Microeconomic Natural Law, Portfolio Principle and Economics Textbooks ()

Received 29 February 2016; accepted 15 May 2016; published 18 May 2016

1. Introduction

Throughout history, the natural environment has undergone incessant pressure from human beings. Every generation of human beings should have an equal economic right to the earth and its resources, and no generation should impinge on the economic rights of future generations.

A person’s life is finite, but not a nation’s. Moreover, individuals generally do not understand all constraints binding their economic behavior, but governments must, especially when they act as stewards for future generations.

Future generations cannot survive if the sustainability of the earth’s resources continues to deteriorate. Therefore, some economic scholars have proposed remedying the microeconomic part of mainstream economic textbooks by endogenizing environmental factors into the pricing mechanism. However, this idea has long been ignored by mainstream economists, who believe that environmental concerns can only be analyzed normatively and not positively; hence, this idea is a minor subject in economic textbooks.

As long as natural resources are necessary to sustain life, natural laws must be relied on to govern economic behavior. After initiating from the risk dimension with a normative framework, the microeconomic natural law automatically endogenizes the necessary environmental variable in the pricing mechanism which can inherently have a strong automatic stabilization effect and be analyzed positively [1] 1.

This study explains that, after combining the microeconomic natural law with the portfolio principle and a few bases in general economic analyses, the capability of managing all fundamental challenges in business operation, financing, and marketing can be directly established in economics textbooks. The reputation of economics as the foundation of all major business and management disciplines must be restored.

2. The Microeconomic Natural Law

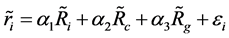

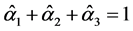

According to Yu [1] , by starting from a normative framework and considering relations and risks, the rate of return on investment (ROI)  for a nonfinancial product i can be determined using

for a nonfinancial product i can be determined using

. (1)

. (1)

This behavioral model links  to, in order,

to, in order,  , the supply-side content of

, the supply-side content of ;

; , the supply-side ROI for product i’s substitutes or (and) complements that can directly affect product i; and

, the supply-side ROI for product i’s substitutes or (and) complements that can directly affect product i; and , the supply-side ROI for product i’s system variable2. After including the system variable

, the supply-side ROI for product i’s system variable2. After including the system variable , all three coefficients in Equation (1) can be proved econometrically to have the following relationship3:

, all three coefficients in Equation (1) can be proved econometrically to have the following relationship3:

. (2)

. (2)

Contrary to all conventional pricing concepts, because  and

and  play dominant roles,

play dominant roles,  must be determined according to Equation (2), and Equation (1) becomes a pricing mechanism that can provide an automatic stabilization effect.

must be determined according to Equation (2), and Equation (1) becomes a pricing mechanism that can provide an automatic stabilization effect.

As explained in Yu [3] [4] , the main proposition of the microeconomic natural law is to endogenize the environmental factor. Achieving this task involves applying the system variable to represent the environmental factor in constructing a model such as Equation (1).

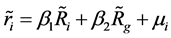

For different financial assets, when their returns cannot exactly replicate each other, the variable,  , in Equation (1) can be removed to yield [1] .

, in Equation (1) can be removed to yield [1] .

(3)

(3)

Similarly, both coefficients in this equation can be proven to have a sum of 1.

In contrast to Equation (3), the capital asset pricing model (CAPM) exogenizes the environmental variable ![]() and is a univariate model having only the market portfolio variable

and is a univariate model having only the market portfolio variable![]() . The direct connection to the fundamental analysis is thus eliminated after excluding the supply-side variable,

. The direct connection to the fundamental analysis is thus eliminated after excluding the supply-side variable,![]() . Because no balancing force with respect to

. Because no balancing force with respect to ![]() is available in the model, the CAPM can be easily manipulated4.

is available in the model, the CAPM can be easily manipulated4.

3. The Portfolio Principle

The microeconomic natural law emphasizes the importance of environmental constraints that are unmanageable with current efforts. It is therefore necessary to identify the current boundary between the manageable and unmanageable parts of risk control even for a globalised enterprise. Clearly, this task cannot be completed using any traditional approach initiated from the return world.

Thus far, only Markowitz’s portfolio theory can be applied reasonably to analyze risk or uncertainty. Its main contributions include optimal resource allocation and the concept of risk diversification based on the mean- variance framework, all of which are necessary to study economic relations. Although this theory has not yet been sufficiently standardized and still cannot manage real interactions, such as synergistic effects, its applicability and necessity are nevertheless valuable and can have wider practical applications in the future; therefore, it should be renamed “the portfolio principle” [1] .

Resource scarcity does not affect any person who has no interest in the resource of concern. Moreover, the fundamental threat of resource scarcity has long been effectively resolved [6] . However, various complex relationships can increase the difficulty of economic analysis. Nevertheless, the microeconomic natural laws and the portfolio principle can both serve as standardized analytical frameworks.

In the past, the difficulty of analyzing risk was due to the components of individual risk varying widely and not being observed or quantified easily5. Moreover, as a key element in the task of risk analysis, system variables cannot legally exist until all individual risk components in the environment are significantly diversified. Uncertainty or risk analysis has never been considered in mainstream economic textbooks, which prefer strongly positive analyses. However, uncertainty or risk is unavoidable in the economic world.

If sufficient stability can be maintained, then the frequency of individual outcomes over a long period begins to indicate the probability distribution of future occurrences. After extensive research, the lognormal distribution hypothesis has been accepted as describing human behavior [8] . Furthermore, when the primary concern of economic management is to lower the risk of failure6, this hypothesis can provide reasonable guidance.

The environment can either constrain or offer opportunities for development. The microeconomic natural law can explain how to endogenize the environmental factor as a constraint into economic behavior, and the portfolio principle can explain how to acquire new opportunities for development.

4. Different Bases in Economic Analyses

The microeconomic natural law stresses the relevance of endogenizing the environmental factor and explains how to achieve this task. It is not itself a complete foundation of all tasks of economic analysis; nor is the portfolio principle, which focuses on analytical tasks regarding relationships and risks. Both of them are crucial for integrating necessary bases in economic analytical tasks to elaborate realistically the contents of an economics textbook.

4.1. Bases of Measurement

As an example, the net profit after tax is the final crucial figure for a company; however, the ROI should also be emphasized for performance evaluation. Moreover, for stockholders, information about the company’s net profits after tax can be obtained only annually, but an individual product’s cycle of production and sales rarely matches an accounting year’s deadline. The challenge is to evaluate the performance of both the product and its company simultaneously.

Assuming no financing, inventory, or tax problems, if the company produces only one item whose average cost per unit is c0 and total quantity sold is q0, then the company’s initial equity is Ω0, which equals![]() , where

, where ![]() is the idle asset. By listing net profits from production and sales as

is the idle asset. By listing net profits from production and sales as ![]() and non-operational profits as

and non-operational profits as![]() , the uncertain annual ROI for Ω0 can be expressed as

, the uncertain annual ROI for Ω0 can be expressed as

![]() . (4)

. (4)

If n products are produced by the company, then the general expression can be

![]() (5)

(5)

where![]() .

.

If the company produces only one item, then the uncertain investment is![]() , where

, where ![]() and F0 represent uncertain variable costs per unit and total fixed costs of production, respectively. If

and F0 represent uncertain variable costs per unit and total fixed costs of production, respectively. If ![]() and

and ![]() are the uncertain average price and total cost per unit, respectively, then the annual ROI can be determined using

are the uncertain average price and total cost per unit, respectively, then the annual ROI can be determined using

![]() . (6)

. (6)

In contrast to![]() , there is also a planned investment that equals

, there is also a planned investment that equals![]() . By setting

. By setting![]() , the relationship with Equation (6) can be expressed as

, the relationship with Equation (6) can be expressed as

![]() (7)

(7)

where ![]() is the growth rate of its production costs, and its inverse represents the degree of cost control,

is the growth rate of its production costs, and its inverse represents the degree of cost control,![]() .

.

However, Equation (7) is only a definition and reveals no exogenous information that affects![]() . The microeconomic natural law must be relied to serve this need by constructing a behavioral model such as Equations (1) or (3).

. The microeconomic natural law must be relied to serve this need by constructing a behavioral model such as Equations (1) or (3).

4.2. Bases of Performance Evaluation

If the efficient set is a circle, then a line can be drawn to separate the circle into three sections. A new line can be drawn within the superior or inferior section to ensure a more detailed evaluation. However, because both measures have inherently different economic attributes, only the process of division can be applied to produce a line basis.

In statistics, ![]() is termed the coefficient of variance; in economics,

is termed the coefficient of variance; in economics, ![]() means the expected rate of return acquired, on average, by assuming one unit of risk. With the existence of an opportunity cost or a predetermined goal rf, only the excess expected rate of return

means the expected rate of return acquired, on average, by assuming one unit of risk. With the existence of an opportunity cost or a predetermined goal rf, only the excess expected rate of return ![]() links directly to the assumed risk,

links directly to the assumed risk,![]() .

. ![]() therefore must be adjusted to become

therefore must be adjusted to become![]() , which in turn encounters the Sharpe ratio. However, in the risk world,

, which in turn encounters the Sharpe ratio. However, in the risk world, ![]() measured from different assets represents heterogeneous products that are not mutually comparable [5] 7. They can be transformed into cumulated probabilities under the hypothesis of lognormal distribution. The outcome of this transformation is called WINDEX [9] ; its economic meaning is “the chance of success to outperform rf,” and its opposite can thus be termed the risk of failure8.

measured from different assets represents heterogeneous products that are not mutually comparable [5] 7. They can be transformed into cumulated probabilities under the hypothesis of lognormal distribution. The outcome of this transformation is called WINDEX [9] ; its economic meaning is “the chance of success to outperform rf,” and its opposite can thus be termed the risk of failure8.

After transforming the Sharpe ratio into WINDEX, various points on the same line with a positive Sharpe ratio can be further evaluated using a cumulative probability basis and the first-order stochastic rules of dominance. This should partially explain why WINDEX is more reliable than the Sharpe ratio.

4.3. Bases of Systematic Risk

By definition, the failure risk of one product or company can be divided into manageable and unmanageable components. An unmanageable component that can meet the Fama threshold is called a systematic risk. In management, the difference between systematic risk and an unmanageable component of failure risk is an empirical concern, which can reveal valuable information about, for example, who should bear the responsibility of risk control. It is therefore necessary to identify clearly whether the systematic component of one product or its company can differ.

Moreover, if only limited resources can be applied to diversify a product’s risk, the choice between product and market diversification should be evaluated if the outcome of systematic risk differs significantly; the conditions of competitors must also be considered.

If failure risk can be effectively reduced with acceptable costs, then its consequence can undoubtedly increase the original expected value under inspection. Therefore, understanding and identifying different bases of systematic risk can provide opportunities for product or company development.

4.4. Reliability

Risk control involves more than identifying manageable and unmanageable components of failure risk; confirming their reliability further is also a concern. In a model like Equations (1) or (3), the analytical conclusion could become dubious if any explanatory variable’s reliability would be lost.

Even if the variable can conform significantly to the hypothesis of lognormal distribution, its reliability cannot be guaranteed. Without any assurance, risk control would become a gamble. This suggests that variable reliability should be a prerequisite for most economic analyses.

5. Applications of the Microeconomic Natural Law

For Equation (6), ![]() , pricing based on a fixed a% markup,

, pricing based on a fixed a% markup, ![]() , can completely transfer the risk of price changes to consumers. The second-best option is pricing based on a fixed amount, A, markup; that is,

, can completely transfer the risk of price changes to consumers. The second-best option is pricing based on a fixed amount, A, markup; that is,![]() . However, a risk of price change remains unavoidable.

. However, a risk of price change remains unavoidable.

5.1. Management of Production

For a product priced with a fixed percentage markup, its total profit growth generally correlates with the growth of sales. Unit elasticity is therefore the point at which profit maximization can be obtained. However, once the product loses its price control ability, the price variable in Equation (6) becomes a temporarily fixed variable, and reducing costs becomes the most convenient competitive strategy. However, if there is pressure to raise costs at this moment, seeking help from other product divisions may be worthwhile. A positive ![]() in Equation (1), reveals exogenous help from complementary products. Another possibility is to regain the product’s price control ability. This task requires the company’s R&D department to upgrade the product’s quality or to invent a next-generation product.

in Equation (1), reveals exogenous help from complementary products. Another possibility is to regain the product’s price control ability. This task requires the company’s R&D department to upgrade the product’s quality or to invent a next-generation product.

5.1.1. Performance Evaluation

Information about all three coefficients in Equation (1) can provide an understanding about one product and its company or market. First, a negative ![]() would not favor the outcome

would not favor the outcome![]() , and a higher

, and a higher ![]() results in a lower

results in a lower![]() , when

, when ![]() is lower than

is lower than![]() . Second,

. Second, ![]() can be used to examine the product i’s degree of dependence with the company or market. As long as

can be used to examine the product i’s degree of dependence with the company or market. As long as ![]() is lower than

is lower than ![]() is, a higher

is, a higher ![]() results in a higher degree of dependence and a smaller effect from the product’s self-improvement. Finally, assuming

results in a higher degree of dependence and a smaller effect from the product’s self-improvement. Finally, assuming ![]() comes strictly from a substitute, if both

comes strictly from a substitute, if both ![]() and

and ![]() increase but

increase but ![]() decreases, then the product would exhibit gradual improvement in performance; otherwise, the product is gradually being marginalized in the company or market.

decreases, then the product would exhibit gradual improvement in performance; otherwise, the product is gradually being marginalized in the company or market.

In contrast to Equation (8), ![]() in Equation (1) can also be applied to examine the cost reduction within the product division. If it deviates excessively from

in Equation (1) can also be applied to examine the cost reduction within the product division. If it deviates excessively from ![]() in Equation (8), then unmanageable factors already substantially affect cost reduction. Accordingly, to place the full responsibility of cost reduction on the product division would be unjust.

in Equation (8), then unmanageable factors already substantially affect cost reduction. Accordingly, to place the full responsibility of cost reduction on the product division would be unjust.

Environmental factors should always be considered in performance evaluation. For example, in Equation (1), as long as ![]() and

and ![]() are higher than

are higher than![]() , expanding the production line increases the risk of resource misallocation, unless

, expanding the production line increases the risk of resource misallocation, unless ![]() can be improved.

can be improved.

5.1.2. Pricing Methods

A product’s pricing method should always be subject to Equation (1) and labeled using the company tag. However, once complements or substitutes emerge in the product market, another pricing mechanism tier must be constructed to include the market factors. In other words, other than Equation (1), the following equation labeled using the market tag must also be applied:

![]() (8)

(8)

where ![]() can be product i’s substitutes, complements, or the net effect of both, and

can be product i’s substitutes, complements, or the net effect of both, and ![]() is the system variable in the market.

is the system variable in the market.

Using the portfolio principle and econometrics enables proving that because ![]() includes

includes ![]() as its com-

as its com-

ponent, including both variables in the same equation is unnecessary when only ![]() can remain in the model

can remain in the model

[1] . Therefore, Equation (8) should also be applied to examine all necessary market management information.

Once issuing common stocks is considered, Equation (3) is applied as the primary pricing mechanism [5] . Unless there is a rating system, different stocks can be treated as homogeneous goods in the financial market and any consideration about a stock’s complements or substitutes can be temporarily ignored.

5.2. Marketing Management

Although returning $1 in cost reduction to the customers necessitates cutting the product’s price by exactly the same amount, the product’s ROI in Equation (6) can still be raised accordingly. This is why cost reduction has long been a common competitive strategy. However, cost reduction cannot be perpetual. Under the pressure of severe competition, if one chooses to downgrade the product to increase popularity, retaining the product’s systematic components and functions and reducing the production costs could serve the company’s needs most effectively.

Environmental sustainability has been the focus of increased attention. Consequently, an increased number of products must be adapted to this trend to maintain their competitive advantages. A company consistently claiming its products to be environmentally friendly is not merely flaunting ethics.

5.3. Financial Management

With respect to the initial invested capital, ![]() , the final outcome would be reduced if

, the final outcome would be reduced if ![]() decreases whereas the production quantity would be unchanged. By contrast, if

decreases whereas the production quantity would be unchanged. By contrast, if ![]() increases, then the company can either reduce the production line without changing the initial invested capital or can consider financing based on internal or external resources after evaluating the following relationship:

increases, then the company can either reduce the production line without changing the initial invested capital or can consider financing based on internal or external resources after evaluating the following relationship:

![]() . (10)

. (10)

The left side represents equity financing by an amount equal to![]() , and the right side represents debt financing, which incurs an interest cost,

, and the right side represents debt financing, which incurs an interest cost,![]() . However, risk measurements from both sides are not identical products. Therefore, applying WINDEX as the basis for performance evaluation is necessary.

. However, risk measurements from both sides are not identical products. Therefore, applying WINDEX as the basis for performance evaluation is necessary.

5.4. Risk Management

If the expected revenues or profits have no reliability9, then luck is the only factor in business operation. Although reducing risk often means sacrificing some development opportunities, under effective management, a minimum level of risk control is still necessary to ensure that all expected values are reliable.

In contrast to companies and industries, products have the greatest variety of development constraints. A company may not be affected significantly by any of its products if it can significantly diversify its product set. Otherwise, each of its products bears an unnecessary risk of failure. If the failure of one product was caused by such unnecessary excess risks, the management team should not be responsible; rather, higher levels of company management should be held accountable.

6. Applications of the Portfolio Principle

The main purposes of economic behavior are to satisfy current needs and to break through environmental constraints to satisfy, as much as possible, future needs. Because a time factor is involved, risk control and optimal resource allocation become unavoidable tasks for economic management, thus necessitating the use of the portfolio principle, or more specifically, WINDEX, as the basis of performance evaluation in the market.

The primary property of the portfolio principle involves integrating both relationship and risk into economic analyses [1] . Thus far, the principal contributions of the portfolio principle include optimal resource allocation under constraints and separation of individual and systematic risk components in the framework of risk diversification. Theoretically and empirically, these contributions can serve as the foundation for conducting a wide variety of economic analyses.

6.1. Pricing under the Law of No-Arbitrage

For a monopolistic product, the supply and demand principle is the prime factor in explaining price changes. As soon as substitutes or (and) complements appear in the market, the law of supply and demand no longer dominates price changes and is replaced by the law of no-arbitrage or one price.

Arbitrage opportunities can be observed directly on the basis of space or time and constitute the common motivation underlying trade. Arbitrage opportunities based on both space and time can only be observed recently in the financial market.

Using the bonds market as an example, assume that bond 1 has a maturity of 2 years with a face value of two million and a coupon rate of 6%. Bond 2 is a similar product with no coupon, and bond 3 is similar to bond 2 but with a 1-year maturity. Accordingly, with respect to future incomes, 100 units of bond 1 can be duplicated by six units of bond 2 plus 106 units of bond 3. Whenever the prices of these three bonds violate the law of no-arbitrage, the opportunity for arbitrage may exist.

Using the Taiwan Index Option in the Taiwan stock market as another example, on November 11, 2014, call and put premiums that matured in January 2015 with an exercise value of 8900 were 371 and 88 at opening and 338 and 110 at closing. For another set of calls and puts with an exercise value of 9000, premiums were 278 and 145 at opening and 273 and 143 at closing. Because the first and second sets can synthesize a future contract with forward values of 9183 and 9133, respectively, shorting the former and longing the latter, the arbitrage opportunity with a gross of 50 (expressed as the difference between the two forward values) can be assured by holding all options until maturity. However, at opening, to short the 8900 call and long the 8900 put results in a net of 283; to long the 9000 call and short the 9000 put results in a net of -133. At closing, all positions are reversed, and the call and put at 8900 yields an outcome of −228; and the call and put at 9000 yields an outcome of 130. Accordingly, the call and put at 8900 result in a net of 55, and the call and put at 9000 result in a net of −3. The final outcome is a net of 52 in one trading day.

Thus far, Taiwan’s options market has not run continuously. Therefore, pricing chaos would be most severe at the opening of the market and would be caused by overnight interruption of market supply and demand. However, these types of arbitrage opportunities can quickly disappear according to the market efficiency.

6.2. Systematic Factors

Based on risk diversification, a company can always evaluate the necessity of diversifying its operation into various industries or nations to reduce its systematic risks. However, even a globalized company cannot escape the effects of the global economy.

A concern is that risk diversification must be carefully evaluated to provide fair competition in the market. Contrary to conventional understanding, localized and globalized companies have different components of systematic risk; allowing them to compete directly against each other would not be justified because, for example, if a localized but not globalized company can conform to the requirement of sustainable development and result in a higher operation cost, allowing them to compete against each other without appropriate adjustments would be unjust.

This is not a proposition of self-protection for the local companies but only a simple and necessary concern of fair competition. A company’s choice to remain localized must be respected, especially when localization can yield superior local values in income generation and multiplication as well as develop irreplaceable social values in local linkages. Even worse, if the globalized company successfully maintains a higher ROI than the growth rate of the local economy, the local economy would inevitably deteriorate after satisfying the insatiable appetite of the globalized company. However, if this justification is overused, conflicts over trade protection might occur. Global organizations, such as the World Trade Organization, must provide necessary details for fair competition on this account, although globalized enterprises and nations with vested interests may not compromise easily.

6.3. Momentum of Asset Pricing Volatility

For a return series of (5, 6, 7, 8, 9) or (5, 6, 7.1, 8.3, 9.6), the trend exhibits steady or aggressive growth, respectively. However, if the return series would be transformed into an ROI series of (0.2, 0.17, 0.143, 0.125) or (0.2, 0.183, 0.169, 0.157), respectively, then the direction of the trend is reversed. Therefore, the materials used in the analytical task must have advantages from the perspective of both sides. This is what WINDEX can provide when it reflects on an asset’s momentum of price movement [5] .

In practice, when the asset to be analyzed is rational10, its WINDEX can be applied to create short-term technical predictive ability [4] . By contrast, fundamental analyses can have long-term predictive ability. Therefore, the dispute between technical and fundamental analyses can be ignored.

6.4. Approaches of Optimal Resource Allocation

If there is no synergistic effect, resource allocation in production between two distinct products in the company follows a curve similar to that illustrated in Figure 1. After the opportunity cost is set as rf, the optimal allocation of resources, or the so-called market portfolio, can be the tangent point m in the figure, an outcome that has the highest opportunity of successfully outperforming rf.

After adding products, an efficient set representing all distribution possibilities of the company’s production resources can be drawn, similar to the larger closed graph in Figure 2. The curve on the left of this efficient set is the efficient frontier where the market portfolio, m, resides. However, realistic constraints always exist regarding the company’s resource allocation. For example, minimum capacity requirements or difficulty in recruiting and training can push the initial efficient set inward to become smaller. The other crucial benchmark in Figure 2 is the minimum-risk portfolio, g. If the company’s product set already surpasses the Fama threshold, then this portfolio, g, can legitimately represent the systematic risk of the company. The final critical point is the current status of resource allocation, z, which is rarely the market portfolio m.

The algorithm for discovering an optimal solution in the portfolio principle can be applied to determine the optimal allocation of production resources under constraints. In practice, other than professional software, the Solver tool in EXCEL can be directly applied. However, this technique provides only the optimal solution at a specific point of time, and considerations to ensure timely adjustments must be further managed.

6.5. Risk Management

In general, the failure risk of a product, ![]() , can be expressed as a manageable risk,

, can be expressed as a manageable risk, ![]() , plus an unmanageable risk,

, plus an unmanageable risk,![]() . Specifically,

. Specifically, ![]() can also be further classified as a company’s manageable risk,

can also be further classified as a company’s manageable risk, ![]() , and a nation’s manageable risk,

, and a nation’s manageable risk, ![]() , and a risk of

, and a risk of ![]() that is unmanageable even by the nation’s government. The responsibility for failure would fall on the product division or the company, if the sources of failure stem from

that is unmanageable even by the nation’s government. The responsibility for failure would fall on the product division or the company, if the sources of failure stem from ![]() or

or![]() , respectively.

, respectively.

For the product division, ![]() ,

, ![]() and

and ![]() all have different levels of systematic risk. However, if

all have different levels of systematic risk. However, if ![]() or (and)

or (and) ![]() is not realistically reduced, all of the company’s product divisions would bear an unnecessary failure risk. Therefore, a nation’s government must also implement risk control crucial to the success of the companies and industries, such as risk control on exchange rates and trade barriers.

is not realistically reduced, all of the company’s product divisions would bear an unnecessary failure risk. Therefore, a nation’s government must also implement risk control crucial to the success of the companies and industries, such as risk control on exchange rates and trade barriers.

Finally, as mentioned in Section 5.4, if an expected value loses its reliability by having a standard deviation that is too high, no effective analysis could be performed. Therefore, unless the stability of the object being analyzed is sufficient, risk reduction should become the priority mission of management.

By definition, total risk equals individual plus systematic risk. Accordingly, efforts on risk reduction can have two distinct directions. However, because reducing individual risk may relate to a loss in competitive advantages, decisions must be carefully evaluated. This should explain why indirect risk diversification is more widely practiced than direct risk reduction for risk management.

6.6. Paths of Development

Risk and return factors have different attributes, but they can improve performance with a similar efficiency. For example, in Figure 4, pushing the less efficient frontier leftward, which is a sign of reducing systematic risk, enables the optimal solution to be switched from m' to a more favorable position of m. This improvement can also be similarly duplicated by a strictly upward movement of the less efficient frontier, a sign of improving expected returns.

In Figure 3, z represents the current situation and m' is the optimal allocation of resources; the line that directly links them is nonlinear and the path of least resistance. In this path, there are two identifiable sectors representing the path of absolute improvement from z to a, which has a property of reducing ![]() and increasing

and increasing

![]()

Figure 1. Optimal allocation of two members.

![]()

Figure 2. Market portfolio with and without constraints.

![]()

Figure 3. Absolute and relative paths of development.

![]()

Figure 4. Changes of the efficient frontier.

E, and the path of relative improvement from a to m', where both ![]() and E increase.

and E increase.

The political benefits of the path of absolute improvement are numerous. Although conservative, these approaches are more realistic in preventing unnecessary adjustments of resource allocation, especially when the composition of the market portfolio can vary over time.

7. Syndicate Applications

Two concerns are discussed in this section to explain how the microeconomic natural law and the portfolio principle can be combined into analytical tasks. The first explains a new approach of performance evaluation; the second explains a method for analyzing industrial structure.

7.1. A Relative Approach to Performance Evaluation

Assume product i can be represented as point z in Figure 4. Its relative performance can then be represented as the deviation of WNDEX, ![]() , which equals

, which equals![]() , and can be used as the basis of evaluation. If

, and can be used as the basis of evaluation. If ![]() increases, even if

increases, even if ![]() is higher than 0, additional opportunities provided by the environment would be wasted. By contrast, if both

is higher than 0, additional opportunities provided by the environment would be wasted. By contrast, if both ![]() and

and ![]() decrease, an ability to resist pressure could be assumed.

decrease, an ability to resist pressure could be assumed.

Once the environmental factor is included in performance evaluation, more objective and just conclusions can be achieved. Furthermore, objects in dissimilar environments can be more justifiably evaluated.

7.2. Analyses of Market Structure

We inspect Equation (2) again. If the sum of all three coefficients is significantly higher than 1, then the market does not surpass the Fama threshold and has an oligopolistic structure; otherwise, it is close to the structure of perfect competition. However, Figure 2 clearly illustrates that the market with competition would be near the minimum-risk portfolio, g, instead of the market portfolio, m. This overrules the superiority of perfect competition, an unavoidable conclusion in the risk-return framework.

Similarly, because a monopoly has no advantage in risk diversification in the market, it can rarely be deemed as an optimal choice for resource allocation. The risk-return world focuses more on the risk instead of the return. Therefore, as long as a new company can contribute risk diversification in the market, there should be no reason to reject it.

Accordingly, the optimal industrial structure is one in which Equation (2) can be applied by every participant and a relatively lower percentage of non-mainstream members are allowed to exist in the industry11. In Figure 2, this means that the optimal industrial structure must be located near the efficient frontier and market portfolio12.

7.3. Disadvantage of Monopoly

In the past, evaluating a monopoly focused only on topics concerning the return. Once the risk is considered, as demonstrated in Figure 1, even introducing one new participant into a monopoly market can achieve some degrees of risk diversification and provide a stronger industrial structure.

Typically, every new product can enjoy a period of natural monopoly. However, according to the portfolio principle, a monopoly can only mean that its individual risks are not sufficiently diversified in the industry. Loss in social welfare continues to exist as long as the monopoly can transfer the cost of inefficient risk diversification to its consumers.

Establishing a stabilized environment for every participant reduces unnecessary excess risks of failure. As long as the Fama threshold cannot be surpassed in the industry, each individual participant must unnecessarily bear a part of the excess risk of failure. This is a sign of inefficient resource allocation.

8. Conclusions

This study is only an introduction of how to collocate the microeconomic natural law with the portfolio principle and several bases in general economic analyses to demonstrate what a textbook of economics can cover. It is impossible to cover all critical topics; however, restoring economics as the foundation of all major disciplines for economic management can still be practically achieved. More crucially, by endogenizing the economic environment, such new economic textbooks can guide the chaotic economic world back to its normal conditions.

The greatest problem caused by all mainstream economic schools is establishing returns as the most essential objects for economic analyses, and hence, forcing risks to merely adopt supporting roles. The economic world therefore is misled by the principle of profit maximization. When the relationship between risk and return can be distorted artificially by using false rules, unfairness and chaos are unavoidable in the economic world. Higher returns contribute mostly marginal welfare; risk controls that are more efficient involve mostly survival.

Traditionally, uncertainty or risk can be analyzed only normatively. However, second-moment measures can include first-moment measures as components (but not vice versa). This means that models based on the former can be transformed directly into models based on the latter (but not vice versa). To insist that only positive analyses be acceptable in quantitative economic analyses would be self-limiting.

Even more self-limiting is that, based on another false rule, the world has been gradually damaged by exogenous costs that have long been permitted. Moreover, every generation represents a small proportion of all generations, past, present, and future. Therefore, no single generation can lay claim to the earth when it belongs to all generations. Environmental factors must be endogenized into all economic behavior. This is the proposition of the microeconomic natural law.

To bear an unnecessary risk of failure is irrational and ineffective for economic management. Hence, system variables are vital for avoiding unnecessary risks of failure. Most importantly, once the system variables are revealed in the market, the economic environment can be endogenized to strongly regulate and automate all pricing behavior in the market. Additional work is necessary to maintain the other two vital natural and social environments.

Fortunately, the macroeconomic natural law still functions normally [3] . However, this may not hold if the destructive power from human beings is not controlled. This characteristic of economics allows for self- destruction under the guise of pursuing self-interest.

Microeconomic natural law can automatically correct false economic rules without any direct intervention from the government. The main purpose of the economy is to develop a promising future; therefore, both microeconomic and macroeconomic natural laws must converge where their goals are identical to that of human beings.

This study explains only why and how to elaborate the product section of the analytical framework in economics textbooks. The illustrated methodology is still far from perfect because the real synergistic effects cannot be quantitatively studied, and natural and social environments are still treated as exogenous factors in the analytical framework. Clearly, economics still has numerous challenges to overcome.

NOTES

1In statistics, expected returns are first-moment measures, and risks are second-moment measures that in turn use returns as bases in calculation. Therefore, to establish an economic model based on risks, one can switch directly to a related model expressed in expected returns; however, the opposite is not possible.

2Fama [2] suggested that the number of participants selected randomly must be at least 15 for sufficiently diversifying the portfolio’s individual risk components. This requirement is called the “Fama threshold”.

3It is estimated on the basis of![]() . This is a unique property characterizing system variables [5] .

. This is a unique property characterizing system variables [5] .

4![]() of the CAPM is measured as

of the CAPM is measured as![]() . As long as

. As long as ![]() is higher than zero, σi and the model’s outcome, Ei, are positively correlated. In addition to its general meaning, we can also infer that CAPM has a higher Ei in the next period if there is a higher σi in this period. All other factors being equal, investors should make the market as chaotic as possible.

is higher than zero, σi and the model’s outcome, Ei, are positively correlated. In addition to its general meaning, we can also infer that CAPM has a higher Ei in the next period if there is a higher σi in this period. All other factors being equal, investors should make the market as chaotic as possible.

5As Moore [7] cited from Chapman, “behaviour could no longer be observed; rather, it had to be understood and experienced from within and interpreted.”

6This is because superior returns increase the likelihood of marginal welfare, and superior risk controls contribute the likelihood of survival.

![]()

7This is because the compositions of individual and systematic risks per unit of total risk and the contents of individual risk can vary with respect to objects, locations, and even time.

8Standard deviations are commonly used to represent risks. However, they are convenient substitutes when the subsequent two premises can be followed. First, rf must be lower than E; second, the hypothesis of lognormal distribution must be maintained.

![]()

9Akin to average values, expected values are the least biased numbers to represent the set of all possible outcomes. However, the efficacy of their applicability remains uncertain.

![]()

10This means that the asset can conform to the hypothesis of lognormal distribution.

![]()

11Non-mainstream members are companies whose business performance is negatively correlated with that of mainstream companies in the industry.

12This is because the market portfolio accepts only mature members that can stably contribute either a dimension of risk or return in the market.