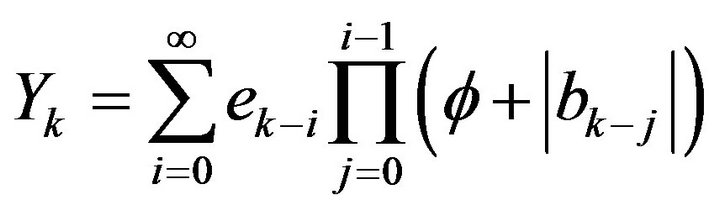

Consider time series  satisfying

satisfying

(1)

(1)

where  are random vectors with independent identical distribution defined in a certain

are random vectors with independent identical distribution defined in a certain  probability space(2)

probability space(2)

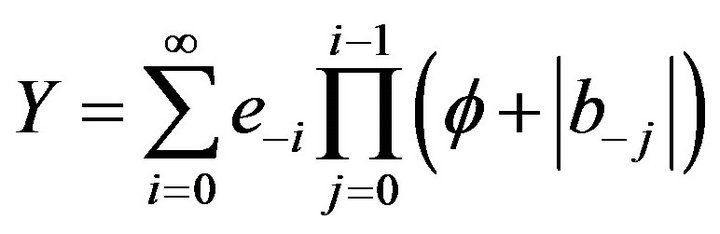

Firstly, we consider the property of the stochastic variable

(3)

(3)

Let .

.

Lemma 1. Suppose that condition (2) satisfied,

(4)

(4)

If

(5)

(5)

Y determined by (3) will be absolute convergence with probability 1.

Proof.

Assume , according to the law of great numbers, existing stochastic variable

, according to the law of great numbers, existing stochastic variable  such that:

such that:

(6)

(6)

where . Then

. Then

(7)

(7)

We will prove . Indeed, due to

. Indeed, due to

and in accordance with lemma Borel-Cantelli, sufficient condition here means proving

and in accordance with lemma Borel-Cantelli, sufficient condition here means proving

with

with  We have:

We have:

From (7), we have .

.

If , (6) can always correct with some

, (6) can always correct with some . Therefore, (7) is always true.

. Therefore, (7) is always true.

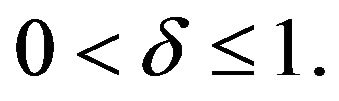

Lemma 2. Suppose that (2) and (5) meet

with some

with some . Then, existing

. Then, existing  such that

such that .

.

Proof.

Suppose

We have , and owing to

, and owing to ,

,  is a decreasing function in the neighborhood of 0. Hence, existing

is a decreasing function in the neighborhood of 0. Hence, existing  such that

such that . Generally less, suppose that

. Generally less, suppose that  Due to the convex, we have

Due to the convex, we have  với

với .

.

Use condition (2) and , we obtain:

, we obtain:

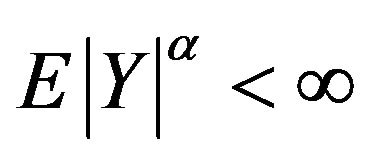

Lemma 3. Assume (2) and (5) are satisfied with

. Then

. Then

.

.

Proof.

Due to condition (2) and inequality Minkowski

. Hence,

. Hence,

.

.

Theorem 1: Suppose that (1), (4) and (5) satisfied with the almost sure convergence of

and process

and process  is the stationary solution of (1)

is the stationary solution of (1)

Proof.

is convergent absolutely, acording to Lemma 1 We have:

is convergent absolutely, acording to Lemma 1 We have: . Therefore:

. Therefore:

is the single solution of (1)

is the single solution of (1)

Obviously,  is a stationary series and

is a stationary series and  is independent of

is independent of .

.

3. Estimation of Model Parameters

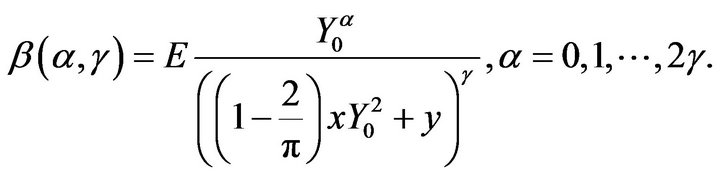

Suppose that

In this section, we care about estimating vectors of  based on Quasi-Maximum Likelihood method.

based on Quasi-Maximum Likelihood method.

With , we have:

, we have:

but , so

, so

Therefore, we have following likelihood function

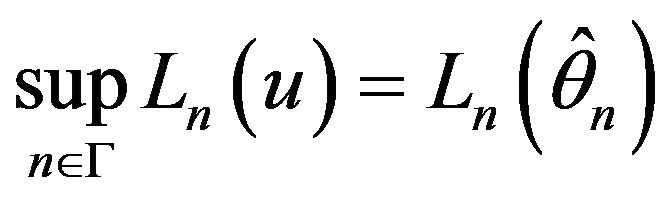

Maximum likelihood estimators determined by:

(8)

(8)

where  is a certain optional appropriate area of

is a certain optional appropriate area of

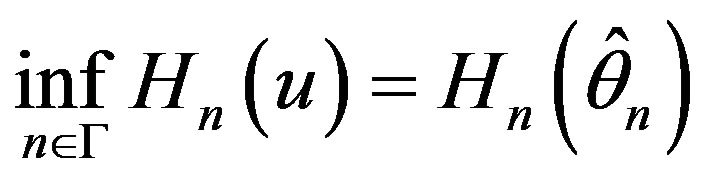

Let

Then (8) can be written as

Assume

(9)

(9)

Now, the consistence of maximum livelihood estimates  is said.

is said.

Theorem 2. Suppose (2), (4), (5), (8), (9) satisfied and . We have

. We have

.

.

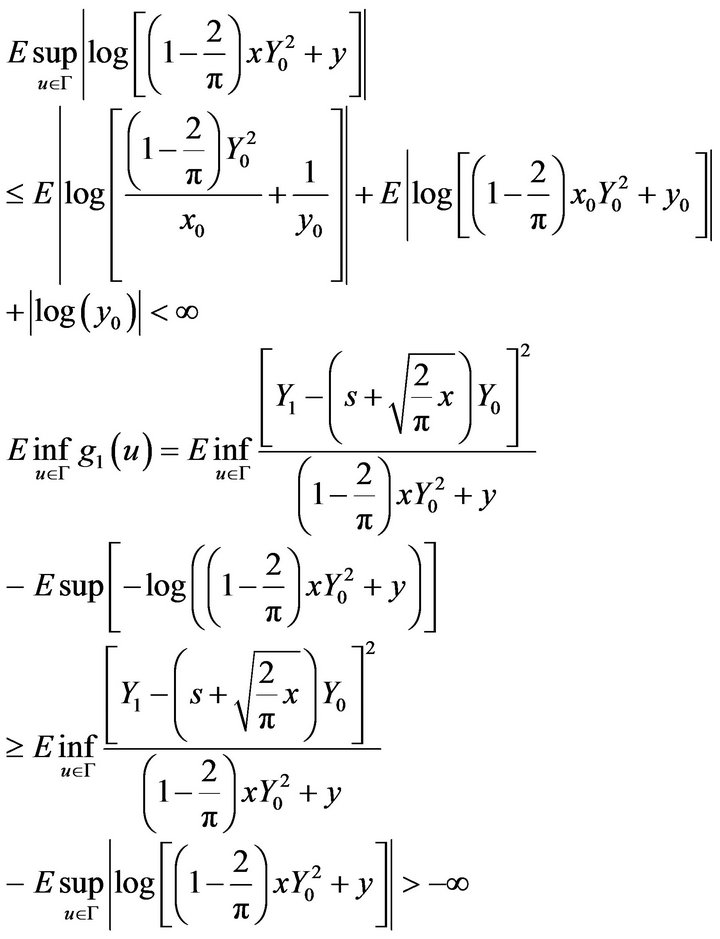

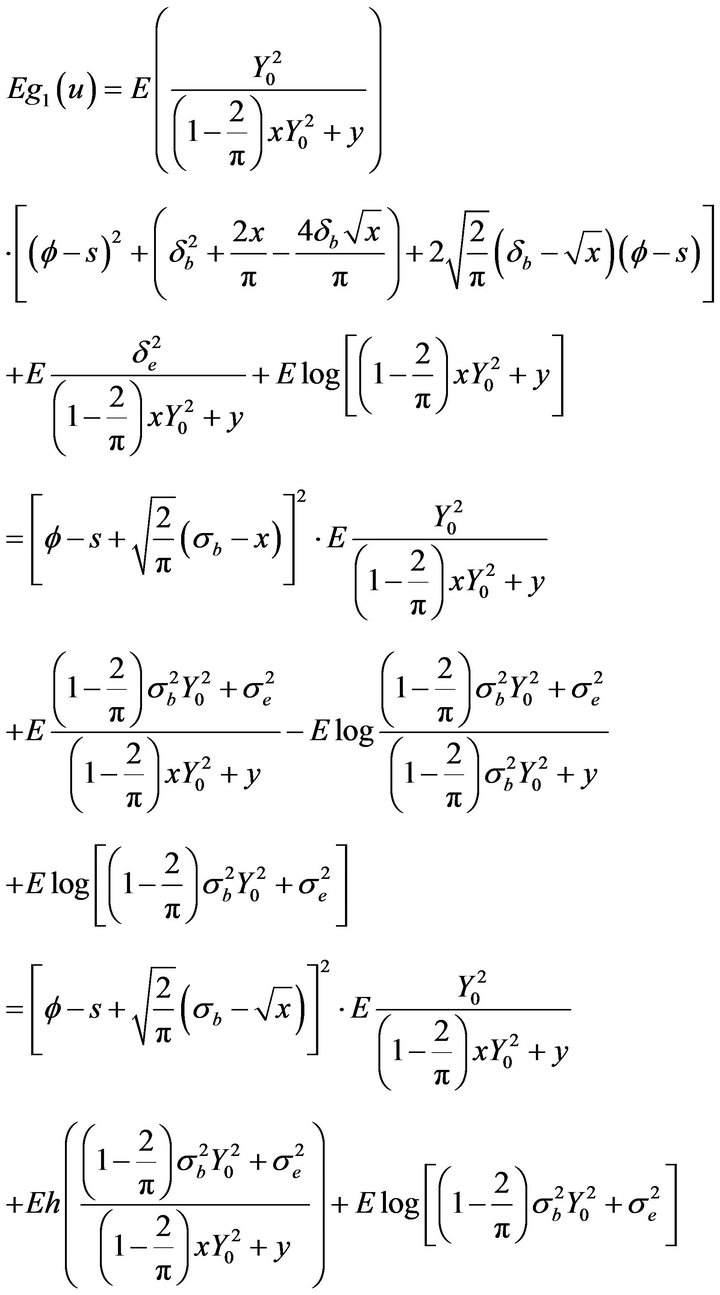

Proof.

Let

and

We will prove  be continuous on

be continuous on .

.

Indeed,

On the other hand,

But

Then

is a continuous function in acordance with

is a continuous function in acordance with

. Next, we will prove:

. Next, we will prove:

.

.

In fact,

where

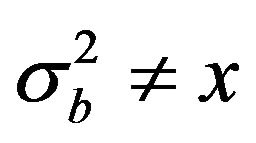

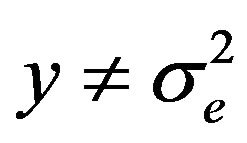

and  if and only if

if and only if

If

If

If  or

or ,

,

But

But  is a stationary series

is a stationary series

But , take conditional expectations

, take conditional expectations  in both sides, we have:

in both sides, we have:

But

Return to theorem , so

, so

But series  is stationary and ergodic with

is stationary and ergodic with , according to Ergodic theorem, we have:

, according to Ergodic theorem, we have:

With each positive integer  is a continuous function in compact set G, so

is a continuous function in compact set G, so

Let  -compact set in

-compact set in  with positive distance to

with positive distance to . Owing to g1(u) being continuous in

. Owing to g1(u) being continuous in , existing an open sphere U(u) with center u with

, existing an open sphere U(u) with center u with  such that:

such that:

.

.

Sets  are open covers of C, so C holds such finite open covers, are called

are open covers of C, so C holds such finite open covers, are called  of C. In accordance with Ergodic thoerem, with every

of C. In accordance with Ergodic thoerem, with every , we have:

, we have:

See that

In out of events  with

with  with

with  satisfying:

satisfying: .

.

Therefore,

But  is continuous and

is continuous and  is singly minimum of

is singly minimum of

Let U is a open sphere with center  and enough small radius and

and enough small radius and . If

. If , existing a random subseries

, existing a random subseries  such that with

such that with , we have:

, we have:

But

hence, with each above , existing random variable

, existing random variable  such that

such that

This completes the proof.

4. Simulation

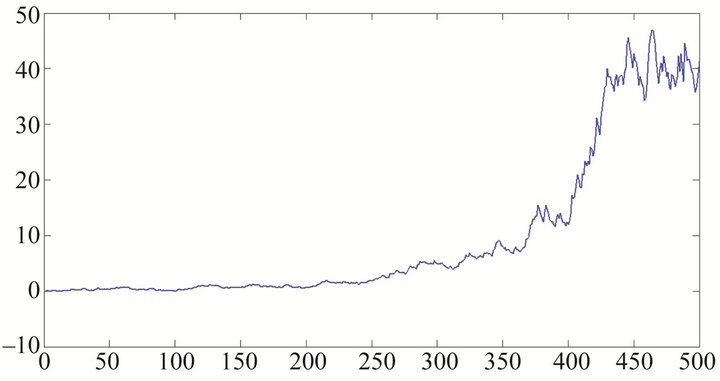

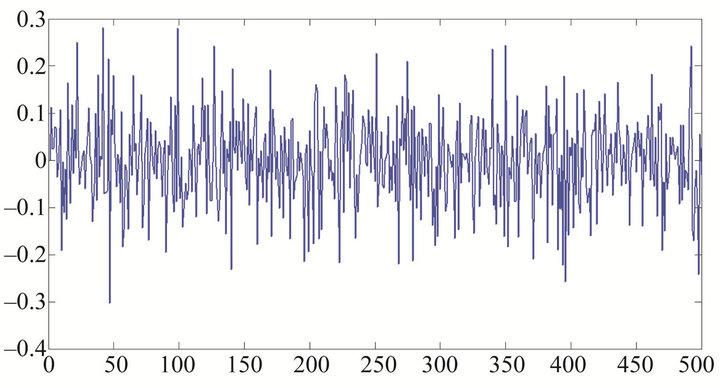

In this section, we simulate series (1) with different values of . These simulations show stationary and non-stationary series cases.

. These simulations show stationary and non-stationary series cases.

We simulate series (1) with different values of  and in each case we can check the stationary conditions of the series (1) by Lemma 1. In Figure 1, we see that the series is not stationary with the negagtive slope

and in each case we can check the stationary conditions of the series (1) by Lemma 1. In Figure 1, we see that the series is not stationary with the negagtive slope  and in Figures 2 and 3 we simulate the not stationary series with positive slope

and in Figures 2 and 3 we simulate the not stationary series with positive slope  and

and . Figure 4 presents a stationary but clustering series, Figures 5-7 present stationary series with parameters are

. Figure 4 presents a stationary but clustering series, Figures 5-7 present stationary series with parameters are ,

,  and

and .

.

Figure 1. Simulation for series Yt defined by (1) with .

.

Figure 2. Simulation for series Yt defined by (1) with .

.

Figure 3. Simulation for series Yt defined by (1) with .

.

Figure 4. Simulation for series Yt defined by (1) with .

.

Figure 5. Simulation for series Yt defined by (1) with .

.

Figure 6. Simulation for series Yt defined by (1) with .

.

Figure 7. Simulation for series Yt defined by (1) with .

.

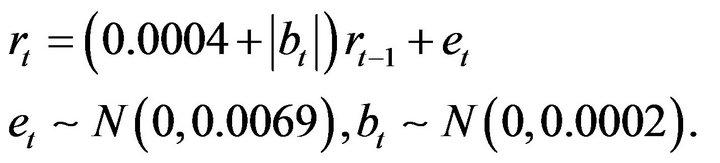

5. Application for Real-Time Series

In this section, we use model (1) for the model of return series of the price of gold on the free market in Hanoi, Vietnam. Figure 8 show the Return series of Gold price .

.

From the data series we estimate for vector

is

is . So, we can use the following model to forecast the future value of gold price:

. So, we can use the following model to forecast the future value of gold price:

Figure 8. Return series of Gold price rt.

Figure 9. Simulation for series Yt defined by (1) with .

.

Figure 9 below is a simulation of the process (1) with parameters .

.