The Distribution of the Value of the Firm and Stochastic Interest Rates ()

1. Introduction

Modeling the value of the firm is one of the more important research topics in finance. The value of an unlevered firm is the value of expected future cash flows discounted at a rate appropriate for an all-equity firm whereas the value of a levered firm is commonly expressed as the value of an unlevered firm plus the gain from leverage due to a tax shield provided by the debt. Including business disruption costs, the optimal capital structure can then be characterized as a trade-off between the interest tax shield and disruption costs. Recent analysis by Hackbarth, Hennessy and Leland [1] extends this line of research by examining an optimal mixture of debt; that is, the optimal mixture of bank debt and market debt (bonds).

Improved models for value of the firm are potentially useful in several contexts. For one example, consider models of credit spreads. Leland and Toft [2] develop an ambitious model of firm value that addresses optimal capital structure, optimal debt maturity, and the term structure of credit spreads. Recently, Qi [3] has modified the Leland and Toft [2] model by setting the lower bankruptcy boundary to be a fraction of bond face value. The importance of good structural models for credit spreads has been enhanced with the growth of credit derivatives and the credit crisis of 2007 and 2008. More specifically, notional amounts of credit derivatives grew by over 100% for every year from 2004 through 2006. At the end of 2006, there was 34.5 trillion outstanding (see Saha-Bubna and Barrett [4]). The weakened credit quality of many financial firms in 2007 and 2008 caused high volatility in equity markets and, also, large changes in the value of credit spreads and credit default swaps.

Our purpose is to derive distributions of  whose evolution critically depends on the models for the short term interest rate process,

whose evolution critically depends on the models for the short term interest rate process, . Models for

. Models for  can be broadly classified as (a) general linear and (b) non linear models. General linear models are also popularly known as affine models. In this context, we refer to Duffie, Filipovic and Schachermayer [5]; Duffie and Singleton [6]; and Lamberton and Lapeyre [7]. In this paper we are particularly interested in a special class of the general linear models called narrow sense linear models described by Arnold [8].

can be broadly classified as (a) general linear and (b) non linear models. General linear models are also popularly known as affine models. In this context, we refer to Duffie, Filipovic and Schachermayer [5]; Duffie and Singleton [6]; and Lamberton and Lapeyre [7]. In this paper we are particularly interested in a special class of the general linear models called narrow sense linear models described by Arnold [8].

The next section describes the processes for value of the firm and short term interest rates. Next, we discuss a general framework for the solution of the distribution of . Then, we describe solutions in the cases where

. Then, we describe solutions in the cases where  processes are narrow sense linear. Such

processes are narrow sense linear. Such  processes are quite popular for models of credit risk. The shapes of the

processes are quite popular for models of credit risk. The shapes of the  distributions are shown to be sensitive to such parameters as the correlation between the

distributions are shown to be sensitive to such parameters as the correlation between the  and

and  processes. For example, a positive correlation displays a

processes. For example, a positive correlation displays a  distribution with fatter tails than one with negative correlation.

distribution with fatter tails than one with negative correlation.

2. The Processes for Value of the Firm and Interest Rates

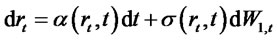

The time evolution of the value,  , of a firm is routinely modeled under the risk neutral measure by a linear, scalar, stochastic differential equation (SDE)

, of a firm is routinely modeled under the risk neutral measure by a linear, scalar, stochastic differential equation (SDE)

, (1.1)

, (1.1)

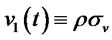

where the instantaneous drift  denotes the (exogenous) stochastic variable known as the short-term interest rate process and

denotes the (exogenous) stochastic variable known as the short-term interest rate process and  is a deterministic function representing the instantaneous volatility as in Acharya and Carpenter [9].

is a deterministic function representing the instantaneous volatility as in Acharya and Carpenter [9].

This general form of value process has been used in numerous important structural models of credit risk. For example, see Merton [10] and Acharya and Carpenter [9] where any dividends and coupon payments, outflows of γ from the firm to investors, are subtracted from the rt drift term. Many firms do not pay dividends and our model is one of zero coupon debt so that a γ of zero is reasonable. We note that Longstaff and Schwartz [11] similarly have a zero γ.

The  drift of

drift of  indicates our model is risk neutral. We could assume different firms have different drifts due to such things as different expected returns in their industry as well as different riskiness of assets and future projects. However, such an assumption is arbitrary and yields a model that is not arbitrage free. We believe it is much more theoretically credible to posit a risk neutral, arbitrage free model.

indicates our model is risk neutral. We could assume different firms have different drifts due to such things as different expected returns in their industry as well as different riskiness of assets and future projects. However, such an assumption is arbitrary and yields a model that is not arbitrage free. We believe it is much more theoretically credible to posit a risk neutral, arbitrage free model.

The dynamics of the short term interest rate are modeled, under the same risk neutral measure, by a (scalar) SDE of the type

, (1.2)

, (1.2)

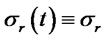

where the instantaneous drift,  and the volatility,

and the volatility,  are smooth functions. It is further assumed that the Wiener increment processes

are smooth functions. It is further assumed that the Wiener increment processes  and

and  are correlated; that is,

are correlated; that is,

(1.3)

(1.3)

with . It is worth noting that in this set up the flow of information is only one way –

. It is worth noting that in this set up the flow of information is only one way – affects

affects  and not vice versa. By combining several well known results from the literature, in this paper we characterize the distribution of the value process

and not vice versa. By combining several well known results from the literature, in this paper we characterize the distribution of the value process  for different choices of the

for different choices of the  processes.

processes.

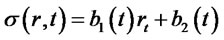

All the known stochastic interest rate models can be broadly classified into two classes—single factor models (SFMs) and multi-factor models (MFMs). We refer to Cairns [12] and Privault [13] for details. In this paper, we are primarily interested in the SFMs. These SFMs can be divided into linear and nonlinear models. Following Arnold [8], linear models can be further subdivided into two subclasses. The SFM in (1.2) is called a narrow sense linear model if

, (1.4)

, (1.4)

and

. (1.5)

. (1.5)

A general linear model, on the other hand, has  in the form (1.4) and

in the form (1.4) and

, (1.6)

, (1.6)

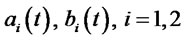

where and

and  are smooth functions of time

are smooth functions of time . The general linear models are also known as affine models as in Duffie, Filipovic, and Schachermayer [5]; Duffie and Singleton [6]; and Lamberton and Lapeyre [7]. The SFM in (1.2) is called a nonlinear model if either

. The general linear models are also known as affine models as in Duffie, Filipovic, and Schachermayer [5]; Duffie and Singleton [6]; and Lamberton and Lapeyre [7]. The SFM in (1.2) is called a nonlinear model if either  and/or

and/or  are nonlinear functions of the short rate

are nonlinear functions of the short rate .

.

Refer to Tables 1(a)-(c) for examples of these models. The narrow sense linear models of Merton [14], Vasicek [15], Ho and Lee [16], and Hull and White [17] are special cases of the Heath, Jarrow and Morton [18] model and define normal/Gaussian processes.

We first solve the scalar SDE (1.2) for , and using it in (1.1), we then recover

, and using it in (1.1), we then recover . It is well known that

. It is well known that  is a lognormal process when

is a lognormal process when  a constant. See Kloeden and Platen [19]. We extend this result by first showing that

a constant. See Kloeden and Platen [19]. We extend this result by first showing that  also inherits this lognormal distribution where

also inherits this lognormal distribution where  is a normal process defined by the narrow sense linear models in Table 1.

is a normal process defined by the narrow sense linear models in Table 1.

This problem of quantifying the probability distribution of  is critical to credit risk analysis. For a review of various approaches to credit risk refer to the books by Duffie and Singleton [6], Bielecki and Rutkowski [20], and Jarrow et al. [21]. Clearly computation of the default probability in structural models requires knowledge of the probability distribution of

is critical to credit risk analysis. For a review of various approaches to credit risk refer to the books by Duffie and Singleton [6], Bielecki and Rutkowski [20], and Jarrow et al. [21]. Clearly computation of the default probability in structural models requires knowledge of the probability distribution of  contingent on the chosen model for the interest rate.

contingent on the chosen model for the interest rate.

3. A framework for the Solution

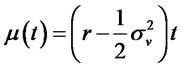

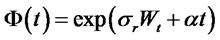

In this section we develop a framework for solving (1.1)- (1.2). Setting  and applying Ito’s lemma, equation (1.1) becomes.

and applying Ito’s lemma, equation (1.1) becomes.

. (2.1)

. (2.1)

See Kloeden and Platen [19].

Setting  and

and

Table 1. Alternative Models of . The single factor model in (1.2) is called a narrow sense linear model if

. The single factor model in (1.2) is called a narrow sense linear model if  and

and . In contrast, the model is called an affine model or a general linear model if

. In contrast, the model is called an affine model or a general linear model if  is of the above form and

is of the above form and . The model is called nonlinear if either

. The model is called nonlinear if either  and/or

and/or  are nonlinear functions of the short rate

are nonlinear functions of the short rate . (a) Narrow sense linear models; (b) General linear or affine models; (c) Nonlinear models.

. (a) Narrow sense linear models; (b) General linear or affine models; (c) Nonlinear models.

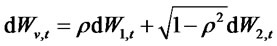

(Shreve [22]) we can rewrite the pair of equations (1.2) and (2.1) as

(2.2)

(2.2)

and

(2.3)

(2.3)

where  and

and  are two independent Wiener increment processes and

are two independent Wiener increment processes and

. (2.4)

. (2.4)

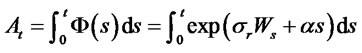

Integrating (2.3), we obtain

(2.5)

(2.5)

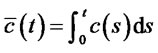

where

(2.6)

(2.6)

and

. (2.7)

. (2.7)

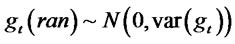

From the properties of the Ito integral, Mikosch [30] and Shreve [22], it follows that

(2.8)

(2.8)

where

. (2.9)

. (2.9)

Since  and

and  are independent Wiener processes, it readily follows that

are independent Wiener processes, it readily follows that  . Thus, the distribution of

. Thus, the distribution of  and hence of

and hence of  critically depend on the properties of the

critically depend on the properties of the  process in (2.2).

process in (2.2).

In closing this section consider the special case when , a constant. Then,

, a constant. Then,

. (2.10)

. (2.10)

Further, when , we obtain

, we obtain

. (2.11)

. (2.11)

4. Narrow Sense Linear Models for rt

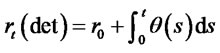

Setting

, (3.1)

, (3.1)

in (2.2), we get a narrow sense (time varying) linear model known as the generalized Hull and White [17] model given by

. (3.2)

. (3.2)

Since all the other narrow sense linear models in Table 1 are special cases of (3.2), we first concentrate on solving (3.2). Defining

, (3.3)

, (3.3)

we get

. (3.4)

. (3.4)

This is known as the fundamental solution of (3.2). Hence the solution of (3.2) is given by (Arnold [8], Gard [31], Kuo [32], Lamberton and Lapeyre [7])

, (3.5)

, (3.5)

where

, (3.6)

, (3.6)

, (3.7)

, (3.7)

and

. (3.8)

. (3.8)

Hence,

(3.9)

(3.9)

where

. (3.10)

. (3.10)

Now combining (3.5)-(3.10), it follows that

. (3.11)

. (3.11)

Applying integration by parts to the second integral on the right hand side of (3.11) and using (3.7), it follows that

(3.12)

(3.12)

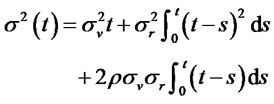

Is also a Gaussian process with mean zero and variance given by

. (3.13)

. (3.13)

Substituting (3.11)-(3.12) in (2.5), we get

(3.14)

(3.14)

where

(3.15)

(3.15)

and

. (3.16)

. (3.16)

Substituting (2.6), (3.12) and (2.7) in (3.16), the latter becomes

(3.17)

(3.17)

Since  and

and  are independent, it follows that

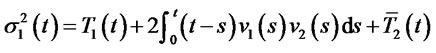

are independent, it follows that  where

where

(3.18)

(3.18)

, (3.19)

, (3.19)

where

and

.

.

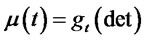

Combining (3.15)-(3.18) with (3.14), we finally obtain

(3.20)

(3.20)

where given by (3.16) and

given by (3.16) and  given by (3.19).

given by (3.19).

We summarize the above developments in the following:

Theorem 3.1: Let the interest rate  evolve according to a narrow sense linear, scalar, SDE of the type (3.2). Then,

evolve according to a narrow sense linear, scalar, SDE of the type (3.2). Then,  is a Gaussian process and consequently

is a Gaussian process and consequently  in (2.5) is also a Gaussian process given by (3.20).

in (2.5) is also a Gaussian process given by (3.20).

Since , from (3.14)-(3.20), we get

, from (3.14)-(3.20), we get

(3.21)

(3.21)

where

(3.22)

(3.22)

and

. (3.23)

. (3.23)

The following corollary is immediate.

Corollary 3.2: Since ,

,

is a lognormal process whose probability density function, as a function of time, is given by

is a lognormal process whose probability density function, as a function of time, is given by

. (3.24)

. (3.24)

It can be verified (Johnson et al. [33]) that the time evolution of the mean and variance of the value process

are given by

are given by

(3.25)

(3.25)

and

. (3.26)

. (3.26)

We now enlist a number of nested corollaries by considering special cases of interest rate models.

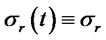

Case 1: Let , a constant. Then

, a constant. Then

,

,  and

and  is given by

is given by

(3.8). From (3.15) and (3.20), the mean is

(3.27)

(3.27)

where  is given in (3.6). From (3.19)-(3.20), the variance is

is given in (3.6). From (3.19)-(3.20), the variance is

. (3.28)

. (3.28)

Case 2: Hull and White [17] model: In this model,  and

and  where

where  and

and  are constants. Thus,

are constants. Thus,  ,

,  and

and

. (3.29)

. (3.29)

Hence the mean is

(3.30)

(3.30)

and the variance is

(3.30a)

(3.30a)

. (3.30b)

. (3.30b)

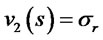

Case 3: Ho-Lee [16] model: In this model,  and

and . Then

. Then

. (3.31)

. (3.31)

The mean is

(3.32)

(3.32)

and the variance is

(3.33a)

(3.33a)

. (3.33b)

. (3.33b)

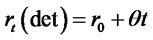

Case 4: Vasicek [15] model: In this model,  ,

,  and

and . Then,

. Then,  and

and

. (3.34)

. (3.34)

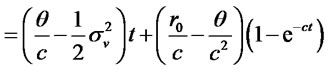

Hence, the mean is

(3.35a)

(3.35a)

(3.35b)

(3.35b)

and the variance is

(3.36a)

(3.36a)

. (3.36b)

. (3.36b)

Case 5: Merton [14]: In this case,  ,

,  and

and . Then

. Then  and

and

. (3.37)

. (3.37)

Hence, the mean is

(3.38)

(3.38)

and the variance is

(3.39a)

(3.39a)

. (3.39b)

. (3.39b)

Case 6: Let , a constant and

, a constant and . Then

. Then ,

,  and

and . The mean

. The mean

(3.40)

(3.40)

and the variance

. (3.41)

. (3.41)

We now provide sample plots of the  distribution, when

distribution, when  follows the Vasicek [15] model, for three different values of the correlation (

follows the Vasicek [15] model, for three different values of the correlation ( , 0.9 and −0.9) in Figures 1-3 respectively. In each case the distribution of

, 0.9 and −0.9) in Figures 1-3 respectively. In each case the distribution of  for

for  and 20 are given. From these figures it follows that as

and 20 are given. From these figures it follows that as  increases both the mean and variance of

increases both the mean and variance of  increases. Further, comparing Figures 1 and 2, it follows that the effect of the positive correlation (

increases. Further, comparing Figures 1 and 2, it follows that the effect of the positive correlation ( ) is to reduce the peak while making the tails fatter compared to the case when

) is to reduce the peak while making the tails fatter compared to the case when . Similarly from Figures 1 and 3, we readily see the negative correlation has the opposite effect of increased peak and thinner tails compared to

. Similarly from Figures 1 and 3, we readily see the negative correlation has the opposite effect of increased peak and thinner tails compared to .

.

The primary motivation for characterizing the distribution of  is to compute the probability of default. Within the framework of structural models, there has been an evolution of the definition of default. In the now classic paper, Merton [10] defines default as the event

is to compute the probability of default. Within the framework of structural models, there has been an evolution of the definition of default. In the now classic paper, Merton [10] defines default as the event  bond with maturity

bond with maturity . Using the results described above, we could readily compute the probability default according to this classical definition1.

. Using the results described above, we could readily compute the probability default according to this classical definition1.

However, Longstaff and Schwartz [11] define default by the event . Recently, Giesecke [34] has expanded on this theme and has defined the default by the compound event

. Recently, Giesecke [34] has expanded on this theme and has defined the default by the compound event  for

for .

.

Recall that the probability of these later events can be readily calculated using the “reflection principle” if  is a standard Wiener process or by using the Girsanov theorem if

is a standard Wiener process or by using the Girsanov theorem if  is a Wiener process with a drift. (See Elliott and Kopp [35] and Giesecke [34]). To enable computation of default probability according to Giesecke [34], in the following, we seek to express

is a Wiener process with a drift. (See Elliott and Kopp [35] and Giesecke [34]). To enable computation of default probability according to Giesecke [34], in the following, we seek to express  in (3.14) as the sum of a drift term and a (time changed) Wiener process.

in (3.14) as the sum of a drift term and a (time changed) Wiener process.

To this end recall that every Ito integral is equivalent to a time changed Wiener process. (See Shiryaev [36], Oksendal [37], Karatzas and Shreve [25]). Accordingly, from (3.17) we obtain

(3.42)

(3.42)

where  and

and  are two independent Wiener process with

are two independent Wiener process with

,

,

and  and

and  are given in (3.19). Since

are given in (3.19). Since  and

and  are independent, there exists a Wiener process

are independent, there exists a Wiener process  such that

such that

(3.43)

(3.43)

where

as given by (3.18)-(3.19).

Combining (3.43) with (3.14), it follows that

(3.44)

(3.44)

where  as in (3.20).

as in (3.20).

5. Conclusions

We have analyzed the impact of  on

on  when

when  evolves according to a narrow sense linear model in Table 1(a). Consider the case when

evolves according to a narrow sense linear model in Table 1(a). Consider the case when  evolves according to a general linear model, such as for example, the Brennan-Schwartz [38] model in Table 1(b). In this case the explicit form of the solution for

evolves according to a general linear model, such as for example, the Brennan-Schwartz [38] model in Table 1(b). In this case the explicit form of the solution for  is well known (Arnold [8], Gard [15], Lamberton and Lapeyre [7]) and is given by

is well known (Arnold [8], Gard [15], Lamberton and Lapeyre [7]) and is given by

where the process  is given by

is given by

with

with . Hence,

. Hence,

involves a process

involves a process

which is an integral of the exponential functionals of the Wiener process. Processes of the type  routinely arise in the evaluation of Asian type options (Vorst [39]). By relating

routinely arise in the evaluation of Asian type options (Vorst [39]). By relating  to a Bessel process, Yor [40] and Geman and Yor [41] have provided a complete characterization of the distribution of the

to a Bessel process, Yor [40] and Geman and Yor [41] have provided a complete characterization of the distribution of the  process. Combining these results with (2.5) to derive the distribution of

process. Combining these results with (2.5) to derive the distribution of  is an interesting open problem. Similarly, computing the distribution

is an interesting open problem. Similarly, computing the distribution  when

when  evolves according to the nonlinear models is Table 1(c) is also wide open. Solutions to these problem will shed further light on the impact of the choice of interest rate models on default probability and hence on credit risk analysis.

evolves according to the nonlinear models is Table 1(c) is also wide open. Solutions to these problem will shed further light on the impact of the choice of interest rate models on default probability and hence on credit risk analysis.

6. Acknowledgements

We are grateful to Robert J. Elliott (University of Calgary) and to Luciano Campi (Universite Paris Dauphine) for their interest and comments that improved the presentation.

REFERENCES

NOTES

1We note that Shimko, Tejima, and Van Deventer [42] build upon the Merton [11] model and solve for bond and equity prices as opposed to value of the firm.