Measurement of U.S. Equity Mutual Funds’ Environmental Responsibility Attractiveness for an Individual Investor ()

*Corresponding author.

1. Introduction

Investors seeking to invest in Social and Environmental Responsible (SER) firms have grown to become an unavoidable fact in capital markets. Indeed, the last financial crisis and the succession of financial scandals have catalyzed and reinforced the SER investors’ movement. In order to assist these investors to identify and select socially and environmentally responsible companies, several social rating agencies try to standardize social and environmental information conveyed in connection with the companies and main stakeholders. Thus, in the United States, KLD offers an aggregate rating of corporate social responsibility for more than 3000 US companies. This rating is based on 8 social and environmental dimensions, which are in turn, integrated by more than 60 criteria.

With regards to the rating of socially responsible mutual funds, few tools are available for investors. The SRI strategy most used by socially responsible mutual funds is screening which is the practice of evaluating mutual funds based on social, environmental, ethical and/or good corporate governance criteria. Positive screening implies investing in profitable companies that make positive contributions to society. Conversely, negative screening implies avoiding investing in companies whose products and business practices are harmful to individuals, communities, or the environment. Most of the papers which can be found in the literature trying to measure mutual funds’ social responsibility degree rely on the number of screens applied by the fund. References [1] -[5] proposed screening intensity (number of applied screens) as a proxy of mutual funds’ social degree. References [2] [5] took also into account the type of applied screen: positive and/or negative and if the fund checks for direct and indirect infringement of social issues. Reference [6] proposed an AHP-based ranking method for socially responsible mutual funds which takes into account together with the screening intensity the engagement policy of the fund, the followed SRI research process, control of companies, external control of the fund, competence of fund managers and communication with companies and investors, among others. Reference [6] called these criteria “Quality of Information” as referred to the transparency and credibility of the non-financial information provided by the fund manager about SRI funds.

The evaluation model proposed in this paper, instead of using screening intensity for measuring the social responsibility degree of the mutual funds, evaluates the Corporate Social Performance of each of the firms invested in by the equity mutual funds, using KLD database for U.S. companies. Then, given the percentage invested in by the mutual fund in each company, the scores are aggregated into one quantitative measure for each mutual fund. In addition, a new criterion, quality of SRI management, is included in the model to incorporate information about the companies’ selection process, investment policy, screening process, research process and the level of expertise of the fund managers with respect to SRI.

SER investors are motivated by different values and will seek companies respecting particular dimensions of Corporate Social Responsibility (CSR). Therefore, in this paper, the proposed evaluation model depends on the investor’s personal preferences reflecting the importance given by the investor to each decision making criterion. The weights given to the different criteria can change from one investor to another as they depend on diverse facts as the country, culture, religion or personal values and beliefs of the investor. In this paper, an approach is presented that allows measurement of the socially responsible attractiveness of mutual funds for a particular investor in terms of a set of socially responsible criteria.

With this aim, a mutual funds’ evaluation model is designed based on MACBETH. Measuring Attractiveness by a Categorical Based Evaluation Technique asks only for qualitative pairwise comparison judgments of the difference in value between alternatives (see [7] - [9] for references and mathematical foundations and [10] [11] for some applications). MACBETH is visually supported by the M-MACBETH software [8] . According to MACBETH procedure, the following steps are followed:

Step 1. Identification of the relevant investment criteria.

Step 2. Definition of descriptors of quantitative performance for each criterion.

Step 3. Definition of “targets” associated with each criterion: “good” and “neutral” performance levels.

Step 4. Obtaining of value functions for each criterion in order to transform qualitative performance levels into quantitative values.

Step 5. Criteria weighting.

Step 6. Aggregation additive procedure.

The structure of the paper is the following: in next section, descriptors of performance for each criterion are presented and reference levels and value functions for each criterion are obtained from dialogue with the individual investor. Next section presents criteria weighting and aggregation of criteria using an additive model. Finally, conclusions are presented.

Some components, such as multi-leveled equations, graphics, and tables are not prescribed, although the various table text styles are provided. The formatter will need to create these components, incorporating the applicable criteria that follow.

2. Identification of Investment Criteria

In this work we have concentrated on the U.S. case although the proposed ranking could be adapted to other countries in order to assist investors with different beliefs or personal values. Three main areas of concern or dimensions have been considered. One, “Quality of the SRI Management” related to the managers’ investment practices, their experience and the transparency and credibility of the information provided (Dimension 1); another one, “Social, Environment and Governance, SEG”, corresponding to socially responsible practices of companies invested in by the mutual funds (Dimension 2); and, finally, “Financial Performance” (Dimension 3). For each of these areas of concern several criteria have been defined to a total of 10 (see Figure 1).

Mutual funds managers can influence the degree of social and environmental responsibility of their funds as they define investment strategies, the research processes and selection rules [12] . Therefore, it seems adequate to incorporate in the evaluation model criteria about the quality of the SRI management. Thus, we have considered 5 criteria belonging to this dimension: screening approach, advocacy and public policy, research process, external control and manager’s SRI competence (see Table 1):

Social, Environmental and Governance (SEG) criteria were derived taking into account KLD’s methodology for their Corporate Social Ratings Monitor (KLD, 2007) [13] . In this work we will only focus on the Environmental dimension and we will evaluate environmental responsibility of equity mutual funds from the evaluation of the firms invested in by the mutual fund taking into account KLD criteria: climate change, products and services, operations management and other.

KLD uses screens to monitor corporate social performance of U.S. firms. They have positive and negative screens. The positive screens indicate strengths of a firm and the negative screens indicate weaknesses. The former suggest that the firm is engaged in some socially responsible actions which may have positive effects on society, and the latter implies that it may have negative effects on society. Finally, the financial dimension includes one criterion, adjusted risk (see Figure 1).

3. Descriptors of Performance and Value Functions for Each Criterion

A total of 46 real U.S. domiciled large cap equity mutual funds constitute our set of alternatives or investment options. Our universe is composed by seasonal funds (age equal or greater than 10 years). These funds have at least 70% of assets in domestic stocks. They are characterized by Morningstar Ltd based on style and size of the stocks they own. In this paper we have considered large market capitalization funds belonging to growth or blend categories. Growth funds main goal is capital appreciation with little or no dividend payouts. Blend funds are funds with portfolios made up of a combination of value and growth stocks. Value funds are stock mutual

![]()

Table 1. Quality of social responsibility management.

Own source based on [6] .

funds that primarily hold stocks that are deemed to be undervalued in price and that are likely to pay dividends. Financial and non-financial data have been considered for 2007 in order to illustrate the presented example.

Performance of mutual funds on criteria belonging to the “Quality of SRI Management” and “Environment” areas of concern is of qualitative nature. The descriptors proposed in this work are constructed on the basis of the identification, for each criterion, of equity mutual funds’ strengths and concerns which are based on KLD’s strengths and concerns for U.S. companies. For the “Quality of SRI management” and based on dialogue with experts from rating agencies, only strengths have been considered (see Table 2) with the aim of rewarding “good” practices.

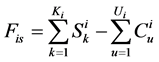

Based on information provided in the mutual funds websites and Social Investment Forum, we have computed, for each criterion i, the number of strengths accomplished by each mutual fund, f:

(1)

(1)

And, from discussion with the individual investor different levels of qualitative performance have been identified for these criteria based on the number of strengths accomplished by the fund. The investor established two reference levels for each criterion, “neutral” and “good”. Reference levels for “neutral” and “good” have been highlighted with yellow and green colors, respectively, in the following tables (Table 3).

Then, a value scale,  , is constructed from discussion with a real individual investor, for each criterion within this dimension (see Figure 2) following a questioning-answering process supported by the M- MACBETH software [8] . The investor was asked to compare the difference in attractiveness between each two performance levels completing the upper triangular part of the judgments matrix: the investors was asked to compare a very good performance with a weak performance; then, a good performance with a weak performance and so on, until completing the last column in the matrix. Then, a very good performance was compared with the rest of performance levels, completing the first row of the matrix from right to left. Finally, second best performance level, a good performance was compared with the other performance levels completing the rest of the matrix.

, is constructed from discussion with a real individual investor, for each criterion within this dimension (see Figure 2) following a questioning-answering process supported by the M- MACBETH software [8] . The investor was asked to compare the difference in attractiveness between each two performance levels completing the upper triangular part of the judgments matrix: the investors was asked to compare a very good performance with a weak performance; then, a good performance with a weak performance and so on, until completing the last column in the matrix. Then, a very good performance was compared with the rest of performance levels, completing the first row of the matrix from right to left. Finally, second best performance level, a good performance was compared with the other performance levels completing the rest of the matrix.

Once the judgments have been obtained, and after checking consistency, M-MACBETH created a numerical scale which was discussed with the investor until she agreed with it. “Neutral” performance has been given a value score of zero and “Good” performance a value score of one.

![]()

Table 2. Description of strengths of criteria within “Quality of SRI Management” dimension.

Source: Own elaboration.

![]()

Table 3. Descriptor of qualitative performance for criteria within the “Quality of SRI Management” dimension.

![]()

![]()

Figure 2. M-MACBETH consistent matrix of judgments for “Quality of SRI management”.

For the “Environment” dimension we defined descriptors of qualitative performance for each of the criteria. With this aim, we first computed the qualitative environmental performance of the companies invested in by the equity mutual funds using KLD’s binary variables for strengths and concerns. Following KLD procedure the variable is equal to one if the firm meets a strength/concern environmental criterion and equal to zero otherwise.

Then, we compute each firm, s, performance in each criterion  belonging to the environment dimension in the following way (see Table 4 for de description of the strengths,

belonging to the environment dimension in the following way (see Table 4 for de description of the strengths,  , and concerns

, and concerns  for each criterion, i:

for each criterion, i:

(2)

(2)

Performance levels (including reference levels) for the above criteria have been obtained from discussion with the investor and are displayed in Table 5, Table 6 and Table 7.

The value scales obtained from an interactive discussion with the investor using M-MACBETH, for the different criteria within a certain dimension (where  is the value of the firm s with respect to criterion i), were obtained as previously described for the “Quality of SRI management” criteria (Figures 3-6).

is the value of the firm s with respect to criterion i), were obtained as previously described for the “Quality of SRI management” criteria (Figures 3-6).

![]()

Table 4. Description of strengths and concerns for criteria within “Environment” dimension.

Source: KLD.

![]()

Table 5. Descriptor of firms’ qualitative performance for “Climate Change” and “Others” within the “Environment” dimension.

![]()

Table 6. Descriptor of firms’ qualitative performance for “Products and Services” within the “Environment” dimension.

![]()

Table 7. Descriptor of firms’ qualitative performance for “Operations Management” within the “Environment” dimension.

![]()

![]()

Figure 3. M-MACBETH consistent matrix of judgments for “Climate Change”.

![]()

![]()

Figure 4. M-MACBETH consistent matrix of judgments for “Products and services”.

The descriptor of the qualitative performance of each mutual fund f, ![]() in each criterion

in each criterion ![]() belonging to the environment dimension,

belonging to the environment dimension, ![]() , is obtained as follows:

, is obtained as follows:

![]() (3)

(3)

where p is the number of firms invested in by mutual fund f, and ![]() is the weighting of firm s in mutual fund f, with

is the weighting of firm s in mutual fund f, with ![]() (this information was provided by Morningstar). Tables 8-11 display the value

(this information was provided by Morningstar). Tables 8-11 display the value

![]()

![]()

Figure 5. M-MACBETH consistent matrix of judgments for “Operations Management.

![]()

![]()

Figure 6. M-MACBETH consistent matrix of judgments for “Others”.

![]()

Table 8. Descriptor of mutual funds’ qualitative performance and effect value scale for criterion “Climate Change” within the “Environment” dimension.

![]()

Table 9. Descriptor of mutual funds’ qualitative performance and effect value scale for criterion “Products and Services” within the “Environment” dimension.

scales (obtained by cross-multiplication), for mutual funds’ qualitative performance:

Financial performance of each mutual fund is measured using Morningstar Rating TM for funds. This rating, often called the “star rating”, debuted in 1985 and was quickly embraced by investors and advisors. The rating is a quantitative assessment of a fund’s past performance―both return and risk―as measured from one to five stars. It uses focused comparison groups to better measure the fund manager skill. Thus, the rating allows investors to distinguish among funds that use similar investment strategies. The method rates funds based on an enhanced Morningstar Risk-Adjusted Return measure, which also accounts for the effects of all sales charges, loads, or redemption fees. The original methodology defined risk as the underperformance relative to the 90-day Treasury Bills. With the enhanced methodology, risk is measured as the amount of variation in the fund’s per-

![]()

Table 10. Descriptor of mutual funds’ qualitative performance and effect value scale for criterion “Operations Management” within the “Environment” dimension.

![]()

Table 11. Descriptor of mutual funds’ qualitative performance and effect value scale for criterion “Others” within the “Environment” dimension.

formance, with more emphasis on downward variation. The Morningstar Rating TM is based on “expected utility theory”. The rating accounts for all variations in a fund’s monthly performance, with more emphasis on downward variations. It rewards consistent performance and reduces the possibility of strong short-term performance masking the inherent risk of a fund (see www.morningstar.com and Table 12 and Figure 7).

Table A1, Table A2 and Table A3 in the appendix display values assigned to the performance of each mutual fund whit respect to each criterion.

4. Criteria Weighting and Additive Aggregation

We defined a fictitious mutual fund called “neutral” mutual fund (a mutual fund which is neutral in every criterion). The investor was first asked to answer the following questions: How much would a swing from neutral to each of the good performance levels for the 10 criteria, increase its overall attractiveness? With these answers the investor filled the last column in the judgments matrix. Then the investor was asked to judge the difference in attractiveness between from the most attractive swing to the second most attractive swing: How much more attractive is a swing from neutral to good in climate change than a swing from neutral to good in products and services? and so on, until completing the M-MACBETH judgments matrix Figure 8 (see Bana e Costa, et al. 2003 for more technical details).

The histogram in Figure 9 shows the derived M-MACBETH weights (in percentages). The total value score ![]() for mutual fund f is obtained as:

for mutual fund f is obtained as:

![]() (4)

(4)

where: ![]() is the weight given to criterion i in dimension j and

is the weight given to criterion i in dimension j and ![]() the value score for mutual fund f with re-

the value score for mutual fund f with re-

spect to criterion i within dimension j. ![]() and

and![]() , and

, and ![]() when the performance of

when the performance of

mutual fund f in the evaluation criterion ![]() equals the criterion target “good” and

equals the criterion target “good” and ![]() when mutual fund f has the neutral performance related to that criterion. Figure 10 displays the overall and partial scores (all values

when mutual fund f has the neutral performance related to that criterion. Figure 10 displays the overall and partial scores (all values

![]()

Table 12. Descriptor of mutual funds’ qualitative performance and effect value scale for criterion “Adjusted Return” within the “Environment” dimension.

![]()

![]()

Figure 7. M-MACBETH consistent matrix of judgments for “Others”.

![]()

Figure 8. Consistent matrix of judgments obtained using M-MACBETH.

![]()

Figure 9. Histogram containing weigths obtained using M- MACBETH.

![]()

Figure 10. M-MACBETH table with partial and total scores.

multiplied by 100) for each mutual fund based on the particular preferences of the investor. Two fictitious mutual funds have been included as references for the rating. A fund called “All upper” which reaches the “good” target for every criterion and a fund called “All lower” which is neutral with respect to all criteria.

For each mutual fund we obtain a set of numerical scores referred to the different criteria and an overall score.

As we can observe and based on the judgments of the investor, all “conventional” mutual funds obtain scores that rank them as worst than the neutral reference fund. Only four mutual funds overcome the target fictitious mutual fund. The rest of the mutual funds are better than the “neutral” mutual fund but worst than the “good” fund.

5. Conclusion

Investors have a limited capacity for handling large amounts of information and a rating of a fund taking into account both, financial and non-financial aspects can provide a useful tool for investment decision making. In this paper, we have proposed an evaluation model for mutual funds based on their socially responsible and financial performance which allows individual investors to make investment decisions taking into account socially responsible information about the mutual funds. To this aim, we have used a Multicriteria Decision Making Technique, MACBETH, which allows measurement of the Attractiveness of each mutual fund with respect to

several qualitative criteria using a Categorical based Evaluation Technique. The application of this approach aims to assist a socially responsible individual investor in his/her investment decision process, providing him/her with a ranking for socially responsible mutual funds based on his/her particular preferences.

Acknowledgements

We would like to thank the “Universidad Complutense de Madrid” and the “Universidad de Oviedo” for their financial support (NILS mobility project (Abel-Call). This work has been financially supported by the Spanish Ministry of Science and Innovation (project ECO2011-28927).

Appendix

![]()

![]()

Table A1. Performance of mutual funds in each criterion within the “Quality of SRI Management” dimension.

Own source based on information provided by mutual fund websites and SIF.

![]()

![]()

Table A2. Performance of mutual funds in each criterion within the “Environment” dimension.

Own source based on KLD database for 2004.

![]()

![]()

Table A3. Performance of mutual funds within the “Financial” dimension.

Source: Morningstar data for 2004.