Challenges of Start-Ups—An Analysis of Individually Tailored Recommendations Based on the Development Phases, Branches, Business Models and Founding Teams ()

1. Introduction

Start-ups are the driving force of economic and technological change in the modern world. With innovative ideas and disruptive technologies, they can revolutionize industries, tap into new markets, and have a crucial impact on the world of tomorrow. Particularly in light of the immense challenges of the coming decades, such as climate change, demographic aging, or resource scarcity (Roters et al., 2023: 231 ff.) , advanced and forward-thinking solutions enabled by the open and resilient working methods of start-ups, are needed (Kulicke, 2021: 28 f.) .

The global crises of recent years, such as the ongoing Ukraine war, the global energy crisis, or the struggle for dwindling resources (Althammer et al., 2022; Guterres, 2022) , are showing their effects on the start-up ecosystem in Germany for the first time in 2022. After a steady increase in entrepreneurial activities from 2416 in 2019 to 3196 in 2021, the increased economic and political uncertainty has led to a decline in new ventures to 2618 in 2022 (see Figure 1). This corresponds to a reduction of −18%, making the second half of 2022 the weakest since recording began in 2019 (Gilde et al., 2023: p. 3) .

At first glance, challenges for start-ups may seem like a well-researched topic. Numerous surveys, studies, and reports delve into current issues, reasons for failure, or challenges faced by young companies. Upon closer examination, it becomes evident that most of these works only address the challenges for

start-ups at a high level, independent of industries, products, business models, or stages of development. Yet, many challenges vary significantly based on these parameters.

Thus, a service-oriented start-up may have fewer issues with initial capital and instead need to focus on recruiting value-adding employees. Conversely, for a manufacturing company with extensive machinery and high fixed costs, capital procurement is a primary concern. For this reason, it is crucial to specify the challenges precisely, to better address the needs of start-ups. Especially considering that, according to the sentiment expressed by Metzger (2023) and Körth (2023) , entrepreneurial activities are expected to significantly rebound in the current year. An increase of 1300 startups in the first half of 2023 is anticipated based on Figure 1. As a result of this it is essential to take a closer look at the challenges and support options to minimize the dropout rate.

The aim of this paper is to develop tailored recommendations for German start-ups based on the current challenges, depending on the stage of development, industry, business model, and team composition. To understand the correlation between developmental stages and challenges faced by start-ups, an extensive literature review of foundational theories is initially conducted, followed by a scientific data collection from 152 start-ups, along with subsequent analysis and evaluation. In this context, the following two questions are addressed throughout the article: What are the most significant challenges facing German start-ups? And what recommendations can be provided to German start-ups in their respective developmental stages, industries, business models, and team compositions to address these challenges?

2. Theory and Literature Review

The field of entrepreneurship, according to the definitions provided by Joseph Schumpeter and colleagues, encompasses much more than just entrepreneurship itself. Rather, it represents visions, creativity, willingness to take risks, and innovations (Hell & Gatzka, 2018: 2 f.; Schumpeter, 1934: 128 ff.) . Each of these characteristics gives rise to challenges and difficulties that founders in start-ups have to overcome. To better understand and contextualize these challenges, the different developmental stages of start-ups, and their associated challenges are analyzed in closer detail.

2.1. Start-Ups

To analyze and define the professional significance of a start-up used in this work, various explanations from literature are listed in Appendix A, and overlapping characteristics are compared. The definitions are examined for the following features: company age, innovation, willingness to take risks, number of employees, and growth.

Initial attempts at defining start-ups emerged in the 1980s. Keebel, for instance, posited 1976 the characteristic “new,” referring to the company’s age, as an important characteristic of a start-up (Luger & Koo, 2005: p. 18) . Other definitions formulated before 2000 also base their understanding of a start-up on the age of a company/organization (Carter et al., 1996: p. 153) . In academic literature between 2000 and 2014, the increasing demands of national and international economic markets, as well as more complex technical solutions, are clearly reflected in the authors’ definitions. The extraordinary level of inventiveness and progress required for this is associated by researchers with the desire for growth (Ehsan, 2021: p. 3; Achimská, 2020: 2 f.) . Newer attempts at definition from 2015 to 2022 incorporate elements from both of these temporary historical phases. In addition to the changing times, as highlighted by Krejcı et al. (2015) , characteristics such as “new,” innovation, and growth are again seen as important features of start-ups due to the dynamic market environment.

In summary, there is no unified consensus among researchers regarding the definition and characteristics of a start-up. Instead, the description reflects a fluctuating portrayal of properties adapted to the current market situation. From Appendix A, it is evident that the characteristic “innovative” is included in nearly 70% of the definitions, followed by “new” (61%) and “scalable” (54%). Lagging behind and only sporadically used are “willingness to take risks” (23%) and “small” (8%). Based on this analysis and considering the fast-paced and complex nature of the current economic environment, along with the associated challenges of rapid growth, the following definition is proposed for the present work: A start-up is a company founded within the last ten years, offering innovative technologies or services that represent a novelty in their nature, and aiming for economic and entrepreneurial growth.

2.2. Development Phases

On the journey from an innovative business idea through development to successful marketing, it represents a protracted trajectory. Along this continuum, the startup undergoes various developmental stages, each of which creates novel exigencies for the company. Typically, the demarcation of these stages is delineated either by corporate or financing phases, as they demonstrate interrelatedness both in terms of expertise and content (Gerlach & Feil, 2022: p. 3; Schuh et al., 2022: p. 10; Kollmann et al., 2022) . Additionally, in colloquial parlance, categorizations based on tasks, prospective objectives, or the product lifecycle are frequently encountered (Grothusen & Blomstersjö, 2023: p. 23; Emran, 2023) .

For the analysis and definition of the developmental phases of a start-up used in this study, various explanations from researchers are shown in Figure 2 and correlated with each other. For better contextualization, the lower part of the graph depicts the general revenue-time trajectory, which can be related to the lifecycle of a start-up. Upon comparison of the research findings, it becomes apparent that clear boundaries between the phases cannot be drawn. The transitions between each phase are fluid and heavily dependent on individual factors. The oldest definition of the developmental phases of a start-up can be found in

![]()

Figure 2. Literature review on the definition of the development phases of a start-up (Source: own illustration, individual sources in text).

the Harvard Business Review from 1983, which distinguishes between the five stages of Existence, Survival, Success/Growth, Take-off, and Resource Maturity (Churchill & Virginia, 1983) . Even this description broadly encompasses many of the characteristics considered important today.

Subsequent newer definitions by Zademach and Baumeister (2014) , Diehm (2017) , and Bogott (2017) describe, as company stages, the Pre-founding, Founding, Growth, and Maturity, and then incorporate an initial connection with financing phases (Pre-)Seed, Start-up, First Stage, Second Stage, Third Stage, and Transition/EXIT into the definition. From 2018 to the present, numerous researchers have provided further explanations of company and financing phases (Breitinger et al., 2022: p. 7; Hahn, 2018: pp. 27-30; Hofstrand, 2022: pp 1-2; Kollmann, Hensellek et al., 2019: p. 25; Schuh et al., 2022: p. 9; Sure & Rimmele, 2020: 52 f.) . It is notable that the greatest agreement among phases and characteristics is observed around the founding period. This may be due, on one hand, to the relevance of this moment, and on the other hand, to the presence of significant and quantifiable characteristics that facilitate classification.

For instance, the Pre-founding and Founding phases clearly differentiate from each other. In the Pre-founding phase, the focus is on developing the product idea and its feasibility, securing initial sources of capital, and creating preliminary plans, whereas in the Founding phase, the product is introduced towards the end, and registration with the commercial register is made (Diehm, 2017: 87 ff.; Zademach & Baumeister, 2014: 121 ff.) . Similarly, the transition to the subsequent Building phase essentially begins with the official founding of the start-up. From then on, the focus is on introducing initial corporate structures, acquiring customers, and increasing emphasis on marketing. In this phase, identifying new financial sources via the Growth Stage is also crucial. Principal capital providers are VCs or banks, which can provide initial loans based on existing substantial values (Breitinger et al., 2022: p. 7; Hofstrand, 2022: 1 f.; Sure & Rimmele, 2020: 52 f.) . Opinions diverge significantly depending on the context for the subsequent phases. The Building, Growth, and Maturity phases are often combined situationally and adjusted in content according to the researcher’s requirements.

Pre-founding Phase: Central to the pre-founding phase is the emergence of the idea and the determination to establish a venture. Once this determination is present, product development can commence, alongside initiating contact with experts and potential partners. Concurrently, provisional business and financial plans as well as the business model need to be formulated. Towards the end of this phase, a feasibility study regarding implementation becomes crucial. This study is necessary to demonstrate seriousness to potential stakeholders. Typically, in this phase (seed phase), funding from FFF (Family, Friends, Fools) and equity is utilized. It is characterized by the absence of revenue, users, and an established company (Kazanjian & Drazin, 1990: 137 ff.; Tech, 2018: p. 216; Zademach & Baumeister, 2014: 121 ff.) .

Founding Phase: The founding phase begins with initiating bureaucratic processes and obtaining all necessary legal safeguards for the startup, culminating in registration with the commercial register and, in the case of two or more individuals, signing the shareholder agreement. Meanwhile, the product must be further developed to market readiness and prepared for launch, as initial test buyers are expected to evaluate the value proposition. An interdisciplinary structuring of task allocation is necessary during this phase (typically: everyone does everything) to enable product distribution. Furthermore, it is essential to have a robust business plan by the end of this phase. The plan is imperative as, from this phase onwards (startup phase), Business Angels (BA) or Early Stage VCs may become potential capital providers, scrutinizing the business concept in their company evaluations. It is also characteristic that there are few to no employees yet and no revenues are possible due to missing legal requirements (Breitinger et al., 2022: p. 7; Kazanjian & Drazin, 1990: 137 ff.; Kollmann, Hensellek et al., 2019: p. 25; Zademach & Baumeister, 2014: 121 ff.) .

Build-up Phase: The build-up phase is characterized by vigor, motivation, and determination. Demand for the product/service gains momentum, necessitating the establishment of required organizational structures (logistics, sales, quality) and the hiring of new employees. Moreover, initial feedback from test customers is received, enabling targeted improvements. The focus in the subsequent process is on enhancing User Experience (UX) and maintaining the initial momentum, allowing acquired customers to recommend and retain the offering. Potential investors in this phase can be acquired through the first financing round (First-Stage Phase). Additionally, VCs and now banks are interested in potential collaborations. Characteristic of this phase is emerging growth in all areas of the company, both in revenue and profit (Breitinger et al., 2022: p. 7; Kazanjian & Drazin, 1990: 137 ff.; Kollmann, Hensellek et al., 2019: p. 25; Zademach & Baumeister, 2014: 121 ff.) .

Growth Phase: Once a company has entered the market, the focus shifts towards establishing and expanding its position. The growth phase specifically emphasizes this aspect. To extensively acquire new customers, investments in sales and marketing need to be significantly increased. This can only be achieved through targeted recruitment of new employees. As the number of employees continues to grow, new areas of responsibility and organizational structures emerge, leading to an adjustment of leadership and corporate philosophy. Additionally, there are new research efforts aimed at introducing updates to the product or entirely new product variations to the market, thereby maintaining interest in the company. In summary, this phase is characterized by growth and change. If the internally generated profit at this stage is insufficient to handle the tasks ahead, the company requires another round of financing (Second-Stage Phase). At this point, it is also possible to turn to conventional bank loans, strategic partners, or private investors (Diehm, 2017: 87 ff.; Hahn, 2018: pp. 27-30; Kollmann, Hensellek et al., 2019: p. 25; Zademach & Baumeister, 2014: 121 ff.) .

Maturity Phase: In the final development phase, on the one hand, company processes and employee structures stabilize, while on the other hand, growth and user numbers stagnate. After several successful years in the market, the next entrepreneurial decision must be made. If the company is in crisis, a new round of financing (Third-Stage Phase) can initiate a restructuring or turnaround. Further financing options include private or public investors as well as mezzanine capital. If the founder wishes to relinquish control of the company, they can opt for an MBI (Management Buy-In) or alternatively an MBO (Management Buy-Out), both of which can lead to a renewed sense of momentum and thus new opportunities and growth. If the company’s valuations are good and there is no end in sight to growth potential, founders have the options of an IPO (Initial Public Offering) or exiting the company (Exit). The exit can take the form of a Trade Sale or Secondary Buy-Out. The difference lies in the fact that in a Trade Sale, all own shares are sold to strategic investors, whereas the Secondary Buy-Out describes the sale to VCs or private equity firms (Diehm, 2017: 87 ff.; Hahn, 2018: pp. 27-30; Kazanjian & Drazin, 1990: 137 ff.; Zademach & Baumeister, 2014: 121 ff.) .

2.3. Start-Up Challenges

Throughout the developmental phases, all founders sooner or later encounter various challenges in implementing their ideas. While hurdles are always to be considered individually, negative influences can generally be reduced through thorough preparation and support. To achieve this, it is essential to be aware of the challenges in advance. As a basis for the subsequent study, the currently most significant challenges faced by startups are derived from the analysis of theoretical approaches as well as the evaluation of practical surveys.

The theoretical approach is based on the well-known Business Model Canvas by Alexander Osterwalder in 2008. It subdivides the business model into nine core processes and can be used to illustrate processes, recognize the central value proposition, and ultimately identify specific challenges/problems within the company. From each of these areas, theoretical challenges can be derived that companies have to contend with (Lampela et al., 2020: 108 ff.; Osterwalder & Pigneur, 2010; Robinson & Lock, 2021: p. 1) .

The practical aspect involves an analysis of current start-up related studies such as the KfW-Gründungsmonitor, the Deutsche Start-up Monitor of the German Start-up Association, the Start-up and Innovation Monitor by mm1, the EXIST study, and the RKW study on challenges within teams. In these studies, the most significant challenges faced by startups in dedicated areas have been surveyed and evaluated. From both approaches, following a thorough analysis, clustering of comparable characteristics, and evaluation of their impact, 15 decisive challenges can be synthesized, listed in Figure 3.

3. Research Methodology

The basis for addressing the research hypotheses is a quantitative study conducted among German start-ups. Additionally, the acquired data must be examined for their quality and validity, and if necessary, processed and cleaned. The data analysis tool SPSS is used for this purpose. Subsequently, the validation of the data model is carried out by testing the variables for consistency and significance outcomes.

3.1. Research Hypotheses

Based on theoretical and practical analyses of the challenges, it can be assumed that the challenges faced by German start-ups depend on the main factor of the developmental phase and other variables such as industry, business model, or founding team. Based on the first research question, the following hypotheses are investigated:

• H1: Depending on the individual developmental stages, German start-ups encounter different challenges.

• H2: Depending on the industry, German start-ups encounter different challenges.

• H3: Depending on the business model, German start-ups encounter different challenges.

• H4: Depending on the composition of the founding team, German start-ups encounter different challenges.

![]()

Figure 3. Summary of the challenges faced by German start-ups (Source: own illusstration).

From the findings of the research hypotheses, various individual recommendations for action can be derived. To this end, various correlations among the influencing parameters are examined and then related to the challenges, which serve to answer the second research question.

3.2. Research Design

For the analysis of the central aspects (challenges and development phases of start-ups) in this paper, a combination of basic literature analysis and a quantitative and standardized survey is utilized to define these variables. For the categorization and clustering of challenges from theoretical literature and practice-oriented studies, the deductive qualitative content analysis method proposed by Mayring (2010) is chosen. This method defines a new category system from existing analyses and theories, serving as a basis for further empirical research (see Chapter 2.3). The publicly available standardized survey includes questions regarding general information, developmental phases, challenges, and general future prospects, among others. The information obtained from the study can subsequently be used to answer the research questions and hypotheses.

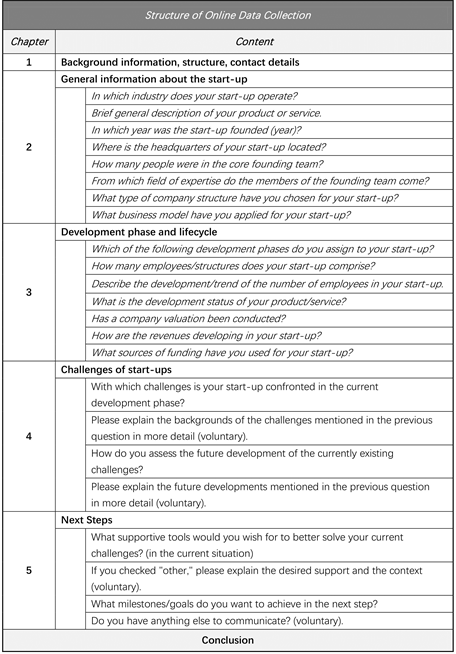

3.3. Survey Structure

In the first chapter, participants are provided with background information on the motivation for data collection and a brief outline of the content. The data collection regarding general start-up facts follows in the second chapter, covering industry, product/service, founding year, headquarters, core founding team, company form, and business model. The start-up phase model developed at the beginning is presented as assistance. Subsequently, participants can classify themselves through single-choice questions regarding the developmental phase itself, employees, product development and company valuation, as well as revenues and financing. In the fourth and fifth sections, the current and future development of challenges are queried using a single-choice grid, and potential solution approaches are analyzed. A five-point Likert scale is used for this purpose. The detailed structure and specific questions are presented in Appendix B.

3.4. Definition of Target Group and Sample Size

In the present survey, the founders of the start-ups form the participants of the study. The limiting characteristics result from the definition of start-ups. For example, no more than ten years may have passed since the company was founded, otherwise it is considered to be established on the market, the business model must be growth-oriented and scalable and be based on an innovative approach. To assess these variables, the start-up, business model and product/service are surveyed at the beginning of the study. Another limitation is the restriction to German start-ups. For this purpose, the general part of the survey checks the location of the main headquarters, which must be within Germany.

Once the characteristics and type of survey have been defined, the sample size required for the research results to be considered representative must be determined. The confidence level and the margin of error are named as decisive assessment factors (Mossig, 2012: 18 ff.) . According to Mossig (2012) and Rinne (1995) , the formula to be used to calculate the minimum required sample size for a finite population is as follows:

(1)

n = minimum required sample size for a finite population;

N = number of elements in the population;

ε = chosen acceptable error;

z = value of the confidence level calculated from the level of confidence;

P = actual mean of the population (standard deviation);

Q = reciprocal (1 − P).

When calculating the minimum number of start-ups required, the first step is to determine the size of the population. According to Grote et al. (2020) , the number of German start-ups in 2019 was around 70,000, although this fell to 60,000 during the coronavirus crisis and then rose again slightly (Kövener, 2021) . Since measurable influences only arise at N smaller than 1000 with this number N of the population, the approximate mean value of N = 65,000 can be used without any problems. The challenges of start-ups in particular have not yet been extensively researched and are therefore considered a niche area, which means that a confidence level of 90% can be selected. The necessary z-value, which in this case is 1.65, can be read from this using standard statistical tables. The margin of error is also set at 7% due to the niche survey. The standard deviation cannot be determined before the survey and is therefore set to the worst possible value of 50%, resulting in the values of P = 0.5 and Q = 0.5. By specifically calculating the result variations, the P value can be can be improved and thus the required minimum number of participants can be reduced. Applied in formula (1), you get:

The minimum sample size required can be set at 139 participants. The results thus obtained reflect 90% of the opinion of all start-ups in Germany with an error probability of ±7%.

3.5. Data Preparation and Validation

In the scientific study conducted here, a total of 177 startups participated. In a first step, 24 companies need to be removed from the original dataset due to incompleteness in filling out or filtering questions. The remaining 153 datasets are checked for tendencies towards extreme positions and centrality, resulting in the exclusion of another participant. In the final consistency check of the responses, no additional anomalies or errors are found, resulting in a final dataset comprising a total of 152 participants. Comparing the achieved number of participants, 152, with the theoretically required sample size (139) to achieve valid statistical power, it can be stated that the present dataset, with a confidence level of 90% and a margin of error of 6.7%, exhibits sufficient statistical validity for further use.

The previously prepared dataset of 152 participants must be further examined for its significance in the next step (see Table 1). For this purpose, the developmental phases in the dataset are modified based on the statements made by the startups themselves, according to the defined definition, to obtain the most accurate statement possible. To assess model significance, the influences of developmental phase, industry, business model, and team composition on startup challenges are examined using multinomial logistic regression analysis in SPSS (Likelihood Ratio Test). Model goodness-of-fit is determined for each case based on significance (at 0.05) (Lehnen et al., 2020; Wu & Vos, 2018: 112 ff.) and the pseudo-R-squared (>0.2) (McFadden, 1979: 306 f.) . From Table 1, it can be inferred that significant models can be established for almost all challenges, except for scalability of business areas (6), establishing effective sales (10), and limitations imposed by politics and laws (14). For all other challenges, the interpretability is at least sufficient. The color shading of the Likelihood Ratio describes the influence of the variable on the challenge from green (valid influence) to red (no discernible influence).

![]()

Table 1. Model validation of multinomial logistic regression (Source: own illustration based on SPSS analysis).

*Assessment according to Cox and Snell, Nagelkerke, McFadden, ** All values are provided in decimal values and are to be interpreted as percentages.

4. Data Analysis & General Insights

The aim of the descriptive analysis of the survey is to obtain a comprehensive overview of the dataset. The raw data should be ordered, summarized, and presented as impartially as possible (Stoltzfus et al., 2018: p. 60) . Interdisciplinary comparisons and correlation analyses are subsequently conducted to address the research hypotheses.

4.1. Evaluation of Demographic Data

Considering the entirety of the valid dataset, survey participants are distributed across a total of twelve federal states. As depicted in Figure 4, Bavaria stands out with by far the highest number of responses (69) from start-ups. Additionally, Baden-Württemberg with 29, Berlin with 17, and North Rhine-Westphalia with 12 can boast a valid number of participants. The remaining participants are distributed across other federal states. Although the dataset can be used to address the challenges of German “start-ups,” it holds higher relevance and significance concerning start-ups in the southern German region.

Regarding the temporal categorization of start-ups, the analysis clearly shows that 74% have entered the market within the last four years. The dataset for 2023 also includes those start-ups that were not yet founded at the time of the survey but have imminent plans to do so. The majority of startups were founded in 2022, with 33 recorded. Additionally, a combined total of 49 participants were acquired for the years 2020 (25) and 2021 (24), allowing for an analysis of potential influences on start-up challenges during the COVID-19 period. In the years around 2014, only five or fewer companies are found.

4.2. Start-Up Backgrounds

When differentiating respondents by industry, it is striking that 43% (65) originate from the IT/software/e-commerce sector. On the one hand, such companies can be founded with low financial expenses, which make the initial hurdles appear lower; on the other hand, this reflects the advancing technological change and digitization in entrepreneurship. The second most common participants are company from the automotive or aerospace sector, accounting for 20% or 31 participants. Start-ups from other sectors occupy subsequent positions. Due to the high proportion of the IT industry, the SaaS approach dominates the business models by a significant margin (40%), which, in conjunction with the fourth-ranked software programming model (10%), constitutes exactly half of all participants (see Figure 5). Simultaneously with the industry breakdown, the creation of a technological/physical product (26%) and service/consulting (16%) rank second and third, respectively, among the business models.

When investigating team composition, it is noticeable that teams of two or three members together represent nearly 70% or 106 of the start-ups. In this composition, increased productivity, reduced workload, and mutual encouragement for new ideas prevail. Teams with one or four members each share third and fourth places at 14%. A team composition of five or more individuals is extremely rare (3%) due to the difficulty of coordination, complexity of self-organization, and extremely high communication effort. Explicitly considering team composition, it becomes clear that the field of business & management is a driving force in the cross-sectoral founding of start-ups. In 91 out of 152 teams, at least one member has an economic background. Close behind are the fields of engineering (78) and computer science (57).

![]()

Figure 4. Distribution of survey participants by location and year of founding (Source: own illustration based on data collection).

![]()

Figure 5. Breakdown by sector, business model, team, type of company (Source: own illustration based on data collection).

The distribution of applied legal forms of business is less surprising. 66% of start-ups are organized as GmbH (limited liability company), which offers various advantages for the founders. Personal liability is excluded, tax savings can be claimed, the sale of own shares is easily regulated in case of disposal, and the reputation in business dealings has proven itself over the years. This is followed by the GbR (civil law partnership) with 13%, the UG (entrepreneurial company) with 9%, a GmbH & Co. KG (limited partnership with a GmbH as general partner) (3%), and the AG (public limited company) (1%). In total, 12 respondents have also indicated that they have not yet chosen a legal form of business, which is due to them still being in the pre-founding phase.

4.3. Distribution of the Development Phases

The distribution of developmental phases in Figure 6 clearly shows a significant overweight of participants in the build-up phase (72). When considering the rate of correct and incorrect classification (based on the control questions in the survey), it becomes evident that 27 founders potentially misclassified their phase. The reason for this lies in the very vague evaluation criteria in this phase. Only the parameters of product status and revenue development allow for specific limitations. If no revenue is generated or the product has not yet been brought to market, the start-up may not have reached the build-up phase yet.

The growth phase has the second-highest number of companies, with 34. Even in this phase, the team and employee parameters only provide a latent indication for phase determination. Start-ups can be excluded if they have just reached market maturity or cannot show revenue growth. It is also noticeable that, although product diversification usually occurs in the maturity phase, ten founders are already planning this in the growth phase.

With a total of 25 start-ups, analysis can still be conducted in the founding phase. When considering the evaluation criteria, both revenue development and product status can be used as exclusion criteria. Eight start-ups have indicated an increasing revenue (which is not possible according to the definition), meaning they must be assigned to the build-up phase. It is noteworthy that these eight companies have also chosen product status as market-ready with planned improvements, which also speaks for the build-up phase and supports the previous assumption. It is also interesting that one company has indicated having between ten and 49 employees already in the founding phase. This can be explained by the highly technological orientation of the company.

The criteria for the pre-founding phase, unlike those of the other phases, are very clear-cut. Thus, no revenues may exist, the product must still be in the development phase, and there must be no or very few employees. With only two possible misclassifications out of a total of 16, this is confirmed. The same applies to companies in the maturity phase. Here, too, the given parameters are largely adhered to. Thus, compared to the initial distribution of developmental phases, there is a slight offset. Valid statements can be made about the founding phase, build-up phase, and growth phase (phases containing more than 20 participants).

4.4. Development of Challenges

The assessment of current challenges is based on the numerical interpretation of the Likert scale. For this purpose, each level of the characteristic is assigned a dedicated value: Not applicable = 0, up to fully applicable = 5. All assessments

![]()

Figure 6. Analysis of start-up development phases according to evaluation criteria (Source: own illustration based on data collection).

related to a challenge are summed using this calculation scheme and then divided by the total number of 152. As a result, a strength score is obtained for each challenge as the degree of influence in the current situation of all German start-ups. An overview is presented in Figure 7.

The analysis identifies building an effective sales strategy and maintaining customer relationships (2.96) as the most significant challenge across all developmental phases. Closely following with a score of 2.91 is establishing an appropriate financial plan and securing the necessary capital, which is not surprising as obtaining financial resources is one of the most significant aspects of starting up. This is closely related to the third-ranked challenge, sustainable development of pricing and cost calculations, and profitability (2.67). If production costs or pricing models are incorrectly structured, the start-up may not generate profit in the long term and thus may not operate successfully in the market in the long run. Subsequent challenges rated by start-ups include marketing, scalability of business areas, strong competition, and recruitment and retention of new employees. Contrary to theoretical information, participants do not consider inconsistencies within the founding team and personal reasons as significant challenges (1.29). This could be due to sample selection or the fact that multiple founders may have been present when answering, influencing the truthful response to the question.

The evaluation in the right column of Figure 7 indicates that no generic statements can be made about the future developments of challenges over the entire lifecycle. Due to the significantly different challenges in each developmental phase, the response tendencies fluctuate so much that their effect is almost canceled out. Only flexible scalability and competition against strong

![]()

Figure 7. Analysis of current challenges as well as future trends (Source: own illustration based on data collection).

competitors show an increasing trend, meaning these challenges are expected to increase on average for all start-ups in the future. For all other challenges, a constant or decreasing trend is observed.

A very instructive statement was made by a survey participant in the last part of the free expression of opinions. It emphasized the existential importance of understanding market needs. While one may know the peculiarities of the product best, it cannot be expected of others. Adapting the product to customers and customers to the product lays the foundation for successful marketing. On the other hand, it is essential to have patience and trust in one’s own approach, but also to never cling to one’s idea for too long and to be flexible and adaptable. In summary: Confident in preparation and agile in strategy.

5. Discussion of Results and Recommendations for Action

The first research hypothesis focuses on the dependency of current challenges on the respective developmental phases of start-ups.

H1: Depending on the individual developmental phases, German start-ups face different challenges.

Challenges are analyzed and evaluated in relation to the pre-founding, founding, build-up, growth, and maturity phases. The evaluation schema of the strength scores is derived from the average values of the Likert ratings. The strongest ratings are marked in red, while the weakest ones are marked in green. Table 2 shows that in the pre-founding phase the two strongest challenges, asserting against competitors is on par with appropriate financing. This highlights that entrepreneurs must consider potential market competitors even before the actual founding, while simultaneously maintaining a solid financial plan. Sustainable

![]()

Table 2. Relationship between challenges and development phases (Source: own illustration based on data collection).

pricing and cost calculation, follows closely as the third-ranking challenge. The areas with the least impact are site selection, business model alignment, and team discrepancies.

In the founding phase, the importance of financial planning continues to grow and becomes the primary focus. With the startup process, significant costs arise that need to be covered, additionally, sales, customer acquisition, and marketing gain importance. Due to limited internal capacities and lack of know-how, respondents rank these areas second and third. Insufficient customer engagement and lack of product market exposure can lead to significant issues. Interestingly, potential errors in product development are only moderately assessed in the first two phases, despite being a crucial factor for successful market entry. The areas of least impact are consistent with those of the pre-founding phase, but in a different order.

During the build-up phase, establishing effective sales becomes imperative for product establishment in the market. Convincing customers of the product’s unique selling proposition (USP) is essential for sustainable success. The challenge for many teams lies in deciding whether to build multiple internal resources or outsource the entire area. Consequently, founders rated this as the most significant challenge in this phase, also reaching its highest score. Financial aspects of financing and profitability closely follow since all these actions involve increased capital requirements. Surprisingly, controlling the production process is rated as the least challenging, even though processes need to stabilize, supply chains need to be built, and problems need to be resolved during the build-up phase.

The growth phase is characterized by momentum, change, and the pursuit of expansion, so it is not surprising that flexible scaling of all business areas is categorized as the most significant challenge by participants. Insufficient preparation for expansion poses a latent risk of failure in growth endeavors. During times of scaling, founders should also continuously reassess pricing models. Therefore, sales and profitability are also considered crucial areas. On the other hand, founders have fewer concerns about market potential or potential legal or political restrictions. Although team discrepancies are consistently rated with a low score, it is noticeable that their importance increases throughout the start-up cycle, suggesting that founders’ personal interests and views may change over time, leading to increased conflicts.

Due to a small number of participants (6), it is not possible to make a valid statement about the challenges of start-ups in the maturity phase. Based on the feedback received, it can be stated that established start-ups see sales, marketing, and competition against competitors as the biggest challenges for their success. Themes such as restrictions due to legislation/politics, team discrepancies, difficulties in recruiting and retaining employees, site selection, and avoiding errors in product and concept development also reach their relative highest values in this phase. Due to the lack of significance, the results must be viewed with caution. Thus, research hypothesis H1 is verified.

The second research hypothesis examines the relationship between current challenges and different sectors of start-ups.

H2: Depending on the sector, German start-ups face different challenges.

When analyzing, it must be noted that out of the distinguishable new sectors, five cannot be included in the evaluation due to a small number of participants. The lower limit per sector is set at 15 responses to ensure meaningful interpretation. In the areas of Personnel/HR (2), Education (4), Agriculture (5), Insurance/Banking/Finance (6), and Food and Nutrition (7), this limit could not be reached, so these areas cannot be further analyzed and are shaded in gray in Table 3. Thus, only Consultancy/Services, Industrial Companies, IT Firms, and the Medical/Healthcare sector fall into the cluster under investigation. Observing the color scale in Table 3, a relatively even distribution is evident. For all four mentioned sectors, appropriate financial planning/coverage and building an effective sales strategy with customer relationship management rank at the top two challenges. Derived from this, the discussion provides detailed insights into the

![]()

Table 3. Relationship between challenges and industries (Source: own illustration based on data collection).

challenges faced by start-ups in different developmental phases and sectors, supporting decision-making processes and strategic planning for start-up founders and stakeholders.

The only exception is in the consulting industry, where the significance of financing is rather situated in the lower midfield by the survey participants, which can be attributed to very low investment requirements. Instead, an extremely strong competition arises, as establishing a consulting firm is associated with significantly fewer hurdles and appears very attractive to new entrepreneurs. Also, the following ranks are shared across all industries, including scalability, marketing, and profitability. Generally, the ratings of challenges in the midfield are very similar and can only be differentiated by marginal differences. Even when considering the least-rated challenges, the founders unanimously agree. For example, difficulties in site selection and potential team problems are assigned the lowest strength scores by all four sectors. Since the cross-industry ratings of all aspects show extremely high consistency, it cannot be said that challenges depend on the industry. Thus, research hypothesis H2 is refuted.

The third research hypothesis examines the correlation between current challenges and the selected business model.

H3: Depending on the business model, German start-ups face different challenges.

When clustering the business models, two of the originally six approaches must be excluded due to a small number of participants. The lower limit of 15 responses cannot be reached by the stationary (3) and online trade (9). This may be due to a lack of innovation aspect, which was a prerequisite for participation, or it may be caused by founders having to choose one model and a retail shop often being implemented in addition to the core business. Nevertheless, valid statements cannot be made for these two areas. In Table 4, the differences between the four highest-rated challenges of the business models can be seen at first glance. For example, participants in the service and consulting sector, consistent with previous analyses, have identified strong competition as the most significant challenge. In second and third places, sales and business scaling follow.

![]()

Table 4. Relationship between challenges and business models (Source: own illustration based on data collection).

For the software-as-a-service business model, sales are placed first, followed by financing and marketing. In the software and programming domain, profitability emerges as the biggest problem. The most significant score is achieved by setting up appropriate financing in the manufacturing technology sector, which aligns with previous findings. Similarly, founders in the industrial sector have identified financial aspects as the biggest obstacle, attributable to high initial production costs. The rating of the least influential challenges also appears plausible. For instance, service providers and IT companies face no issues with production control or site selection, as neither is their primary focus. Likewise, there are few legal restrictions to worry about in these sectors. It’s different for manufacturing technology companies, for which these factors do matter. Therefore, a numerically higher rating can be observed, still falling within the lower range contextually. As the most significant challenges differ significantly across all business models, and otherwise there is only a low level of agreement, the dependence of challenges on business models can be confirmed. Thus, research hypothesis H3 is verified.

The fourth research hypothesis deals with the dependence of current challenges on the number of team members in the founding team.

H4: Depending on the composition of the founding team, German start-ups face different challenges.

The distribution of founding members ranges from one individual to a team of six persons. Meaningful interpretations cannot be made for team sizes of five and six members as significantly fewer responses were received than the required lower limit of 15. Therefore, in Table 5, these two columns are grayed out and not further investigated. For team sizes of one to four, a very high similarity in both the absolute ratings and the ranking of challenges can be observed from the following table. Nonetheless, the most significant challenges differ for three out of the four groups.

For sole founders, cost and pricing calculations take precedence, followed by the implementation of an effective sales strategy. Teams of two individuals consider financial planning as the greatest challenge, with sales ranking second. Larger founding teams of three and four persons rate sales with the highest strength score. On the second and third places, respectively, are the competitive landscape, business scalability, and marketing. Ultimately, it must be noted that despite peripheral differences in ratings, there are too many overlaps and similar trends to speak of a dependence.

Another insight is that for more than half of the challenges, there is an increasing trend in ratings as the number of team members increases. This refutes the general belief that a larger team can assess tasks and problems more easily due to their greater knowledge. In this context, it can also be noted that disagreements regarding these problems are higher in teams with an even number of persons than in those with odd numbers. This can be explained by the effect of majority decision. In teams with odd numbers of members, there will always be

![]()

Table 5. Relationship between challenges and founding team (Source: own illustration based on data collection).

a clear voting result in case of disagreements, minimizing discussions (Witt, 2016: 1 ff.) . Therefore, while there are partial differences in challenges, the overlaps in ratings outweigh them. Thus, research hypothesis H4 is refuted.

6. Recommendations for Actions and Conclusion

In the final part of the analysis, the previously obtained results of the current challenges faced by start-ups are synthesized with the corresponding significance values, and recommendations for action are derived from them. The resulting eight recommendations for action cover the most important challenges and focus on the stated needs of the founders. Thus, the second research question can be answered as follows:

What recommendations for action can be given to German start-ups in their respective stages of development, industries, business models, and team compositions to cope with the challenges?

1) Sales/Customer: IT/software companies need to ensure sufficient personnel capacity for sales, marketing, and customer care during the founding and establishment phase.

2) Financing: During the pre-founding and founding phases, all start-ups must focus on sustainable financial planning, especially manufacturing companies, which can attract the necessary attention from investors only through a convincing unique selling proposition (USP) and thereby cover their capital requirements.

3) Profitability: Especially IT/software and industrial companies must continuously review their pricing and cost calculation models from the beginning to the establishment phase and adapt them to the changing conditions of the development phases with the help of external experts or internal resources.

4) Scalability: The challenge of company scaling and expansion primarily occurs in the growth phase, affects all industries and concepts equally, and must be supported by external experts due to its complexity.

5) Competitors: With strong competition in the market, founders of all development phases are confronted, which is why the creation of a convincing USP must take place as early as possible (pre-founding/founding phase), especially for start-ups with a trivial value proposition (consulting).

6) Recruiting: To master the challenge of recruiting and retaining employees in today’s environment, founders must leverage and develop the benefits of a start-up, creativity, innovation, individuality, and flexibility.

7) Founding team: To handle internal problems and differences within the founding team, the team must have an odd number of members (majority decision) and the contractual situation must be clearly regulated.

8) Production process: To manage and supply production processes accurately, manufacturing companies must adequately plan their financial and personnel resources during the founding and growth phases.

7. Conclusion

This paper has demonstrated the manifold and fascinating nature of entrepreneurship research in its various facets. In summary, it can be stated that the insights and recommendations developed within this study provide founders with a valid indication of the challenges they will face and how they can address them. Particularly, the differentiated and individual examination of each case represents the added value of this work. Achieving a comprehensive solution requires not only individual measures but also the appropriate synergy of several individual measures and the exploration of interdisciplinary connections. Derived from this, two topics have emerged as particularly interesting, in which further research endeavors would yield academic as well as practical benefits. Firstly, the influence of knowledge, personality traits, and experiences of founding members on the startup should be mentioned. If the synergy of different personas and expertise can be better explored, it might be possible to provide recommendations for the optimal team composition for individual situations. The second point that particularly stands out, is that especially for inexperienced new founder, the immense bureaucratic and lengthy process at the beginning can be a daunting hurdle to overcome. A deep and comprehensive analysis on the implementation and necessity of bureaucratic processes could significantly contribute to increasing entrepreneurial activities in Germany.

8. Limitations

Throughout the research process, it became evident that the field of entrepreneurship research is still in its infancy compared to other topics. While there is a solid number of foundational articles and works on general themes, as the topics become more specific and detailed, it becomes increasingly difficult to identify valid sources or verify found information through other scholarly sources. Especially in the area of individual challenges faced by start-ups, there are hardly any significant works available. This prompted considerations of designing a two-part survey to directly query the challenges from the founders in the first part. Due to time limitations, this approach could not be pursued. Additionally, the limited accessibility of large, current studies that are only available for a fee posed a challenge. Nevertheless, it was still possible to create a valid database as the foundation of the study.

The analysis of the sample size showed that the number of participants provides a representative result regarding the dependent challenges. When adding another variable, the sample size becomes noticeably smaller (e.g., the challenges in the founding phase for consulting firms). The same applies to the origin of the participants, which, due to the selection method, mostly come from the southern German region, resulting in the validity of the results being limited to start-ups from southern Germany. For these reasons, many subgroupings lose their significance (see SPSS analysis), which must be properly interpreted when interpreting the results. Future work could increase the significance and level of detail with a larger and more homogeneous sample.

Appendix A

Appendix B