An Empirical Examination of the Impact of Banks on Economic Growth in Sierra Leone (2001-2017) ()

1. Introduction

Growth is an increase or expansion in every aspect of the human index, businesses, economy, etc. Economic growth is an increase in the productive capacity of an economy that will result in an increase in its gross domestic product (GDP). This can trigger an increase in the standard of living, wages and income, and socio-economic activities. Economic growth means the sustainable increase in the per capita income over time as a result of the increase in physical capital, human capital, and progress in technology (Harrod, 1948).

Economic growth as a development process is believed to be a fundamental goal of the world economy. Emerging economies with low living standards, high inflation rates, and increasing poverty and unemployment within their countries seek to improve productivity and increase their national income (Duramany-Lakkoh, 2020). However, banks as financial institutions established to provide specialized financial services, play an important role in the financial system and help to make the overall economy of a country more efficient. Banks are the backbone of any operating market economy. These institutions have two principal tasks: Firstly, they channel the transfer of payments between households, corporations, and government entities in which cash only plays a minor role in everyday activities. Banks organize a large part of our monetary dealings through electronic transactions. The purpose is to distribute economic goods and services or to settle financial obligations. Individual households transfer rents and pay their bills, as well as companies, pay wages, taxes, and contributions to social insurance electronically. Secondly, banks act as financial intermediaries by accepting deposits from the surplus unit and give out to the deficit unit (Annor & Obeng, 2017).

The focus of this research is to establish the contribution of the banking sector to the overall development of the Sierra Leone economy, using Gross Domestic Product and the Dependent variable. Theoretically, this paper gives an insight into the banking sector in Sierra Leone with specific reference to savings mobilization and resilience to internal and external shocks that affect the financial system and the economy as a whole. The empirical tests, on the other hand, give reasonable estimates of how the variables used in this study affect the productivity in the economy as a result of banks’ performance. There have been some significant studies on the banking sector in Sierra Leone, however, this study attempts to examine the key banking variables using the ordinary least square approach, bringing a short-term analysis that is uncommon in the literature.

1.1. Statement of the Problem

Many researchers have claimed that the role of banks has a positive impact on the economic growth of a country. The financial sector in Sierra Leone is one of the shallowest in Sub-Sahara Africa. Sierra Leone experienced a civil war that lasted over a decade (1991-2002) and the deadly Ebola epidemic in 2014 has hindered the country’s economic development over the years. Although foreign direct investment has helped to promote economic growth over the years (Duramany-Lakkoh et al., 2021).

Although the banking sector in Sierra Leone is relatively stable and sound, it continues to be exposed to risk from other sectors of the economy. The high sectoral loan concentration, slightly higher Non-Performing Loan (NPL) ratio, and a high degree of dollarization remains key transmission channels of the risks from other sectors to the banking sector (Duramany-Lakkoh, 2021a). A decline in the iron ore prices over the years remained a key challenge, whereas, on the fiscal funds, the accumulation of government arrears remains a key challenge to the quality of commercial banks’ loans. Fiscal dominance has crowded out credit growth in the private sector. While commercial banks in Sierra Leone are anticipated to promote economic growth by facilitating credit to the relevant players in the economy. It is relevant to assess whether banks are creating any impact on the economy or not.

The above problem made it incumbent to conduct this study. This work is expected to add to the literature with regard to the impact of banks on the economic growth in Sierra Leone.

1.2. Significance of the Study

As stated earlier, Banking is a vital element and it is one of the major contributing factors in the development of a country’s economy (Aurangzeb, 2012). This impact is expected to have a positive effect on economic growth. As such; it is worth examining the impact of banks and how they have contributed to the economic development of Sierra Leone. The civil conflict and Ebola outbreak had some disruption on the economy, but with the successful change of governments through democratic means over the past two decades, the country has gone through some major transformations in the banking sector. This study intends to examine the following areas form the banking sector: Bank Liquidity Reserve to Bank Asset Ratio (BLR), Domestic Credit to Private Sectors (DCPS), Interest Rate Spread (IRS), Gross Domestic Savings (GDS), and Deposit Interest Rate (DIR) and considering economic growth as the dependent variable.

Moreover, the invention of new technology such as internet banking, mobile banking and new entrants in the market have improved service delivery over the years and augmented the access of banking products to clients.

1.3. General Objectives

The aims of the study are to know whether there is a positive relationship between the banking sector and the economic growth of Sierra Leone. The study also aims to analyze the role of banks in the economic growth of Sierra Leone.

1.4. Specific Objectives

1) To determine whether commercial banks have contributed to the economic growth of Sierra Leone;

2) To show how commercial banks have influenced savings and investment levels in Sierra Leone.

1.5. Research Questions

This research will focus on answering the following questions:

How do commercial banks in Sierra Leone contribute to the economic growth of Sierra Leone?

How do commercial banks influence savings and investment in Sierra Leone?

1.6. Research Hypothesis

A null hypothesis (H0) will be considered in this research. This hypothesis states that there is no relationship between banking sector development and economic growth.

2. Literature Review

2.1. Theoretical Literature Review

2.1.1. Sierra Leone Banking Structure

The Bank of Sierra Leone (BSL) also known as the Central Bank of Sierra Leone has the legal mandate to issue licenses to all financial institutions to operate within the country. It guarantees a sound and safe operational financial system’ including the payment and securities settlement systems, which entail a good understanding of the main microeconomic trend. The central bank was established in 1964 after gaining independence in 1961 from Great Britain (Duramany-Lakkoh, 2021b).

However, before gaining independence, the West Africa Currency Board (WACB), which was established in 1912, was charged with the responsibility of issuing currency in Sierra Leone. WACB was also responsible for issuing currency in Nigeria, Ghana, and the Gambia. In 1963, the Bank of Sierra Leone Act was passed into law and started operations on 4th August 1964 which marked the issuing of the Leone currency as a legal tender.

In the late 1980s, the financial system in Sierra Leone comprised the banking sector with four commercial and eight rural banks. The four commercial banks were Standard Chartered Bank (SL) Ltd, Barclays Bank (SL) Ltd (now Rokel Commercial Bank), Sierra Leone Commercial Bank Ltd, and the International Bank for Trade and Industry (IBTI).

In around 2017, the number of commercial banks in the country has risen to fourteen with one hundred and nine branches nationwide. There are seventeen community banks, eleven insurance companies, and sixty-two exchange bureaus. In addition, there are eighteen micro finance institutions (MFIs), five deposit-taking MFIs, and one apex bank. There are also fifty-nine financial service associations (FSAs), two mobile financial services providers, and one stock exchange.

Out of the 14 commercial banks operating in Sierra Leone, four are locally owned and ten are subsidiaries of foreign banks. In relation to locally owned banks, the government is the majority shareholder of two banks, while two local commercial banks are wholly privately owned.

2.1.2. An Overview of the Sierra Leone Economy

Sierra Leone experienced a civil war between 1991 and 2001 which led to adverse and unstable economic activities. The economy of Sierra Leone grew positively after the war from 2002-2014 which was largely driven by agriculture and mining. As a result of the boom in the extraction and exportation of iron ore and investment of the government into infrastructural development and agricultural funding, the country gained a double-digit GDP growth of 15.18% in 2012; and in 2013 it grew significantly by 20.72% as the highest since 2002, which marked the country as one of the fastest-growing economies in the world. Due to the Ebola outbreak and the drop in the iron-ore price in 2014, the economy was contracted by 20.60% in 2015. In 2016, the economy began to improve and grew by 6.06%, when the country was declared Ebola-free (World Development Indicators, 2018).

In 2017, Sierra Leone was faced with a slowdown of economic growth to 4.21% from 6.06% in 2016, constituted mainly due to weak performance in the mining sector and a serious negative effect of accumulation of government procurement arrears in the construction and distributive trade sectors. Though inflation was moving downwards over the year, a contractionary monetary policy was used throughout 2017 due to internal and external pressures. Notwithstanding macroeconomic challenges, the key fiscal soundness indicators show that the banking sector was well-capitalized, liquid, profitable, and a continuous decrease in non-performing loans (NPLs). Though the banking sector continued to be over-dependent on investment securities and exposed to a high sectoral concentration of loans, and a fairly high level of NPLs.

The financial system in Sierra Leone is largely bank-based, which means the banks are the major players in the chain of payments, money, and foreign exchange markets and they play a significant role in the government securities market (Duramany-Lakkoh, 2020).

2.1.3. Theoretical and Models of Economic Growth

The banking sector in developing and promoting economic growth has been a debatable topic by various researchers over the years. Some embrace the view that the banking sector plays a significant role in stimulating economic growth while others have the opinion that it merely follows economic growth. This section will therefore discuss some of the existing opinions reviewed.

1)Schumpeterian Model of Economic Growth

Schumpeter (1934), a pioneer of financial development and economic growth

![]() Sourced: computed by authors (2021)—E-views.

Sourced: computed by authors (2021)—E-views.

Figure 1. GDP growth rate from 2000 to 2018.

theory stated that bank credit is an essential element of economic development. In his contribution to economic growth, he explained and coined the economic progress based on the entrepreneurs’ initiative and innovation, through a competitive market that stimulates economic growth. He offered an insightful and unique economic structure that highlighted the importance of market industrialization. In his view, an economy cannot stand on its own without driving factors such as bank credit, investment in the advancement of new technologies, and technical expertise.

In this regard, for an economy to develop, it needs entrepreneurs to efficiently allocate resources to their most productive channels.

2)The Exogenous Growth Model or Neo-Classical Growth Model

This is also called the Solow-Swan growth model. It is one of the most popular models for economic growth in economic literature. It is an expansion of the Harrod Growth Model (Harrod, 1948). The expansion is sphere headed by including a new term “increase of productivity”; economic growth arises from the addition of more capital and labor input and from creative ideas and new technology. When more capital is introduced coupled with sufficient labor, technical expertise, and the advancement of new technology, economic growth is greatly enhanced. This model also indicates the significance of new capital, population growth, and progress in technology. Harrod (1948) suggested that a certain percentage of income in an economy must be saved and invested to grow at a certain rate. There are two indicators with regards to this theory; i.e. savings and capital-output ratios. The first looks at how much is saved from a given amount of income. The second looks at how much new capital is required to generate a given amount of national income. If a sufficient level of saving is maintained, growth will be sustained.

The growth rate of output in a stable form is exogenous and it is independent of the savings rate and technical progress. An increase in the savings rate results in an increase in the output per worker.

3)The Endogenous Growth Model

This holds the view of internal factors as opposed to the neo-classical model. This theory embarks on the knowledge base economy and the effect of the positive outflows that can lead to economic growth. In this case, the role of financial intermediation is a key factor with regard to economic growth and has a direct link to this model.

In this regard, several writers such as Levine (1997), Bencivenga & Smith (1991), and Saint-Paul (1992) have incorporated in the endogenous growth model the role of the financial system in enhancing economic growth. Bencivenga & Smith (1991) were with the opinion that centered on the effective financial intermediation that arises when liquidity risk is sufficiently managed to encourage savers to invest in productive investments that can stimulate economic growth. Saint-Paul (1992) argues that a well-developed and well-functioning stock market can uphold economic growth through risk-sharing activities by entrepreneurs. Similarly, Saint-Paul (1992) and Levine (1997) placed more emphasis on the significance of stock markets in generating finance needed for investments purposes, especially in less liquid assets.

2.2. Empirical Literature Review

Calderon & Liu (2003) used data found from 109 countries for the period of 1960 to 1994 examined a common relationship between financial sector development and economic growth. They found that the impact of economic growth on financial development becomes insignificant over long periods (developed countries).

Abusharbe (2017) carried out an empirical study that examined the impact of some banking sector indicators (credit facilities, depositors’ funds, the number of branches, and interest rate,) on the gross domestic product using quarterly data from the period of 2000 to 2015. He used the ordinary least square regression to conclude that growth or output is significantly influenced by boosting the performance of the banking sector. His result revealed that bank credits are positively related to economic growth. His results show that the supply leading banking industry development tends to influence the productive capacity of the Palestinian economy. Unlike interest rates, customers’ deposits and the number of branches have no significant impact on economic growth.

Apergis et al. (2007) carried out panel integration and co-integration methods for a dynamic heterogeneous panel of 15 OECD and 50 none OECD countries over the period of twenty-five years (1975 to 2000), to look at the causal relationship between the financial sector and economic growth. The study assessed the impact of three different measures of financial development. Two of the three measures employed in the study are the bank credit, measured by bank credit extension to the private sector over GDP, and financial institutions’ credit extension to the private sector over GDP, and private sector credit measured by banks. The results show a bi-causal connection between financial expansion and economic growth involving that financial development caused economic growth while at the same time economic growth led to the expansion of the financial sector.

Fisher (1937) gave a subjective economic value of a country’s financial development and economic growth as not only a function of the amounts of goods and services owned or exchanged, but also the moment when they are purchased with money. This model, generalized to the case of goods or services relating to the period (including the case of infinitely many periods) has become a standard theory of capital and interest (Volume Information, 1969); In the evidence presented, in order to isolate properly the economic factor influencing interest rate, the result must examine the determinant of the rate to be estimated by using the structural model of the behavior in the financial sector and alternatively a set of the reduced-form equation that can be testified and estimated directly, which can be related to the endogenous variables (i.e. interest rate).

Jayaratne & Strahan (1996) provide evidence on how bank branches can function or perform toward the financial market that directly affects economic growth and financial development; they did this by studying the re-creation and unleashing of the banking sector. These studies showed that the expansion of bank branches can lead to an increase in per capita growth in income and output significantly provided there are good bank branch reforms. They also investigated the effect of bank branches’ network and geographical strategies on cost efficiency, product offering, and diversification of various services which lead to an exacerbated by the increasing distance between headquarters and branches. As a result, this does lead to a positive effect due to the larger bank size which can neutralize the bank’s structural change in terms of local economic development.

The methodology employed by most studies reviewed includes the ordinary least square regression to analyze and establish the relationship between the banking sector and economic growth, with a few others using the granger causality test in determining the direction of this relationship and Co-integration and Error Correction Model. For this work, the writers will use the ordinary least square method since we intend to look at the relationship between the two.

3. Methodology

This study uses data from various reliable sources, which include the Bank of Sierra Leone Stability Report, World Development Indicators, the World Bank Index, etc. The scope of the study is a seventeen-year period starting from 2001 to 2017 (inclusive). There is no definite justification for how economic growth can be measured within the framework for a regression (Vinh & Batten, 2006). Hence, there is no explicit guide as to what variables can be suitable in determining economic growth when specifying a regression equation.

In most cases, the various variables that are used to determine the impact of the banking sector on economic growth from various literature include; bank deposits, deposit interest rate, bank credit, interest rate spread (i.e. lending rate minus deposit rate), the interest rate on credits, bank liquid reserves to bank assets, gross domestic savings and bank branches. However, due to the limited availability of data on some of the variables discussed, the study intends to use the following variables; interest rate spread, bank liquid reserves to bank assets ratio, domestic credit to the private sector by banks, deposit interest rate, and gross domestic savings.

The study uses aggregate data from all 13 banks in Sierra Leone.

3.1. Model Specification

The model in this paper is estimated using data available on the above variables, and this can be represented as follows:

(1)

where:

GDP—Gross domestic product.

IRS—Interest rate spread.

BLR—Bank liquid reserves to bank assets ratio at time.

DCPS—Domestic credit to private sector by banks.

DIR—Deposit interest rate.

GDS—Gross domestic savings.

t—time period.

Adding the error term (ε) to the specification above, the regression will generally be presented in an equation as follows:

(2)

(2)

where:

—are coefficients; and are expected to be greater than zero.

—are coefficients; and are expected to be greater than zero.

ε—Denotes the error term which denote or captures all the other variables that have an impact on GDP that were not included in the model.

With the assumed function in Equation (2), linearizing it through logs, we get the following econometric model.

(3)

(3)

3.2. Definition and Justification of Variable

GDP growth was considered in this model to show the level of aggregate demand in the domestic economy. Being the only macroeconomic variable considered in the model, GDP is taken into account as the dependent variable in order to reflect the impact that the banking sector variables would have on economic growth. GDP is mentioned to be the total market value of the total production of goods and provision of services in a country within a particular period. It includes all government spending, consumers’ consumption, and investment spending plus total net export.

The interest rate spread shows the difference between the price charged by banks when giving out loans to private sector customers and that which banks pay to the surplus units for the funds deposited (i.e., the interest rate charged by banks on loans to private sector customers minus the interest rate paid by commercial or similar banks for demand, or savings deposits).

Bank liquid reserves to bank assets ratio were considered as it is used to maintain and boost confidence in the banking system. Banks have to maintain a certain ratio of funds deposited with the authorities such as the central bank. Such funds can be requested by the banks when there is an emergency on the use of funds and also for the smooth functioning of their day-to-day operations. It also serves as a means to check the liquidity position of the banks by the monetary authorities.

Domestic credit to the private sector is the amount of credit lent by commercial banks to the private sector of the economy. This is very important as it is likely to have a positive direct impact on GDP growth because banks usually offer to fund many sectors of the economy. These funds are essential for activities such as infrastructural projects, corporations, and SMEs financing, agricultural projects, and other public needs. As such, increases in loans and advances provided by banks would likely lead to an increase in GDP growth, vice-visa.

The deposit interest rate is used to encourage savers to deposit more funds; banks pay interest for the funds deposited by their customers. This variable takes into account the size of fund banks mobilize to expand on their lending base to households, private and public sectors which in turn enhance economic growth.

Gross domestic savings is the leftover from final consumption which denotes how much individuals are actually saving or depositing with banks.

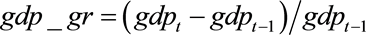

As the Sierra Leone financial system is mostly bank-based, we will try to highlight the relationship between the growth rate of GDP in relation to the explanatory variables, using graphical representations in establishing whether we have a relationship or not. If there is a relationship that is directly propositional to the growth rate of GDP, then we can say that the banking sector is a determinant of GDP growth in the country. Therefore, the growth rate of GDP is calculated at any given period (time-t) by the equation:

(4)

(4)

From results obtained on the relationship between the explanatory variables and GDP growth, we will then conduct further statistical and econometric analysis from the data available.

4. Research Finding and Analysis of Result

4.1. Graphical Representation and Analysis

Figure 2 shows that GDP recorded its highest growth rates of 26.42% and 20.72% in 2003 and 2014 respectively. There were also significant declines in 2002 by −6.35% and −20.60% in 2016 which later bounced back into positive figures in

![]() Sourced: Computed by authors (2019)—E-views.

Sourced: Computed by authors (2019)—E-views.

Figure 2. Gross domestic product growth rate.

2017 by 6.06%.

Figure 3 shows the growth rate of bank liquidity reserve during the period studied. It is indicated that in 2005 it recorded the highest growth rate of 56% which later declined to its lowest ever during the period studied (i.e. −44%) the following year. From 2010 to 2014, there was a steady increase reaching a pick of 38.94%, but later declined to around a negative of 1% in 2015. In comparison to GDP, there was a decline from 6.60% in 2005 to 4.51% in 2006. Also in 2014, it declined from 20.72% to 4.56% in 2015. During this period; it was found that BLR growth rate and GDP growth rate were moving in a similar trend.

Figure 4 shows that domestic credit to the private sector increased from 26.32%

![]() Sourced: Computed by authors (2019)—E-views.

Sourced: Computed by authors (2019)—E-views.

Figure 3. Bank liquidity reserve growth rate.

![]() Sourced: Computed by authors (2019)—E-views.

Sourced: Computed by authors (2019)—E-views.

Figure 4. Deposit credit to private sector growth rate.

in 2002 to 46.35% in 2003 which has the same increasing trend of GDP from −6.35% to 26.42% within the same period. From 2009 to 2010, DCPS decreased from 47.29% to −4.78%, While GDP had an opposite direction by decreasing from 5.40% to 3.19% respectively.

In Figure 5, we can see a continuous decrease in growth rate throughout the period. Although DIR had an increase in growth rate from around −8% in 2009 to around 8.87% in 2011 as compared to GDP which was fluctuating around 5% respectively. In 2011, DIR had a sharp decrease from 9% in 2011 to −32% by the end of 2015. However, during this same period, there was an increase in growth for GDP from 5% in 2011 to around 21% in 2014 but later decreased to −21% by the end of 2016.

From Figure 6, we can see that GDS did not change much throughout the entire period with an exception in 2012, 2013 2014. There was consistent negative growth rate despite the insignificant growth in 2002, 2006, 2009, and 2015. In 2013 alone, it recorded the lowest decline of around-161,710.62% which was just before the Ebola outbreak in the country.

Figure 7 shows interest rate spread increased from around −22.61% to 17.12% in 2002 and 2005 respectively, while GDP increased from −6.35% to 6.6% during the same period. In 2013 and 2014, IRS growth had a slight increase from 9.80% to 9.96%, while GDP had a significant growth rate from 15.18% to 20.72% respectively.

From the above results, it shows that only domestic credit to the private sector has a similar growth rate pastern towards economic growth in Sierra Leone when considering the variables selected for the banking sector from 2001 to 2017. Other variables such as the interest rate on deposit, bank liquidity reserve, interest rate spread, and gross domestic savings all indicate different growth rate directions.

![]() Sourced: Computed by authors (2019)—E-views.

Sourced: Computed by authors (2019)—E-views.

Figure 5. Deposit interest rate growth rate.

![]() Sourced: Computed by authors (2019)—E-views.

Sourced: Computed by authors (2019)—E-views.

Figure 6. Gross domestic savings growth rate.

![]() Sourced: Computed by authors (2019)—E-views.

Sourced: Computed by authors (2019)—E-views.

Figure 7. Interest rate spread growth rate.

4.2. The Regression Model Results (Dependent Variable: GDP)

Table 1 reveals that bank liquidity reserve has a negative relationship to GDP in Sierra Leone which is insignificant. The domestic interest rate has a negative but insignificant relationship to GDP. This means a one percent increase in DIR would not create any positive impact on GDP. Gross domestic savings shows a negative relationship to GDP. Also, the interest rate spread has a negative but insignificant relationship to GDP. From the hypothesis stated earlier, we reject the null hypothesis for the variables BLR, DIR, and IRS. For the variables DCPS and GDS, we accept the null hypothesis since the probability values are less than 5%.

![]()

Table 1. Shows the least square test for Equation (2).

Sourced: Computed by authors (2019)—E-views.

5. Summary of Findings

This paper examines the impact of the banking sector on the economic growth in Sierra Leone from 2001 to 2017. The country has been marred by the economic downturn, with the fall in iron ore prices, natural disasters such as the Ebola epidemic, mudslides, and man-made disasters including a deadly civil war in the 1990s that lasted for over a decade. The country is largely dependent on foreign aid, domestic bank borrowing and borrowing from international financial institutions such as the IMF and World Bank to support the country’s budget deficits, although it has a vast deposit of mineral resources such as diamond, iron ore, gold, bauxite, fertile land for agricultural purpose and tourist attraction centers.

Economic growth as a development process is believed to be a fundamental goal of the world economy. With Sierra Leone being an emerging economy with low living standards, a high inflation rate, and increasing poverty and unemployment, it seeks to improve productivity and increase its national income by improving its financial sector. However, banks as financial institutions established to provide specialized financial services, play an important role in the financial system and help make the overall economy of a country more efficient and sustainable. Moreover, Banks are the backbone of any operating market economy. While the commercial banks in Sierra Leone are anticipated to promote economic growth by facilitating credit to the relevant players in the economy. With this, it is relevant to assess whether the banking sector is creating an impact on the economic growth of the country.

From the review of relevant literature, we can see that there different opinions on the relationship between economic growth and banking. Writers such as McKinnon (1973) and King and Levine (1993), embraced the view that the banking sector plays a significant role in stimulating economic growth while Calderon and Liu (2003) have the opinion that it merely follows economic growth. However, this research discussed some models such as the Schumpeterian model of economic growth, the exogenous growth model/neo-classical growth model, and the endogenous growth model used to determine economic growth.

Using the least square model and regression analysis the researchers examined whether the banking industry contributes to economic growth in Sierra Leone for the period between 2001 to 2017 using five descriptive variables to measure banking sector growth, these variables include; bank liquidity reserves, domestic credit to private sectors, deposit interest rate, interest rate spread, and gross domestic savings. The writers also used the gross domestic product to measure the economic growth of the country.

6. Conclusion

From the outcomes of the regression and analysis of the results, GDP is strongly influenced by some of the banking indicators especially domestic credit to the private sector. In general, the research found that banks do not create a significant impact on the economic growth of Sierra Leone based on the indicators examined. It is seen that only domestic credit to the private sector has a positive and significant impact on GDP, while deposit on interest rate has a positive but insignificant impact on GDP. The other indicators such as bank liquidity reserve, interest rate spread, and gross domestic savings neither have a positive nor significant impact on GDP. Domestic credit to the private sector tends to have a positive impact due to its effectiveness to stimulate investment and bolster economic growth. It is also believed to have an impact on economic growth which has led to the expansion of businesses and economic activities, which in turn has created room for output and employment in Sierra Leone.

Appendix A1. World Development Indicators 2018

Appendix A2. Compiled by Authors (2019)—E-views

Appendix A3. Durbin Watson Statistics

Appendix A4. The Lagrange Multiplier Test or LM Test

Appendix A5.

![]()