The Exchange Rate Response of Credit-Constrained Exporters: The Role of Location ()

1. Introduction

The response of exports to changes in the nominal exchange rate is notoriously weak [1] . The theoretical relation between exchange rates and trade was earlier argued using the elasticity approach, where the J-curve and the Marshal-Lerner condition were the building blocks1. The core assumption of the elasticity approach is, even though the short-run differs from the long-run, a positive relation between depreciations and exports.

In the aftermath of the financial crisis some episodes of large depreciations appeared to have had little impact on exports [5] . Incomplete exchange rate pass-through to (domestic) prices is a part of the explanation for the weak link between exchange rates and exports (see for instance Goldberg and Knetterer [6] , Nahamura and Zermon [7] , Rodriguez-Lopez [8] or Aubion and Ruta [9] for comprehensive surveys). A number of explanations have been put forward for the less than perfect pass-through, ranging from pricing to-market (see Atkeson and Burstein [10] ) and local distribution costs (see Corsetti and Dedola [11] ) to short-run nominal rigidities (see Gopinath, Itskhoki and Rigobon [12] ).

Variations in exchange rate pass-through create variations in export supply responses. Today there seems to be variations in the export supply response across countries, sectors and time periods. Freund and Pierola [13] find that depreciations stimulate exports in developing but not in developed economies. Eichengreen and Gupta [14] indicate stronger export responsiveness to exchange rates for services than for goods, while Ahmed et al. [5] show reduced export responsiveness post 2000. Looking beyond countries, sectors and time periods the role of cross-border production has lately become the focus of attention when analysing the relation between exchange rates and trade flows. Amiti et al. [15] for instance shows lower responsiveness in Belgian firms with higher import shares while Ahmed et al. [5] finds weaker responsiveness for countries integrated in global value chains.

This paper aims to investigate the relation between exchange rates and exports highlighting the role of economic integration. However, instead of a conventional global value chain approach (see for instance Koopman et al. [16] ), we consider a flow-of- funds constraint taking the economy’s global market integration into account. The implication of where production is located, relative to the location of the credit market and the first- and the second-hand market for capital inputs, for the transmission of exchange rates into exports is the focus of attention.

The paper allows a flow-of-funds constraint to govern the behaviour of credit-con- strained exporters and compares the export supply response (to a depreciation) across four different regimes. The regimes are referred to as a developed economy, a developing economy and two transition economies with different production technology and credit market structure, respectively. A developed economy exporter faces a flow-of- funds constraint but finds both credit and capital inputs at home. The export response is determined by an income effect. In a developing economy the credit-constrained exporter finds both credit and capital inputs abroad. This introduces a cost channel, a collateral channel, a wealth channel and a funding channel for how the exchange rate impacts export supply.

Turning to our two transition economies, one imports capital inputs while the other develops its capital inputs at home. This is due to that the former transition economy has a domestic production structure that mirrors the international production structure, while the production structure of the latter is developed locally. While the latter economy has both the first- and the second hand market for capital inputs at home, finds the former both markets abroad. International first- and second hand markets for capital inputs brings exchange rate effects into the flow-of-funds constraint through both the cost- and the collateral channel as in the case of a developing economy. We also allow transition economies to differ in terms of whether or not the credit market is domestic. If not, the flow-of-funds constraint contains, as in the case of a developing country exporter, a funding channel for the exchange rate.

To characterise our two transition economies we mix the production structure and the credit market location, in a way still not captured by neither a developed nor a developing country exporter. The two transition economies are thus either characterised by the combination of a foreign credit market and a domestic production structure or by the combination of a domestic credit market and an international production structure. This places transition economies in between the developed and the developing economy, but also allowing for different paths to global integration. The interaction between the balance-sheet effects that accompany the various combinations of the location of production relative to the location of the credit market and the first- and the second-hand market for capital inputs creates a context specific export supply response that differ both between countries at different stages of development and across transition economies with different strategies to globalisation.

The rest of the article is structured as follows. In the second part we discuss our approach in relation to relevant literature. In the third part we classify four regimes and present the model structure. The fourth part sets out the expressions for export supply and derives the export supply response to exchange rate shocks. The last part concludes.

2. Related Literature

Our framework is motivated by the seminal Bernanke and Gertler [17] paper highlighting the role of credit-constraints. Applying a flow-of-funds constraint Krugman [18] , Aghion, Bachetta and Banerjee [19] and Cespedes, Chang and Velasco [20] amongst others, questioned the textbook effect of depreciations on exports, and argued the possibility of contractionary effects. Analysing the export supply response of a representative credit-constrained exporter assuming different national economic structures this paper allows for both expansionary and contractionary effects of a depreciation.

We position our reasoning between four regimes, referred to as a developed, a developing and two transition economies, a credit importing and a capital importing transition economy, respectively. The regimes produces an alternative framing of an economy’s global integration, compared to for instance the global value chain approach. The possibility to import inter-mediaries keeps the distinction between forward- and backward linkages and upstream or downstream location still relevant (see again Koopman, Wang and Wei [16] ).

The advantage of the partial flow-of-funds approach is that it allows us to explicitly distinguish between an income channel, a cost channel, a wealth channel, a funding channel and a collateral channel for the exchange rate. The flow-of-funds constraint allows us to highlight both the integration of an economy’s financial- and the integration of economy’s real side into the global economy. The impact of the features residing on the real side of the economy, that is the income channel and the cost channel, is well known and analysed both within intra- and industry models for trade (see for instance Smith [21] for a standard approach to trade theory). The impact on trade from the financial factors, highlighted by the funding channel and the collateral channel, is on the other hand not yet that well established, but is analysed by Amiti and Weinstein [22] Antras and Foley [23] amongst others. The flow-of-funds approach allows us to analyse the interaction between the financial and the real side. Gopintha [24] relates credit- constraints explicitly to both an exporter’s marginal cost and to the exporter’s mark-up, relating both the income channel and the cost channel to the credit constraint while Strasser [1] shows how credit-constrained exporters that can not afford to do Pricing-to-Market (PTM) is more inclined to pass-through exchange rates than exporter’s than can, introducing a divergence in the income channel between exporters that are credit-constrained and exporters that are not.

3. Regime Classification and the Flow-of-Funds Constraint

We consider a firm that produces exclusively for the international market. The exporter needs external capital to take advantage of improved international market conditions, and credit is the only type of capital available. The exporter is credit-constrained and faces a flow-of-funds constraint. To attract credit collateral is needed and capital inputs, which either are imported or produced at home, serve as collateral. In the case of imports, is the second-hand market for capital inputs abroad, as capital inputs has no alternative use at home. If, on the other hand, capital inputs are produced at home, the second-hand market is domestic. To highlight the role of location complete pass- through is assumed, making the income effect of a depreciation equal for all, irrespective of location.

Based on the location of the credit market and the first- and second hand markets for capital inputs we introduce four regimes (see Table 1):

A developed economy. The credit market is domestic, capital inputs are produced at home and the second hand market for capital inputs is domestic.

A technology importing transition economy. The credit market is domestic, but capital inputs are imported and the second-hand market is abroad.

A credit importing transition economy. The credit market is abroad, but the production of capital inputs and the second-hand market are domestic.

A developing economy. The credit market, as well as the first- and the second market for capital inputs, are both located abroad.

While a developed economy is completely integrated in the global economy is the situation the opposite for a developing economy, as it neither is connected to the global credit market nor applies a global production structure. The two transition economies might be seen as economies with different strategies to globalization, alternatively as transition economies at different stages of the globalization process where economies, when producing for exports, at first applies a local production structure while later in the globalization process starts adapting the international production structure.

The flow-of-funds constraint. The exporter faces a flow-of-funds constraint each period where the sum of income and borrowing constrain the amount that may be spent on wages, investments and interest payments on the prevailing debt. Debt is restricted by collateral. As some sluggishness is assumed in the default process, collateral is constrained by the present value of capital inputs.

The flow-of-funds constraint is:

where the components are derived as follows:

Production technology. The firm exports good X which is produced using labour N and capital K as inputs. The production function is

(1)

(1)

which, by normalising labour , allows us to express production per employee

, allows us to express production per employee  as

as

(1’)

(1’)

Export income. The firm exports all of its production and export income (EI) equals

(2)

(2)

where  is the exchange rate, defined as a higher value represents a weaker currency. The international market price of X is given by

is the exchange rate, defined as a higher value represents a weaker currency. The international market price of X is given by .

.

(3)

(3)

When the first-hand market is abroad, and capital inputs are imported, investment costs equal

(4)

(4)

where  is the international market price on capital inputs in period t.

is the international market price on capital inputs in period t.

Credit-constraints and the second hand market for capital inputs. The credit market is characterised by asymmetric information and debt is restricted by its collateral value. Capital inputs can be bought at home or abroad and, as capital is assumed to be culture-specific the second hand market where collateral can be traded, is thus either domestic or foreign.

When both the credit market and the markets for capital input are domestic, debt  is constrained by the expression

is constrained by the expression

(5)

(5)

where R is the discount factor and ![]() the period t + 1 domestic market price on capital inputs.

the period t + 1 domestic market price on capital inputs.

Equation (5) states that the discounted value of debt cannot exceed the collateral value, which equals the present value of capital inputs in the domestic market.

When, on the other hand, the exporter borrows at home but both the first- and the second hand market for capital input are foreign, debt ![]() is constrained by the expression

is constrained by the expression

![]() (6)

(6)

where ![]() is the exchange rate and

is the exchange rate and ![]() the period t + 1 international market price on capital inputs.

the period t + 1 international market price on capital inputs.

When the exporter borrows abroad and both the first- and the second hand market for capital inputs are foreign, debt ![]() is constraint by the interaction between the international market price on capital inputs in period t + 1 and the exchange rate, where now both the current and the expected future exchange rate

is constraint by the interaction between the international market price on capital inputs in period t + 1 and the exchange rate, where now both the current and the expected future exchange rate ![]() is included.

is included.

![]() (7)

(7)

In the fourth scenario is the credit market foreign, but both the first- and the second-hand market for capital inputs domestic. Debt ![]() is now determined by the expression

is now determined by the expression

![]() (8)

(8)

as funding is foreign but the second hand market for capital, where collateral can be traded, is domestic. As the exporter is credit-constrained, it is by definition less patient than the market and all debt restrictions are in the following assumed to hold with equality.

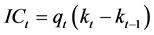

4. The Export Supply Response

When combining the flow-of-funds constraint with the expressions for export income, investment costs and the relevant credit-constraint expression, we find both the export supply and the export supply response to a depreciation across our four regimes. At first we consider a credit-constrained exporter located in a developed economy in order to highlight the conventional income effect.

4.1. An Exporter in a Developed Economy

For an exporter in a developed economy both the credit market and the first- and the second hand market for capital inputs are domestic. Inserting for investment cost, and letting represent wages, the flow-of-funds constraint equals

![]() (9)

(9)

When inserting for ![]() we can express exports from a developed economy exporter

we can express exports from a developed economy exporter ![]() as:

as:

![]() (10)

(10)

Export is determined by the interaction between the user cost of capital ![]() and the net-worth of the exporting firm

and the net-worth of the exporting firm![]() . While the user cost equals

. While the user cost equals ![]() is the net-worth given as

is the net-worth given as ![]() and is determined by exportable income

and is determined by exportable income ![]() plus the domestic market value of capital inputs

plus the domestic market value of capital inputs ![]() less wages and the prevailing level of debt

less wages and the prevailing level of debt![]() .

.

When analysing the export supply response the only exchange rate effect that comes into play is a conventional income effect. We find that a depreciation impacts positively on export supply as long as the user cost is positive ![]() 2.

2.

![]() (11)

(11)

Being contingent on the user cost, the export supply response deviates from the textbook case even for an exporter from a developed economy. As the income effect is positively related to user cost, so is the export supply response. Figure 1 pictures the positive relation between export supply and the exchange rate (assuming a positive user cost). The export response is positively influenced by both international market prices and export volumes, as indicated by the shift in the export supply curve from ![]() to

to![]() .

.

![]()

Figure 1. The exchange rate response of a credit constrained exporter.

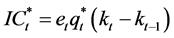

4.2. An Exporter in a Developing Economy

For an exporter in a developing economy both the credit market as well as the first- and the second hand market for capital inputs are foreign, and additional channels emerge for the exchange rate impact on exports. The flow-of-funds constraint equals

![]() (12)

(12)

By inserting for ![]() export supply

export supply ![]() equals

equals

![]() (13)

(13)

Exports is again determined by the exporter’s net-worth ![]() and the user cost of capital

and the user cost of capital![]() . The user cost is affected by the interna-

. The user cost is affected by the interna-

tional market prices on capital inputs (both in the first- and in the second hand market) as well as both the current and the future exchange rate.

In addition to the income effect is the export response also characterised by a wealth effect![]() , a cost effect

, a cost effect![]() , a funding effect and a collateral effect. The latter two are related to the present value component

, a funding effect and a collateral effect. The latter two are related to the present value component![]() . While the denominator

. While the denominator ![]() captures the funding effect is the collateral effect given by

captures the funding effect is the collateral effect given by![]() .

.

A depreciation impacts the export supply response negatively through the cost effect and through the funding effect. As both capital inputs and credit are imported, a weaker currency raises the cost of both, thereby impacting negatively on exports. The positive income effect is supported by the wealth effect, and potentially also by the collateral effect. This is due to that a weaker currency increases the international value of exporters today (the wealth effect) and (potentially) also tomorrow (the collateral effect).

Before we derive the export supply response we need to make assumptions regarding the exchange rate process. While the wealth effect is determined by the current exchange rate, is as mentioned the collateral effect contingent on how the exchange rate is expected to evolve. Collateral might, instead of having a positive impact as indicated above, have a negative impact.

We consider three cases, starting with a simplifying assumption of static expectations. Thereafter we consider rational expectations and a stationary exchange rate and then the case with adaptive expectations.

![]() (14)

(14)

The response is determined by the interaction between the income effect and the wealth effect (the first two terms in expression 14) and the cost effect and the funding effect (the last two terms in expression 14), where the impact of the latter two is negative.

Inserting for ![]() and

and ![]() we express the condition for

we express the condition for ![]() in terms of a critical exchange rate

in terms of a critical exchange rate

![]() (15)

(15)

The critical exchange rate ![]() is positively related to

is positively related to ![]() (the funding effect) and

(the funding effect) and ![]() (the cost effect). The higher the import intensity and the more indebted the firm the weaker is the exchange rate necessary for a positive export response to a depreciation. On the other hand, both the income effect and the wealth effect push for a positive export response at stronger currency values.

(the cost effect). The higher the import intensity and the more indebted the firm the weaker is the exchange rate necessary for a positive export response to a depreciation. On the other hand, both the income effect and the wealth effect push for a positive export response at stronger currency values.

When expectations are rational and the exchange rate is mean-reverting (operationalised by![]() ) the export supply response equals

) the export supply response equals

![]() (16)

(16)

After rearranging, and (again) inserting for ![]() and

and![]() , the condition for

, the condition for ![]() is expressed in terms of the critical exchange rate

is expressed in terms of the critical exchange rate ![]()

![]() (17)

(17)

Compared to static expectations the critical rate is higher, and a weaker currency is now necessary for a positive export supply response. This is because the collateral effect has a negative impact on export supply when the exchange rate is mean-reverting as a depreciation in period t is followed by an appreciation in period t + 1.

When expectations are adaptive (operationalised by assuming![]() ) the export supply response is

) the export supply response is

![]() (18)

(18)

The condition for ![]() is now, except from that adaptive expectations allows

is now, except from that adaptive expectations allows

the collateral effect to impact positively on the export supply response, analogue to the case with rational expectations, and the critical exchange rate ![]() equals

equals

![]() (19)

(19)

When comparing the critical exchange rates of our three cases we find ![]() a ranking determined by how the expected exchange rate impact the collateral effect.

a ranking determined by how the expected exchange rate impact the collateral effect.

4.3. An Exporter in a Credit Importing Transition Economy

In a transition economy where the production structure is developed locally but funded abroad, the flow-of-funds constraint equals

![]() (20)

(20)

Inserting for ![]() and rearranging allows us to express exports from a credit importing transition economy

and rearranging allows us to express exports from a credit importing transition economy ![]() as

as

![]() (21)

(21)

Export is again determined by net-worth ![]() and the user cost of capital

and the user cost of capital![]() . The user cost is determined by domestic market prices, but

. The user cost is determined by domestic market prices, but

related to the exchange rate through the funding effect. The export supply response equals

![]() (22)

(22)

and is determined by the interaction between the (positive)income effect and the (negative)funding effect. Assuming a positive user cost, using the definition of ![]() from (8)

from (8)

and the expression for ![]() given by (21), the condition for

given by (21), the condition for ![]() is

is

![]() (23)

(23)

The critical exchange rate ![]() necessary for a positive export supply response is higher the more indebted the exporter, while the level of export income allows for a positive export supply response at stronger currency values.

necessary for a positive export supply response is higher the more indebted the exporter, while the level of export income allows for a positive export supply response at stronger currency values.

4.4. An Exporter in a Technology Importing Transition Economy

For an exporter importing capital inputs, but funding itself in domestic credit markets is the flow-of-funds constraint:

![]() (24)

(24)

Inserting for debt―using expression (6)―allows us to express exports from a technology importing transition economy ![]() as

as

![]() (25)

(25)

For this exporter net-worth ![]() includes both an income

includes both an income

effect and a wealth effect while the user cost ![]() entails a cost effect and

entails a cost effect and

a collateral effect.

Applying the mean-reverting assumption from above, and inserting for![]() , the export supply response is

, the export supply response is

![]() (26)

(26)

![]() (27)

(27)

When importing capital the condition for a positive export supply response is expressed in terms of a critical future expected exchange rate, highlighting the role of collateral. As the sources of funding are located at home while the second hand market is abroad is the condition for a positive export supply influenced by the present value of collateral, which here is represented by the expected future exchange rate.

5. Conclusions

This paper analyses how credit-constrained exporters responds to depreciations. It presents a partial model where balance-sheet effects are influenced by location. The focus of the paper is how the location of production, relative to both credit markets and the first- and the second-hand market for capital inputs, affect the transmission of exchange rates to exports.

To give our framework some purchase we position our reasoning between four regimes referred to as a developed economy, a developing economy and two transition regimes with different adaption to both credit markets and production technology respectively.

When exporters are located in developed economy depreciations stimulate exports through a conventional income effect, as long as the user cost of capital is positive. As a positive response is contingent on the user cost, the textbook relation between the exchange rate and exports is questioned even for exporters in developed economies.

In a developing economy where exporters import both capital inputs and funding is the effect of a depreciation determined by the income effect’s interaction with a wealth effect, a cost effect, a collateral effect and a funding effect. The condition for a positive export supply response is given in terms of a critical exchange rate. While the income effect and the wealth effect pulls the critical rate towards weaker currency levels, is the impact from the cost effect and the funding effect the opposite. There is in addition a collateral effect influenced by the (expected) future exchange rate. When the exchange rate is mean-reverting the collateral effect pushes the critical rate towards stronger currency values.

Also for transition economy exporters, where either credit or capital inputs are imported, and the export supply response therefore lacks either the cost effect or the funding effect, is the response to a depreciation in general uncertain.

In all regimes is the export supply response highly context specific and, even for a developed economy exporter, there is a potential deviation from the textbook case. The location-driven balance sheet effects show how both the existence of a domestic credit market and the location of where capital inputs are produced and may be traded matter for how exports respond to depreciations. The context specific response shows how elasticities may differ across countries, industries and time periods.

Acknowledgements

The author would like to thank an anonymous referee for helpful comments on an earlier version of the paper.