Automatic Variable Selection for High-Dimensional Linear Models with Longitudinal Data ()

Keywords: Variable Selection; Diverging Number of Parameters; Longitudinal Data; Quadratic Inference Functions; Generalized Estimating Equation

1. Introduction

Longitudinal data arise frequently in biomedical and health studies in which repeated measurements form the same subject are correlated. A major aspect of longitudinal data is the within subject correlation among the repeated measurements. Ignoring this within subject correlation causes a loss of efficiency in general problems. One of the commonly used regression methods for analyzing longitudinal data is generalized estimating equations (Liang and Zeger, [1]). Generalized estimating equations (GEE) using a working correlation matrix with nuisance parameters estimate regression parameters consistently even when the correlation structure is misspecified. However, under such misspecification, the estimator can be inefficient. For this reason, Qu et al. [2] proposed a method of quadratic inference functions (QIF). It avoids estimating the nuisance correlation structure parameters by assuming that the inverse of working correlation matrix can be approximated by a linear combination of several known basis matrices. The QIF can efficiently take the within subject correlation into account and is more efficient than the GEE approach when the working correlation is misspecified. The QIF estimator is also more robust against contamination when there are outlying observations (Qu and Song, [3]).

High-dimensional longitudinal data, which consist of repeated measurements on a large number of covariates, arise frequently from health and medical studies. Thus, it is important for statisticians to develop a new statistical methodology and theory of variable selection and estimation for high-dimensional longitudinal data, which can reduce the modeling bias. Generally speaking, most of the variable selection procedures are based on penalized estimation using penalty functions. Such as,  penalty (Frank and Friedman, [4]), LASSO penalty (Tibshirani, [5]), SCAD penalty (Fan and Li, [6]), and so on. In the longitudinal data framework, Pan [7] proposed an extension of the Akaike information criterion (Akaike, [8]) by applying the quasi-likelihood to the GEE, assuming independent working correlation. Wang and Qu [9] developed a Bayesian information type of criterion (Schwarz, [10]) based on the quadratic inference functions. Fu [11] applied the bridge penalty model to the GEE and Xu et al. [12] introduced the adaptive lasso for the GEE setting, and references therein. These methods are able to perform variable selection and parameter estimation simultaneously. However, most of the theory and implementation is restricted to a fixed dimension of parameters.

penalty (Frank and Friedman, [4]), LASSO penalty (Tibshirani, [5]), SCAD penalty (Fan and Li, [6]), and so on. In the longitudinal data framework, Pan [7] proposed an extension of the Akaike information criterion (Akaike, [8]) by applying the quasi-likelihood to the GEE, assuming independent working correlation. Wang and Qu [9] developed a Bayesian information type of criterion (Schwarz, [10]) based on the quadratic inference functions. Fu [11] applied the bridge penalty model to the GEE and Xu et al. [12] introduced the adaptive lasso for the GEE setting, and references therein. These methods are able to perform variable selection and parameter estimation simultaneously. However, most of the theory and implementation is restricted to a fixed dimension of parameters.

Despite the importance of variable selection in high-dimensional settings (Fan and Li, [13]; Fan and Lv, [14]), variable selection for longitudinal data that take into consideration the correlation information is not well studied when the dimension of parameters diverges. In this paper we use the smooth-threshold generalized estimating equation based on quadratic inference functions (SGEE-QIF) to the high-dimensional longitudinal data. The proposed procedure automatically eliminates the irrelevant parameters by setting them as zero, and simultaneously estimates the nonzero regression coefficients by solving the SGEE-QIF. Compared to the shrinkage methods and the existing research findings reviewed above, our method offers the following improvements: 1) the proposed procedure avoids the convex optimization problem; 2) the proposed SGEE-QIF approach is flexible and easy to implement; 3) the proposed method is easy to deal with the longitudinal correlation structure and extend the estimating equations approach to high-dimensional longitudinal data.

The rest of this paper is organized as follows. In Section 2 we first propose variable selection procedures for high-dimensional linear models with longitudinal data, and asymptotic properties of the resulting estimators. In Section 3 we give the computation of the estimators as well as the choice of the tuning parameters. In Section 4 we carry out simulation studies to assess the finite sample performance of the method. Some assumptions and the technical proofs of all asymptotic results are provided in the Appendix.

2. Automatic Variable Selection Procedure

2.1. Model and Notation

We consider a longitudinal study with  subjects and

subjects and  observations over time for the

observations over time for the  th subject

th subject

for a total of

for a total of  observation. Each observation consists of a response variable

observation. Each observation consists of a response variable  and a covariate vector

and a covariate vector  taken from the

taken from the  th subject at time

th subject at time . We assume that the full data set

. We assume that the full data set

is observed and can be modelled as

is observed and can be modelled as

(2.1)

(2.1)

where  is a

is a  vector of unknown regression coefficients, and

vector of unknown regression coefficients, and  diverging as the sample size increases.

diverging as the sample size increases.  is random error with

is random error with . In addition, we give assumptions on the first two moments of the observations

. In addition, we give assumptions on the first two moments of the observations , that is,

, that is,  and

and , where

, where  is a known variance function.

is a known variance function.

2.2. Quadratic Inference Functions

Denote  and write

and write  in a similar fashion. Following Liang and Zeger [1], a GEE can be used to estimate the regression parameters,

in a similar fashion. Following Liang and Zeger [1], a GEE can be used to estimate the regression parameters,  ,

,

(2.2)

(2.2)

where  is the covariance matrix of

is the covariance matrix of . The matrix

. The matrix  is often modelled as

is often modelled as , where

, where  is a diagonal matrix representing the variance of

is a diagonal matrix representing the variance of , that is,

, that is,  ,

,  is a common working correlation depending on a set of unknown nuisance parameters

is a common working correlation depending on a set of unknown nuisance parameters . Based on the estimation theory associated with the working correlation structure, the GEE estimator of the regression coefficient proposed by Liang and Zeger [1] is consistent if consistent estimators of the nuisance parameters

. Based on the estimation theory associated with the working correlation structure, the GEE estimator of the regression coefficient proposed by Liang and Zeger [1] is consistent if consistent estimators of the nuisance parameters  can be obtained. For suggested methods for estimating

can be obtained. For suggested methods for estimating , see Liang and Zeger [1]. However, even in some simple cases, consistent estimators of

, see Liang and Zeger [1]. However, even in some simple cases, consistent estimators of  do not always exist (Crowder [15]). To avoid this drawback, Qu et al. [2] suggested that the inverse of the working correlation matrix,

do not always exist (Crowder [15]). To avoid this drawback, Qu et al. [2] suggested that the inverse of the working correlation matrix,  is approximated by a linear combination of basis matrices,

is approximated by a linear combination of basis matrices,  , such as

, such as

(2.3)

(2.3)

where  are known matrices, and

are known matrices, and  are unknown constants. This is a sufficiently rich class that accommodates, or at least approximates, the correlation structures most commonly used. Details of utilizing a linear combination of some basic matrices to model the inverse of working correlation can be found in Qu et al. [2].

are unknown constants. This is a sufficiently rich class that accommodates, or at least approximates, the correlation structures most commonly used. Details of utilizing a linear combination of some basic matrices to model the inverse of working correlation can be found in Qu et al. [2].

Substituting (2.3) to (2.2), we get the following class of estimating functions:

(2.4)

(2.4)

Instead of estimating parameters  directly, they recognized that a GEE (2.4) is equivalent to solving the linear combination of a vector of estimating equations:

directly, they recognized that a GEE (2.4) is equivalent to solving the linear combination of a vector of estimating equations:

, (2.5)

, (2.5)

where

However, (2.5) does not work because the dimension of  is obviously greater than the number of unknown parameters. Using the idea of generalized method of moments (Hansen, [16]), Qu et al. [2] defined the quadratic inference functions (QIF),

is obviously greater than the number of unknown parameters. Using the idea of generalized method of moments (Hansen, [16]), Qu et al. [2] defined the quadratic inference functions (QIF),

(2.6)

(2.6)

where

Note that  depends on

depends on . The QIF estimate

. The QIF estimate  is then given by

is then given by

.

.

Then, based on (2.6), according to Qu et al. [2], the corresponding estimating equation for  is

is

, (2.7)

, (2.7)

where  is the

is the  matrix

matrix .

.

2.3. Smooth-Threshold Generalized Estimating Equations Based on QIF

Variable selection is an important topic in high dimensional regression analysis and most of the variable selection procedures are based on penalized estimation using penalty functions. Because of these variable selection procedures using penalty function have a singularity at zero. So, these procedure require convex optimization, which incurs a computational burden. To overcome this problem, Ueki [17] developed a automatic variable selection procedure that can automatically eliminate irrelevant parameters by setting them as zero. The method is easily implemented without solving any convex optimization problems. Motivated by this idea we propose the following smooth-threshold generalized estimating equations based on quadratic inference functions (SGEEQIF)

, (2.8)

, (2.8)

where  is the diagonal matrix whose diagonal elements are

is the diagonal matrix whose diagonal elements are , and

, and  is the

is the  dimensional identity matrix. Note that the

dimensional identity matrix. Note that the  th SGEE-QIF with

th SGEE-QIF with  reduces to

reduces to . Therefore, SGEE-QIF (2.8) can yield a sparse solution. Unfortunately, we cannot directly obtain the estimator of

. Therefore, SGEE-QIF (2.8) can yield a sparse solution. Unfortunately, we cannot directly obtain the estimator of  by solving (2.8). This is because the SGEE-QIF involves

by solving (2.8). This is because the SGEE-QIF involves , which need to be chosen using some data-driven criteria. For the choice of

, which need to be chosen using some data-driven criteria. For the choice of , Ueki [17] suggested that

, Ueki [17] suggested that  may be determined by the data, and can be chosen by

may be determined by the data, and can be chosen by  with an initial estimator

with an initial estimator . The initial estimator

. The initial estimator  can be obtained by solving the QIF (2.6) for the full model. Note that this choice involves two tuning parameters

can be obtained by solving the QIF (2.6) for the full model. Note that this choice involves two tuning parameters . In Section 4, following the idea of Ueki [17], we use the BIC-type criterion to select the tuning parameters.

. In Section 4, following the idea of Ueki [17], we use the BIC-type criterion to select the tuning parameters.

Replacing  in (2.8) by

in (2.8) by  with diagonal elements

with diagonal elements . The SGEE-QIF becomes

. The SGEE-QIF becomes

. (2.9)

. (2.9)

The solution of (2.9) denoted by  is called the SGEE-QIF estimator.

is called the SGEE-QIF estimator.

2.4. Asymptotic Properties

We next study the asymptotic properties of the smooth-threshold estimator. Let  be the fixed true value of

be the fixed true value of

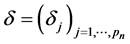

. Denote

. Denote  and

and . Denote by

. Denote by  the number of true nonzero parameters.

the number of true nonzero parameters.  may be fixed or grow with

may be fixed or grow with . We assume, under the regularity conditions, the initial QIF estimator

. We assume, under the regularity conditions, the initial QIF estimator

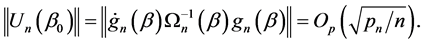

obtained by solving the QIF (2.6) satisfies

obtained by solving the QIF (2.6) satisfies  when

when  and

and where

where  is the true value of

is the true value of . Following Fan and Peng [18] and Wang [19], it is possible to prove the oracle properties for the SGEE-QIF estimators, including

. Following Fan and Peng [18] and Wang [19], it is possible to prove the oracle properties for the SGEE-QIF estimators, including  consistency, variable selection consistency and asymptotic normality.

consistency, variable selection consistency and asymptotic normality.

To obtain the asymptotic properties in the paper, we require the following regularity conditions:

(C1). The parameter space  is compact, and

is compact, and  is an interior point of

is an interior point of .

.

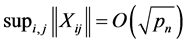

(C2). ,

,  ,

,  ,

,  ,

,  , where

, where  is the

is the  th component of

th component of .

.

(C3). .

.

(C4). The weighting matrix  converges almost surely to a constant matrix

converges almost surely to a constant matrix , where

, where  is invertible. Furthermore, the first and second partial derivatives of

is invertible. Furthermore, the first and second partial derivatives of  in

in  are all

are all .

.

(C5).  is a twice differentiable function of

is a twice differentiable function of . Furthermore the third derivatives of

. Furthermore the third derivatives of  are

are .

.

(C6). All the variance matrixes , and

, and .

.

(C7). .

.

(C8).

We define the active set  which is the set of indices of nonzero parameters, where

which is the set of indices of nonzero parameters, where

The following theorem gives the consistency of the SGEE-QIF estimators.

The following theorem gives the consistency of the SGEE-QIF estimators.

Theorem 1. Under conditions C1-C8, for any positive  and

and , such that

, such that ,

,  and

and , as

, as . There exists a sequence

. There exists a sequence  of the solutions of (2.9) such that

of the solutions of (2.9) such that

.

.

Furthermore, we show that such consistent estimators must possess the sparsity property and the estimators for nonzero coefficients have the same asymptotic distribution as that based on the correct submodel.

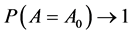

Theorem 2. Suppose that the conditions of Theorem 1 hold, if , as

, as , we have 1) Variable selection consistency, i.e.

, we have 1) Variable selection consistency, i.e.

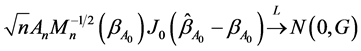

2) Asymptotic normality, i.e.

where  is a

is a  matrix such that

matrix such that ,

,  is a

is a  non-negative symmetric matrix,

non-negative symmetric matrix,  , and “

, and “ ” represents the convergence in distribution.

” represents the convergence in distribution.

Remark: Theorems 1 and 2 imply that the proposed SGEE-QIF procedure is consistent in variable selection, it can identify the zero coefficients with probability tending to 1. By choosing appropriate tuning parameters, the SGEE-QIF estimators have the oracle property; that is, the asymptotic variances for the SGEE-QIF estimators are the same as what we would have if we knew in advance the correct submodel.

3. Computation

3.1. Algorithm

Next, we propose the iterative algorithm to implement the procedures as follows:

Step 1, Calculate the initial estimates  of

of  by solving the initial QIF (2.5) estimator. Let

by solving the initial QIF (2.5) estimator. Let .

.

Step 2, By using the current estimate , we choose the tuning parameters

, we choose the tuning parameters  by the BIC criterion.

by the BIC criterion.

Step 3, Update the estimator of  as follows:

as follows:

where

and .

.

Step 4, Iterate Steps 2-3 until convergence, and denote the final estimators of  as the SGEE-QIF estimator.

as the SGEE-QIF estimator.

3.2. Choosing the Tuning Parameters

To implement the procedures described above, we need to choose the tuning parameters . Following Ueki [17], we use BIC-type criterion to choose these two parameters. That is, we choose

. Following Ueki [17], we use BIC-type criterion to choose these two parameters. That is, we choose  as the minimizer of

as the minimizer of

where  is the SGEE-QIF estimator for given

is the SGEE-QIF estimator for given ,

,  is simply the number of nonzero coefficient

is simply the number of nonzero coefficient . The selected

. The selected  minimizes the

minimizes the .

.

3.3. Choosing the Basis Matrices

The choice of basis matrices  in (2.2) is not difficult, especially for those special correlation structures which are frequently used. If we assume

in (2.2) is not difficult, especially for those special correlation structures which are frequently used. If we assume  is the first-order autoregressive correlation matrix. The exact inversion

is the first-order autoregressive correlation matrix. The exact inversion  can be written as a linear combination of three basis matrices, they are

can be written as a linear combination of three basis matrices, they are ,

,  and

and , where

, where  is the identity matrix,

is the identity matrix,  has 1 on two main off-diagonals and 0 elsewhere, and

has 1 on two main off-diagonals and 0 elsewhere, and  has 1 on the corners (1, 1) and (m, m), and 0 elsewhere. Suppose

has 1 on the corners (1, 1) and (m, m), and 0 elsewhere. Suppose  is an exchangeable working correlation matrix, it has 1 on the diagonal, and

is an exchangeable working correlation matrix, it has 1 on the diagonal, and  everywhere off the diagonal. Then

everywhere off the diagonal. Then  can be written as a linear combination of two basis matrices,

can be written as a linear combination of two basis matrices,  is the identity matrix and

is the identity matrix and  is a matrix with 0 on the diagonal and 1 off the diagonal. More details about choosing the basis matrices can be seen in Zhou and Qu [20].

is a matrix with 0 on the diagonal and 1 off the diagonal. More details about choosing the basis matrices can be seen in Zhou and Qu [20].

4. Simulation Studies

In this section we conduct a simulation study to assess the finite sample performance of the proposed procedures. In the simulation study, the performance of estimator  will be assessed by using the average the mean square error (AMSE), defined as

will be assessed by using the average the mean square error (AMSE), defined as  averaged over

averaged over  times simulated data sets.

times simulated data sets.

We simulate data from the model (1.1), where  with

with ,

,  and

and .

.

While the remaining coefficients, corresponding to the irrelevant variables, are given by zeros. In addition, let

, where

, where  denotes the largest integer not greater than

denotes the largest integer not greater than . To perform this simulation, we take the covariates

. To perform this simulation, we take the covariates  from a multivariate normal distribution with mean zero, marginal variance 1 and correlation 0.5. The response variable

from a multivariate normal distribution with mean zero, marginal variance 1 and correlation 0.5. The response variable  is generated according to the model. And error vector

is generated according to the model. And error vector

, where

, where  and

and  is a known correlation matrix with parameter

is a known correlation matrix with parameter  used to determine the strength of with-subject dependence. Here we consider

used to determine the strength of with-subject dependence. Here we consider  has the firstorder autoregressive (AR-1) or compound symmetry (CS) correlation (i.e. exchangeable correlation) structure with

has the firstorder autoregressive (AR-1) or compound symmetry (CS) correlation (i.e. exchangeable correlation) structure with . In the following simulations, we make 500 simulation runs and take

. In the following simulations, we make 500 simulation runs and take  and

and .

.

In the simulation study, for each simulated data set, we compare the estimation accuracy and model selection properties of the SGEE-QIF method, the SCAD-penalized QIF and the Lasso-penalized QIF for two different working correlations. For each of these methods, the average of zero coefficients over the 500 simulated data sets is reported in Tables 1 and 2. Note that “Correct” in tables means the average number of zero regression

Table 1 . Variable selections for the parametric components under different methods when the correlation structure is correctly specified.

Table 2. Variable selections for the parametric components under different methods when the correlation structure is incorrectly specified. The term “CS.AR(1)” means estimation with the fitted misspecified AR(1) correlation structure, while “AR(1).CS” means estimation with the fitted misspecified CS correlation structure.

coefficients that are correctly estimated as zero, and “Incorrect” depicts the average number of non-zero regression coefficients that are erroneously set to zero. At the same time, we also examine the effect of using a misspecified correlation structure in the model, which are also reported in Tables 1 and 2. From Tables 1 and 2, we can make the following observations.

1) For the parametric component, the performances of variable selection procedures become better and better as  increases. For example, the values in the column labeled “Correct” become more and more closer to the true number of zero regression coefficients in the models.

increases. For example, the values in the column labeled “Correct” become more and more closer to the true number of zero regression coefficients in the models.

2) Compared with the penalized QIF based on Lasso and SCAD, SGEE-QIF performs satisfactory in terms of variable selection.

3) It is not surprised that the performances of variable selection procedures based on the correct correlation structure work better than based on the incorrect correlation structure. However, we also note that the performance does not significantly depend on working covariance structure.

5. Discussion

In this paper, we have proposed the smooth-threshold generalized estimating equation based on quadratic inference function (SGEE-QIF) to the high-dimensional longitudinal data. Our method incorporates the within subject correlation structure of the longitudinal to automatically eliminate the irrelevant parameters by setting them as zero, and simultaneously estimates the nonzero regression coefficients. As a future research topic, it is interesting to consider the variable selection for the high/ultra-high dimension varying coefficient models with longitudinal data.

Acknowledgements

This research was supported by the National Natural Science Foundation of China (11171012, 11331011), the Science and technology project of the faculty adviser of excellent PHD degree thesis of Beijing (20111000503), the Beijing Municipal Education Commission Foundation (KM201110005029), and the Beijing municipal key disciplines (No.006000541213009).

[2] K. L. Liang and S. L. Zeger, “Longitudinal Data Analysis Using Generalised Estimating Equations,” Biometrika, Vol. 73, No. 1, 1986, pp. 13-22. http://dx.doi.org/10.1093/biomet/73.1.13

[3] A. Qu, B. G. Lindsay and B. Li, “Improving Generalized Estimating Equations Using Quadratic Inference Functions,” Biometrika, Vol. 87, No. 4, 2000, pp. 823-836. http://dx.doi.org/10.1093/biomet/87.4.823

[4] A. Qu and P. X. K. Song, “Assessing Robustness of Generalized Estimating Equations and Quadratic Inference Functions,” Biometrika, Vol. 91, No. 2, 2004, pp. 447-459. http://dx.doi.org/10.1093/biomet/91.2.447

[5] I. E. Frank and J. H. Friedman, “A Statistical View of Some Chemometrics Regression Tools (with Discussion),” Technometrics, Vol. 35, No. 2, 1993, pp. 109-148. http://dx.doi.org/10.1080/00401706.1993.10485033

[6] R. Tibshirani, “Regression Shrinkage and Selection via the LASSO,” Journal of Royal Statistical Society, Series B, Vol. 58, No. 1, 1996, pp. 267-288.

[7] J. Q. Fan and R. Li, “Variable Selection via Nonconcave Penalized Likelihood and Its Oracle Properties,” Journal of American Statistical Association, Vol. 96, No. 456, 2001, pp. 1348-1360. http://dx.doi.org/10.1198/016214501753382273

[8] W. Pan, “Akaike’s Information Criterion in Generalized Estimating Equations,” Biometrics, Vol. 57, No. 1, 2001, pp. 120-125. http://dx.doi.org/10.1111/j.0006-341X.2001.00120.x

[9] H. Akaike, “Information Theory and an Extension of the Maximum Likelihood Principle,” Proceedings of the 2nd International Symposium on Information Theory, Budapest, 1973, pp. 267-281.

[10] L. Wang and A. Qu, “Consistent Model Selection and Data-Driven Smooth Tests for Longitudinal Data in the Estimating Equations Approach,” Journal of the Royal Statistical Society: Series B, Vol. 71, No. 1, 2009, pp. 177-190. http://dx.doi.org/10.1111/j.1467-9868.2008.00679.x

[11] G. Schwarz, “Estimating the Dimension of a Model,” The Annals of Statistics, Vol. 6, No. 2, 1978, pp. 461-464. http://dx.doi.org/10.1214/aos/1176344136

[12] W. J. Fu, “Penalized Estimating Equation,” Biometrics, Vol. 59, No. 1, 2003, pp. 126-132. http://dx.doi.org/10.1111/1541-0420.00015

[13] P. R. Xu, W. Fu and L. X. Zhu, “Shrinkage Estimation Analysis of Correlated Binary Data with a Diverging Number of Parameters,” Science China Mathematics, Vol. 56, No. 2, 2013, pp. 359-377. http://dx.doi.org/10.1007/s11425-012-4564-y

[14] J. Fan and R. Li, “Statistical Challenges with High Dimensionality: Feature Selection in Knowledge Discovery,” Proceedings of the International Congress of Mathematicians, Vol. 3, European Mathematical Society, 2006, pp. 595-622.

[15] J. Fan and J. Lv, “A Selective Overview of Variable Selection in High-Dimensional Feature Space,” Statistica Sinica, Vol. 20, No. 1, 2009, pp. 101-148.

[16] M. Crowder, “On the Use of a Working Correlation Matrix in Using Generalised Linear Models for Repeated Measures,” Biometrika, Vol. 82, No. 2, 1995, pp. 407-410. http://dx.doi.org/10.1093/biomet/82.2.407

[17] L. Hansen, “Large Sample Properties of Generalized Method of Moments Estimators,” Econometrica, Vol. 50, No. 4, 1982, pp. 1029-1054. http://dx.doi.org/10.2307/1912775

[18] M. Ueki, “A Note on Automatic Variable Selection Using Smooth-Threshold Estimating Equations,” Biometrika, Vol. 96, No. 4, 2009, pp. 1005-1011. http://dx.doi.org/10.1093/biomet/asp060

[19] J. Fan and H. Peng, “Nonconcave Penalized Likelihood with a Diverging Number of Parameters,” The Annals of Statistics, Vol. 32, No. 3, 2004, pp. 928-961. http://dx.doi.org/10.1214/009053604000000256

[20] L. Wang, “GEE Analysis of Clustered Binary Data with Diverging Number of Covariates,” The Annals of Statistics, Vol. 39, No. 1, 2011, pp. 389-417. http://dx.doi.org/10.1214/10-AOS846

[21] J. Zhou and A. Qu, “Informative Estimation and Selection of Correlation Structure for Longitudinal Data,” Journal of the American Statistical Association, Vol. 107, No. 498, 2012, pp. 701-710. http://dx.doi.org/10.1080/01621459.2012.682534

[22] J. J. Dziak, “Penalized Quadratic Inference Functions for Variable Selection in Longitudinal Research,” Ph.D Thesis, The Pennsylvania State University, 2006. http://sites.stat.psu.edu/~jdziak/DziakDissert.pdf

Appendix. Proof of Theorems

Proof of Theorem 1

Let . It suffices to prove for any

. It suffices to prove for any , there is a constant

, there is a constant , such that

, such that

(A.1)

(A.1)

for  enough. This will imply that there exists a local solution to the equation

enough. This will imply that there exists a local solution to the equation . Such that

. Such that  with probability at least

with probability at least . The proof follows that of Theorem 3.6 in Wang [19], we will evaluate the sign of

. The proof follows that of Theorem 3.6 in Wang [19], we will evaluate the sign of  in the ball of

in the ball of . Note that

. Note that

(A.2)

(A.2)

where  lies between

lies between  and

and  Next we will consider

Next we will consider  and

and  respectively. For

respectively. For , by Cauchy-Schwarz inequality, we can derive that

, by Cauchy-Schwarz inequality, we can derive that

According to condition (C7), consider the  th

th  block of

block of ,

,

, let

, let  denote the

denote the  th components

th components , by some elementary calculation, we obtain

, by some elementary calculation, we obtain

where  is the

is the  th element of

th element of , hence, we have

, hence, we have . By C3 and C4, we obtain,

. By C3 and C4, we obtain,

(A.3)

(A.3)

Since , we only need to obtain the convergence rate of

, we only need to obtain the convergence rate of . Assume that

. Assume that  is the initial estimator, and is

is the initial estimator, and is  -consistent. By using the condition

-consistent. By using the condition  for any

for any  and

and , we have

, we have

which implies that  for each

for each . Therefore, we have that

. Therefore, we have that . Hence, by (A.3), we obtain that

. Hence, by (A.3), we obtain that

. (A.4)

. (A.4)

Now, we consider , we can derive that

, we can derive that

By above result, we get . Thus, it is easy to show that for sufficiently large

. Thus, it is easy to show that for sufficiently large ,

,  on the ball of

on the ball of  is asymptotically dominated in probability by

is asymptotically dominated in probability by , which is positive for the sufficiently large

, which is positive for the sufficiently large . The proof of Theorem 1 is completed.

. The proof of Theorem 1 is completed.

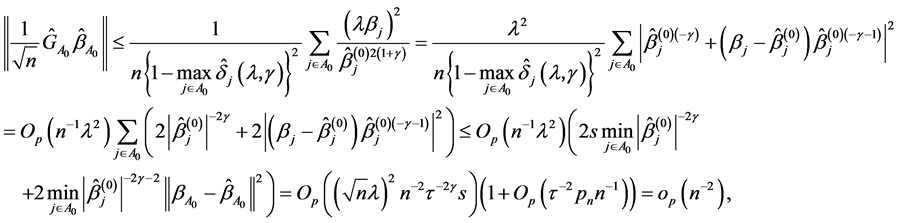

Proof of Theorem 2

According to Dziak [21], it is known that the initial estimator  obtained by solving the QIF is

obtained by solving the QIF is  - consistent. For any given

- consistent. For any given , by

, by , then,

, then,

(A.5)

(A.5)

which implies that

(A.6)

(A.6)

On the other hand, by the condition , for any

, for any , and

, and , we have

, we have

which implies that  for each

for each . Therefore, we prove that

. Therefore, we prove that .

.

Thus, we complete the proof of 1).

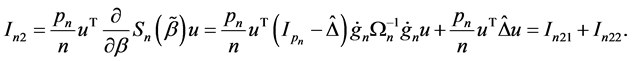

Next, we will prove 2). As shown in 1),  for

for  with probability tending to 1. At the same time, with probability tending to 1,

with probability tending to 1. At the same time, with probability tending to 1,  satisfies the smooth threshold generalized estimating equations based on quadratic inference functions (SGEE-QIF)

satisfies the smooth threshold generalized estimating equations based on quadratic inference functions (SGEE-QIF)

(A.7)

(A.7)

Applying a Taylor expansion to (A.7) at , it easy to show that

, it easy to show that

where . Since, we have

. Since, we have

where . Then, if

. Then, if  holds, by the Slutsky theorem, we can prove Theorem 2 (2). We write

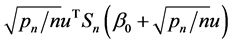

holds, by the Slutsky theorem, we can prove Theorem 2 (2). We write where

where

Since , we have

, we have

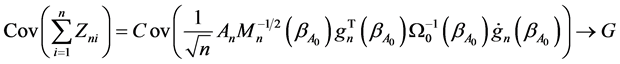

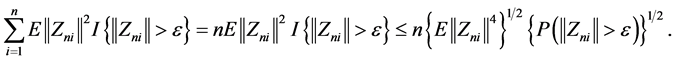

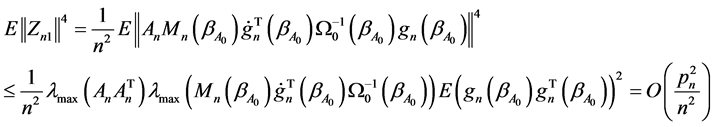

To establish the asymptotic normality, it suffices to check the Lindeberg condition, i.e., for any ,

,

(A.8)

(A.8)

Using the Cauchy-Schwarz inequality, we have

By Bhebyshev’s inequality,

and

Thus, we have

Therefore,  satisfies the conditions of the Lindeberg-Feller central limit theorem. Hence, the proof of Theorem 2 is completed.

satisfies the conditions of the Lindeberg-Feller central limit theorem. Hence, the proof of Theorem 2 is completed.