Guinea’s Bauxite Resources Evaluation and Forecasting Using Elasticity Demand Method ()

1. Introduction

Bauxite is the primary mineral used to manufacture alumina, which leads to aluminum manufacturing (BAUXITE, n.d.). Aluminum alloys are used to make a wide range of products all over the world (Widder et al., 2019). It’s called after the southern French town of Les Beaux, where chemist Berthier first noticed it in 1821 (BAUXITE, n.d.).

During the colonial period in Guinea, the mining industry flourished. Iron, gold, diamonds, and bauxite are among the minerals extracted. Guinea’s bauxite reserves rank first in the world from the Polar Regions to the Polar Regions, accounting for 35 percent (10 - 40 billion tons) of the world’s bauxite reserves, with 23 billion tons in the Boke region.

With more than a quarter of all proven bauxite resources, Guinea was the world’s third biggest bauxite producer in 2019 (Widder et al., 2019).

“In Guinea, the first bauxite mining began at the 1960s in Fria, known as the Aluminum Company of Guinea (ACG), where Pechiney built Africa’s first alumina refinery. Following the discovery of the high-grade Sangaredi sedimentary bauxite basin in the early 1970s, CBG (Compagnie des Bauxites de Guinea) began bauxite export operations. There are currently two more big bauxite mining companies: CBK (Compagnie des Bauxites de Kindia), RUSAL, and SMB (Société minière de Boké), which was founded by Winning Group, a subsidiary of Weiqiao China” (Nandi, 2017). Within a year, this Chinese firm built two jetties on the river Nunez, doubling production from 15 to 20 million tons per annum (Nandi, 2017). Guinea is expected to overtake Australia as China’s leading bauxite supplier, according to experts (Nandi, 2017).

With the highest bauxite reserves and a steady export-oriented growth plan, Guinea has been racing to surpass many countries and become the world’s major bauxite exporter. The last four-year historical data set clearly shows this trend (GUINÉE RÉPUBLIQUE DE GÉOLOGIE, MINISTÈRE DES MINES ET DE LA, 2021).

Mineral asset, especially bauxite, is one of the key sources of national wealth in Guinea, and mining is a critical sector of the economy.

The national accounts, on the other hand, present a skewed image of economic health since they show the contribution of mining to GDP but not the concurrent depletion of mineral riches.

This constraint is solved by environmental and natural resource accounts, which provide accounts for the value of mineral reserves and the cost of depletion (Lange, 2003).

The accounts are used to evaluate how minerals are being used to create a sustainable economy.

Recovery of resource rent created by mining and investment of this rent in other kinds of wealth capable of producing income and employment once Bauxites are depleted are required for sustainable development (Lange, 2003).

With Guinea’s bauxite mining expanding at such a rapid pace, the Government must carefully examine an official government policy of reinvesting all Bauxite resource income in public infrastructure, human capital, and foreign financial assets (Atkins et al., 2016; Guyana, Ministry of Natural Resources Co-Operative Republic of Guyana, 2019).

Minerals can only contribute to long-term sustainable development through increasing national wealth (Wagner et al., 2016).

2. Materials and Methodology

For the purpose of the Evaluation of bauxite mineral resources in Guinea, the GDP elasticity demand method is used based on domestic demand and exportation quantity and also forecasting the domestic demand to 2025.

2.1. Analysis of Guinea’s Bauxite

2.1.1. Reserves in the National Situation

Bauxite is widely distributed all over the world, especially in tropical regions. The main deposits are usually close to the surface because it is created by weathering of aluminum-rich rocks.

The world’s bauxite reserves exceed 20 billion tons, of which Guinea, Australia, Brazil and Vietnam account for more than 60% (Zinov’ev & Sole, 2004) (see Figure 1 below).

Guinea contains the world’s largest bauxite reserves, which are used to make aluminum. Guinea bauxite contains a certain amount of alumina, has a resource of more over 40 billion tons, 23 billion tons of which are found in the Boke region (Equipment Used in Bauxite Mining, n.d.).

Guinea’s highly competitive production levels allow it to supply all of the world’s major markets (Bauxite - Ministry of Mines and Geology/Republic of Guinea, n.d.).

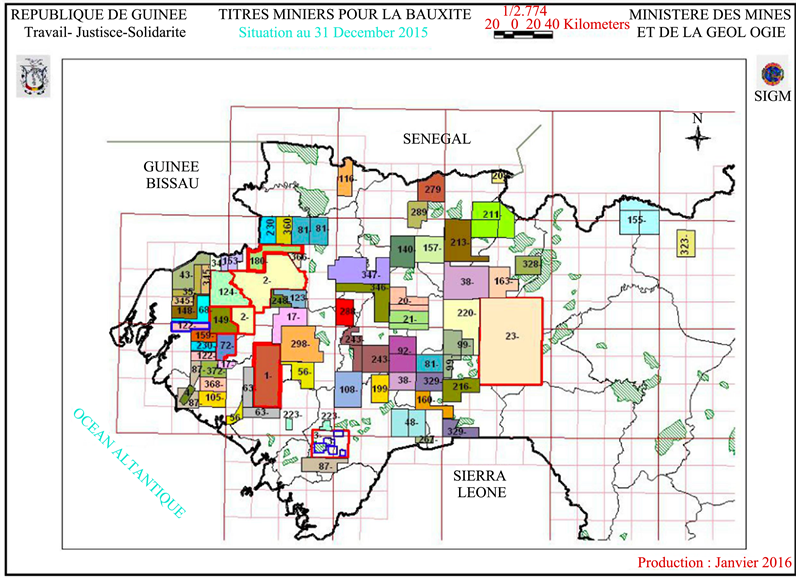

Lower Guinea’s Boke, Kindia, fria, and Boffa; Central Guinea’s Tougue, Pita, Mali, Mamou, Dalaba, and Fouta Djallon; and Upper Guinea’s Dinguiraye, Dabola, and Siguiri have the most reserves (Bauxite - Ministry of Mines and Geology/Republic of Guinea, n.d.) (see Image 1).

Image 1. Ministry of mines and geology bauxite cadastre.

2.1.2. Grade

Bauxite has many physical forms, including small red beans, red-yellow “soil”, and large, pale, hard rocks.

The main criterion for identifying an ore body as bauxite is that it should contain aluminum in the form of aluminum hydroxide, with a minimum content of about 30% (calculated as Al2O3). The average grade of Al2O3 in Guinea bauxite is 46%, which varies from place to place, with 47%, 48% or more in some places (see Table 1).

The naturally low active silica concentration (2%), which makes Guinea bauxite the most favorable factor for alumina production in the world, is one of the most remarkable aspects of Guinea bauxite (Nandi, 2017). Furthermore, Guinea laterite bauxite is also predominantly gibbsite in nature, including less than 2% boehmite, making it suited for low-temperature alumina production. Only Sangaredi sedimentary bauxite high-grade has a significant quantity of monohydrate, which it swiftly consumes (see Table 1).

2.1.3. Mining Business Leading Company

Guinea now has ten (10) operational bauxite mining firms, with CBG being the earliest and oldest, having started operations in 1973, and SMB-Winning Group

![]()

![]()

Table 1. Guinea bauxite chemical and mineralogical composition.

being the largest producer. From a resource standpoint, the CBG concession area possesses about 4 billion tons of bauxite deposits, placing it top among all operating bauxite mines (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020). Bauxite is mined utilizing the open cast mining method, which includes drilling/blasting and the use of a surface miner (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020). Surface miners are currently working in more Guinea bauxite mines because it is a more efficient and environmentally friendly method that does not require crushing of the ore (Evans, 2016; A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020). As demonstrated in Table 2 and Figure 2 below with the mining capacity per year, current bauxite deposits and the extraction capability of the main mining companies corporations are in good shape (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020).

This suggests that Guinea’s bauxite resources may last for many years, but the quality of some of these mines, particularly in the alumina sector, may deteriorate. Silica in Boke bauxite rarely grows, despite the low alumina value, but silica in Kindia may be slightly greater. Among the mines described above, AGB2A was the first in Guinea to adopt dry crushing and screening technology for bauxite beneficiation, generating one of the highest grade ore, as shown in Table 3 below (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020).

The mine produces a lot of fine powder during this dry bauxite beneficiation process, and the recovery rate of high-grade ore is just 50% - 60% (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020). The bauxite value of these rejected high-silica fines will be recovered by further washing and drum washing tests (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020).

![]()

Figure 2. Major companies bauxite reserves.

![]()

Table 3. Guinea bauxite chemical and mineralogical component.

2.1.4. Development and Utilization Status

As a fast-growing bauxite producer, Guinea’s bauxite output ranks third in the world in 2017. This West African country accounts for nearly 15% of global bauxite production. In 2017, Guinea produced approximately 48.64 MMT of bauxite (see Table 4).

Sangaredi Mine (also known as the Boke Mine) is the largest bauxite mine in Guinea.

Guinea Bauxite Company (CBG) is a joint venture between Halco Mining (51 percent) and the government that operates one of the country’s primary bauxite production firms (49 percent) (CBG Guinea Bauxite Mining, n.d.). The mine’s annual production capacity exceeds 14 MMT. CBG is now one of the world’s largest bauxite mines (Cbg Guinea Bauxite Mining, n.d.).

![]()

Table 4. Guinea Bauxite production and exportation from 2000.

To date, Guinea has the second most new bauxite project in the world.

2.1.5. Pricing Bauxite

Costs:

On September 6, 2021, the price of Guinea bauxite in China’s top metal consumer market reached its highest level in nearly 18 months because buyers were uneasy about supply after the country’s coup d’état.

Guinea, a West African country, is the second largest bauxite producer in the world, second only to China.

Asian Metal’s valuation of Guinea bauxite shipped to China is US$50.50 per ton, up 1% from September 3, and the highest level since March 16, 2020. So far in 2021, prices have soared by about 16% (Majumder, 2021).

2.2. Domestic Demand in Next Five Years

Elastic Coefficient method:

The alternating rise and fall of the level of economic activity is called the economic cycle, which has an important impact on the demand for minerals. The Demand elasticity coefficient refers to the change caused by every 1% growth of GDP.

The elasticity of bauxite ore consumption and trade is different from the elasticity of demand price. The price demand elasticity is the percentage of change in bauxite ore demand caused by 1% change in bauxite price under specified conditions. It is generally negative, indicating that the price increases, the demand for bauxite ore decreases, and the demand for bauxite increases when the price decreases. The price elasticity of bauxite demand is closely related to the elasticity of bauxite consumption and trade, but the sensitive direction in price changes is just the opposite, and the latter two are generally positive. A large number of studies show that the relationship between GDP and ore consumption is significantly positively correlated (Zhu, Hong, & Wang, 2019). Therefore, the elasticity of bauxite consumption and trade reflected by GDP growth can most truly reflect the sensitivity of national economic development to bauxite demand during a specific length of time. The greater the cost of bauxite, the greater the demand for bauxite, the less the demand for bauxite, the greater the trade demand for bauxite, and the greater the demand for bauxite, the less the price elasticity of international bauxite.

In Mineral resource demand forecasting, GDP elasticity demand is often used to refer to the response process of mineral resource demand to the change of GDP (total or per capita). As In the Mining sector, the Government income generally comes from taxes and royalties annually, we are going to use Annual Production/exportation data and Guinea’s GDP growth rate to calculate the GDP elasticity of demand from 2000 to 2020.

The GDP elasticity of mineral demand can be expressed by the GDP elasticity coefficient.

The GDP elasticity coefficient is the percentage change in quantity demanded for every 1% growth of GDP in the total national economy, reflecting the sensitivity of bauxite demand (including import) to GDP growth. The calculation formula is as follows:

Note: As we use GDP growth rate values, then we will determine the percentage changed in quantity demand of all the data from 2000 to 2020.

%∆Qd = % Change in quantity demanded;

%∆GDP = % Change in GDP/GDP growth rate;

Ed = GDP elasticity coefficient demand of Mineral resource;

∆Qd = Change in quantity demanded;

∆GDP = Change in GDP;

Qd = Initial Quantity demanded of Mineral resource;

GDP = Initial GDP growth rate.

Determination of % change in quantity:

where: ∆Qd = Q1 − Qd.

Note: here, ∆Qd represents the quantity increased value and Q1 represents the updated quantity.

Remarkably, Guinea’s bauxite production and exportation growth from 2000 to 2020 and we also can notice the biggest bauxite quantity production and exportation through these past 5 years, over 52% of Guinea’s bauxite prodution since 2000 belongs to the period 2016-2020 and 56% of the exported bauxite belongs to the period 2016-2020 (see Figure 3, Figure 4 and Table 5). From this data analysis results, we can also see the improvement of Guinea’s GDP growth rate (see Table 4 and Figure 5) (Bulletins Statistiques Minières - Ministry of Mines and Geology/Republic of Guinea, n.d.).

![]()

Figure 3. Guinea’s Bauxite production and exportation growth in quantity.

![]()

Figure 4. % Change in Guinea’s bauxite production and exportation.

![]()

Figure 5. GDP Elasticity of Bauxite consumption.

![]()

![]()

Table 5. Guinea bauxite production and exportation rate (2000-2015) and (2016-2020).

High and stable demand growth of Guinea’s bauxite is attributed to its wide application to industries and also to the increasing number of bauxite mining companies.

The law of demand states that as the price falls, so does the amount demanded, although it does not specify how much (Demand Elasticity, n.d.). We can see on the graphic (Figure 5), the evolution of Guinea’s Bauxite elasticity of demand. Furthermore, we know that if the demand elasticity is less than one, the demand is inelastic, if it is equal to one, the demand is unit elastic, and if it is greater than one, the demand is elastic. Knowing this logic, most of the GDP elasticity demand that we determined are superior than 1, mostly recent years. From 2011 up to now the elasticity demand for bauxite exportation is elastic (see Table 4).

Future forecast or projections:

Guinea’s bauxite shipments have clearly risen, and Chinese alumina factories will increasingly rely on this ore.

For forecasting the demand/production of mineral resources in the next n years, we will use the Elasticity coefficient method of forecast to calculate.

The calculation formula is as follows:

where:

Or also:

Qn = Forecast value of mineral resources demand in the next n years;

Q0 = Actual consumption of mineral resources in the forecast starting year/previous year;

= Average GDP elasticity coefficient demand for Bauxite Mineral resource consumption;

rd = The Average annual growth rate of demand/production for mineral resources;

rGDP = The annual growth rate of GDP;

N = Total number of years.

After all analysis,

for production is 2.61 and for Exportation 3.08, and also as the rd of the years are approximatively all the same here, so we will be using the Actual consumption value of mineral resources in the forecast starting year as the value of Q0 starting from 2020.

Forecasting the production

Forecasting the Exportation

From the forecasting data analyzed in Table 6 and Figure 6, Guinea’s bauxite will experience an average growth of 9.55% in production and 12.07% in exportation (from 2021 to 2025), which shows a big possibility of high demand of Guinea’s Bauxite in the coming 5 years.

Stimulated by the entry of new industrial enterprises into the country’s bauxite production and the increasing investment and production capacity of existing enterprises, by the end of 2025, Guinea’s bauxite production capacity is expected to reach 195.70 MMT.

![]()

Table 6. Guinea bauxite production and exportation forecasting data to 2025.

Due to the expected increase in Guinea bauxite exports, strong rivalry may arise, posing new hurdles for nations exporting high-silicon and boehmite bauxite. Only bauxite with high-availability alumina and low-activity silica will be able to compete at the current alumina pricing. China is without a doubt the world’s greatest bauxite user. Recently, several alumina mills have been importing Guinea trihydrate bauxite in large quantities. China is anticipated to enhance its alumina production capacity, according to statistics from Antaike, China’s non-ferrous metal industry research center (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020).

The worldwide bauxite market was valued $9.90 billion in 2019 and is predicted to increase at a CAGR of 3.3 percent from 2020 to 2027 (Bauxite Market Size, Share Analysis Report, 2020-2027, n.d.). The market’s expansion is mostly attributable to rising aluminum demand. Construction, automotive, packaging, and electrical and electronic devices are among the end-use industries. Bauxite is primarily utilized as a raw material in the manufacturing of alumina and then as a raw material in the production of aluminum, hence the market is mostly driven by global aluminum output (Bauxite Market Size, Share Analysis Report, 2020-2027, n.d.). The sector is undergoing huge transformative changes as a result of rising demand in China. In 2019, China led the worldwide bauxite sector, accounting for 58.0 percent of total revenue (Bauxite Market Size, Share Analysis Report, 2020-2027, n.d.). According to the International Aluminum Association, China is the world’s greatest producer of primary aluminum, generating around 58 percent of all aluminum in 2019 (Bauxite Market Size, Share Analysis Report, 2020-2027, n.d.). As a result, as of 2019, China is the largest market, and it is likely to stay so during the projection period (Bauxite Market Size, Share Analysis Report, 2020-2027, n.d.).

EXPORTATION PREDICTION BASED ON CHINA CONSUMPTION

Supply and demand:

The demand for bauxite will continue to increase because the amount of aluminum used in developing countries is much lower than the typical use in more advanced economies (Aluminium - the Changing Global Market, n.d.).

The world bauxite export trade is growing. In 2019, the total trade volume of bauxite in major producing countries exceeded 120 million tons. Guinea has become a major exporter in recent years. In 2019, it exported to China (44.4 million tons), Ukraine, Ireland, Germany, India, etc. (Aluminium - the Changing Global Market, n.d.; Liu & Dong, 2019).

China is the world’s largest user of aluminum and importer of bauxite. China bought more than 100 million tons of bauxite in 2019, with virtually all of it coming from Guinea, Australia, and Indonesia (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020; Schwart, 2019).

Driven by new investment mainly from China, Guinea’s bauxite exports continued to grow in 2020 (see Table 7), over 82.56 MT exported and 58% of which were exported to China. China is expected to remain the mainstay of Guinea’s bauxite importers (see Table 7).

Based on Table 7 and Figure 7 data from 2000 to 2015, China’s bauxite exportation quantity from Guinea was not that considerable, but these recent five years with the starting of new Chinese bauxite companies in Guinea, we are experiencing Guinea’s fastest bauxite production and exportation ever, over 34% of Guinea’s bauxite produce since 2000 were exported to China with 14% of average bauxite exported to China.

Starting analyzing from 2016, China has import from Guinea 60% of the total bauxite exported and just import from Guinea 0.51% of total bauxite exported during the period 2000-2015 (see Table 8 and Figure 8).

![]()

Figure 7. Exportation growth and average.

![]()

Figure 8. Average bauxite exported to China from 2000 to 2020.

![]()

Table 7. Guinea bauxite exportation rate to China from 2000.

![]()

![]()

Table 8. Guinea bauxite exportation rate to China from 2000.

The main China’s bauxite imported from Guinea was made from 2016, over 99% of Chinese Guinea’s importation and 1% is made between 2000-2015 (see Table 8).

The demand for imported bauxite will continue to rise, and Guinea will become the main contributor (see Figure 9 and Table 7).

Bauxite imports are increasing as China’s bauxite output declines. Given China’s total alumina production of 74 million tons and a 2.6-ton average bauxite consumption, China’s bauxite demand might be in the region of 190 million tons, with roughly 70 million tons coming from local mines (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020). Because of the high-quality bauxite and rapidly-developing infrastructure, China will import around 120 million tons of bauxite, the majority of which will come from Guinea (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020).

According to Asian Metal, China imported roughly 100.6 million tons of bauxite in 2019, including 70.7 million tons of bauxite (from Guinea, Indonesia, Brazil, Malaysia, and India) and 29.9 million tons of boehmite (from Australia and other nations) (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020). In 2019, Guinea shipped 44.4 million tons of bauxite to China, with the remaining 25.9 tons of ore going to all corners of the globe (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020; Wood, 2019). The share of Guinea bauxite in China may expand further in 2021, based on the present trend this year. With a total export volume of 94.9 metric tons in 2019, Guinea, Australia, and Indonesia remain the top three exporters of Chinese bauxite. Bauxite is now imported from Guinea and Sierra Leone by VEDANTA and HINDALCO alumina refineries (A Booming Bauxite Mining Industry of Guinea and Future Prospects/AlCircle Blog, 2020).

It is expected that there will be fierce competition in China’s market space in the next few years. The objective of market participants is to access China’s

![]()

Figure 9. Average bauxite exported to China from 2016 to 2020.

enormous aluminum production industry with their business approach (Bauxite Market Size, Share Analysis Report, 2020-2027, n.d.). Due to more stringent mining, the supply of bauxite in China is tightening, and it is expected that bauxite imports will flood into China in the next few years (Bauxite Market Size, Share Analysis Report, 2020-2027, n.d.).

3. Conclusion

Overall, Guinea is very interesting: given the concentration of minerals, the quality of its bauxite deposits is much better, and reserves are important.

So far, it is clear that there is lagged relationship between Guinea’s bauxite production/exportation, Bauxite prices and Guinea’s government revenues. Bauxite production/exportation started upwards in 2015-2016 and Guinea’s government revenues increased accordingly. Therefore, with all these new investments and expansions in Guinea, the country’s bauxite exports are more likely to grow. Guinea mining department data shows the incredible exported quantity of 82.56 million tons in 2020. In 2017 and 2018, Guinea exported 48.64 million tons and 58.05 million tons respectively according to the ministry of mines and geology of guinea’s data (see Table 4).

With the increase in export volume, the export income of Guinea bauxite is also expected to increase. And as the export forecast quantity is higher than the production, Guinea will experience also an increase in production in the coming years.

The quick growth of Bauxite mining in Guinea has resulted in an equally rapid increase of government revenues.

Although COVID-19 has caused the overall economic slowdown, Global and Guinea’s bauxite and alumina production increased in 2020, the recovery of the global aluminum market is expected to lead to growth in bauxite and alumina demand in the next few years.

As many projects in the development stage are expected to be put into production soon, and most of the undeveloped bauxite deposits provide major opportunities for mining companies, Guinea may to become a global leader in bauxite production and exportation in the near five years.

Guinea possesses the world’s greatest bauxite deposits, with over 40 billion tons of the mineral.

Guinea’s bauxite mining and exports are picking up rapidly. The current Production volume is about 87.77 MTPA, and it is planned to reach 195.70 MTPA by 2025.

Bauxite is created through redshifts of aluminum-bearing sediments (siltstone) and diabase on low-lying plateaus 100 m to 300 m above mean sea level.

Bauxite has a low silica concentration (approximately 2.5 percent SiO2-only half of which is reactive) and a medium to high alumina content (46 - 48 percent).

Bauxite in Boke is essentially gibbsite with a boehmite content of less than 3% and low impurity content, then organic component.

Bauxite mining is simple in Guinea, and due to the naturally low silica content in the ore, no dry or wet beneficiation process is required.

Although the Trombetas bauxite in Brazil is regarded the greatest in the world in terms of alumina output, the price of Guinea bauxite is relatively low, the resources are relatively large, and the future potential is huge. Guinea bauxite will become the main motivation of the alumina industry.