1. Introduction

From the start of this century, in 2000, Greece embarked on a major program of port governance reform. While developments were initially limited to devolution of control to corporatized port authorities, the most recent years (2008-2020) have been eventful. The arrival of a global container terminal operator in 2008 and the selling of it reshaped the Greek port system (Pallis & Syriopoulos, 2007a).

Some of the Greek goals are traded to be continued, an expansion of bilateral trade and mutual investments, and in parallel to have investments in the energy, transport and banking sector.

In continue, other two different models, depending on each case, are selected for the utilization of the ten regional ports located in the HRDF portfolio. These are the Port Authorities of Alexandroupolis, Elefsina, Patras, Igoumenitsa, Kavala, and Heraklion, which have long-term concession agreements with the Greek State, for the use of the respective ports until 2042. The HRDF owns 100% of the shares. The first tenders were announced by the summer of 2021 and still they continued.

2. Investing in the Greek Ports and Logistics Sector

One of the greatest advantages is that Greece stands in the crossroad of three continents (Europe, Asia, Africa) and connecting, people, goods and cultures. For that reason, Greece has long been an important strategic node for transportation in the greater region.

In other words, maritime transport is the most important mode of global trade by volume with 70% by value. Container throughput in European ports has been growing at 6% annually, while traffic through South-East Mediterranean ports has been growing at more than 8% annually (Hellenic Statistical Authority, 2021).

In this environment, Greece’s geographical position as a Gateway between East and West render is highly attractive for investments in logistics and transport to take advantage of these increasing trade flows and cost-effective manner. Overall, Greek ports are strategically located and could easily be transformed into regional logistics hubs for goods travel from Asia to the European Community. This is opportunity for major global manufacturers to use Greece as an assembly, logistics and quality assurance center for their products manufactured in Asia and sold in Europe (Rodrigue et al., 2016).

Additionally, as part of the wide range Privatization Program that is under process, the Greek government has a rich portfolio of future infrastructure projects. This portfolio includes many investments, among others:

• Ports as companies of limited liability

• Rail infrastructure

• Athens international airport

• Other regional airports

• Advanced of cruises

• Advanced of terminal ports

• Rail and road transport investments

• Logistics centers assembly and quality assurance facilities

• Energy resources

• Utilization of tourism

The Piraeus Port Case

The potential for Greece to become a major logistics, distribution and assembly hub for Europe has been recognized by major investors such as Chinese COSCO, which has heavily invested in Piraeus port.

The main port of Greece, Piraeus is a large port with significant capacity both as a container port, as a passenger terminal and as a car terminal. It is close to the Mediterranean maritime route (210 nautical miles) and provides access to a large logistics center in Thriassio and a high speed cargo-train route leading into Europe. All these allow Piraeus to be a competitive European port and main gate to Europe (Pallis, 2007b). From 2010, Piraeus port started a remarkable recovery path partly due to COSCO Pacific, which acquired OLP S.A.

Also, significant is the agreement between the Greek Rail company TRAINOSE, acquired by Ferrovie dello Stato Italiane, and HP for the exclusive transport of HP goods coming through Piraeus to the European markets. Following the same path, Huwaei established a pilot distribution center in the Port of Piraeus whereas ZTE Corp has also developed a logistics center in the Port of Piraeus.

After 9 years, in 2019 ranked 1st among Mediterranean commercial ports and 25th internationally, with a total capacity of 4.9 million TEU. Piraeus, due to it’s connection with the big cargo train started from Thriassio and ended in the Europe and shipping routes with Asian countries (China, Japan, India, Korea) establish it as premium import point.

3. Why to Invest in Greece

3.1. Competitive Freight Costs

Greek ports with their significant geographical position, allows the offering of competitive sea freight cost for transported containers, while offering access to a set of growing economies in the broader area.

3.2. Transport Infrastructure

The investments in road and rail infrastructure make Greek ports directly interconnected with modern road and rail links, and make intermodal transport of cargo till their final destination more quick and cost-effectively. Moreover, despite that, a supporting meter is that under the new European Infrastructure Policy (TEN-T) more than 26 bn eur will be invested in European infrastructure, including railway, road, port, airport and multimodal infrastructure projects in Greece.

3.3. World Champion Shipping Sector

From the Ancient times, Greek ship owners control the world’s largest merchant fleet. It is arguably the oldest form of employment in Greece. Greek shipping remains number one in the world, according to new report by the Union of Greek Shipowners (European Commission).

Although the country accounts only 0.16% of the world population, Greek shipowners own 19.42% of global tonnage and 58% of the European Union.

More particularly, with data of UGS IN 2021, own 30.25% of the world tanker fleet, 14.64% of the world’s chemical and products tankers and 15.58% of the global LNG/LPG fleet.

In addition, Greek shipowners own 21.7% of the world carriers and 9.53% of the world container vessels.

3.4. Know-How and Skilled Labor

Greek manufacturing and maritime culture, ensures the availability of skilled logistics and assembly employees for the staffing of local distribution centers.

The Greeks have been a maritime nation since antiquity, as the mountainous landscape of the mainland, and the limited farming area and the extended coastline of Greece led people to shipping. The geographical position of the region on the crossroads of ancient sea lanes in the eastern Mediterranean, the multiplicity of islands and the proximity to other advanced civilizations helped shape the maritime nature of the Greek nation at an early stage. In Greece and the wider Aegean, international trade existed from the Minoan and Mycenean times in the Bronze Age.

Furthermore, the presence of goods such as pottery, gold, copper objects far away from their area of provenance attests to this wide-ranging network of shipping transport and trade that existed between the Greek mainland and the Greek islands. The Greeks soon came to dominate the maritime trade in the region, gradually expanding it along the shores of the Mediterranean to Egypt, Phoenicia, Asia Minor, the Black Sea, and establishing colonies.

3.5. Efficient Global Logistics Providers

Several global 3PL providers such as Kuhne & Nagel, DHL, Schenker, Geodis, Panalpina, and Express are currently operating in Greece. Also, all the big shipping companies have local offices and branches in Greece, as Cosco, Maersk, MSC, MSC CGM and many others. Recently, a logistics network funded by the Hellenic Federation of Industries (SEV) has been created, to improve collaboration between logistics providers and the rest of the Greek economy.

4. Financial Performance of Greek Ports

4.1. Port Revenues

This study consists of 6 Greek ports operating all in the domestic territory as “Societes Anonymes” (SAs). We will compare and analyze some data, in order to understand the route of each of the 6 ports that we discuss about and to show which port is strong where and show all the reasons that make Greek ports so attractive.

A mixed and rather modest financial performance is evidenced over the last 12-year period (2008-2020). Both revenue and net earnings show steadily declining trends. Four out of 6 ports indicate declining revenue growth rates.

Only Elefsina and Patras ports show steadily rising trends. The big dead here is Elefsina port, which started with low rates in 2008 and 8 years later in 2020 has multiply his revenue almost seven times, from 839,377?to 5,791.798?(Table 1).

Overall, Elefsina is the location of Elefsis Shipyards, Greece’s second largest yard, an oil refinery and the logistics centre. It is considered an extension of Piraeus port, the biggest port in Greece.

Also, is near to Athens city, the capital and the main hub in Greece. Elefsina with the necessary investments can compete Piraeus port and because of the near distance of it to get “part of the pie”.

Patras port shows stable increasing trend all these years, and stays one of the top regional ports with the highest revenues, from 2012 with 1.508.194? to 2016 with 2.508.405 and finally to 2020 with a small decrease of 69.665?(Table 1).

4.2. Greek Ports Investing Profits

Talking about investing profits we see that port of Igoumenitsa has the highest evolution 2020 with 1.211.506? which means that made and received a lot of investments after 2016. More specifically, port of Igoumenitsa in 2016 had 35.211?investing profits and 4 years later the profit was 1.211.506? which means 34 times higher (Figure 1).

Many different companies have expressed interest for this port, due to it’s connectivity with Italy. Every year many Ro-Ro vessels they do transportations of goods between Greece and Italy for the northern European countries. Cruise ships are much uploaded as well between Trieste, Bari and Ionian islands.

Moreover, port of Igoumenitsa, is a big hub of the trans-European transport network (TEN-T) via the Eastern Mediterranean Corridor (ORIENT-EAST MED Corridor) and holds a strategic position in the implementation of a sustainable and efficient sea transport route. Geographically, Igoumenitsa, it is the closest port of Greece to the countries of the Adriatic Sea, thus being an important bridge of people and goods to and from Western Europe.

![]()

Figure 1. Greek port investing profits. Notes: all amounts in Euros. Source: compilation of data reported in the annual financial accounts.

Talking with data, every year, 2.5 million passengers and about 250,000 trucks travel from the port of Igoumenitsa and the goal is to increase traffic. At this moment, the operation of the new port and the infrastructure expansion projects, the 2nd Phase that has already been completed and the 3rd Phase that is under construction, in combination with the improvement of the infrastructure in Egnatia and Ionia Road, they have significantly upgraded the capacity and quality of service of the port’s freight traffic (development of unaccompanied cargo services), passenger and tourist traffic (cruise development). This port is a hub to Italy but also through Egnatia to the rest of Greece and the Balkans, to Turkey.

The second place take Patras port, which is also very high and have done many investments there too, like 18 times more than four years ago at 2016, considering that 2016, in that difficult year, Patra had investing profits 41.265?and in 2020 756.637? Third place in 2020 takes Heraklion port with 281.338?and fourth place with big difference takes Kavala port with 27.856?(Figure 1).

4.3. Greek Port Operating Profits

Continuing, a highly interest finding though is revealed when operating profits, meaning Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) are examined. The results 4 out of 6 ports show declining operating profit growth rates (Figure 2).

To measure the operating profit of each port, we consider these circumstances and we do the following calculation:

Operating Profit = Revenue − Cost of Goods Sold (COGS) − Operating Expenses − Depreciation & Amortization

Only port of Heraklion shows steadily increasing trend after 2012 with 1.041.404? earnings (1st in the list) after 4 years is almost double the growth to 2.160.264?(2nd in the list) and 4 years later there is growth up to 10%, meaning

![]()

Figure 2. Greek port operating profits. Notes: all amounts in Euros. Source: compilation of data reported in the annual financial accounts

2.850.608?and rise it at the top of the list. This is a margin indicator that the port is earning enough money from business operations to pay for all the associated costs involved and works properly.

The port of Heraklion seems to be a “steak”. Heraklion, finds in Crete, the biggest Greek island. This island is also the southest of Greece and has connection with Egypt, Cyprus and all the east countries. This port is very interesting mostly for Italian investors. The tourism is very developed there and every year welcomes hundred of cruise ships.

Concerning Figure 2, Port of Heraklion follows port of Elefsina, with double increase every 4 years. We can see that is a rapid growing port, and proved that only in 4 years, with many changes for local and foreigh investors and immediate amortization of investment. Talking with data, in 2012 the operating profits are 258.777?(3rd in the list), 2016 are 603.923?(4th in the list) and 2020 are 1.592.311?(2nd in the list).

4.4. Totas Assets (Total Equity & Liabilities)

In Figure 3, talking about total assets for total equity and liabilities, we observe that at 2012 Patras port started with really high assets 55.752.693? more than double, from the second one, port of Heraklion with 22.029.711? Port of Patras had so high total assets, because port authority focused on increasing revenues, reducing expenses and it total reducing asset costs. Last place take port of Kavala, with only 5.196?

Four years later, in 2016 we observe a steadily increase of total assets from all the ports, except of port of Patras, with a slight decline but remains at the top with 52.761.357 eur. In 2020, because of COVID-19 we see another decline in 37.836.532? but still remains at the top. The unexpectable surprise here is the port of Kavala, that started 2012 with 5.196? after 4 years at 2012 increased in 7.610 and 4 years later, in 2020 marked increase to 9.053.501. First time we see

![]()

Figure 3. Total assets per port (Equity and Liabilities). Notes: all amounts in Euros. Source: compilation of data reported in the annual financial accounts.

port of Kavala so strong, competitive and ready to receive proposes for many ambitious investors (Figure 3).

The Port of Patras (O.L.PA. S.A) is the main Western Gate of the country. As regards passengers and commerce, it serves Southern and Central Greece. It has important financial, intellectual and social impact to the country. It is listed as port of International Interest: Category K1, JMD 8315.2/02/07 (GG B202).

Moreover, it is part of Trans-European Transport Network (TETN) and set out for the period 2012-2050 in Decision 661/2010/EU, which is the guidelines for the development of TETN and COM (2011) 650/19-10-2011, for the Regulation Plan on the guidelines for the development of the TETN.

Despite that, Patras port has signed many international partnerships among them European programs, as MoS Venice-Patras for developing and upgrading of East Mediterranean Mos and link between Greece and Italy. Another one is Ten Ecoport for sustainability of people and freight along the sea network between Adriatic, Ionian and Black Sea areas (Brooks, 2017).

Moreover, it has dynamic entry in the tourism market by additional promotion as tourist port, for Mega Yachts and cruise and the expansion of it to new markets, as container market. It is advantage for this port that there is an extrovert political and commercial cooperation between ports of the Adriatic Sea and Ionian Islands.

The development of new entrepreneurial and investing actions made the port competitive and contribute to advanced multimodal maritime transport (Pallis and Syriopoulos 2007).

Furthermore, it has cooperation with other big Western ports, as port of Igoumenitsa, Corfu, and Katakolo. Despite that, serves and other smaller regional ports, knows as “orphan” ports, but with potentialities. Except from the cooperation with other regional ports, cooperate with business bodies, as the Commercial and Industrial Chamber of the Prefecture of Achaia, Association of Western Greece Industries, etc.

4.5. Cash and Cash Equivalents of the End of Period

According to Figure 4 all the Greek ports have higher cash and cash equivalents in the end of period compare to the past. This, showing a growth and better management by the port Authorities. Steadily increase trend show port of Patras, of Elefsina and Heraklion. The big challenge was for port of Kavala that last 8 years has very low cash and cash equivalents, 1.898?in 2012 and 2.138?in 2016, but in the end of 2020 has 4.658.053? This huge growth is due to legal tenders of the port, many checks that received, saving accounts, short term investment securities within three months, bankers’ acceptances and commercial papers.

Kavala Port Authority (OLK SA) is situated in northeastern Greece (East Macedonia region) and is responsible for the management of four ports, the Passenger/Central Port of Kavala “Apostolos Pavlos”, the Commercial Port of Kavala Philippos B, Port of Keramoti and Port/shelter of Eleftheres. It has decided the exploitation via sub-concession of the right to use, maintain, operate and exploit a multi-purpose terminal within a part of Philippos B port, that is open to tenders for new investors.

OLK SA has the right to use and operate the buildings, land and facilities of the port land-side zone of Kavala Philippos B port on the basis of a concession agreement (dated 15 January 2003, amended in 2019) with the Hellenic Republic. The Concession Agreement and its appendices were ratified by law 4597/2019, which provides that the duration of 60 years, expiring on 15 January 2063. The main port activities of the commercial port of Kavala, Philippos II include multipurpose cargo handling. Container vessels may also be potentially served at the port facilities. The port offers ready-for-use port infrastructure and areas for cargo handling and storage. It also presents expansion possibilities, offered by a recently completed port extension (quay walls and terminal area).

![]()

Figure 4. Cash and cash equivalents in the end of period per port. Notes: all amounts in Euros. Source: compilation of data reported in the annual financial accounts.

Port of Heraklion also noted growth in 2020, with almost 20% more cash and cash equivalents compare to 2016. The only port that noted so noticeable downward trend was port of Igoumenitsa, because of wrong choices from the port Authorities, many checks that didn’t received and open accounts with investments and bankers.

4.6. Port of Alexandroupoli

Another port that last years has really high interest for many international investors is port of Alexadroupolis. The port of Alexandroupolis has great interest from Americans, because of the geostrategic position, economic importance and the value of it. The privatization of this port will proceed with the sale of a majority stake in the Alexandroupolis Port Authority. Today works only 25% of its capacity and consider the inappropriate investments this capacity and multiplied more than four times, we understand that only 5% is unitized. American interest in the port has been publicly expressed for both energy and military reasons. Also, has the prospects to become the main point for transport goods from East to West and the opposite (Pallis & Vaggelas, 2005). Based on the revenue forecasting models of the HRDH consultants, Alexandroupolis can bring annual revenues from 5 to 20 million euros per year in the long run depending on whether its prospective operation as an energy hub will be implemented.

Vicinity of TAP

It is recalled that it is adjacent to the Trans-Adriatic Natural Gas Pipeline (TAP) and the route of the Greece-Bulgaria (IGB) vertical connecting pipeline, while it is the focus of plans for imports of liquefied natural gas to the Balkans through the construction of a pre-built construction (LNG) from American and Greek business interests. In particular, Gastrade plans to put into operation a floating liquefied natural gas regeneration station off Alexandroupolis. However, other interests have been interested in this port. In the area, for example, some combined transport activities have already been developed by companies such as Kuehne + Nagel and Cosco Shipping-Agency.

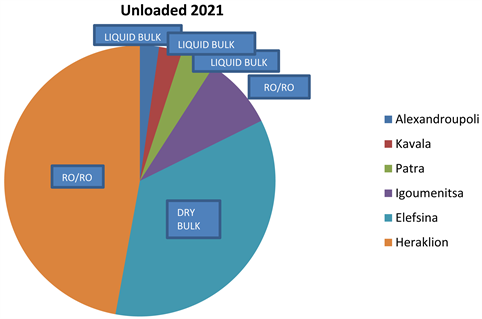

5. Loaded and Unloaded Tons (2021)

Coming in 2021, the following pies compare the unloaded and loaded quantities of goods in tons in every regional port that we have analyze for the first three months of the year. We see and compare the most frequent good of transportation per port. The categories of goods that unloaded are: liquid bulk, dry bulk, containers, Ro/Ro and other.

The first pie shows that port of Heraklion was the most popular destination for unloading among other regional ports with 453.948 tons and most of it was RO/RO vessels. Heraklion port follows Elefsina port with 339.203 tons of dry bulk. After that is Igoumenitsa with 82.622 tons in total and only 58,396 in RO/RO. Port of Patras and Kavala unloaded mostly liquid bulk. The smallest piece of the pie has port of Alexandroupolis with 21.906 tons and the main type or transportation was with liquid bulk (Hellenic Statistical Authority, 2021).

Source: compilation of data reported in ELSTAT.

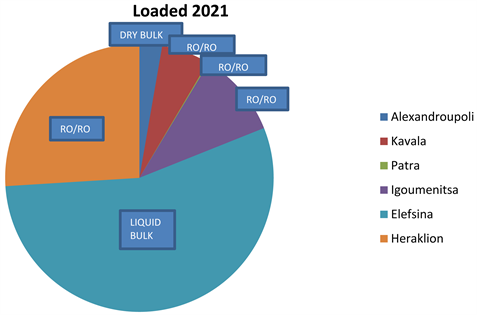

From the other hand, the second pie shows which ports loaded the most and what kind was the most frequent for transportation during the first three months of 2021.

Now, we can realize that happen the opposite from the loading in the first two ports. The first place takes port of Elefsina with 456.273 tons and 377.950 tons liquid bulk and second place takes port of Heraklion with almost half tons, meaning 215.341 tons and 210.821 tons in RO/RO. Third and fourth place take port of Igoumenitsa and port of Kavala with loading more RO/RO and dry bulk. Fewer loadings did port of Alexandroupolis, as a smaller port but most of them dry bulk with 19.030 tons out of 22.597 who did in total. Last place take port of Patras that did many unloading, but only few loadings. This happened to Patras port because is feeder port for Greece, especially to Kalamata, Athens and many of the refugees camps founds around. Also, it is connected with Italy and serves some RO/RO (Hellenic Statistical Authority, 2021).

Source: compilation of data reported in ELSTAT.

6. Conclusion

This paper explored the dynamics and outcomes of regional Greek ports via the lens of financial analysis and compares one to each other during the period of 12 years (2008-2020). We compared these ports with their process every 4 years for four different time periods and we used data from their annual financial reports.

The main points of analysis were mostly about returns and profits to new potential investors, the traffic in the ports, chances for growing, future investments in the ports and around them and of course connectivity with roads, trains, airports that make transportation easier and with higher volumes.

All these parameters are very important for any investor that is interested to be part of regional Greek ports, to invest in them and gain huge future profits under the necessary investments, because of all these reasons that we have already referred. We could say that these six ports are some of the best regional ports, very powerful, rich, with good infrastructures and now is the time for reclassifications and to see how after the ambitious investments the European shipping map will be configured.

https://www.enterprisegreece.gov.gr/en/invest-in-greece/sectors-for-growth/logistics

http://maritime-weekly.com/maritime-weekly/china-looking-invest-elefsina-port-greece/

https://www.patrasport.gr/?section=2286&language=en_US

https://www.investopedia.com/terms/a/assetclasses.asp

https://corporatefinanceinstitute.com/resources/knowledge/accounting/cash-equivalents/

https://www.worldstockmarket.net/what-the-americans-see-in-the-port-of-alexandroupolis/

https://www.portkavala.gr/about/financial/

https://www.ola-sa.gr/en-us/statistics/balancesheets.aspx

https://www.patrasport.gr/?section=2115&language=en_US

https://olig.gr/en/financial-data/

https://olig.gr/en/infrastructure-features/

https://elefsisport.gr/en/announcements/balance-sheets/

https://portheraklion.gr/index.php/en/organization/statistical-data

https://www.investopedia.com/terms/o/operating_profit.asp

https://smallbusiness.chron.com/improve-return-total-assets-56271.html

https://greekreporter.com/2021/03/10/greek-shipping-remains-number-one-in-the-world/

https://www.ugs.gr/en/greek-shipping-and-economy/greek-shipping-and-economy-2021/

https://www.statistics.gr/en/statistics/-/publication/SMA06/