Regulatory Economic Appraisal Is the Core for Business Sustainability ()

1. Introduction

An economic analysis is a process in which business owners gain a clear picture of the existing economic climate as it relates to their company’s ability to thrive (Quain, 2018)1. This analysis is generally done for many types of organizations and can be carried out by mathematicians, statisticians or economists. This economic analysis is particularly important for small and emerging companies for their economic sustainability. There are, of course several kinds of economic appraisal approaches managers can use to gain insight into the future of their companies. These are for instance, Cost effects analysis and Costs Minimization Analysis (Quain, 2018)1.

Cost effects analysis is a testing ground for consequentialism and for the counterfactual analysis that requires a collection of decision-aiding techniques that have in common the numerical weighing of advantages against disadvantages (Hansson, 2007). While analyzing the cost effectiveness, a number of factors can be taken into consideration. These effects can be caused by natural disasters, diseases or death as well as environmental degradation.

Cost minimization is very important at the macroeconomic level. Managers take into account many factors to make management decisions. For example, increasing or decreasing wages will depend on many factors. But most managers can decide to reduce the number of employers to increase salaries because low salaries can sometimes mean unemployment when employers have a low level of motivation as they may feel to be unemployed. Besides, increasing the minimum wage (https://www.wsj.com/articles/BL-WB-48594) has a general impact on the general business environment particularly in liberal market economies. Raising the federal minimum wage “would help around 28 million Americans from all walks of life pay the bills, provide for their kids, and spend that money at local businesses,” he said. “And that grows the economy for everyone” (Wall Street Journal, 2014)2.

In doing this research, we want to answer the following questions: what is business regulation for managers while doing economic analysis? How many types of economic appraisals can managers do? What is sustainability? How does economic evaluation affect business sustainability?

This work is made of five important parts, an introduction, three chapters and a conclusion that comes after the chapters.

2. Chapter One: What Is Business Regulation for Managers?

Regulations govern business in the modern economy particularly after the World Financial Crisis that shook the whole world in 2008. Since that time, global firms and markets have been regulated. In response to global social activism, many firms have adopted voluntary regulatory standards to avoid additional regulation and/or to protect their reputations and brands. Activists have targeted highly visible firms and have been willing to work cooperatively with them. The most important civil regulations are multi-stockholder codes, whose governance is shared by firms and nongovernmental organizations (NGOs), and which rely on product and producer certifications. Such codes face the challenge of acquiring legitimacy and of persuading both firms and NGOs of the value of their standards. The emergence of civil regulation addresses but does not resolve the challenge of making global firms and markets more effectively and democratically governed (Vogel, 2008)3.

3. Doing Business Worldwide Overview

While analyzing the state of business in the world, Doing Business 2017 shares more information about the state of business in different regions of the world.

Doing Business dans les Etats membres de l’OHADA 2017 is the second report in the Doing Business series covering OHADA (Organization for the Harmonization of Business Law in Africa) Member States—Benin, Burkina Faso, Cameroon, the Central African Republic, Comoros, the Democratic Republic of Congo, the Republic of Congo, Côte d’Ivoire, Equatorial Guinea, Gabon, Guinea, Mali, Niger, Senegal, and Togo. This second edition tracks regulatory reforms since 2011 in five Doing Business indicator areas covered by the OHADA Uniform Acts and regulations—starting a business, getting credit, protecting minority investors, enforcing contracts and resolving insolvency. (https://www.doingbusiness.org/en/reports/regional-reports/ohada).

Main Findings

● Throughout OHADA economies, entrepreneurs face different regulatory burdens depending on where they establish and run their business, but some economies are top performers on multiple indicators. For example, starting a business, enforcing contracts and resolving insolvency is easier in Côte d’Ivoire than in any other OHADA economy.

● The rankings on each indicator show that although some economies lead the pack in certain areas, no economy is the best or worst performer in all areas. This means all Member States have good practices to share.

● The difference in the performance of OHADA economies is widest on three indicators—starting a business, resolving insolvency and enforcing contracts.

● Since 2011 two OHADA Uniform Acts have been revised: l’Acte uniforme relatif au droit des sociétés commerciales et du groupement d’intérêt économique and l’Acte uniforme portant organisation des procédures collectives d’apurement du passif.

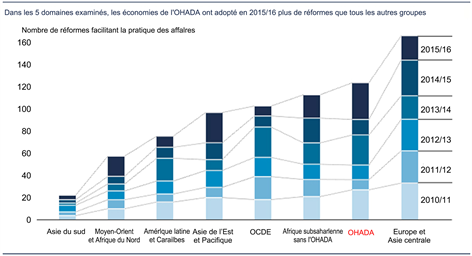

● There is still significant room for OHADA economies to converge among themselves and with the average for the rest of Sub-Saharan Africa. The good news is that Member States have maintained a strong pace of reforms since 2011. Over five years, they implemented 95 reforms across the areas measured and were the most reform-minded group of economies in 2015/16.

The Doing Business in OHADA 2017 report was produced by the Global Indicators Group (Development Economics) and funded by the OHADA Business Law Reform Program of the World Bank Group. The program includes support to the OHADA Member States and the OHADA Permanent Secretariat in reforming and implementing the common set of laws.

Source: Doing Business database.

Note: OCDE is the average for high-income OECD economies; OHADA is the average for the 17 OHADA economies; Afrique subsaharienne sans l’OHADA is the average for the 31 other economies of Sub-Saharan Africa.

This chapter has proven that regulation is an integral part of economic analysis. It is a universal economic practice that is essential for effective business management. Business managers must therefore regularly use it.

4. Chapter Two: Types of Economic Analysis for Managers

According to Market Business News (https://marketbusinessnews.com/financial-glossary/economic-analysis/), economic analysis involves assessing or examining topics or issues from an economist’s perspective. Economic analysis is the study of economic systems. It may also be a study of a production process or an industry. The analysis aims to determine how effectively the economy or something within it is operating. For example, an economic analysis of a company focuses mainly on how much profit it is making. (https://smallbusiness.chron.com/types-economic-analysis-3904.html).

4.1. Cost-Effect Analysis

One of the most effective types of economic evaluation is the cost-benefit analysis, also referred to as benefit-cost analysis. (Economic Appraisal Tool for Cohesion Policy 2014-2020, December 2014) This is a technique used to determine whether a project or activity is feasible by weighing the monetary cost of doing the project or activity versus the benefits. A cost-benefit analysis will always compare the cost of the effort against the benefits that result from that effort. Because it deals solely in monetary terms, a cost-benefit analysis is one of the most bottom-line types of economic evaluation. It can provide valuable insight into comparing and contrasting work projects, help determine whether an investment opportunity is ideal, and help assess the consequences of implementing changes to your business. However, there is a drawback to this analysis as it is difficult to place a monetary value on some activities such as the benefits of increased public safety versus the cost of increasing law enforcement presence in major cities. After performing the cost-benefit analysis, a small business owner can make an educated business decision.

4.2. Cost-Effective Analysis

In a cost-effective analysis, you weigh the effectiveness of a project against its price. Unlike with cost-benefit analysis, however, a low cost doesn’t mean high effectiveness, and the reverse is also true. For example, let’s say you’ve determined that installing an automated system that can handle customer orders 24 hours a day, seven days a week, is the cheapest way to boost your incoming orders. After research, however, you determine that many calls that come into the automated system are not complete because callers hang up when they hear the automated voice on the system. Your market research also indicates that your customers want to speak to a live representative. A cost-effective analysis would tell you that the cheaper route of installing an automated system is not effective in processing more orders. Depending on the type of business you own, you may find that saving money doesn’t result in creating a desirable effect on your business.

Thus managers must know the different types of economic analysis to be able to monitor closely the profitability of the business they are running. This will make the business increase its economic value accordingly.

4.3. Cost-Minimization Analysis

As the term suggests, the cost-minimization analysis focuses on finding the cheapest cost to complete a project. This is one of the economic evaluation methods that business owners use when cost savings are at a premium and outweigh all other considerations. It is also used when there are two or more ways to accomplish the same task. Cost-minimization analysis is most often used in healthcare. For example, drug manufacturers may compare two drugs that have been shown to produce the same effect in patients, or a pharmaceutical company may implement a cost-minimization analysis to determine which of two medications that treat the same illness will cost the least amount of money to produce. In many instances, the generic equivalent of a name-brand drug is the least expensive drug to manufacture, especially if it produces the same therapeutic effect in patients.

5. Chapter Three: Economic Analysis Impact on Business Sustainability

Generally used in sustainable development, sustainability can also be related to business. Business sustainability can be defined as the ability of firms to respond to their short-term financial needs without compromising their (or others’) ability to meet their future needs. Thus, time is central to the notion of sustainability (Bansal & Desjardine, 2014).

To achieve business sustainability economic appraisal plays a key role. Economic appraisal is done by analyzing different benefits for businesses, researchers, young professionals and students as well as the general public.

Economic analysis is performed with the help of various tools, which are shown in Figure 1.

The different tools of economic analysis (as shown in Figure 1) are discussed in detail below.

![]()

Figure 1. Tools of economic analysis. (https://www.economicsdiscussion.net/economics-2/4-tools-of-economic-analysis-with-diagram/4197).

1) Economic Variables:

Involve those variables whose values are dependent on the values of other variables. Moreover, the values of these variables are affected by a change in the value of other interrelated variables.

For example, the demand for a product is dependent on its price. This implies that demand for a product falls with an increase in its prices and vice versa. Therefore, the demand for a product is a dependent variable.

2) Independent Variables:

Refer to variables that are independent and are not affected by a change in any other variable. In the preceding example of the demand for a product and its price, the demand for the product is a dependent variable, while the price of the product is an independent variable.

3) Endogenous Variables:

Refer to variables whose value can be obtained within the model under consideration. For example, the price of a product in the supply and demand model is endogenous. This is because the price of the product is set in response to consumer demand.

4) Exogenous Variables:

Refer to variables whose value is obtained outside the model under consideration. For example, in the case of an increase in domestic petrol price due to an increase in international petrol price, the international petrol price is the exogenous variable.

The slope is one of the most important tools used for economic analysis. It helps in determining the changes produced in one variable with a change in another variable. Therefore, the slope can be defined as the change that occurs in the dependent variable due to the change in the independent variable. The relationship between a dependent and independent variable can be represented as a straight line on a graph.

The shape of the line determines the type of relationship between the two variables. This line is termed the slope of the line. If the slope is steeper, then the relationship between the two variables is weak and vice-versa. Suppose a unit change in the independent variable x brings changes in the dependent variable y.

In such a case, the slope would be:

Slope = change in y/change in x

If the slope of a line is positive, the line moves upward when going from left to right. On the other hand, if the slope is negative, then the line moves down when going from left to right.

Let us understand the concept of the slope with the help of an example. In the demand curve, the slope represents the ratio of the change in the independent variable price (P) to the change in the dependent variable which is demand (D). If the price of a product decreases (-AP), then the demand for that product would increase (AD).

This chapter therefore proves that regular economic analysis is very vital for business sustainability. The tools of economic analysis as well as relevant variables support the idea that economic appraisal promotes organizational financial resilience.

6. Conclusion

This study has displayed that economic analysis, which is also economic appraisal or evaluation is key for effective business management. It has equally shown different types of economic appraisal for organizations leaders to achieve their goals and visions. Many economic evaluations are therefore very essential for business sustainability, proof of a good business environment and development. Despite limited resources, this work has been able to cover different areas involved in economic analysis. More types of economic analysis should be worked on to understand further the best strategic tools for economic analysis for managers.

NOTES

1Sampson Quain (2018) defined economic analysis in his article updated on 29 October 2018 whose reference is cited below. It is also in this article where he spoke about Cost-Effective Analysis and Cost-Minimization Analysis.

2Wall Street Journal https://www.wsj.com/news/archive/2014/may

3David Vogel (2008) in his article about Private Global Business Regulation spoke about regulation and governance. https://www.annualreviews.org/doi/abs/10.1146/annurev.polisci.11.053106.141706