1. Introduction

In a society where the Marxist capitalist system dominates, everyone pursues profits and self-interest, aiming to secure the highest income at the lowest cost. However, in pursuing this goal, individuals and organizations face a crossroad where intersecting roads are resolved in unpredictable ways by an invisible hand. This can lead to disagreements and differences in what is considered right or wrong, and some may avoid their obligations, including tax obligations. The abuse of tax obligations is called tax evasion, and this term will be the focus of this study.

The first question we will explore is whether tax evasion is a global problem or a domestic issue mainly faced by developing countries. We will also examine whether there are indicators that directly affect the development of tax evasion or not.

While Albert Einstein once said that the hardest thing to understand in this world is taxes, in this work, we will try to reach a perception of tax evasion, its contributing factors, and measurement based on various studies.

As this topic is rarely covered in other articles, we choose to focus on evasion in the context of how technology might be used to improve or prevent it. The crosswise model (CM; Yu, Tian, & Tang, 2008 ), a development of the randomized response method (RRT; Warner, 1965 ), is a novel substitute for normal direct questioning for the purposes of this article due to the challenges in measuring evasion. In survey research, the CM may contribute to improving the validity of prevalence estimates of tax evasion and its predictors.

We will examine prior efforts to gauge tax evasion and its determinants using surveys in the sections that follow. The implementation of the CM will next be discussed after we submit our primary research questions. After a discussion of our empirical findings, we will provide some general conclusions.

The paper is structured to present the main concept of tax evasion in a developing country by defining it through the literature review and methodology. The first part refers to introduction of tax evasion, what are the reasons for tax evasion, giving detailed information on the influencing factors. The second part is the description of factors such as money laundering, corruption, underground economy, culture and technology. The most important part is the methodology, the methods of measuring fiscal evasion through direct and indirect techniques such as direct survey; randomized response methodology; cross-wide model and indirect techniques such as approach based on electricity; approach calculating currency demand; the theory if people employed in the informal economy or difference between the official and real labor force. The other part of paper is the empirical study to investigate the relationship between age and the acceptance of technology as a means to combat tax evasion. The crosswise approach also enables us to obtain conclusions in accordance with the proposed hypotheses and the regression technique using ANOVA to validate these results. The final part describes some ways how to reduce tax evasion and decrease the informal economy in a developing country including conclusions from the used methodology for the effect of tax evasion.

2. Literature Review

Numerous studies on tax evasion have shown that it is a complex problem that is challenging to define comprehensively in theory and practice. Tax evasion can take various forms, and it is difficult to capture all the nuances of the issue in a single definition.

However, among the various definitions proposed, the one provided by (Sandmo, 2005) is considered the most accurate. According to Sandmo, tax evasion refers to the violation of the law when a taxpayer fails to report income from work or capital that is taxable, and they engage in illegal activities that make them subject to administrative or legal action by the authorities.

In a more in-depth analysis of the term tax evasion, (Storm, 2013) states that while tax evasion has been an endemic problem in developing countries for many years, it has become an increasingly predictable issue even in developed countries as more and more governments struggle to balance their budgets.

It exists a connection between tax evasion and technology which it makes an innovation in our study regarding to technology as a factor influencing tax evasion. Technological changes greatly improve the government’s ability to collect taxes, primarily by increasing the tracking and analysis of all electronic transactions. These innovations allow the government to greatly expand the use of tax administration improvements such as electronic filing, third-party information returns and presumptive taxes.

Technology will increasingly enable the government to acquire better data, analyze it more thoroughly, and build better systems and procedures, all of which will improve the government’s capacity to collect taxes.

But so far, regardless of which tendency will dominate total levels of tax evasion, a second, more dismal, and unqualified conclusion of other studies is: Technology will have a significant negative impact on economic inequality through its influence on the distributional patterns of tax evasion, virtually probably leading to increasing inequality.

2.1. Difference between Tax Evasion and Tax Avoidance

Tax evasion and tax avoidance are often used interchangeably, but they are actually two distinct terms. Tax evasion is always illegal, and it refers to individuals or businesses that intentionally do not declare or account for their taxes. This includes the hidden economy, where people conceal their taxable sources of income.

On the other hand, tax avoidance involves exploiting loopholes in the tax code or utilizing legal means to reduce one’s tax liability. It is not always illegal, but some forms of tax avoidance may be deemed unethical or against the spirit of the law.

While tax avoidance may be profitable in some cases, not all forms of tax avoidance are feasible or profitable in practice. Nonetheless, there are legal means of reducing tax liabilities that are widely used by individuals and businesses.

Which Are the Causes of Tax Evasion?

It is crucial that any nation understand the root causes of a complicated occurrences like tax evasion since only then can a strategy to stop it be developed. Although the problem is incredibly complicated, it is unquestionably a task that all nations must carry out. In a recent comment, we emphasized the limited ability of tax policy to redistribute income and emphasized the significance and gravity of tax evasion as it is now practiced in Latin America as well as the enormous imbalance in the distribution of income. According to what we stated, many nations lack formalized and systematic measurement of evasion with proper periodicity and outcomes distribution.

Tax evasion has a variety of causes, some of which include:

· The country’s tax system in and of itself.

· Anarchic allocation of authority among the several levels of government, particularly in federal nations.

· Population with low levels of education.

· The tax laws are neither accurate nor simple enough.

· Inflation.

· High tax pressure and rates.

· Significant unofficial economy.

· Regimes of permanent regularization (moratoriums, whitewashing, etc.).

There is a heavy emphasis on intangibles, which makes it challenging to assign them a genuine value and pinpoint their point of origin. The financial system contains several complex calculations that enable quick and easy money mobilization.

Controlling the transfer pricing of associated multinational corporations is challenging because 50% of their operations are within their own groups, which today account for almost 60% of global commerce.

There are growing challenges for taxing and governing the digital economy due to the major technological advancements in electronic commerce, collaborative platforms, digital currencies, and new methods of commercializing commodities and services.

2.2. The Connection between Tax Evasion and Economic Crime

2.2.1. Money Laundering

To understand the connection between money laundering and tax evasion, we must first familiarize ourselves with them. “Money laundering is a complex activity in which the source and nature of the money are masked in order for the money to appear legitimate and then become usable, transferable, and negotiable” (He, 2010) .

To simplify it further, money laundering is a criminal act that aims to present wealth with an illegal origin or the part of the wealth that was illegally obtained or hidden from tax authorities and other authorities (2013). Based on the two aforementioned studies, we understand that there is a considerable correlation between tax evasion and money laundering as one of the primary indicators.

The connection between money laundering and tax evasion is significant as they often go hand in hand. Tax evasion is the act of intentionally not reporting income or assets to tax authorities to avoid paying taxes owed. The illegal income obtained through tax evasion is often laundered to make it appear legitimate and to avoid detection by authorities. This is why money laundering and tax evasion are considered to be interconnected crimes.

Is corruption or the underground economy a fundamental factor in the process of evasion?

2.2.2. Corruption

Tax evasion and corruption often coexist and perhaps interact in most cases, given the mutual relationship of how the presence of corruption can distort the effects of tax consolidations, creating obstacles to government revenue collection.

Studies have shown that there is a positive correlation between corruption and tax evasion. For example, (Buehn & Schneider, 2012) found evidence to support this relationship. On the other hand, (Erceg & Lindé, 2013) reach a different conclusion. Using a Stochastic General Equilibrium (DSGE) model of a currency union, in the short term, a reduction in spending reduces output by more than a labor tax increase, due to limited accommodation by the central bank and exchange rate. In fact, there is strong evidence that the effects of tax consolidations have not yet been fully understood. Below, based on analyses, we will study in detail the connection between corruption and tax evasion.

To address the relationship between corruption and tax evasion, we consider the study by Blanchard and Leigh (2014) on regressions, controlling for the aforementioned criminal violations. As a proxy for tax evasion, we use estimates of the shadow economy as a share of total GDP offered by (Elgin & Oztunali, 2012) , while for corruption we use the Corruption Perception Index. We also include 26 European countries considered by (2014), either those with high and low values in tax evasion or those with high and low corruption. We then add to the regressions taken, a phenomenon that is equivalent to a group with high corruption or emphasized tax evasion. We also perform the same regression using an example of three countries that do not belong to the same group in both of the above indexes.

According to a sample study from (2014), we find that the planned tax consolidation coefficient is −1.431 for the high tax evasion group, −1.540 for the high corruption group, and −1.518 for the high tax evasion and corruption group. In all cases, they are larger, in absolute value, than the baseline results of the study, showing that the implied underestimation of tax multipliers is more pronounced in countries with high tax evasion and/or corruption. In other words, these two characteristics reinforce the argument presented that corruption is closely related to tax evasion.

2.2.3. Underground Economy or Black Market

We study the relationship between underground economic and financial development in a model of tax evasion and banking intermediation. The main implication of the analysis is that the marginal net benefit from declaring income increases with the level of financial development. Thus, in line with empirical observation, we find that the lower the phase of such development, the higher the incidence of tax evasion and the larger the size of the underground economy.

For the most part, the main factors presented as influencing the underground activity have been related to aspects of public policy and administration. These include the burden of taxes and social security contributions, the complexity and arbitrariness of the tax system, the extension of bureaucracy and regulations, and the incidence of corruption and rent-seeking (Friedman et al., 2000; Schneider & Enste, 2000) .

Assuming that all face the same tax obligations and seek access to the same credit market, we investigate the extent to which financial development can influence agents’ incentives to participate in the underground economy by underreporting their income, while still doing formal business.

As far as the benefits of informality are concerned, an individual who invests a portion of their wealth in the underground economy can avoid some tax obligations and earn a higher return rate in the black market from the investment. For the reasons suggested later, we assume that this return is shrinking in the total volume of funds deposited in the black market. This means that there are interactions among those who engage in tax evasion, as each participant’s involvement in this market imposes a negative externality on others.

As such, an individual’s incentive to engage in tax evasion may depend heavily on the total incidence of this activity. In this context, we show that the marginal net benefit from declaring higher wealth increases with the level of financial development. Consequently, we find the result that the lower the phase of such development, the higher the degree of tax evasion and the larger the size of the underground economy (Blackburn et al., 2012) .

2.3. Linking Tax Evasion with Other Areas of Life

2.3.1. Culture and Tax Evasion

Research shows that a number of factors can influence the likelihood of tax evasion. These include institutional, demographic, and attitudinal factors, as well as cultural values. However, assessments of the role of culture in tax evasion are more limited and less well-understood.

One theory that sheds light on the cultural dimensions of tax evasion is institutional anomie theory, which emphasizes four specific cultural dimensions that may promote or suppress illegal tax evasion: individualism, achievement orientation, self-confidence, and human orientation.

Individualistic cultures, which prioritize personal achievement and self-interest, may be more prone to tax evasion than collectivist cultures, which emphasize group goals and interdependence. Studies have shown that in individualistic cultures, decision-making is dominated by goal-oriented rationality, with a strong focus on achieving personal goals at the expense of ethical considerations. This may lead to behaviors that neglect ethical concerns and prioritize individual benefit, potentially fueling firms’ tendencies to evade taxes illegally.

In contrast, collectivist cultures minimize the favoring of individual goals achievement, with greater focus on group goals achievement. As a result, members of collectivist societies may be more likely to prioritize the collective good over personal benefit, and as such, may be less prone to tax evasion.

While these cultural dimensions are important, it’s worth noting that cultural factors alone do not determine the likelihood of tax evasion. Other factors, such as institutional and attitudinal factors, also play a significant role. For example, factors such as corruption, weak rule of law, and low levels of trust in government can also contribute to tax evasion, regardless of cultural values.

Understanding the cultural dimensions of tax evasion is an important step in developing effective policies to combat this problem. By understanding the underlying cultural factors that contribute to tax evasion, policymakers can design more targeted and effective strategies to promote compliance and ensure that everyone pays their fair share of taxes.

2.3.2. Egoism as a Factor Influencing Tax Evasion

Tax evasion is often driven by egoism, which compels individuals to deceive others in order to benefit themselves at the expense of the community. Empirical evidence suggests that people with selfish personalities are more likely to engage in tax evasion (Korndörfer et al., 2014) . Egoism not only catalyzes tax evasion, but also serves as its hidden motive.

Individualistic cultural values, as measured by the IAT, can encourage decision-makers to prioritize achieving their goals over ethical or legal considerations. In societies with strong individualistic values, companies may be more willing to deviate from accepted norms and evade taxes. While some studies have found a negative association between individualism and tax evasion (Richardson, 2008; Tsakumis et al., 2007) , these studies only included institutional control variables. Other research has shown that individualistic cultures promote controversial ethical decision-making by managers and have higher norms for company-level bribery (2013; 2004).

In summary, egoism and individualistic cultural values can contribute to tax evasion. While some studies have found a negative association between individualism and tax evasion, the relationship is complex and may depend on specific cultural and institutional factors.

2.3.3. Technology

Technology is now a necessity and its connections with every aspect of life are unavoidable. It has both sides of the coin since it will make it easier for the government to have control over the tax system, but it will increase economic inequalities considerably. Specifically, tax evasion will become much more difficult for individuals whose income comes mainly from wages or interests and will be eased for individuals with high incomes and multinational companies.

The basic issue in tax administration has always been obtaining information about taxpayers and their activities, and for most of history, tax administrations did not have complete, accurate, and coherent information. Information has been limited for a considerable period of time. Nobody would want to pay a large amount of tax debts, which would lead to tax evasion if this situation were not controlled by the relevant authority. Due to the lack of information from individuals who simply submitted a tax return, tax evasion erupted worldwide throughout much of the 21st century.

However, technological changes have fundamentally influenced the flow of information in tax administrations. These changes are mainly noticed in developed countries, but they are not absent in developing countries. The technological evolution begins with “digitization” or the transformation of information storage into digital formats for use by computers.

Technology has opened the doors to a series of methods, all of which affect the flow of information in tax administration: obtaining and storing information, transmitting information, and analyzing information (Alm, 2021) .

The advancement in technology has greatly benefited the government and its tax administration in terms of improving tax collection by increasing the tracking and analysis of all electronic transactions. These technological changes have enabled the government to widely implement tax administration improvements such as electronic registration, returns from third parties, and presumed taxes. The use of P2P networks, blockchain or supply chain management systems can also help trace transactions, while workers in large companies subject to third-party information and source-keeping systems can be monitored more efficiently.

However, technology also makes it easier for individuals and companies to engage in tax evasion by using global supply chains to find revenues in tax havens and launder money. It is important to note that technology can be a double-edged sword, and the government needs to be vigilant in ensuring that individuals and companies do not use it for illegal purposes such as tax evasion.

Blockchain is an important instrument to consider when discussing tax evasion. While blockchain technology has many useful features, it has also been identified as a potential tool for committing tax evasion. Researchers have noted this issue, with some anecdotal evidence suggesting that the technology is already being used for this purpose (Marian, 2013) .

On the other hand, technology can also be used to improve tax enforcement by enabling new policies that focus on “enforcement”, “trust”, and “service”. These policies were not previously possible, but can now have a significant impact on the practice of tax evasion (Alm & Torgler, 2011) . By leveraging technology, tax authorities can implement more effective enforcement strategies, foster greater trust between taxpayers and the government, and provide better service to taxpayers.

2.3.4. Other Consideration about the Technology

Predictions on the effect of technology on tax evasion are complicated by a number of other factors. The amount of knowledge that taxpayers have about the tax system may expand as a result of technology. Yet, it is still unclear how this feature of technology will affect compliance. For instance, field studies frequently demonstrate that informing people they will be “closely examined” (via a message) generally increases their compliance rate; however, when people assume they won’t be closely examined, their compliance rate drops, and the overall effect on compliance is frequently negative.

Laboratory studies also suggest that informing people about audit findings may have unintended consequences: if the information you receive indicates that your “neighbors” are cheating, you may likely have a tendency to cheat as well. Also, because of the complexity of the tax code, taxpayers sometimes are unsure of how much tax they should be paying. It has frequently been proposed that simplifying the tax code, for example by facilitating easier access to technology, will increase compliance. In fact, studies in the lab show that a tax system’s complexity tends to reduce compliance while improved administrative services that make it simpler for a person to pay taxes tend to increase compliance. Yet, at this point, the problem functions like a triangle. For instance, technology affects tax evasion. Technology benefits people in so many ways, but not everyone is familiar with it, which makes them dubious (most likely a considerate age above 45 – 50. Nevertheless, these effects are quite sporadic and modest. As a result, the idea that technological advancements providing taxpayers with improved knowledge about the tax system will promote compliance is not well supported by the available data (Alm, 2019) .

In order to determine the amount of revenue that people in Scandinavian nations (Denmark, Norway, and Sweden) dodged through offshore banking, Alstadsaeter et al. (2019) relate this information to micro-level administrative data for these nations. The 0.01% wealthiest families avoid about 25% of their taxes, a level of tax evasion that is far higher than the typical estimates (around 5% of taxes) produced by random tax audits. They discover surprising and high levels of tax evasion by the extremely affluent.

Of course, there are serious and unanswered questions concerning the generalizability of these figures, which were produced from quite specialized data sets and for extremely particular countries. Despite still, the distributional impacts of tax havens and money laundering will mostly benefit upper income levels, according to this study. More generally, the data supports the idea that technology advancements will make it more difficult for the really wealthy to avoid paying taxes, even as they make it simpler for those who participate in the P2P economy to do so. Finding fresh information and innovative techniques that can quantify these impacts far beyond the purview of current studies presents a challenge for academics.

3. Methodology (Measuring Tax Evasion Tax)

Regarding the shadow economy, several techniques have been employed over time to estimate its magnitude. Direct and indirect approaches can be used to categorize these techniques.

3.1. Direct Survey to Measure Tax Evasion

Direct measurement offered by surveys is another strategy (e.g., Forest & Kirchler, 2010; Webley et al., 2001; Wenzel, 2005 ). In other words, respondents are asked if they have ever filed false tax returns or whether they have always disclosed all of their income (for a standardized test, see Kirchler & Wahl, 2010 ). Empirical academics have attempted to assess the prevalence of tax evasion across society based on this information (e.g., Becker & Mehlkop, 2006 ). Moreover, survey data have the advantage of simultaneously measuring a variety of covariates (e.g., sociodemographic variables, opportunity structures, or personality characteristics) that are hypothesized to be associated with tax evasion, thus making empirical investigations of explanatory hypotheses possible.

Neverthless, measurement error resulting from routinely false reporting on sensitive behavior-related items is a significant issue with direct survey measurements. In precisely, respondents are more likely to hide their avoidance behavior and give socially acceptable replies if they fear shame or penalties (i.e., they may systematically underreport the behavior of interest; (Alm & Torgler, 2011; Forest & Kirchler, 2010; Slemrod & Weber, 2012) . (Webley et al., 2001) found that 69% of tax evaders who were classified as such denied their evasion in their self-reports when compared to actual classifications of those filers as either evaders or nonevaders based on an in-depth examination of their most recent two tax returns by independent tax inspectors. Although such a difference may, to some extent, be explained by a lack of knowledge, some tax filers’ unintentional errors that were classified as tax evasion by the tax professionals, or some differences in the understanding of tax evasion by tax filers and tax professionals, such differences have been interpreted as empirical evidence for tax filers’ socially desirable responses when questioned directly (Kirchler & Wahl, 2010) .

Survey researchers have given respondents the option to submit their responses to the sensitive tax evasion question in a sealed envelope (the “sealed-envelope technique”; (Becker & Mehlkop, 2006) ) or to place their completed questionnaires into a locked box (the “locked-box technique”) in order to reduce this type of response bias. Other academics have changed the definition of tax evasion to ask for tax morale instead (Frey & Torgler, 2007) .

Nonetheless, it is clear that the justification for and attitude toward tax evasion are distinct from the activity itself, and that putting replies in a sealed envelope or box may not provide the necessary level of secrecy. Additionally, prior studies have advocated the use of “de-jeopardizing techniques” (Lee & Kim, 2013) , such as the randomized response technique (RRT; (Warner, 1965) ) or the crosswise model (CM; Yu et al., 2008 ), which were created to reduce self-protective response bias and to elicit more honest responses to delicate questions. (Korndörfer et al., 2014)

3.2. Randomized Response Methodology (RRT)

RRTs create a probabilistic relationship between the sensitive question and the provided answer using randomizing tools like dice or coins (Warner, 1965) . For instance, responders are given two assertions in the traditional RRT (1965), where one of the claims is the opposite of the other. The following are examples of tax evasion:

(A) In order to reduce my tax liability, I have submitted at least one false statement on my tax return. (B) I have never lied on my tax return to get a lower tax bill.

The next step is for respondents to choose one of the two statements (e.g., Statement A if the outcome is 1 or 2 and Statement B if the outcome is 3, 4, 5, or 6) using a randomizing device (e.g., dice), whose outcome should not be revealed to the interviewer, and to then respond “yes” or “no” to the chosen statement. Respondents are intended to (a) really answer the question (i.e., minimize nonresponse) and (b) answer more genuinely since the significance of a given answer remains uncertain because the interviewer is unaware of the output of the randomizing device (i.e., reduce response bias). When questioned via the RRT, many sensitive behaviors are more commonly reported than when questioned directly (Lensvelt-Mulders et al., 2005) .

The efficacy of the RRT has been the subject of conflicting results in earlier research, which also highlighted the core methodological issues with this questioning methodology. They may best be summed up as follows: Some may find this disrespectful since they still need to explicitly answer to the delicate subject. They may therefore respond “no” or with no response at all, regardless of how the randomizing device turns out. Second, while participating in online surveys, respondents might not have access to the necessary randomizing tool and might thus choose any response. Third, some respondents may find it difficult to understand the RRT (such as the double negative in the traditional technique by Warner, 1965 ) or may have misgivings about the entire procedure and choose not to follow the instructions (2014). Therefore, the standard RRT may not be an effective method for determining tax evasion, especially when using online questionnaires.

3.3. Crosswise Model CM

The crosswise model (CM) The CM does not have any of the issues listed above, in contrast. By using a nonsensitive question with a known population distribution, the CM is specifically usable for online surveys where participants may not have access to dice or another randomizing device. This is in contrast to the traditional RRT formats in that (a) respondents do not need to directly respond to the sensitive question and can instead use value-free answer categories to answer two questions together in a block; (b) no traditional randomizing device (e.g., dice) is needed to apply the CM; and (c) the (for a similar discussion). As online surveys are more suited to the CM, see also (Ridder et al., 2014) .

Here is how the CM operates: Instead of directly posing the sensitive question, it is posed in a block with a nonsensitive question whose population distribution is known. The two distinct questions do not demand a direct answer from respondents. Instead, they are asked to provide a joint response to the two questions, in which they are only required to state whether their responses are the SAME (both “yes” or both “no”) or DIFFERENT (one answer is “yes” and the other answer is “no”; a translation of the CM used in our study can be found in the Appendix). Because the interviewer is unaware of the respondent’s responses to each question, either response option—SAME or DIFFERENT—could suggest that the respondent demonstrates (or does not demonstrate) the sensitive feature. So, there isn’t a clear self-protective answer strategy for the CM, and because the question-and-answer procedure is more anonymous, it is believed that respondents would be more forthright in their responses.

The reasoning behind the CM is clear, as can be seen. According to Yu et al. (2008) , the prevalence of the sensitive behavior p may be calculated as follows under the presumption that the sensitive and nonsensitive variables are uncorrelated:

Formulas 1. CM formula

where k is the observed sample fraction of respondents who gave the Identical response, and p is the recorded population prevalence of the nonsensitive item (which is an unbiased estimator of the unobserved population proportion k). Furthermore, the following methods may be used to determine the sample variance of pCM:

Formulas 2. Variance of pCM

In addition to prevalence estimates, regression analysis utilizing a binary dependent variable produced by the CM and a vector of covariates may be used (Maddala, 2016) ; for a detailed description of a maximum likelihood procedure with a modified likelihood function). Also, respondents believed that the CM safeguarded their replies better than previous RRT systems in online surveys (Ridder et al., 2014) .

3.4. Indirect Techniques

1) The theory behind this technique is that if people employed in the informal economy were able to conceal their income for tax reasons but not their expenditures, then the gap between national income and national expenditure estimates could be used to estimate the size of the informal economy. This strategy implies that every element of the spending side is well assessed and built in such a way that it is statistically independent of factors affecting revenue. 2019 (Schneider and Medina);

2) The difference between the official and real labor force is based on the notion that, if the overall labor force participation rate is assumed to stay constant, a fall in the official labor force participation can be seen as an increase in the significance of the informal economy. As changes in the participation rate may be explained by a variety of factors, including the state of the economy, the difficulty of finding employment, and decisions regarding schooling and retirement, these figures are only marginally indicative of the size of the informal economy;

3) Approach based on electricity: According to Kaufmann and Kaliberda, the best physical indication of total (official and unofficial) economic activity is the amount of power consumed. These authors propose utilizing the difference between the increase of electricity consumption and growth of official GDP as a proxy for the expansion of the informal economy based on studies that imply the electricity-overall GDP elasticity is close to one. This approach has a number of flaws, including the following: (i) only a portion of the growth of the informal economy is captured because not all activities in the informal sector require a significant amount of electricity or the use of other energy sources (such as coal, gas, etc.); and (ii) the electricity-overall GDP elasticity may differ significantly across countries and over time.

4) Approach to calculating currency demand: Assuming that cash is used for all informal transactions to avoid leaving a paper trail for the authorities, an increase in the size of the informal sector will result in a rise in currency demand. With this approach and its underlying assumptions, there are a number of issues: Because not all transactions involve cash as a medium of exchange, (i) this procedure may understate the size of the informal economy; (ii) increases in currency demand deposits may be caused by a slowdown in demand deposits rather than an increase in currency used in informal activities; (iii) it seems arbitrary to assume equal velocity of money in both types of economies; (iv) the assumption of no informal economy in a base year is debatable.

4. Empirical Analysis

Our study aimed to investigate the relationship between age and the acceptance of technology as a means to combat tax evasion. We formulated two hypotheses, which were tested through a survey consisting of nine questions. The survey was responded by 163 individuals, who were selected from near 285 people of email contacts which had varying ages, education levels, and employment status.

To be more specific in the sufficiency of the study, to draw the necessary conclusions if we can verify the following H1 hypotheses, we use the Cochran formula. The results are presented in Table 1.

So as can be seen in Table 2, Table 3, out of 285 email contacts, 171 people expressed their willingness to our questionnaire, where 8 of them preferred not to answer, while the other 163 allowed us to do the study according to their answers. Thus further, a random sample of 163 people from our target demographic should be sufficient to provide the necessary levels of confidence. Demographic data is included below:

Source: Compiled and calculated by the authors.

Source: Compiled and calculated by the authors.

The sample’s gender ratio was 43.2% women to 56.8% males, with the bulk of participants being between the ages of 18 and 28. As we all know, the age range of 18 to 28 is the range that most people utilize in their everyday lives, there are apparent differences in how individuals make their judgments based on the impression of the impact of technology on tax evasion. technology. We have included the responses from the questionnaire we collected using the crosswise model technique in the tables above since we chose to get information directly from respondents rather than having them feel pressured to lie or avoid taking responsibility.

We claim that by conducting this survey in an anonymous manner (we didn’t ask for any personal information like name, surname, email, or place of employment), online, and with quiz questions, we were able to get open responses about how they handle tax evasion and whether technology has an impact on solving the issue.

If they are aware that such a phenomena occurs, the first three questions can help us determine how much the notion of technology has been shaped in this important area of life.

The second three questions are intended to demonstrate how confident people are in using digital platforms to carry out various fiscal actions (for example, in the specific case of Albania, are there any government platforms with information about citizens or businesses under the name E-Albania, or the Directorate of Tax-Payers DTP), where various payments and declarations are included.

The last questions, on the other hand, are of a logical nature, asking whether people try to avoid tax evasion in various situations of daily life and whether they would choose to settle their obligations in electronic form if doing so would have more advantages than doing so physically or avoiding it.

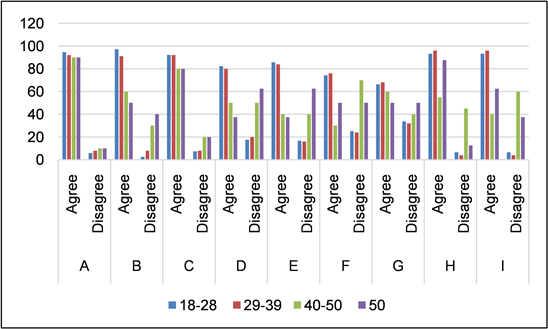

Graphic 1 we will see how we arrived at the conclusion that the first and second hypotheses are approved.

Hypotheses to be studied:

H1: Young age support the idea that technology has an impact on the avoidance of tax evasion.

H2: Age +50 do not approve the implementation of technology for daily use to avoid tax evasion.

According to the agreement of each question from A to I, depending on the ages, the aforementioned graph displays the findings from the survey. The age

Source: Compiled and calculated by the authors.

Graphic 1. The results of survey.

range of 18 to 28 dominated concerns about the relationship between the enhancement of tax evasion by technology, and we saw from the graphic perspective that they would like to fulfill their duties online. They even seem to be more aware of preventing financial fraud in daily life than people over the age of 40. Age +40 acknowledge the link between tax evasion avoidance and technology, but they are not overly hopeful about exploiting it.

This imbalance may be brought on by everyday technology use, widespread misunderstanding of the risk of evasion, the necessity to avoid obligations, or mistrust of technological platforms. As the crosswise approach also enables us to utilize them more readily to obtain conclusions in accordance with the proposed hypotheses, we decided to employ the regression technique using ANOVA to validate these results.

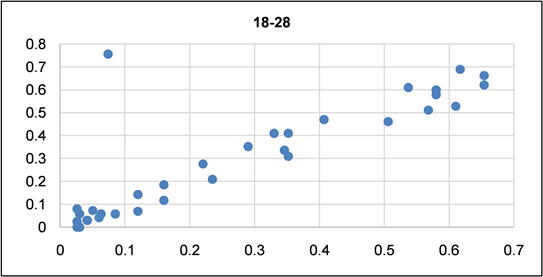

First, in the results table through ANOVA, we see the regression coefficient, which has come out positive for both the dependent and independent variables. This indicates a close relationship between them, as we know that if variable X increases, variable Y will also increase. This result is observed in both studies of age intervals 18 - 28 and +50, which we have included as hypotheses.

The study of ANOVA (interval 18 - 28).

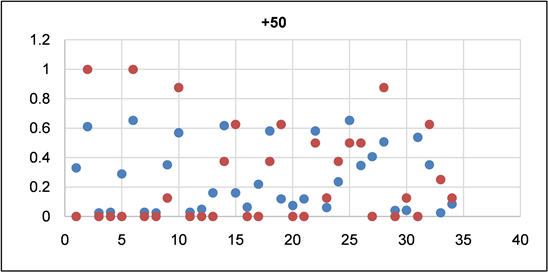

The study of ANOVA (interval +50)

Another important factor to consider is the standard error, which tells us how much error we can expect in our predictions for each independent variable. While it is often assumed that younger people use technology more and are more open to it, and that older people are more skeptical of technology and trust it less, this is not always the case. In reality, there are young people who are against technology or have difficulty using it, and there are older people who are skilled at using advanced technology and see it as a way to combat tax evasion.

The standard error for both the 18 - 28 age group and the +50 age group is between 0.03 and 0.06, with the largest error found in the +50 age group. While this error is relatively small, it still needs to be taken into account when drawing conclusions from the data.

The level of significance also needs to be considered, as it cannot be zero and must be above 0.05. In this study, there is a significant relationship between technology, trust in it, and the desire for a more advanced and independent future, and the avoidance of tax evasion, with values of 0.2 and 0.8. However, there are also contradictions in other studies, which suggest that this relationship may not always hold true.

Overall, the relationship between age, technology, and tax evasion is a complex one, and while there is evidence to suggest that technology is an important factor, further research is needed to fully understand this relationship. Graphical representations of the data (Graphic 2) can also help to illustrate this relationship more clearly.

The first graph shows each point close to each other, forming a constant linear line with a positive slope. According to statistical laws, this type of representation shows a very close relationship between youth and technological usage, indicating their proximity to the idea of tax evasion through this important factor as part of daily life. Therefore, the first hypothesis is approved.

The second graph shows a somewhat chaotic picture, with an irregular relationship between the dependent and independent variables, undermining the initial hypothesis of a link between age and technology use in tax evasion. However, considering that the respondents in this age group are fewer in number compared to younger individuals, and other factors such as not every individual in this age group has an electronic device such as a computer or smartphone, or lack of sufficient information about this age range, we cannot conclude whether the +50 age group has a problem of mistrust towards technology or lacks other necessary indicators (Graphic 3).

Source: Compiled and calculated by the authors.

Graphic 2. Graphical representation of the relationship between the 18 - 28 age.

Source: Compiled and calculated by the authors.

Graphic 3. Representation of the relationship between the +50 age group and technology factors.

Crosswise model.

To prove the accuracy of the predictions made by the respondents, we ran an analysis with CM. We found that, in addition to the age variable’s significant effect, the cross-sectional logistic regression model produced three other significant predictors of tax evasion in the CM condition: daily technology use, lack of knowledge in use, and mistrust of electronic platforms. The other explanatory factors and their interactions with the CM dummy variable, which indicates the condition for the effect of technology on evasion (Agree = 1, Disagree = 0), were also incorporated into the regression model.

As can be seen in the table, there are stronger statistical correlations with certain (but not all) predictors of tax evasion. The interaction terms for the variables daily use of technology, ignorance in usage, and mistrust of electronic platforms were significant. As the null hypothesis implies that the predictor is not significant, we can also use the Z-score to determine if the predictor variables in probit analysis and logistic regression have a significant impact on the answer. So, logically, the predictor variable’s significance decreases as alpha approaches 0 or 0.05; in our situation, the three variables indicated above have the greatest values, with respective sums of 2.93, 0.48, and 0.45.

5. Reducing Tax Evasion in Developing Countries

There are several important policy implications that can be drawn from this research. Firstly, the findings have significant applications for behavioral economics and can inform the design of public policies in areas such as taxation. Secondly, the cost of implementing strategies to combat tax evasion, such as including relevant signals in tax bills and other official documents, is relatively low. This suggests that policymakers should consider the benefits and costs of different policies when designing interventions, as recommended by Sandmo (2005) .

Thirdly, “universal” policies may not be effective, as they may have different effects on different categories of taxpayers. Policymakers should therefore tailor their policies, particularly nudges, to different groups of taxpayers based on their behavior and attitudes.

Finally, the way in which messages are communicated to taxpayers is crucial. Effective messaging can influence taxpayers in a positive way and encourage them to comply with tax regulations. Policymakers should therefore invest in developing effective communication strategies that resonate with different groups of taxpayers.

Overall, these policy implications highlight the importance of considering the behavioral factors that drive tax evasion and designing policies that are tailored to different groups of taxpayers. By doing so, policymakers can increase compliance with tax regulations and reduce the prevalence of tax evasion.

6. The Consequences of Tax Evasion

Tax avoidance has a significant impact on public spending, making it difficult to finance anticipated expenditures. In general, tax and fee collection is based on the principle of public interest, meaning that a decrease in public goods can have negative consequences for society. A shortfall in public funds implies less investment in critical areas such as infrastructure, education, cultural activities, scientific research, and healthcare.

It’s important to recognize that tax evasion is influenced by two factors:

· The efficiency of public administration and

· The potential profit made by avoiding tax contributions.

To combat tax evasion, the Ministry of Finance has the challenging task of simplifying tax laws while also clearly describing the tactics, potential loopholes, and limitations of such measures. By exchanging necessary information in a timely manner and creating a suitable control structure, the financial administration, tax inspectors, and authorities can prevent the hiding of income from private firms.

In addition, it is crucial to pay special attention to the country’s tax laws and ensure that they are fair to everyone. A fair tax system can help prevent tax avoidance by incentivizing taxpayers to comply with tax laws.

Moreover, tax evasion can have a ripple effect on the economy, causing significant losses in revenue for governments and reducing the availability of public goods and services. Therefore, it’s essential to address tax avoidance and promote a culture of tax compliance to ensure that public funds are used efficiently and effectively for the benefit of all.

7. Recommendations for Decreasing the Informal Economy

1) Reducing the size of the informal sector is a crucial national responsibility that requires government participation and action. To achieve this, governments can take a variety of actions such as easing budgetary strain, simplifying the tax system, lowering the cost of complying with regulations, enhancing the implementation of new standards, and strengthening business registration procedures. By doing so, governments can remove impediments to competition and reduce the size of the informal sector.

2) The informal economy is often caused by complicated licensing, labor market, and administrative regulations that make it difficult for businesses to operate formally. Therefore, by simplifying these regulations and procedures, the government can encourage businesses to operate in the formal economy and contribute to the fiscal system.

3) Statistics show that nations with lower taxes tend to have a lower proportion of the informal economy. Tax exemptions, on the other hand, only serve to stabilize the informal sector rather than reduce it. Therefore, the tax system should be modernized with generally straightforward taxes that make sense to citizens and are appropriate for the Albanian economy. By establishing links between those who contribute to the fiscal system and those who benefit from it, people and companies can be incentivized to work together in the formal economy.

4) As the economy continues to be formalized and the informal sector steadily shrinks, official institutions are becoming more confident that they can keep public highways secure. This is because the formal economy generates more tax revenue, which can be used to fund public services and infrastructure, including road maintenance and security.

5) The informal economy tends to be larger in nations with higher levels of corruption. Therefore, combating corruption is crucial for reducing the size of the informal sector. To achieve this, state institutions must be strengthened and consolidated, civic awareness and personal accountability must increase, and public administration must be modernized and strengthened. These measures can help to eliminate corruption and create an environment that is conducive to formal economic activity.

8. Conclusion

Tax evasion occurs when individuals or businesses intentionally fail to declare and pay their taxes. This hidden economy involves individuals hiding their presence or taxable sources of income. The purpose of this study was to examine the interrelation of tax evasion with direct or indirect indicators, including economic factors and daily life activities.

From the literature used, it was found that tax evasion is closely related to money laundering, corruption, and the underground economy. These factors play a crucial role in shaping this economic phenomenon. Additionally, empirical evidence suggests that culture and selfishness in personality are the main catalysts of tax evasion. The study also focused on articles that highlighted technology as the primary influencing factor, particularly in the latest changes in Albania.

To test the relationship between tax evasion and technology, a survey was conducted, and regression analysis was applied through hypotheses. The results showed that the age difference plays a significant role in the conclusions drawn. While most individuals supported technology in avoiding tax evasion, they also used it for the ease of their daily lives. It should be noted that the younger age group, particularly the 18 - 28 age range, was more receptive to this result than those over 50. The age range of 18 to 28 dominated concerns about the relationship between the enhancement of tax evasion by technology, and we see that they would like to fulfill their duties online. They even seem to be more aware of preventing financial fraud in daily life than people over the age of 40. Age +40 acknowledges the link between tax evasion avoidance and technology, but they are not overly hopeful about exploiting it. The level of significance also needs to be considered, as it cannot be zero and must be above 0.05. In this study, there is a significant relationship between technology and the desire for a more advanced and independent future, and the avoidance of tax evasion, with values of 0.2 and 0.8.

To prove the accuracy of the predictions made by the respondents, we ran an analysis with CM. We found that, in addition to the age variable’s significant effect, the cross-sectional logistic regression model produced three other significant predictors of tax evasion in the CM condition: daily technology use, lack of knowledge in use, and mistrust of electronic platforms. The interaction terms for the variables daily use of technology, ignorance in usage, and mistrust of electronic platforms were significant. So, logically, the predictor variable’s significance decreases as alpha approaches 0 or 0.05; in our situation, the three variables indicated above have the greatest values, with respective sums of 2.93, 0.48, and 0.45.

The study emphasized that tax evasion is a complex issue influenced by various factors. To combat this problem effectively, policymakers must consider these factors and design appropriate policies. Furthermore, the study highlighted the need to address cultural and personality factors, as well as the role of technology in shaping tax evasion. By doing so, we can promote tax compliance and contribute to the sustainable development of our economy.