Analysis and Test of Multifractal Characteristics of the European Carbon Emissions Market—Based on the Framework of Wavelet Leaders ()

Received 11 March 2016; accepted 22 March 2016; published 25 March 2016

1. Introduction

With the aim of preventing the excessive greenhouse gases emissions from bringing irreversible effect on the environment and human society, the international community made mandatory emission reduction task for the each participating nation via the Kyoto Protocol. Thus, carbon emission permits became a kind of relatively scarce resource and began to be regarded as a kind of financial asset. In order to reduce the cost of emission reduction as much as possible, the so-called carbon trading markets were established among participating nations. The European Union Emission Trading Scheme, New South Wales Greenhouse Gas Abatement Scheme in Australia and the American emissions trading system are the famous carbon trading markets in the world. These carbon trading markets can improve the allocation efficiency of the carbon emission permits.

Many factors can dramatically affect the carbon price levels such as the climate, the international emissions policy, the design of market system and the financial crisis. So, the market prices of carbon emission permits fluctuate in an extremely complex way. For example, during the pilot phase of European Union Emission Trading Scheme, the European Union allowances (EUAs) prices dropped from a peak of 30 Euro to near zero, because of the regulation of “No Banking” and excessive releases of EUAs. The highly volatile carbon prices have brought a huge challenge to the market participants and regulators. Therefore, the purpose of this paper is to find out a way to depict the volatility characteristics of carbon prices accurately which may have a vital practical significance for the trading and risk management in the carbon market.

2. Literature Review

The volatility of the carbon prices has already attracted some interest in the literature. Daskalakis et al. [1] found that there was a high level of volatility and extreme discontinuous variations in carbon market, so the general models couldn’t depict the behavior of the carbon price efficiently. Chevallier [2] used three indicators (conditional variance, implied volatility and realized volatility) to measure price volatility for European Union Allowances. He detected the instability in volatility of carbon prices based on retrospective tests and forward-looking tests. The empirical results showed that there were strong shifts in carbon market. Benz and Trück [3] examined the spot price dynamics of European Union Allowances and found that the returns showed skewness, excess kurtosis and dissimilar volatility behaviors during different phases. So, they used Markov switching and AR- GRACH models to build a forecasting model for EUAs. Based on an in-sample and out-sample forecasting analysis and the comparing analysis of different approaches, their study supported this kind of models which could capture characteristics and dissimilar volatility behaviors of the log returns during different phases. Seifert, Uhrig-Homburg and Wagner [4] developed a stochastic equilibrium model and analyzed the carbon spot price dynamics. They found that the carbon prices didn’t follow any seasonal patterns. An adequate carbon price process should possess the martingale property and exhibit a time- and price-dependent volatility structure. However, Paolella and Taschini [5] found that a generalized asymmetric t innovation distribution suited the stylized features of CO2 price very well.

Because of the inherent complexity, there are linear and nonlinear patterns in carbon prices [7] . Obviously, the research within the scope of parametric and semi-parametric models can’t effectively depict the volatility behavior of carbon prices which contain the nonlinear patterns. As a result, some scholars began to use nonparametric models to capture the nonlinear characteristic of the carbon market missed by traditional parametric models. The nonparametric model was first introduced to the carbon market by Chevallier [8] . The empirical results showed that nonparametric modeling can significantly improve the forecasting accuracy of the carbon price compared with the traditional linear AR models. So, nonparametric models could describe the behavioral characteristics of carbon prices better. Feng ZH, Zou LL, Wei YM [9] examined the carbon price volatility from the perspective of nonlinear dynamics. Specifically, firstly, based on serial correlation and variance ratio tests, they tested whether current carbon prices fully reflected the related historical information. In this way, they wanted to determine whether the carbon market was weak-form efficient. Results showed that the weak-form efficiency was not realized in the carbon market. Then, they used the R/S, modified R/S and ARFIMA to test the long-term memory of carbon prices. But only the short-term memory had been found in the carbon market. So, the mono-fractal models were not applicable in the European carbon market.

As we can see from the literature review above, neither the traditional econometric models nor the mono- fractal models can capture the characteristics of carbon prices accurately and effectively. Mandelbrot [10] proposed that the multifractal model had better applicability and stronger practicability in portraying the complex volatility of the capital market. According to the financial asset attributes of carbon emissions permits, this paper will try to test and analyze the price fluctuation of the European carbon market based on the multifractal model. The remainder of this work is organized as follows: in next section, we give a simple introduction of multifractal theory and wavelet leaders, namely the theoretical analysis. In Section 4, we test and analyze the multifractal characteristics of the European carbon market, namely the empirical analysis. In last section, we summarize the main conclusions in this paper.

3. Theoretical Analysis

3.1. Multifractal Theory

Fractal market can be divided into the multifractal market and the mono-fractal market. The scaling characteristics of mono-fractal sequences do not change over time. So we can use a global scaling exponent to characterize the singularity of mono-fractal sequences. This means that only a fractal dimension is needed to describe overall singularity features of mono-fractal sequences. But the scaling characteristics of the multifractal sequences change with time. So multifractal analysis need to study the fractal dimension’s probability distribution of the subsets at different scales so as to reflect their regularity and singularity of the signals in detail. To achieve an accurate and effective analysis of the European carbon market, we detect the multifractal property of carbon prices fluctuations firstly.

In practice, we use the multifractal spectrum to describe the dynamic characteristics of the system in the multifractal analysis. The multifractal spectrum is composed of the local Holder exponent and the Hausdorff dimension. The Holder exponent depicts the singularity of the market volatility and the Hausdorff dimension depicts the probability distribution of the local Holder exponent. Their mathematical definitions are as follows:

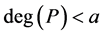

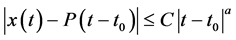

For the time series , if there is a constant

, if there is a constant  and a polynomial P (

and a polynomial P ( ,

, ) which make it satisfy the following condition:

) which make it satisfy the following condition: , if

, if , then

, then , we say that the time series

, we say that the time series  belongs to

belongs to . The Holder exponent of

. The Holder exponent of  at

at  is

is .

.

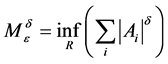

Set ,

,  and let

and let  be the infimum of all e-coverings of A. For any

be the infimum of all e-coverings of A. For any![]() , the d-dimensional Hausdorff measure of A is

, the d-dimensional Hausdorff measure of A is![]() . If there is a

. If there is a ![]() such that:

such that:![]() ,

,

![]() and

and![]() ,

, ![]() , then

, then ![]() is the Hausdorff dimension of set A.

is the Hausdorff dimension of set A.

According to the definition of the Holder exponent and the Hausdorff dimension, we know that multifractal spectrum can describe the diversity of price fluctuations at different scales. Thus, the multifractal spectrum is the comprehensive and detailed characterization of system’s dynamics characteristics.

3.2. Wavelet Leaders

The existing method of multifractal analysis can be divided into two categories: numerical analysis and wavelet analysis. Compared with the numerical analysis, wavelet analysis has an unparalleled advantage in studying the multifractal characteristics of the signal. The wavelet analysis mainly includes the wavelet transform modulus maxima method (WTMM) and the wavelet leaders (WL). The wavelet transform modulus maxima method adopts the continuous wavelet transform, so the cost of computation will increase with the signal’s dimension. In addition, this method is no longer applicable when there is oscillation singularity in signal. However, the wavelet leaders use the discrete wavelet transform which makes the decomposition algorithm faster and the cost of computation lower. And this method is also applicable when the signal contains oscillation singularity or chirp-type singularity. So, this article uses the wavelet leader to test the multifractal characteristics of the European carbon market. Specific steps are as follows:

1) Let ![]() with compact support be an elementary function and its number of vanishing moment

with compact support be an elementary function and its number of vanishing moment ![]() should be a positive integer (

should be a positive integer (![]() ). Let the collection of dilated and translated templates of

). Let the collection of dilated and translated templates of![]() :

:![]() be the orthonormal basis of

be the orthonormal basis of![]() . Based on these, we can

. Based on these, we can

get the discrete wavelet transform coefficients of![]() :

:![]() . In essence,

. In essence,

the time series ![]() and its discrete wavelet transform coefficients are different manifestations of the same subject. And the discrete wavelet transform (DWT) will not lost any information of the original sequence. So, it is possible and effective to study the characteristics of the original sequence based on the discrete wavelet transform coefficients.

and its discrete wavelet transform coefficients are different manifestations of the same subject. And the discrete wavelet transform (DWT) will not lost any information of the original sequence. So, it is possible and effective to study the characteristics of the original sequence based on the discrete wavelet transform coefficients.

2) Let ![]() be the dyadic intervals and

be the dyadic intervals and ![]() be the union of the dyadic interval and its two adjacent intervals. Then, let’s define wavelet leaders as:

be the union of the dyadic interval and its two adjacent intervals. Then, let’s define wavelet leaders as: ![]() . Namely, the wavelet leaders are the maximum of wavelet coefficients within the neighborhood of

. Namely, the wavelet leaders are the maximum of wavelet coefficients within the neighborhood of ![]() for all finer scales.

for all finer scales.

3) Then, we can compute the structure functions from the wavelet leaders:![]() ,

,

where ![]() is the number of the wavelet leaders

is the number of the wavelet leaders ![]() at scale

at scale![]() .

.

4) In the limit![]() , the structure functions decay as power laws of the scales:

, the structure functions decay as power laws of the scales:![]() , where

, where ![]() are the scaling exponents. So the scaling exponents can be obtained from the linear regressions of

are the scaling exponents. So the scaling exponents can be obtained from the linear regressions of

the structure functions vs. scales in a logarithmic graph. Namely,![]() .

.

5) Through a Legendre transform of the scaling exponents, we can get the upper bound of the multifractal spectrum:![]() . The inequality can be converted to equation directly in most multifractal models. Namely,

. The inequality can be converted to equation directly in most multifractal models. Namely,![]() . In this way, we get the so-called multifractal spectrum.

. In this way, we get the so-called multifractal spectrum.

Because of the complexity of the Legendre transform in practice, Chhabza [11] proposed the experience formula to calculate the scaling exponents, the Holder exponent and the Hausdorff dimension based on the theory of Shannon, Eggelston and Billingsley. The experience formula is as follows:

![]()

where![]() ,

, ![]() and

and

![]() . The weights

. The weights ![]() can be expressed as

can be expressed as ![]()

with ![]() (

(![]() ), where

), where ![]() reflects the confidence level of the scaling exponents. In addition,

reflects the confidence level of the scaling exponents. In addition,

the weights must satisfy the following constraints: ![]() and

and![]() .

.

According to the relationships between the scaling exponents ![]() and the orders q of multi-resolution torques, the wavelet leaders can determine the fractal characteristics of the European carbon market. If the relationships between

and the orders q of multi-resolution torques, the wavelet leaders can determine the fractal characteristics of the European carbon market. If the relationships between ![]() and q are linear, the European carbon market is a mono-fractal market. However, if the relationships between

and q are linear, the European carbon market is a mono-fractal market. However, if the relationships between ![]() and q are nonlinear, the European carbon market is a multifractal market. After determining the multifractal characteristics of the European carbon market, we can adopt multifractal analysis to study the price volatility of this market.

and q are nonlinear, the European carbon market is a multifractal market. After determining the multifractal characteristics of the European carbon market, we can adopt multifractal analysis to study the price volatility of this market.

4. Empirical Test

4.1. Data Introduction

At present, the European Union Emission Trading Scheme is the most mature carbon trading market in the world where the trading mechanism is the most robust and trading volume is the largest. The BlueNext Exchange and the European Climate Exchange (ECX) are the largest trading markets of carbon spot and carbon futures in this system, respectively. So, we select the spot prices of European Union Allowances in these two markets as the research object of this paper.

The sample data in this paper are from the Bloomberg database. To be specific, the data of the phase 1 are from BlueNext Exchange and the sample interval is June 27, 2005 to June 29, 20071 (a total of 500 data); the data of the phase 2 are also from BlueNext Exchange and the sample interval is February 26, 2008 to December 5, 2012 (a total of 1186 data); the data of the phase 3 are from European Climate Exchange and the sample interval is December 7, 2012 to May 8, 2015 (a total of 622 data). This paper adopts the Matlab R2012b for data processing.

To simplify the analysis of price volatility, this paper converts the spot prices of EUAs into logarithm yields:

![]()

where t is the trading day, ![]() is the closing price of carbon spot on t and

is the closing price of carbon spot on t and ![]() is the logarithm yield on t.

is the logarithm yield on t.

4.2. Test the Multifractal Characteristics

The discrete wavelet transform of carbon yield sequences in this paper is based on the Daubechies wavelet which chooses 3 as vanishing moment. Then, in order to get the complete multifractal spectrum, the orders of multi-resolution torques of three phases are selected as: [−15, 15], [−8, 8] and [−12, 12]. Finally, the relationships between scaling exponents and the orders of multi-resolution torques can be obtained according to the Chhabza algorithm. And then we can examine the multifractal characteristics of the European carbon market in three phases.

The relationships between the scaling exponents and the orders of multi-resolution torques in three different phases are shown in Figure 1. As we can see in the figure, the relationships between the scaling exponents and the orders of multi-resolution torques are significant nonlinear in three phases and show as the convex increasing functions. Therefore, the European carbon market has shown the significant multifractal characteristics in all of the three phases.

4.3. Analysis of the Empirical Results

First of all, we use the width of the multifractal spectrum (![]() ) to analyze the multifractal characteristics of carbon price fluctuations on the whole. The width of the multifractal spectrum (

) to analyze the multifractal characteristics of carbon price fluctuations on the whole. The width of the multifractal spectrum (![]() ) measures the absolute magnitude of price fluctuations from the point of extreme value, namely the non-uniformity of the price fluctuations. The bigger

) measures the absolute magnitude of price fluctuations from the point of extreme value, namely the non-uniformity of the price fluctuations. The bigger ![]() means the greater difference of volatility’s singularity and the greater multifractal characteristics. On the contrary, the multifractal characteristics are weaker.

means the greater difference of volatility’s singularity and the greater multifractal characteristics. On the contrary, the multifractal characteristics are weaker.

The width of multifractal spectrum of the European carbon market in three phases is shown in Table 1. The width of multifractal spectrum of the third phase is greater than that of other two phases. It suggests that the price volatility is the most uneven and multifractal characteristics are the strongest in third phase. By contrast, the width of the multifractal spectrum of phase two is the smallest, which means that the price volatility is relatively homogeneous, namely a higher market efficiency in second phase. The reason for this result might be that: at the first stage, the policy and market mechanism was imperfect and participants didn’t have a profound understanding about the carbon market, so the market efficiency was low. At the second stage, the market mechanism was more robust and participants were more rational, so the market efficiency had improved. In Post-Kyoto period, the uncertainty of the international carbon emission reduction policy makes the European carbon market to be extremely sensitive to many factors so that market efficiency has fallen dramatically.

Because the Hausdorff dimension reflects the way of price fluctuations, the variance of Hausdorff dimension (![]() ) can indicate the singularity of the price volatility from a more detailed perspective. Thus the variance of the Hausdorff dimension (

) can indicate the singularity of the price volatility from a more detailed perspective. Thus the variance of the Hausdorff dimension (![]() ) can be used to measure the complex multifractal market volatility. Given the variance of the Hausdorff dimension and the width of the multifractal spectrum can measure the market volatility from different perspectives, this paper combines these two measures and innovatively put forward an indicator, namely,

) can be used to measure the complex multifractal market volatility. Given the variance of the Hausdorff dimension and the width of the multifractal spectrum can measure the market volatility from different perspectives, this paper combines these two measures and innovatively put forward an indicator, namely,![]() . The VhS can comprehensively reflect price fluctuations in the multi-frac- tal market. This indicator not only solves the inapplicability of the traditional risk measure indicators in the multifractal market, but also overcomes the limitation of the traditional risk measure indicator that they can only depict the range of price fluctuations. To test the validity of VhS in capturing carbon price fluctuations characteristic within each phase, we adopt the sliding window method to get these indicators in different periods. We select 255 days (about one year) as the width of the sliding window and one day as the sliding step.

. The VhS can comprehensively reflect price fluctuations in the multi-frac- tal market. This indicator not only solves the inapplicability of the traditional risk measure indicators in the multifractal market, but also overcomes the limitation of the traditional risk measure indicator that they can only depict the range of price fluctuations. To test the validity of VhS in capturing carbon price fluctuations characteristic within each phase, we adopt the sliding window method to get these indicators in different periods. We select 255 days (about one year) as the width of the sliding window and one day as the sliding step.

The logarithm yield sequences, variances and VhS of the European carbon market in three different phases are

![]()

Table 1. The width of the multifractal spectrum of three phases.

shown in Figures 2-4. As we can see in the Figure 3, in the second phase VhS are less than 0.5 most of the time. It also proves that the market efficiency is relatively higher in phase two. By comparing variances with VhS in every phase, we find that the indicator VhS not only can describe the range of carbon price fluctuations just

![]()

Figure 1. The relationships between the scaling exponents and the orders of multi-resolution torques.

![]()

Figure 2. The logarithm yield sequences, variances and VhS in phase 1.

![]()

Figure 3. The logarithm yield sequences, variances and VhS in phase 2.

![]()

Figure 4. The logarithm yield sequences, variances and VhS in phase 3.

as the variance do, but also can capture the complex behaviors of price fluctuations sensitively. When we compare the logarithm yield sequences with the VhS, we find that the VhS can seek out the abrupt change points in the logarithm yield sequences effectively, which may play an important role in the identification and management of market risk in future study. It can be seen that the indicator VhS can depict the complex price volatility in the multifractal market effectively.

5. Conclusions

In this paper, the research results show that:

1) The nonlinear relationships between the scaling exponents ![]() and the orders q of multi-resolution torques in three phases indicate that the European carbon market is a multifractal market.

and the orders q of multi-resolution torques in three phases indicate that the European carbon market is a multifractal market.

2) By the comparative analysis of the width of multifractal spectrum of different phases, we find that the multifractal characteristics of the European carbon market in phase 3 are the strongest.

3) The proposed indicator VhS in this paper can depict the price fluctuations of the multifractal market effectively, which provides a new train of thought for the risk management in multifractal market.

NOTES

![]()

1Due to the provision of “No Banking”, the residual EUAs of the first phase were invalid in next phase. As a result, the price of EUAs was almost zero at the end of the first phase. Considering the validity of the data, this paper deletes the data of the last half of 2007.