Regulating Liquidity Risks within “Institutional Protection Schemes” ()

1. Introduction

“Liquidity is the lifeblood of financial institutions”

(Harris, 2013: p. 179)

“Liquidity […] it is merely the oil greasing the wheels of the financial system, so that they function frictionless and costless. Nevertheless, smooth periods do not last for ever.”

(Nikolaou, 2009: p. 43)

The financial crisis unveiled specific weaknesses of the functioning of financial markets and the risk man- agement of its most crucial participants—financial intermediaries, mainlycredit institutions. Especially the dry- ing up of unsecured interbank lending markets disclosed the strong mutual dependence and interconnectedness of financial institutions, having the consequence of contagion risk and potential domino-effects in global mar- kets.

Although a lot of banks have sufficiently implemented preparations in order to avoid to get hit by a severe crisis scenario, most banks predominantly build up capital buffers and underestimated the probably central risk of the heart of banking—liquidity risk. When liquidity is cheap (low interest/lending rates) banks create incen- tives to search for higher yield, decreasing their costly liquidity buffers and consequently increasing the entire systemic risks. Cheap funding sources do have the effect that liquidity risks get underestimated and therefore not priced, which has the effect of further risk-concealing of assets and funding sources. Particularly interbank lend- ing is a major source of funding, and thus funding risk.

In order to avoid future crisis, global actors and standard-setters, such as the (former) G20 and Banking Com- mittee of Banking Supervision (BCBS), decided to strengthen financial regulators. This package of new stan- dards, named “Basel III”, was also introduced by the European legislator via a respective regulation (CRR) and a directive (CRD IV). One of the most crucial regulation issues in CRR and CRD IV is the topic of liquidity and liquidity risk.

Usually, global standards in banking regulation addresses banking groups, meaning a structure of a (control- ling) parent entity and subordinated entities (subsidiaries). Also Basel III focuses on the regulation of banking groups.

However, especially in Austria, Germany and Spain, the majority of credit institutions are not part of a bank- ing group. Those banks often are part of a so called decentralized sector, meaning that plenty of smaller banks are holding participations in one bigger (central)-institution (non-technically a subsidiary of many parents). The idea of such structures is to maintain autonomous and independent on solo-bank level to the greatest possible extent.

Generally CRR and CRD IV consider such models of banking networks, concretely (and most important) in the type of an Institutional Protection Scheme (IPS). According to the CRR an IPS is a “contractual or statutory liability arrangement which protects those institutions and in particular ensures their liquidity and solvency to avoid bankruptcy where necessary.” (Art 113 para 7 CRR), established by a broad number of institutions with a predominantly homogeneous business profile. IPS’ seems attractive to smaller banks because they may stay in- dependent to a large extent and thus, additionally, gain big privileges in banking regulation.

The paper deals with the question whether IPS’ are sufficiently regulated by CRR and CRD IV, focusing on the topic liquidity and liquidity risk. As mentioned, the basic notion of Basel III focuses on banking groups, not on banking networks and by no means on IPS.1 This raises the question whether the scope and content of the European regulations regarding liquidity risk deals with networks of banks, especially IPS, in an appropriate manner. Note that the issue of the regulation of decentralized sectors and of IPS’ is highly political. However, this paper does not elaborate an analysis of the ongoing political debate and lobbying concerns.

Thus, the paper on hand explains the approach of the European legislator of “Regulating Liquidity Risks within ‘Institutional Protection Schemes’”. From a structural perspective, this paper provides an overview about the basic notion of the Basel-Accord and its European implementation. In order to better understand the issue of liquidity regulation, this paper also grants an analysis of the specific categories of liquidity and liquidity risk. Central elements of the paper are the definition and further explanation of the specific structure and connected regulatory privileges concerning Institutional Protection Schemes and the mapping of the main issues of Euro- pean liquidity regulation, including pillar I (CRR), pillar II (CRD IV) and systemic liquidity regulation oppor- tunities, as well as supervisory powers referring to liquidity regulation and systemic risk.

2. Overview: Liquidity Regulation under “Basel III”

Today’s banking supervision is mainly driven by globally agreed standards. In order to better understand the current framework of European regulatory legislation, especially regarding liquidity regulation, the following achievements describe the evolution of the Basel Accord and underline the origin of the liquidity regulation stated now in CRR.

2.1. The Basel Accord

The term Basel Accord can be defined as the comprehensive documentation of recommendations and standards issued by the Basel Committee of Banking Supervision (BCBS). The BCBS is the most important standard-setter in the field of prudential banking supervision on a global level. The primary objective of the BCBS’ recommen- dations is to strengthen banking regulation as well as to enhance supervisory cooperation in order to support fi- nancial stability (Charter of the BCBS, 1 ff). Established in 1974, the BCBS published a comprehensive set of proposals within the framework of banking supervision (Larson, 2011: p. 5), the most crucial recommendations were disclosed under the notation “Basel I” (BCBS, 1988), “Basel II” (BCBS, 2004) and finally “Basel III” (BCBS, 2010).

Within the framework of Basel I, the notion of a minimum capital requirements (8%) calculated via (credit risk) risk-weighted assetswas introduced (BCBS, 1998: p. 14). Basel II further developed the notion of Basel I (Nowak, 2011: p. 22), particularly through complementing the existing framework (BCBS, 2004: p. 3 ff) by a second (Internal Capital Adequacy/Supervisory Review Process) and third pillar (market discipline; Larson 2011: p. 15). Under pillar III, institution has to disclose most important facts about their risk situation and methods of calculation (BCBS, 2004: p. 175 ff; Blundell-Wignall/Atkinson, 2010: p. 2). In contradiction to pillar I (capital requirements) the requirements according to pillar II (BCBS, 2004: p. 158 ff) provides more flexibility to the supervised entities (Internal Capital Adequacy) and the regulator (Supervisory Review Process). While pillar I generally requires the same set of minimum standards to all institutions (e.g. minimum capital of 8%), pillar IIforces institutions to a higher self-assessment of risks and coverage (e.g. “ICAAP”), supervised on ongoing basis by the regulator (SREP—Supervisory Review Process).

All threepillars have been reviewed and complemented since 2006. The latest developments within the Basel Accord are called “Basel III” (Larson, 2011: p. 2). Among others, as a lesson learned from the financial crisis (Nowak, 2011: p. 10), the issue of liquidity risk was broadly integrated in all three pillars of the Basel Accord (BCBS, 2011: p. 8 ff).

However, the recommendations issued by the BCBS are not legally binding (Larson, 2011: p. 6). Thus in Europe, the implementation of the Basel Accord follows the standard procedure of legislation according to Art 114 TFEU.

2.2. The Financial Crisis—Basel III

The global financial crisis, which first rose in the US, hit the European economy and the financial intermediates to a large extent. Politicians as well as regulators reacted in many ways, particularly in the area of adapting the respective—but yet not harmonized—banking regulations. In 2009 the BCBS unveiled its proposals for a mate- rial adoption of the Basel Accord-framework (Nowak, 2011: p. 4) with the aim of “strengthening the resilience of the banking sector” (“Basel III”) and comprehensive recommendations regarding to Liquidity risk manage- ment for banks. In succession the G20-leaders decided in 2010:

“We endorsed the landmark agreement reached by the BCBS on the new bank capital and liquidity framework, which increases the resilience of the global banking system by raising the quality, quantity and international consistency of bank capital and liquidity, constrains the build-up of leverage and maturity mismatches, and introduces capital buffers above the minimum requirements that can be drawn upon in bad times” (G-20, 2010: p. 7).

The Basel III-recommendations include a comprehensive set of adjusted and new provisions (Nowak, 2011: p. 22 ff) particularly regarding capital (stricter definition of eligible capital instruments, new composition of the eligible capital basis), capital buffers (introduction of a buffer-regime including a capital conservation buffer, a countercyclical buffer and a buffer concerning SIFIs—Systemically Important Financial Institutions)2, internal governance and remuneration (fit & properness of the management body, oversight of remuneration policies), leverage (introduction of a leverage ratio to minimize pro-cyclical effects), systemic risks (introduction of a SIFI-regime and respective supervisory measures to address systemic risks) and liquidity (introduction of two liquidity ratios).

2.3. Liquidity Regulation under Basel III

Indeed the necessity of sound liquidity risk management did not appear during the crisis of 2007/8 at first. Given that maturity transformation, and therefore liquidity risk, lies at the core of banking risks, the BCBS early under- lined the importance in the supervision of this specific issue (BCBS, 1992). Over the years the BCBS’ recom- mendations referring to liquidity risk management became more comprehensive and granular (see particularly BCBS, 2000; BCBS, 2008). Thus the supervision of liquidity risks under pillar II were agreed on global level (“Basel 2.5”; BCBS, 2008a; BCBS, 2008b). In Europe, the Committee of European Banking Supervisors (CEBS) adopted this idea, issuing Recommendations on Liquidity Risk Management (CEBS, 2008) for the European banking market. After two further guidelines, namely the Guidelines on Liquidity Buffers & Survival Periods (CEBS, 2009), the Guidelines on Liquidity Cost Benefit Allocation (CEBS 2010) and the second adoption of the CRD (Directive 2009/111/EC-“CRD II”) the notion of liquidity risk as pillar II-risk was implemented through the EEA.

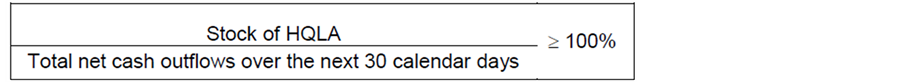

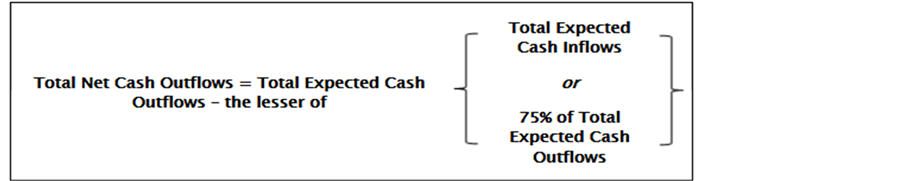

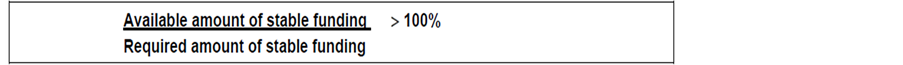

In additional precision to the adoptions mentioned above, the BCBS extended its liquidity framework by de- veloping two minimum standards for short-term and funding liquidity. These two standards have been devel- oped to reach two separate—but complementary—aims. The first objective is to enhance short-term resilience of a bank’s liquidity risk profile by ensuring that it has sufficient high quality liquid assets (HQLA) to survive a significant one-month-stress scenario (Blundell-Wignall/Atkinson, 2010: p. 17): The so called “Liquidity Cov- erage Ratio” (LCR).

The second goal is to strengthen resilience over a one-year-time horizon by establishing additional incentives for banks to fund their activities with more stable sources of funding (Blundell-Wignall/Atkinson, 2010: p. 18): This is the “Net Stable Funding Ratio” (NSFR). This latter ratio has been developed to provide a sustainable maturity structure of assets and liabilities. In July 2011 the European Commission proposed to implement Basel III via two legal acts: The Capital Requirements Regulation (“CRR”), including the LCR and the NSFR (Pillar I), and the adopted Capital Requirements Directive (Directive 2013/36/EU-“CRD IV”), including adjusted pro- visions regarding to liquidity risk management (Pillar II). Bythe 1st of January 2014 the new liquidity regula- tions entered into force.

3. Definitions of “Liquidity” and “Liquidity Risk”

In terms of banking regulation, it must be concretely clear which specific risk is regulated by which kind of measures or ratio in order to effectively address problems in an early stage. Thus in the following, the terms li- quidity and liquidity risk should be defined and further distinguished.

3.1. Basics

Defining the terms Liquidity and Liquidity risk is not an easy task. In contrast to other types of financial risks (e.g. market risk, credit risk, systemic risk, etc.) there is no common and straight legal definition on European level concerning liquidity or liquidity risk. However, specific provisions in CRD IV and CRR are determining requirements to credit institutions referring to manage liquidity risk. In order to better understand these issues. Further information and proposals for definitions could be found in the literature.

In general the idea of liquidity refers to the “ability of an economic agent, to exchange his or her existing wealth for goods and services or for other assets” (Nikolaou, 2009: p. 10). So in first, liquidity should be under- stood as a concept of flows (and not stock), second on the ability to realize this flows (make assets to cash for example). Consequently liquidity risk normally is based in a situation where there is no or limited opportunity (or only with inappropriate cost) to realize flows.

According to Nikolaou (2009) three types of liquidity, and therefore liquidity risks, should be differentiated: central bank liquidity, market liquidity and funding liquidity (Nikolaou, 2009: p. 10). In order to focus more on liquidity regulation under Basel III in reaction to the current financial crisis, it makes sense to concentrate on this clear tripartite categorisation and argue which are the main elements of these types of liquidity and finally assesswhat are the key risk drivers and how these risks are linked. In the following some recent literature (e.g. Nikolaou, 2009; Bervas, 2009) and classic definitions (Hicks, 1936; Keynes, 1936) will be explained and high- lighted.

3.2. Central Bank Liquidity (Risk)

Because of its specific importance for the financial system it should be expressed that the mandate of central banks to provide the financial market with sufficient liquidity in line with its concrete policy stance can be seenas the origin of modern notions of liquidity and liquidity risk. Without the existence of base money (M-zero does include banknotes in circulation and credit institutions reserves with the central bank, liability-side of the central bank’s balance-sheet; OECD, 1971; p. 109) there would be no currency, therefore no liquidity and con- sequentially no liquidity risk in the financial market (Affinito, 2013; p. 4). Thus there is a fundamental reliance of credit institutions to the central bank (Bindseil, 2013; p. 4; Berrospide, 2013; p. 8) because of the inherent li- quidity deficit in financial markets, arising from the need for banknotes and the minimum reserve requirement in line with monetary policy (Nikolaou, 2009; p. 12). Liquidity is provided by the central bank via open market oper- ations (asset-side of the central bank’s balance sheet), in order to approximate the lending rates in the (short- term) interbank-market to the concrete target policy rate (Nikolaou, 2009: p. 12).

Central bank liquidity risk is a very special case, particularly rare in industrialized countries. From the per- spective of the lender of first and last resort as the monopole of liquidity provision, a central bank formally can- not be illiquid in a narrow sense. The only way a central bank could be illiquid in a broader sense would be situation where there is no (more) demand on domestic currency (e.g. hyperinflation, exchange rate crisis) and therefore the central bank cannot fulfil its mandate in ensuring price stability. However, focussing on the pure ability to provide liquidity there is no limitation to the central bank even in these cases (Nikolaou, 2009: p. 16).

3.3. Market Liquidity (Risk)

In common market liquidity is defined as the “ability to trade an asset at short notice at low cost and with little impact on its price” (Nikolaou, 2009: p. 14). In more basic terms, assets may be considered as liquid if they are easily and immediately convertible into cash with little or no loss of value (EBA, 2013a: p. 15).

Obviously the quality of liquidity of diverse assets differs in a very broad range and among various dimen- sions, which means that liquidity is a relative concept (Bervas, 2009: p. 64; Keynes, 1936: p. 86) and therefore difficult to measure and quantify. Generally market liquidity usually is measured under the notion of different dimensions, e.g. tightness, market depth and resilience (Bervas, 2009: p. 65). Tightness measures the cost of a reversal of position at short notice for a standard amount (tightness of the bid-ask-spread; CEBS, 2009: p. 24), market depthcorresponds to the volume of transactions that may be immediately executed without slippage of best limit prices, and resiliencerepresents the velocity in which prices revert to their equilibrium level following a random shock in the transaction flow (Bervas, 2009: p. 65). More concretely EBA measured the liquidity of different asset classes under a broad set of methods, i.e. price impact, bid/ask-spread, trading volume and turnover, zero-trading day and volatility (EBA, 2013a: p. 15ff).

Consequently market liquidity risk is the risk of “not being able to immediately liquidate or hedge a position at current market price” (Bervas, 2006: p. 64). The liquidation of assets in short notice is not only important for banks which speculate with different asset- or currency-classes. Given that every business bank—because of its role as liquidity transformation intermediary—has a certain degree of liquidity risk, sufficient market liquidity can minimise funding stress, e.g. via generating additional liquidity out of assets in order to meet obligations when they come due. Therefore having sufficient market-liquid assets in the portfolio (Keynes, 1936: p. 86) is crucial for banks in order to decrease funding liquidity risks.

In the financial market, market liquidity risk should be priced in order to cover the underlying risks, namely asa cost or a premium of a specific asset or asset class (Hicks, 1936: p. 164). The higher the market liquidity risk, the larger should be the premium. Therefore the price of an asset reflects, among other parameters, liquidity costs, which are the symptom of liquidity risk (Nikolaou, 2009: p. 19). Given that a serious liquidity stress sce- nario is a very rare situation, in practice market liquidity risk is usually underestimated and therefore not ade- quately priced by the concerned market participants.

It should also be noted that market liquidity risk empirically shows the nature of having effects across differ- ent markets (region) and types of market (e.g. equities, bonds). Thus the liquidity of an asset can immediately change under various scenarios, i.e. fire sales of big asset amounts by other market participant (decrease of price), down-rating of the debt-issuer (decrease of credit quality), new rules and regulations (Liquidity buffer or collateral-basket non-eligibility), psychological effects (Keynes, 1936: p. 86) etc. On these grounds it could be concluded that market liquidity risk is strongly linked with systemic risks in general.

Mostly relevant referring to liquidity regulation in the banking sector are two types of market liquidity: li- quidity in the interbank market (liquidity is being traded among banks) and liquidity in the asset market (assets are being traded among financial agents; Nikolaou, 2009: p. 15). Both types have been addressed by the new li- quidity rules arising from Basel III.

3.4. Funding Liquidity (Risk)

Funding liquidity is the “ability to fund increases in assets and meet obligations as they come due” (BCBS 2008a: p. 2; Keynes, 1936; p. 59). In other words an institution is liquid “as long as inflows are bigger or at least equal to outflows (Nikolaou, 2009; p. 13). Mainsources of funding liquidityare funds from the depositors (sight or term deposits), the market (via the liquidation of assets or respectively selling, repurchasing, securitisation of assets), the interbank market (secured and unsecured) or the respective central bank (open market operations). Empirically the stableness of such funds broadly differs. Whereas retail deposits remain—even in times of stress (excluding the extreme scenario of a “bank run”; Shin, 2008: p. 4 ff)—usually for a long term, deposits granted by financial institutions are highly liquid and leave the bank very soon in a stress scenario. In the recent crisis for example, the drying up of the interbank market in 2007/2008 generated a systemic funding risk in consequence.

Following these assumptions funding liquidity risk is the “inability of a financial intermediary to service their liabilities as they fall due” (Nikolaou, 2009: p. 17). Credit institutions are strongly dependent from (more or less) stable funding sources, such as retail deposits and the secured interbank market. In situations when depositors worry about the solvency or liquidity of the respective credit institution, funding sources may suddenly may got lost: Retail clients claim their deposits back (“bank run”; Shin, 2008: p. 4 ff) or do not roll-over, partner-banks cut off liquidity and credit lines, etc.

Given that the potential sources of funding liquidity are very heterogeneous and differ in their risk-averseness, the measurement of funding liquidity risk is challenging. Usually three types of metrics are used to measure funding liquidity risk (Nikolaou, 2009: p. 17): static balance sheet analysis (simple point-in-time backward look- ing approach), dynamic stress testing techniques (dynamic break down of inflows and outflows) and scenario analysis (complex assumption of different idiosyncratic, market and combined stress-scenarios).

Sometimes funding liquidity risk is designated as consequential risk because it usually follows the impact of other sources of banking risk, such as market risk (Matz/Neu, 2007: p. 4). As example, the raising of funds via the liquidation of assets suffers in times of market uncertainties when prices cannot be calculated transparently and big market participants leaving the market, letting the entire price-level of assets decrease.

3.5. Interim Conclusion

As liquidity is declared as the “lifeblood of financial institutions” (Harris, 2013: p. 179), so equally liquidity risks are endogenous to banking business (Nikolaou, 2009: p. 23). Nevertheless in smoothly functioning finan- cial markets liquidity stress is a rare scenario, which typically leads to the underestimation and lack of pricing of liquidity risks by market participants. The possible categorizationin three different types of liquidity and liquid- ity risk shows that liquidity depends on the concrete perspective, task and business model of the financial inter- mediary. While a central bank—as a monopolist of liquidity naturally immune against typical liquidity stress— provides a certain amount of liquidity that should balance demand and supply of liquidity, credit institutions, which gains profit via maturity transformation (taking short-term deposits and lending on long-term), may en- sure the efficient allocation of liquidity resources within the market. Market liquidity itself guarantees the (re-)distribution of liquidity, e.g. via securitisation of (illiquid) loans.

The different types of liquidity risks are closely linked (Affinito, 2013: p. 3). As we have seen above, market and funding liquidity are strongly connected, even their specific risks. Even the sources of liquidity risk are di- verse: e.g. fire sales of assets may lead to market disruptions and the drying up of market liquidity, and therefore increases funding risk. Reputational risks can lead to the drain of huge amounts of deposits, which may lead to fire sales in order to generate liquidity from assets. In liquidity-belongings a vicious circle of lacks of confidence may head to a systemic crisis, as seen in the years 2007-2009.

In general we may acknowledge that in incomplete markets, liquidity risks basically arise from the asymmetry of information between market participants (Nikolaou, 2009: p. 11). In the cases of market liquidity risks, busi- ness partners may have different views about the concrete pricing of an asset or portfolio, which market-wide leads to bigger bid-ask-spreads (CEBS, 2009: p. 24), higher volatility and decreasing liquidity of such assets. Furthermore funding stress also can be triggered by information asymmetry, i.e. when rumours damage the reputation of a still solventbank which potentially leads to a bank run.

4. Institutional Protection Schemes (“IPS”)

Institutional Protection Schemes (IPS) were mentioned in numerous provisions of the CRR. In 2006 originally establishedby the European legislator in order to harmonize the roles of conventional banking groups with de- centralized sectors within the framework of the calculation of risk weighted exposure amounts (Standardized Credit-Risk Approach; see Art 111 CRR et seqq), the importance of IPS are heavily increasing via CRR.

In the following it should be explained what type of banking network IPS’ exactly are, what are the require- ments to legally establish an IPS, which legal and consequences arise with the permission by the competent au- thority and finally, what could be specific liquidity risks within IPS.

The following achievements should be read within the assumption that institutions which are willing to estab- lish an IPS really and freely decide to enter an IPS as a—in contrast to banking groups and networks according to Art 10 CRR—relatively weak connection between institutions in order to stay autonomous to a high extent. This assumption is necessary in order to underline the specific differences between IPS’, banking groups and networks according to Art 10 CRR. This assumption is highly realistic because the supervisory approval ac- cording to Art 10 CRR does trigger much more privileges to the connected entities, e.g. an automatic capital- and solvency-waiver. So if member-institutions would agree with more strict rules, such in the case of Art 10 CRR, there won’t be a reason to apply a permission concerning Art 113 para 7 CRR (IPS), because the sample of privileges under Art 10 CRR is much broader. Consequently this paper claims that IPS-members attempt to stay as autonomous as possible under the IPS-framework (see Chapter 4.4).

4.1. Characterization

Within the framework of CRR, the term “IPS” (Art 113 para 7 CRR) is legally defined. According to Art 113 para 7 CRR an IPSis a

“Contractual or statutory liability arrangement which protects those institutions and in particular ensures their liquidity and solvency to avoid bankruptcy where necessary.” (Art 113 para 7 CRR).

The definition of an IPS clearly states the aim of the respective establishment, namely the financial protection of its members against insolvency and illiquidity (Blume, 2007: p. 98). As well as banking groups or other types of bank-networks, an IPS is not a legal entity but a civil law-arrangement between specific financial undertak- ings in order to mutually protect each other from financial stress situations (Stern, 2013: p. 207 ff). Although not explicitly mentioned in CRR, the provision of Art 113 para 7 CRR presumes the existence of a legal entity, which is ongoing responsible for the regulations referring to the established IPS (in the following: consolidating entity; Stern, 2013: p. 208), e.g. providing an IPS-risk-review (Art 113 para 7 point d CRR) and a consolidated report (Art 113 para 7 point e CRR). The being of a consolidating entity is also mentioned in Art 8 para 4 second sentence CRR (“Liquidity-Waiver”).

In addition to the closing of a liability arrangement, the establishment of an IPS finally depends on a prior permission granted by competent authorities according to Art 113 para 7 CRR. The requirements under which circumstances the respective competent authority is allowed to grant permission, are listed in the sub-paragraphs of Art 113 para 7 CRRand shall be explained in the following.

4.2. Requirements for the Establishment of an IPS

Art 113 para 7 CRR presents the legal requirements for the establishment of an IPS. The wording “competent authorities are empowered to grant provision” (Art 113 para 7 CRR) may let us assume that Art 113 para 7 points (a) to (i) CRR are minimum standards for the establishment of an IPS, and certain discretion is granted to competent authorities within the approval procedure framework (PRA, 2014).

4.2.1. Potential Members of an IPS (Art 113 Para 6 Point a and d, Para 7 Point a and h)

The Membership in an IPS is limited to undertakings which are an

“institution, a financial holding company or a mixed financial holding company, financial institution, asset management company or ancillary services undertaking subject to appropriate prudential requirements” (Art 113 para 6 point a, para 7 point a).

The sample of undertakings follows those categories of counterparties for which a zero-percent weighting within the framework of the Standardized Credit-Risk Approach (Art 111 CRR ff) can be granted. In practice the most usual participants of an IPS are institutions according to Art 4 No 3 CRR (credit institution or investment firm) and financial institutions according to Art 4 No 26 CRR (e.g. leasing companies, payment institution, financial holdings etc. See Annex I CRD IV).3

In further limitation of the IPS-membership only domestic undertakings can join an IPS (Art 113 para 6 point d, para 7 point a CRR). Therefore, IPS never can be established cross-border.Note that this does not hinder an indirect cross-border reference, i.e. if an IPS-member is a part of a cross-border banking group (e.g. parent in- stitution or subsidiary is located in other EEA- or Non-EEA-state).

Finally, Art 113 para 7 point h CRR states that the IPS “shall be based on a broad membership of credit insti- tutions of a predominantly homogeneous business profile” (Art 113 para 7 point h CRR). Point h apparently un- derlines the importance of banks being members of an IPS. Without a broad membership of credit institutions an IPS cannot be established. The term broad membership is not legally defined. Even it is not clear, to what extent a predominantly homogeneous business profile is sufficient in order to establish an IPS (Blume, 2007: p. 113 ff). Considering the aim of an IPS in order to protect its members from financial stress situations, a broad membership should ensure the diversification of individual risks and increase the common capital base on IPS-level. A predominantly homogeneous business profile of IPS-members has the advantage of (probably) more coherent risk measuring metrics on IPS-level, having in mind that the IPS-members generally faces similar financial risks (Blume, 2007: p. 113). Therefore the inclusion of a cross-border active investment bank within an IPS established by a small sample of conventional retail banks, generally is not approvable. Given that the IPS has only to be predominantly (and not fully) homogeneous, the bigger the sample of banks in the IPS gets, the more variance can be accepted by the competent authority (Stern, 2013: p. 207).

On the other hand, the requirement of a predominantly homogeneous business profiles accepts the likely cor- relation of risks within the IPS. Such correlating risks should be included in the risk management on IPS-level, as well as diversification factors.

4.2.2. Liability Arrangement

The members of an IPS have to establish a “contractual or statutory liability arrangement which protects those institutions and in particular ensures their liquidity and solvency to avoid bankruptcy where necessary.” (Art 113 para 7 CRR). From a contract-law perspective, such liability arrangements should be categorized as a continuing obligation contract. With exception of point fleg.cit, the CRR does not provide more concrete requirements about the content and conditions of the liability arrangement. Particularly Art 113 para 7 CRR does not deter- mine the specific point of time or trigger-event in which cases a support in order to ensure liquidity and solvency to avoid bankruptcy is necessary (IPS-trigger-event).

Art 113 para 7 point f CRR states that “members of the institutional protection scheme are obliged to give advance notice of at least 24 months if they wish to end the institutional protection scheme” (withdrawal-pro- vision; Art 113 para 7 point f CRR). The respective withdrawal-provision should avoid situations in which well capitalized banks worry about the solvency of other IPS-members and therefore would like to exit the IPS before the risks are realized and the well-capitalized bank would be faced by claims in order to transfer own funds or liquidity to the struggling bank (Blume, 2007: p. 109). From the opposite perspective, the withdrawal-provision should provide sufficient time to the remaining IPS-members in order to adjust the weakened IPS and its level of capital and liquidity. The being of a withdrawal-provision may let assume that IPS-members can also be dismissed from the IPS-membership within the same timeframe. This setting may arise when IPS-members breach fundamental provisions of the liability arrangement and therefore jeopardize the survival of the entire IPS.4

The CRR does neither fix any concretization about the extent of protection measures, nor specifications about trigger-moments (Blume, 2007: p. 102), especially when protection is finally necessary to avoid bankruptcy (early-intervention). Particularly questionable is, whether the arrangement has to include an unlimited right for each participant to claim for protection in a financial stress situation. Such unlimited rights might lead to unin- tended moral hazard incentives, because individual risks are covered by fully mutualized own funds or liquidity buffers. Such incentives may create an inappropriately increase of individual risk appetite (search for yield) in order to gain more individual profit, collateralized by IPS-funds. To avoid inappropriate moral hazard, supervi- sors usually accept the limitation of such liability arrangements to a certain extent (limited right to be supported), for example referring to concrete levels of supplementary payments by the IPS-members (e.g. maximum pay- ments are calculated on individual capital floors5) or individual risk-based payments on membership (e.g. calcu- lation on risk-weighted assets). The right of protection can also be contractually conditioned on individual be- haviour of the IPS-member, e.g. consideration of IPS-wide risk limitation (i.e. specific large exposure rules). Note that an unlimited right to claim protection could like lead to increased contagion risk within the IPS (Blume, 2007: p. 99) and would jeopardize the general aim of an IPS, namely the protection of members con- cerning the risks of insolvency and illiquidity.

However, even limited rights and potential payments in the case of a solvency or liquidity stress situation may hit an IPS and its members very hard. It should be underlined that an insolvency or illiquidity case within an IPS questions the efficiency of the respective IPS. In such situations competent authorities have to decide whether the granted permission must be rejected or not. Given the legal and economic consequences of the establishment of an IPS (see Chapter 4.3) such supervisory decisions are usually very tough.

4.2.3. Readily Available Funds (Art 113 Para 6 Point e, Para 7 Point a and b CRR)

The liability arrangement has to ensure that “the institutional protection scheme is able to grant support neces- sary under its commitment from funds readily available to it” (Art 113 para 7 point b CRR) and that within the IPS “there is no current or foreseen material practical or legal impediment to the prompt transfer of own funds or repayment of liabilities from the counterparty to the institution” (Art 113 para 6 point e CRR). Both require- ments are highly imprecise and practically difficult to proof. In each case, funds are used in order to protect other IPS-members. While para 6 point e leg.cit require a general free-flow of funds between IPS-members, para 7 point b par.cit directly address a certain time horizon in which funds are transferable (“readily available”). The requirement concerning the avoidance of legal impediments (para 6 point e par.cit) could only be met if the li- ability arrangement is sufficiently transparent in ruling issues when own funds and liquidity has to be transferred (triggers). Furthermore the liability arrangement shall not include any provision that contradicts other contrac- tual agreements between the IPS-members, such as contracts referring to the shifting of profits or cash pooling. Legal impediments can also arise from specific supervisory requirements, e.g. stricter regulations concerning concentration risks and large exposures. Material practical impediments may evolve from different sources, e.g. insufficient IT-support (Stern, 2013: p. 5). A generally low level of capital within an IPS does in any case let assume material practical impediments concerning the prompt transfer of own funds. Similarly insufficient liquidity buffers on solo-basis creates practical impediments in order to transfer liquidity.

Funds should only be considered as always readily available if the IPS have an exclusively access to funds dedicated to the aims of the respective IPS, namely the protection against bankruptcy of IPS-members (Stern, 2013: p. 4). In the end the IPS should have an own pool of assets and funding sources, provided by the IPS-mem- bers ex-ante (IPS-membership-fee). Given that IPS’ are not legal entities, the pool should be administrated by a specialized entity including an IPS-committee, which might be composited of representatives and risk-managers of the IPS-members. In order to avoid conflicts of interest such committees need strict governance-rules (Stern, 2013: p. 5).

4.2.4. Risk Management (Art 113 Para 7 Point c, d and i CRR)

Art 113 para 7 point c requires that the IPS

“disposes of suitable and uniformly stipulated systems for the monitoring and classification of risk, which gives a complete overview of the risk situations of all the individual members and the institutional protec- tion scheme as a whole, with corresponding possibilities to take influence” (Art 113 para 7 point c CRR).

In more abstract words, an IPS needs own risk management tools (Blume, 2007: p. 102 ff). The requirement to establish an IPS-risk management shows that the IPS shall not only operate in bankruptcy-cases but in preventive ways to avoid insolvency and illiquidity. Given that risk management requirements are a part of the Basel Pillar II-concept (Art 74 CRD IV et seqq), the minimum standards for risk management in banking groups should also be validfor IPS’ (see i.e. the Austrian implementation of Art 86 CRD IV et seqqvia § 3 and § 12 KI-RMV), namely for the responsible consolidating entity. However, in CRD IV IPS’ are not explicitly men- tioned in this regards.

Such risk management tools shall include opportunities for measuring financial risks on solo- and consoli- dated basis comprehensively. In addition the IPS “conducts its own risk review which is communicated to the individual members” (Art 113 para 7 point d CRR). Though a comprehensive monitoring of risks is crucial, an IPS also needs certain possibilities to take influence on individual members in order to minimize risks on IPS-level e.g. via setting of individual risk limitations. The wording “possibilities to take influence” is very soft, letting assume that such possibilities according to Art 113 para 7 CRR are not equal to the possibility to issue instructions to the management of institution according to Art 10 CRR (Rabobank; Stern, 2013: Footnote 11). So taking influence pursuant to Art 113 para 7 point c CRR can only be effective if certain sanctions were an- nounced, e.g. penalty payments or finally dismissing the IPS-membership.

Finally, competent authorities have to monitor the performing of the IPS-risk management on an annual basis (Art 113 para 7 point I CRR), e.g. via on-site-inspections. Given that a functioning risk management is approval requirement, material deficits in the risk-management can lead to the supervisory rejection of the permission.

4.2.5. Consolidation/Aggregation (Art 113 Para 7 Point e and g CRR)

Similarly to banking groups even IPS shall publish an annual financial report. However, in contrast to banking groups an IPS can choose whether it issues a consolidated or aggregated report (Art 113 para 7 point e). Both reports have to include the balance sheet, the profit-and-loss account, the situation report and the risk report, concerning the IPS as a whole (Blume, 2007: p. 105). While consolidation rules are broadly anchored in legal provision (see Art 11 CRR ff), there are no harmonized rules regarding aggregation, which probably might lead to problems in comparing the financial figures of different IPS’. Whatever type of report the IPS has chosen, a multiple gearing6 of own funds must be avoided (Art 113 para 7 point g CRR).

4.3. Regulatory Consequences Regarding the Establishment of an IPS

Members of an established IPS may obtain a broad amount of regulatory privileges, which can be listed as follows.

4.3.1. Waiver on the Calculation of Risk Weighted Exposure Amounts within the IPS (Art 113 Para 7 Crr)

Art 113 para 7 CRR is the central provision regarding the establishment of an IPS. Under the CRR-credit risk standardized approach (Art 111 CRR ff), institutions has to assign their exposures to specific exposure classes in order to calculate their concrete risk weighting. Generally exposures against other institution shall be weighted according to Art 119 CRR ff (minimum 20%). Within an IPS, members have the right to do not apply those weightings and instead of that, apply a 0%-percent weight, assuming that such exposures need not to be covered by own funds (Blume, 2007: p. 92).

4.3.2. Waiver from Specific Deduction Requirements (Art 49 Para 3 CRR)

According to the general CRR-own funds-approach, capital holdings in other institutions shall be deducted in order to minimize inappropriate contagion risk among the financial market participants (see Dellinger/Burger/ Puhm, 2011: p. 143 ff). In addition to the IPS-permission, institutions can seek approval in order to be waived from own funds deduction requirements within the IPS (Art 49 para 3 CRR). Permission may be granted by the competent authorities if the IPS ensures an appropriate own funds-level on consolidated basis according to Art 92 CRR et seqq, and guarantees that the multiple use of own funds-elementsis eliminated (Art 49 para 3 point v CRR).

4.3.3. Recognition of Minority Interest Arising Within the Cross-Guarantee Scheme (Art 84 para 6 CRR)

Under the CRR, minority interest within banking groups7 cannot fully be included in the consolidated calcula- tion of own funds. The own funds regime assumes that such minority holdings are not sufficiently suitable in order to absorb losses in times of crisis (Recital 38 CRR). In the special case that an IPS is a banking group at the same time8, the CRR allows the recognition of minority interest within a cross-guarantee scheme according to Art 4 No 127 CRR. In addition to the requirements in order to establish an IPS, the membership in across- guarantee schemecannot be withdrawn for a time horizon of ten years (“voluntary exit of a subsidiary”; Art 4 No 127 pointg CRR; Stern, 2013: p. 6). Furthermore the competent authority is explicitly empowered to prohibit an exit of a subsidiary from the cross-guarantee scheme (Art 4 No 127 point h CRR).

4.3.4. Waiver on Large Exposures (Art 400 Para 1 Point f CRR)

Art 395 CRR sets limits to large exposures in order to minimize concentration risks. Generally an institution shall not incur an exposure “to a client or group of connected clients the value of which exceeds 25% of its eli- gible capital” (Art 395 para 1 CRR). According to Art 400 para 1 point f CRR members of an IPS are waived from large exposure limits within the same IPS (Jergitsch/Motter/Siegl, 2010: p. 46).

4.3.5. Liquidity (Art 8 Para 4 and 5, Art 416 Para 1 Point f, Art 422 Para 3 and 8, Art 425 Para 4 Crr)

The liquidity regulations under the CRR mention the establishment of an IPS in many provisions. With the most serious consequences it should be underlined that members of an IPS, equally to subsidiaries in a banking group, can seek approval in order to be waived from the liquidity requirements on solo basis (“Liquidity-Waiver”; Art 8 para 4 CRR). Requirements to receive a liquidity-waiver are the fulfilment of the liquidity requirements accord- ing to Part 6 CRR (LCR, NSFR) on a consolidated basis, a sufficient level of liquidity including a free transfer of liquidity among IPS-members, and finally a guarantee that there are no practical or legal impediments to move liquidity within the IPS (Art 8 para 4 point a-d CRR).9

In the case that a liquidity-waiver according to Art 8 para 4 CRR is granted, the competent authorities may also decide to waive these privileged institutions from the liquidity risk-management requirements according to Art 86 CRD IV et seqq on solo basis (Art 8 para 5 CRR). Although not explicitly mentioned in CRR, it could be assumed from a systemic view (see Waiver-requirements in Art 10 CRR) that there has to be instruction rights in favour of the consolidating entity in order to monitor and limit liquidity risks centrally (Stern, 2013: p. 3).

Note that if approved by the competent authority, the regulator allows the respective credit institution to carry on business, even maturity transformation as a key element of banking business (BCBS, 2008a: p. 2), without quantitative (LCR, NSFR; Art 8 para 4 CRR) or qualitative (liquidity risk management; Art 8 para 5 CRR) li- quidity regulations on solo basis (Stern, 2013: p. 6).

If no waiver on solo-basis is granted, institutions may ask the regulator in order to formally recognize their specific business model and respective liquidity risk, for instance via the approval of privileged treatment of in- flows (Art 425 para 1 or 4 CRR) or outflows (Art 422 para 8 CRR).

Art 425 para 1 first and second sentence CRR (75%-cap-waiver) states that as a general rule, institutions shall only report capped liquidity inflows to the competent authorities. Capped inflows are inflows limited to 75% of outflows (Art 425 para 1 first and second sentence CRR).10 Some specific inflows are exempted from the capby the CRR. Most important to mention is the exemption of interbank deposits within banking groups according to Art 113 para 6 CRR (zero-percent-weighting) and IPS. The European legislator assumes, according to Art 113 para 6 point e, para 7 point a and b CRR, that—in this cases—are no legal or practical impediments for the free transfer of liquidity.

In addition to explicit CRR-exemptions, according to Art 425 para 1 last sentence CRR the competent au- thorities have the power to waive this cap in full or partially in favour of banking groups. Paradoxically this 75%- cap-waiver-procedure is not applicable for IPS. As a result, all inflows within IPS, with the exemption of inter- bank deposits and inflows explicitly mentioned in CRR (e.g. inflows from specific mortgage lending or promotional loans), shall always be capped by the reporting entity (BCBS, 2013: p. 34).

Art 425 para 4 CRR enable competent authorities to grant a privileged treatment of inflows regarding credit or liquidity facilities within IPS and banking groups (Stern, 2013: p. 4). As a general rule, the liquidity reporting of facilities follows an asymmetric approach, concrete manifested as 0%-inflow to the liquidity-receiver (“buyer” of facility; Art 425 para 2 point g CRR) but 100%-outflow to the liquidity provider (Art 424para 5 CRR).11 By way of derogation of the stated treatment and with permission granted by the competent authority, institutions may report higher liquidity inflows from credit or liquidity facilities if the institution can ensure that there are “reasons to expect a higher inflow even under a combined market and idiosyncratic stress of the provider” (Art 425 para 4 point a CRR). In practice, such evidence is hard to adduce, particularly for institutions which never were really hit by a liquidity stress event and therefore have no practical experience with a stress-scenario.

One more requirement according to Art 425 para 4 CRR is remarkable: In order to get an approval for privi- leged liquidity inflow treatment, the liquidity provider has toapply (diverging from Art 422, 423 or 424 CRR) a corresponding symmetric or more conservative outflow from the facility. As a result this means that the permis- sion of the privileged treatment according to Art 425 para 4 CRR does also depend on the reporting behaviour of the counterparty(!)

Inversely Art 422 para 8 CRR states a privileged treatment for other outflows that do not fall under Art 422 para 1 to 5 CRR (Art 422 para 7 CRR). Notably Art 422 para 1 to 5 CRR does mention the most important li- quidity outflows, e.g. secured lending and capital market-driven transactions (0% - 100%), depositor in order to obtain clearing, custody or cash management (5% - 25%), outflows from the legal or statutory minimum deposit within an IPS (25% - 100%), excluding additional outflows from derivative contracts (Art 423 CRR) and credit or liquidity facilities (Art 424 CRR).Therefore it is questionable, which other outflows Art 22 para 7 CRR really means. Most important outflows which are not mentioned in Art 422 to 422 CRRare outflows from unsecured lending (BCBS, 2014: p. 27).

In practice it is likely that the permission according to Art 422 para 8 CRR will be addressed overwhelmingly for unsecured lending outflow issues.

Finally, Art 416 para 1 point f CRR recognizes

“legal or statutory minimum deposits with the central credit institution and other statutory or contractually available liquid funding from the central credit institution or institutions that are members of the network referred to in Article 113(7), or eligible for the waiver provided in Article 10, to the extent that this funding is not collateralised by liquid assets” (Art 416 para 1 point f CRR)

as a potential categoryof HQLA. Given the fundamental Basel-approach of minimizing interbank-dependence (IMF, 2013: p. 16), the Recognition of such interbank deposits or other interbank-funding sources as HQLA is astonishing and will be discussed in Chapter 6.2.

4.3.6. Internal Governance (Art 91 CRD IV)

Beyond the capital and liquidity regulations according to CRR, the CRD IV introduced specific regulations re- ferring to the internal governance of credit institutions. Beside qualitative requirements concerning the effec- tiveness of the credit institutions organisation (Art 88 CRD IV), the fitness and properness of the management body (Art 91 para 7 CRD IV) and the avoidance of conflicts of interest (Art 88 para 1 CRD IV), Art 91 para 1 CRD IV states that “all members of the management body shall commit sufficient time to perform their func- tions in the institution” (Art 91 para 1 CRD IV) and limits the number of executive and non-executive director- ship in a quantitative way (Art 91 para 3 CRD IV).12 By derogation of this limits, members of the management body within IPS or banking groups may count all their (executive or non-executive) directorships within the IPS as one single directorship (Stern, 2013: p. 7). Notwithstanding this derogation it should be noted that in any case members of the management body has to commit sufficient time to perform their functions (Art 91 para 2 CRD IV).

4.3.7. Clearing

The EMIR13 sets

“clearing and bilateral risk-management requirements for over-the-counter (‘OTC’) derivative contracts, reporting requirements for derivative contracts and uniform requirements for the performance of activities of central counterparties (‘CCPs’) and trade repositories” (Art 1 para 1 EMIR).

according to Art 4 para 1 EMIR financial counterparties shall basically clear all OTC derivative contracts. Among other transactions, intragroup transactions corresponding to Art 3 EMIR are exempted from the clearing obligations (Art 4 para 2 EMIR), while Art 3 para 3 point b EMIR recognizes transaction between members within the same IPS as intergroup transactions and there waive members of an IPS from clearing obligations (Stern, 2013: p. 7).14

4.4. Differences to Banking Groups or Networks According to Art 10 CRR

In conventional banking groups one or more institutions are controlled by a parent institution, namely a parent credit institution, a financial holding or mixed financial holding company (Art 11 CRR ff). In its role as parent institution the controlling company has significant influence over the subordinated entities, e.g. via the power to nominate one or more members of the management board and, reciprocally, the power to revoke such nomination. More strictly the central institution of a network according to Art 10 CRR (credit institutions permanently affiliated to a central body) has the power to issue concrete instructions against the credit institutions permanently affiliated (Stern, 2013: p. 2013). Therefore subordinated and permanently affiliated institutions regularly have strongly limited autonomy concerning their business strategies and decisions. Contrary to this, members of an IPS stay autonomous to a large extent (Stern, 2013: pp. 211-213). As mentioned above, the risk management system of IPS just has to ensure that there are certain possibilities to take influence on individual members. From a systemic view, such possibilities to take influence cannot have the same quality as instructions according to Art 10 para 1 CRR, because permanently affiliated credit institutions, in return, are waived from banking regulations, reconciling the fact of limited independence.15

As a result, IPS’ are not networks of banks which were centrally and governed and controlled like banking groups or networks according to Art 10 CRR. The power of the consolidating entity is limited to monitor the member’s activities and taking influence, not issuing instructions, when members are likely to breach the terms of the respective liability arrangement or other aims of the IPS.

Equally to banking networks according to Art 10 CRR, IPS’ has to ensure the ongoing solvency and liquidity of its members. This point is a major difference to banking groups, where the parent institution usually does not have an obligation to protect the subordinated entities16 and, in the last resort, may write-off the assets book value of the subsidiary.

In contradiction to banking groups and banking networks according to Art 10 CRR (Rabobank; Stern, 2013: Footnote 11), IPS’ are not directly addressed by European regulations. While banking groups and banking net- works according to Art 10 CRR are required to fulfil banking regulations, such as requirements concerning own funds, large exposures, liquidity, leverage and disclosure (parts 2 to 8 CRR), on a consolidated basis (Art 10 para 1, Art 11 para 1 and 3 CRR), IPS’ do not have to meet any specific CRR-requirements (pillar I and III) on a consolidated level (Stern, 2013: p. 8). Even in CRD IV (pillar II), IPS are not explicitly mentioned.17

Given the aim of the establishment of an IPS to protect members from financial hazard, its respective regula- tory consequences, and further the concrete requirement in Art 113 para 7 point e and g CRR (consolidated or aggregated financial report), the decision of the European legislator not to extend regulations referring capital and liquidity to IPS is remarkable and hard to understand from a prudential perspective.

4.5. Specific Issues of Liquidity Risks within IPS’

Given that an IPS, equally to a banking group, is not a legal entity and therefore has no assets or liabilities, an IPS itself never can be hit by liquidity risks. So the debate about liquidity risks within an IPS always addresses the members of an IPS, which naturally are banks with a predominantly homogeneous business profile (Art 113 para 7 point h CRR), and particularly the consolidating entity as—in most cases—responsible institution.18

As discussed above, the connection of liquidity risk and banking business is inextricable. Every IPS-member has certain funding needs and therefore has to face liquidity risks, at any time on solo basis, even though differ- ent shape. Special challenges may occur to the consolidating entity as responsible unit in order to protect the members of the IPS.

Considering the aim of an IPS, namely ensuring the solvency and liquidity of its members at any time in order to avoid bankruptcy (Art 113 para 7 CRR), an extraordinary situation occur: Numerous credit institutions com- mit themselves to protect other members, concretely fund them (via transfer of own funds or liquidity), if neces- sary to avoid bankruptcy of the latter. Generally, a big figure of participating institutions may ensure a certain level of risk-diversification which can minimize the specific risk to each single participant. In a perfect world, funds can be transferred to the entity where most liquidity is needed, and may balance the demand within the en- tire IPS. However, the financial crisis has shown how quickly liquidity may dry up, even between strongly con- nected entities. In a stress-scenario, the risk of becoming illiquid always concerns the solo-entity as a legal per- son, therefore enhance incentives to hoard liquidity (Berrospide, 2013: p. 4) when funding is most needed by other struggling entities, even IPS-members.

So the relationships within an IPS can be seen from, at minimum, two perspectives: From the IPS-perspective (members of the IPS which are potentially asked for support) and the struggling institution-perspective (member who may ask for support). Irrespective of the economic situation of the respective IPS-member (e.g. current level of capital and liquidity, profitability, risk appetite, etc.), every struggling IPS-member has the formal legal right to ask for IPS-support if it is necessary to avoid bankruptcy. This may generate a moral hazard-situation within the IPS, because every member recognizes its legal right to ask for support at any time if necessary. As mentioned above, the holding of liquid assets is expensive for banks, because such assets regularly are yielding low. The expectation of IPS-support may create incentives to members to hold more high yielding assets rather than highly liquid assets in their portfolio in order to increase their profitability, but simultaneously increase their liquidity risk on solo basis and consequently elevate the liquidity risk of the entire IPS because of a mini- mized counterbalancing capacity (liquidity buffer) on IPS-level.

Anyway, the IPS-members have to acknowledge that they may suffer a liquidity outflow if another IPS- member struggles and become likely to fail (IPS-perspective). Depending on the concrete internal structure of the respective IPS, such outflows were manifested either as balance-sheet item (liability, e.g. membership pay- ment to an IPS-liquidity buffer on consolidated level), off-balance-sheet items (contingent liability, e.g. guaran- tee) or both (e.g. in a situation when the IPS-liquidity buffer on consolidated level is insufficient big or liquid to take measures against the respective liquidity stress-scenario, the IPS-liability agreement may claim additional contributions in order to refill the liquidity buffer). From this view, IPS-members are not only vulnerable because of their own liquidity risk but also being potentially directly hit by a liquidity stress-scenario which arises from another IPS-member. Such liquidity risks normally has to be priced, e.g. via shifting the costs of holding a liquidity buffer (opportunity costs) or via calculating a fee referring to the use of a liquidity facility. Within an IPS, the pricing of such liquidity risks does only play a subordinated role because of the fundamental aims of the IPS in order to avoid illiquidity of the IPS-members. Consequently liquidity risk should be centrally monitored and consistently priced within an IPS (see Art 113 para 7 point c CRR in connection with Art 86 para 1 CRD IV) in order to avoid underestimation of liquidity risks. It should be underlined that such centralization of liquidity risk management should not lead to situation whereas IPS-members fully give up their responsibilities in order to limit liquidity risks. Particularly it should be avoided that the consolidating entity (or the central institution) has to play the role as a lender of last resort within the IPS.19

Notably an IPS-trigger-event may create additional contagion risk within the IPS (BCBS, 2008: p. 17). This contagion risk may also be amplified by the fact that IPS-members are active within a predominantly homoge- nous business model (Art 113 para 7 point h CRR), which means that IPS-members face correlation risks to a greater extent (e.g. second round effects from a credit crunch, O’Grady, 2008).

In order to protect one or more members, and bringing them back to adequate levels of capital and liquidity, the supporting members were weakened by the trigger-event. Such weakening may activate a new IPS-trigger- event as second round-effect, starting a vicious circle of decreasing support-opportunities and increased prob- ability of new trigger-events. At the end, the economic and legal survival of the entire IPS would be jeopardized.

So obviously one single extraordinary event can trigger disastrous consequences and may heavily hit an IPS and its members. Therefore it seems that the establishment of an IPS’ creates a specific type of systemic liquid- ity risk. Single IPS-members may endanger the existence of the whole IPS, particularly in the case if they are “too big” or “too embedded/to interconnected” (Espinosa-Vega, 2009; BCBS, 2014: p. 1) to fail.

4.6. Interim Conclusion

The achievements above presented a brief overview about the notion and structure of IPS’, including the differ- ences to conventional banking groups, the regulatory privileges for IPS and the specific liquidity risks within this network. It also shows the extraordinary complexity of such banking networks which constitutes challenges to both, participating members of the IPS, and the regulator. Naturally the role of the regulator is not limited to the granting of the final permission to establish an IPS. On the one hand, the risk management systems of IPS’ have to be audited on an annual basis. On the other hand, and more awkward, it is questionable how supervisors should behave in the case of IPS-trigger-events, especially if the IPS-funds are not appropriate to ensure liquid- ity and solvency at any time.

Given the broad number of regulatory privileges to the members of an IPS, the withdrawal of the IPS-per- mission can hit the whole banking network very hard. In most cases the own fund requirement would suddenly increase because of the abolition of privileges referring to deduction, minority interest and large exposures. Fur- thermore a potential liquidity-waiver to the members has to be retreated by regulator, given that an IPS is the fundamental requirement for a waiver-approval. Considering that an IPS includes a broad number of credit in- stitutions, the withdrawal of the IPS-permission may also generate huge exogenous effects to other market par- ticipants, particularly increasing their risk weight of assets because of potential down-rating or, in the case of insolvency of an IPS-member, asset write-offs, which may start a new exo- or endogenous vicious circle.

So both sides, IPS-members and regulators, should avoid—as far as possible—the withdrawal of an IPS- permission in order to minimize systemic risks in the financial sector. From this perspective it can be assumed that sufficient liquidity regulation of IPS’ are crucial in order to ensure stability to the financial market as a whole. The following chapters should elaborate the most important issues of liquidity risk regulation under the CRR and the CRD IV referring to the specific risk within IPS’.

5. CRD IV: Requirements on Liquidity Risk Management

Requirements for risk management are an elemental part of the Basel Pillar II-approach (internal capital ade- quacy, supervisory review process). In essence, under Pillar II, credit institutions have to sufficiently measure, monitor, limit and cover their banking risks (ICAAP, risk management, ILAAP). The competent authorities are responsible for the ongoing supervision of the banks risk management mechanism.

Since the second adoption of the CRD via CRD II (Directive 2009/EU) credit institutions are required to fulfil specific minimum standards referring to their liquidity risk management. The basic notion for the Annex V No 14 - 22 CRD (Liquidity Risk Management) was established by the BIS-paper Principles for Sound Liquidity Risk Management and Supervision (BCBS, 2008b).

Under CRD IV, the requirements were integrated into Art 86 CRD IV. Therefore the minimum requirements on liquidity risk management still demand transposition into national law. However, considering the European focus on this paper, the following achievements concentrate on the minimum standards anchored in CRD IV, not on their respective national transpositions.

5.1. Legal Basics & Scope

According to Art 74 para 1and 2 CRD IV credit institutions shall have

“[…] robust governance arrangements, which include a clear organisational structure with well-defined, transparent and consistent lines of responsibility, effective processes to identify, manage, monitor and report the risks they are or might be exposed to, adequate internal control mechanisms, including sound administration and accounting procedures, and remuneration policies and practices that are consistent with and promote sound and effective risk management” (Art 74 para 1 CRD IV).

Thus Art 74 CRD IV is the fundamental requirement regarding the implementation of risk management me- chanisms within credit institutions. As a general principle, the risk management function of a credit institution has to be “comprehensive and proportionate to the nature, scale and complexity of the risks inherent in the busi- ness model and the institution’s activities” (Art 74 para 2 CRD IV). This proportionality approach should meet concerns regarding the differences in—among others—business models, sizes of balance sheets and specific risk exposure.

Concrete specifications of the content and processes of risk management were anchored in Art 76 to 95 CRD IV, which include the technical criteria concerning the organisation and treatment of risks (Art 76 CRD IV et seqq), particularly regarding to internal approaches for calculating own funds requirements (Art 77 CRD IV), the treatment of Credit and counterparty risk (Art 79 CRD IV), Concentration risk (Art 81 CRD IV), Market risk (Art 83 CRD IV) and Liquidity risk (Art 86 CRD IV). Further concretisation of the CRD IV-risk management requirements has to be provided by EBA via Guidelines (Art 74 para 3 CRD IV).20 In the context of liquidity risk management, CEBS (as the predecessor of EBA, Art 8 para 1 point l EBA-R) have already issued two cru- cial Guidelines. First, the CEBS Guidelines on Liquidity Buffers & Survival Periods (CEBS, 2009) and second, the CEBS Guidelines on Liquidity Cost Benefit Allocation (CEBS, 2010). Both Guidelines are still valid. Ac- cording to Art 16 para 3 EBA-R supervisors and credit institutions have to comply with Guidelines issued by CEBA/EBA or, in the case of non-compliance, shall inform the concerned regulator in order to state the rea- sons for non-compliance (Art 16 para 3 EBA-R).21 Therefore the named Guidelines are important in order to in- terpret the requirements coming from Art 86 CRD IV.

Basically all institutions have to fulfil the minimum standards for risk management both on solo and group level (Art 109 CRD IV). However Art 109 para 1 CRD IV states that competent authorities are allowed to waive the respective risk management requirements on solo-level when Art 7 CRR (“Solvency-Waiver”) applies.

Remarkably Art 109 para 1 CRD IV speaks of the entire (Title VII Chapter 2) Section II CRD IV which in- cludes the technical criteria for the treatment of all significant types of banking risks, including liquidity risk. The inclusion of a waiver referring to liquidity risk management requirements in linkage with the Solvency- Waiver seems systemically irrational. On the one hand, the notion of Basel III (and its implementation via CRR and CRD IV) assumes that liquidity risks cannot be fully captured by own funds requirements (BCBS, 2008b: p.6), on the other hand the opportunity to waive liquidity risk management requirements was explicitly fixed in Art 8 para 5 CRR, connected to the provisions concerning the Liquidity-Waiver (Art 8 CRR). The crucial difference between Art 109 para 1 CRD IV, which refers to Art 7 CRR, and Art 8 para 5 CRR is the possible scope of application. While Art 7 CRR affects only banking groups, Art 8 CRR also concerns IPS’.22

5.2. Minimum Standards Concerning Liquidity Risk Management

While most Pillar II-regulations in CRD IV (i.e. credit risk, market risk, etc) are (naturally23) vague formulated, the provisions regarding liquidity risk management are extensive and concrete. Moreover, the respective word- ing of CRD IV addresses the competent authorities as responsible supervisor to ensure compliance of the super- vised entities with regulatory standards, and do not directly concern credit institutions. Only via transposition of CRD IV into national law the credit institutions were required to comply.24 The following achievements high- light the specific provisions listed in Art 86 CRD IV (Liquidity risk).

5.2.1. Liquidity Risk Policy and Strategy (Para 1, 2 and 7)

Institutions are required to have

“robust strategies, policies, processes and systems for the identification, measurement, management and monitoring of liquidity risk over an appropriate set of time horizons, including intraday, so as to ensure that institutions maintain adequate levels of liquidity buffers” (Art 86 para 1 CRD IV).

These strategies have to take into account all business lines, currencies, branches and legal entities (Art 86 para 1 CRD IV; CEBS, 2009: 11 para 42).

The committed risk tolerance has to be communicated to all relevant business lines (Art 86 para 2 last sen- tence CRD IV), which clearly illustrates that limitations of liquidity risks (as outflow from the entre institutions risk appetite approach, CEBS, 2009: p. 3) directly concerns the business divisions of an institution, not only in- ternal control mechanisms. In order to effectively communicate the banks risk appetite, a liquidity risk manage- ment mechanism always shall include concrete limits of liquidity risk and risk mitigation tools (Art 86 para 7 CRD IV; CEBS, 2009: p. 22 para 9).

Following the general proportionality-approach (CEBS, 2009: p. 6 para 14), the liquidity risk management systems shall be proportionate to the “complexity, risk profile, scope of operation of the institutions and risk tol- erance set by the management body and reflect the institution’s importance in each Member State in which it carries out business” (Art 86 para 2 CRD IV; CEBS, 2009: p. 18).

The minimum standards underline the importance of a functioning systems concerning the allocation of li- quidity costs, benefits and risks (Art 86 para 1 last sentence CRD IV; CEBS, 2010a).

5.2.2. Liquidity Buffer (Para 1, 2 and 6)

The liquidity risk management mechanisms has to “ensure that institutions maintain adequate levels of liquidity buffers” (Art 86 para 1 CRD IV).The CEBS Guidelines on Liquidity Buffers & Survival Periods (CEBS, 2009) defines the term liquidity buffer as follows: “A liquidity buffer is defined as the short end of the counterbalanc- ing capacity under a ‘planned stress’ view” (CEBS, 2009: para 4)25. Thus, a liquidity buffer has to ensure that the institution is able to withstand a liquidity stress for a period of at least one month without changing their business models (CEBS, 2009: p. 3 para 1). In order to fulfil this task, a buffer has always to be of sufficient size (certain amount of liquid assets) and available in a very short period of time to meet the stress scenario within the survival periods (CEBS, 2009: p. 3 para 37). Therefore, the calculation and set-up of the liquidity buffer al- ways have to consider the results of internal (Art 86 para 9 CRD IV) and external (e.g. EBA-stress-test) stress- testing.

Concerning the quality of the buffer, institutions have to ensure that the composition of the buffer is of suffi- cient liquidity. Therefore only assets which provide the characteristics of high liquidity shall be included in the liquidity buffer, including the holding of collateral immediately available for central bank funding (Art 86 para 11 CRD IV). All liquid assets must be available at any time within the survival period and quickly transferable between concerned entities (CEBS, 2009: p. 22).

However, the basic decision of which types of assets or asset-categories are included in the buffer lies, fol- lowing the general flexible concept of the pillar II-approach, in the responsibility of each institution. In a second step, competent authorities have the duty to monitor and supervise the composition, size and calculation-method of banks liquidity buffers (Li-SREP; EBA, 2013b), and take action/measures (Art 104 and 105 CRD IV), if the liquidity buffer of the institution seems too small or insufficiently composed.

According to the general scope of liquidity risk management requirements, a liquidity buffer has to be hold both on solo and consolidated level (CEBS, 2009: p. 18). Thus the parent entity is responsible for the sufficiency of the liquidity buffer on group level. In group-context, especially in cases of cross-border groups, institutions shall account to “existing legal, regulatory and operational limitations to potential transfers of liquidity and un- encumbered assets amongst entities, both within and outside the European Economic Area” (Art 86 para 6 CRD IV).

5.2.3. Monitoring of Funding and Asset Positions (Para 4, 5 and 6)

A functioning liquidity risk management has to ensure that the bank always has an effective overview about its concrete liquidity situation. In this matter banks has to monitor and manage all funding and asset positions (CEBS, 2009: p. 10 para 33). Given that liquidity management is a concept of flows, the respective processes shall include all significant “current and projected material cash-flows in and arising from assets, liabilities, off- balance-sheet items, including contingent liabilities and the possible impact of reputational risk” (Art 86 para 4 CRD IV). One of the most important issues concerning the management of funding positions lies in the appro- priate diversification of funding sources (CEBS, 2009: p. 17 para 67).

On the asset-side, according to the requirements concerning the liquidity buffer, liquid assets must be quickly available at any time, even in stress-situations. In this regard, institutions shall always be aware about potential legal of practical impediments referring to the transfer of liquid assets, particularly in the cross-border-context (Art 86 para 5 and 6 CRD IV).

Furthermore institutions shall, in order to generate additional liquidity in stress-situations via secured inter- bank-lending, distinguish between pledged and unencumbered assets (Art 86 para 5 CRD IV).26

5.2.4. Stress-Testing and Liquidity Recovery Plans (Para 8 to 11)

Every liquidity risk management system shall include sufficient stress-testing methods (CEBS, 2009: p. 11 ff). Possible methodologies of stress-testing and proposals for adverse situations, which should be taken into account, are recommended both in the CEBS Guidelines on Stress Testing (CEBS, 2010b) and CEBS Guidelines on Liquidity Buffers & Survival Periods (CEBS, 2009). In general, institutions shall consider the “potential im- pact of institution-specific, market-wide and combined alternative scenarios” (Art 86 para 9 CRD IV), both in different time horizons and varying degrees of stress assumptions.

As a lesson learned from the financial crisis, institutions shall particularly include off-balance sheet liabilities, e.g. in favour of special purpose vehicles (SPV; Art 86 para 8 CRD IV). The stress-testing results should be re- flected in the composition and size of the institutions liquidity buffer. Consequently, both instruments are close- ly linked.

In addition, institutions have to implement effective liquidity recovery plans (contingency funding plans— CEBS, 2009: p. 21), considering the results of the stress-tests (Art 86 para 10 CRD IV). Recovery plans shall in- clude the processes concerning the banks activities within the stress-period in order to restore liquidity, e.g. the generation of liquidity via liquidation or repurchasing of high liquid assets (Art 86 para 11 CRD IV).

5.2.5. Excursus: Systemic Responsibility (Para 3)

Since the implementation of CRD IV, the requirements concerning liquidity risk managements were comple- mented by a provision concerning bank’s systemic responsibility in liquidity risk issues. Institutions shall have “liquidity risk profiles that are consistent with and, not in excess of, those required for a well-functioning and robust system” (Art 86 para 3 CRD IV). Irrespective of the difficulty to operationalize such requirements, this provision seems, from a pillar II-conceptual perspective, systemically irrational. Pillar II-requirements basically should address idiosyncratic risks, not risks that are generated itself by the respective bank to other institutions. However, according to this provision competent authorities “shall monitor developments in relation to liquidity risk profiles, for example product design and volumes, risk management, funding policies and funding concen- trations” (Art 86 para 3 CRD IV) and take action when the financial stability is probably jeopardized, e.g. via Art 104 and 105 CRD IV (supervisory powers).

5.3. IPS: Evaluation of the Requirements and Challenges