Understanding the Indian Way of Airport Privatization: Case of Indira Gandhi International Airport, Delhi ()

1. Introduction

Airports are an important strategic and economy-oriented infrastructure (Edwards, 2005) . By the nature, the airport consists of complex infrastructure with multiproduct enterprises (Betancor & Rendeiro, 1999) . Airports are in a long-span relationship with a specific investment of committed stakeholders with sunk costs time and effort (Hart, 1995) . Since the 1980s major and regional airport privatization became a reality (Wittmer, Bieger, & Müller, 2011) . Airports are intended to provide aviation services for airlines and tourists (Junior, Hollaender, Mazzanati, & Bortoletto, 2021) . It includes various services as aeronautical and non-aeronautical like runway facilities for aircraft takeoffs and landings, aircraft fueling and maintenance terminals for passengers, automobile parks, maintenance hangar, and navigational services, etc. (Zhang & Zhang, 2003) . A smooth functioning of air transport is important to smooth functioning results in significant socioeconomic development (Tolcha, Bråthen, & Holmgren, 2020) . Airport privatization has various forms of models to transfer the whole airport to the private operation or transfer of full ownership (Tang, 2021) . Privatization indicates the shifting or sharing of any governmental rights, functions, and responsibilities to the private sector, or private company in whole or in part (Hong & Yoo, 2001) . Airport privatization is important on three major bases, 1) the privatized airports help to reduce government investment, 2) helps to increase economic efficiency 3) helps in ownership shifts. Due to these characteristics, studies on airport privatization have aroused professional and academic attention. There is an ample literature on airport privatization. Several researchers have reviewed comprehensive literature on the importance of airport privatization and their outcomes in worldwide and country wise (Graham, 2020; Hooper, 2002; Matsumura & Matsushima, 2012) focused on the positive impact of airport privatization. Oum, Adler, & Yu (2006) added several arguments, that airport privatization has achieved higher efficiencies in European countries. Additionally, Chen, Lai, & Piboonrungroj (2017) have argued for the improvement of the techno-economic efficiency of privatized airports in Europe and Asia-Pacific. Greece has selected the efficiently viable 14 regional airports to be privatized (Fragoudaki & Giokas, 2020) . Research from Latin America (Perelman & Serebrisky, 2012) had got high total factor productivity in private airports compared to public airports. Weisbach, Jang, Kim, & Howell (2022) has examined 2,444 airports in 217 countries revealed that private equity ownership improves efficiency, increases the number of passengers, and gets the chance of winning awards. While comparing the Indian airports to the European and developed countries the scale of airport privatization has been limited in India.

India started airport privatization activities at the end of the 1990s. Before, the 1990s Indian airports were paying less attention to profit. There is always a debate about the pros and cons of airport privatization in India. Kriesler (2016) concluded that there are no conclusive theoretical or empirical arguments that consistently show privatization as improving the allocations of resources. Similarly, Bettini & Oliveira (2016) concluded that these types of partnerships allow direct and indirect effects on airlines and passengers. Besides it, there are ample reasons behind the move toward the privatization of public airports. Typical reasons are to upgrade airport performance, improve ability, diversify its operations, enhance profitability, fund expansion, and improve competitiveness. These days the mobility of passengers on air travel is increasing and putting pressure on Indian airports to enhance services. Additionally, commercial aviation is also, importantly observed integral part of socioeconomic prosperity, international trade, and international tourism in India (Agrawal, 2021) .

2. The Objective of the Study

In the year 2006, IGIA decided to go into PPP/ Joint Venture (JV) with the DIAL, Delhi International Airport Limited. The project is awarded to DIAL for 30 years of the concession (extendable for 30 years i.e., 60 years). The objective of this case is to understand how PPP has been practiced at Brownfield Airport. Could it be a successful case? For, this purpose, Indira Gandhi International Airport is analyzed.

Methodology

A Doctrinal method is adopted. This method helps to understand the history of airport privatization in India. The descriptive approach is adopted to determine the need for airport privatization. The IGIA PPP as a case is analyzed. The data used in this research are secondary: Academic Journals, Indian electronic media, GoI database, AAI database concession drafts, JSTOR, Science Direct, and ICAO reports.

3. The Importance of Airport Privatization

These days, air transport is taken as a modern and integrated transport service (See, Ülkü, Forsyth, & Niemeier, 2021) . Airport forms an important part of air transportation, the operation is merged with air mode and land modes (Ashford, Stanton, Moore, Coutu, & Beasley, 2013) . Airports act as hubs of commercial infrastructure (Wells & Young, 2011) . Airports are big in business (Doganis, 1992) . Airports are connected with geography and people with economies and are important for job creation (Olfat, Amiri, Soufi, & Pishdar, 2016) . Additionally, airports are intended to provide local businesses with access to international markets and are regarded as a significant source of income in the areas they serve (Air Transport Action Group, 2018) .

Airport development in India starts in 1912 December, the first historic flight was commenced under the UK government, from London-Karachi-Delhi route (Singh, Sharma, & Srivastava, 2019) . India has a geography of the continental dimension, with an extensive network of airports distributed throughout its territory (Kashiramka, Banerjee, Kumar, & Jain, 2016) . Before the 1990s two organizations International Airport Authority (IAAI) and National Airport Authority were operating the Indian air transport (Sridhar, 2003) . The investment in airport development, management, and operation was limited and was guided by the Ministry of Civil Aviation (MoCA). The growth of the airline’s industries, passengers, and custom movement has put pressure on Indian aviation and airport capacity to upgrade its services (Raghavan & Yu, 2021) . Forecasting the Indian economy and increasing air passengers, India has benchmarked private sector involvement in airport development and modernization. In the literature, ample modes of airport privatization have existed (Cruz & Marques, 2011) . In this paper, the author has used the word privatization as private sector involvement that does not strictly define the concept of fully privatized airports. To date, India does not have any fully privatized airports. The argument made for airport privatization in India is the private participation through the Public-Private Partnership PPP model. The PPP model and the policies in airports are focused on decreasing GoI investment, increasing airport charges, and against the monopoly of AAI (MoCA, 2003) .

In economic terms, ample arguments are in favor of airport privatization. Whilst airport privatization is important and is in controversy as well (Graham, 2011) . The US government started airport deregulation in the mid of 1970s, (Senguttuvan, 2005; Ashford, Stanton, Moore, Coutu, & Beasley, 2013) . After the implementation of the deregulation policy, the airport infrastructure and the management of the airline industry started to be reformed (Bruijne, Kuit, & Heuvelhof, 2006) . In the late 1970s under the thatcher government the privatization of the airports has begun (Bortolotti, Fantini, & Siniscalco, 2003) . Eventually, the UK practiced policies are followed by governments around the world (Serebrisky, 2003) . A successful airport privatization was the sale of the BAA British Airports Authority, in the year of 1987 (Doganis, 1992) . Following the UK’s experience, countries in Asia, Europe, Australia, New Zealand, India, China, Latin America, and the Caribbean countries started to privatize major airports (Poole Jr, 2021) . In the year 1990-2005, 100 airports were contracted through private sectors in 38 developing countries to modernize their infrastructure (Andrew & Dochia, 2006) . These contracts entered short-term to long-term operation, development, and management of airports with private sector involvement. Respectively, in the year 2017, 600 or above of airports worldwide, had been privatized (Chaouk, Pagliari, & Miyoshi, 2019) . Additionally, in the year 2020, around, 20 percent of the world’s airports had been privatized (Belsie, 2023) .

In the process of airport privatization in India, the Cochin International Airport comes in first as successful privatization (Akintoye & Beck, 2008; Batool, Hussain, & Abid, 2018) . Cochin International Airport is built by a special company called Special Purpose Vehicle (SPV), Cochin International Airport Limited, CIAL (Balachandran, 1998) . On the formation of the CIAL, around 11,000 investors subscribed to more than 900 million Indian rupees collected from more than 30 countries (Ohri, 2012) . Since 2006, six more airports were privatized through PPP models for 30 years of the concession. It shows that the introduction of liberalization in the Indian airport business has dramatically increased the level of competition within the private sector.

According to India’s IATA’s 20-year passenger data, it predicted 190 million passengers in 2015-16 whilst it achieved 223 million (Jose & Ram, 2018) . Further, IATA Report, 2017 has predicted 278 million passengers in 2025-26. Since 2015 Indian air transport has witnessed a 15% - 20% exceptional transformation. It has targeted 400 - 500 million passengers in 2024 (IATA, 2022) . Similarly, there is a demand for 2380 new commercial aircraft by 2038 (Kumari & Aithal, 2020) . However, providing services for targeted passengers through the existing airport facilities and infrastructure is not easy. Thus, partial privatization and partnering with private sectors are important in the investment in the Indian airport industry.

4. Airport Privatization Scenario in India

To date, there is not any fully privatized airport in India. So-called privatized airports are in form of Joint ventures (JV) or partially funded and operated by private sectors. For partial privatization, the PPPs model is accepted and implemented. PPPs in airport sectors are intending to generate financial value and allocate operational risk to the private sector (Sresakoolchai & Kaewunruen, 2020) . PPPs in Indian airports and activities began at the end of the 1990s and early 2000s. Since the 1990s, Indian airports started to cope with the higher traffic through a combination of larger aircraft. The addition of runways, terminals, and investment in new airports was started. The privatization or Private Sector Participation (PSP) privatization policy was initiated as private participation in privatization and strategic sales (Estrin & Pelletier, 2018) . Airport privatization is encouraged by the existence of legislation in the form of PSP in infrastructure provision (ADB, 2000) .

On the progress of airport privatization reforming the policies, in the year 2003, Naresh Chandra Committee introduced a report called road map for Indian civil aviation development 2003 highlighting the airport privatization policies (MoCA, 2003) . This has become a base recommendation on private sector participation in Indian airports. The privatization policy has been aimed to bridge the funding gap and improve the operation and management efficiency of air services (Puri, 2003) .

Similarly, the existing airports were built several decades ago and need modernization and expansion. One of the reasons for airport privatization in India was the state-owned airport charges were very high (Moses, 2016) .

For the process, an airport restructuring committee in MoCA has identified the needed private sector involvement to upgrade the Indian airports. The pre-feasibility reports are made available to private investors (MoCA, n.d.) . Major airports like Bengaluru, Delhi, Mumbai, and Hyderabad decided to restructure the existing infrastructure in a world-class on a PPP basis (In, Casemiro, & Kim, 2017) . The committee has recommended the PPP model in a Joint Venture (JV) concession for a long-term period time 30 years to 60 years and 99 years. These PPP-procured airports are intended to provide higher Value for Money (VFM) and boost economic efficiency (Cruz & Marques, 2011) .

Firstly, the PPP model privatization has started at Cochin International Airport in 1994 at Kochi (Kashiramka, Banerjee, Kumar, & Jain, 2016; Ohri, 2012) . Further, International airports, in Major cities like Bangalore, Hyderabad, Mumbai, Delhi, and Nagpur has selected and privatized with the PPP approach, (JV) under the Build Operate and Transfer (BOT) approach (Singh, Dalei, & Raju, 2015) . The modernization of these airports would mean the achievement of the road map of civil aviation.

Instead of complete privatization, the GoI has decided that PPP should be the primary instrument for reforming the airports (Bhadra, 2008) . GoI has created new laws and regulations with private sectors in investment in new runways and terminals (Jacquillat & Sakhrani, 2014) . The PPP model is one of the used models in green-field and brownfield airport development and modernization. Currently, the GoI has done several PPP agreements with private sector investors. Several airports, water dromes, and heliports are on the way to development (Iyer & Thomas, 2021) . Major airports are under PPP agreements.

As a first phase of airport privatization, the Major six international airports were privatized through the PPP model (Table 1).

After the successful completion of 6 PPP projects BIAL, CIAL, DIAL, and MIAL the GoI is looking forward to implementing the PPP model for more airports at Kolkata, Jaipur, Chennai, and Ahmedabad (Emrouznejad, Banker, Ray, & Chen, 2016) . Similarly, in the year 2019, Adani Group won the bidding in Ahmedabad, Jaipur, Lucknow, Thiruvananthapuram, and Mangaluru airports for 50 years of concession (Poole, 2020) . The diversification has become necessary as the GoI is planning to lease the top 25 AAI-owned airports to private companies (Majumder, 2023) . To date, 100% foreign investment has also been allowed in the construction, development, and management of airports with selective approval from the Foreign Investment Promotion Board (FIPB) (Singh, 2016; Yadav, 2020) . In the year 2021, the domestic aviation of India is ranked as the third largest (IBEF, 2021) .

5. Background of Indira Gandhi International Airport

IGIA is in New Delhi capital city of India (Dixit & Teck, 2011) . Delhi is an economic and political hub endowed with multiple functions banking, insurance, manufacturing, hotels, and tourism (DUPONT, 2011) . Delhi covers 1,484 km2 of land having Safdarjung and IGIA airports. IGIA traces its beginnings back to the erstwhile Palam airport (Bhattacharji, 1975) . Palam airport was the base for the British Air Force during the Second World War. After India’s independence in 1947, the Palam airport continued to manage by the Indian forces. The airport was renamed “IGIA” after the female Prime Minister Indira Gandhi in 1986 (Mizokami, 2017) . IGIA covers an area of approximately 5106 acres. Currently, IGIA has three terminals, and terminals 4, 5, and 6 are planned to build in the future. In terms of annual air passengers, IGIA is one of the busiest airports in India (Bhat, Kurup, & Acharya, 2015) . In the year, 2010 DIAL completed the construction of Terminal 3 (Balakrishnan & Masthan, 2013) . In the year 2015, the Airport Council International ACI recognized the IGIA as the best airport in 40 to 50 million passenger categories (Bhat, Kurup, & Acharya, 2015) . It surpassed 48 million passengers in 2015-16, a growth of 18% in passengers over the previous year, ranking 25th busiest airport in aircraft operation (GMR, 2016) . Similarly, in the year 2015, IGIA had 900 flight operations occurred per day (Jenamani & Ray, 2019) . According to the Airports Council International ACI, IGIA is ranked 16th in 2020 having 28,500,545 passengers, 13th in 2021, and 37,139,957 passengers (ACI, 2022) . Additionally, in international passenger movement, IGIA was ranked 16th with passengers 28,500,545 and 13th with 37,139,957 passengers (ACI, 2022) .

![]()

Table 1. Privately operated airports.

Source: (Gupta, 2015; Singh, Dalei, & Raju, 2015) .

During the COVID-19 Pandemic, IGIA handled 37.14 million passengers. IGIA has performed as the top airport in India in handling domestic and international passenger traffic in 2020 and 2021 (Gupta, 2022) (Table 2).

6. The Privatization of Indira Gandhi International Airport

To make the IGIA an excellent standard airport under the ICAO standards, the PPP model has been implemented (Puri, 2003) . In the year 2006, on 31 January DIAL won the concession contract OMDA for 30 years. DIAL is a JV consortium also called a Special Purpose Vehicle (SPV) (BalaKrishnan & Masthan, 2013) . The concession agreement consists of investment, design, construction, and operation of the DIAL for until 2036, with a further option to extend it by the next 30 years with the fixed assets (Dixit & Teck, 2011; AAI, 2008) . The Joint venture was construct with GMR, Grandhi Mallikarjuna Rao, Fraport of Frankfurt, Germany, Malaysia holdings, AAI, and India Development Fund (Pratap & Chakrabarti, 2017) . The JV partners are holding 74 percent of the equity and the rest of the 26 percent of equity is of AAI (De, 2008) . The concession was created to seize the private sector’s efficiency in developing IGIA as an excellent infrastructure at a specific time (Jain, Raghuram, & Gangwar, 2008) . Under a contract, the ownership of the airport remains with the AAI. According to the Master Development Plan, two important reforms were subsequently undertaken that helped IGIA trace to privatization 1) expansion of its airside infrastructure and 2) upgrade of terminal capacity of 100 million passengers annually (GMR Infrastructure Limited, 2022) . The legal process was selected on the base of financial, technical, and legal consultants under a legal section of 12(A) (1) AAI Act, 1994 (AERA, 2010) (Figure 1).

![]()

Table 2. Indira gandhi international airport modernization plan.

Source: Halai (2008) .

![]()

Figure 1. DIAL equity ownership up to 201. Source: Compiled by the Author.

Until 2015, DIAL was structured by GMR Group’s 50.1% equity investment of around US$ 500 Million, AAI’s 26% equity investment of US$ 260 Million, Fraport AG’s 10% equity investment of US $ 100 Million, and Malaysian Airports Holdings (Mauritius) private limited 10%, US$ 100 Million investment, and IDF 3.9% US$ 39 Million (DIAL, 2006) . According to the agreement, the DIAL was agreed to share 45.99% of its revenue with AAI (KPMG).

6.1. The Concession Agreement between DIAL and AAI

The concession contract was award to DIAL, a consortium consisting of 74% to the private sector DIAL and 26% of the public sector AAI (Mathur, 2012) . In 2015 March Malaysia, airports withdraw 10% of equity to GMR. To date GMR owns 64%, AAI owns 26% and Fraport owns 10% equity (PTI, 2015) . DIAL shares 45.99 percent of its revenue with AAI. In 2020, the DIAL 30 years, a concession for the IGIA shifts to Adani Enterprises. To date, Adani Enterprise holds 74% equity in DIAL. Adani Enterprises has taken over the role of the lead shareholder in DIAL. DIAL is continuing the management and operation of the IGIA (Table 3).

6.2. The Legal Framework of IGIA PPP

The framework included provisions for the lease agreement between the AAI and the private sector consortium DIAL, as well as regulations governing the operation, management, and maintenance of the airport. The following framework was applied and governed by the several laws and regulations. Airports Authority of India Act, 1994: The IGIA PPP project is executed under the AAI Act; AAI is the implementing agency for the project.

1) Approved by Public Private Partnership Appraisal Committee (PPPAC) Guidelines.

2) Model Concession Agreement (MCA): The IGIA PPP project was executed under the MCA outlining the terms and conditions of the agreement between the AAI and DIAL.

3) The Airport Economic Regulatory Authority of India (AERA) Act, 2008: The IGIA PPP project is subject to the regulatory oversight of AERA. Which is responsible for the economic regulation of IGIA.

Several other laws: The IGIA PPP project is also subject to various other laws and regulations, environmental laws, labor laws, and taxation laws (Figure 2).

Source: compiled by the Author.

According to the project structure, the GoI shall not intervene or interrupt the design, construction, and completion. The EPC Engineering Procurement and Construction contractors are Larsen and Toubro, Pratibha Industries, and Kashyap Sons. Mott Mac Donald is Consultant from the private sector. On the public sector side, Kelkar Committee is consulting AAI on airports authority and legality. After the establishment of AERA in 2008, DIAL is under the regulation of AERA. AERA sets the tariffs in services like landing, parking, and housing of aircraft, and passenger services such as security, user development fees, and the related charges for aeronautical services provided at the IGIA.

6.3. Performance of IGIA

After the renovations, the airport expanded its capacity in three categories Passenger, Custom and Traffic movements. This section discusses the air traffic, customs, and cargo performance from 2010 to 2021.

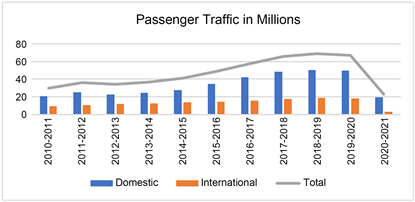

6.3.1. Traffic Scenario of IGIA

Source: (APAO, n.d.) .

In the year 2010, IGIA handled approximately 30.9 million passengers that marked a significant increase from the previous year. This was mainly due to the opening of Terminal 3 in July 2010 that greatly expanded the capacity to handle more passengers. After the successful PPP implementation, the IGIA is continuously the growth trajectory of passengers.

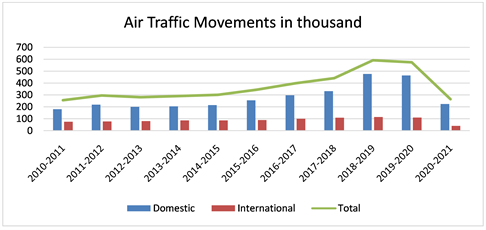

6.3.2. Aircraft Movement since 2010-2021

Source: (APAO, n.d.) .

Since 2010, the number of aircraft movements at IGIA has been steadily increasing. The numbers reflecting the growth of air travel in India and the airports expanding capacity to handle more flights. In 2010, the airport recorded approximately 302,500 aircrafts movements. In 2015, IGIA handled around 366, 500 aircraft movements, representing a growth about 21% comparing 2010. In 2019 IGIA recorded approximately 480,000 aircraft movements, that was 30% increase from 2015 and a 59% increase from 2010. However, due to the COVID-19 pandemic and subsequent travel restrictions the number of aircraft movements declined in 2020-2021.

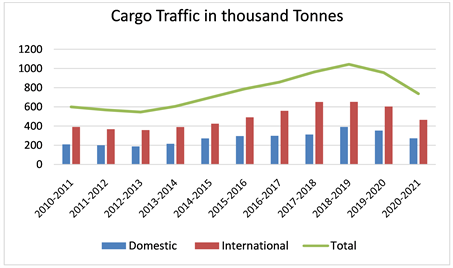

6.3.3. Custom Cargo Traffic since 2010-2021

Source: (APAO, n.d.) .

In the Financial year 2010-11 IGIA handled 460,051 metric tons of cargo. Over the years, the cargo traffic of the airport has grown steadily, and in the financial year 2019-2020, the airport handled 981,502 metric tons of cargo, that was the double amount of cargo handled in 2010-11. However, due to the impact of COVID-19, the cargo traffic of the airport declined in the financial year 2020-21. The airport handled a total of 736,732 metric tons of cargo that was 25% decline compared to 2019-2020.

DIAL PPP success factors: 1) strategic location: IGIA is in a strategic location, the capital city of India also called an economic hub. It also serves as a gateway to India for millions of passengers annually. The airport is well connected to the city and is easily accessible from different parts of India.

The PPP framework for DIAL has been successful in promoting private sector investment in airport infrastructure and improving the quality of service at the airport. This model has served as a model for other PPP airports in India and around the world. Recognition and awards won by IGIA: 1) Golden Peacock National Quality Award 2015 2) best airport staff in Central Asia/India in 2021 3) COVID-19 Airport Excellence Award. Similarly, in 2020, DIAL achieved the best Airport Staff achievement awarded by Skytrax. Airport Service Quality (ASQ) awarded IGIA was ranked 2nd in 40 million passengers.

6.3.4. Economic Performance Gained in the Year 2021-2022

Source: (DIAL, 2021) available at annual-report-fy-20-21.pdf (newdelhiairport.in). Access on March 24, 2023.

During the financial year ending March 31, 2021, DIAL recorded a total revenue of 344.97 million US dollar against USD 560.84 million US dollars in 2020, a decrease of 40.47%. In the year 2022 it has 403.38 million US dollar corresponding increase by 21.22%. Similarly, DIAL also recorded Profit After Tax for 2.33 million US dollar in the financial year March 2022 against the loss after Tax 43.42 million US Dollar. This implies that the recovery of passengers and Users in the IGIA leads to an increase in revenue.

DIAL PPP success factors: 1) strategic location: IGIA is in a strategic location and the capital city of India is called an economic hub. It also served as a gateway to India for millions of passengers. The airport is well connected to the city and easily accessible to different parts of India.

Recognition and awards won by IGIA: 1) Golden Peacock National Quality Award 2015 2) best airport staff in Central Asia/India in 2021 3) COVID-19 Airport Excellence Award. Similarly, in 2020, DIAL achieved the best Airport Staff achievement awarded by Skytrax.

7. Conclusion

The Indian airports are being looked as business oriented rather than the responsibility of the GoI. As a result, privatization policies were implemented. The motivation of airport privation in India has been driven by bringing the private investments in airport infrastructure development. Since 1999, the GoI took important steps with the inauguration of Cochin International Airport with the involvement of private sector. Since 2006, it has pushed PPP policies in brownfield and greenfield airport projects. Altogether, there were six airports under PPP model agreements. The IGIA was one of the remarkable PPP projects in Indian airport sector. IGIA is an ongoing PPP project. The PPP framework for DIAL has been successful in promoting private sector investments in airport infrastructure and in improving airport QoS. Importantly, it will take time to make and draw decisions about the success and failure of IGIA PPP.

Author Statement

This work is entirely the work of single author Assistant Prof Phuyal Mohan.

Financially Supported by Mitsubishi UFJ Trust Banking 2022.