Asset Prices, Nominal Rigidities, and Monetary Policy: Negative Monetary Policy Responses to Asset Price Fluctuations ()

1. Introduction

Should monetary policy respond to asset price fluctuations? To this classic monetary policy question, a recent paper by Carlstrom and Fuerst [1] provides a negative answer. They find that equilibrium indeterminacy arises if monetary policy positively responds to share prices in a standard sticky-price economy. An increase in inflation reduces firm’s profits, and share prices decline since they reflect the firm’s profits. Then, the monetary policy response to share prices implicitly weakens the overall reactions to inflation. This is a source of equilibrium indeterminacy in their model.

The intuition of Carlstrom and Fuerst’s [1] to this indeterminacy result would lead one to think that negative monetary responses might be good from the viewpoint of equilibrium determinacy. The work by Faia and Monacelli [2] is closely related to this conjecture. They find that the optimal monetary policy is to respond to asset prices negatively in a sticky price model with financial frictions a la Carlstrom and Fuerst [3] .

To address this question, we extend the model of [1] where a central bank can respond to asset prices negatively. We find that equilibrium indeterminacy also arises by a negative monetary response to asset prices. If a central bank responds to asset prices negatively, an increase in asset prices lowers the nominal interest rate. Since the asset price is the discounted sum of firms’ profits, this decrease in the nominal interest rate means a decrease in the discount rate. Then, there is an upward pressure of asset prices, and an increase in the asset price causes further increases in the asset price. This is a source of equilibrium indeterminacy from a negative monetary response to asset prices.

The rest of this paper is organized as follows. Section 2 introduces our model. Section 3 presents the main results and their interpretation. Section 4 discusses the robustness of the results. Finally, Section 5 presents our concluding remarks.

2. The Model

Our model is the same as that of [1] . Nominal prices are sticky and there is no capital, assets are shares of monopolistic competitive firms, and the asset price is defined as the discounted sum of monopolistic competitive firms’ profits.

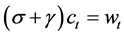

The linearized equilibrium system is given as follows:

, (1)

, (1)

, (2)

, (2)

, (3)

, (3)

(4)

(4)

(5)

(5)

(6)

(6)

(7)

(7)

where  denotes consumption;

denotes consumption; , the real wage rate;

, the real wage rate; , the inflation rate;

, the inflation rate; , the nominal interest rate;

, the nominal interest rate; , share prices;

, share prices; , the dividend; and

, the dividend; and , the real marginal cost.

, the real marginal cost.  denotes the relative risk aversion;

denotes the relative risk aversion; , the Frisch elasticity;

, the Frisch elasticity;![]() , the steady-state real marginal cost;

, the steady-state real marginal cost;![]() , the sensitivity of monetary policy to inflation; and

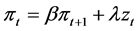

, the sensitivity of monetary policy to inflation; and![]() , the sensitivity of monetary policy to share prices. (1) is the labor supply curve; (2) and (3), the Euler equations for consumption and share, respectively; (4), the definition of the dividend; (5), the marginal productivity condition; (6), the Phillips curve; and (7), monetary policy. Note that, while [1] assumes that

, the sensitivity of monetary policy to share prices. (1) is the labor supply curve; (2) and (3), the Euler equations for consumption and share, respectively; (4), the definition of the dividend; (5), the marginal productivity condition; (6), the Phillips curve; and (7), monetary policy. Note that, while [1] assumes that![]() , we do not employ it.

, we do not employ it.

As shown by [1] , the dividend is given by

![]() (8)

(8)

where

![]() .

.

We employ an assumption on ![]() following [1] .

following [1] .

Assumption 1.![]() .

.

Under this assumption, an increase in the real marginal cost decreases the dividend.

The equilibrium system is reduced to the following matrix form:

![]()

where

![]() .

.

The first equation is the consumption Euler equation (2); the second, the New Keynesian Phillips curve (6); and the third, the Euler equation for share (3).

For the analysis, we transform this system as follows:

![]()

where

![]()

3. Main Results

A necessary and sufficient condition for the equilibrium determinacy of this three-dimensional system is as follows

Proposition 1. Suppose that![]() . A necessary and sufficient condition for equilibrium determinacy is

. A necessary and sufficient condition for equilibrium determinacy is

![]() .

.

where

![]()

![]()

Proof. A necessary and sufficient condition for equilibrium determinacy is that all roots of ![]() should be inside a unit circle. It is easily shown that one of the roots is

should be inside a unit circle. It is easily shown that one of the roots is

![]() ,

,

where

![]()

![]()

Necessary and sufficient conditions for equilibrium determinacy are![]() ,

, ![]() , and

, and![]() . The condition

. The condition ![]() is from

is from![]() . The condition

. The condition![]() is from

is from ![]() and

and![]() .

.

Q.E.D.

Since![]() , we obtain Proposition 1 of [1] as a corollary.

, we obtain Proposition 1 of [1] as a corollary.

Corollary 1. Suppose that ![]() and

and![]() . A necessary and sufficient condition for equilibrium determinacy is

. A necessary and sufficient condition for equilibrium determinacy is

![]() .

.

Figure 1 shows the determinacy and indeterminacy regions by numerical simulations. The vertical axis is the

![]()

Figure 1. Determinacy regions (1): Baseline.

central bank’s stance on inflation![]() , and the horizontal axis is the central bank’s stance on the share price

, and the horizontal axis is the central bank’s stance on the share price![]() . We discretize the parameter space of

. We discretize the parameter space of![]() , and check condition for determinacy for each. In the region with diamonds, equilibrium is determinate, and in the others, equilibrium is indeterminate. Following [1] , we set

, and check condition for determinacy for each. In the region with diamonds, equilibrium is determinate, and in the others, equilibrium is indeterminate. Following [1] , we set![]() ,

, ![]() ,

, ![]() , and

, and![]() .

.

The existence of the upper bound of ![]() for determinacy,

for determinacy, ![]() , is interpreted by the Taylor principle as in [1] . An increase in inflation reduces firm’s profits and the share prices decline since they reflect the firm’s profits. Then, the monetary policy response to share prices implicitly weakens the overall reaction to inflation.

, is interpreted by the Taylor principle as in [1] . An increase in inflation reduces firm’s profits and the share prices decline since they reflect the firm’s profits. Then, the monetary policy response to share prices implicitly weakens the overall reaction to inflation.

Why is there a lower bound,![]() ? Negative monetary policy responses to asset prices imply that an increase in the asset price causes a decrease in the nominal interest rate. As in (3), the current asset price is a discounted sum of the future asset price and dividend. A decrease in the nominal interest rate means a decline in the discount rate, which creates upward pressure on the asset price. As a result, an increase in the asset price causes further increases in the asset price. Finally, a negative monetary policy response should be a source of indeterminacy. Therefore, it is found that both positive and negative monetary policy responses are sources of equilibrium indeterminacy

? Negative monetary policy responses to asset prices imply that an increase in the asset price causes a decrease in the nominal interest rate. As in (3), the current asset price is a discounted sum of the future asset price and dividend. A decrease in the nominal interest rate means a decline in the discount rate, which creates upward pressure on the asset price. As a result, an increase in the asset price causes further increases in the asset price. Finally, a negative monetary policy response should be a source of indeterminacy. Therefore, it is found that both positive and negative monetary policy responses are sources of equilibrium indeterminacy

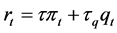

4. Robustness: Sticky Price-Wage Economy

In the case where wages are also sticky a la [4] , the linearized intratemporal optimization condition (1) becomes

![]() (9)

(9)

and the following two equations are introduced to the log-linearized equilibrium system:

![]() (10)

(10)

![]() (11)

(11)

where ![]() is nominal wage inflation

is nominal wage inflation

In this case, it is difficult to derive an analytical condition for equilibrium determinacy. Then, we calculate the determinacy region by numerical simulations. Figure 2 is the analogue of Figure 1. We set ![]() by following [1] . The other parameter values are the same as in Section 3. It is found that the indeterminacy result is robust to this sticky price-wage model.

by following [1] . The other parameter values are the same as in Section 3. It is found that the indeterminacy result is robust to this sticky price-wage model.

5. Concluding Remarks

In this paper, the effects of monetary policy responses to asset prices are investigated. [1] found that a positive monetary policy response is a source of equilibrium indeterminacy since it implies that the monetary policy response to share price implicitly weakens the overall reaction to inflation. Following this intuition, negative monetary policy response to asset prices might be good for equilibrium determinacy because it might strengthen the

![]()

Figure 2. Determinacy regions (2): Sticky price-wage economy.

all overreaction to inflation. We have found that negative monetary policy response is also a source of indeterminacy. This is because an increase in asset prices generates further increases in asset prices through monetary policy. Therefore, the central bank should not respond to asset prices both positively and negatively from the viewpoint of equilibrium indeterminacy.

Acknowledgements

I would like to thank Keiichiro Kobayashi for their helpful comments and suggestions. Of course, the remaining errors are mine. This work was funded by a Senshu University research grant (“Equilibrium Indeterminacy, Share Prices, and Monetary Policy”) in 2012.