1. Introduction

Budgeting is an applicable concept in ensuring the effective running of a business organization and provides an effective way of managing scarce financial resources within organizational settings. A budget describes the financial plan for future activities. It entails preparing detailed projections of future amounts (Ho, 2018) . Most business organizations use operational and capital budgeting in computing their financial resources. Based on the estimated feasibilities of values, they can be balanced, surplus, or deficit budgets. Usually, time and money limit financial help to individuals and business organizations; thus, efficient utilization and management of such resources are critical concerns to business operations (Ho, 2018) . Although planning is crucial in achieving excellent functionality, budgeting remains one of the essential tools that corporate managers’ leverage to augment plans and control organizational resources. In this context, a budget is a plan indicating the organization’s objectives while showing how the top management intends to obtain and utilize various resources to attain the set organizational goals and objectives.

The management of business organizations uses the images to plan and quantify the organizational goals and objectives tangibly (Ho, 2018) . Due to numerous project implementation errors, budget deficits and other financial limitations can stall business progress. Therefore, creating a budget for a business project and other undertakings is crucial for successful business strategies. Budgeting is also vital in public administration, especially in managing public resources. Managers of state corporations are primarily responsible for ensuring the effective management of financial resources within the organizational setting. The research area deals with public administration; thus, budgeting will provide significant insights into public corporations’ best practices in managing financial resources (Ho, 2018) . For instance, the administrative budget helps break down all the essential planned expenses, thus enabling corporate managers to estimate and quantify progress associated with the proposed business projects.

2. Budget as a Tool

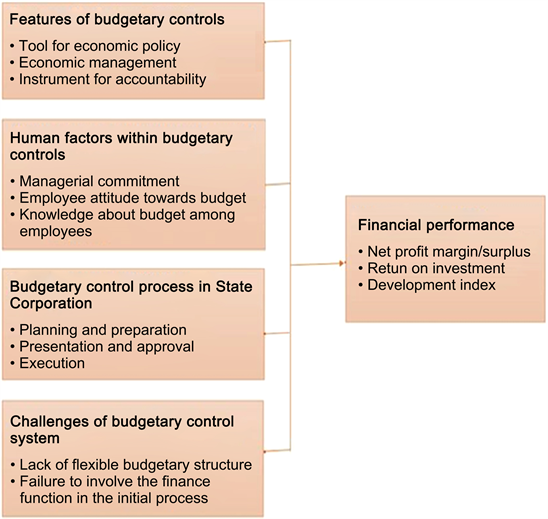

Budgets are essential tools for evaluating the effectiveness of leadership and management within an organizational setting. Adherence to best accounting and budget preparation practices allows corporate leaders and managers to determine various aspects of business operations and their alignment with the set organizational goals and objectives (Ralev, 2019) . Evidence from preliminary studies reveals the critical role of proper budget reporting in facilitating excellent decision-making processes (Ralev, 2019) . Usually, the management of business organizations leverages budgets in evaluating the employers and performance of departments within the respective organizations. In this context, enhancing performance can be done through benchmarking activities. Corporate managers use budgets to determine the number of units produced or services rendered, including the labor hours and materials utilized in making the units of services. The process entails allocating resources to different compartments within a specified budget, then comparing the actual cost with the set estimates (see Appendix A).

Budgets assist with determining the skills of managers in managing and leading business organizations. Attainment of such objectives tends to be two folds. Firstly, it is imperative to know the organizational goals and objectives (Ralev, 2019) . Business strategy should align with organizational goals. Effective managers should balance the proposed business strategy and the overarching objectives. Secondly, it is crucial to determine the administrative resources needed to accomplish the set objectives or the shortcomings that can hinder realizing such goals (Ralev, 2019) . With effective management, variations in budgeted figures and outcomes are attributed to the influences of market forces beyond corporate management. Proper budget management also illustrates the effectiveness of corporate leadership in directing, leading, and motivating team members to attain desired goals and objectives (Ralev, 2019) . Team members play essential roles in achieving the organizational objectives, thus the need for active participation in the business organization’s daily running. Therefore, corporate leadership is determined by prudent organizational resources to achieve business objectives.

3. History of Budget Concept

The budget system in the U.S. has evolved, which provides the means for the president and Congress to deliberate on significant expenditures, including the sources of raising such financial resources (Dearborn, 2019) . The decisions associated with the budget have important implications concerning the country’s running, including various sectors and departments, where the budgeting process in the U.S. originated (Dearborn, 2019) . The Taft Commission’s recommendations formed the Budget and Accounting Act (1921). The primary aim was to be an executive budget at the national level in the U.S., thus becoming the current federal budget (Dearborn, 2019) . Therefore, the legislative and executive branches influence public expenditure and collect financial resources.

The legislative and executive branches play critical functions in the budgeting process. In this duality of roles, the administrative branch agencies provide information concerning the proposed budgeting to the state governors, who recommend budgets before submitting the same to the legislative branch (Chohan & Jacobs, 2017) . The principle of separation of powers makes budgeting in the U.S. unique compared to other countries. The formulation stage, presidential, and congressional phases help enhance accountability in public spending and management of government affairs (Chohan & Jacobs, 2017) . The process is codified through procedural rules, reflected in the executive branch’s statutes and congressional legislature. The latter is responsible for formulating policies and ensuring the appropriation of funds. Such fundamental contributions are necessary to promote transparency and accountability in public budgeting.

4. Public and Private Sector Budgeting

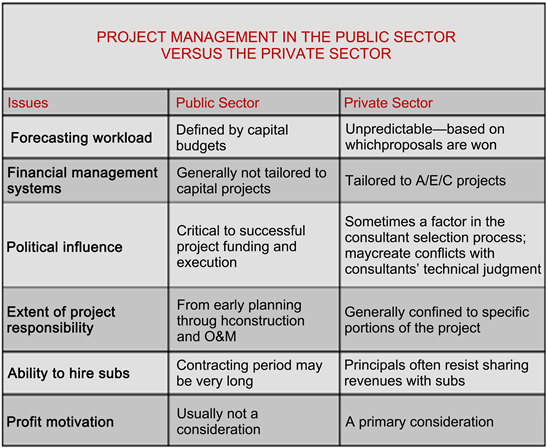

Usually, public budgeting entails the selection of ends and the selection of means to reach those ends. It implies the division of society’s economic and financial resources between the public and private sectors and the allocation of such resources among the competing needs in the public sector. The private sector complements the general and public sectors, especially in producing and utilizing goods and services. The private sector generates demands for government services, thus providing critical economic roles (Mauro, Cinquini, & Grossi, 2017) . Both the public and private sectors leverage budgets as essential planning tools. The public sector balances the budget while the private sector organizations use budgets to predict functional outcomes by forecasting revenues and expenditures against profit margin (see Appendix B).

Information facilitates prudent decision-making in any organization, both public and private sectors. Usually, a budget serves as a financial plan that indicates the revenues and expenditures of an organization (Mauro, Cinquini, & Grossi, 2017) . Therefore, providing a clear picture of how the organizations use the available financial resources is critical. Budgeting allows organizations to see the necessary finances to attain organizational goals and objectives. It enables corporate managers to evaluate past financial information to determine how resources have been allocated, including aligning the budgeting process with the existing organizational goals. Such information forms the basis for future resource allocation in the subsequent fiscal year.

Private sector budgeting describes the practices and principles that organizations in the private sector leverage to create a budget and allocate resources. Unlike in the public sector, organizations in the private sector use budgeting to predict revenue collection and expenditure of the financial sources to promote sustainability and increased profitability. Therefore, the budgeting process tends to be systematic and strict (Mauro, Cinquini, & Grossi, 2017) . The norm in the private sector is budget preparation on an annual basis. Developing the proposed budget entails accommodating team members’ input from various departments within the organizational setting (Mauro, Cinquini, & Grossi, 2017) . Corporate managers in different departments help develop estimates for their respective departments to facilitate seamless processes in running and managing such an organization.

5. Private and Public Sectors: Growth of Different Forms of U.S. Governments

The private and public sectors in the U.S. have undergone tremendous growth. Private business entities produce most goods and services, approximately two-thirds of the U.S.s’ total economic output (Evan & Holý, 2020) . About one-third of the economy is through the contributions of the government sector. According to the recent World Bank (W.B.) report, domestic credit to the U.S.’s private sector is approximately 192% (2019). The private sector is expected to proliferate in the next five years (Evan & Holý, 2020) . The U.S. public sector employs about 20.2 million people, constituting approximately 14.5% of the workforce. The growth of the private sector is a critical determinant of the continued improvement in the country’s gross domestic product (G.D.P.) (Evan & Holý, 2020) . The complementary roles between the private and public sectors have increased job opportunities, the production of goods and services, and the general improvement in service delivery (https://usa.usembassy.de/etexts/gov/federal.htm).

The historical growth of local, state, and federal governments are the reason for expansion over the decades. The size and scope of the government are crucial for numerous reasons. For instance, the government affects economic resource allocation by taxing, spending, and regulating (Boyd, 1997) . The U.S. Government’s size and scope expanded tremendously, especially in the last quarter of the nineteenth century. For example, growth has been significant in areas such as immigration. However, the government did little to regulate immigration, especially during the Civil War. The increase in the sizes of different levels of government is for political and economic reasons. For instance, the U.S.G.’s growth has been motivated by increasing political representation and enhancing the administration of essential services. It also allowed for improved accountability and prudent use of financial resources by creating adequate checks and balances from various government arms.

Various levels of government within the U.S. utilize multiple sources of revenue to fund different government expenditures. The federal government’s primary sources of revenues include individual income taxes, payroll taxes, and corporate income taxes. Other critical sources include tax revenues such as excise taxes, estate tax, and additional fees and levies. State government revenues are collected from sales, charges, fees, and transfers from the federal government. Other sources of income include intergovernmental transfers from other local governments. Significant large sources of government revenues enable it to finance various recurrent and development expenditures in different fiscal years (Boyd, 1997) . The federal government finance multiple projects in local states. The collaboration and partnership between the states and federal governments have remained significant in attaining development agendas in the U.S. Direct taxes are the primary sources of government revenues for state and federal governments.

Types of Government

The U.S. has several forms of municipal governments. The main types include council-manager, mayor-council, commission, town meeting, and representative town meeting. Many kinds of budgeting approaches are available in municipalities. Budgeting is inevitable and critical in ensuring the prudent utilization of financial resources while providing essential services to the targeted populace (Stone & Can, 2019) . Usually, municipal budget preparation tends to be tedious and cumbersome. Council-manager, as a form of government, has unique characteristics. For instance, the city council oversees the general administration to ensure the policy’s alignment with the set budgets (Stone & Can, 2019) . The board also appoints a professional city manager to conduct day-to-day administrative functions. The major is handpicked from the council on rotational voting patterns. According to recent reports from the International City/County Management Association (ICMA), council-manager has grown significantly from 48% to 55% in usage (1996-2017) (Stone & Can, 2019) . It is the most popular form of municipal government in cities with at least 10,000 populace, especially in the Southeast and Pacific coast regions. Arizona, Kansas, Maryland, and Texas are the most notable.

For example, in Midland, Texas, the council-manager is the most common form of municipal government, helping attain prudent management of financial resources while providing essential services to the residents (Jimenez, 2020) . The City of Midland uses traditional line-item budgeting to determine its operating budget. The budgeting process entails examining the existing programs and reducing or reallocating financial resources to attain improved efficiency in the management of public resources (Jimenez, 2020) . The standard process of evaluating programs allows the city-manager administration to respond to the changing economic and political environment, including the community, citizens, and employees’ needs. Usually, the budget development process is a formal approach that enables the city to create its program priorities, including setting goals for service delivery in every fiscal year.

6. Democratic and Republican Party’s stance on the National Security Budget

Issues concerning national security budget spending are critical for homeland security in the U.S. The budgetary allocation of financial resources to the relevant departments and agencies, including the Department of Homeland Security (D.H.S.), continues to receive a bipartisan approach (Tama, 2019) . Democrats and Republicans view allocating financial resources as critical in improving property and life safety. Budget cuts are ongoing concerns, particularly regarding the preparation and implementation of the budget estimate. Most democrats favored cutting $76 billion from the base military budget and $15 billion from the overseas contingency operations expenditures—approximately $91 billion in gross cuts for national security (Tama, 2019) . The proposed interventions will reduce government spending on national security and dependence. At the D.H.S., Trump’s admiration has offered a 7% increase of $2.8 billion, while most Democrats and the general public prefer a budget cut of $2 billion for national defense.

The Republican Party has keenly interested in managing public money within the defense system. For instance, Trump’s administration proposed $94.4 billion for the defense budget (Tama, 2019) . The areas of concern include the overseas contingency operation, especially in Iraq and Afghanistan. Increasing military expenditure has received more significant support from the Republicans, which they deemed critical in enhancing national security (Tama, 2019) . Despite the essential concerns associated with deficits and unnecessary wars, Congress spends approximately $600 billion on national security annually (Tama, 2019) . The amount is greater than the spending by legislators on other aspects of the federal budget besides Social Security and Medicare. The current expenditure on national security is more than the budgetary allocation at the Cold War height (Tama, 2019) .

Political influence has and continues to play a significant role in preparing national budgets, especially in distributing financial resources to the D.H.S. and maintaining overseas contingency operations in war-torn areas. Additionally, political parties tended to take different stances depending on financial resources. For example, the Republican Party holds different views concerning the importance of defense spending for core constituencies, the public’s insulation from war, and coinciding perceptions of geopolitical threats. Nevertheless, the party has always retained a pro-defense stance. In most cases, the Republicans do not support any attempt to downsize defense budgets, irrespective of shifting geopolitical realities and dwindling financial resources. National security maintenance is within the domain of the federal government.

7. Conclusion

A budget describes the financial plan for future activities. Proper budget management also illustrates the effectiveness of corporate leadership in directing, leading, and motivating team members to attain desired goals and objectives (Ralev, 2019) —the budget system in the U.S. The legislative and executive branches play critical functions in the budgeting process. The principle of separation of powers makes budgeting in the U.S. Usually; public budgeting entails the selection of ends and the selection of means to reach those ends. Therefore, providing a clear picture of how the organizations use the available financial resources is critical. Public budgeting describes the selection of ends and means to attain those ends. The budgeting process entails examining the existing programs and reducing or reallocating financial resources to achieve improved efficiency in the management of public resources (Jimenez, 2020) . For instance, Trump’s administration proposed $94.4 billion for the defense budget (Tama, 2019) .

Appendix A: Budget as a Tool

Note. Adapted from Hassan & Siraj, (2015) . Utilizing the Budgetary Control Framework to build the Electronic Budgetary Control (EBC) System: The University of Karbala in Iraq as a case study. International Journal of Innovative Research in Advanced Engineering (IJIRAE) ISSN: 2349-2163, 2(2). ResearchGate. https://www.researchgate.net/publication/330351259_Utilizing_the_Budgetary_Control_Framework_to_build_the_Electronic_Budgetary_Control_EBC_System_The_University_of_Karbala_in_Iraq_as_a_case_study

Appendix B: Public and Private Sector Budgeting

Note. Ellegood (2015) . WHAT PUBLIC WORKS PROJECT MANAGERS NEED TO KNOW. Concrete Construction; PSMJ.COM. https://www.concreteconstruction.net/business/management/what-public-works-project-managers-need-to-know_c