Efficient Pricing of European-Style Options under Heston’s Stochastic Volatility Model ()

1. Introduction

Stochastic volatility models such as the model of Heston (1993) [1] are a frequent choice among finance researchers and practitioners to approximate stock price dynamics. Popularity of Heston’s model stems from its ability to reproduce a number of important time-series features of stock prices that are not adequately captured by geometric Brownian motion dynamics. In particular, Heston’s model is able to account for the leverage effect, that is, an increase in the volatility of a stock when its price declines, and a decrease in the volatility when the price rises (for more details, see Aït-Sahalia and Kimmel, 2007 [2]). As such, the model is often employed when pricing derivative securities, since it helps to correct for empirical deficiencies of the famous Black and Scholes’ (1973) [3] formula (for a discussion, see Aït-Sahalia and Lo, 1998 [4]).

Under Heston’s dynamics, the values of Europeanstyle options cannot be expressed in closed form. Instead, they may be computed numerically using the transform methods of Duffie et al. (2000) [5] and Bakshi and Madan (2000) [6], which require inverting the characteristic function of an underlying state price vector. The characteristic function can be expressed analytically using Heston’s original solution, or alternatively obtained as a special case of a more general solution of Zhylyevskyy (2010) [7]. This paper applies a particularly suitable inversion procedure and exploits symmetry properties of characteristic functions, in order to derive a computationally efficient formula for the value of a European-style put. The value of a European-style call is obtained using a parity relationship for European-style derivatives. Exploiting the symmetry of the characteristic function allows for a reduction of the domain of integration in the inversion, and cuts roughly in half the time needed for option valuation.

Efficient pricing of European-style options under Heston’s dynamics is important from a practical standpoint, since many single-name and index equity options listed on organized exchanges are European-style. Also, values of the European-style options may be used in methods of calculating prices of derivative securities of a different style, for example, in the Geske-Johnson method (Geske and Johnson, 1984 [8]) of pricing American-style options using a compound-option technique (for an implementation, see Zhylyevskyy, 2010 [7]).1

2. Stock Price Dynamics

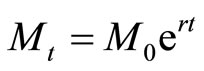

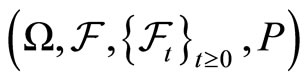

The financial market is assumed to admit no arbitrage opportunities. Thus, there is a risk-neutral probability measure, denoted here as P, under which discounted asset prices are martingales (Harrison and Kreps, 1979 [13]). One of the traded assets is a riskless bond fund with a share worth  at time t, where

at time t, where  is some initial value and

is some initial value and  is a risk-free rate. It will be convenient to use this bond fund as a numéraire security and discount asset prices by

is a risk-free rate. It will be convenient to use this bond fund as a numéraire security and discount asset prices by  when appropriate.

when appropriate.

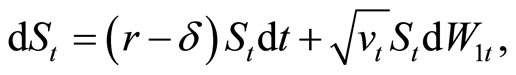

The dynamics of a stock price,  under P are described by a system of stochastic differential equations

under P are described by a system of stochastic differential equations

(1)

(1)

(2)

(2)

where  stands for a dividend rate,

stands for a dividend rate,  represents an unobservable squared volatility,

represents an unobservable squared volatility,  and

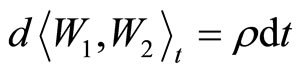

and  are correlated standard Brownian motions on a filtered probability space

are correlated standard Brownian motions on a filtered probability space  with

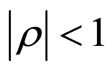

with  and

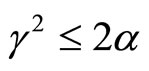

and , and α, β, and γ are nonnegative constants satisfying a restriction

, and α, β, and γ are nonnegative constants satisfying a restriction  in order for

in order for  to be almost surely positive (Chernov and Ghysels, 2000 [14]).

to be almost surely positive (Chernov and Ghysels, 2000 [14]).

To derive values of European-style options, it will be convenient to work with a log-price,  Applying Ito’s lemma to Equation (1), the evolution of the logprice is described by a stochastic differential equation

Applying Ito’s lemma to Equation (1), the evolution of the logprice is described by a stochastic differential equation

(3)

(3)

3. Characteristic Function

Let τ denote the time duration between current date t and some future date T,  Given the log-price

Given the log-price  and squared volatility

and squared volatility  the conditional characteristic function of the state vector

the conditional characteristic function of the state vector  is

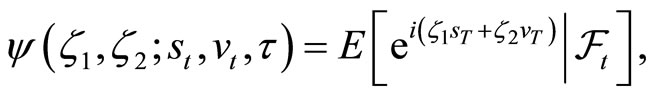

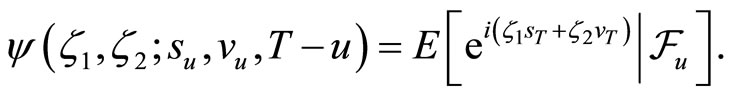

is

where E is the expected value taken under P and  and

and  are real-valued arguments.

are real-valued arguments.

Likewise, the conditional characteristic function of  at a date

at a date  is

is

Since , the σ-field

, the σ-field  and therefore,

and therefore,

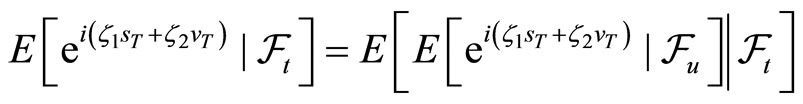

by the law of iterated expectations. Thus,

by the law of iterated expectations. Thus,

(4)

(4)

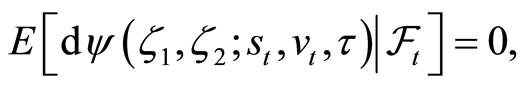

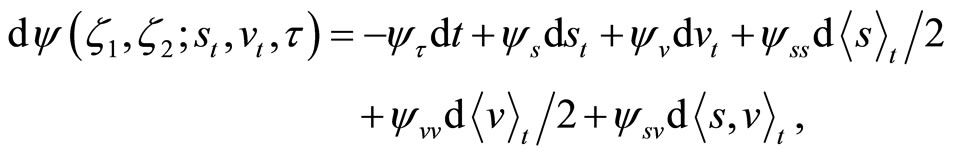

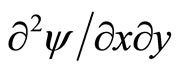

by taking u arbitrarily close to t. Applying Ito’s lemma to ψ it follows that

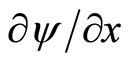

where  and

and  denote

denote  and

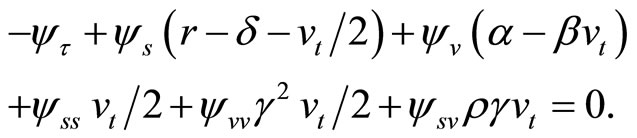

and , respectively. Then, Equations (2), (3), and (4) imply that ψ solves a partial differential equation

, respectively. Then, Equations (2), (3), and (4) imply that ψ solves a partial differential equation

(5)

(5)

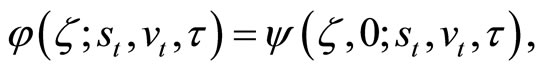

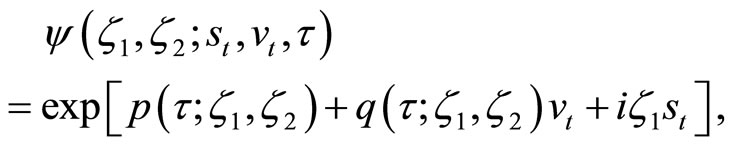

Zhylyevskyy (2010) [7] provides a complete solution for ψ using Equation (5). For reference, the solution is outlined in the appendix. The marginal conditional characteristic function of the log-price , which will be inverted to derive the value of a European-style put, is obtained as a special case:

, which will be inverted to derive the value of a European-style put, is obtained as a special case:

(6)

(6)

where  is a real-valued argument.

is a real-valued argument.

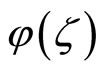

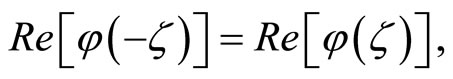

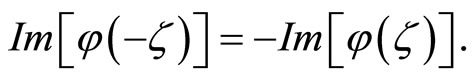

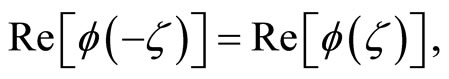

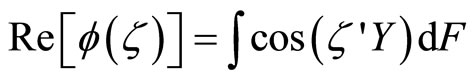

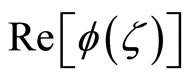

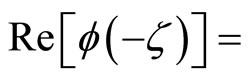

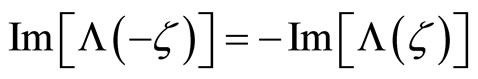

The complex-valued function  is symmetric in the sense that its real part is an even function,

is symmetric in the sense that its real part is an even function,

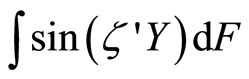

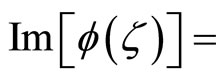

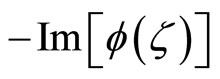

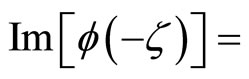

while its imaginary part is an odd function,

This symmetry will allow for a simplification of the option value’s expression and is a property of all characteristic functions, as Lemma 1 shows.

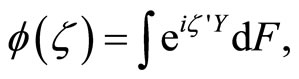

Lemma 1. Let  be the characteristic function of a random vector Y, where

be the characteristic function of a random vector Y, where  is a real-valued vector of the same dimension as Y. The real part of

is a real-valued vector of the same dimension as Y. The real part of  is an even function,

is an even function,

and the imaginary part of  is an odd function,

is an odd function,

.

.

Proof. By definition,  where F is the cumulative distribution function of Y. Applying Euler’s formula,

where F is the cumulative distribution function of Y. Applying Euler’s formula,

and

.

.

It then follows from the properties of trigonometric functions that

and

.

.

4. Option Value Formulas

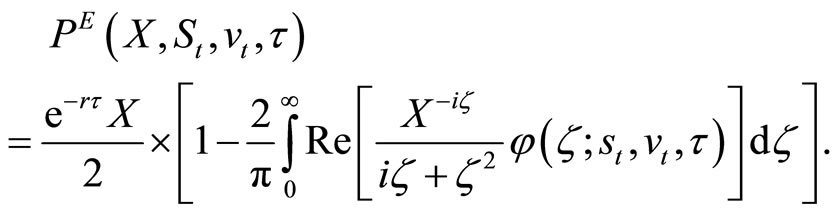

This section applies the transform methods of Duffie et al. (2000) [5] and Bakshi and Madan (2000) [6], and exploits the symmetry of the characteristic function φ to obtain computationally efficient formulas for values of European-style puts and calls under Heston’s dynamics. Initial steps of the derivation follow the approach of Epps (2004) [15], but the idea to exploit the symmetry of the characteristic function is novel.

Let  denote the current value of a European-style put with a strike price X, given the (current) underlying stock’s price

denote the current value of a European-style put with a strike price X, given the (current) underlying stock’s price  volatility

volatility  and time to expiration

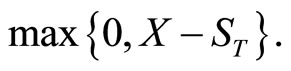

and time to expiration  The put is allowed to be exercised on date T when its value will be

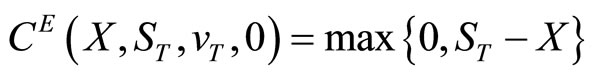

The put is allowed to be exercised on date T when its value will be  =

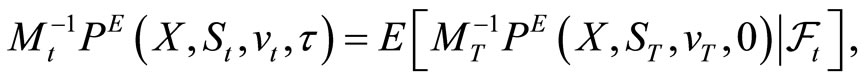

=  The first fundamental theorem of asset pricing implies that the put’s value, discounted by the share price of the riskless bond fund, is a martingale. Thus,

The first fundamental theorem of asset pricing implies that the put’s value, discounted by the share price of the riskless bond fund, is a martingale. Thus,

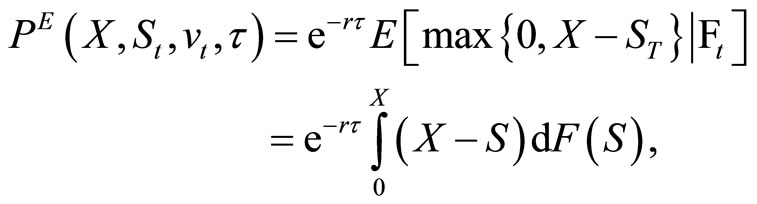

and therefore,

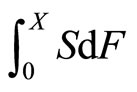

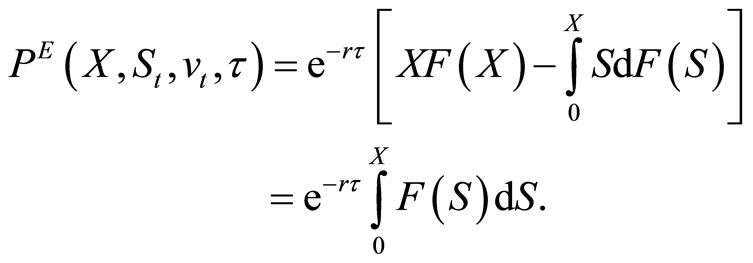

where F is the conditional cumulative distribution function of . Note that

. Note that  since the stock price cannot be negative. Integrating

since the stock price cannot be negative. Integrating  by parts, the put’s value can be expressed as

by parts, the put’s value can be expressed as

Observe that

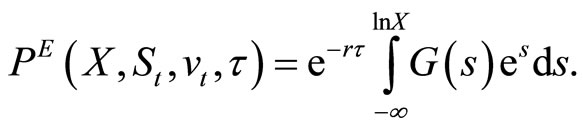

where G is the conditional cumulative distribution function of the log-price  Hence, by changing variables as

Hence, by changing variables as  the put’s value can be re-expressed as

the put’s value can be re-expressed as

(7)

(7)

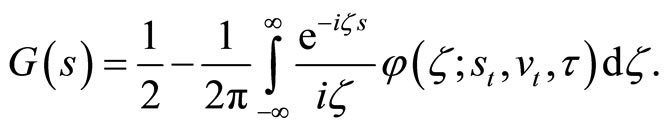

The characteristic function φ can be inverted to obtain G as follows (Gil-Pelaez, 1951 [16]):

(8)

(8)

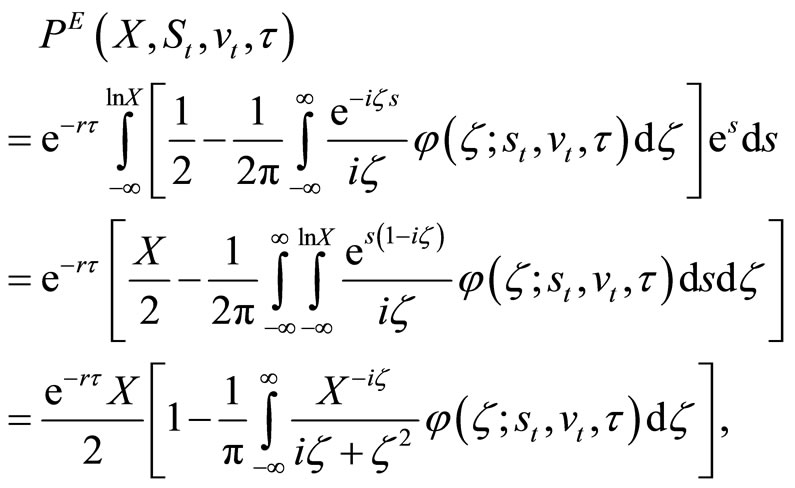

Plugging Equation (8) into Equation (7),

(9)

(9)

where the change in the integration order after the second equality sign is due to Fubini’s theorem.2

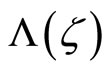

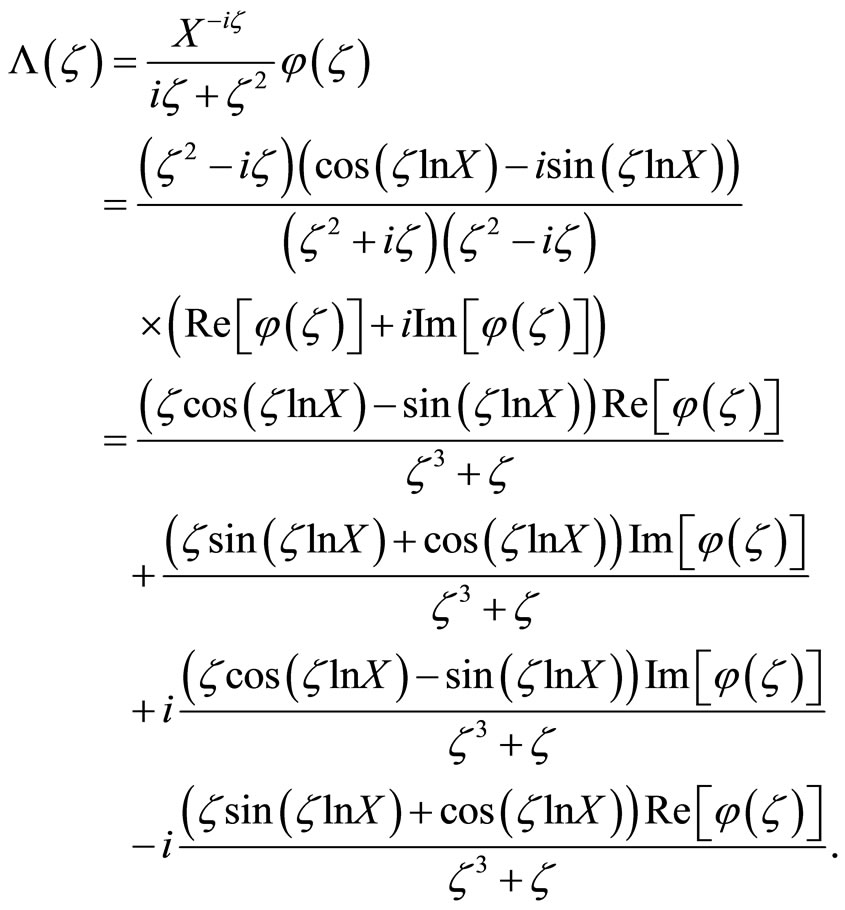

The put option value formula, Equation (9), can be simplified by exploiting the symmetry of φ. Denoting the complex-valued integrand in Equation (9) as  and applying Euler’s formula to it,

and applying Euler’s formula to it,

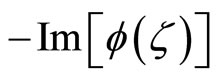

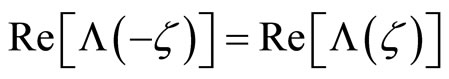

It then follows from the properties of trigonometric functions and Lemma 1 that  and

and . Therefore, by applying properties of even and odd functions,

. Therefore, by applying properties of even and odd functions,

(10)

(10)

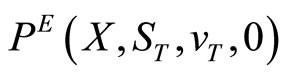

The oddness property of the imaginary part of  is not particularly surprising, since the imaginary part must integrate out to zero in order for

is not particularly surprising, since the imaginary part must integrate out to zero in order for  in Equation (9) to be real-valued. However, the evenness property of the real part of

in Equation (9) to be real-valued. However, the evenness property of the real part of  is not immediately obvious. It allows for a reduction of the domain of integration, as Equation (10) shows.

is not immediately obvious. It allows for a reduction of the domain of integration, as Equation (10) shows.

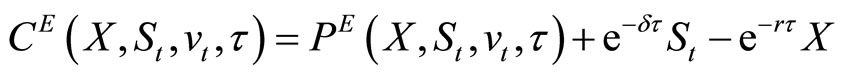

Finally, let  denote the current value of a European-style call with a strike price X, given the stock’s price

denote the current value of a European-style call with a strike price X, given the stock’s price , volatility

, volatility  and time to expiration

and time to expiration  The call is allowed to be exercised on date T when its value will be

The call is allowed to be exercised on date T when its value will be . By a put-call parity relationship for European-style options (Merton, 1973 [17]), which holds regardless of specific stock price dynamics,

. By a put-call parity relationship for European-style options (Merton, 1973 [17]), which holds regardless of specific stock price dynamics,

where

where  can be obtained using Equation (10).

can be obtained using Equation (10).

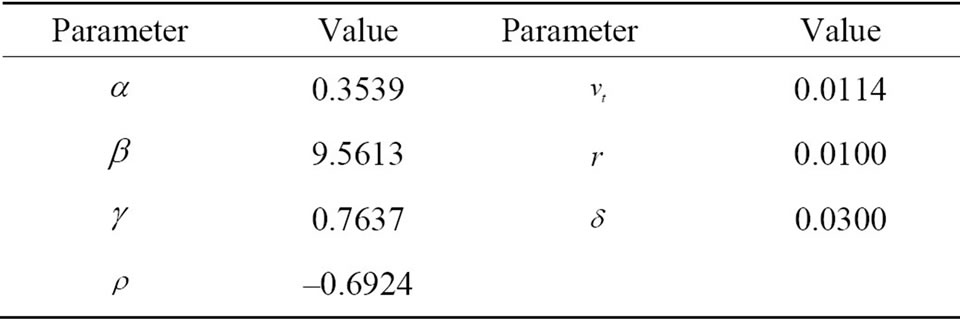

5. Numerical Investigation

Equations (9) and (10) require numerical integration to calculate option values in practice. Intuitively, reducing the domain of integration in Equation (10) should allow for an increase in computational speed without a loss in precision. To assess actual performance of the two option value formulas, I conduct a numerical exercise. Namely, I calculate large series of put option values by applying both Equation (9) and Equation (10), and record the total computation time in each case. Parameter values used in the exercise are listed in Table 1 and correspond to calibrated values for the dynamics of the S & P 100 Index in July 2004 (Zhylyevskyy, 2010 [7]).3 Series of put options are generated by varying the underlying price  from 450 to 550 and the strike price X from 350 to 650. All options have a duration of three months. Numerical integration is implemented using the Gauss-Kronrod quadrature method (Press et al., 2001 [18]).

from 450 to 550 and the strike price X from 350 to 650. All options have a duration of three months. Numerical integration is implemented using the Gauss-Kronrod quadrature method (Press et al., 2001 [18]).

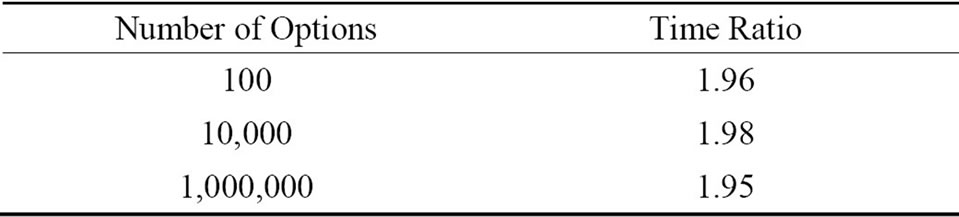

Table 2 reports the ratio of time needed to calculate all option values in series comprising 100, 10,000, and 1,000,000 options, using Equation (9) relative to Equation (10). As can be seen, by applying Equation (10) instead of Equation (9), the computation time can be cut almost in half. This outcome is expected since the integration in Equation (9) is conducted over the entire real line, while in Equation (10) it is only performed over the nonnegative domain. Most likely, since a small fixed cost of calling the integration routine is borne regardless of the region of integration, the computation speed increases by slightly less than twice overall.

The results of the numerical exercise indicate a computational advantage of Equation (10). This option value formula can help to reduce the cost of computationally intensive tasks that require evaluating multiple European-style derivative securities under Heston’s dynamics, such as in the cases of calibrating model parameters and calculating American-style option values by the compound-option scheme of Geske and Johnson (1984) [8].

Table 1. Parameter values in numerical exercise.

Table 2. Relative performance of option value formulas.

6. Conclusion

Efficient pricing of European-style derivatives under the stochastic volatility dynamics of Heston’s model has practical relevance, due to the model’s popularity. This paper utilizes a standard transform approach based on inverting the characteristic function of the log-price, and exploits the function’s symmetry in order to derive a computationally efficient formula for the value of a European-style put. The value of a call option is obtained using the parity relationship. The computational advantage of the formula stems from reducing the domain of integration in the inversion procedure, and is illustrated numerically. The method can help to mitigate the time cost of algorithms that require repeated evaluation of European-style options under Heston’s dynamics.

Appendix

The conditional characteristic function of the state vector  is

is

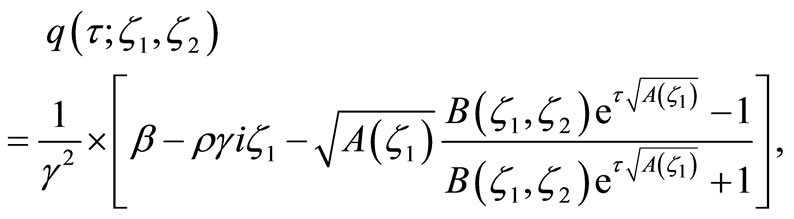

where complex-valued functions  and

and  are defined below.

are defined below.

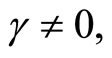

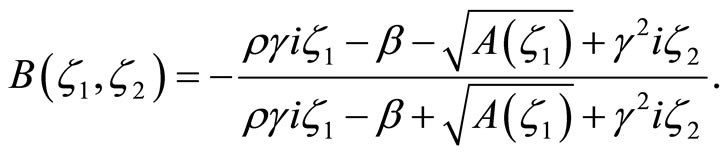

In particular, if

and

and

where

and

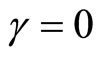

The case of  is not particularly interesting because it rules out stochastic volatility. Expressions for the functions p and q in that case and all derivations can be found in Zhylyevskyy (2010) [7].

is not particularly interesting because it rules out stochastic volatility. Expressions for the functions p and q in that case and all derivations can be found in Zhylyevskyy (2010) [7].

NOTES

2Observe that the double integral is finite because

3The S & P 100 Index includes 100 leading stocks in the United States, which are components of the broader S & P 500 Composite Index and represent roughly 45% of the equity market capitalization.