Theoretical Economics Letters

Vol.06 No.05(2016), Article ID:70733,17 pages

10.4236/tel.2016.65100

Accounting Conservatism: Evidence from Indian Markets

Sushma Vishnani, Dheeraj Misra

Jaipuria Institute of Management, Lucknow, India

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: August 26, 2016; Accepted: September 18, 2016; Published: September 21, 2016

ABSTRACT

This paper establishes existence of conditional conservatism in accounting practices of Indian corporate. It estimates firm-year measure of accounting conservatism (C- score). This study validates the C-score, asymmetric timeliness measure, and establishes monotonicity of C-scores. The paper also focuses on the study of the empirical properties of C-score and finds positive association of C-score decile ranks with decile wise Leverage and Variability. The C-score decile ranking is negatively associated with Size, Age, Market-to-Book Value ratio, Return on Assets and Non-Operating Accruals. Through this study, the forecasting capability of C-scores is established. C-scores can predict conditional conservatism up to two years ahead. This study is expected to play an important role in furtherance of research in this area in the Indian context.

Keywords:

Conservatism, Accounting Conservatism, Conditional Conservatism

1. Introduction

Conservatism has been an area of interest for many accounting researchers [1] - [9] . Researchers in the area of accounting conservatism have talked about two types of conservatism: Conditional Conservatism and Unconditional Conservatism. “Conditional conservatism” is defined as a tendency to accelerate losses and defer gains. This characteristic of conservatism is referred to in the academic literature as “asymmetric loss recognition timeliness” [1] [8] [10] - [12] . “Unconditional conservatism” is defined as an accounting bias toward reporting low book values of net assets relative to their market value [10] . Unconditional conservatism does not depend on news events. Conditional conservatism is situational, while unconditional conservatism is pervasively and consistently applied. Examples of unconditional conservatism include the immediate expensing of R & D and advertising, causing economic assets to be omitted from balance sheets. Past studies differentiate unconditional conservatism, which reflects the predetermined application of conservative accounting policies, from conditional conservatism, which is event-driven [11] .

Mostly the accounting researchers are attracted more towards conditional conservatism and the determining factors and/or its effects. The plausible reason may be that these researchers are keener on identifying contracting and valuation dimensions of conservatism which flows from unconditional conservatism [6] .

The main objective of this study is to investigate the presence of the accounting conservatism in Indian companies. The reverse regression model proposed by Basu [1] has been used for this purpose. The model has been extensively used in previous researches [2] [13] - [15] . However, asymmetric timeliness conservatism measure of Basu [1] is sensitive to factors not related to accounting conservatism, such as extent of uniformity in the contents of economic news, nature of economic events, etc. [7] . It has been suggested in earlier researches [6] [7] that Basu model [1] should be used in conjunction with other models for studying accounting conservatism. Thus, the firm-year conservatism score (C-score), suggested by Khan and Watts [9] , is used as an additional measure of conditional conservatism to study its empirical properties. Khan and Watts [9] model is built on the basic foundation of Basu model [1] . In Basu [1] model, earnings are regressed on contemporary stock returns, with a dummy variable to capture differential impact of the negative return sample and an associated interaction term. In Khan and Watts [9] , Basu [1] model is run with annual cross sectional data, specifying the asymmetric earnings timeliness coefficient as a linear function of firm-specific characteristics―size, market-to-book value and leverage, as additional variables. These three factors have theoretical as well as empirical linkages with the extent of conditional conservatism [16] . The firm-year conservatism measure, C-Score, is calculated by substituting the firm’s size, market-to-book value and leverage into the estimated regression for that year.

This study is done in the following steps:

To study whether earnings are more strongly associated with contemporary negative stock market returns (proxy for bad news) or contemporary positive stock mar- ket returns (proxy for good news), Basu [1] model is used.

C-score for each firm-year in the sample is calculated using Khan and Watts [9] model.

The validity of the calculated C-scores is empirically verified.

The C-scores are used to predict Basu’s [1] asymmetric timeliness measure for up to three years ahead.

The association between C-scores and various factors expected to have linkages with variation in conditional conservatism (such as, investment cycle length, size of firm, age of firm, leverage, etc.) is examined.

Our study is the first of its kind in Indian context. It provides detailed evidence of conservatism and factors associated with it under Indian GAAPs. It also provides insights for future research with regard to various factors which may lead to conservatism or various outcomes of conservatism. Since India is on the verge of converging with International Financial Reporting Standards (IFRS), whose framework gives more importance to “neutrality” vis-à-vis “conservatism”, findings of our study may have some implications for accounting standard setters.

The remainder of the paper is structured as follows. Section 2 gives theoretical framework of our study. Section 3 describes in brief the Basu (1997) model and its appropriateness for measuring conditional conservatism. It also describes the procedure used for estimating C-scores of Indian firm-years. Section 4 deals with the data used in the study. Section 5 discusses the empirical results and Section 6 gives summary and conclusions.

2. Theoretical Framework

Conservatism, in accounting, refers to recognition of expenses and liabilities prudently, even if there is uncertainty about the outcome; but incomes and assets are recognized only when there is full surety of receiving them. As per the conservatism principle, if there is uncertainty about incurring a loss, it should still be provided for in the books of account. On the contrary, if there is uncertainty about earning a gain, it should not be accounted for in the books of account. Traditionally, accounting conservatism is defined by the maxim “anticipate no profit, but anticipate all losses” [17] . Some instances of conservatism in accounting practices are: valuing closing stock at cost or market price whichever is lower, creating provision for doubtful debts, writing off intangible assets like goodwill, patent, etc. This suggests that conservatism is practiced by accountants and enforced by standard setters since years.

Accounting standard setters have increasingly viewed conservatism as being at odds with “neutral” financial reporting [8] . In 2010, the IASB (International Accounting Standards Board) revised its Conceptual Framework and rejected the concept of conservatism (or prudence), contending that conservatism compromises neutrality, an aspect of faithful representation. On 16th Feb, 2015, Ministry of Corporate Affairs (MCA), India notified the applicability of Ind AS (Indian Accounting Standards issued by ICAI, fully converged with IFRS) for Indian companies’ w.e.f. 1/4/2015 in phased manner. The Framework for Preparation and Presentation of Financial Statements as per Indian Accounting Standards also emphasize on “neutrality” as an important characteristic of the information contained in the financial statements. Though “prudence” should also be followed in preparation of financial statements as per the Framework. However, the exercise of prudence does not allow, for example, the creation of hidden reserves or excessive provisions, the deliberate understatement of assets or income, or the deliberate overstatement of liabilities or expenses, because the financial statements would not be neutral and, therefore, not have the quality of reliability.

Nonetheless “conservatism” as a property in financial statements has been emphasized historically by accountants [4] . Evidence from Indian Companies about the conservatism and the factors associated with conservatism may provide an insight to the practitioners as well as standard setters about whether accounting standards should maintain, decrease or increase the conservatism in the preparation of financial statements.

Earnings reflect bad news more quickly than good news as accountants require a higher degree of verification for recognizing good news than bad news in financial statements [1] . This asymmetry in verification becomes all the more desirable in situations when the two parties in a contract have asymmetric payoffs. For instance in a debt contract, lender is entitled to get back the face value of debt at the time of maturity. At the time of maturity of debt, two possibilities are there-one, the value of net assets of the firm exceeds the value of debt; and the second, value of net assets of the firm may be less than the value of debt. In first situation, the lender will be paid his outstanding dues; while in the second situation, the lender shall get less than his outstanding balance of loan. Thus, lenders are more concerned with the downside of earnings and net assets. Conditional conservatism is characterized by the asymmetric recognition of positive and negative economic news.

In accounting, bad news, proxied by negative stock returns, is recognized in earnings on a timelier basis than good news, proxied by positive stock returns [1] [3] [18] [19] . Basu [1] argues that conservatism has influenced accounting practice for last five centuries. The explicit benefit of conservatism is it serves as an efficient contracting mechanism [1] . Watts [4] had given four explanations for accounting conservatism viz., contracting; litigation, taxation and political costs. The contracting explanation implies that conservatism enhances the efficiency of earnings as a measure of performance and net assets as a measure of the firm’s abandonment value. Conservatism posited by contracting, litigation, and political costs reasons is in accordance with the common aversion to opportunistic payments to managers and other parties. The limited tenure and liability of managers encourage them to build bias and noise in the value estimates of reported figures. Further, the lack of verifiability of many valuation estimates creates more scope for the managers to do so. Asymmetric verifiability confines that bias and noise. Conservatism is an established feature of accounting measurement in free market countries, and is one mechanism used to constrain managerial opportunistic behavior and to enhance the reliability of financial reporting and disclosure [20] .

3. The Model

3.1. Basu Asymmetric Timeliness Measure of Conservatism

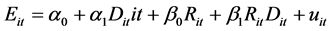

The reverse regression model by Basu [1] is an intuitively appealing method for measuring the level of conditional conservatism. There is a large literature providing empirical evidence on existence of asymmetric earnings timeliness [5] . Basu [1] is one of the most widely used measure of conditional conservatism [6] . As per Basu [1] , accounting earnings are expected to have stronger association with contemporary negative stock market returns, which are proxy for bad economic news, vis-à-vis contemporary positive stock market returns, which are proxy for good economic news. The explanation offered for this phenomenon is that unrealized losses are more likely to be recognized instantly under conservative accounting than unrealized gains. Basu’s model is specified below:

(1)

(1)

where, i indexes the firm,

t indexes year,

Eit equals annual earnings per share in year t scaled by beginning stock price,

Rit is the firm’s common stock return from nine months before fiscal year-end t to three months after fiscal year-end t,

Dit equals one if Rit is negative and zero otherwise, and

uit is the disturbance term.

The unconditional slope coefficient in this model (β0) reflects the extent to which current accounting earnings reflects economic news (as proxied by contemporary stock returns) in a timely fashion. More the accounting earnings capture economic news; more positive and statistically significant the β0 shall result. When earnings reflect current bad news (Rit < 0) more rapidly than good news (Rit > 0), a positive statistically significant β1 is the result.

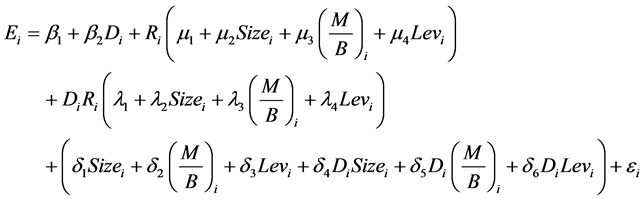

3.2. C-Score Measurement

Khan and Watts [9] argued that Basu’s asymmetric timeliness measure of conditional conservatism fails to recognize the timing of changes in conservatism level for each individual firm. Hence, they suggested the modified version of Basu [1] model. This modified model estimates annual cross-sectional Basu [1] regressions, specifying the asymmetric earnings timeliness coefficient as a linear function of firm-specific characteristics―size, market-to-book and leverage.

The annual cross-sectional regression model [9] used to estimate C-Score, firm-year measure of conditional conservatism and G-Score, firm-year measure of good news timeliness, is:

(2)

(2)

where, i indexes the firm,

E equals annual earnings per share scaled by beginning stock price,

R is the firm’s common stock return from 9months before fiscal year-end tothree months after fiscal year-end (measuring news),

D is a dummy variable equal to 1 when R < 0 and equal to 0 other wise,

Size is the natural log of market value of equity,

M/B is the ratio of market value of equity to book value of equity,

Lev is ratio of debt to equity.

Equation (2) is estimated annually for all firms. Using the regression results from Equation (2), C-score is derived using following equation:

(3)

(3)

While, G-score is derived using following equation:

(4)

(4)

Empirical estimators of μi and λi, i = 1 to 4, are estimated from annual cross-sectional regressions. A higher C-score indicates increased conditional conservatism.

4. Data

We have extracted data from PROWESS, a database of CMIE (Centre for Monitoring Indian Economy Pvt. Ltd.). Prowess is a database of the financial performance of Indian companies. Annual Reports of individual companies is the principal source of this database. The database covers listed and unlisted companies. For listed companies, the database includes data sourced from the stock exchanges. Prowess contains time-series data from 1998-99.

Our initial sample consisted of 8000 firm-year observations. We had extracted data for 500 listed Indian companies which formed part of S & P BSE 500 index as on 10th November, 2015 for the years 2000 to 2015. S&P BSE 500 index represents nearly 93% of the total market capitalization on BSE, a leading stock exchange of India that was established in the year 1875. S&P BSE 500 covers all 20 major industries of the Indian economy. After deleting firm-years with missing data for any of the variables used in estimation, we were left with 5914 firm-year observations. To contain the effect of outliers in the sample, we winsorised observations lying in the top and bottom 1 percentile of each continuous variable. After winsorising, we were left with 5803 firm-year observations for the purpose of our study.

Table 1 shows the descriptive statistics for 5803 firm-years between financial year 2000 and 2015.

The definition of variables is given below:

E is price deflated earnings (before abnormal items) per share,

R is annual stock market returns calculated to end three months after the fiscal year-end,

Size is the natural log of market value of equity,

M/B is the ratio of market value of equity to book value of equity,

Lev is ratio of debt to equity,

ROA is return on total assets,

NOAcc is non-operating accruals scaled by lagged total assets,

Inv Cycle is measure of length of investment cycle, calculated by dividing depreciation expense by lagged assets,

Table 1. Descriptive statistics.

Age is the age of the firm, measured as the number of years from the date of incorporation of firm,

CFO is cash flow from operations deflated by lagged total assets,

Volatility is the standard deviation of daily stock returns.

5. Empirical Results

5.1. Basu (1997) Model

Table 2 depicts our results from running Basu’s reverse regression (specified in Equation (1) in Section 3.1).

Our results depict existence of accounting conservatism in Indian firms as is evident from the coefficient of D*R which is positive and statistically significant. The results are consistent with earnings being timelier in reporting publicly available “bad news” than “good news”. Also, the intercept term is positive and significant, which indicates that unrealized gains from previous periods, uncorrelated with current news, are recognized in current periods. Adjusted R2 is at acceptable level of 8.5%. The earnings is about two and half times [((0.0527 + 0.0426)/0.0426) = 2.24] as sensitive to negative returns as it is to positive returns.

5.2. C-score Estimation

Table 3 depicts mean values of coefficients from estimation of Khan and Watts (2009) regression model (specified in Equation (2) in section 2.2). The regressions are run annually from 2000 to 2015. The t-statistics for each coefficient is also reported.

The results reported in Table 3 further confirm presence of conservatism in accounting practices by Indian firms as the coefficient for D*R (the asymmetric timeliness coefficient) is positive as well as statistically significant. The coefficient values depict by and large similar signs as predicted barring the coefficient for R*M/B. The coe-

Table 2. Basu (1997) reverse regression results.

Table 3. Mean coefficients from estimated cross-sectional regression for financial years 2000 to 2015.

fficient of R*Size is insignificant. However, the coefficient of D*R*Size is significantly negative, suggesting larger companies have lower asymmetric timeliness. The coefficients of R*M/B and D*R*M/B are insignificant, though the signs of the two coefficients are as per the prediction. This may be due to ‘buffer problem’ mentioned in [21] . The coefficient of R*Lev is significantly negative, as well as the coefficient of D*R*Lev is also significant and positive, and the signs are as predicted. This is consistent with higher level of conservatism followed by highly levered firms. Existence of debt contracts in a firm calls for conservative accounting practices [4] .

The parameter estimates given in the table above are used to calculate the C-scores and G-scores for 5803 firm-years as per Equations (3) and (4) [mentioned in Section 3.2].

Table 4 depicts descriptive statistics of the estimated C-scores and G-scores. C-score is the firm-year measure of incremental bad news timeliness. Higher C-score denotes higher level of accounting conservatism and vice-versa. While, G-score is the firm-year measure of good news timeliness.

The mean and median values of C-scores and G-scores are approximately similar, suggesting C-score and G-score distributions are almost symmetrical. Further, majority of C-scores are greater than zero (5324 out of 5803) indicating all-predominance of accounting conservatism in financials reported by Indian firms.

Table 5 depicts correlation between C-scores and G-scores.

There is almost perfect negative correlation, which is statistically significant at 0.01 level, between C-scores and G-scores, consistent with theoretical understanding of asymmetric timeliness for bad news vis-à-vis good news.

5.3. C-Score Validation

To further empirically check the efficacy of C-scores in capturing the conditional conservatism, we perform the below mentioned three tests. To perform these tests, firms

Table 4. Descriptive statistics.

Table 5. Correlation between C-scores and G-scores.

**Correlation is significant at the 0.01 level.

are first categorized into C-score deciles for each year. Then they are ranked as per their decile categorization in each year. Higher rank denotes higher level of conservatism. Finally a pool is created of firm years for each decile category.

1) We ran the Basu (1997) panel regression model (as specified in Equation (1)) on data pooled in each C-score decile; we obtained the asymmetric timeliness measure of conditional conservatism (β1 in Equation (1)) for each decile from regression statistics. Then we study whether Basu’s measure of conditional conservatism obtained from these regressions is in increasing order across the C-score deciles, to make the two measures consistent with each other, or otherwise.

Table 6 below depicts coefficients from Basu (1997) model measured for the pool of data under each C-Score decile.

Conservatism is increasing in C-score and higher decile comprises of firm years with relatively higher C-scores. β1, Basu’s asymmetric timeliness coefficient for bad news, depicts approximately increasing trend as per expectations of higher conservatism level for higher deciles. However, β1for 10th C-score decile is lower than that of 9th C-score decile, which is indisagreement with the measure of monotonicity. Though, Spearman’s Rho (measure of monotonicity) shows statistical significance in the positive correlation between C-score decile and β1. Β0, measure of good news timeliness, is expected to have the negative correlation with C-score decile as highly conservative companies shall recognize good news in earnings negligibly. Our results reported in Table 6 show negative rank correlation between the two as expected although the same is insignificant.

In nutshell, this test establishes the efficacy of C-score in capturing the conditional conservatism.

Table 6. Coefficients from basu model by c-score decile.

**Correlation is significant at the 0.01 level (2-tailed).

2) We studied the distributions of Return on Assets (ROA) and Non-operating Accruals (NOAcc) C-score decilewise. We estimated the first, second and third moments of the two variables for each of the ten C-score deciles to conduct our study. ROA and NOAcc are likely to be more variable and negatively skewed for firms following higher degree of accounting conservatism [5] [18] . The firms following higher level of conditional conservatism shall tend to account for losses more quickly than gains. This shall lead to decreasing trend of ROA across C-score deciles. Such firms, with higher level of conditional conservatism, will have larger negative accruals from unrealized losses recognized in accounting and hence lower total accruals. This shall lead to decreasing trend of NOAcc, as well, across C-score deciles. Further, firms following higher level of conditional conservatism in accounting are expected to have higher unrealized losses and hence higher negative accruals. This is expected to cause negatively skewed distributions of ROA and NOAcc for such firms. Firms with higher unrealized losses are expected to have lower level of persistency in their earnings distributions and thus higher variability [5] . The similar effect is expected on accruals. Thus, firms which are more conditionally conservative will have more variability in their ROA and NOAcc.

Table 7 below reports the results of this test.

Table 7 shows mean, standard deviation and skewness of ROA and NOAcc for C-score deciles from 1 to 10. It also reports the rank correlation between the C-score decile and other variables reported in the various columns. Rank Correlation is the measure of monotonicity of the two ranked variables.

Table 7. C-score decilewise distributions of ROA and NOAcc.

#Correaltion is significant at .01 level (2-tailed).

The decilewise mean values of ROA as well as NOAcc depicts the statistically negative association with C-score decile ranking, which is in agreement with the earlier empirical studies [8] [9] as well as theoretically expected relationship. The standard deviation of ROA is increasing up to C-score decile rank 6, consistent with prior literature discussed above. However, it starts declining after decile rank 6 which is in abeyance with expected association between C-score decile rank and decilewise Standard deviation. This resulted in negative rank correlation coefficient. The rank correlation coefficient between C-score decile ranks and standard deviation of NOAcc is estimated to insignificant. Thus, the existence of association between variability of ROA and NOAcc with C-score decile ranks, as discussed above, cannot be proved. Similarly, association between decilewise skewness and C-score decile ranks could not be established as discussed above.

In nutshell, this test confirms partially the validity of C-score, as a measure of conditional conservatism.

3) We studied association of certain firm-specific variables with level of conservatism. This study is expected to provide some evidence in Indian context as though these conservatism determining variables have been studied in the context of various countries [8] [9] [16] [22] [23] ) but no such study has been done in Indian context. The variables that we have studied are: Size, Age, Market-to-Book ratio, Volatility, Investment Cycle and Leverage.

Larger firms are likely to have lower information asymmetry owing to their mature status. This may call for lower contracting demand in larger firms, hence lower level of conditional conservatism.

Older firms are expected to have better corporate governance mechanisms in place which is helpful in reducing agency problems. Such firms’ existing assets are more verifiable which calls for lower level of conditional conservatism. On the other hand, younger firms’ managers have tendency not to disclose all information to investors, leading to agency problems [24] . Such firms’ demand for conditional conservatism shall be on higher side. LaFond and Watts [16] have shown the relationship between information asymmetry and accounting conservatism.

Earnings conservatism has been empirically shown to be more associated with lower price-to-book value firms than with higher price-to-book value firms [13] . The explanation given for this negative association is that the litigation is more likely to occur, and involve greater claims for damages, for firms with lower P/B ratios signaling financial distress and depressed security prices. This arises from allegation of overstated net asset. However, high market-to-book value firms are usually growth firms wherein presence of agency costs [23] is more likely. For such firms, high level of conservatism to contain such agency costs is desirable. Thus, positive association between M/B and conservatism is expected. Since both kinds of association, positive and negative, between market-to-book ratio and level of conservatism has been empirically proven we shun from making any explicit prediction about this relationship.

Volatility is an indicator of firm-specific uncertainty while conditional conservatism in accounting is supposed to control the information uncertainty [25] . Thus, conditional conservatism and volatility are expected to have positive association. Further, conservative firms are likely to recognize unrealized losses with occurrence of bad news. Volatility is also expected to be higher around bad news time. Thus, the two are expected to co-exist, not influence each other.

Length of investment cycle is expected to have direct association with level of accounting conservatism. Longer the investment cycle, more is the futurity involved with regard to outcome, and hence higher level of uncertainty. Though the future outcome may be losses as well as gains, but the investors are concerned about the negative outcome. This uncertainty may be handled with higher level of conditional conservatism.

Leverage and conditional conservatism are expected to have positive association. Highly levered firms face agency problem between shareholders and debtholders [25] . Conditional conservatism is an apt solution for agency problem as it restricts the ability of firms to overstate net assets, thereby protecting the debtholders who are subject to downside risk but not eligible for upside gain. Presence of debt contract in the firm’s capital structure also demands accounting conservatism [4] .

Table 8 below reports the mean values of the variables discussed above. It also shows the rank correlation between decilewise mean values of each variable vis-à-vis C-score decile ranks. The table also reports the rank correlation coefficient of G-score, the good news timeliness measure, with C-score decile ranking.

Table 8 displays the average values of C-scores and G-scores in each C-score decile, which reflects that the most conservative firm-years (i.e. decile 10) report highest level of conditional conservatism (highest mean C-score) and lowest level of good news timeliness (lowest mean G-score). The statistically significant negative rank correlation, measure of monotonicity, between C-score decile and G-score decile wise also confirms this.

Table 8. C-score decile wise mean values of selected variables.

@Correaltion is significant at .05 level (2-tailed); #Correaltion is significant at .01 level (2-tailed).

Table 8 reports statistically significant negative association between market-to-book ratio and C-score decile, i.e., firms with lower level of conditional conservatism have relatively higher market-to-book ratio. Our results are in agreement with Khan and Watts [9] .

Table 8 shows statistically significant perfect negative correlation between size of the firm and the level of conservatism. This indicates that smaller firms follow relatively higher level of conditional conservatism in their accounting practices. Our results are in agreement with Khan and Watts [9] and Lai and Taylor [8] .

Leverage is monotonically increasing in the C-score deciles in Table 8. This indicates more levered firms tend to be more conservative in their accounting practices than less levered firms. Our results are in agreement with Khan and Watts [9] .

Table 8 reports statistically significant negative rank correlation between age and C-score decile. This indicates younger firms are more conservative than older firms. Our results are in conformity with Khan and Watts [9] and Lai and Taylor [8] .

No significant relationship between investment cycle and accounting conservatism shows in our study. Table 8 reports statistically significant perfect positive relationship between C-score deciles and decilewise mean values of volatility. Our results are agreement with Khan and Watts [9] and Lai and Taylor [8] .

In nutshell, this test establishes the validity of C-score, as a measure of conditional conservatism, by establishing its consistency with certain other variables which have been empirically used as indicators of conservatism in prior literature.

5.4. C-score Forecasting Ability

Finally, we explore the predictive ability of C-scores calculated up to three years ahead. For conducting our study, we categorize firms into deciles based on their C-scores for each of the years t-3, t-2, and t-1. Thereafter, Basu pooled regression is run for year t data for each decile.

Table 9 below reports the results of our study. Be aware of the different meanings of

Table 9. Forecasting ability of c-score for basu asymmetric coefficient.

*Correlation is signifiant at .05 level (2-tailed); **Correlation is significant at the 0.01 level (2-tailed).

the homophones “affect” and “effect”, “complement” and “compliment”, “discreet” and “discrete”, “principal” and “principle”.

Table 9 displays the Basu asymmetric coefficient for each decile, with reference to three data sets t-1, t-2 and t-3. It also reports the rank correlation, measure of monotonicity, between Basu coefficients decilewise and C-score deciles. The rank correlation is positive, as expected, but it is statistically significant only for t-1 and t-2 sets. The highest and the most significant relationship is reported for t-2 category. Our study shows that the forecasting ability of C-scores is best up to 2 years ahead.

6. Conclusions

This study is first of its kind in the Indian context. It confirms presence of conditional conservatism in the accounting practices of Indian firms. First, our study demonstrates existence of conditional conservatism in Indian financial reporting using a large sample of Indian firm-years (5803 firm years from financial year 2000 to financial year 2015). Second, our study estimates C-score, a firm-year measure of conditional conservatism. Estimation of C-score involves consideration of firm-specific characteristics―size, market-to-book and leverage. Third, our study probes the empirical properties of C- scores to establish its validity as a measure of conditional conservatism. We have conducted the tests to establish the forecasting ability of C-scores about future conditional conservatism. Our tests establish forecasting ability of C-scores up to two years ahead.

Our study establishes that Indian corporate respond more quickly to bad news than good news; i.e. it confirms existence of asymmetric timeliness. However, this asymmetric timeliness is of lower scale in case of larger firms as compared to smaller firms. Further, highly levered firms have higher asymmetric timeliness and vice versa.

The C-scores and G-scores derived for 5803 firm years, establish all pervasiveness of conditional conservatism in Indian corporate. Subsequently, we have run the test to validate the C-score, the firm-year measure of conditional conservatism. Our tests confirm the validity of C-score. C-scores decile ranks and decile wise Basu asymmetric timeliness measure (coefficient for D*R) is reported to have statistically significant positive rank correlation in this study. Further, ROA and NOAcc depict negative rank correlation with C-score which indicates highly conservative companies have lower values of ROA and NOAcc. Our test of rank correlation between C-score decile and firm specific variables exhibit positive relationship of conditional conservatism with leverage as well as volatility; while negative relationship with market-to-book ratio, age and size.

In nutshell, our rigorous study on existence of conditional conservatism and the factors associated with conditional conservatism is expected to provide useful insights to researchers in this area for probing further the causes and effects of conservatism in Indian context. Further, in the regime of fair value accounting, that has just started in Indian corporate, our study is expected to guide standard setters in taking a call on asymmetrical verification standards.

Cite this paper

Vishnani, S. and Misra, D. (2016) Accounting Conservatism: Evidence from Indian Markets. Theoretical Economics Letters, 6, 1000-1016. http://dx.doi.org/10.4236/tel.2016.65100

References

- 1. Basu, S. (1997) The Conservatism Principle and the Asymmetric Timeliness of Earnings, Journal of Accounting and Economics, 24, 3-37.

http://dx.doi.org/10.1016/S0165-4101(97)00014-1 - 2. Ball, R., Kothari, S.P. and Robin, A. (2000) The Effect of International Institutional Factors on Properties of Accounting Earnings. Journal of Accounting and Economics, 29, 1-51.

http://dx.doi.org/10.1016/S0165-4101(00)00012-4 - 3. Holthausen, R. and Watts, R. (2001) The Relevance of the Value-Relevance Literature for Accounting Standard Setting. Journal of Accounting and Economics, 31, 3-76.

http://dx.doi.org/10.1016/S0165-4101(01)00029-5 - 4. Watts, R.L. (2003) Conservatism in Accounting, Part I: Explanations and Implications. Accounting Horizons, 17, 207-221.

- 5. Watts, R.L. (2003) Conservatism in Accounting, Part II: Evidence and Research Opportunities. Accounting Horizons, 17, 287-301.

- 6. Ryan, S. (2006) Identifying Conditional Conservatism. European Accounting Review, 15, 511-525.

http://dx.doi.org/10.1080/09638180601102099 - 7. Givoly, D., Hayn, C. and Natarajan, A. (2007) Measuring Reporting Conservatism. Accounting Review, 82, 65-106.

http://dx.doi.org/10.2308/accr.2007.82.1.65 - 8. Lai, C. and Taylor, S.L. (2008) Estimating and Validating a Firm-Year-Specific Measure of Conservatism: Australian Evidence.

- 9. Khan, M. and Watts, R.L. (2009) Estimation and Empirical Properties of a Firm-Year Measure of Accounting Conservatism. Journal of Accounting and Economics, 48, 132-150.

- 10. Ball, R. and Shivakumar, L. (2005) Earnings Quality in UK Private Firms: Comparative Loss Recognition Timeliness. Journal of Accounting and Economics, 39, 83-128.

http://dx.doi.org/10.1016/j.jacceco.2004.04.001 - 11. Beaver, W.H. and Ryan, S.G. (2005) Conditional and Unconditional Conservatism: Concepts and Modeling. Review of Accounting Studies, 10, 269-276.

http://dx.doi.org/10.1007/s11142-005-1532-6 - 12. Balkrishna, H., Coulton, J. and Taylor, S. (2007) Accounting Losses and Earnings Conservatism: Evidence from Australian GAAP. Accounting and Finance, 47, 381-400.

http://dx.doi.org/10.1111/j.1467-629X.2007.00218.x - 13. Pae, J., Thornton, D.B. and Welker, M. (2005) The Link between Earnings Conservatism and the Price-To Book Ratio. Contemporary Accounting Research, 22, 693-717.

http://dx.doi.org/10.1506/9FDN-N6ED-LJE9-A1HL - 14. Ruddock, C., Taylor, S.J. and Taylor, S.L. (2006) Nonaudit Services and Earnings Conservatism: Is Auditor Independence Impaired? Contemporary Accounting Research, 23, 701-746.

http://dx.doi.org/10.1506/6AE8-75YW-8NVW-V8GK - 15. Ahmed, A.S. and Duellman, S. (2013) Managerial Overconfidence and Accounting Conservatism. Journal of Accounting Research, 51, 1-30.

http://dx.doi.org/10.1111/j.1475-679X.2012.00467.x - 16. LaFond, Ryan and Watts, R.L. (2008) The Information Role of Conservative Financial Statements. The Accounting Review, 83, 447-478.

http://dx.doi.org/10.2308/accr.2008.83.2.447 - 17. Bliss, J.H. (1924) Management through Accounts. The Ronald Press Co., New York.

- 18. Givoly, D. and Hayn, C. (2000) The Changing Time-Series Properties of Earnings, Cash Flows and Accruals: Has Financial Reporting Become More Conservative? Journal of Accounting and Economics, 29, 287-320.

http://dx.doi.org/10.1016/S0165-4101(00)00024-0 - 19. Ryan, S. and Zarowin, P. (2003) Why Has the Contemporaneous Linear Returns-Earnings Relation Declined? The Accounting Review, 78, 523-553.

http://dx.doi.org/10.2308/accr.2003.78.2.523 - 20. Cheng, C., James, K. and Kung, F. (2010) Is Conditional Conservatism Higher for Overseas Listed Chinese Companies on the Hong-Kong Stock Exchange? Irish Accounting Review, 17, 31-53.

- 21. Roychowdhury, S. and Watts, R.L. (2007) Asymmetric Timeliness of Earnings, Market-to-Book and Conservatism in Financial Reporting. Journal of Accounting and Economics, 44, 2-31.

http://dx.doi.org/10.1016/j.jacceco.2006.12.003 - 22. Campbell, J.Y. and Hentschel, L. (1992) No News Is Good News: An Asymmetric Model of Changing Volatility in Stock Returns. Journal of Financial Economics, 31, 281-318.

http://dx.doi.org/10.1016/0304-405X(92)90037-X - 23. Smith, C. and Watts, R. (1992) The Investment Opportunity Set and Corporate Financing, Dividend and Compensation Policies. Journal of Financial Economics, 32, 263-292.

http://dx.doi.org/10.1016/0304-405X(92)90029-W - 24. Jensen, M.C. and Meckling, W.H. (1976) Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3, 305-360.

http://dx.doi.org/10.1016/0304-405X(76)90026-X - 25. Guay, W. and Verrecchia, R.E. (2007) Conservative Disclosure. Working Paper, University of Pennsylvania, Philadelphia.