Open Journal of Social Sciences

Vol.03 No.10(2015), Article ID:60453,6 pages

10.4236/jss.2015.310012

“Fisher Effect” Theory and “Fisher Paradox” in China’s Economy

Chaofan Chen

School of Economics and Resource Management, Beijing Normal University, Beijing, China

Email: ccfforever@163.com

Copyright © 2015 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 3 October 2015; accepted 19 October 2015; published 22 October 2015

ABSTRACT

“Fisher Effect” is the famous theoretical assumption about the interest rate and inflation rate. The paper first elaborates the basic principle of “Fisher Effect” theory, then finds the “Fisher Paradox” that may exist in China’s economy from the domestic and foreign scholars’ empirical study. Moreover, based on the data of China in 1980-2012, we conduct the Granger Causality Test of “Fisher Effect” and preliminarily conclude that from the empirical perspective, China does not exist long- term stable relationship between interest rate and inflation rate. Finally, it explains China’s “Fisher Paradox” root in the controlling characteristics of interest rate from policy perspective.

Keywords:

Fisher Effect, Fisher Paradox, Granger Causality Test, Interest-Rate Market

1. Introduction

In the 20s to 30s of 20th century, capitalist countries had completed the transition from free capitalism to monopoly capitalism. At the same time, capitalism contradictions were intensified and exploded a severe economic crisis. In such a big background, traditional economics gradually developed to the modern economics. During this period, economists like Robinson, Chamberlain, Irving Fisher, etc., played a role in inheriting the past and ushering in the future.

The famous “Fisher Effect” reveals the relationship among nominal interest rate, actual interest rate and inflation rate, which is always an important problem in macro economics and finance research [1] . Fisher, in his illuminating book, talks about the interaction among actual inflation, expected inflation and nominal interest and the demand for real money balances (Mengxi Chen, 2003) [2] . Fisher thinks that, in the fully expected situation, the change of nominal interest rate and inflation rate is one-to-one, the rising of a country’s expected inflation rate will eventually lead to proportional rising of the country’s currency deposit rates. As we know, the current situation of China’s eco- nomy is not stable, for instance, in August 2010, the CPI index hit a year high, which promoted the expected inflation rate. This article first makes a theoretical exploration of “Fisher Effect”, then conducts an empirical analysis based on China’s economic environment in order to explore whether China exists the “Fisher Effect” among CPI, inflation rate, interest rate and currency mechanism.

2. The Basic Theory of “Fisher Effect”

2.1. “Fisher Effect”―Based on the Relative PPP Theory

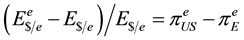

The relative purchasing power parity theory corresponds to the absolute PPP theory. The relative (PPP) means: in any given period of time, the changing percentage of two kinds of currencies’ exchange rate will equal to the difference of the two countries’ changing percentage of price level at the same time, just as formula (1).

(1)

(1)

Among them,  denotes the dollar against the euro, πt denotes the rate of inflation.

denotes the dollar against the euro, πt denotes the rate of inflation.  expresses price changing rate from to time t to time t − 1. We know that a country’s money supply permanent increasing will make the proportionate rise of price level, which leads to continuing inflation. In the long run, increasing money supply will ultimately affect the level of interest rates. According to the monetary analysis method, we combine the relative purchasing power parity (PPP) theory and the interest rate parity theory to do research of the relationship between inflation and interest rates. Interest parity condition is that expected return of different monetary assets is equal, here refers to the yields of dollar assets (one-year dollar deposit rates) and the dollar yields of euro assets (one-year euro interest deposit rates and the expected rate of depreciation of the dollar) are equal, just as formula (2).

expresses price changing rate from to time t to time t − 1. We know that a country’s money supply permanent increasing will make the proportionate rise of price level, which leads to continuing inflation. In the long run, increasing money supply will ultimately affect the level of interest rates. According to the monetary analysis method, we combine the relative purchasing power parity (PPP) theory and the interest rate parity theory to do research of the relationship between inflation and interest rates. Interest parity condition is that expected return of different monetary assets is equal, here refers to the yields of dollar assets (one-year dollar deposit rates) and the dollar yields of euro assets (one-year euro interest deposit rates and the expected rate of depreciation of the dollar) are equal, just as formula (2).

(2)

(2)

According to formula (1), we get the changing percentage of the dollar/euro exchange rate is equal to the difference between the rate of inflation, so people would expect the dollar/euro exchange rate will equal to the difference between the two countries expected inflation rate. That is, convert the changes of real exchange rate and inflation into the changes of expected exchange rate and inflation, as formula (3).

(3)

(3)

Among them, . Combining formula (2) and formula (3), we can get the relationship between the difference between the real interest rate and the difference between the expected inflation rate:

. Combining formula (2) and formula (3), we can get the relationship between the difference between the real interest rate and the difference between the expected inflation rate: . The long-term relationship between inflation rate and interest rate is “Fisher Effect”. Paul R. Krugman interprets “Fisher Effect” theory with changes of interest rate, price level, exchange rate caused by changes of federal money supply growth rate, see Figure 1.

. The long-term relationship between inflation rate and interest rate is “Fisher Effect”. Paul R. Krugman interprets “Fisher Effect” theory with changes of interest rate, price level, exchange rate caused by changes of federal money supply growth rate, see Figure 1.

2.2. “Fisher Effect”: Expected Inflation, Real and Nominal Interest Rate

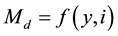

The Fisher believes that money demand can use  to express.

to express.  denotes the demand for real money; y denotes the actual income; i denotes the nominal interest rate. This shows the actual money demand

denotes the demand for real money; y denotes the actual income; i denotes the nominal interest rate. This shows the actual money demand is a function of y and i and also the reciprocal of money velocity. At the same time, Fisher points out i is determined by two factors: the real interest rate and inflation expectation on one time point:

is a function of y and i and also the reciprocal of money velocity. At the same time, Fisher points out i is determined by two factors: the real interest rate and inflation expectation on one time point: , real interest rate is only determined by real factors, such as capital productivity, time preference, risk preference and so

, real interest rate is only determined by real factors, such as capital productivity, time preference, risk preference and so

Figure 1. Interaction effect of money supply, interest rates, price level and exchange rate.

on, which has nothing to do with the rate of inflation and its value changes rarely, therefore can be considered as constant. So when the actual inflation rate is equal to the nominal rate of inflation, nominal interest rate and real interest rate is equal. We can explain it from the angle of the borrowers, assuming the borrowing rate is 2%, the expected inflation rate is 20%, when interest rate is lower than 22% the lenders are not willing to lend money to borrowers. In a word, we once again prove that the rate of inflation will affect nominal interest rate.

3. Empirical Research of “Fisher Effect”

3.1. Putting forward the “Fisher Effect” and “Fisher Paradox”

The Strict “Fisher Effect” theory thinks that: in the situation of rational expectations, effective market should compensate the change of the purchasing power of money in the long term, which means the nominal interest rate and inflation rate is one-to-one, the change of the price of any product cost will be displayed in the monetary cost, currency holding cost is basically equivalent with the product cost. If “Fisher Effect” exists, it means that money is super neutral and there is no money illusion, so nominal interest rate could be a good indicator variable of expected inflation rate. “Fisher Effect” is a judgment of monetary policy mechanism. Krugman found some important phenomenon in the empirical study of international economics: although purchasing power parity (PPP) went rotten in empirical research, “Fisher Effect” was confirmed in the large scope [3] . He proved the relationship between inflation rate and interest rate based on empirical data from 1970-2000 of Switzerland, The United States and Italy. Since 1970, the three countries had experienced different levels of inflation, with rising of expected inflation rate, the interest rate also increased sharply. Similarly, in the year of deflation, interest rate tended to decline, in the long run, inflation rate and interest rate tended to be consistent especially in the Nordic Sweden, so experiences proved that the conclusion was very ideal.

However, “Fisher Effect” that proved by Krugman is questioned by many scholars. Opponents think it is very difficult to verify the long-term equilibrium relationship between the two in practice. They believe in the open economy, the change tendency of the nominal interest rate and inflation rate is different, the sign of “Fisher Effect” is not obvious, thus put forward the “Fisher Paradox”. A lot of researches use the cointegration test of time series method, while the conclusion miss by a mile: King and Watson rejected the long-term equilibrium relationship between the two [4] , Ghazali and Ram lee used the 1974-1996 monthly data of the G7 countries, and found that the nominal interest rate and inflation rate did not exist long-run equilibrium relationship [5] . Many scholars think that the “Fisher Paradox” also exists in China: Jingquan Liu tested the unit root properties of nominal interest rate and inflation rate sequence by using the methods of unit root test and points in the whole inspection, then adopted the cointegration test to judge the long-term equilibrium relationship between the two, finally showed china’s economy did not appear the significant “Fisher Effect” [6] [7] . Shaoping Wang and Wenjing Chen investigated the nonlinear characteristic of the nominal interest rate and inflation rate by using the monthly data from 1990 to 2007 of china and the nonparametric method, the results found that there was only weak “Fisher Effect” in China [8] .

In the economical operation of china, the change of nominal interest rate and inflation rate is not only closely related in some periods, but also keep separate in other periods. Since 2006, China’s CPI reaches new highs, although most inflations belong to structural inflation, huge capital account surplus does provide a steady stream of liquidity. The focus of the empirical research is that whether there is a long-term stable relationship among the inflation rate, interest rate and interest rate policy in China.

3.2. Granger Causality Test of “Fisher Effect”

Towards “Fisher Effect”, economic scholars’ research is increasingly high-end, the methods of studying “Fisher Effect” trend mathematical statistics. In this article, we adopt Granger causality test to do preliminary empirical inspection of “Fisher Effect” in china’s economy. The empirical variables are 1980-2009 China’s inflation rate and the nominal interest rate, which are set by the Chinese central bank, and the data come from 1980-2009 “China statistical yearbook”.

The main idea of Granger test is: in order to test the causality between X and Y, first estimate the degree of Y explained by its own lag, following verify the degree of Y after introduction of the lag value of X, if it can improve the explaining degree of Y, X will be the Granger cause of Y, specific content is as follows.

Assume that Un is all information set until t stage, Xn is the information set of X until t stage, Un − Yn is all information except X until t stage,  denotes the conditional distribution function of Yt + 1. If we have formula (4), we can think variable X is the Granger cause of Y. Information set Un includes all relevant information. If in the information set of Un, information X can improve the prediction of Y, we say relative to the information set of Un, X is the Granger cause of Y.

denotes the conditional distribution function of Yt + 1. If we have formula (4), we can think variable X is the Granger cause of Y. Information set Un includes all relevant information. If in the information set of Un, information X can improve the prediction of Y, we say relative to the information set of Un, X is the Granger cause of Y.

(4)

(4)

According to the above definition, assume that the information set Un only consists of sequence Xt, Yt, and Xt, Yt is zero mean stationary variables. The concrete practice of Granger test is first to do constraint regression and unconstrained regression of formulas (5) or (6), and then apply the two residual sum of squares to calculate F-statistic and conduct the test.

(5)

(5)

(6)

(6)

Assume that X not the Granger cause of Y, the null hypothesis test of (5) function is: if the null hypothesis is satisfied, we will have formulas (7) and formula (8).

Among them,

Under the confidence level

In this paper, in order to test whether interest rate changes is Granger cause of inflation rate, firstly, we should test whether the time series of China’s inflation rate is steady. On the basis of SIC criteria, we conduct ADF root test to judge stationary of inflation rate and interest rate sequences. Test results show that inflation rate sequence is stationary while the interest rate sequence needs to do first order difference in order to reach significant level, see Table 1.

The treated sequence can be used for Granger test, and the result of Granger test of inflation rate and interest rate sequence are listed as Table 2.

Test results show that the P value is big and the F value is small, so we can’t reject null hypothesis: inflation rate does not Granger Cause of interest rate; interest rate does not Granger Cause of inflation rate, the causal feedback contact does not exist. Although the Granger test can’t fully reflect the reality, we can at least explain China existing “Fisher Effect” from the point of statistics―there is no long-term stable relationship between the

Table 1. Statistical value and probability of ADF root test.

Note: The left column is the test of inflation rate sequence, and the right side is the test of interest rate sequence. The right side of the table is the testing result of interest rate sequence after a first order difference.

Table 2. Statistical value and probability of ADF root test.

nominal interest rate and inflation rate.

4. Analysis of “Fisher Paradox” in China’s Economy

As existing “Fisher Paradox” in China’s economic, we initially inform that there is no significant causal link between the inflation rate and interest rate in current. Inflation is mainly due to the expansion of quickly increasing demand, and it is closely related to the monetary and fiscal expansion expenditure exceeding the growth of supply. We will analyze “Fisher Paradox” in two ways.

4.1. China’s Interest Rate Market Has Strong Controlling Features

Before 1996, there was no deregulation of interest rates in China and inflation rates had very weak influence in interest rates. After 1996, our country gradually implemented market-oriented interest rate reform, so that the nominal interest rate could be in line with market rates. But China’s interest rate market regulation was still strong .Through analyzing of “Fisher effect” theory, we could know that residents will be able to make a reasonable inflation expectations timely through changes of interest rates when the nominal interest rate market trend is very strong. However, due to China’s interest rates market regulation features are very significant, interest rate can’t be flexible to conduct monetary policy and even cause distortion, so the residents’ inflation expectations appear bias. Inflexibility in nominal interest rate directly causes greater deviation between the expected inflation rate and the actual inflation rate, which weakens the link between nominal interest rate and inflation rate in some extent. It results in converse direction changes between real interest rate and inflation rate, which is “Fisher Paradox”.

There was a strict “Fisher Effect” in most developed countries. When the United States crisis spread to global countries, the real economy of all countries suffered strikes in varying levels. With price level and economic growth were falling, whether socialist or capitalist countries strengthened the intensity of macroeconomic regulation and controlling in order to avoid a recession. While monetary policy was used as an important means to regulate the economy, the United States, Europe, Japan and other major capitalist countries cut interest rates. This fully reflected that the linkage mechanism among the rate of inflation (declining in economic crisis), monetary policy and interest rate was one-to-one. China’s government had repeatedly cut interest rate in face of the economic crisis. But what was different with the west countries was that China’s interest rate policy was the central bank-led and directly affected on the market. While the capitalist countries were market-driven, central bank formulated appropriate policies complying with changes in market interest rate.

We can find that national monetary policy seems to fit “Fisher Effect” even in face of recession in economic crisis, which is in order to stabilize the economy and financial operations for purpose. But clearly, the actual main entities are different, which result in monetary policy and interest rate policy are always in line with “Fisher Effect” whether low inflation or high inflation during the recession period or economic overheating. However, China’s linkage effects of currency and interest rate exist differences no matter in economic overheating period or in the general period. Market regulation features are obvious.

4.2. China’s Interest Rate Policy Is Not Sensitive

“Fisher Effect” theory based on interest rate is very sensitive to the price. But in the current circumstances, China’s interest rate policy is commonly issued by administrative orders, so that the interest rate policy in China is lack of effective transmission mechanism and the reaction mechanism, interest rate policy has not completely combined with market economy (Qunyong Wang and Na Wu, 2009) [9] . This means China’s interest rate policy almost does not have market response and policy efficiency. As the economic adjustment signal, interest rate policy in China can’t play its effect well under the politically driven pattern and investment conversion mechanism which makes capital price is too low. At the same time, it takes a long time from the formulation to implementation of China’s interest rate policy, and the changing of China’s price level is large frequency, high speed, so changes of interest rate can’t keep up with the changes of the price which can lead to no long-term stable relationship between the nominal interest rate and inflation rate. Interest rate as the intermediate target of monetary policy, its conduction effect is not ideal so as to weak the effect of monetary policy and the response of monetary policy to the price may also deviate. In China, a typical example is that the wage growth can’t keep up with soaring price, which inevitably causes a lot of discussion (Jia Ying, 2008) [10] . In addition, the feedback of interest rate of its monitoring targets such as inflation, economic growth is not stable, which leads to the forecasting by micro main body is not stable. Because the sensitivity of micro main body to interest rate is low and the ability of pricing is very weak, the micro main body is totally in a weak position in the interest rate decision game with the central bank, the prediction of interest rate of micro main body does not come from the market that makes it not be able to have rational expectations of currency and inflation.

5. Policy Recommendations

China should further strengthen the reform of the interest rate market, letting interest rate more in line with the market trend, and reduce administrative intervention, making interest rate become an important signal of transmitting monetary policy and an important lever of macroeconomic regulation. Looking the experience of inflation management in China, administrative intervention will cause greater damage to economic entity, only “soft landing” that conforms to the market rule could make the economy gradually return to a normal level. Facing the high CPI index and structural inflation, interest rate only accords with the market economy law can it correctly guide for people’s rational expectations, the economy could gradually to smooth over. At the same time, formulation of interest rate should be timely, reduce the time lag and intervention, thus the rapid response of microscopic main body to interest rate could help them form a rational judgment on the monetary policy and inflation and adapt to changes of economy. According to “Fisher Effect” theory, because the expansion monetary policy cannot be sensitive to increase inflation pressure, we believe that the expansion of credit scale and moderately lower nominal interest rate is still an important option for the macroeconomic regulation, which helps achieve stable economic growth. At the same time, in face of the current inflation in the economy, focusing on solving supply lag problem caused by fiscal investment and adjusting economic structure is useful policy that accords with the economical practice.

Cite this paper

ChaofanChen, (2015) “Fisher Effect” Theory and “Fisher Paradox” in China’s Economy. Open Journal of Social Sciences,03,80-85. doi: 10.4236/jss.2015.310012

References

- 1. Fisher, I. (1965) The Theory of Interest. Kelley.

- 2. Chen, M.X. (2003) History of Economic Theory. China Renmin University Press, Beijing.

- 3. Krugman, P.R. and Obstfeld, M. (1998) Price Levels and the Exchange Rate in the Long Run. In: Krugman, P.R. and Obstfeld, M., Eds., International Economics: Theory and Policy, Scott, Foresman, and Co., Boston, 378-409.

- 4. King, R.G. and Watson, M.W. (1997) Testing Long-Run Neutrality. FRB Richmond Economic Quarterly, 83, 69-101.

- 5. Ghazali, N.A. and Ramlee, S. (2003) A Long Memory Test of the Long-Run Fisher Effect in the G7 Countries. Applied Financial Economics, 13, 763-769. http://dx.doi.org/10.1080/09603100210149149

- 6. Liu, J.Q., Guo, Z.F. and Xie, W.D. (2003) Points in the Whole Inspection of the Time Series and Fisher Effect Mechanism Analysis. Journal of Quantitative Technical Economics, 4, 59-63.

- 7. Liu, J.Q., Sui, J.L. and Yan, C. (2009) “Fisher Effect” Partition System and Its Test in China’s Economic. Journal of Nantong University (Social Science Edition), 1,107-108.

- 8. Wang, S.P. and Chen, W.J. (2008) Nonparametric Test China’s “Fisher Effect”. Journal of Statistical Research, 25, 79-85.

- 9. Wang, Q.Y. and Wu, N. (2009) Revisit to “Fisher Effect”: The Panel Cointegration Base on the International New Data. Journal of Southern Economy, 7, 61-62.

- 10. Ying, J. (2008) Correlation Studies of Interest Rate and Inflation Rate. Journal of Modern Business, 4, 125.