An Analysis of E-Commerce Enterprises Sustainable Development and Financing Structure ()

1. Introduction

Recent years, electronic commerce gradually becomes a hot topic of the public because of O2O business model. Enterprises are involved in e-commerce, such as catering, transport, education and so on. On the one hand, enterprises take advantage of the internet to build green supply chain, make the whole supply chain and enterprises more efficient. On the other hand, enterprises expand the market through financing, get a rapid performance promotion in a very short-term. But there are also some enterprises who don’t have clear profit model. They grow too fast, the resources and management ability can’t match the growth speed of enterprises. This situation makes enterprises face serious business difficulties, even the risk of bankruptcy. Enterprises pay attention to the issue of sustainable development. From the perspective of sustainable development theory, this paper selects 98 listed E-commerce companies, uses SPSS to do empirical analysis. Based on the Higgins sustainable growth model, study analyzes the financial statements of listed companies. The result shows that the enterprises do not achieve sustainable growth. On the basis of the research result, paper further analyzes the relationship between financing and the sustainable growth. Finally, we put forward several methods to adjust the structure of financing to help enterprises achieve sustainable growth.

2. Theoretical Framework

As for electronic commerce enterprises development research, academic circles mainly focus on the following two aspects: evaluation of sustainable development, analysis of financing structure. First, sustainable development evaluation. The research achievements of foreign literature are four classic models of the sustainable development at the earliest. Higgins first proposed the Higgins SGR (Sustainable Growth Rate) model [1] . He emphasized the effective allocation of resources. He was against the enterprise blindly pursuing growth. Higgins model was the first one to use quantitative method to study the model of the sustainable development, which is the most classic sustainable growth model. Van Horne optimized the sustainable development model on the basis of Higgins [2] . He studied respectively the sustainable growth model under static and dynamic environment, but the model parameters are complex, which increased the difficulty of the operation. Higgins model and Van Horne model were based on the same accounting equation (assets = liabilities + owner’s equity). Other two classical sustainable growth models are Rappaport model and Colley model, which are based on cash flow diameter [3] . Other scholars expand the research of sustainable development concept and model .They apply in different industries. Garbie put forward sustainable development evaluation indicators for manufacturing enterprises, evaluated the sustainable development of manufacturing enterprises through mathematical quantitative model [4] . Santiteerakul & Sekhari (2015) applied the sustainable development model to the evaluation of enterprises in the field of supply chain [5] . Domestic research about the sustainable developmental evaluation mainly focus on financial perspective and study the sustainable development of the enterprises in different areas. Xiaoyan Zhang (2009) studied the ethnic autonomous region sustainable development situation of listed companies, combined with financing, investment, dividend distribution.She put forward suggestions to promote the development of sustainable [6] . Hong Qin (2015) found the relationship between the gas enterprise investment scale, cash flow and enterprise sustainable development, put forward several methods to maintain the stability of the investment and the long-term sustainable development of the enterprise [7] . Fuzhou Han (2014) used the sustainable growth model to analyze 44 United States’ listed E-commerce companies in 2008-2012 [8] . The financial data showed that the enterprises did not achieve sustainable growth. He put forward that financing, profits and other factors influence the sustainable development of the enterprises. But he did not do further empirical test. Existing literature research covers industry enterprises, such as biological pharmaceutical industry, coal industry and information technology industry, etc.

On the one hand, the e-commerce supply chain restructured, brought performance growth; On the other hand, the rapid financing expansion and enterprises bankruptcy phenomenon existed. Whether e-commerce enterprises realized sustainable development or not is still a question. Therefore, put forward hypothesis 1.

Hypothesis 1: The sustainable growth rate and the actual growth rate are not significantly different.

According to the research literature, enterprises sustainable development of different industries show that investment and financing closely related to sustainable development of the enterprise. Thus research further analyses the relationship between the financing structure and the sustainable development in electronic commerce enterprises. Literature review showed that the pecking order theory of financing is the cornerstone of modern financing structure theory. According to this theory, the financing order should be internal financing, external financing, indirect financing, direct financing, debt financing and equity financing. Internal financing has a low cost and risk. It is good for the promotion enterprise’s performance. Enterprises financing usually choose external financing first. Pecking order theory and the concept of sustainable development have intrinsic consistency. Rong Qiu (2016) studied e-commerce enterprise financing mode, analyzed the relationship between the financing and financing efficiency. Finally, he solved the problem of enterprises financing difficulties and put forward constructive suggestions [9] . Jianping Tu, Xue Yang (2013) analysed supply chain finance of the e-commerce platform and its influence on enterprises development [10] . He also studied the similarities and differences between different traditional financing models. The quantitative research of financing structure and sustainable development in the electronic commerce field are not too much, the main result of quantitative research is financing structure and corporate performance. Although performance and sustainable development of enterprises have internal consistency, but they still belong to different object of study. So research takes the methods and ideas for reference. Based on the pecking order theory, Donglin Yong (2012) studied the performance of listed tourism companies, found that internal financing is positively related to corporate performance [11] , external financing is negatively related to corporate performance. Feifei Dai (2014) [12] , Pengfei Zhang (2015) [13] made a research in different industries, found similar conclusion. Hypothesis 2 and hypothesis 3 are based on these theories.

Hypothesis 2: The internal financing of electronic commerce listed companies is positively related to the sustainable growth rate.

Hypothesis 3: The external financing of electronic commerce listed companies is negatively related to the sustainable growth rate.

Research on the relationship between the equity financing and the development of enterprises have three different conclusions. 1) Equity financing ability is positively related to corporate earnings. Lixia Yu and Gen Zhao (2011) studied A-share listed company data, found that the directional equity and corporate performance are significantly positively related [14] . Xian Huang (2009) put forward that the listed company ownership structure and corporate benefit have same direction change [15] . Lijun Liu did an empirical study of the listed companies’ financing structure in China. According to the research of financing preference, listed companies prefer the order of “equity financing, debt financing, internal financing”. 2) The equity structure is negatively related to the profitability. Xiangjian Zhang and Jin Xu (2005) found that after equity allocation, listed companies’ performance declined. 3) The equity financing and corporate profitability appear inverted u-shaped relationship. Feifei Dai (2014) found that too high or too low ownership concentration are detrimental to the ascension of business performance. Pecking order financing theory is that enterprises should give preference to equity financing, then choose debt financing. But due to the particularity of capital market in China, the relevant financial system is imperfect, e-commerce listed companies prefer equity financing (venture capital and private equity) than creditor’s rights financing. So hypothesis 4 is put forward.

Hypothesis 4: The Equity financing of electronic commerce listed companies is positively related to the sustainable growth rate.

As for the relationship between creditor’s rights financing and enterprise sustainable development, there are two different opinions. 1) The creditor’s rights financing and profitability are positively related. Zheng Ni and and Shanwei Wei (2006) found that creditor’s rights financing sends positive signals to the market and it is related to corporate value. 2) Creditor’s rights financing is negatively related to the profitability. Xian Huang (2009) found that creditor’s rights financing influences enterprise benefits in the opposite direction. Xiujuan Gu and Yaping Kong (2010) found a significant decline in performance after the issuance of bonds through the empirical study. Based on the theory of pecking order, the risk and cost of creditor’s rights financing are higher, therefore put forward hypothesis 5.

Hypothesized 5: The debt financing of electronic commerce listed companies is negatively related to the sustainable growth rate.

3. Model and Variables

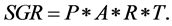

To study the development of e-commerce enterprises, research uses Higgins sustainable growth model to evaluate the sustainable growth rate. Model contains four dimensions, sales net interest rate, total asset turnover, equity multiplier, retention ratio. Sales net interest rate reflects the enterprise business ability; Total asset turnover reflects the assets turnover flow capacity; Equity multiplier reflects the equity of debt, the financing way, the enterprise capital structure; Retention ratio reflects the enterprise’s distribution policy. The model structure is advantageous for the enterprise to carry out the sustainable development evaluation, helps managers to improve management skills according to the result of the performance evaluation, adjust the structure of financing and financial leverage, achieve sustainable growth.

To study the relationship between financing structure and the enterprise sustainable growth rate, paper builds five regression models. Traditional financing structure includes bond financing rate, but electronic commerce public finance data show that bond financing project is less. Inadequate data is not suitable as independent variables. Variables include internal financing rate and external financing rate. Internal financing rate can be divided into depreciation financing rate (DF) and retained earnings financing rate (RF). External financing rate can be divided into stock financing rate (SF), short-term debt financing rate (SBF), long-term debt financing rate (LBF), commercial credit financing rate (CF),fiscal financing rate (FF) .

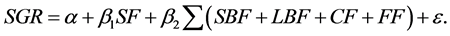

To study internal financing, external financing and the relationship with enterprise sustainable growth rate, verify hypothesis 2 and hypothesis 3, research builds regression model 1.

Model 1:

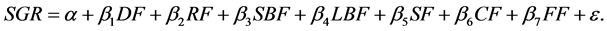

To study the equity financing and debt financing and the relationship with enterprise sustainable growth rate, verify hypothesis 4 and hypothesis 5, research builds regression model 2.

Model 2:

To have a comprehensive review of the relationship between variables and the enterprise sustainable growth rate, further verify the hypothesis 2 to hypothesis 5, research builds regression model 3.

Model 3:

4. Empirical Analysis

4.1. Samples and Data

The research object is e-commerce listed companies. The research focuses on sustainable development. In order to make the conclusion more persuasive, research selects a long period of time sequence data to analyze the annual financial statements, otherwise it is easy to cause the instability of the conclusion. Sample companies refer to the China securities regulatory commission website, net of information of listed companies, flush financial network electronic commerce section. Take out of the enterprises which are in abnormal financial position (ST companies), for example negative net profit for two consecutive years. Finally research selects 98 listed e-commerce companies. The list is showed in Appendix, which is at the end of the paper. Given the samples are not enough in 2015 financial statements, paper captures data from 2010 to 2014, five years, 490 samples in total. Financial statement data source is from the CSMAR database, and its branches, such as company research series database, China listed company financial statements, the Chinese listed company financial index analysis database. CSMAR database is the first, also the largest database in economic, financial and securities information. All the information in the database come from the company financial statements.

The definition of variables:

SGR: Higgins sustainable growth rate.

P: Business net interest rate, P = net profit/business income.

A: Total asset turnover, A = operating income/average total assets; the average total assets = (ending balance of assets + ending balance of assets a year ago)/2.

R: Earnings retained rate, R = (net profit − cash dividend)/net profit.

T: Rights and interests multiplier, T = the final total assets/initial owners’ equity.

g: The actual growth rate, g = (the current business income − business income of the previous period)/business income of the previous period.

To do an overall analysis about the sustainable growth rate and the actual growth rate, study which is higher and more stable, the paper made a descriptive statistical analysis. Descriptive statistical analysis is carried out on the sample data, as shown in Table 1.

Table 1 descriptive statistical analysis results show that the actual growth rate is around 20%, which is higher than the sustainable growth rate( 7.5%). From the point of maximum, the actual growth rate is higher than the sustainable growth rate. From the point of minimum, the actual growth rate is lower than the sustainable growth rate. The actual growth rate ranges at a larger extent. Compared with the actual growth rate standard deviation (0.34), the sustainable growth rate is 0.15, which is relatively stable. Data is consistent with actual situation, sustainable growth rate showes a good development trend.

4.2. Sustainable Growth Test

The sustainable growth rate and the actual growth rate distribution are unknown. To test whether the e-commerce listed companies achieve sustainable growth or not, research chooses non parametric test-Wilcoxon symbol rank test. Confidence level is 95%. Wilcoxon symbol rank test results are showed in Table 2.

![]()

Table 1. Descriptive statistical analysis.

![]()

Table 2. Wilcoxon symbol rank test.

Test results show that among 490 listed e-commerce companies, negative rank number is 319, which accounts for more than 65% in the total number; Positive rank number is 171. The actual growth rate is generally higher than the sustainable growth rate, there is no equal real growth rate and sustainable growth rate. Inspection results is significant. Hypothesis 1 is refused. Test results are in conformity with the reality. E- commerce listed companies take financing strategy in great quantities. Actual grow rate is too high, resources and management can’t match the fast speed. Part of the enterprise capital chain collapsed. Enterprises do not achieve green sustainable development.

4.3. Regression Analysis

Regression model 1 results are showed in Table 3: internal financing rate is positively related to the sustainable growth rate, sig. value is 0.016. The result is significant, hypothesis 2 is verified. Internal financing cost is low, mainly comes from retained earnings. It is consistent with the sustainable development principle of enterprises, enterprises should first choose internal financing. External financing rate is negatively related to the enterprise sustainable growth rate, sig. value is 0.004. The result is significant, hypothesis 3 is verified. External financing cost is higher than internal financing and the risk is bigger. Enterprises should control the scale of external financing.

The regression model 2 results are showed in Table 4: equity financing rate is negatively related to the sustainable growth rate, sig. value is 0.002. The result is significant, hypothesis 4 is refused. By analysing the present situation of electronic commerce enterprise financing, the financing scale is over the range of sustainable growth.In order to achieve sustainable development, the enterprise should control the scale of equity financing. Rate of debt financing is negatively related to the sustainable growth rate, sig. value is 0.001. The result is significant, hypothesis 5 is verified. Debt financing cost is higher, which is consistent with the reality. The debt financing projects are relatively less.

![]()

Table 3. Regression model 1 results.

![]()

Table 4. Regression model 2 results.

Regression model 3 results are showed in Table 5: retained earnings financing rate is positively related to the sustainable growth rate, sig. value is 0.043. The result is significant, further verifies the hypothesis 2. The regression results of the commercial credit financing rate is not significant. Research finds that the commercial credit financing includes notes payable, accounts payable, and advance payments. Less data cause unstable. Long-term debt financing rate, stock financing rate is negatively related to the sustainable growth rate, sig. value is 0.The result is significant, further verifies hypothesis 3. Short-term debt financing rate is not significant, because the electronic commerce main purpose of financing is capital expansion. Listed companies are more inclined to long-term loan financing. Short-term financing has less amount of data. Fiscal financing rate is positively related to the sustainable growth rate, the result is significantly. Because the listed electronic commerce companies enjoy the preferential tax policy in China, such as tax incentives. It is conducive to the development of enterprises. Depreciation financing rate has no significant relation with the sustainable growth rate. Because the electronic commerce companies are mostly light assets. The proportion of the depreciation financing is small. So the impact on enterprise sustainable growth is not stable, which is consistent with the reality (Table 5).

5. Conclusions

The innovation is combing the sustainable development theory with pecking order theory, using Higgins sustainable growth model to study the financing, the growth and bankrupt of the companies. The empirical results show electronic commerce listed companies do not achieve sustainable growth. The main contributions of research are analysing the growth rate of E-commerce listed companies and providing a model for enterprise financing decision reference. Corporate financing structure is related to the sustainable growth rate. Internal financing rate is positively related to the sustainable growth rate, external financing rate is negatively related to the sustainable growth rate. Further analysis finds that positive correlation relationship includes: retained earnings financing rate, fiscal financing rate. Negative correlation relationship includes: equity

![]()

Table 5. Regression model 3 results.

financing rate, debt financing rate, long-term debt financing rate. No significant correlation relationship includes: commercial credit financing rate, short-term debt financing rate, depreciation financing rate. According to the study, Chinese e-commerce listed companies can adjust the financing structure, make financing innovation, achieve the goal of sustainable development of enterprises.

First of all, from the perspective of enterprises. They need to improve the internal financing rate proportion, achieve self-accumulation of the enterprises. To establish a clear profit model and a stable partnership, enterprises should correct the selection order of financing. The adjustment of financing structure order: 1) Internal financing. Choose the retained earnings financing according to the enterprise operating performance and profitability. 2) External financing. First choose creditor’s rights financing. The order in creditor’s rights financing is fiscal financing rate, long-term debt financing rate, short-term debt financing rate, commercial credit financing. Then choose equity financing. The order in equity financing is stock financing and bond financing.

Secondly, from the perspective of government. Promote the marketization of financial system reform, further open the bond market, cultivate a stable and mature stock market. The equity financing, debt financing can have positive impact on the sustainable development of enterprises. Government policy, fiscal, taxation can play positive role in promoting enterprise performance. Policy can contribute to the sustainable developmental of companies.

Appendix