An Inventory Model for Perishable Items with Time Varying Stock Dependent Demand and Trade Credit under Inflation ()

1. Introduction

In the classical inventory models payment for the items paid by the supplier depends on the payment paid by the retailer and in such cases the supplier offers a fixed credit period to the retailer during which no interest will be charged by the supplier so there is no need to pay the purchasing cost by the retailer and after this credit period up to the end of a period interest charged and paid by the retailer. In such situations the retailer starts to accumulate revenue on his sale and earn interest on his revenue. If the revenue earned by the retailer up to the end of credit period is enough to pay the purchasing cost or there is a budget then the balance is settled and the supplier does not charge any interest, otherwise the supplier charges interest for unpaid balance after the credit period. The interest and the remaining payment are made at the end of replenishment cycle.

In traditional EOQ models the payment time does not affect the profit and replenishment policy. If we consider the inflation then order quantity and payment time can influence both the supplier’s and retailer’s decisions. A large pile of perishable foods such as fruits, vegetables, milk, bread, chocklet etc. attract the consumers to buy more. Buzacott [1] considered an EOQ model with different type of pricing policies under inflation. Silver and Peterson [2] developed an inventory model and show that the consumption rate is proportional to the displayed stock level. Baker and Urban [3] proposed an inventory model for deteriorating items with the demand rate is a polynomial function of instantaneous stock level. Mandal and Phaujdar [4] presented an inventory model for deteriorating items with stock level dependent consumption rate. Vrat and Padmanabhan [5] considered an inventory model with stock dependent demand under constant inflation rate. Padmanabhan and Vrat [6] developed an EOQ model for perishable products under stock dependent selling rate. Bose et al. [7] considered an inventory model for deteriorating items with time dependent demand and shortages under inflation and time discounting. Mandal and Maiti [8] developed an inventory model for damageable items with stock dependent demand and variable replenishment rate. Chung and Lin [9] determine an optimal replenishment policy for an inventory model of deteriorating items by considering inflation and credit period. Chang [10] proposed an EOQ model for deteriorating items under inflation and time discounting assuming that the supplier offers a trade credit policy if the retailer order size is larger than a certain level. Dye and Ouyang [11] developed an EOQ model for perishable items with stock dependent selling rate by allowing shortages. Hou [12] presented an inventory model for deteriorating items with stock dependent consumption rate and shortages under inflation and credit period. Jaggi et al. [13] determine an optimal ordering policy for deteriorating items under inflation induced demand. Sana and Chaudhuri [14] developed a deterministic EOQ model with stock dependent demand and delay in payments. Valliaththal and Uthayakumar [15] presented an inventory model for perishable items under stock and time dependent selling rate with shortages. Roy et al. [16] considered an inventory model for deteriorating items with stock dependent demand under fuzzy inflation and time discounting over a random planning horizon. Sana [17] proposed a lot size inventory model with stock dependent demand and time varying deterioration and partial backlogging. Chang et al. [18] determine an optimal replenishment policy for an inventory model of non-instantaneous deteriorating items with stock dependent demand. Sarkar et al. [19] presented an EMQ (economic manufacturing quantity) model of an imperfect production process with time dependent demand and time value of money under inflation. Yan [20] considered an EOQ model for perishable items with freshness dependent demand and partial backlogging. Nagrare and Dutta [21] developed a continuous review inventory model for perishable products with inventory dependent demand. Sana [22] proposed a control policy for a production system inflation assuming a stock dependent demand and sales team promotional effort.Shuai et al. [23] considered an inventory model for perishable products with stock dependent demand and trade credit under inflation.

Table 1 and Table 2 show the variation of the parameters r and M when  and Table 3 & Table 4 show the variation of parameters r and M when

and Table 3 & Table 4 show the variation of parameters r and M when . Figure 1 & Figure 2 are correspond to the developed model. Figure 3 & Figure 4 show the variation of retailer’s total cost with respect to the parameters r and M when

. Figure 1 & Figure 2 are correspond to the developed model. Figure 3 & Figure 4 show the variation of retailer’s total cost with respect to the parameters r and M when  and Figure 5 & Figure 6 show the variation of retailer’s total cost with respect to the parameters r and M when

and Figure 5 & Figure 6 show the variation of retailer’s total cost with respect to the parameters r and M when .

.

In the present paper we presented an inventory model for perishable items with time varying stock dependent demand and trade credit under inflation. Although there are so many research papers related to the perishable

![]()

Figure 1. Corresponding to developed model.

![]()

Figure 2. With n cycles in the developed model.

![]()

Table 1. Variation of retailer’s total cost with respect to the change of parameter r.

![]()

Table 2. Variation of retailer’s total cost with respect to the change of parameter M.

![]()

Table 3. Variation of retailer’s total cost with respect to the change of parameter r.

![]()

Table 4. Variation of retailer’s total cost with respect to the change of parameter M.

![]()

Figure 3. Variation in TC with respect to r.

![]()

Figure 4. Variation in TC with respect to M.

![]()

Figure 5. Variation in TC with respect to r.

![]()

Figure 6. Variation in TC with respect to M.

products with stock dependent demand under inflation. This paper deals with the same type problem and it provides an approximate solution procedure of this problem for minimizing the present value of retailer’s total cost.

2. Assumptions and Notations

We consider the following assumptions and notations corresponding to the developed model

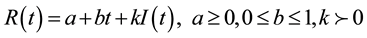

1) The demand rate  is

is

2) ![]() is the constant deterioration rate.

is the constant deterioration rate.

3) ![]() is the ordering cost per order.

is the ordering cost per order.

4) ![]() is the holding cost per unit.

is the holding cost per unit.

5) ![]() is the shortage cost.

is the shortage cost.

6) M is the credit period.

7) T is the replenish cycle length.

8) r is the inflation rate.

9) ![]() is the interest charged per $ per unit time when

is the interest charged per $ per unit time when![]() .

.

10) C is the purchasing cost per unit.

11) P is the selling price per unit with![]() .

.

12) Q is the initial inventory level.

13) L is the planning horizon.

14) The supplier sells one single item to the retailer.

15) The items are replenished when the stock level becomes zero.

16) The supplier provides a credit period, which is dependent on the order quantity.

17) The lead time is zero.

18) Shortages are not allowed.

19) The inventory planning horizon is finite and the numbers of cycles are finite in the planning horizon.

20) I(t) is the inventory level at any time t.

3. Mathematical Formulation

Suppose an inventory system consists the maximum inventory level at any time t = 0 and due to both demand and deterioration the inventory level decreases in the interval![]() . The replenishment cycle starts with the initial maximum inventory level Q and ends with zero stock level. The retailer’s instantaneous inventory level at any time t in the interval

. The replenishment cycle starts with the initial maximum inventory level Q and ends with zero stock level. The retailer’s instantaneous inventory level at any time t in the interval ![]() is governed by the following differential equation

is governed by the following differential equation

![]() (1)

(1)

With the boundary condition

![]()

The equation (1) can also be written as

![]() (2)

(2)

where ![]()

With the boundary condition

![]()

For a 2nd order approximation of ![]() and

and![]() , the solution of Equation (2) is

, the solution of Equation (2) is

![]() (3)

(3)

Using the boundary condition, I(0) = Q the initial order quantity is

![]() (4)

(4)

Now we discuss the following two cases

(1) ![]() and (2)

and (2) ![]()

3.1. Case I

When ![]() then in this case the retailer can sell all the items before the end of credit period M because the credit period M is greater than the replenishment cycle length so no interest will be charged by the retailer. Since the purchasing cost is paid at the end of credit period M.

then in this case the retailer can sell all the items before the end of credit period M because the credit period M is greater than the replenishment cycle length so no interest will be charged by the retailer. Since the purchasing cost is paid at the end of credit period M.

During the 1st cycle the present value of ordering cost is

![]() (5)

(5)

During the 1st cycle the present value of purchasing cost is

![]()

![]() (6)

(6)

During the 1st cycle the present value of holding cost is

![]()

![]() (7)

(7)

Therefore during the 1st cycle the present value of retailer’s total cost is

![]()

![]() (8)

(8)

Since there are m cycles in the planning horizon L then the present value of retailer’s total cost over the planning horizon L is

![]()

![]()

![]() (9)

(9)

The necessary condition for ![]() to be minimum is that

to be minimum is that ![]() and the sufficient condition is

and the sufficient condition is ![]() at the optimum value of T.

at the optimum value of T.

![]() (10)

(10)

![]() (11)

(11)

3.2. Case II

When ![]() then there are three possibilities

then there are three possibilities

1) Let ![]() then at M the revenue earned by the retailer is more than the purchasing cost

then at M the revenue earned by the retailer is more than the purchasing cost

so in this case no interest will be charged by the supplier although the credit period M is smaller than the replenishment cycle length T so the present value of retailer’s total will be same as that in case I.

![]() (12)

(12)

2) Let ![]() then at M the revenue earned by the retailer is less than the purchasing cost

then at M the revenue earned by the retailer is less than the purchasing cost

and the retailer has a budget to pay the remaining short purchasing cost so in this case there is still no interest charged by the supplier although the credit period M is smaller than the replenishment cycle length T so the present value of retailer’s total will be same as that in case I.

![]() (13)

(13)

3) Let ![]() then at M the revenue earned by the retailer is less than the purchasing cost

then at M the revenue earned by the retailer is less than the purchasing cost

and the retailer has no budget to pay the remaining short purchasing cost so in this case for unpaid balance the interest will be charged by the supplier from M to T. The interest and the remaining payments are made at the end of replenishment cycle. So in this case the retailer’s total cost containing the ordering cost, holding cost, purchasing cost paid at M, the interest and the remaining payments are made at the end of replenishment cycle.

The present values of retailer’s ordering and holding are same cost as in case I

During the first cycle the purchasing cost paid at M is equal to the amount of revenue earned by the retailer up to M so

![]()

![]() (14)

(14)

During the first cycle the present values of remaining payments and interest paid at the end of replenishment cycle are

![]()

![]() (15)

(15)

During the 1st cycle the present value of retailer’s total cost is

![]() (16)

(16)

Since there are m cycles in the planning horizon L then the present value of retailer’s total cost over the planning horizon L is

![]()

![]()

![]() (17)

(17)

The necessary condition for ![]() to be minimum is that

to be minimum is that ![]() and the sufficient condition is

and the sufficient condition is ![]() at the optimum value of T.

at the optimum value of T.

![]() (18)

(18)

![]() (19)

(19)

4. Numerical Parameters

Let us consider the following parameters in the appropriate units

![]()

4.1. Numerical Example I

When ![]() then solving the equation

then solving the equation![]() , we find the optimum value of T satisfying the condition

, we find the optimum value of T satisfying the condition![]() .

.

Since ![]()

As we increase the parameter r then the value of total cost decreases.

As we increase the parameter M then the value of total cost decreases.

4.3. Numerical Parameters

Let us consider the following parameters in the appropriate units

![]()

4.4. Numerical Example II

When ![]() then solving the equation

then solving the equation![]() , we find the optimum value of

, we find the optimum value of ![]() satisfying the condition

satisfying the condition![]() . Since

. Since ![]() so the total cost is maximum.

so the total cost is maximum.

As we increase the parameter r then the value of total cost increases.

As we increase the parameter M then the value of total cost decreases.

5. Conclusion

In this paper, we proposed an inventory model for perishable items with time varying stock dependent demand under inflation and time discounting. In the numerical analysis we study the effect of the change of the parameters r and M on the optimal solution. From Table 1 and Table 2 we observe that as we increase the parameters r and M then the replenishment cycle length increases and the corresponding total cost decreases since the total cost decreases and the revenue increases on his sell to pay the purchasing cost and in the case when ![]() no interest will be charged by the supplier from the retailer. When the inflation rate increases then the retailer wants to short the length of replenishment cycle. From Table 3 we see that as we increase the parameter r then the value of replenishment cycle length and total cost decreases. From Table 4 we see that as we increase the parameter M then the value of replenishment cycle length increases and the value of total cost decreases. Thus we see that when the credit period is short then the retailer wants to order less and decrease the chargeable interest. When the credit period is large enough then the retailer wants to order more and he earns enough revenue on his sell to pay the purchasing cost therefore the credit period attracts the retailer to buy more or less.

no interest will be charged by the supplier from the retailer. When the inflation rate increases then the retailer wants to short the length of replenishment cycle. From Table 3 we see that as we increase the parameter r then the value of replenishment cycle length and total cost decreases. From Table 4 we see that as we increase the parameter M then the value of replenishment cycle length increases and the value of total cost decreases. Thus we see that when the credit period is short then the retailer wants to order less and decrease the chargeable interest. When the credit period is large enough then the retailer wants to order more and he earns enough revenue on his sell to pay the purchasing cost therefore the credit period attracts the retailer to buy more or less.

NOTES

*Corresponding author.