Eliciting Probabilities, Means, Medians, Variances and Covariances without Assuming Risk Neutrality ()

1. Introduction

The economic literature on the elicitation of an expert’s subjective beliefs has focused on so-called proper scoring rules. These mechanisms, which are used in many economic experiments, reward the expert on the basis of post-elicitation events such that it is in the expert’s interest to report her true beliefs if she is risk neutral. The quadratic scoring rule (QSR) [1] is the most popular rule, used to elicit the probability of an event or the mean of a random variable. In the absence of risk neutrality, there is an incentive to report conservative beliefs in order to avoid large losses [2]. This is a problem, since risk neutrality is shown to be widely violated in experimental studies [e.g. 3]. Indeed, Armantier and Treich [4] show experimentally that consistent with risk aversion, elicitation with the quadratic scoring rule leads to conservative bias in reported beliefs.

There are different ways to get around this problem. Offerman et al. [5] propose a way to correct for deviations of risk neutrality and expected utility, by quantifying the size of deviations for each individual. Alternatively, an earlier literature starting with Smith [6]1 shows how one can induce risk neutrality by rewarding subjects using binary lottery tickets. This idea has been used to show how to elicit the subjective probability of an event [e.g. 10,11] in a way similar to the elicitation of a reservation price [12].

We extend this literature in several ways. First, we prove that deterministic schemes are not adequate if one does not know the risk preferences of the expert. Second, we combine the literature on scoring rules for risk neutral preferences with the literature on incentivizing with lottery tickets to show that one can elicit a median or any quantile without making assumptions on risk preferences. We also present an alternative way to elicit a probability or mean based on the randomized quadratic scoring rule. Third, we present a new deterministic rule, and its randomized counterpart, to elicit variances and covariances when two independent observations are available.

2. Preliminaries

We consider two people, an expert and an elicitor. The expert has subjective beliefs about the distribution  of a bounded random variable

of a bounded random variable  that yields outcomes belonging to

that yields outcomes belonging to  with

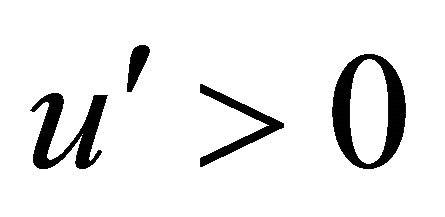

with . The expert maximizes expected utility for some utility function

. The expert maximizes expected utility for some utility function  on

on  such that

such that  for some

for some . The elicitor only knows that

. The elicitor only knows that  yields outcomes belonging to

yields outcomes belonging to , and would like to learn some parameter

, and would like to learn some parameter  of the distribution

of the distribution . We consider the use of a reward system or scoring rule

. We consider the use of a reward system or scoring rule  which rewards the expert on the basis of her report

which rewards the expert on the basis of her report  and a single random realization

and a single random realization  of

of . Here,

. Here,  is a distribution over the rewards which includes a deterministic reward as a special case. In the literature,

is a distribution over the rewards which includes a deterministic reward as a special case. In the literature,  is called strictly proper for

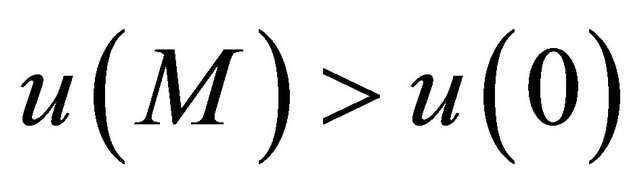

is called strictly proper for  if

if

for all

for all . We say that a rule elicits

. We say that a rule elicits  if

if  for all

for all  and all

and all  with

with .

.

3. Limitations of Deterministic Rewards

Consider an elicitor who wishes either to learn about the mean of some random variable  with support in

with support in , or about probability of some event

, or about probability of some event . We obtain the following result.

. We obtain the following result.

Proposition 1. A scoring rule with a deterministic reward cannot elicit the probability  or the mean

or the mean .

.

The proof is in the Appendix. The intuition is simple. The elicitor has only one parameter, the realization , to incentivize the expert to tell the truth. On the other hand, there are two dimensions of uncertainty as the elicitor does not know

, to incentivize the expert to tell the truth. On the other hand, there are two dimensions of uncertainty as the elicitor does not know  and

and

4. Probabilistic Elicitation

We now consider elicitation using probabilistic or randomized reward functions. The idea, first elaborated by Smith [6], is that one pays the experts in lottery tickets rather than money. The size of the prize is given by the probability of winning the lottery. Hence  where

where  is now the payoff distribution awarded conditional on

is now the payoff distribution awarded conditional on . Using this idea, we show how to elicit probabilities, means, different quantiles, and variances and covariances.

. Using this idea, we show how to elicit probabilities, means, different quantiles, and variances and covariances.

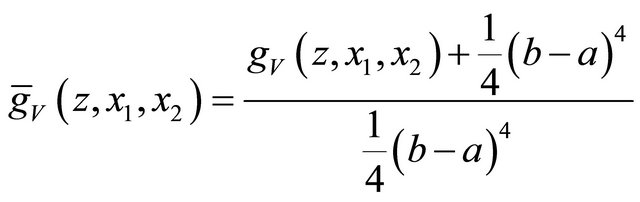

4.1. Randomization Trick

We use the following “randomization trick” to transform deterministic into probabilistic payoffs. First, given a deterministic reward function , determine

, determine  and

and

such that  and

and

Second, draw a realization  from a uniform distribution on

from a uniform distribution on  and then pay

and then pay  if

if  and pay

and pay  if

if

Formally, we replace the deterministic reward  by the randomized reward

by the randomized reward

where  is a lottery that pays

is a lottery that pays  with probality

with probality  and

and  with probability

with probability  Consequently,

Consequently,

The expected utility of the expert equals an affine transformation of . Thus, a report that maximizes her expected utility is a report that maximizes the utility of a risk neutral expert and vice versa. In particular,

. Thus, a report that maximizes her expected utility is a report that maximizes the utility of a risk neutral expert and vice versa. In particular,  elicits

elicits  iff

iff  is strictly proper for

is strictly proper for .2

.2

4.2. Eliciting Probabilities

Randomized rewards for the elicitation of probabilities have received quite some attention. Grether [10] (see also Holt [15, ch. 30] and Karni [16]) presents a simple reward function where a prize is rewarded with some probability that depends on the draw of two uniformly distributed random variables. Allen [11] presents an alternative rule that relies on a draw of a random variable that has a more complex probability distribution. Mclvey and Page [17] uses a randomized version of the quadratic scoring rule in an experimental application, which is similar to the rule we present below.

The QSR (for the event ) is given by

) is given by

and is strictly proper for  [1]. The randomized quadratic scoring rule (for the event

[1]. The randomized quadratic scoring rule (for the event ), short rQSR, is defined by

), short rQSR, is defined by

The following result obtains:

The following result obtains:

Proposition 2. The randomized quadratic scoring rule elicits .

.

Note that the expected payoffs under rQSR are identical to those under the rules of Allen [11] and McKelvey and Page [17] when .

.

4.3. Eliciting the Mean

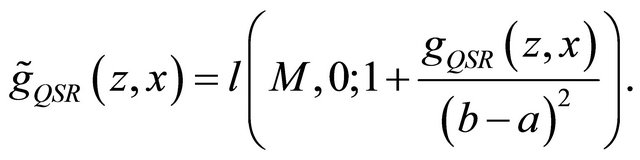

To elicit the mean, we combine the randomization trick with the fact that the QSR  is a strictly proper scoring rule for the mean (for risk neutral experts). Given

is a strictly proper scoring rule for the mean (for risk neutral experts). Given  and

and  we obtain the randomized quadratic scoring rule as defined by

we obtain the randomized quadratic scoring rule as defined by

Proposition 3. The randomized quadratic scoring rule elicits .

.

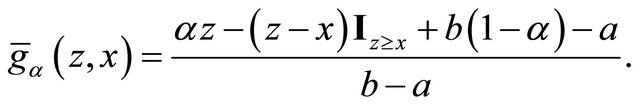

4.4. Median and Quantiles

The quantile scoring rule, due to Cervera and Munoz [18] is a strictly proper scoring rule for the quantile  of the distribution

of the distribution  of

of  for any given

for any given . Its reward function is given by

. Its reward function is given by  The randomized quantile scoring rule is hence given by

The randomized quantile scoring rule is hence given by  where

where

Proposition 4. The randomized quantile scoring rule elicits the quantile .

.

In particular, Proposition 4 shows how to elicit the median by setting .

.

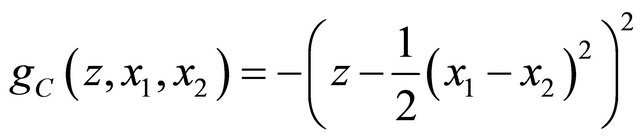

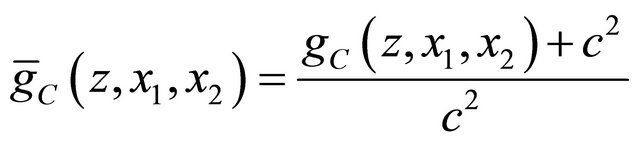

4.5. Variance and Covariance

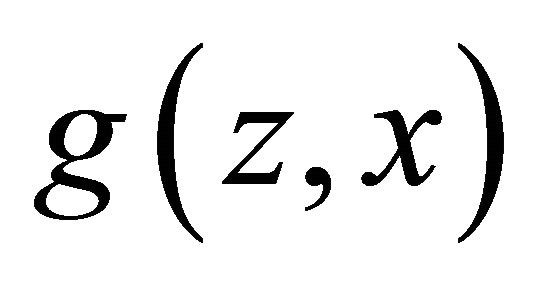

In order to elicit the variance of  we assume the elicitor can condition on two independent realizations

we assume the elicitor can condition on two independent realizations  and

and  of

of  when rewarding the expert. So we conder a reward function

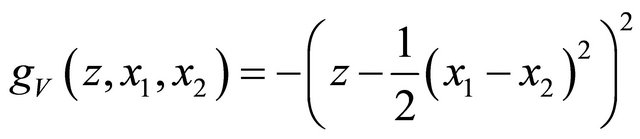

when rewarding the expert. So we conder a reward function  We first construct a strictly proper scoring rule. Following Walsh (1962),

We first construct a strictly proper scoring rule. Following Walsh (1962),

where

where  and

and  are indendent copies of

are indendent copies of  We combine this with the quadratic scoring rule to obtain that the variance scoring rule

We combine this with the quadratic scoring rule to obtain that the variance scoring rule  that is strictly proper for

that is strictly proper for  Given

Given

we obtain the randomized variance scoring rule by

Proposition 5. The randomized variance scoring rule elicits the variance of

Similarly we can elicit the covariance given two ranm variables  and

and  We assume that

We assume that

for  Here we condition on a realization

Here we condition on a realization  drawn from

drawn from  Again following Walsh (1962)we use the fact that

Again following Walsh (1962)we use the fact that

and then use the QSR to define the covariance scoring rule  that is strictly proper for

that is strictly proper for  Given

Given  and

and

we obtain the randomized covariance scoring rule by

Proposition 6. The randomized covariance scoring rule elicits the covariance of  and

and

5. Conclusions

We have rigorously shown the limits of deterministic scoring rules for belief elicitation. To overcome those limitations, we applied the idea of paying in lottery tickets to transform known deterministic scoring rules for belief elicitation, such as the well-known QSR, into randomized rules. These rules provide agents with incentives to truthfully report parameters of a subjective probability distribution for all risk preferences, and can be used in experimental applications.

This paper has considered the theoretical side. On the empirical side, it is an open question whether these rules have the desired properties in actual applications, and how they are best presented to subjects. Selten et al. [19, see also review therein] raises doubt whether subjects rewarded using lotteries behave as if risk neutral in experiments. More recently, Harrison et al. [14,20], and Hossain and Okui [13] provide evidence that the produre can induce subjects to behave more in line with risk neutrality.

Appendix

Proof of Proposition 1. If one can elicit the mean of a random variable for all distributions in  then one can also elicit the probability of an event as

then one can also elicit the probability of an event as  if

if  is the Bernoulli random variable such that

is the Bernoulli random variable such that  if and only if

if and only if  Hence it is enough to show that one cannot elicit

Hence it is enough to show that one cannot elicit  to prove that one cannot elicit

to prove that one cannot elicit

We first show that  and

and  are differentiable almost everywhere. Once this is established the first order conditions reveal the impossibility.

are differentiable almost everywhere. Once this is established the first order conditions reveal the impossibility.

Consider  where

where  So

So

Let

Let

Assume that  elicits

elicits  for all concave

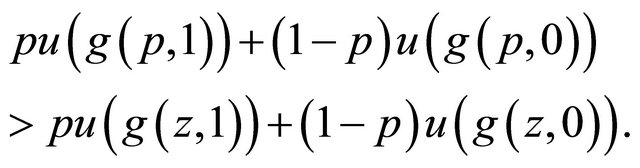

for all concave . Then we have for all

. Then we have for all

For  and

and  we have

we have

so

so

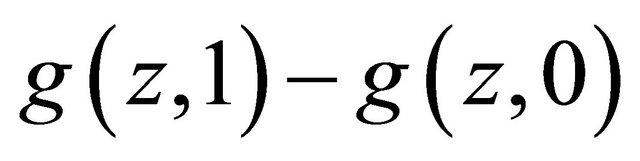

Hence we have shown that  is strictly increasing in

is strictly increasing in

Similarly, for  we have

we have

and since

it follows that  So

So  strictly decreasing in

strictly decreasing in  and hence

and hence  is strictly increasing.

is strictly increasing.

From the above two strict monotonicity statements we obtain that  and

and  are differentiable almost everywhere. Let

are differentiable almost everywhere. Let  be the set where they are differentiable.

be the set where they are differentiable.

For  and differentiable

and differentiable  we can calculate

we can calculate

and infer that

(1)

(1)

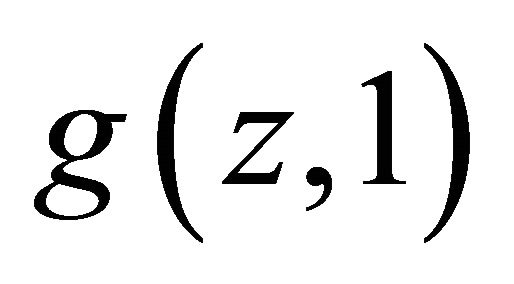

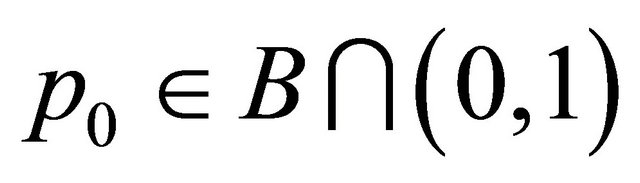

It is easy to argue with generalized version of the intermediate value theorem that there is  such that

such that  Consider

Consider  that is differentiable with

that is differentiable with . Then rewrite (1) as:

. Then rewrite (1) as:

(2)

(2)

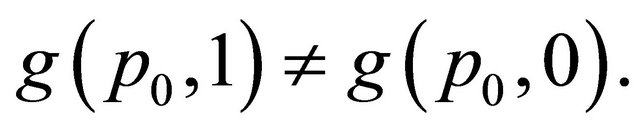

Since  is strictly increasing in

is strictly increasing in  there is some

there is some  such that

such that

So when

So when  the left hand side of (2) depends on

the left hand side of (2) depends on . Therefore, (2) cannot hold for all

. Therefore, (2) cannot hold for all .

.

NOTES

2Other authors have independently worked on similar mechanisms. Hossain and Okui [13] presents a randomized mechanism for eliciting the mean of a symmetric distribution, allowing for unbounded support with some additional restrictions. Harrison et al. [14] considers a version of the rQSR (see below), which they call the Binary Lottery Procedure. Both papers also consider non-expected utility theory.