Impact of Foreign Direct Investment on International Trade in West African Economic and Monetary Union Countries Using Dynamic Panel ()

1. Introduction

The interdependence of relations between nations in the world is becoming more and more important with economic and financial globalization. International trade and FDI are interrelated and are the two variables that have played a driving and catalytic role in this process with the emergence of multinational firms. International trade can be defined as the exchange of goods and services across international borders (Rugman, Collinson, & Hodgets, 2006), and FDI refers to ‘the flow of funding provided by an investor or a lender (usually a firm) to establish or acquire a foreign company or to expand or finance an existing foreign company that the investor owns and controls (Pugel, 2009). The first international trade theories refer to classical economists (Ricardo, 1817; Smith, 1776) who introduced the theories of absolute and comparative advantage. Absolute advantage describes a scenario in which an entity can manufacture a product at a higher quality and a faster rate for a greater profit than another competing business or country can accomplish. Comparative advantage differs in that it takes into consideration the opportunity costs involved when choosing to manufacture multiple types of goods with limited resources. The traditional theories of location of FDI group together theories relating to FDI, those which come under macroeconomic approaches which consider that FDI is a movement of capital motivated by international differences in the profitability of capital, and those which relate to the theory of the firm based on market imperfections. Raymond Vernon (1966) explained that FDI takes place due to the threat a firm faces in a market that it usually exports to and also due to the need to access cheaper factors in those countries where it faces competition. The foreign trade of WAEMU countries would result in an overall surplus balance of CFA franc (The CFA franc, officially franc of the African Financial Community) 19.6 billion in 2020, after a surplus of CFA 1635.1 billion a year earlier. This development would be linked to the decline in net capital inflows in the financial account, coupled with a worsening of the current account deficit, the effects of which would be mitigated by an improvement in the capital account surplus. The current account deficit would increase by 29.7% to stand at CFA 5001.9 billion, due to a sharp deterioration in the balance of goods and services (−1280.9 billion CFA) mainly due to a decline in exports (−4.5%) greater than that of imports (−3.7%).

The analysis (Figure 1) of the diversification index by country of the Union indicates a deterioration in the situation of Guinea-Bissau, whose exports are

![]() Source: Central bank of west african states, 2020.

Source: Central bank of west african states, 2020.

Figure 1. Export diversification index in WAEMU countries.

increasingly concentrated on cashew nuts. The situation in Burkina also deteriorates from one period to another in connection with gold, which occupies a preponderant place in sales outside this country. For the other countries of the union, their situation remained almost stable over the period 2016-2019, compared to 2012-2015. From a structural point of view, Senegal and Togo remain the most diversified countries in the Union. Guinea-Bissau also remains the least diversified country in the union.

Net flows (Figure 2) of foreign direct investment to WAEMU countries have grown steadily since the early 2000s, particularly in the republic of NIGER (id = 6) and TOGO (id = 8). Indeed, these flows increased at an average annual rate of 18.8% over the period 2006-2011, against 3.5% between 2000 and 2005. Relative to GDP, these flows increased from 1.9% in 2000 to 2.9% in 2011, after reaching 3.4% and 3.2% respectively in 2009 and 2010.

From 2000 to 2015, Figure 3 shows that the republic of NIGER has the highest average FDI inflow (5.94321) followed by TOGO (3.72497) and MALI (2.72267) because of their enormous factorial endowments in natural resources which are essential elements in the attraction of FDI.

The paper is divided into five parts as follows: the first part describes the general background through the introduction, the second part describes the brief theoretical and empirical review, the third part describes the method of the different regressions, the fourth part comes out the regression results and finally the fifth part resumes the conclusion.

2. Brief Theoretical and Empirical Review

The literature gap we highlighted is that most of the study on the relationship between trade and foreign direct investment in poor countries do not include a

![]() Source: Author, 2021.

Source: Author, 2021.

Figure 2. FDI evolution in WAEMU countries from 2000 to 2020.

![]() Source: Author, 2021.

Source: Author, 2021.

Figure 3. Average FDI inflows in WAEMU countries from 2000 to 2015

proxy variable describing these latter as net buyers in international trade hence, this study is different from others in the sense that we have defined a variable describing the net imports to fill the research gap.

A lot of studies have been conducted on the relationship between trade and FDI in the world. Numerous studies like (Culem, 1988; Ozawa, 1992; Ruggiero, 1996; Ethier & Horn, 1990; Porter, 1990; Wei et al., 1999) concluded that that international trade and investment are linked. Some of the studies like (Brainard, 1997; Brouthers et al., 1996; Goldberg & Klein, 1997) confirmed the relationship between trade transaction and international investment. FDI plays a key role in inter-firm and intra-firm trade (Muchielli et al., 2000). Common markets within regional economic integration promote complementarity between international trade and FDI (Castilho & Zignago, 2000). FDI stimulates international trade transactions while promoting gains from trade between countries (Kiyoshi, 1973; Hakura & Jaumotte, 1999). Culem (1988), Aizenman & Noy (2005) found a bidirectional linkage between FDI and trade. Cheap taxes, cheap interest rate, cheap labour, low-cost production, low-cost factors, attract FDI in a country and make it able to improve its export and trade balance. Hence, FDI could strengthen the trade potential of host countries (Cabral, 1995; Blake & Pain, 1994). Both international trade and FDI are said to increasingly develop economic globalization (Ruggiero, 1996). FDI is conducive to the development of local enterprises and favor industrial development which in turn increase the export efforts of nations (Haddad & Harrison, 1993). Chang and Gayle (2009) found substitute link between international and FDI in the United States. This result was confirmed by other studies (Bhasin & Paul, 2016 in Southeast Asia; Daniels & von der Ruhr, 2014 in the United States). Some studies found that the link between international trade and FDI depends on the economic context of a country. In many regions, the link can be complementary while in others it is substitute or even a causality effect. Swenson (2004) found a complementary link between trade and FDI in the United States. Other studies confirmed that there is causality effect between FDI inflow and trade (Egger et al., 2001; Jayachandran & Seilan, 2010; Zhang & Felmingham, 2001). A wide range of empirical researches found evidence link between trade and foreign direct investment. Zhang and Song (2000) found that FDI significantly affects international trade positively in Chana. FDI significantly influenced international trade in some Organization for Economic Cooperation and Development (OECD) countries (Pain & Wakelin, 1998). Clausing (2000) found that FDI impacts significantly and positively trade in the United States. Zhang and Li (2007) investigated the link between trade and FDI in China and found that they are positively correlated. Magalhaes and Africano (2007) showed that there is positive relationship between inward FDI and trade in Portugal. Lipsey and Weiss (1984) studied the relation between FDI and trade in the United States at firm level and found that a firm’s outward FDI is likely to develop exports both of intermediate goods and final goods. Alguacil and Orts (2002) showed that there is a long-term Granger causality from FDI to exports in Spain. Min (2003) studied the impact of FDI inflow on the trade flows in Malaysia and the results revealed that the impact of FDI on the host country’s export performance is statistically significant and positive. Alguacil, Cuadros and Orts (2002) have checked the relationship between foreign direct investment, exports and economic performance in Mexico and they concluded that there is a positive causal relationship between FDI and exports.

3. Methodology

3.1. Data

The study utilized panel data of 8 countries of WAEMU from 2000 to 2015 obtained from World Development Indicators. The term “panel data” refers to the pooling of observations on a cross-section of households, countries, firms, over several time periods. We have simulated a lot of regressions for the choice of the appropriate time interval and finally it is the one that lasts from 2000 to 2015 that meets our expectations the most.

3.2. Panel Data Model Framework

The fundamental advantage of a panel data set over a cross section is that it will allow the researcher great flexibility in modeling differences in behavior across individuals. The basic framework for this method is a regression model of the form:

(1)

(2)

There are K regressors in

, not including a constant term. The heterogeneity, or individual effect is

where

contains a constant term and a set of individual or group specific variables, which may be observed, such as race, sex, location, and so on, or unobserved, such as family specific characteristics, individual heterogeneity in skill or preferences, and so on, all of which are taken to be constant over time t. As it stands, this model is a classical regression model. If

is observed for all individuals, then the entire model can be treated as an ordinary linear model and fit by least squares. The complications arise when

is unobserved, which will be the case in most applications. We will examine a variety of different models for panel data. Broadly, they can be arranged as follows:

3.2.1. Model 1: Pooled Estimation Model

If

contains only a constant term, then ordinary least squares estimator provides consistent and efficient estimates of the common

and the slope vector

:

(3)

3.2.2. Model 2: Fixed Effects Model

If

is unobserved, but correlated with

, then the least squares estimator of

is biased and inconsistent as a consequence of an omitted variable.

However, in this instance, the model

, (4)

where

, embodies all the observable effects and specifies an estimable conditional mean. These fixed effects approach takes

to be a group-specific constant term in the regression model. It should be noted that the term “fixed” as used here signifies the correlation of

and

, not that

is non stochastic.

3.2.3. Model 3: Random Effects Model

If the unobserved individual heterogeneity, however formulated, can be assumed to be uncorrelated with the included variables, then the model may be formulated as

, (5)

that is, as a linear regression model with a compound disturbance that may be consistently, albeit inefficiently, estimated by least squares. These random effects approach specifies that

is a group-specific random element, similar to

except that for each group, there is but a single draw that enters the regression identically in each period.

Before applying the GMM, we successively estimated three models can be used for estimation for panel data: PEM (Pooled Estimation Model), FEM (Fixed Effects Model) and REM (Random Effects Model).

The main panel data model tests are based on the following:

· FEM versus PEM

F test will be used to choose between FEM and PEM, i.e., to test if there are fixed effects in data.

· REM versus PEM

Breusch and Pagan Lagrangian Multiplier Test will be used to test for random effects.

· REM versus FEM

Hausman test will be used to choose between FEM and REM.

3.3. Model 4: Feasible Generalized Least-Squares Model (FGLS)

The persistence of heteroscedasticity in our regression leads us to also explore the generalized least squares (GLS) method. Heteroscedasticity, cross-sectional and serial correlations are important issues in the error terms of panel regression models. There are two approaches to dealing with these issues. The first approach is to use the ordinary least squares (OLS) estimator but with a robust standard deviation that is resistant to heteroscedasticity and correlations.

The second approach is to use the Generalized Least Squares (GLS) estimator which directly accounts for heteroscedasticity and cross-sectional and serial correlations in the estimation. It is well known that the GLS estimator is more efficient than the OLS estimator.

The linear model is of the form:

(1)

The model can be stacked and represented in full matrix notation as:

(2)

Or

, is the vector NT × 1 of

with each

as an N × 1 vector;

, is the matrix NT x d of

with each

as being a vector N x d;

, is the vector NT × 1 of

with each

as an N × 1 vector.

If we consider that each element of

is uncorrelated to any of the elements of

with:

, then suppose that

is positive definite and

is invertible, then the FGLS estimator is:

(3)

3.4. Model 5: The Generalized Method of Moments (GMM) Model in Dynamic Panels

A dynamic model is a model in which one or more lags of the dependent variable appear as explanatory variables. Unlike dynamic panel GMMs, standard econometric techniques such as ordinary least-squires (OLS) do not allow obtaining unbiased estimates of such a model, because of the presence of the lagged dependent variable on the right of the equation. This leads to biased estimates. The GMM method is based on the orthogonality conditions between the lagged variables and the error term, both in first differences and in level. When the dynamic model is expressed in first differences, the instruments are in level, and vice versa. In the model to be estimated, the use of lagged variables as instruments differs according to the nature of the explanatory variables: 1) For exogenous variables, their current values are used as instruments. 2) For predetermined or weakly exogenous variables (variables which may be influenced by past values of the dependent variable, but which remain uncorrelated with future realizations of the error term), their values lagged by at least one period can be used as instruments. 3) For endogenous variables, their values lagged by two or more periods can be valid instruments. The validity of the selected instruments can be confirmed or invalidated, based on Hansen’s and Sargan’s tests. There are two variants of GMM estimator in dynamic panel: The GMM estimator in first differences and the GMM estimator in system.

3.4.1. GMM in First Differences

The GMM estimator in first differences of Arellano and Bond (1991) consists in taking for each period the first difference of the equation to be estimated in order to eliminate the individual specific effects. The general form of the first difference equation is:

(1)

This is equivalent to:

where i denotes the country (

) and t denotes the time period (

), y is the dependent variable, X is the vector of explanatory variables and

models the time-invariant country specific effects, and

is a stochastic error term which is assumed to be uncorrelated over all i and. The AR(1) coefficient

represents the persistence or memory of the process that generates

. The OLS estimator is inconsistent in this model because

is correlated with

hence, the regressor

is correlated with

:

is an instrument for

;

is a valid instrument as it is not correlated with

;

is a good instrument as it is correlated with

.

In our analysis, the specification of Equation (1) is given by:

(2)

where trd denotes trade, it is the sum of exports and imports of goods and services measured as a share of gross domestic product (% of GDP), fdi denotes foreign direct investment (% of GDP), dcp denotes domestic credit to private sector (% of GDP), upop denotes urban population (% of total population), nimp denotes net imports (difference between imports and exports) to take into account the characteristics of poor countries in international trade (a net importer is a country or territory whose value of imported goods and services is higher than its exported goods and services over a given period of time). It is then a question of instrumenting the endogenous variable delayed by its past values of 2 periods and more. However, this method does not identify the effect of time-invariant factors. In addition, Blundel and Bond (1998) showed using Monte Carlo simulations that the GMM estimator in system is more efficient than that in first differences, the latter gives biased results in finite samples when the instruments are weak. Hence, we adopt the GMM system method.

3.4.2. GMM in System

The system GMM estimator of Blundel and Bond (1998) combines first difference equations with level equations. The instruments in the equation in first differences are expressed in level, and vice versa. The general form of the equation system is:

(3)

The detail of the system equations is given by:

(4)

The main dynamic panel tests are based on the following assumptions, which must be accepted:

· Sargan and Hansen test: H0, the instruments are valid.

· Arellano-Bond test for zero autocorrelation in first-differenced errors,

H0: Absence of second-order correlation of residuals.

H1: Negative correlation of order 1 of the residuals.

The model contains unobserved panel-level effects which may be either fixed or random. By construction, the unobserved panel-level effects are correlated with the lag(s) of the dependent variable and this makes most standard estimation approaches inconsistent (Arellano & Bond, 1991). Arellano and Bond (1991) develop a generalized method of moments (GMM) estimator which yields consistent parameter estimates for models of this type. In their approach the unobserved country-specific heterogeneity is eliminated by using a first differencing transformation. The Arellano and Bond (1991) approach is specifically designed for situations where there are a large number of cross sections and a small number of time periods. Unfortunately, the Arellano and Bond (1991) approach can, in some instances, perform poorly if the autoregressive parameters are too large or the ratio of the variance of the panel-level effect to the variance of the idiosyncratic error is too large. Blundell and Bond (1998), building on the work of Arellano and Bover (1995), develop a system GMM estimator which addresses these problems by expanding the instrument list to include instruments for the level equation. In this present paper, we use the system GMM approach to estimate our model.

4. Empirical Findings

4.1. Statistics of Model Variables

We can notice that the statistics of all model variables are in logarithm. It is necessary to explain that there is a large gap between the minimum and maximum of all variables, this reflects the remarkable difference of trade, foreign direct investment, domestic credit to private and net imports across countries. This could be due to the spatial differences in resources and economic activities within the WAEMU countries such as ports, natural resources, skilled labor and insecurity (Table 1).

4.2. Choice between Pooled Estimation Model, Fixed Effect Model and Random Effect Model

The fixed effect and random effect models show that if there is an increase in foreign direct investment, domestic credit to private, urban population and net imports, international trade increases in selected West African countries but, an increase in net imports results in a decrease in international trade in the pooled model (Tables 2-4).

Source: Author, 2021.

Source: Author, 2021. ***p < 0.01, **p < 0.05, *p < 0.1.

Source: Author, 2021. ***p < 0.01, **p < 0.05, *p < 0.1.

Source: Author, 2021. ***p < 0.01, **p < 0.05, *p < 0.1.

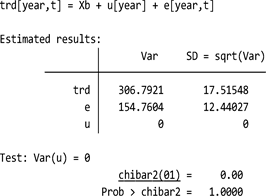

Breusch and Pagan Lagrangian Multiplier Test is used to choose between pooled estimation model and random estimation model. Annex 1 displays the statistics results. Apparently, null hypothesis of no random effects is rejected meaning that compared to random estimation model, pooled estimation model is more efficient.

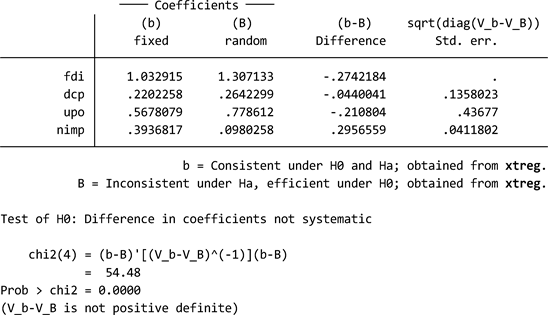

Hausman test is used to choose between fixed estimation model and random estimation model. The statistics results are shown in Annex 2 and the null hypothesis that individual effects are independent with other explanatory variables is rejected, which is the basic assumption for fixed estimation model. Therefore, fixed estimation model is more efficient.

From the tests for fixed effects and pooled estimation model, random estimation model is rejected. Then, F-test in Table 3 is used to choose between pooled estimation model and fixed estimation model so that to test if there are fixed effects in data. The result show that null hypothesis of no fixed effects will be rejected and mean that the fixed effects are significant. Hence pooled estimation model results are biased in estimation while fixed estimation model will be more efficient than the latter.

In Annex 3 we tested the residual independence and the null hypothesis of no serial correlation is rejected. The persistence of serial correlation justifies the use of others models.

4.3. Results from Feasible Generalized Least-Squares Model (FGLS)

The model shows (Table 5) that if there is increase in foreign direct investment, domestic credit to private and urban population, international trade increases in selected West African countries but, an increase in net imports results in a decrease in international trade.

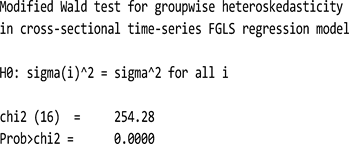

We used Modified Wald test for groupwise heteroskedasticity in cross-sectional time-series FGLS regression model in annex 4 and the null hypothesis of homoskedasticity is rejected. The persistence of heteroskedasticity justifies the choice of the system GMM estimator of Blundel and Bond (1998).

4.4. Results from the System GMM Estimation Model

We see that we accept the presence of an AR (1) effect for the residuals and we accept the absence of an AR (2) effect. This is consistent with the assumptions made. In addition, the Sargan or Hansen tests validate the choice of instruments. AR (1) and AR (2) are Arellano and Bond (1991) tests for first-order and second-order autocorrelation in the first differenced errors. When the regression errors are independent and identically distributed, the first differenced errors are by construction autocorrelated. Autocorrelation in the first differenced errors at orders higher than one suggest that the GMM moment conditions may not be

![]()

![]()

Table 5. Cross-sectional time-series FGLS regression.

Source: Author, 2021. ***p < 0.01, **p < 0.05, *p < 0.1.

valid. The Sargan test (Arellano & Bond, 1991) is a test for over identifying restrictions (a Chi2 test to determine if the residuals are correlated with the instruments). A rejection from this test indicates that model or instruments may be miss-specified. The test is also not robust to heteroskedasticity and a large amount of heteroskedasticity in the regression equation can cause the test to over reject. The AR (2) test shows no evidence of autocorrelation at conventional levels of significance. The Sargan test shows no evidence of miss-specification at conventional levels of significance. Moreover, the explanatory variables are statistically and positively significant except net import. The estimated coefficient on the lagged international trade variable is positive, highly persistent and statistically significant at the 5% level indicating that international trade in 1 year is heavily influenced by international trade in the previous year. FDI has positive effect on international trade of WAEMU countries as expected. The coefficient tells that if FDI increases by 1%, international trade of WAEMU countries will increase by about 2.74% on average. That means the FDI boosts WAEMU’s international trade. In many studies, FDI has been found to accelerate international trade (Sun, 2001; Alguacil & Orts, 2002; Alguacil, Cuadros, & Orts, 2002; Min, 2003). Financial development trough domestic credit to private sector has positive effect on international trade of WAEMU countries as expected. The coefficient tells that if financial development increases by 1%, international trade of WAEMU countries will increase by about 1.78% on average (Table 6).

![]()

![]()

Table 6. Dynamic panel-data estimation, two-step system GMM.

Source: Author, 2021. ***p < 0.01, **p < 0.05, *p < 0.1.

Most empirical studies (Table 6) analyzing the effects of financial development on international trade found evidence of a relationship between trade and finance: a well-developed financial system appears to lead to a higher volume of trade and also to have an impact on its structure (Kim et al. 2010; Becker et al. 2013; Bilas et al. 2017). Urban population has positive effect on international trade of WAEMU countries as expected. The coefficient shows that if urban population increases by 1%, international trade of WAEMU countries will increase by about 0.33% on average. In an extension of the original gravity model of bilateral trade with special emphasis on the influence of the population size on a country`s trade flows, Nuroğlu (2010) showed that the impact of population on bilateral trade flows was positive for the exporting country. Urban population could be relevant to trade because people provide the entrepreneurs, labour and consumers. It also influences economic growth. Urban population may have a positive impact on the international trade so that it may increase the amount of qualified labor force, the level of specialization and more products to export as a result. The higher the urban population is, the higher the production of goods and services of quality are, which may increase the demand of quality goods of partner countries. The variable net is not significant meaning that WAEMU countries must substitute imports for exports so that export income is reinvested in the production and marketing of tradable goods.

5. Conclusion and Policy Implication

The aim of this paper has been to explore the impact of the variable of interest for this study, which is FDI on international trade in the WAEMU countries using dynamic panel approaches. More precisely, we also have investigated the effects of other variables on trade flows like financial development, urban population and net imports. Our key finding is that there exists a positive and significant impact of FDI on the international trade of WAEMU countries. This is consistent with the economic theory which implies that a higher level of FDI should increase commercial exchanges, especially for sectors with increasing return to scale, and accelerate integration into the international markets. Financial development and urban population have positive and statistically significant effects on the international trade of WAEMU countries as expected. The effect of net import on international trade is positive but not statistically significant. Our analysis implies that WAEMU countries can benefit in terms of trade flows from further developing their investment partnerships with foreign multinational firms in sectors with increasing returns to scale. They must develop efficient finance intensive to boost trade in the long run and mobilize savings to remove liquidity constraints and lower the cost of capital, which increases competitiveness. The positive sign for urban population shows that a higher urban population is good to increase international trade flows. WAEMU countries must financially support the urban population to become entrepreneurs with better specialization opportunities conducive to international trade.

Annex

Annex 1: Breusch and Pagan Lagrangian multiplier Test for Random Effects

Source author, 2021.

Annex 2: Hausman Test

Source author, 2021.

Annex 3: Test for Serial Correlation on Fixed Estimation Model

Source author, 2021.

Annex 4: Modified Wald Test for Groupwise Heteroskedasticity in Cross-Sectional Time-Series FGLS Regression Model

Source author, 2021.