The Stochastic Error Rate Estimation of Prediction Distributions ()

1. Introduction

The calculation of the provisions for disaster payments is intended to allow the integral payment of the commitments to the policy-holders and the recipients of the contract. The provisions measure the commitments that the insurer still has to honor. Nevertheless, this countable concept requires a subjacent probabilistic model since it allows one to define the ultimate claim, taking into account the disasters not yet declared, but which have occurred, the disasters not sufficiently funded. Reserves are given by evaluating the provisions for each contract, IBNR (sinister not yet declared) and IBNER (sinister not sufficiently funded). Traditional methods of provisioning (by triangulation) rest on the assumption that the data are homogeneous and in sufficient quantity to ensure a certain stability and a certain credibility. The purpose of this paper is to propose a stochastic extension of the Chain-Ladder model concerning the partial prediction reserve and to estimate the error rate of prediction distributions, which seems to be closer to reality for us than the existing methods of Schnieper [2] ; Mack [3] ; Liu and Verrall [4] ; Verrall and England [5] .

Models in which parameters move between a fixed number of regimes with switching controlled by an unobserved stochastic process, are very popular in a great variety of domains (Finance, Biology, Meteorology, Networks, etc.). This is notably due to the fact that this additional flexibility allows the model to account for random regime changes in the environment. In this paper we consider the prediction of partial reserve and consider the estimation of error rate of prediction distributions for a model described by a stochastic differential equation (SDE) with Markov regime-switching (MRS), i.e., with parameters controlled by a finite state continuous-time Markov chain (CTMC) [1] and [6] . Such a model was used, for example, in Deshpande and Ghosh (2008) [7] , to price options in a regime switching market. In such a setting, the parameter estimation problem posed a real challenge, mainly due to the fact that the paths of the CTMC were unobserved. A standard approach consists in using the celebrated EM algorithm (Dempster, Laird and Rubin, 1977) [8] as proposed, for example in Elliott, Malcolm and Tsoi (2003) [9] and Hamilton (1990) [10] , study this problem using a filtering approach.

The rest of the paper is structured as follows. In Section 2, we present the stochastic model for our problem. Section 3 is devoted to predicting the claims reserves variance. We conclude with a summary in the last section.

2. Hypotheses and Description of the Model

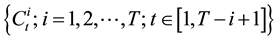

We suppose that the available data have a triangular form indexed by the year of accident, i, and the development time, t. Given a triangle, on T years, the goal is to consider models using a minimum of parameters, in order to envisage the best possible amounts of payments of future disasters. We note the evolution of the amounts of payments of the cumulated real disasters obtained by .

.

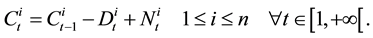

indicates the evolution of the cumulated real disasters indexed by the year of accident, i, and the time of development, t. We suppose that the increase in the disasters obtained

indicates the evolution of the cumulated real disasters indexed by the year of accident, i, and the time of development, t. We suppose that the increase in the disasters obtained  is the sum of the disasters not sufficiently funded

is the sum of the disasters not sufficiently funded  and of the disasters not declared yet claims

and of the disasters not declared yet claims . In the paper [1] the following relations between C, N and D is proposed.

. In the paper [1] the following relations between C, N and D is proposed.

(1)

(1)

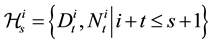

We indicate  for all the variables in the triangles D and N observed until the moment s.

for all the variables in the triangles D and N observed until the moment s.

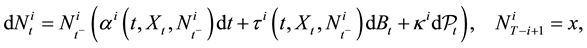

To simulate the future claims, it is supposed that the not sufficiently funded claims , the stochastic differential equation of diffusion and the not yet incurred claims

, the stochastic differential equation of diffusion and the not yet incurred claims  are governed by the stochastic dif-

are governed by the stochastic dif-

ferential equation of Black and Scholes with jump. This assumption on the probability density function of  ensures positivity and for

ensures positivity and for  ensures the membership

ensures the membership , contrary to what is proposed by Liu and Verrall [4] .

, contrary to what is proposed by Liu and Verrall [4] .

Conditionally with , we simulate the distribution of

, we simulate the distribution of  as solution of the following stochastic differential equation:

as solution of the following stochastic differential equation:

(2)

(2)

where  is a standard Brownian motion on

is a standard Brownian motion on![]() ;

; ![]() is the Poisson process of intensity

is the Poisson process of intensity![]() ;

; ![]() is a Markov process at continuous time;

is a Markov process at continuous time;![]() ;

;![]() ; verifying

; verifying

![]()

and ![]() is a positive constant.

is a positive constant.

Conditionally with![]() , we suppose that the evolution of

, we suppose that the evolution of ![]() is governed by the following diffusion:

is governed by the following diffusion:

![]() (3)

(3)

where ![]() is a standard Brownian motion on

is a standard Brownian motion on![]() ;

; ![]() is a Markov process at continuous time;

is a Markov process at continuous time; ![]() and

and ![]() such that

such that ![]() and

and![]() . The process

. The process ![]() is assumed to be a continuous time Markov process taking values in the set

is assumed to be a continuous time Markov process taking values in the set ![]() The transition probabilities of this chain are denoted by

The transition probabilities of this chain are denoted by ![]() and the transition rate matrix is

and the transition rate matrix is ![]() with

with

![]()

For any state ![]() consider priors

consider priors ![]() and

and ![]() defined as follows

defined as follows

![]() (4)

(4)

![]() (5)

(5)

![]() (6)

(6)

where ![]() denotes a Gamma distribution with shape parameter

denotes a Gamma distribution with shape parameter ![]() and scale parameter

and scale parameter![]() .

.

Let us define the log-returns ![]() for the Equation (2) and

for the Equation (2) and ![]() for the second Equation (3),

for the second Equation (3), ![]()

Given a path ![]() Let

Let ![]() be the time spent by the path X in state j in the time interval

be the time spent by the path X in state j in the time interval![]() . Define

. Define

![]() (7)

(7)

![]() (8)

(8)

Then, conditional on the path X, the solutions of the Equations (2) and (3) are respectively given by :

・ the solution of the first Equation (2) is

![]() (9)

(9)

and,

・ ![]() are i.i.d.

are i.i.d.![]() ,

, ![]() for the second Equation (3).

for the second Equation (3).

3. Predicted Claims Reserves Variance

The main reason for using stochastic models is to estimate the error rate of prediction distributions. It is useful for solvency, capital modelling and measurement of risk. We begin by proving how the predicted error rate can be calculated. The predicted error rate is obtained from the predicted variance of the partial reserve of loss. We

remember that ![]() the variables in triangles D and N observed until a time s. Let

the variables in triangles D and N observed until a time s. Let![]() . The future claims IBNR and IBNER estimators are given respectively by

. The future claims IBNR and IBNER estimators are given respectively by![]() ,

, ![]()

![]() and

and![]() . Our objective is to predict the partial reserve. We denote

. Our objective is to predict the partial reserve. We denote

the partial reserve by:

![]() (10)

(10)

![]() is its estimator.

is its estimator.

The mean square error prediction of ![]() can be written as follows

can be written as follows

![]()

Theorem 3.1 Let ![]() and

and![]() , respectively the future claims IBNR and IBNER of the ith contract, verifying Equations (2) and (3), then the mean square error prediction of partial reserve is

, respectively the future claims IBNR and IBNER of the ith contract, verifying Equations (2) and (3), then the mean square error prediction of partial reserve is

![]() (11)

(11)

Proof. The mean square error prediction of the partial reserve can be written as follows

![]() (12)

(12)

Using the fact that

![]()

and

![]()

As a first step, we calculate

![]()

We calculate the second term (12), taking into account

![]()

and

![]()

Then

![]()

![]()

4. Conclusion

We have studied the Bayesian approach for the regime switching geometric Brownian motion proposed by [1] . It has been observed empirically that sinisters fluctuate among periods of high, moderate and low volatilities, so in this paper the estimation of the error rate of prediction distributions is proposed. For the future research, our developments raise an interesting axe when the Markov chain is hidden.

Acknowledgements

We would like to thank the reviews for the comments.