Excessive Privatization in an International Mixed Oligopoly: Normative View ()

1. Introduction

Much literature on mixed oligopoly studies privatization of a public firm in a single country framework. De Fraja and Delbono [1] investigate the effect of privatization on social welfare and find that privatization lowers welfare if there are relatively few private firms in the market and raises welfare if there are relatively many private firms. Matsumura [2] develops the model of De Fraja and Delbono [1] to consider the possibility of partial privatization and obtains the result that partial privatization is probably optimal. De Fraja and Delbono [1] and Matsumura [2] confine the analyses in a domestic market, thus they do not mention the interaction among countries1. In the article of Bárcena-Ruiz and Garzón [8] , they first analyze privatization problem in a single market comprising two public firms and two countries. This significant extension on mixed oligopoly enables us to discuss strategic interaction among governments. They assume that each government maximizes its own country’s social welfare and show that neither government privatizes the public firm when the marginal cost of public firms is low enough.

Dadpay and Heywood [9] investigate privatization of a public firm in a similar analytical framework. They do not assume that public firms are necessarily less efficient than private firms, but allow the asymmetry of the total output consumed by each country’s consumers. It is showed that neither country has an incentive to unilaterally privatize its public firms, and that privatization of both public firms increases global welfare in most relevant cases.

While they have examined the impact of the decision by a particular government on another country’s welfare, Bárcena-Ruiz and Garzón [8] have neglected such a question: whether these independent decision-makings are efficient or not from the perspective of an integrated market. Dadpay and Heywood [9] has simply analyzed the effect of privatization on the global welfare, but only mentioned one case that two public firms were privatized simultaneously. Specifically, they do not discuss whether such a case emerges endogenously. It is very likely, in their model, that neither government selects to privatize its public firm though they obtain the result that privatization of both public firms may increase global welfare. Unlike Dadpay and Heywood [9] , our paper firstly discusses what decision can be made by the government of maximizing its own country’s welfare. After that, if the government chooses privatization strategy, then the effect of this strategy on global welfare is examined. In addition, Bárcena-Ruiz and Garzón [8] and Dadpay and Heywood [9] assume the complete privatization/nationa- lization choice, indicating that the governments hold 100% shares of a public firm or no share is held by governments if a public firm is privatized. We incorporate the possibility of partial privatization into two-country model to obtain a more general result to a certain extent. The main viewpoint of this paper is that there is excessive privatization in an international mixed market.

The remainder of the paper is organized as follows. Section 2 presents the model and derives the main results. Section 3 concludes the paper.

2. Model

In order to highlight the strategic incentives of privatization policy in the mixed market with two countries, we describe the model in its simplest form. The basic model follows the canonical international oligopoly model, pioneered by Brander and Spencer [10] , with which some readers may be familiar.

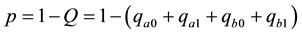

We presume that there are two countries, and in each country i  there is one public firm and one private firm. It is also postulated that the public firm maximizes a certain objective function given later and the private firm seeks to maximize its own profit. We follow traditional third country model and assume that all products produced in country a and b is exported to the market of third country, where no producer exists. The inverse demand function in the third market is given by

there is one public firm and one private firm. It is also postulated that the public firm maximizes a certain objective function given later and the private firm seeks to maximize its own profit. We follow traditional third country model and assume that all products produced in country a and b is exported to the market of third country, where no producer exists. The inverse demand function in the third market is given by

, (1)

, (1)

where p is market price and Q is total output.  denotes the output of firm

denotes the output of firm  in country i. We label the public firm as

in country i. We label the public firm as  and the private firm

and the private firm .

.

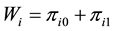

Production of homogeneous good in country i is conducted under the cost function given by . We do not consider the entry problem, so

. We do not consider the entry problem, so  is assumed in the following analysis. Then, the profit of firm j in country i is given by

is assumed in the following analysis. Then, the profit of firm j in country i is given by

. (2)

. (2)

Since all products are exported to the third market, the social surplus in country i is given by

. (3)

. (3)

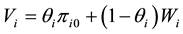

The model suited for describing a typical privatization policy is developed by Matsumura [2] . We follow his analytical framework and assume that the government owns a share of the public firm. The manager of this firm will maximize the weighted average of social surplus and the firm’s profit. Thus, we specify a partially privatized public firm’s objective function as follow

. (4)

. (4)

Note that the manager of fully privatized firm  seeks to maximize the firm’s profit only, while the manager of a fully nationalized firm

seeks to maximize the firm’s profit only, while the manager of a fully nationalized firm  maximizes social surplus. The manager of private firm in each country simply seeks to maximize its profit represented by (2).

maximizes social surplus. The manager of private firm in each country simply seeks to maximize its profit represented by (2).

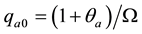

For any given degree of privatization, the optimum outputs are obtained as follows

, (5)

, (5)

, (6)

, (6)

, (7)

, (7)

where![]() . Using (5)-(7) with (1), the price level is given by

. Using (5)-(7) with (1), the price level is given by![]() . Furthermore, we have the levels of firms’ profits and social surplus as

. Furthermore, we have the levels of firms’ profits and social surplus as

![]() , (8)

, (8)

![]() , (9)

, (9)

![]() , (10)

, (10)

![]() , (11)

, (11)

![]() . (12)

. (12)

The non-cooperative government chooses its privatization policy independently. They choose ![]() to maximize

to maximize ![]() given by (11) and (12). The maximization yields

given by (11) and (12). The maximization yields

![]() ,

,![]() ,

,![]() . (13)

. (13)

Let![]() , we obtain the optimum degree of privatization

, we obtain the optimum degree of privatization ![]() for all i. This result is different from that of Bárcena-Ruiz and Garzón [8] and Dadpay and Heywood [9] .

for all i. This result is different from that of Bárcena-Ruiz and Garzón [8] and Dadpay and Heywood [9] .

Using this basic result, we can now illustrate the tendency to lead excessive privatization. Let us consider the coordinated privatization policy. The degree of privatization in the cooperative equilibrium would be obtained by maximizing ![]() with respect to

with respect to ![]() and

and![]() . This maximization problem gives

. This maximization problem gives

![]() . (14)

. (14)

This indicates that the optimal degree of privatization is given by![]() . From above discussion, we have the following result.

. From above discussion, we have the following result.

Proposition. There is excessive privatization in the international mixed market.

Using a mixed oligopoly model with a single international market, Dadpay and Heywood (2006) shows that privatization increases global welfare, although their model is rather different from our model. The result presented in above proposition seems to be opposite of their viewpoint. To understand this result, consider the case in which two governments independently choose the degree of privatization. Under (1), the government tries to make domestic firms produce much and the foreign firms produce less. (5)-(7) shows the privatization in country i works to decrease the outputs of foreign firms;![]() , and

, and![]() . It also reduces the output of domestic private firm, but it increases the output of domestic public firm;

. It also reduces the output of domestic private firm, but it increases the output of domestic public firm;![]() , and

, and![]() . Since there is a negative relationship between the foreign firms’ outputs and the degree of privatization in the domestic market, the government can improve the social surplus by increasing the extent of privatization.

. Since there is a negative relationship between the foreign firms’ outputs and the degree of privatization in the domestic market, the government can improve the social surplus by increasing the extent of privatization.

Obviously, an increase (a decrease) in the degree of privatization in country i, decreases (increases) the firms’ output in country r, and consequently it decreases (increases) the social surplus in country r. In the case of coordinated decision-making, this external effect is considered, indicating that the non-cooperative governments privatize their public firms excessively.

3. Conclusions

The literature that studies the privatization issues in a framework of a mixed oligopoly with two countries is less. This paper introduces partial privatization into two-country model so that we can obtain a more general result. We focus our attention on such question: in a world market to be consisted of two countries, when each government only seeks its own country’s social welfare, is the choice of each government on privatization policy efficient? We found that there is excessive privatization in an international mixed market.

This paper uses a simple model and only makes a preliminary study. It might be extremely meaningful to extend model to asymmetry in the number of domestic and foreign firms and to allow consumer of two countries to present, which is remained for further research.

Acknowledgements

The author thanks the editor and the anonymous referee for their useful comments and constructive suggestions. She also acknowledges financial supports from national social science foundation of China (No. 14BJL114), the planning fund of humanity and social science research of Chinese Ministry of Education (No. 13YJA790030) and the independent innovation foundation of

Shandong

University

(No. IFW12112).

NOTES

1See Corneo and Rob [3] , Fujiwara [4] , Ghosh and Mitra [5] , Han [6] and Nakamura [7] for extensive research on privatization in a single country framework.