Measurement of Fiscal Absorbing Capacity in Megacities and Analysis on Their Influence Factors

—Empirical Research Based on Factor Analysis Combined with Panel Data ()

1. Introduction

1.1. Research Background

Fiscal revenue is government’s financial guarantee to perform duties and safeguard national long-term governance and stability. Ever since reform and opening up, China’s fiscal revenue has increased from 113.236 billion yuan in 1978 to 14,035 billion yuan in 2015. The progressive implementation of the strategic disposition-comprehensively deepening reform and the requirement-accelerating transformation of government functions put forward in the 18th CPC National Congress have highlighted the importance of local governments offering public services.

From the middle of the 19th century, along with the fast development of western industrialization, the size and number of cities have been expanding and increasing with an unstoppable trend. Cities have become the political, economic and cultural center of a country. Central cities have brought about both aggregation effect and radiation effect, have made more and more resources gathering in cities and have spread the influence of cities to even wider areas. At present, our country is at an accelerated development period accepted internationally with an urbanization level transforming from 30% to 70%. In November, 2014, the State Council issued Notice on Adjusting Standard of City Size Division that defines cities with over ten million populations as megacities. Now, there are totally seven megacities in our country, including Beijing, Tianjin, Chongqing, Shanghai, Guangzhou, Shenzhen and Wuhan.

Megacities in the national economy play the most important role in the national economy as the status and role of economic growth pole. Megacities often offer the national advanced productivity, the more high-end technology and personnel, capital intensive and more advanced management methods, has high production efficiency and benefit, in the national economic growth plays an irreplaceable role.

After the reform of tax distribution system, local governments face a common awkward situation of financial difficulty, and problems derived from it such as land finance and local platform of investment and financing result in adverse effect on national governance. Tough transfer payment is one of the tools to offset local fiscal deficit, long-term relying on it still cannot reverse local fiscal difficulty. Hence, improving local fiscal absorbing capacity plays a key role in promoting local economic development and stimulating local governance, as it not only decides the sustainability of government’s disposable financial resources but affects the quality of supplied public goods and services. Then how to measure fiscal absorbing capacity and how to study relevant factors affecting such capacity in a scientific way own important guiding significance for setting up fiscal and tax policies and is worth deeply investigating.

The concept “fiscal absorbing capacity” should date back to 1962 when ACIR put forward “fiscal capacity” or more specifically, “tax capacity”. They defined it as “resources that can be imposed within jurisdiction to raise revenue”. Later, in order to further clarify “fiscal capacity”, ACIR defined it as “government’s ability to provide capital for public services” and included factors such as tax income into assessment scope. And accordingly, it formulated RRS and set up RES successively. Compared with those capitalist countries with simple fiscal mechanisms and focusing on taxation, China makes its fiscal mechanism play an essential part in tax revenue and account for quite a proportion in tax revenue. And due to the existence of such difference, the definition of “fiscal capacity” in foreign countries cannot be directly used for China’s fiscal mechanisms. As a result, scholars at home and abroad made new definitions for “fiscal capacity” on the basis of foreign research.

1.2. Literature Review

Our country’s definition of fiscal absorbing capacity is firstly seen in national capacity report written by Wang Shaoguang adn Hu Angang (1993) [1] . This report points out that national capacity consists of absorbing capacity, regulation capacity, legal capacity and coercive capacity, among which absorbing capacity is the core of all national capacity and the foundation of other three capacities, representing the capacity that a nation mobilizes and absorbs all kinds of social resources. Later on, scholars put forward such similar concepts as “fiscal self- supporting capacity” and “fiscal revenue capacity”, all of which (for instance, Guo Jiqiang (1996)) basically follow the definition of “fiscal absorbing capacity” by Wang and Hu. There are three types of current researches involving fiscal absorbing capacity, which are about to be narrated as below [2] .

The first type is to regard fiscal absorbing capacity as a dimension of analysis while measuring fiscal capacity. The most common method is factor analysis, a method for dimensionality reduction, which is able to make comprehensive analysis of multiple variables and to extract the main factors so as to explain the most information of original variables with fewer factors. For example, Yuan Xiaoyan (2011) measures fiscal capacity from such three interpretive layers as fiscal revenue capacity, fiscal expenditure capacity and fiscal self-supporting capacity and she gets the final scores of fiscal capacity accordingly [3] .

The second type is to make factor analysis on all interpretive layers. Luo Yan, Jiang Tuanbiao and Chenping (2012) measure fiscal capacity in three interpretive layers including fiscal absorbing capacity, fiscal expenditure capacity and fiscal expenditure profit, and make factor analysis on fiscal absorbing capacity to get its comprehensive scores [4] . This method overcomes the shortage that using factor analysis without considering interpretive layers. These two studies are relatively common-seen for now, but fiscal absorbing capacity is not the main subject of research but an interpretive variable of analysis. In addition, both types of studies have a suspicion of indicator accumulation in indicator selection, meaning that including as many indicators related to fiscal absorbing capacity into interpretive layers as possible. I hold the opinion that the way that dividing all indicators into real fiscal absorbing capacity-related indicators and potential fiscal absorbing capacity-related indications to evaluate real fiscal absorbing capacity should refer to productive indicators as evaluation basis. Therefore, the paper focuses on practical capacity in the measurement of fiscal absorbing capacity, and indicators selected in the paper are productive ones.

The third type of research is empirical study on the relativity of fiscal absorbing capacity. This type of research only focuses on fiscal absorbing capacity but it mainly adopts provincial statistics as the basis of empirical analysis. There are not many documents about places at grassroots level under provincial level. The existing studies include Shang YuanJun, Yin Ruifeng (2009), Jia Zhilian (2011), Chendu and Chen Zhiyong (2016) [5] [6] [7] , all of whom make empirical analysis on 31 provinces in China. However, I believe that the effect of humanistic quality, cultural philosophy and even historical reasons exists among different regions, but most of the documents do not take this issue into consideration in indicator selection. Seven megacities may not be the same in administrative level, but they are on the same level in terms of population, which includes the effect of taxation policies. Besides, when governments serve as lower-level managers under provincial level, the performance effect of their functions also has extremely important effect on national governance, from which we can see that study on the fiscal absorbing capacity of megacities is of certain significance. The paper is to measure fiscal absorbing capacity by taking China’s seven megacities as research samples, and make empirical study on relevant influence factors so as to overcome the shortages existing in the countermeasures, suggestions and bases put forward by former researches.

1.3. Research Significance

Compared with other cities, megacities are more mature, high degree of opening to the outside world, stronger urban soft power, strong ability of surrounding radiation. These cities in space is the core of the national city network nodes, and integration of regional resources on the function, driving the development of region, participate in international competition. Under the combination of government and market, the rapid development of urban space, except for productivity development to promote and accelerate the industrialization pro- cess, infrastructure construction, a large number of population agglomeration, service requirements and other factors [8] [9] . Because our country urbanization process for a shorter time in the future will still be to faster development, not only will have more permanent population in large cities gathered themselves together, and other megacities will also gradually transformed into large cities. The development of these large city in the future, ask will face a series of challenges. In this paper for megacities in the future economy, the system construction research has practical significance.

2. Fiscal Absorbing Capacity: Indicator System and Measurement

2.1. Indicator Selection

Fiscal absorbing capacity is the directly perceived expression of the amount or degree of the income governments obtain. While making empirical analysis, many scholars adopts the indicator-per capita financial revenue to represent fiscal absorbing capacity. Per capita financial revenue excludes the effect of demographic factor, thus reflecting the direct productive level of a local government acquiring revenues. However, higher revenue that local governments acquire does not mean stronger fiscal absorbing capacity of them. On the one hand, there are differences existing among regions on fiscal expenditure level. In principle, local governments with high fiscal expenditure are required to have high fiscal income so as to avoid a too big financing gap. On the other hand, standardability issue exists in income-acquiring channels of local governments, which means that if pursing higher fiscal revenue is the only work target, officials would be stimulated to increase the degree of non-tax revenue such as penalty and confiscatory income and administrative charges. Other ways to acquire tax income may also be generated, such as excessive tax and stricter tax assessment and inspection. Fiscal revenues mainly put emphasis on tax revenues after all, but the above methods mentioned may violate the principle of statutory taxation, deviating from the practice of levying tax in accordance with the law, which can worsen some issues including local land finance, fund raising and debt financing through platform of investment and financing. Fiscal revenues acquired through these channels are usually not sustainable or we could simply refer to them as overdraft.

Hence, as to indicator selection for fiscal absorbing capacity, fiscal absorbing scale represented by per capita financial revenue should be regarded as one of the explanatory variables in measurement, on the basis of which we could introduce two interpretive layers including fiscal absorbing autonomy and fiscal absorbing sustainability. The former one mainly display as the fiscal expenditure’s self-supplying degree of local governments’ fiscal revenues; that is to say, to what extent financial resources acquired by local governments meet the local supply of public goods and services. In the consideration of fiscal absorbing sustainability, it is generally believed that tax revenues are relatively stable and sustainable while factors causing irregularity and instability easily exist in channels acquring non-tax income. Therefore, we adopt tax income’s proportion in general budgetary financial revenue to represent the fiscal absorbing sustainability. The indicators related to the above three layers are shown in Table 1.

This paper would define fiscal absorbing capacity from three layers including fiscal absorbing scale, fiscal absorbing autonomy and fiscal absorbing sustainability and adopt factor analysis to make comprehensive assessment of the indicators of these three layers including per capita financial revenue, general budget income’s proportion in general budget expenditure and tax income’s proportion in general budget income to get fiscal absorbing capacity index. In previous documents, measurement of factor analysis is mostly used in cross-section data

![]()

Table 1. Explanatory layer and indicator selection.

and less used in panel data. In accordance with the economic meaning of factor analysis, the purpose of using it for cross-section data analysis is to make a comprehensive analysis on the multiple samples on one cross section.

2.2. Factor Analysis Treatment

The paper takes seven megacities from 2008-2014 as research samples. Before making factor analysis, it is needed to standardize (Z-score) data. Per-capita financial expenditure is absolute indicator excluding demographic factors, while fiscal autonomy and tax income’s proportion in fiscal revenues are relative indicators. The dimension of the three indicators are not consistent, and relatively large difference in data would lead to unreasonable output result. Therefore, before making factor analysis on original variables, it is required to standardize (Z-score) the three indicators year by year. The processed data should conform to the standardizenormal distribution, mean value is 0 and standard deviation is 1.

Each year’s factor analysis results of the indicators of all three layers are shown in the following Table 2, in which KMO test statistics is an indicator used to compare the correlation coefficient among all variables. KMO’s value ranges from 0 to 1, and value closer to 1 means correlation stronger and are more suitable for factor analysis. From Table 2, we could know that KMO’s values from 2008-2014 are all greater than 0.6, thus suitable for factor analysis. Bartlett’s test of sphericity is used to test whether correlation matrix is unit matrix or not; that is to say, to test whether all these variables are independent or not. In factor analysis, if original hypothesis is rejected, it means factor analysis is allowed; if factor analysis is accepted, it means that there may be some information able to be provided for the test of whether variables are independent or not and that factor analysis is not suitable. Table 2 shows that all P values (significance probability of statistical value of Bartlett’s test of sphericity) are less than the significance level of 0.05, so the original hypothesis is rejected and factor analysis is allowed.

![]()

Table 2. Each year’s total variance tested and interpreted by factor analysis.

All the data from “China Statistical year book” from 2009-2015.

2.3. Evaluation Result and Analysis

Generally speaking, there are two principles for principal component factor selection: the first principle is that eigenvalue of factor is greater than 1; the second principle is that factor should have high accumulated variance contribution rate-the higher the variance contribution rate, the stronger capacity of factor to interpret original variance. From 2008 to 2014, there is only one principal component factor whose total variance’s initial eigenvalue interpreted by factor analysis is greater than 1 and whose variance contribution rates are all over 70%. Taking the variance contribution rate of extracted principal component factor as weight, we could obtain the fiscal absorbing capacity scores of seven megacities from 2008 to 2014.

From the above Table 3, we could learn that Beijing got the highest comprehensive scores on average; Shenzhen is in the second place and Shanghai is the third. The following cites are Wuhan, Tianjin, Chongqing and Guangzhou in sequence. It can be preliminary estimated that the administrative rank and economic level of a region do have a relatively large effect on its fiscal absorbing capacity.

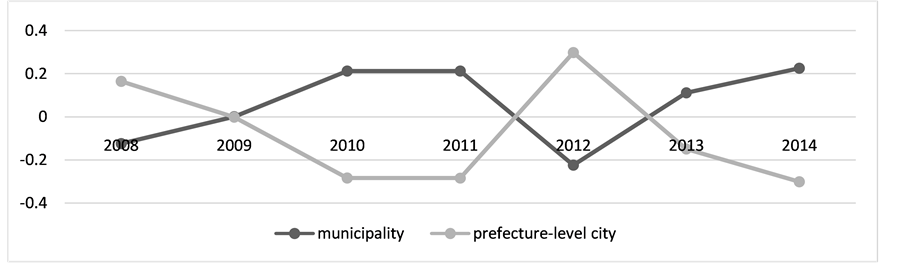

During the seven years from 2008 to 2014 (Chart 1), the fiscal absorbing capacity level of the four municipalities was relatively stable, which was related to the stability of fiscal income mechanism. There was relatively big fluctuation in 2009 and 2012. In 2009, the fiscal capacity of municipalities experienced certain

![]()

Table 3. Each city’s scores in fiscal absorbing capacity from 2008 to 2014.

All the data from “China Statistical year book” from 2009-2015.

Chart 1. Tendency chart for prefecture-level cities’ fiscal absorbing capacity from 2008 to 2014 (zone chart).

rise while the fiscal absorbing capacity of prefecture-level cities fell to some extent. In 2012, the average fiscal absorbing capacity of municipalities obviously experienced downtrend compared with that in 2011 while the situation for prefecture-level cities was the opposite. Then it could be estimated accordingly that in the measurement of fiscal absorbing capacity, a contradictory relationship existed between municipality and prefecture-level city, which may be connected with the flow of fiscal decentralization and production factors across regions. As China’s provincial-level administrative unit, municipality is both political and economic center, which is able to attract a huge amount of labors in surrounding areas and to introduce production capital. However, municipality is also influenced by economic situation and policies, which could lead to the phenomenon that labor and capital flow into surrounding areas, causing effect on local development level or industrial structure and changing local fiscal absorbing capacity, which explains why municipality and prefecture-level city display contrary tendency in the change of fiscal capacity. What’s more, it could also be noticed that there may be a relatively big gap among prefecture-level cities in the same area in terms of fiscal absorbing capacity.

Though fiscal absorbing capacity is represented by local income indicators, it is closely connected with local governments’ level providing public goods and services. The significance of improving local fiscal absorbing capacity, one the one hand, is embodied in its positive effect on the quality of public goods and services supplied; on the other hand, this practice could promote balanced development among regions. Generally speaking, restricted by historical factors or self-ability, city residents usually feel difficult to “vote with their feet”, and it is more beneficial to cities’ sustainable development by improving fiscal absorbing capacity and the quality of supplied public goods.

As the score for fiscal absorbing capacity is comprehensively evaluated on the basis of three productive indicators including per capita financial income, fiscal autonomy and tax income’s proportion in fiscal revenue, it means a kind of outcome contrast. Therefore, cities’ scores for fiscal absorbing capacity are only applicable to comparison among regions without knowing other factors’ effect on such capacity. If specific analysis is wanted, empirical study of correlation is needed.

3. Empirical Test Based on Fixed-Effect Panel Model

3.1. Indicator Selection and Data Resource

In current documents, there are relatively few researches that make empirical test of fiscal absorbing capacity. Three types of influence factors are adopted in the paper as explanatory variables, including political factor, economic factor and demographic factor, among which fiscal decentralization is the representative indicator of political factor. Decentralization and centralization can not only relieve local fiscal pressure but improve the efficiency of public goods supply. We could preliminary assume that they would influence local fiscal absorbing capacity. I believe that fiscal decentralization in prefecture-level cities is reflected more on fiscal expenditure level. And since fiscal absorbing capacity as explained variable is income indicator, the paper would use expenditure indicator to measure fiscal decentralization so as to avoid a possible mistake of circular argument.

In expenditure indicator selection, considering that huge difference in tax transfer payment exists between municipalities and prefecture-level cities, the paper would synthesize the views of Zhang Shuxiao and Guo Qingwang [10] [11] [12] , and adopt the indicator - municipal fiscal expenditure per capita (municipal fiscal expenditure per capita + provincial fiscal expenditure per capita + central fiscal expenditure per capita) [13] [14] to represent fiscal decentralization degree attempting to reduce the effect brought by transfer payment. In order to express this explanatory variable more accurately, we refer to it as fiscal expenditure decentralization degree.

On economic factor level, we mainly consider economic development level, industrial structure and trade openness, among which economic development level is represented by per capita GDP excluding demographic factor. In indicator selection for industrial structure, as the small proportion primary industry occupies in economic aggregation of these cities, local governments obtain few fiscal revenues depending on primary industry, the proportions of secondary and tertiary industry are thus chosen for study. Due to the large difference among all cities in urbanization level-for example, there is even no rural residents in Shenzhen-urbanization level is also included into indicators. Owing to geographic environmental factors of these seven cities, large difference exists in trade openness as well; therefore, trade openness is also taken into consideration.

Population density is the metric for demographic factor [15] . It is generally believed that the degree of population concentration would influence the governance of local governments-backward areas with vast territory and a sparse population is more difficult to be governed than areas with a high degree of population concentration. In absorbing fiscal revenues, high degree of population concentration could lower government’s collection cost and improve absorbing efficiency. Although there are more than ten million of permanent residents in these seven cities, their coverage is quite different. Hence, studying demographic factor’s effect on local fiscal absorbing capacity is of certain meaning. Among the six explanatory variables in index layer, except for GDP per capita and population density, other variables all share relative number form. To reduce the effect of heteroscedasticity, we adopt logarithmic form for per capita GDP and population density. The specific indicator selected is shown in Table 4.

3.2. Model Building

On the basis of the variables selected in these three interpretive layers, let’s assume there is a linear relation among variables and verify each variable’s effect on the fiscal absorbing capacity of prefecture-level capacity by building a multiple regression model, which is shown as below:

![]()

Table 4. Factors related to fiscal absorbing capacity of prefecture-level cities.

All the data from “China Statistical year book” from 2009-2015.

In this model, the explained variable F represents the fiscal absorbing capacity of prefecture-level cities. Among explanatory variables, LNGDP, SECI, TERI, OPEN, UR, LNDOP and α stand for per capita total β value, proportion of secondary industry, proportion of tertiary industry, trade openness, urbanization rate, population density and constant term respectively. βs represent all indicator coefficients. The i in variable subscript stands for the ith city while t stands for the tth year.

Hausman test was used to decide which model is to be selected: fixed-effect model or random effect model. The null hypothesis of Hausman test makes random effect model happen. But according to the Hausman test result, small probability event happened and null hypothesis was rejected; therefore, fixed- effect model is selected.

3.3. Empirical Result and Analysis

The result of fixed-effect regression model is shown in Table 5. Along with the increase of explanatory variables, the fitting degree of the model becomes higher accordingly. Among the seven explanatory variables in political factor, economic factor and demographic factor, the fitting degree reaches to 91.17%, showing that this model owns high explanatory ability. Except for population density logarithm being notable under the level of 5%, other five variables among all explanatory variables are notable under the level of 1%, and one is not notable at all.

![]()

Table 5. Regression result of factors affecting fiscal absorbing capacity.

Remark: numbers in brackets are standard deviation; *, ** and *** means that explanatory variables are notable under the level of 10%, 5% and 1% respectively. All the data from “China Statistical year book” from 2009-2015.

The regression result in (6) shows that fiscal expenditure decentralization has remarkable and positive influence on the fiscal absorbing capacity of these seven cities. In current documents, due to the difference in fiscal decentralization indicator selection, the regression result and analysis varies as well. Different from those of municipalities, governments of prefecture-level cities have weak autonomy. This paper adopts fiscal expenditure decentralization represented by expenditure indicators to further refine and clarity the significance of indicators. From the regression result, we could know that fiscal expenditure decentralization can promote government to improve fiscal absorbing capacity. Every 1% of increase in fiscal expenditure decentralization can contribute to 0.7% increase of fiscal absorbing capacity. Fiscal expenditure decentralization reflects the division of local powers of property and duties. The current fiscal decentralization system is not perfect yet, and financial power usually could not be consistent with power of duties. Almost all governments of prefecture-level cities share the same problem that their power is not strong enough to support their duty performance. Therefore, decentralization of government expenditure of prefecture-level cities should be emphasized so that powers of property and duties could be allocated among governments at all levels more normatively.

On economic factor level, we could see that per capita GDP logarithm, secondary industry’s proportion and trade openness all have positive effect on the fiscal absorbing capacity of prefecture-level cities. Among them, the positive effect of secondary industry’s proportion is the most notable while that of tertiary industry is least notable, which may be due to the current tax system in our country. According to current tax system, after VAT reform local governments’ income mainly comes from the sharing part of value-added tax, and tax resources are mainly from manufacturing industry, construction industry and real estate industry. But such features of the tertiary industry as decentralized operation and strong concealment of income lead to greater difficulties for tax collection and management, which further expresses that both improvement of tax system and that of collection and management efficiency are of great significance for cities’ fiscal absorbing capacity around the country, and shows industrial structure’s importance in regional fiscal absorbing capacity. Both per capita logarithm and total amount of import and export trade have positive effect on local fiscal absorbing capacity as well: the more developed a region’s economic level is, the more tax resources it has. Therefore, municipal governments should take a region’s opening degree into consideration to promote trade among regions and to improve fiscal absorbing capacity. That urbanization rate is negatively related to such capacity may be because the urbanization we is experiencing now is not the urbanization in an absolute sense: a huge amount of rural residents move to cities without enjoying the welfare the urban residents do, which is to say, household registration system results in such huge difference between floating population and permanent population that urban scale benefit cannot be efficiently exerted, thus causing adverse influence. That opening degree is quite relevant may be because international taxation is a tax point and tariff revenue is a growth point for fiscal revenues.

Demographic factor’s effect on fiscal absorbing capacity is considered on the basis of government’s governance. It is universally believed that high degree of population concentration is beneficial to government’s governance. It can not only increase government’s administrative efficiency while reducing the fiscal collection cost but improve fiscal absorbing capacity to some extent. The regression result shows that although all seven cities owns population more than ten million, regions with higher population density have stronger fiscal absorbing capacity, which is consistent with our expectation hypothesis.

4. Summary and Inspiration

Fiscal absorbing capacity is related to local governments’ efficiency of public goods supply and to the sustainable development of local finance. If such capacity is not strong enough, it would lead to many problems such as the irregularity of local land finance and platforms of investment and financing, which is even more serious in less developed regions, causing negative effect on our country’s long-term governance and stability. Therefore, out of the consideration for national governance, improving the fiscal absorbing capacity of prefecture-level cities can contribute to the performance of local governments’ functions and the development of local economy. The paper measures the fiscal absorbing capacity of the seven megacities from 2008 to 2014 and makes an empirical study on their influence factors by adopting a fixed-effect model combined with factor analysis. The study result shows that economic development level, the proportion of secondary industry, trade openness and demographic factor all have significant and positive effect on fiscal absorbing capacity on provincial level; urbanization rate has negative effect and the tertiary industry has no notable effect. However, between municipalities and prefecture-level cities, there are significant differences existing. From the economic development level, the higher per capita GDP, the more revenue resources and the stronger fiscal absorbing capacity governments have. On the industrial structure level, increasing the proportions of the secondary and tertiary industry is beneficial to improving fiscal absorbing capacity, especially in less developed and agriculture-oriented regions. Generally speaking, secondary industry is the dominant industry in most cities. Such industries belonging to secondary industry as manufacturing industry and construction industry functioning in accordance with the current tax system provide rich tax resources for government and own relatively high contribution level. However, the secondary industry in a region may be restricted by the development bottleneck from increasing its proportion. Therefore, the practice that promoting internal optimization and upgrading of secondary industry by introducing high and innovative technology and high-quality talents and putting more efforts into developing tertiary industry should be taken into consideration. With equal population, population density could cause an effect on fiscal absorbing capacity as well. Hence, our country should spare no effort to improve the household registration system so as to offset the huge gap between registered population and permanent residents.

As political factor, administrative distinction between prefecture-level cities and municipalities is an objective factor and unchangeable. Consequently, though fiscal expenditure decentralization has a significant effect on fiscal absorbing capacity, the decentralization pattern is hard to be changed in a short time. But from another perspective, such livelihood expenditures as education, health care and social insurance are quite close to people’s daily life, so the infrastructure of them should be firmly guaranteed. However, suffering difficulties in finance, local governments often have a quite small budget on the expenditure level. As to this matter, expenditure responsibility division among local government, provincial government and central government should be considered. Part of the expenditure responsibilities in terms of elderly care, land planning and jurisdiction should be handed over to the central government to relieve the financial pressure on local governments. In the meantime, through the reform of transfer payment system, financial guarantee over local government’s basic public service can be strengthened; and through optimizing the expenditure decentralization of local governments and improving local fiscal absorbing capacity, a virtuous circle can be formed to promote the coordinated development of regional finance.