The Contribution of Management Commentary Index (Ma.Co.I) in Annual Banking Reports (ABR) and the Chronicle of the Great Greek Crisis ()

1. Introduction

According to the European Community Regulation No. 1606/2002, all the European Union listed companies are required to prepare their consolidated financial statements in accordance to International Financial Reporting Standards (IFRS) as from 1 January 2005. The main faculty of the IFRS implementation in the EU is its ability to enhance comparability and to improve the quality of the firms’ financial statements. As the International Accounting Standards Board (IASB), [1] points out, the companies’ annual reports are separated in two main constituents: a) the narrative information where the management team gives qualitative information while comments and analyses key issues of an enterprise’s vision, mission, financial prospects and strategy and b) the financial results where annually quantitative financial information are presented in the form of balance sheets, cash flow statements, ratios and financial ratios. The importance of the annual reports narrative portion has been recognized by practitioners and researchers where the advances in the improvement of the amount and the quality of information provided to investors, lenders, among others, is judged as significant. This narrative portion in the financial statements is referred to as “Management Discussion and Analysis-MD&A” in the US and “Operating and Financial Review―OFR” or “Business Review” in the UK. However, in most European countries, it is called “Management Commentary (MC)”. The [1] defines the notion of MC as “the information that accompanies financial statements as being a part of an entity’s financial reporting. It explains the main developments and issues underlying the progress, performance, and position of the entity’s business during the period covered by the financial statements. Furthermore, it presents and analyses the main trends and factors that are likely to affect the entity’s future development, performance and position”.

The investigated parts of this research are four. The first part examines the impact of the IFRS adoption in the Greek banking sector by addressing a hypothesis on how the value relevance of earnings and book value has changed between the periods prior (2002-2004) and after (2005-2010) the implementation of the IFRS. To answer this question, the Ohlson model (OM) is utilised, presenting a linear relationship between Price per share (P), EPS and Book Value (BV). We used an evaluation framework suggested by [2] which expresses a stock’s value as a function of Earnings per Share (EPS) and the Book Value (BV) per share; in particular, we applied regression analysis on stratification data. Our results are supported by the findings of [3] and [4] , who concluded that the assumption of the relevance of accounting values could not be rejected. The second part compares the quality of narrative information disclosed in the Annual Banking Reports (ABR). The purpose of the latter investigates how and whether the quality of narrative financial reports information has changed between the pre-IFRS (2000-2004) and first post-IFRS (2005-2007) periods. The Management Commentary Framework (MCF) analysis was conducted using an Index of 70 indicators (questions) divided in 5 categories (the Management Commentary Index-Ma.Co.I), which proposed by the [5] .

The third part reports the quality of narrative information of annual banking reports using the Ma.Co.I index; we consider data for the period after the Greek financial crisis (2008-2010). Key Performance Indicators (KPIs) are used to enhance understanding of the quality of narrative information disclosure in a very important transitional period [6] . Finally, Spearman’s rank correlation coefficient is considered to assess the relationship between the key financial indicators and the quality of the Ma.Co.I.

Our reported results indicate that the Ohlson model has been utilized proposing a linear relationship between P, BV and EPS measured on a per share basis; we find that the P has been positively related to BV and EPS after the implementation of the IFRS principles (this is in contrast with the results for the period before the IFRS). Moreover, the results show that MC has been considerably improved in the same period, while a positive impact in the key financial indicators has been observed. Furthermore, we find that Debt tends to be the most important indicator of MC, while in the beginning of Greek crisis period the disclosure quality of narrative portion of annual reports are lower. Finally, the Ma.Co.I which constructed by Alexandros Garefalakis and published 3 years ago to [6] study shows practically (in this research) that the Ma.Co.I is able to predict the quality of ABR and help to the protection of investors.

The structure of the paper is as follows: Section 2 provides a brief introduction in the related literature in view of the banking sector and the quality of narrative reporting. Section 3 describes the methodology and the data sets, while setting the research questions. Section 4 analyses and interprets the outcomes of the examined questions, explicitly presenting the results. Section 5 summarizes the main implications and conclusions of the study.

2. Literature Review

2.1. The Banking Sector

During the last decade, a significant transformation has occurred in the financial environment. The key roles of the banking industry’s operations are fierce competition, market liberalization, internalization and integration, technology expansion, development of new specialized financial products and growth of financial derivatives’ market [7] . These challenges have led financial institutions to alter its operational context for effective deployment of all its prospects in the financial markets [8] . As mentioned [9] , there is a strong association between the banks’ liquidity provided and the measures of the economic activity. Consequently, the changes that banks promote in their financing policy and strategy have a vast impact not only to the Gross National Product (GNP) but also to other fundamental macroeconomic indicators that influence an economy’s activity and wealth. Evidently, the potency and economic steadiness of the financial institutions play a critical role in national economies worldwide. On the one hand, a vigorous banking sector accelerates the economic growth of a nation. On the other hand, the financial instability in financial institutions causes numerous deficiencies in the macroeconomic level of a country [10] .

Two of the ultimate missions of the financial institutions are considered to be the increase of shareholders’ value and the attainment of profitability. Despite the fact that banks address plentiful, flexible and remarkable alternatives to individuals and enterprises, their main objective is the long term profitability to strengthen and guarantee future survival [11] . Financial institutions focus on financial results in order to cope with the entrance obstacles that new institutions face in the banking sector along with the intense competition of the existing ones. Earnings and profitability goes at the very heart of their existence, as they are used to cover numerous necessitates of the banks’ image such as to “pay dividends to shareholders, to increase equity, to finance activities which improve the social profile and the brand name in the market share” [8] [12] .

A report conducted by the [13] indicates that the effectiveness of the banking system is an area of great importance. However, during the banking sector’s process of efficiency and competitiveness examination, obstacles arise from the intangible products and services which financial institutions provide into the markets [14] . A great diversity of bank performance measurement variables have been mentioned by numerous scholars, such as costs and efficiency factors. In the early of 80’s, [15] introduced interest margin as an important dimension of accessing US commercial banks performance, calculating the interest income minus expenses and dividing it with total assets. In addition, [16] , examined bank performance using a correlation analysis model which includes indexes of profitability, loan market share and the pricing policy of the bank services. Moreover, [17] investigated the technical efficiency of large banks. Their research indicated that larger banks exhibit a greater level of technical efficiency while operating under a diminishing amount of scale returns. Lastly, a research conducted by [18] , emphasizes on the banks’ size, concluding that it affects its efficiency.

[19] compared the regulated and deregulated markets, highlighted that in both type of markets, book value and earnings were strongly related with cost recovery, ROA, and security prices. As a result, both “asset capitalization” (BV) and “operational efficiencies” (earnings) tended to be key indicators in the market evaluation of the firm’s future prosperity and security price.

In a research conducted by [12] , a wide range of performance measures used by scholars and practitioners in banks were observed. The researchers made a distinction between “traditional, economic and market-based” measures of performance. The most important traditional measures of assessing financial performance are ROE and ROA. In addition, the study mentions that ROE and ROA are considered as important determinants of profitability and reflect the banks’ performance. The Return on Assets (ROA) indicator represents how effectively a business has been using its operating assets while the Return on Equity (ROE) indicator is a measure of how well a company has “reinvested earnings to generate additional earnings”.

Aside from the banks’ financial performance, [20] highlights asymmetric information as another important dimension of the banks’ financial operating scheme. According to the study, banks deal with asymmetric information conflicts not only when they lend to enterprises and evaluate their forthcoming forecasts, but also when they are intended to be borrowed from the financial markets. In this light, [21] , mention that the increase in the quality of annual reports narrative portion play a key role in debt financing.

[22] highlights the financial statements analysis as an important tool in presenting the financial position of an organisation. The financial statements analysis and valuation is essential due to a great diversity of groups (investors, public authorities, shareholders) who are interested in the stated financial results and the management comments concerning the prospects of banks’ growth and vision. According to its application, each group analyses financial statements for different purposes and in different aspects of the presented annual or quarterly outcomes. As mentioned by [23] , the accounting strategies managers’ utilize, may affect the reported financial results of an enterprise. The latter, in conjunction with financial reporting disclosures, may raise opportunistic situations about the future forecasts of financial performance [8] . “The banks are disposed in liquidity and monetary fluctuation risks, changes in the interest rates and the danger of bankruptcy of the counterparties”. These risks are reflected in the financial reporting disclosures where the management of banks states how is going to surpass the stated threats. As a result, the external parties have a clearer point of view about how banks will restructure their operations to avoid future hazards [24] [25] .

2.2. The Greek Banking Sector

The Greek economy is characterized as bank?based. The Greek banks, operating as mediating institutions, offer a wide range of services extending from portfolio management and suitable saving opportunities to exceptional funding prospects not only to individuals but also to enterprises leading to modernization and growth alternatives [26] [27] . During the period 2002 to 2007, the Greek financial sector has developed dynamically and rapidly. The expansion of the Greek economy was steadily above the European average growth rates. In addition, the remarkable decrease of the interest rates as well as the privatizations in the Greek financial sector changed the competition variables, while engendering multiple benefits for the economy and the shareholders. Evidence from the Greek stock market highlights the performance of the banking sector, as the rates of growth were double in comparison with the other sectors [28] .

The Greek financial institutions through their effort to take upon the opportunities engendered by the changes in the global and national financial sector were led to strategic co-operations based on mergers and acquisitions in order to strengthen their position in the market by developing large financial corporations. These actions have reinforced their capital structure, expanded their networks while the services they offered were more attractive to the potential customers [29] .

Various scholars have focused on the factors which assess the performance and profitability of Greek banks. In 1995, [30] conducted a research for the period 1989-1991 relating to the release and performance of the Greek banking sector, concluding that the lead indicators of profitability were quite different from other countries because of the strong regulation in Greece. In addition, [27] performed a multi-criteria analysis to estimate the performance of banking sector using ratios analysis techniques during the period 1989-1992 basing on a utility model of Greek commercial banks to rank them. Furthermore, [31] investigated the competitiveness and effectiveness of the Greek financial institutions and highlighted that during the decade of 1990, the majority of medium sized financial institutions succeeded in a consistency of their profitability levels.

In addition, the financial crisis period (2008 to 2010), which originally broke out in the United States in autumn 2008 with the collapse of the Lehman Brothers investment bank, evolved into a global economic crisis as a consequence of interlinked globalized economies, causing the greatest recession period since the 1930s and a serious deterioration of public finances in most Western countries.

Especially since its dramatic deterioration in October 2008, the global financial crisis started to negatively affect the Greek economy and particular the Greek banking sector as well, leading to a considerable weakening of expectations in terms of liquidity and viability of the banking sector in general.

During the aforementioned period at least two issues are observed; first, the disclosure of narrative information in Greek banking sector’s annual reports is not that easy to be read, due to complexity of the text that does exists within the financial statements and second, the information associated with risk and the strategy implemented by the banking institutions is not included in annual reports. These two problems were repeatedly highlighted by the Bank of Greece and international organizations as well in reports from the Governor of the Bank of Greece from 2008 to 2014, Dr. George Provoloulos. As a result, this research investigates the quality of narrative part of the Greek Banking Institutions’ financial statements for the crisis period.

Most researches are based on survey derived quantitative factors taken from banks’ financial statements characteristics and accounts. To the best of our knowledge survey is limited in the literature on the narrative qualitative information that banks include within their annual reports to assess their performance from a qualitative point of view. The current study intends to bridge the gap between the traditional examination of banks’ performance and the up to date information derived from the narrative part of their financial reports.

2.3. IFRS and the Quality of Financial Reports

In the past years, the financial markets were in a diffusible and strict command of control where the state’s interference on the banks’ property and operations was potent. Some of the most important influential factors were the exogenous determination of rates, the binding commitments on deposits, and the credit control [7] . The mean of the asymmetric information between the interested parties concerning the banking sector was introduced by [32] . As they mentioned, the production of satisfactory information presented to the involved associates was critical in order to avoid the problem of moral hazards in the banking sector. [32] conducted a research based on the efficient information and how the latter adds value to the enterprises. According to the outcome of this research, the satisfactory presentation of critical information in the narrative part of the financial statements drives the increase of the banks’ profits and liquidity [7] .

In 2005, International Accounting Standards Board (IASB) introduced the IFRS reporting standards framework proposing the transition from the domestic accounting principles of European countries to the International Accounting Standards. One of the main reasons of the implementation of IFRS, as pointed out by [33] , was the achievement of capital market integration. [34] noted that the benefits of the adoption of IFRS include “higher comparability data, lower transaction costs and greater international investment”. In addition, [8] points out that IFRS also assists investors in making “informed financial decisions and predictions of firms’ future financial performance and giving signal of higher quality accounting and transparency”. Therefore, the IFRS would tend to decrease “earnings manipulation and improve stock market efficiency”, while they would also tend to positively impact on firms stock returns and stock-related financial performance measures.

Worldwide, this fundamental change in the quality of corporate reporting is to be achieved by using further narrative information in annual reports, placing more emphasis on the management discussion and analysis statement in the annual reports. In some circumstances, for example, the regulators are extending and revising the guidelines, while in other cases, disclosures are becoming mandatory information; in the post-Enron period, MD&A regulations are being strengthened (e.g., [35] ) in the USA; in Canada, the Canadian Institute of Chartered Accountants (CICA) issued more detailed MD&A guidelines and six disclosure principles are set out as well as a five-part integrated disclosure framework developed covering strategic, key performance drivers, capabilities, results and risks [36] . In the UK, the Accounting Standards Board issued revised OFR guidance which draws upon the Jenkins framework [37] . Finally, consideration of MC statements was put on the IASB agenda in 2002. An exceptional case between the countries mentioned above is Greece, since its financial reporting system does not follow a recognized set of Standards related to the presentation of narrative information. However, in the last ten years Greece has begun to adjust its local accounting standards (e.g.: General Accounting System-GAS) to the IFRS principles. In the light of this, it would be quite interesting to search for how Greek banks altered their practices and reporting quality on their annual reports focused on narrative part of information.

In addition, several studies attempt to evaluate the narrative reports with different methods. A great number of practitioners base this evaluation on a ‘disclosure index’. [38] , in a wide-known study, proposes an index to measure the voluntary disclosure level in 122 businesses in the machinery industry. [38] study was based on the narrative disclosures’ analysis. The Canadian Institute of Chartered Accountants introduced the Jenkins Report [39] which sets, principally, the guidelines for the selection of items included in the analysis, and the study of the annual report. The categories of information were five: background information; summary of historical results; key non-financial statistics; projected information; and management discussion and analysis. This study included 35 major elements spread across the five categories.

3. Research Methodology

3.1. Sample and Data

Our study analyses the quality of the narrative reports of Greek commercial banks over the periods prior (2002-2004) and after (2005-2010) the implementation of the IFRS in Greece. The total number of Greek banks, operating in the whole period are 30 from which 14 commercial banks and 16 cooperative banks. Only 14 commercial banks were listed in the Athens Stock Exchange over the period 2002?2010. The total number of the listed commercial banks which were selected for the study is eleven (three banks excluded due to the lack of data availability). In order to evaluate the quality of the information disclosed in the MC, we gathered the appropriate financial reports of the banks from the Datastream database and the banks’ official websites.

3.2. Research Questions and Models

The purpose of the current study is to explore the mandatory adoption of the IFRS and the quality of narrative reports. The four research questions that are to be examined are as follows:

Q1: Does the value relevance of earnings and book value have changed the stock price in Greek Banking Sector after the mandatory adoption of IFRS for the next 3 years?

Q2: Does the quality of the narrative part in Management Commentary (MC) of the ABR and the Key Financial Indicators have been improved after the next 3 years of mandatory adoption of IFRS?

Q3: Does the quality of narrative part (MC) of ABR changed during the crisis period (2008 to 2010)?

Q4: Is there a relation between the Key Financial Ratios and Quality of MC?

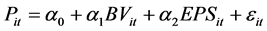

In order to answer the first research question, we will examine the hypothesis of how the IFRS adoption has changed the value of EPS and book value. The value relevance of book value and earnings provided under the Greek Accounting Standards (GAS) and the IFRS, suggesting that the IFRS facilitates higher narrative quality accounting information for investors in comparison to GAS [40] . Specifically, the IFRS propose that under these principles, the use of fair value measurements present more accurate not only a company’s current thesis but also its future performance. As [21] argue, accounting amounts which reveal better a firm’s underlying economics grant investors with important information assisting them in the decision making process. In this respect, the IFRS is considered to be a more investors-oriented regime. Alternatively, the GAS is principally oriented in the direction of stakeholders, with particular awareness to creditors. Thus, they tend to have a preference on traditional accounting practices to maintain capital upholding during the time. The model that was utilised to analyse the first research question is the OM which proposes a linear relation between price of a share (P), earnings per share (EPS) and book value per share (BV). The value which was used to calculate the price of a share was six months after the fiscal year to ensure that the corporate report and additional disclosures about the IFRS were available to investors as proposed by [2] . The dependent variable is considered to be P, while the explanatory variables include BV and EPS, both measured on a per share basis, feeding the price-levels regression as follows:

(1)

(1)

where:

Pit: is the price of a share of firm i six months after the fiscal year-end t;

α0: is the intercept term;

BVit: is the book value per share of firm i at the end of the year t;

EPSit: is the earnings per share of firm i for time period t-1 to t;

εit: is the error term.

In order to thoroughly propose the second and third research question, we seek to rate the MC quality of the banks. The MC quality is defined as the amount of narrative information disclosed in the annual reports. The tool which was used to rate the amount of information disclosed in the annual reports, based on the Ma.Co.I proposed by the IASB (see, [5] [6] ).

3.3. The Management Commentary Index (Ma.Co.I)

The Ma.Co.I provides the capacity to assess the disclosure quality of the firm's Management Commentary and to produce a quantitative value for that quality that might then be utilized as a part of further empirical analysis [6] . Our technique is implemented in two stages as depicted below:

First stage

We propose a new checklist called the Ma.Co.I that was developed for the detailed evaluation of financial reporting quality and was initially presented by the FASB and the IASB (for more details, see [5] [41] ). The amount of narrative information revealed in an annual report is what determines an MC’s quality. The Ma.Co.I includes of 37 constituent points that are classified into five categories as follows:

Category 1: The nature of the business

Category 2: Objective and strategy

Category 3: Key resources, risks and relationships

Category 4: Results and prospects

Category 5: Performance measures and indicators

These five categories are presented in Table A2, with their codes for the points and the number of points used in this research. The points selected after thoroughly consideration of MCF of 2010 which proposes specific guidelines that must be disclosed in Annual Report for maximizing the quality of information (see also Table A1 for details).

Second stage

In the second stage, we derived the Narrative information that was requested from the Final MCF given in 2010 using the points in Table A2.

The Ma.Co.I uses 70 KPIs for 37 points, taken by the MCF [5] . This was the case because some points require more than one KPI to cover the information suggested by the MCF. Therefore, the maximum quality score of the index is reached when the annual financial statement includes 70 KPIs. The information on the number of appropriate KPIs is given by the Factor Analysis method. Some points need more than one KPI to cover the appropriate amount of information (for example, refer to Table A3, where point 2 uses 3 KPIs). Furthermore, Table A3 proposes the final checklist of Ma.Co.I with 70 KPIs [6] .

The disclosure score of the Ma.Co.I indicates the extent of disclosure compliance with the MCF. Based on this, a dichotomous scoring approach is applied by manually capturing each KPI’s disclosure quality. If a required quality dimension is met, it is scored as one; otherwise, it is scored as zero. If a quality dimension is not applicable to a specific KPI, it is scored as ‘not applicable’ (NA) (e.g., [42] [43] ). Consequently, the Ma.Co.I total disclosure score (denoted as T) is measured for each firm with the following formula:

where: di is the score of each KPI (“1” if the item is mentioned and “0” otherwise), and m is the maximum number of KPIs (70 disclosure items in total) that is expected to be disclosed by firms in compliance with MCF. The value of T depends on the number of KPIs disclosed by the firms. In addition, the quality and quantity score of the Ma.Co.I index for each firm lies between 0 and 100 or 0 and 70.

In addition, the mean of the main financial Indicators and ratios (ROE, ROA) of the two periods are compared in order to examine whether there is any change or not ( [44] [45] ).

In the Fourth research question, we attempted to investigate the relationship between the average of the key financial Indicators (ROE, ROA, Total Equity, Total Debt and Total Assets) and the Management Commentary score (MCs) utilizing the Spearman’s rank correlation coefficient, a non?parametric index [46] . The scale of the Spearman’s index r lay in a range between −1 and 1. If r = −1, the two variables examined are considered to be uncorrelated while r = 1 stipulates complete correlation. The upper financial Indicators were selected because Total Equity, Total Debt and Total Assets are integral parts of Financial Statements and present the financial position of an organization; further, ROE and ROA evaluate the profitability and performance.

4. Analysis

4.1. Ohlson Model

The work of [2] had a profound impact on accounting research. What are the reasons for this enthusiasm for the Ohlson Model (OM)? A survey of the accounting literature reveals five possible reasons [46] . First, it appears that there is consensus among accounting researchers that one of the desirable properties of the OM is its formal linkage between valuation and accounting numbers. Second, researchers appreciate the versatility of the model [45] [46] . Third, the enthusiasm with the OM appears to be a response to [47] challenge that traditional approaches used in accounting research find a very weak linkage (low r-squared) between value changes and accounting information. Fourth, and related to the previous point, the high r-squared found in analyses that rely on the OM is interpreted to suggest that little value relevance is related to variables other than book value of equity, net income, and dividends. Moreover, the very high explanatory power of the models leads to conclude that the OM can be used for policy recommendations.

In Table 1, regression model results are presented for the period 2002?2004. With respect to analysing the outcomes for this period, it can be observed that the EPS has a positive relation with the P of a share six months after the fiscal year; BV has a negative relationship with the P (both EPS and BV are statistically significant different from zero).

Table 2 presents the results of the regression model for the period 2005-2007. According to the regression model, it can be noticed that the E and the BV positively affect the change of P six months after the fiscal year (both variables are significant).

The results produced in Table 1 are not consistent to answer our hypothesis therefore we will investigate the validity of the model presented in Table 2, which assumes a linear relationship between P, BV and EPS after the adoption of the IFRS. Various diagnostic tests were performed to establish goodness of fit and appropriateness of the model. First, it was examined as if there was multicollinearity in the model.

Also, the outcome of Table 1 and Table 2 indicates that BV and EPS have a positive correlation not only with P but also with each other during the examined period. In addition, we find that the correlation between the three variables tend to be increased after the implementation of IFRS. Moreover, we report that there is a greater amount of correlation among earnings and the other two variables.

4.2. Quality of Narrative Information and Financial Indicators

Research on the quality of the narrative part of the annual banking reports (ABR) has

![]()

Table 1. OLS Model 2002-2004 (Dependent Variable: P).

Notes: R-squared = 0.582, Adjusted R-squared = 0.545, Durbin-Watson stat = 1.69, F-statistic = 1.60, Prob (F-statistic) = 0.000, *denotes significance.

![]()

Table 2. OLS Model 2005-2007 (Dependent variable: P).

Notes: R-squared= 0.72, Adjusted R-squared=0.70, Durbin-Watson stat=1.49, F-statistic=32.94, Prob (F-statistic) = 0.0000, * denotes significance.

long been hampered by lack of tools that permit an objective analysis of qualitative dis- closure. Thus, despite the continued demand for better comparability in financial re-porting practices, in our sample, a large number of Greek Banking Institutions do not seem to converge toward a single set of standards for both the narrative and financial disclosure.

Τable 3 presents the descriptive statistics of the MC quality score based on the Ma.Co.I. For the financial reports of the eleven (11) banks, the narrative reporting quality has been considerably improved. To be more specific, the mean of the MC score of the financial reports narrative part prepared under Greek Accounting Standards (GAS) was 49%, while under the IFRS had reached 68%, a growth of approximately 39% in the mean MC score. In addition, the maximum level of narrative reporting quality for the period 2002-2004 was 0.81, while during 2005-2007, it increased to 0.90. Conversely, the minimum amount of narrative reporting quality after the adoption of the IFRS is 0.32, while during the pre-IFRS period was only 0.02. These Indicators point out the reporting quality enhancement in the IFRS era with relation to the GAS era. The latter is also depicted in the decrease of the standard deviation from 0.244 to 0.165, which indicates that the data points tend to be very close to the mean, with lower variability as well. In addition, the asymmetry of the probability distribution (skewness) has been decreased as well as the kurtosis has been extremely regularized from 2.5 to 2.04; therefore, the quality of financial reporting has been normalized between the 11 banks, attaining higher levels. Overall, the quality of MC was significantly improved in the IFRS period vs the GAS period, stating the Greek Banking System became better in terms of financial statements disclosure and quality in general.

In Table 4, the frequencies of MC scores are presented. The rows of the table present the number of the narrative quality reports for the period before the adoption of IFRS, while the columns present the equivalent numbers for the period after the IFRS adoption in Greece. The total of the 3-year narrative reports for each of the 11 banks before and after the IFRS implementation are categorized according to their MC scores.

In addition, during the GAS period, the MC scores of the 33 reports have been

![]()

Table 3. Descriptive statistics of MC quality.

![]()

Table 4. Descriptive statistics of MC quality.

spread out from very low levels of MC score (approximately 0) to high levels of 0.81 (81% of quality). The accumulation is observed between 0.30 and 0.80 with the higher percentage to be included in the intervals [0.4, 0.60) and [0.6, 0.8).

On the contrary, in the period after the implementation of IFRS, there is normalisation of differences between “good” and “bad” narrative quality information disclosed, while the mean has been displaced in higher levels of quality information outputs with an increasing dispersion in the intervals [0.6, 0.8) and [0.8, 1) therefore indicating improvement of narrative reporting quality and an alternation of the financial reporting orientation of the banks.

Figure 1 diagrammatically compares the MC quality score of the Greek banks between the two periods (2002-2004 and 2005-2007).

Table 5 that follows presents the improvement of management commentary quality. In analysing more extensively the results, three are the institutions with the highest positive impact on their financial reporting quality: increased its reporting quality from 24.67% to 60.67% a growth of 146%. In addition, Bank #9 raised its reporting quality by 125% despite the fact that it has the lowest level of reporting quality in comparison with the other banks. Finally, Bank #3 improved its MC by approximately 106%. Banks with the highest percentage of MC prior the implementation of the IFRS (2002-2004) had a steadily progress, such as Bank 10 (6.49%), Bank #5 (29.03%), Bank #8 (14.62%) and Bank #7 (44.44%) reaching in reporting quality outputs over 80%. The lowest amount of MC of the period 2005-2007 has been observed both in Banks #4 and #6 with a percentage of 49.67% and 53% respectively, without significant improvement of quality between the two periods.

Table 5 is taken form [7] research which used the Ma.Co.I for measuring the quality of Management Commentary score (MCs) for the eleven (11) Greek banks and we add in a separate row the ranking of banks. The outcome of this deed is truly innovative result, where actually the first 3 positions (and in correct sequence) are the banks that provide the best disclosure quality of narrative information (as Ma.Co.I stated) which totally consort with the ranking of best Greek banks according to Bank of Greece in

![]()

Figure 1. Average MC Scores of Greek banks, during the 2 periods (years 2002-2004) and (years 2005-2007).

![]()

Table 5. MC scores of the Greek banks for the pre- and after-IFRS implementation periods (source: Dimitras et.al 2013).

2010. An important innovative characteristic of the above results is that the Management Commentary Index (Ma.Co.I) is able to measure the actual quality and reliability of the banks financial statements and proposed the ranking of them.

Furthermore, in Table 6, Mergers and Acquisitions between banking Institutions are depicted with the positions these banking institutions hold during the period 2005-2007 according to their quality disclosers in their financial statements. The only banking institution that it was not engaged in banks Mergers and Acquisitions is the National Bank of Greece (NBG), where in contrast to the results of Ma.Co.I for the year 2013 (which were very low), considered by many as the best banking group for this period. Also, and for this case, Ma.Co.I index correctly predicted the quality of the MC information. In our estimation this is the reason where there was not a serious proposal for

![]()

Table 6. Mergers and Acquisitions in the Greek Banking System (source: [48] ).

merging of NBG with another banking group so far. This shows that the quality of disclosure of narrative information was very important case for reek Banking Institutions and still remains.

As a result, taking into account the information provided in the above tables, we observe the following core characteristics:

1) It is demonstrated in practice that the more quality in narrative information does exists in an organization’s financial statements, the more the investors trust and invest with less risk in this organization, enhancing therefore terms of profitability and sustainability of its business.

2) In addition, we observe that the Bank #3 is ranked in the 6th place and thus did survived on the banking scene, despite significant changes in the ranking of Greek Banking Institutions as [7] express in their research, remaining active until today, although it is not included in the systemic banks.

3) Unlike the above, Bank #9 where it ranked in the last place, we find it today being the only one from the list that has been driven into bankruptcy. Also in this case, the Ma.Co.I provided accurate information even before three years ago.

4.2.1. Financial Indicators Trend Analysis

The trends analysis of financial ratios Return on Equity (ROE) and Return on Assets (ROA) between the two periods (Figure 2) show that the banks’ mean ROE improved approximately by 219%. At the same time, there is a positive change of the mean ROA from 0.433 to 1.06 which is translated into a growth of 144.47%.

The results of the trend analysis between the two periods highlighted the following (Figure 3): the Total Equity of the Greek banks appears to be increased from 906, 52 millions of ?to 1.68558, a raise of 85.94%. Furthermore, there is an increase in Total Debt from 2.17264 to 3.65703 millions of ?

Finally, it becomes apparent that after the IFRS adoption, banks have increased their Total Assets from 17.190,855 millions of ?to 27.499,640, which consists an increase of approximately 60%. As the results we indicate, the main financial ratios of the eleven (11) Greek banks that have been evidently improved, assuming a positive impact after their transition from GAS to IFRS.

4.2.2. Disclosure Quality of Narrative Information in Greek Crisis Period

In Table 7, for the 2nd (years 2005-2007) and the 3rd period (years 2008-2010) we observe that the Bank #7 ranks first in the list, the Bank #9 takes the lowest ranking in

![]()

Figure 2. Change of average ROE and ROA respectively between the periods prior and after the implementation of IFRS.

![]()

Figure 3. Change of average key financial Indicators between the periods prior and after the implementation of IFRS.

![]()

Table 7. MC scores of the Greek banks for the years 2002 to 2010.

relation to the quality of the information provided in its financial statements; the same also happens with the Bank #4 which was led to bankruptcy and acquisition by Bank #10 in the coming years.

Moreover, we observe that overall quality in information provided in financial state- ments improved by 18.82% between the first (year 2002-2004) and second period (years 2005-2007), but it this trend didn’t continued during the third reporting period (economic crisis years 2008-2010), that marked a reduction in absolute numbers of about 1.45%. So, the beginning crisis period tended to affect the Greek Banks with the lower quality of narrative information.

4.3. Spearman’s Correlation Coefficient

The final stage of the current research focused on the assessment that the financial Indicators affect mainly the narrative reporting quality of the two periods. The sample size used was the eleven banks (n = 11). Table 8 examines the correlation of average of financial Indicators with MC before and after the implementation of the IFRS, testing the following variables: Total Equity, Total Debt, Total Assets, ROA and ROE. It is worth highlighting that during the Greek Accounting Standards period, none of the five indicators seem to have a strong correlation with MC.

Conversely, under the IFRS principles, it has been observed that Total Debt has a strong correlation with MC with a correlation coefficient of 0.69 indicating a satisfactory level of significance between 5% and 1% according to the Spearman’s scoring. Τhis could be explained by the interest of the investors in MC quality in the recent years that made the Greek banks maintain a higher MC quality in order to support their high leverage policy. This phenomenon has to be further investigated in the light of newer data on MC quality and leverage in order to examine further this relation.

5. Conclusions

The current research adds new insight related to the quality and the form of narrative reporting in the business sector to the existing literature. Various scholars have attempted to analyse the narrative portion of financial statements, however, the results presented a theoretical basis of assessment. In this study, a quantitative approach of the qualitative data adopted using the Ma.Co.I. Therefore, we believe that this study would commence a more systematic approach of evaluating the narrative reporting that orga-

![]()

Table 8. Spearman’s correlation coefficient of the average financial Indicators with MC in the pre- and post-IFRS implementation period.

nisations address for internal and external use.

The purpose of the current research was to examine the periods prior and after the implementation of the IFRS while focusing on the effects on the Greek commercial banks’ financial and narrative reporting [49] [50] . Firstly, the present study investigates how the value relevance of earnings and book value has changed between the two periods. The Ohlson model has been utilized proposing a linear relationship between P, BV and EPS measured on a per share basis. The regression model points out that the P has been positively affected by BV and EPS after the implementation of the IFRS principles in contrast with the period before the IFRS where there was not any linear relationship between P, BV and EPS. Secondly, the current paper examines the change of the narrative reporting quality of the banks while inspecting the key financial figure trends between the two periods. The results clearly show that MC of the Greek banks has been considerably improved after the adoption of IFRS. Furthermore, it has been proved that there is a positive impact of the selected financial ratios and Accounts (ROE, ROA, Total Assets, Total Equity and Total Debt) for the transition of GAS to IFRS. Evidence indicates that Total Debt with a level of significance 0.69 tends to have a strong relation with MC quality in the period after the implementation of the IFRS, while other financial Indicators of the study do not appear to have a strong relation with MC neither prior nor after the implementation of IFRS. Moreover, the beginning of Greek crisis period seems to affect the disclosure quality of narrative part of ABR in addition to two previous periods. Finally, an important innovative characteristic of the above results is that the Management Commentary Index (Ma.Co.I) is able to measure the actual quality and reliability of the banks financial statements and proposed the ranking of them.

Appendix

![]()

![]()

Table A1. Coding in 37 major points the “ifrs practice statement management commentary” published by the IASB, 2010 pp 12-16.

![]()

![]()

Table A2. Descriptions of 37 major points.