Do Insect and Mold Damage Affect Maize Prices in Africa? Evidence from Malawi ()

1. Introduction

Smallholder post-harvest loss (PHL) for staple grains is a widespread and important problem throughout Sub-Saharan African (SSA). PHL occurs during grain harvesting, transporting, processing, and storage, and is primarily caused by insect pests and mold [1] . For example, the region’s most important staple grain, maize is under constant threat from the extremely destructive larger grain borer when it is placed in storage.

PHL creates two major challenges for smallholders. The first challenge is widely recognized; PHL causes quantity loss in the amount of grain that is available to meet household consumption and income needs later in the year. Entomology research suggests that insects like larger grain borer can damage up to 30% of stored maize over a 6-month period, unless smallholders have access to improved storage technologies [2] [3] . Economists also recognize the importance of quantity loss as an implicit part of storage costs in models of smallholders’ storage behavior [4] - [7] .

The second challenge is an economic problem that has received less attention in the literature. Depending upon how the market values grain quality, households may be forced to accept steep price discounts when they sell grain that has been damaged by mold or insects [8] - [10] . The magnitude of these discounts has major ramifications for household income, food security, and the safety of the grain that consumers in SSA eat.

Against this backdrop, our objective is to estimate discount schedules for damaged maize in SSA. We use a choice experiment (CE) incorporated into a survey of small- scale maize traders in rural Malawi. Malawi is an ideal case study to estimate maize discount schedules because i) as in many other African countries, maize is by far the most produced, traded and consumed grain, accounting for 53% of available calories [14] and ii) the vast majority of farmers harvest only one time during the year from April to July, so insect damage is a major issue as maize must be kept in storage for many months. In addition, having one growing season and poor infrastructure with high transport costs means that maize prices can increase by up to 100% between harvest and lean seasons [15] .

Several studies have documented significant price discounts from insect damage for common beans in Tanzania [16] and cowpeas in West Africa [17] [18] . However, there is very little literature that estimates discounts for damaged maize in Africa. Compton et al. [19] uses focus groups with traders in Ghana during the 1993/94 season to investigate price discounts for insect-damaged maize and is the only article to estimate a discount schedule for insect damage. Kadjo et al. [10] surveyed farmers in Benin and compares price discounts for insect damaged maize using stated preference and revealed preference methods. The authors find larger price discounts in the early post- harvest period when maize is plentiful, compared to later in the lean season when maize is scarce.

This article builds upon and extends the previous literature in two main ways. First, the CE used in this article is conducted in the marketplace with traders actively buying grain, making the occasion and setting, as well as choice, mimic reality as closely as possible. Second, to our knowledge, this article is the first to use choice experiments to evaluate WTP for insect and mold damage in SSA by maize traders. Using the Equality Constrained Latent Class method to correct for non-attendance to the price attribute, results of our study find that traders place a statistically and economically significant discount on insect-damaged maize. We estimate that a 1% increase in maize damage reduces the price of maize by 2.8% to 3.6%, depending on damage level.

The rest of the article is organized as follows. We present the choice experiment and the theoretical framework. We introduce the Equality Constrained Latent Class Approach that is used to estimate trader WTP estimates of discounts for insect and mold damage, data collection and results. Finally, we draw conclusions about the value of formal discount schedules.

2. Methodology

2.1. Choice of Methodology

In measuring trader WTP for grain quality, there are several possible approaches. One possible approach is to use experimental auctions with maize of different qualities. However, maize traders do not operate in auction-settings; maize traders are buying and selling in one-on-one individual transactions in the marketplace. Furthermore, the development of auctions was cost prohibitive to construct enough samples to auction for this study. A second possible approach is to use revealed preference data by purchasing maize in the market and evaluating the relationship between maize price and quality using hedonic methods. The advantage of this approach is that it is consequential. However, the major disadvantages are that the information about maize quality is limited to the observed maize quality in the market which may not include samples of highly damaged maize, and to collect enough data often takes several years. A third possible approach is choice experiment (CE) and given the market setting in which traders operate in Malawi, as well as the transactions themselves, the CE is the best fit for the research question, geography, and decision makers involved. The validity of CEs using SP data to estimate attribute valuations of agricultural products is well documented in previous literature [21] [22] .

2.2. Choice Experiment

The objective of our CE is to evaluate Malawian maize traders’ WTP for maize attributes. Lancaster [23] argues that utility is not necessarily derived from a good itself; rather, utility is gained from the individual attributes composing a good. In this context maize is viewed as a collection of variety and quality maize attributes which are heterogeneously valued by Malawian maize traders.

The CE used in this article is administered according to the following procedure. We create a realistic purchasing scenario, by conducting in the market on a market day when maize is frequently bought and sold. By approaching working maize traders in the market, we know they have experience visually evaluating and buying maize. Each trader is approached individually because when a trader purchases grain from a farmer, they negotiate one-on-one to agree on a price. We offer the traders physical samples of maize that had different levels of insect and mold damage. No payment is requested for the samples. The maize samples, each comprised of one kilogram (kg) of maize, are placed in clear, gallon-size (3.78 L) Ziploc® Slide-Lock bags. The price per kg of maize is clearly labeled on each bag, and the enumerator also verbally reports the price to assure understanding. The price level is designated as the final buying price after any negotiation1. CEs are generally administered through written descriptions of attribute variables which are presented in an internet survey [24] , mail [25] , or an on-site survey [26] . Written descriptions are advantageous when respondents are educated, literate and can independently assess attributes between alternatives. However, low education levels and illiteracy may prohibit unaided responses to written surveys. For our target population of maize traders in Malawi, we hired enumerators to conduct the CE in the local language.

One common weakness of choice experiments is that WTP estimates can be over- estimated due to the hypothetical nature of the experiment, as compared to purchasing situations in which budgetary constraints are recognized and taken into account explicitly. Investigating more specific non-hypothetical product attributes, such as maize insect damage levels, may require physical interaction with the actual product to accurately simulate a purchasing experience [27] . Compton et al. [19] follow this protocol in focus groups with maize traders and note they tend to physically examine maize samples before valuation, as one would in a real purchasing scenario. In our CE, traders are shown a series of two one-kg samples of maize with varying attribute levels for price, variety, insect damage, and mold damage. For example, a choice bag could contain a hybrid maize variety called DK8033, of which 5% of grains have (only) mold damage, 30% have (only) insect damage, and 65% are undamaged kernels. The other choice bag could contain a local variety maize, of which 0% of grains have mold damage, 10% have (only) insect damage, and 90% are undamaged kernels. They are encouraged to remove contents for further examination since they must visually discern the variety, insect damage and mold damage attributes of each sample. Many of the traders did remove the maize for closer inspection. They are asked to evaluate each set of samples as if they are negotiating with a farmer who has two maize samples to sell. Traders are then asked to indicate their preferred sample, or if they would “opt-out” from purchasing either of the two samples.

2.3. Choice Experiment Attributes and Levels

Quality attributes of insect damage, mold damage and maize variety are incorporated since they are highlighted in the literature as influential or potentially influential in price formation. Insect damage is the primary attribute of interest, and the most significant post-harvest problem for maize in Malawi. The larger grain borer is the most destructive of the storage insects common in Malawi, and it causes an average 5% - 10% dry weight loss over 6 - 8 months of storage [2] . This 5% - 10% dry weight loss translates to about 22% - 40% damaged grain [28] . Therefore, 30% and 20% insect damage levels were chosen as reasonable estimates of grain damage rates with no or very low insecticide use [29] [30] . Roughly 2% - 3% dry weight loss translates to 10% damaged grains [28] which is a reasonable estimate for damage with standard insecticides available to Malawian farmers [30] [31] . The near or complete absence of grain damage would be rare, though technically possible with high doses of insecticides or hermetic storage. Therefore, 0%, 10%, 20%, and 30% insect damage were chosen to represent a reasonable range of damage which could be presented to traders2.

Mold damage is tested at 5% grains with visible mold damage based on interviews with extension personnel. The Malawian maize harvest occurs in the dry season, allowing producers to effectively solar-dry maize to safe storage moistures which greatly reduce the potential for mold development. Extension officials indicate that mold is much less of a storage constraint than insects, and thus this low, yet visually-detectable level is chosen for evaluation in the CE.

Two varietal attribute levels were chosen for our CE, namely local and hybrid. While many regions of SSA have several named local varieties, “local” maize is not further differentiated in Malawi [32] . The hybrid maize selected is DK8033, a widely dispersed dent hybrid that would likely be known to all or most maize traders3. Compton et al. [19] did not find notable price differences among varieties in Ghana, however Smale et al. [32] , and Lunduka et al. [33] note considerable preference for local maize in Malawi.

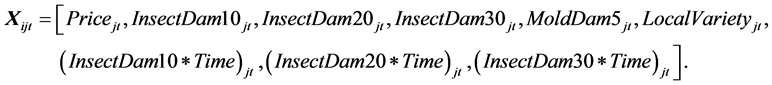

Willingness-to-pay Estimation Table 1 summarizes each maize attribute and their levels in the CE. In this context  is a 9 × 1 vector of maize attributes,

is a 9 × 1 vector of maize attributes,

Non-price maize attributes are effects-coded relative to the maize sample which has no insect damage, no visible mold damage, and is of the hybrid variety DK8033. Effects-coding is performed with insect damage levels (10%, 20%, and 30% damage are represented as InsectDam10, InsectDam20, InsectDam30, respectively), 5% mold damage (MoldDam5), and the variety variable (LocalVariety) to avoid confounding results between attribute levels and opting out options [21] . In addition the insect damage levels are interacted with the time in months that grain is stored (Time), resulting in three interaction terms. The β’s in the above-described models are utility parameters to be estimated. Interpretation of individual coefficients is discouraged in random utility models, however, the coefficients can be used to estimate mean WTP and confidence intervals. Willingness-to-pay (WTP) estimates provide information on the marginal rate of substitution between price and each of the physical maize attributes. WTP is given by:

(7)

(7)

![]()

Table 1. Maize variety and quality attributes evaluated.

where  is the willingness-to-pay for the mth attribute,

is the willingness-to-pay for the mth attribute,  is the estimated utility parameter for the mth attribute, and

is the estimated price coefficient. Since effects coding is used, the WTP calculation is multiplied by two [21] . The delta method is used in this analysis to estimate confidence intervals on WTP estimates; the delta method takes a first order Taylor series expansion around the mean value of the variables and calculates the variance for this expression [34] [35] 4.

is the estimated utility parameter for the mth attribute, and

is the estimated price coefficient. Since effects coding is used, the WTP calculation is multiplied by two [21] . The delta method is used in this analysis to estimate confidence intervals on WTP estimates; the delta method takes a first order Taylor series expansion around the mean value of the variables and calculates the variance for this expression [34] [35] 4.

A fractional factorial experimental design is constructed through the OPTEX procedure in SAS to identify an experimental design maximizing D-efficiency (78.99). The total of 30 choice sets to be presented were randomly blocked into three groups of ten to keep the choice task reasonable for respondents [36] [37] . Each block contains a total of 20 kg of maize and is transported in a rolling suitcase with segmented compartments.

3. Theoretical Framework

3.1. Random Utility Theory

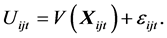

Random utility theory assumes that economic actors seek to maximize their expected utility subject to the alternatives, or choice set, they are presented. Based on Manski [38] , an individual’s utility is a random variable because the researcher has incomplete information. Choice experiments assume an individual (i) maximizes utility (U) attained from an alternative (j) at choice scenario [time] (t). Utility is composed of both a deterministic  and stochastic elements (

and stochastic elements ( ), represented here as:

), represented here as:

(8)

(8)

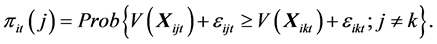

An individual facing a choice between two alternatives j and k is assumed to optimize his or her utility, represented by π, such that probability of choosing j is:

(9)

(9)

In this context,  is a vector of product attributes and

is a vector of product attributes and  is the random error term iid over all individuals, alternatives and choice situations [39] . The deterministic component of utility

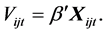

is the random error term iid over all individuals, alternatives and choice situations [39] . The deterministic component of utility  is assumed to be linear in parameters and the functional form for the deterministic component can be expressed as:

is assumed to be linear in parameters and the functional form for the deterministic component can be expressed as:

(10)

(10)

3.2. Latent Class Model

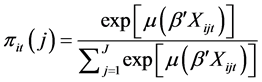

The LCM is an extension of the traditional multinomial logit model (MNL), which states that the probability of an individual choosing j takes the form:

(11)

(11)

where μ is a scale parameter inversely related to variance of the error term, assumed equivalent to 1 within any dataset. Building on MNL, the LCM incorporates S number of discrete ![]() values with utility expressed as

values with utility expressed as ![]() [41] . Equation (11) then becomes:

[41] . Equation (11) then becomes:

![]() (12)

(12)

where ![]() is vector of parameters for class s, and

is vector of parameters for class s, and ![]() is the probability that individual (i) is sorted into class s.

is the probability that individual (i) is sorted into class s.

3.3. Attribute Non-Attendance and Equality Constrained Latent Class Approach

In CEs, respondents are asked to choose from amongst provided alternatives, each alternative for which they are provided a bundle of attributes. An assumption of unlimited substitutability between the attributes used to describe the alternatives provided gives rise to the continuity axiom and implies that respondents make trade-offs between all attributes described to choose their most preferred alternative in the choice set [42] . Attribute non-attendance (ANA) occurs when respondents ignore specific attributes when choosing between alternatives [42] [43] . Of particular concern when calculating WTP is when respondents do not take into account the “price” attribute. When simply proceeding with a model which does not account for this effect, inflated WTP estimates may lead to improper policy recommendations.

The Equality Constrained Latent Class (ECLC) uses a latent class approach to algorithmically group individuals according to their patterns of attribute attendance [42] . Scarpa et al. [42] measure total attendance, total non-attendance, all single attribute non-attendance, and dual attribute non-attendance of price with non-price attributes. We approach the ECLC by creating three latent classes―total attendance, total non- attendance, and partial non-attendance of the price attribute. Total non-attendance must be accounted for to remove any individuals who chose haphazardly and may bias estimation of coefficients. Partial non-attendance must be treated in context with the experiment design. In this article, non-price attributes are not disclosed in written form to traders, therefore discernment of maize attributes is performed individually. As such, non-attendance to certain non-price attributes is plausible and acceptable; attributes such as maize variety may in fact carry no importance to the respondent5.

3.4. Data Collection

Maize traders were surveyed in January and February 2012 in five districts, drawn from all three regions of Malawi; Thyolo and Zomba in the Southern Region, Lilongwe and Nkhotakota in the Central Region, and Mzimba in the Northern Region. We selected districts to maximize geographic diversity of sampling with reasonable approximations for key maize production areas, marketing, and post-harvest management statistics, as determined from nationally representative data from the Ministry of Agriculture and Food Security (2009) Agricultural Input Subsidy Survey [44] [45] . According to the 2008 national census, the Central and Southern Regions contain 87% of the national population, motivating the larger proportion of districts from these regions in the sample [44] . Roughly two-thirds of traders approached agreed to participate in the survey. In total, valid surveys were collected from 252 maize traders across these markets.

Many traders in Malawi travel to villages to purchase maize on farm, or they allow farmers to assume transportation costs and approach them in markets to buy their grain [46] . Maize markets generally function as daily or weekly trading centers, attracting traders of diverse sizes [46] . In our survey, a minimum of 50 traders per district were sampled in maize markets on official market days. This gives us the benefit of conducting the valuation in a setting where actual purchases occur, a factor determined influential in helping respondents make realistic choices [47] . At least three markets were sampled in each district, including at least one major and one minor market. As the focus of this study was in markets, we have potentially excluded rural assemblers who are not present on market days. One should note that these assemblers and other traders not operating within markets may have different characteristics than those traders within markets (such as being disproportionately male). Therefore these results should be interpreted as applying to maize traders who buy and sell within maize markets.

Random sampling of all district markets was not possible due to daily trader movement and severe national fuel shortages that prevented sampling of remote markets. Two Malawian university graduates were hired and trained as survey enumerators to conduct this experiment in Chichewa, the dominant local language. While the surveying procedures described were employed to obtain a random sampling which was representative of Malawi market traders, it is acknowledged that numerous demographic and trader-specific factors (i.e. experience level, past experience with enumerators, personality) may influence willingness to participate in the survey and experiment. Thus, while careful sampling procedures were employed, the authors acknowledge the ever-present risk of sample selection bias.

4. Results

Detailed descriptive statistics for traders surveyed are presented in Table 2. The overall sample is balanced in gender and age. Females have an average 2.9 more years of experience trading maize, but operate in fewer districts and markets. Male traders sell about four times the quantity of maize as females and are more than twice as likely to use a truck when sourcing grain. In the previous marketing season (2010/11), traders sourced about 80% of their stocks in the “Harvest months” between April and July, about 12.3% between August and November, and only 6.7% of stocks in the “Lean Season” months from December to March. In the 2011/12 marketing season, traders report more balanced purchasing throughout the marketing season. These differences in the timing of trader purchases may reflect price patterns and farmer willingness-to-sell at market prices, as prices declined throughout the 2010/11 marketing season but rose dramatically throughout the 2011/12 season. The average trader stores maize sourced during the harvest season for 2.5 months, compared to 1.3 months for maize sourced during the mid-season and 0.5 months for maize sourced during the lean season. On average, men store almost one month longer than women. Male and female traders report significantly different marketing margins of 22.1% and 35.2%, respectively. Marketing margins may be related to the scale of trade, as most women sell much smaller quantities per transaction.

We use the ECLC methodology to control for price non-attendance. In this CE, the non-price attributes of insect damage, mold damage and variety are not disclosed in

![]()

Table 2. Trader descriptive statistics.

written form. Thus discernment of maize attributes is performed individually making ANA to non-price attributes plausible and acceptable. We follow the ECLC method by only treating the price attribute which is explicitly revealed. We find total non-atten- dance represents 3.8% of the sample and price non-attendance represents 61.8% of the sample6. Rates of ANA to price attributes vary significantly in the literature. Scarpa et al. [42] find that 92% of their sample does not attend to the price attribute. For comparison, Widmar and Ortega [49] investigate various criteria for ANA using coefficients of variation and find rates as low as 8% ANA to price when using a cutoff of three and as high as 35% when using a cutoff of one.

Table 3 presents the results for the ECLC model that corrects for price non-atten- dance. Traditionally, WTP estimates are given in currency units. The structure of the

![]()

Table 3. Malawian trader willingness to pay for maize quality results with the Equality Constrained Latent Class Model (ECLC).

Note: 95% confidence intervals are in brackets and derived by the Delta method [35] . Note: *, ** and *** indicate significance at the 10%, 5%, and 1% level, respectively.

We find all significant WTP estimates for grain damage discounts are negative and ordinal, demonstrating that traders can distinguish physical attributes and there is a distinct price difference between grain damage levels7. Insect damage causes disutility, and the disutility increases with the intensity of insect damage8. Estimates from the ECLC model indicate that traders discount maize with 10% insect damage by 36% which translates to a discount schedule of approximately 3.6% price discount per 1% insect damaged grain (IDG) when the trader is not storing the grain. When insect damage is 20% or 30%, the discount per 1% IDG is lower at 3.3% and 2.8% respectively, again assuming traders are not storing the grain that they are purchasing. Mold damage at 5% of grain causes more disutility than insect damage at 10% of grain.

One important factor which traders must consider when purchasing maize is the expected storage period before re-sale. Traders are asked to report their average storage time between purchase and resale. Among surveyed traders, 56% store grain for a week or less before resale in the lean season while another 15% store grain for a month or more. All interaction variables between insect damage and trader storage time before resale are negative and significant. A trader who plans to store 10% IDG maize for one month before resale will discount the grain 13% more than another trader who plans to sell immediately. The additional damage discount for grain to be stored is expected because damaged grain does not store as well as undamaged grain.

For completeness, standard LCM results are presented in Appendix, including coefficients and WTP estimates. The premiums and discounts for the maize attributes estimated by the LCM, which are qualitatively consistent with the ECLC estimates, are also much larger than discounts generally observed in the market. The larger than expected discounts are hypothesized to stem from non-attendance of the price attribute, thus motivating the preference for the ECLC model9.

5. Conclusions

This article contributes to the literature by estimating the price discounts for insect damage in African rural maize markets. Malawi is selected as the case study for the East and Southern African region because of the single growing season, large seasonal variation in prices and presence of larger grain borer, as destructive insect that can potentially decimate maize in storage. WTP estimates for maize characteristics from 252 maize traders are elicited through a choice experiment (CE) using physical samples of maize. Several challenges exist with the use of CE in developing countries, including presentation of products and the navigating the complexity implementing experiments in the field. Increased attention has been placed recently on the application of choice modeling for low income respondents and in developing country contexts, including research protocols and experimental design and implementation [51] .

The key results from the maize CE are as follows. First, we find traders discount maize with insect and mold damage and these discounts are statistically significant and economically important. Some countries in East Africa have published official discount schedules for parameters including IDG. However, there is little evidence to suggest that these discount schedules are used in rural markets across the region where most transactions are negotiated bilaterally in high frequency and low volumes. This article helps to better document the marketing reality of the smallholder farmer where the traders discount damaged grain but these discounts are not transparent to the farmer. In this regard, establishing clear standards for grain quality is considered an important step to improve grain markets in sub-Saharan Africa [12] .

Third, this article also uses the ECLC method to treat significant non-attendance of the price attribute. The resulting ECLC WTP estimates are more consistent with observed market premiums and discounts and suggest that the WTP discounts and premiums in the LCM model that are not corrected for price non-attendance are greatly overestimated.

NOTES

1Negotiation is typical between maize traders and farmers, and thus it is important to specify that the labeled prices are post negotiation. Compton et al. [19] similarly designate post-negotiation prices with Ghanaian traders.

2Rounding at standard increments of 10% also helped ensure accuracy of the volumetric sample construction. This was crucial since we are using physical grain samples for the choice experiment.

4There are various methods available, and commonly used, to estimate confidence intervals for WTP estimates including the delta, Fieller, Krinsky-Robb, and bootstrap methods. Hole [35] found these methods to be reasonably accurate and yield similar results to one another.

5ANA was also investigated by a coefficient of variation approach popularized by Hess and Hensher [48] . Results confirm the presence of ANA in the price attribute and variety attribute (though varietal indifference is plausible and allowable in this context). ANA is not of concern in the mold or insect damage attributes. These results help confirm the structure of the ECLC classes selected here. Results available from the authors upon request.

6Various potential relationships can be explored with regard to identification of relationships between trader demographics or characteristics and ANA. Relationships are investigated by correlating individual-specific coefficient estimates and key characteristics collected in the survey. Relationships to non-attendance robust to model specification identified are increased full ANA among low-educated traders and decreased full ANA among first-year traders. First year traders may be particularly inclined to focus on price compared to more experienced traders, contributing to lower ANA. Low-educated traders may have decreased consistency within their choices, driving full ANA; this finding matches results of Jones et al. [50] in which low-educated US consumers had significantly higher preference transitivity violations in a CE. Further, female maize traders had slightly increased combined full and price ANA.

7Traders who can sell damaged grain as livestock feed may place higher valuation on damaged grain than other traders who lack access to these markets. However, we do not believe that this sort of selection bias is a major issue in our context for three reasons. First, the livestock sector in most animals that are grown for home consumption in Malawi are free range and fed on grass. Second, Jayne et al. [46] estimate that after an average harvest in Malawi only 30,000 out of nearly 426,000 metric tons (7%) of marketed maize is purchased by the livestock and beer brewing industries combined. Third, Jayne et al. [46] also indicate that most industrial animal feeders and processors purchase maize from estate farms and large-scale traders. Estate farms and large-scale traders generally do not participate in the rural markets we surveyed, although large-scale traders may buy from small-scale traders in these rural markets.

8A broader graphical demonstration of trader ability to differentiate between damage levels based on marginal utility kernel densities [48] also confirms these results. Available from the author upon request.

9The relative magnitude of the price coefficient increases dramatically in the ECLC model relative to the LCM model, decreasing WTP discount estimates by more than two-thirds. While only Class 2 had a significant price coefficient in the four-class LCM model, significant WTP estimates are possible for Class 1, 2, and 3. WTP estimates are not interpreted for Class 4, for which all coefficients are insignificant. The LCM, however, estimates classes 1 and 2 severely discount 10% IDG at over 50%, and class 2 discounts 20% IDG at 70%. The marginal discount for each 1% IDG is in excess of 5%, about 7-fold higher than the 0.75% price reduction for each 1% of IDG reported by Compton et al. [19] . The larger than expected discounts are hypothesized to stem from non-attendance of the price attribute.

Appendix: Malawian Trader Latent Class Model Coefficients and WTP for Maize Quality Attributes.

Note: Log-likelihood −1808.31; Pseudo-R2 0.347. Note: Standard errors are presented in parenthesis below parameter estimates. Note: *, ** and *** indicate significance at the 10%, 5%, and 1% level, respectively.

![]()

Submit or recommend next manuscript to SCIRP and we will provide best service for you:

Accepting pre-submission inquiries through Email, Facebook, LinkedIn, Twitter, etc.

A wide selection of journals (inclusive of 9 subjects, more than 200 journals)

Providing 24-hour high-quality service

User-friendly online submission system

Fair and swift peer-review system

Efficient typesetting and proofreading procedure

Display of the result of downloads and visits, as well as the number of cited articles

Maximum dissemination of your research work

Submit your manuscript at: http://papersubmission.scirp.org/

Or contact me@scirp.org