Received 8 April 2016; accepted 31 May 2016; published 3 June 2016

1. Introduction

Three main and novel findings are obtained from our analysis. First, a small redistribution of wealth among contributors is not necessary neutral.1 Second, unlikely what common sense might suggest, a redistribution of wealth from a richer contributor to a poorer contributor can increase the private provision of public goods regardless of whether individuals’ valuation for these goods increase or decrease as their level of wealth increases. Third, under some circumstances, a small redistribution of wealth from a poorer contributor to a richer contributor can increase the provision of public goods. We characterize the conditions under which each of these possibilities occurs.

The remainder of this paper is organized as follows. In Section 2, we motivate in more detail both our main assumption and our analysis. Section 3 presents a simple example to illustrate our main point, and Section 4 develops a general framework and presents the main results. Section 5 concludes.

Besides this theoretical inconsistency in the literature, there are several cases in which individual valuation for public goods can be affected by their level of wealth. Firstly, consider environmental quality. Richer individuals may value their health and the health of their children more than poorer individuals, because the opportunity cost of getting sick or taking care of their children is greater for them. Since environmental quality might importantly affect individual health, richer individuals’ valuation of environmental quality should also be greater than that of poorer individuals. Additionally, changes in individual wealth should affect this valuation.

Another case in which individuals’ valuations of a public good may also increase with the level of wealth is public safety. Since richer individuals are more attractive to criminals than poorer ones, the former may value neighborhood public safety more than the latter. Using survey information for Brazil’s neighborhoods, [26] compute that a household’s concern for public safety increases as its level of wealth increases. Although they relate this result to a strong income effect, they also claim that it can be partly explained by increments in the marginal utility of public safety as a household’s wealth increases.

One can also think of cases where the valuation of public goods may be negatively correlated with the level of wealth. For instance, it may be that richer individuals place less value on public parks, inasmuch as they have access to private (excludible) spaces with similar characteristics; poorer individuals, on the other hand, may value public parks more, as they do not have access to such spaces. In this case, an individual’s valuation of the public good increases as the individual’s wealth decreases. Unfortunately, as far as we know, no evidence to this effect is currently available.

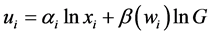

The new assumption we introduce into this framework is the following: preference intensities of individuals 1 and 2 for the public good depend on their respective levels of wealth. Therefore, the log-linear utility function for each individual can be represented as , where, for simplicity,

, where, for simplicity,  is assumed to be a continuous monotone function of that individual’s level of wealth. Therefore, if

is assumed to be a continuous monotone function of that individual’s level of wealth. Therefore, if  is an increasing function of wealth, the individual i’s valuation of the public good increases as his level of wealth in-

is an increasing function of wealth, the individual i’s valuation of the public good increases as his level of wealth in-

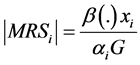

creases. The opposite happens if  is a decreasing function of wealth. Notice that, under these circumstances, the absolute value of the individual’s

is a decreasing function of wealth. Notice that, under these circumstances, the absolute value of the individual’s , given by

, given by , is also a function of the indi-

, is also a function of the indi-

vidual’s respective level of wealth. Hence, if ,

,  increases as increases. The opposite happens if

increases as increases. The opposite happens if![]() .

.

Each individual simultaneously chooses![]() , and

, and ![]() in order to maximize his utility, subject to his budget constraint and the public good’s production technology, and taking the contribution of the other individ-

in order to maximize his utility, subject to his budget constraint and the public good’s production technology, and taking the contribution of the other individ-

ual as given. In an interior solution, the required Nash equilibrium condition for each i is given by![]() . Taking this condition for each i, and the respective individuals’ budget constraints, this is obtained that, in equilibrium, the aggregate provision of the public good is given by:

. Taking this condition for each i, and the respective individuals’ budget constraints, this is obtained that, in equilibrium, the aggregate provision of the public good is given by:

![]() (1)

(1)

where ![]() Remarkably, the private provision of G depends not only on the total wealth of the two individuals (W), but also on each individual’s respective level of wealth, which affects

Remarkably, the private provision of G depends not only on the total wealth of the two individuals (W), but also on each individual’s respective level of wealth, which affects ![]() through each individual’s respective preference intensity for the public good,

through each individual’s respective preference intensity for the public good,![]() .

.

in this analysis ![]() is replacing by

is replacing by![]() ,

, ![]() is replacing by

is replacing by![]() , and there is assumed that either

, and there is assumed that either ![]() or

or![]() . In this case, the aggregate provision of the public good in equilibrium is then given by

. In this case, the aggregate provision of the public good in equilibrium is then given by

![]() , and this only depends on the total amount of wealth (W), but not on its distribution between the two contributors.

, and this only depends on the total amount of wealth (W), but not on its distribution between the two contributors.

We can use Equation (1) to study the effect of changes in an individual’s wealth on![]() . Differentiating

. Differentiating ![]() with respect to

with respect to![]() , we get:

, we get:

![]() (2)

(2)

where![]() , and

, and![]() . The first term in the parentheses in Equation (2)

. The first term in the parentheses in Equation (2)

(multiplied by![]() ) is always positive and corresponds to the increment in the individual allocation to public

) is always positive and corresponds to the increment in the individual allocation to public

change as his level of wealth changes. ![]() if this consideration is not taken into account. This term is positive if and only if

if this consideration is not taken into account. This term is positive if and only if![]() , and negative if and only if

, and negative if and only if![]() . Interestingly, when the individual’s valuation for the public good decreases as his respective level of wealth increases, the final effect of an increment in

. Interestingly, when the individual’s valuation for the public good decreases as his respective level of wealth increases, the final effect of an increment in ![]() on

on ![]() can be negative. In this case, the public good is an inferior good.

can be negative. In this case, the public good is an inferior good.

We can use Equation (2) to study how a redistribution of wealth between individuals 1 and 2 affects the final provision of G. Let us consider a small progressive redistribution of wealth―i.e., a redistribution of wealth from individual 2 (the richer individual) to individual 1 (the poorer individual), with W remaining unchanged, and both individuals still contributing a positive amount of resources to the public good after redistribution. The final

effect of this redistribution on the total provision of public good is given by![]() . Using Equation (2),

. Using Equation (2), ![]() transforms into:

transforms into:

![]() (3)

(3)

Since![]() , the final effect of a progressive redistribution of wealth on the aggregate provision of G de-

, the final effect of a progressive redistribution of wealth on the aggregate provision of G de-

pends on the sign of the expression in parentheses in Equation (3). There are two terms involved in![]() . The first

. The first

term, ![]() , measures individual i’s relative change in his preference intensity for the public good as wi changes. The second term,

, measures individual i’s relative change in his preference intensity for the public good as wi changes. The second term, ![]() , measures i’s spending on the private good relative to total spending in G.4

, measures i’s spending on the private good relative to total spending in G.4

To fix ideas on how a redistribution of wealth can affect the level of G, let us assume that![]() .6 Imposing this assumption in Equation (3), it follows that:

.6 Imposing this assumption in Equation (3), it follows that:

![]() (4)

(4)

not enough to obtain this result. If![]() , but

, but![]() , a progressive redistribution of wealth might decrease the aggregate provision of G. The same type of analysis can be done for the case where

, a progressive redistribution of wealth might decrease the aggregate provision of G. The same type of analysis can be done for the case where![]() .

.

4. A General Framework

Consider the general model for the private provision of public goods, wherein there is one public good (G), one private good (x) and n consumers. Same as before, each consumer i decides how to allocate his or her total exogenous wealth (![]() ) between consumption of the private good, and contributing to the provision of the pub-

) between consumption of the private good, and contributing to the provision of the pub-

![]() (5)

(5)

If richer individuals value G more than poorer individuals, then function ![]() increases as individual wealth increases. Conversely,

increases as individual wealth increases. Conversely, ![]() decreases as individual wealth increases if richer individuals value G less than poorer individuals. We assume that

decreases as individual wealth increases if richer individuals value G less than poorer individuals. We assume that ![]() is a continuous monotone function of wealth. We concentrate

is a continuous monotone function of wealth. We concentrate

Under the conditions described above, each of n individuals simultaneously chose![]() , and

, and ![]() in order to maximize his utility, subject to his budget constraint and the public good’s production technology, and taking the contribution of the other individuals as given. At an interior solution, the necessary Nash Equilibrium condition for each i is given by:7

in order to maximize his utility, subject to his budget constraint and the public good’s production technology, and taking the contribution of the other individuals as given. At an interior solution, the necessary Nash Equilibrium condition for each i is given by:7

![]() (6)

(6)

Equation (6) implicitly defines each contributor’s best response contribution to the public good. For non-con- tributors, the best response is zero contribution to the public good.8 We denote by C the set of contributors, and by ![]() the number of contributors. Furthermore, without loss of generality, we assume that those individuals

the number of contributors. Furthermore, without loss of generality, we assume that those individuals ![]() are contributors.

are contributors.

Assuming that the conditions of the implicit function theorem are satisfied, it follows from Equation (6) that for each![]() :

:

![]() (7)

(7)

Plugging Equation (7) into the individual budget constraint and summing up over those i’s ∈ C, we get:

![]() (8)

(8)

Let![]() ; applying the implicit function theorem then, we obtain:

; applying the implicit function theorem then, we obtain:

![]() (9)

(9)

Equation (9) represents aggregate private provision of the public good in this economy. Since for a given vector of individuals’ respective wealth, ![]() , each consumer’s maximization problem is exactly the

, each consumer’s maximization problem is exactly the

same as his maximization problem in the standard model of the private provision of public goods, the existence of an equilibrium in our framework is already a well-known result (see [2] ).

4.1. Changes in Wealth

We begin by analyzing how changes in a contributor’s level of wealth affect the private provision of![]() . We state this result in Proposition 1.

. We state this result in Proposition 1.

Proposition 1. Assume that![]() . For any contributor i,

. For any contributor i, ![]() if and only if

if and only if![]() ; and

; and ![]() if and only if

if and only if![]() .

.

Proof. Applying implicit differentiation to Equation (8), for any contributor i, we get that, ![]() , where

, where![]() . It follows from Equation (6) that

. It follows from Equation (6) that![]() . Thus, the effect of an increase in a contributor level of wealth can be written as:

. Thus, the effect of an increase in a contributor level of wealth can be written as:

![]() (10)

(10)

It also follows from Equation (6) that![]() . Given the properties of the utility function, it follows that

. Given the properties of the utility function, it follows that ![]() and

and ![]() for all contributor i. Therefore,

for all contributor i. Therefore,![]() . Furthermore, the sign of

. Furthermore, the sign of ![]()

depends on the sign of the right-hand term in the parentheses of Equation 10. The result in Proposition 1 follows from the sign of this term. QED

Proposition 1 raises the possibility that the public good in our framework can be an inferior good. When this is the case, although equilibrium existence is guaranteed (see [2] ), uniqueness is not (see [9] for some examples). In this context, uniqueness means that there is a unique Nash equilibrium (i.e. a unique vector of contributions) with a unique quantity of public good and a unique set of contributors. The existence of multiple equilibria makes it difficult to analyze how any redistribution of wealth affects the provision of public good in our framework. For this reason―and similar to [1] and [2] (see Theorem 1, pp. 29)―in what follows, we concentrate on analyzing the effect of small redistributions of wealth (i.e., those redistributions that only involve contributors and that do not affect the set of contributors) on the aggregate provision of G.

4.2. Changes in the Distribution of Wealth

Let us now study how a small redistribution of wealth affects the aggregate provision of G in our framework. We state this result in Proposition 2.

Proposition 2. Let us consider contributors 1 and 2 with![]() , and assume that

, and assume that![]() .

.

a) A small redistribution of wealth, either progressive (from 2 to 1) or regressive (from 1 to 2) is not neutral if and only if![]() .

.

b) If![]() , a small progressive redistribution of wealth increases G.

, a small progressive redistribution of wealth increases G.

c) If![]() , a small progressive redistribution of wealth decreases G. Furthermore, in this case, a small regressive redistribution of wealth increases G.

, a small progressive redistribution of wealth decreases G. Furthermore, in this case, a small regressive redistribution of wealth increases G.

Proof. Consider contributors 1 and 2 with![]() . The effect of a small progressive redistribution of wealth (from 2 to 1), keeping W unchanged, is given by

. The effect of a small progressive redistribution of wealth (from 2 to 1), keeping W unchanged, is given by![]() . Replacing the derivatives and carrying out some simple algebraic manipulation, this equation transforms into:

. Replacing the derivatives and carrying out some simple algebraic manipulation, this equation transforms into:

![]() (11)

(11)

If the redistribution is regressive, then the change in G is given![]() . Since

. Since![]() , the results in Proposition 2 follow from Equation (11). QED

, the results in Proposition 2 follow from Equation (11). QED

Proposition 2(a) states the condition under which a small redistribution of wealth in not neutral. Clearly, this redistribution is neutral if, as it has been assumed in previous literature,![]() . Neutrality also emerges

. Neutrality also emerges

under the same implicit conditions that the standard model of the private provision of public goods imposes on individuals’ behavior. As [2] claim, in the standard framework, after a redistribution of wealth between contributors, each individual consumes exactly the same amount of the private good that he did prior to the redistribution. In other words, the standard model implicitly imposes the condition that when there is a redistribution of

wealth, then ![]() for all the contributors. Actually, this condition is unlikely to happen. Notice that, Equation (11) can be also written as

for all the contributors. Actually, this condition is unlikely to happen. Notice that, Equation (11) can be also written as![]() . Therefore, if the condition that the standard model imposes on each individual’s behavior holds (i.e.

. Therefore, if the condition that the standard model imposes on each individual’s behavior holds (i.e. ![]() for all contributors), then it immediately follows that a redistribution of wealth in our framework is also neutral. Moreover, our model shows that this is not the only case where one can expect neutrality following a redistribution of wealth. It can also happen if

for all contributors), then it immediately follows that a redistribution of wealth in our framework is also neutral. Moreover, our model shows that this is not the only case where one can expect neutrality following a redistribution of wealth. It can also happen if ![]() is equal for all the contributors involved in the redistribution.

is equal for all the contributors involved in the redistribution.

Results in Proposition 2(b) and 2(c) state the conditions under which a progressive/regressive redistribution of wealth among contributors increases/decreases the aggregate provision of G. This result depends on the sign of the right-hand term in parentheses in Equation (11). For each individual (1 and 2), this expression involves two

terms. The first term is![]() , which captures the change in i’s preference intensity for the public good (vis-a-vis the private good) as his level of wealth changes. The other term,

, which captures the change in i’s preference intensity for the public good (vis-a-vis the private good) as his level of wealth changes. The other term, ![]() , captures the change in i’s preference intensity for the public good as his private consumption changes. Notice that, given our (standard)

, captures the change in i’s preference intensity for the public good as his private consumption changes. Notice that, given our (standard)

assumptions on![]() , this last term is always positive. The ratio between these two terms then can be understood as the relative change in the individual’s preference intensity for public goods (as wealth changes).9

, this last term is always positive. The ratio between these two terms then can be understood as the relative change in the individual’s preference intensity for public goods (as wealth changes).9

Therefore, results in Proposition 2(b) and 2(c) indicate that if the relative change in the individual’s preference intensity for public goods is larger for individual 1 (the poorer individual) than for individual 2 (the richer individual), then a redistribution of wealth from 2 to 1 always increases the final provision of G. When the opposite happens, a redistribution of wealth from 2 to 1 always decreases the final provision of G. In order to increases G in this case then, a regressive redistribution of wealth is required. Thus, our results allow us to anticipate which type of redistribution could be most useful for improving the efficiency of the aggregate provision of G.

Interestingly, to the extent that we assume that ![]() is a monotone function of an individual’s wealth, our result does not depend on the sign of

is a monotone function of an individual’s wealth, our result does not depend on the sign of![]() . In other words, when an individual’s valuation for G increases as

. In other words, when an individual’s valuation for G increases as

his or her respective level of wealth increases, it is possible to observe either an increment or a decrease in the final provision of G following a progressive redistribution of wealth. The same thing happens when an individual’s valuation for G decreases as his or her respective level of wealth increases. Notice that this holds even if we

assume that![]() , as we did in the example in Section 3. As Proposition 2 indicates, what matters

, as we did in the example in Section 3. As Proposition 2 indicates, what matters

in determining the final effect of a redistribution of wealth on G is how the magnitudes of the relative change in the individual’s preference intensity for public goods compares across those individuals involved in the redistribution of wealth.

As noted above, Equation (11) can be also used to study the effect on G of a redistribution of wealth when function ![]() is assumed to be a non-monotone function of wealth. If this is the case, the sign for

is assumed to be a non-monotone function of wealth. If this is the case, the sign for ![]() could be important for determining how a redistribution of wealth affects G.

could be important for determining how a redistribution of wealth affects G.

5. Conclusions

Which type of wealth redistribution might be most useful in reducing the under-provision of public goods in our framework depends on how the relative change in individuals’ MRSs compares across individuals. This relative change is defined as the ratio between the change in the absolute value of the individual’s MRS as his or her level of wealth changes, and the change in the absolute value of the individual’s MRS as his or her private consumption changes. If this relative change in MRSs is greater for poorer individuals than for richer individuals, then a progressive redistribution of wealth will always increase the final provision of G. When the opposite happens, a regressive distribution of wealth is needed in order to increase the final provision of G.

Acknowledgements

I thank Richard Cornes, Jorge Garcia, Pierre Pestieau and Julio Robledo for very useful comments on a previous version of this paper.

![]()

2These circumstances are: the presence of corner solutions [2] ; impure public goods [3] [4] ; large economies [5] [6] ; non-Nash behavior, such as the presence of nonzero conjectural variations [7] ; information asymmetries [8] ; inferior public goods [9] ; differences in the marginal cost of providing public goods [10] [11] .

4In equilibrium,![]() . From this, it follows that

. From this, it follows that![]() .

.

5There is another way to understand the two terms in parentheses in Equation (3). Actually, in the next section, we relate these terms to changes in the (absolute value of) the individual’s ![]() generated by changes in individual’s wealth and changes in private consumption.

generated by changes in individual’s wealth and changes in private consumption.

6This assumption implies several things. First of all, since![]() , it follows that

, it follows that ![]() if and only if

if and only if ![]() . Actually, as noted in footnote 5, we use this last interpretation in our analysis in the next section. Notice also that in our example, this assumption implies that

. Actually, as noted in footnote 5, we use this last interpretation in our analysis in the next section. Notice also that in our example, this assumption implies that![]() .

.

7Notice that function ![]() represents a particular function for each i. For instance, in our example in Section 3, this function differs across individuals for the term

represents a particular function for each i. For instance, in our example in Section 3, this function differs across individuals for the term![]() .

.

8An individual i is a contributor if![]() ; otherwise, individual i is a non-contributors.

; otherwise, individual i is a non-contributors.

9Notice that Equation (3) in our example in Section 2 can be rewritten as ![]() where

where![]() . Since in this case

. Since in this case ![]() Equation (3) can be directly obtained from Equation (11). Thus, as anticipated in Section 3, an analysis of Equation (3) can be also done in terms of the changes in the absolute value of individuals’ MRSs as respective individuals’ levels of wealth and private consumption change.

Equation (3) can be directly obtained from Equation (11). Thus, as anticipated in Section 3, an analysis of Equation (3) can be also done in terms of the changes in the absolute value of individuals’ MRSs as respective individuals’ levels of wealth and private consumption change.